Best Crypto Charts & Analysis (2026) – Bitcoin & Altcoins

Cryptocurrency & Bitcoin Charts Sites, Analysis, and Predictions Sites: Everything You Need to Know + FAQs

Are you feeling overwhelmed by the constant ups and downs of cryptocurrency prices? Ever wonder how seasoned investors consistently make the right moves while others get caught in a maze of confusion? Here’s the thing—not all of them have crystal balls. They understand the power of data and use the right tools to track markets, analyze trends, and even lean on predictions to stay ahead. And guess what? You can too!

The crypto world isn't just about luck; it’s about using knowledge to make informed decisions. But when it comes to tracking Bitcoin, altcoins, or any emerging token, the challenge is real. Prices shift fast, social media hype can create chaos, and let’s face it—there’s so much data out there, it can feel impossible to know where to start.

Why Do So Many Crypto Investors Struggle with Tracking Trends?

Let’s get real. Crypto prices don’t care if you’re asleep or enjoying your weekend. Markets open 24/7, and volatility is the name of the game. Whether Bitcoin is surging to new highs or altcoins are tanking, it often feels like there’s just no way to keep up. Sound familiar?

Here are some common struggles I’ve seen other crypto enthusiasts face:

- Not understanding how to interpret price charts or candlestick patterns.

- Feeling overwhelmed by the sheer volume of market data available.

- Falling victim to emotional trading influenced by sensational news or social media hype.

- Lacking reliable tools to track trends and make sense of predictions.

Trust me, you’re not alone. The good news? These problems aren’t impossible to overcome. But you need the right resources and a clearer understanding of what’s out there.

How This Guide Can Make Your Crypto Journey Smoother

If you’ve ever stared at a price chart and thought, How does anyone make sense of this?, this guide is for you. There are platforms out there that transform confusing data into actionable insights. From Bitcoin’s next move to altcoin breakouts, the key is knowing where to look.

In the sections to come, I will introduce you to some of the most reliable charting platforms, explain how market analysis works, and show you how to use prediction tools to your advantage. You’re also going to get answers to burning questions many crypto investors have but rarely ask out loud.

Let’s Turn Challenges Into Opportunities

It’s easy to feel lost when you’re new to the game—or even when you’ve been in it for years. Staying ahead in crypto doesn’t mean being a genius; it means equipping yourself with the right knowledge and tools. So, ready to get started learning about the platforms and strategies that can give you the edge?

Still overwhelmed by all the options for charts and analysis out there? Don’t worry—I’m about to break it down for you. The next section will focus on what crypto charting websites actually do and why they’re essential.

What Are Crypto Charting Websites, and Why Do You Need Them?

If you've spent even five minutes in the crypto world, you've likely heard about the importance of "reading charts." But what exactly does that mean, and why does it matter? Let’s break it down in simple terms—crypto charting is your window into understanding how the market is moving. Whether you’re trading Bitcoin or altcoins, these charts allow you to make smarter, calculated decisions instead of relying on blind luck. Because in a market this volatile, who can afford to guess?

The Role of Technical Analysis in Crypto Success

Imagine trying to navigate a stormy sea without a compass. That’s what trading without technical analysis feels like. Crypto charting platforms are designed to help you analyze patterns in price movement so you can better understand where the market might be heading. They give you access to tools like candlestick charts, which show price highs, lows, and closing prices over specific time periods. Think of them as a roadmap, helping you see opportunities and risks before making a trade.

Take TradingView, for example. It’s one of the most popular charting tools in the crypto space, and for a good reason. It’s packed with features like trendline analysis, Fibonacci retracement tools, and even the ability to create custom indicators. Or look at Coinigy, which syncs with multiple exchanges so you can track your portfolio across platforms. These tools turn data into actionable insights, giving you the edge you need to stay ahead.

"Successful trading isn’t about predicting the future. It’s about preparing for different possibilities." – Anonymous Pro Trader

Benefits of Using Professional Crypto Chart Tools

Why bother with platforms like Kraken Pro or Binance’s built-in charting tools? Here’s why:

- Real-time Data: These platforms provide you with up-to-the-second market updates, so you’re not flying blind.

- Customization: Want to focus on a specific timeframe or overlay multiple indicators? These tools let you personalize the charts to match your strategy.

- Convenience: Integrating analysis with your trading platform saves time and minimizes errors. No more toggling between ten browser tabs!

Let’s say you’re eyeing an Ethereum trade. A quick glance at Binance’s trading interface shows you not just the price action but also order book depth, trade volumes, and more. These insights can be the difference between a winning and losing trade.

Who Are Chart Sites Best Suited For?

Here’s the thing: crypto charting websites aren’t just for day traders glued to their screens 24/7. They’re useful for investors of all levels. Beginners can use simpler tools like percentage price change charts, while advanced traders can create complex strategies deploying RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence) indicators.

It’s all about visualization. Without charts, it’s like trying to solve a thousand-piece puzzle without seeing the picture on the box. You could get there eventually, but it’ll take a lot longer—if you don’t give up halfway.

The question remains—once you’ve got the charts down, how do you make sense of the numbers and interpret the bigger picture? That’s where analysis tools come in, and trust me, they play a massive role in making informed decisions. So, are you ready to discover how to unpack crypto data like a pro? Let’s check out the next step.

Bitcoin and Cryptocurrency Analysis: Unpacking Tools and Methods

Let’s face it—crypto markets can feel like a maze. Prices move, whales trade, news breaks, and before you know it, the winds have shifted. If you’re not actively analyzing the market, you’re already behind. Thankfully, technology has gifted us analysis platforms that cut through the noise to give you actionable insights. Numbers speak, but analysis interprets. Here's how the right tools can supercharge your crypto game.

On-Chain Metrics Explained

Imagine being able to see under the hood of the Bitcoin blockchain. That’s exactly what on-chain metrics give you—a bird’s-eye view of what’s really happening on the network. Platforms like Glassnode are leading the charge here, offering data straight from the blockchain itself. Think transaction volumes, wallet movements, mining activity, and other metrics you’ve likely overlooked.

Why does this matter? Let’s use a concrete example. A sudden spike in wallets holding at least 1 BTC might indicate accumulation before a price rally. Similarly, a surge in active addresses might signal growing interest and adoption, a potential precursor to market activity. If you can spot these patterns early, that’s a major edge.

"Numbers are everywhere. The secret is not just seeing them, but understanding what they mean." – Anonymous

Sentiment Analysis for Crypto

Price movements in crypto aren't just about the “math.” Believe it or not, emotion drives much of the market—fear, hype, optimism, or panic. This is where sentiment analysis steps in. Tools like LunarCrush focus on crowd behavior, gathering data from social media platforms, news, and even search trends to help you see what people are feeling.

Picture this: Bitcoin is trading sideways, but suddenly, Twitter blows up with hashtags like #BitcoinToTheMoon. LunarCrush processes millions of tweets and posts to quantify that buzz into a Social Volume Score. Pair that data with a big news announcement, and you might just predict the next breakout before it happens.

Another tool, The TIE, specializes in separating genuine social media chatter from all the junk. If the crowd’s sentiment tilts overwhelmingly negative, it could signal the perfect buying opportunity. Why? Because the long-term bulls make a move when everyone else feels bearish.

Combos to Watch: Market and Sentiment Insights Together

Let’s get tactical. Combining market metrics with crowd sentiment can reveal some startlingly accurate predictions. Some platforms, like IntoTheBlock, already integrate multiple datasets to give you a more holistic view. For instance:

- Pairing on-chain data such as wallet accumulations with bullish sentiment spikes could indicate a large market move coming soon.

- Couple network activity (high transaction, high activity) with negative sentiment—this often signals whales are quietly accumulating before the market rebounds.

Take Ethereum as an example. In early 2022, there was a significant uptick in whale wallets buying ETH during a time of low public optimism. Sentiment analysis tools flagged this, alerting savvy investors to the potential long-term play. The result? An eventual rally no one saw coming—except for those astutely monitoring the data.

So, which side are you on—the crowd or the ones watching the crowd? Combining these methods isn’t just smart, it’s essential. Almost like unlocking a cheat code for the markets.

What’s Next for Crypto? The Prediction Debate

Now that you’ve cracked the code on using analysis tools, let me challenge you with an intriguing thought: Can predictive algorithms really tell us the future of Bitcoin and altcoins? Is it science—or just hype? Stick around, because next, we’re exploring the fascinating world of crypto prediction platforms. Can AI or advanced algorithms turn you into the next big crypto guru? Let’s find out.

Crypto Prediction Sites: Fact or Fiction?

Let’s be honest—who wouldn’t want a crystal ball to predict Bitcoin’s next big move? The idea of knowing exactly when to buy low and sell high is every trader’s dream. But can these prediction platforms really deliver? Or are they just selling hope? Let’s peel back the layers and see how these tools work, which ones are worth your time, and how to tell fact from fantasy.

How to Spot Realistic Predictions vs. the Hype

It’s far too easy to get swept up by impressive graphs and bold claims. But how do you separate useful insights from unreliable hype? Here are some tips to keep you grounded:

- Check the time frame: Short-term predictions (like for the next day or week) tend to be highly volatile and less reliable. Long-term forecasts are more measured, but still come with limitations.

- Watch out for extremes: Any prediction promising Bitcoin will soar to $1M within a year or crash to zero is likely chasing clicks—not accuracy.

- Understand the method: Reputable platforms are transparent about their methodology. If they don’t explain how their predictions are calculated, take those forecasts with a grain of salt.

- Look for reviews: Check what other crypto enthusiasts are saying. Have the predictions been reliable in the past, or do they fall short more often than not?

At the end of the day, no algorithm can guarantee where the market is going. However, using predictions wisely—alongside charting tools and solid analysis—can make you a more informed trader.

Speaking of solid tools, wouldn’t you want to know which reliable sites are trusted across the crypto community for analysis and data? Stick around as we explore the ultimate go-to resources in the next section. You don’t want to miss this one!

Trusted Resources for Crypto Data and Analysis

Have you ever felt overwhelmed by the endless choices for cryptocurrency tools out there? I get it—when you're trying to stay one step ahead in the market, the last thing you need is to waste time on unreliable platforms or data sources. That’s why I want to share some of the most trusted resources I personally rely on to keep my finger on the pulse of Bitcoin, Ethereum, and other cryptocurrencies.

My Go-To Platforms for Charts and Analysis

Not all charting or analysis platforms are created equal, but over the years, I’ve found a handful of tools that consistently deliver accurate and actionable insights. Here’s a breakdown of the resources I swear by:

- TradingView: Whether I’m tracking real-time price changes or mapping out long-term trends, TradingView is always my first pick. It offers highly customizable charts, social sharing features for ideas, and thousands of indicators. Bonus? It’s beginner-friendly but advanced enough for pros.

- Coinigy: Need to link multiple exchange accounts and track everything in one dashboard? Coinigy shines in simplifying multi-exchange trading, making it perfect for anyone juggling multiple platforms.

- Cryptowatch: This tool is all about speed and simplicity. The interface is minimal, but it gives you exactly what you need—real-time prices, volume trends, and alerts on multiple coins and trading pairs. Think of it as the no-frills powerhouse for traders on the move.

The best part? Most of these platforms offer free plans, so you can test them out and figure out which works best for your style before committing to a paid subscription.

Staying Updated with Industry Leaders

Ever heard the saying, “You’re the average of the five people you spend the most time with?” Well, in crypto, you’re the average of the insights you follow. Staying informed from trusted analysts and prediction providers can make a huge difference—not just in knowing where the market is but in where it’s headed.

- PlanB (Stock-to-Flow Creator): If you’ve been in crypto for any length of time, you’ve likely come across PlanB. His Stock-to-Flow model has been a game-changer for price prediction, and while no model is perfect, it offers a unique perspective on Bitcoin’s scarcity-driven value.

- IntoTheBlock: This platform is a goldmine for anyone hungry for actionable blockchain insights. It’s not just about price trends—they cover on-chain metrics, social sentiment, and macroeconomic factors. Truly a fantastic tool for those looking to go deeper (without needing to be a data scientist).

- Glassnode: This one deserves another mention because it’s simply outstanding for tracking on-chain activity. From wallet movements to whale transactions, its insights can give you a clear edge in understanding market dynamics.

When in doubt, lean on the people and platforms that have proven themselves over time. A quick glance at what top analysts are saying can save you hours of research and help you confidently plan your next move.

“In a market where emotion drives decisions, data is your friend, and trustworthy data is your compass.” - Anonymous

Do these names sound familiar? If not, now’s the perfect time to check them out. But here’s the burning question: with all these platforms and tools, how do you decide which one’s right for you? Do you need something free? Or perhaps it’s time to explore premium features? Stick around, because I’ll help you figure it out next!

Choosing the Right Platform for You

With so many tools, charts, and prediction platforms out there, how do you pick the one that really works for you? Let me tell you right away—it’s not a one-size-fits-all answer. The right platform will depend entirely on your goals, experience level, and what you want to achieve in this crazy crypto world.

Know Your Goals

Here’s a truth that doesn’t get said enough: if you don’t know where you’re heading, the best tools in the world won’t make a difference. Take a second to think about your crypto journey:

- Are you a day trader? Then you need tools that offer real-time updates, detailed candlestick charting, and perhaps even alerts. Platforms like TradingView or Cryptowatch are stellar choices for fast-paced decisions.

- Thinking long-term? If you're more of a hodler, platforms with deep analysis like Glassnode or prediction tools like WalletInvestor might make your life easier.

- Interested in market sentiment? If getting a pulse on social trends intrigues you, platforms like LunarCrush will be more your style. It’s amazing how much we can learn from social media analysis!

Choosing the platform that aligns with what you care about the most is half the battle won. Don’t skip this step—know your "why."

Free vs. Paid Tools

I won’t sugarcoat it—free tools are great, but sometimes there’s just no beating the extra insights that premium plans offer. Here’s the deal:

- For beginners, free features on platforms like Coinbase or Binance might be all you need to understand the basics.

- If you’re serious about crypto and need advanced metrics, predictive analytics, or institutional-level data, subscriptions like TradingView’s Pro plan or Coinigy’s paid version can open new doors.

Here’s a quick tip I’ve learned along the way: don’t assume "free" means "limited." Many platforms like TradingView offer powerful tools even in their free tier. But when you’re ready to take things to the next level, paying might be worth unlocking time-saving or profit-making features.

“Price is what you pay. Value is what you get.” — Warren Buffett

When it comes to crypto tools, think about whether the features will actually help you make smarter decisions. If the answer is yes, the right paid tool could pay for itself over time.

Trial and Error: Finding What Clicks

The best part of this digital age we live in? You don’t have to fully commit right away. Practically every major crypto platform offers something like a free trial or a basic plan. This gives you the perfect chance to try out different tools and see what really clicks for your style.

Testing multiple platforms can be eye-opening. For example: maybe you love the simplicity of Coinigy, but prefer the detailed community engagement on TradingView. Or perhaps, you get hooked on LunarCrush’s unique sentiment analysis but add CryptoCompare to cross-check predictions. Play around. Experiment. Your perfect mix could be a blend of several platforms!

If you’re just getting started, don’t hesitate to track your results while trying out tools. Did TradingView’s alerts help you make better trades? Was WalletInvestor’s prediction accurate compared to the market? Keep asking these questions, and you’ll quickly see which platforms prove themselves over time.

One last thing to keep in mind as you explore? Don’t forget to review the integrations of these platforms. If you use particular exchanges like Binance or Kraken, make sure the tool you love syncs effortlessly. Convenience adds up!

The Next Step in Making Better Crypto Moves

So now you’ve got everything you need to start picking out the perfect platforms for your goals. But that’s just the start of the game, isn’t it? Once you’ve chosen your tools, the real question arises: How do you use all that data to actually make smarter moves?

In the next section, I’ll break down how to avoid common charting mistakes, what indicators actually matter (hint: you don’t need a hundred of them), and how to turn insights into actionable decisions. Let’s make sure your strategy is as sharp as your tools!

Tips for Interpreting Data and Making Smarter Moves

Now that you’ve got the tools in your hands, the next step is learning how to use them effectively. If you’ve ever felt like staring at charts was more confusing than helpful, you’re not alone. The trick isn’t to focus on doing everything; it’s about doing the right things. Let me show you how you can keep it simple, avoid mistakes, and sharpen your skills.

Keep It Simple

“The essence of strategy is choosing what not to do.” This quote from Michael Porter couldn’t be more relevant when you're staring at 20 different indicators on a Bitcoin chart. You don’t need to use them all. Overloading your screen with RSI, MACD, Bollinger Bands, Fibonacci retracements, and dozens of moving averages can paralyze you instead of helping you.

Instead, pick a few that align with your strategy. For example:

- Short-term traders: Focus on candlestick patterns, volume trends, and RSI (Relative Strength Index).

- Long-term investors: Consider simple moving average (SMA), on-chain metrics, and accumulation zones.

Find out what resonates with your approach and stick to it. The more you simplify, the faster you’ll start identifying reliable trends and patterns in the market.

Avoid Common Charting Mistakes

If you’re new to analyzing crypto charts, certain mistakes can hurt your progress. Even seasoned traders fall into these traps. Let’s make sure you don’t.

- Over-relying on one tool: Relying solely on one type of analysis (like candlestick patterns) can give you a partial or even misleading view of the market. Always complement technical data with other insights, like sentiment analysis or volume trends.

- Ignoring timeframes: Ever noticed how the same coin can look bullish on the daily chart but bearish on the 4-hour chart? Not adjusting your timeframe to your trading plan can lead to conflicting signals.

- Forcing patterns: If you find yourself “trying” to see a breakout or a trend where there really isn’t one, stop. The market is always right—waiting for more confirmation is better than chasing false setups.

If you avoid these common pitfalls, you’ll start to see the market with more clarity. A lot of the mistakes traders make aren’t about numbers, but psychology. Learn to trust the tools without bias.

Practice Makes Perfect

Would you trust a surgeon who’s fresh out of med school without hands-on experience? Probably not, and the same principle applies here. Before you start placing risky trades based on what you “think” you’ve figured out, test your strategies first.

Here’s how:

- Use demo accounts: Platforms like Binance and Bitfinex offer paper trading options where you can simulate trades with fake money. It’s a stress-free way to test your setups.

- Track predictions: If you’re using prediction platforms, document their forecasts in a spreadsheet and see how accurate they are over time. Do they match your analysis? Are their targets too optimistic?

- Analyze your mistakes: Every missed trade or loss is a lesson in disguise. Review your charts and notes to understand where you went wrong.

Experience is your greatest teacher. Every chart you study, every prediction you test, and every simulated trade you execute brings you one step closer to being a confident, data-driven investor.

But how do you know if you've chosen the right tools, chart patterns, or predictions in the first place? What separates a solid platform from one that’s all hype? Keep reading—you’re about to find the answers you’ve been looking for.

Frequently Asked Questions (FAQs)

If you’ve made it this far, I’m guessing you’re serious about upping your crypto game. That’s awesome. Now, let’s focus on the questions I get all the time when it comes to charting, analysis, and predictions. Whether you’re a curious newbie or someone trading daily, these answers will give you clarity and direction.

What Is the Best Site for Crypto Chart Analysis?

This one comes up often, and the answer really depends on what you’re looking for. If simplicity and reliability are what you need, TradingView is hard to beat. It’s packed with features like custom indicators, chart comparisons, and incredible community-shared scripts that let you explore market trends in a way that makes sense to you.

Another favorite is Coinigy. Think of it as your all-in-one trading hub. It integrates with tons of exchanges, so you can track all your assets in one place. This is perfect if you’re juggling multiple coins or want a clean interface to stay organized.

And if you’re into exchange-native tools, platforms like Binance or Kraken Pro also offer solid charting features tailored to their ecosystems. The key is trying out these tools to see what resonates with your style.

What’s the Best Crypto Prediction Tool?

Predicting the wild world of crypto might seem like a stretch, but there are platforms out there pushing boundaries. Want AI-driven insights? Give yPredict a look. It uses machine learning to crunch historical data and identify patterns. Many traders love how precise, trend-spotting tools like this are.

For simpler, no-frills forecasts, WalletInvestor is another strong pick. It’s user-friendly, doesn’t overcomplicate things, and offers estimates for both short-term and long-term price trends. These tools might not have crystal balls, but they’re trustworthy for informed decision-making.

How Do I Choose a Trusted Crypto Website?

This is probably the most important question. With so many sites promising to be “the best,” how do you know which ones to trust? My advice? Stick with platforms that have stood the test of time and are celebrated within the crypto community.

- CoinMarketCap: The go-to for tracking prices and wallet-worthy data.

- CryptoCompare: Reliable stats and tools for comparing exchanges and coins.

- Cryptolinks.com: A curated hub of top resources, updated to keep you ahead in the game.

It’s all about credibility. Watch out for hype-heavy sites or any that refuse to back their claims with real proof. A little research goes a long way in protecting your wallet and confidence.

One More Question: Which Crypto Tool Has the Most Impact?

You clicked in looking for answers, but now’s the real moment to think: What’s your biggest need right now? Trend tracking, predictions, comparisons? Figuring that out will change how you approach the tools I mentioned—because honestly, it’s not about the most popular pick, it’s about the one that fits you best.

And hey, there’s something big coming up next. What’s the smartest way to bring all these tools together in your strategy? You won’t want to miss it.

Get Started Today and Stay Informed

Let’s face it—navigating the wild world of crypto without the right tools is like driving a car blindfolded. Over the course of this guide, we’ve explored the importance of charting, analysis, and prediction platforms in shaping smarter crypto decisions. Now it’s time to bring everything together and look at how to set yourself up for success starting today.

Make Your Move

The crypto market won’t wait for anyone. If you’ve ever thought about improving your game or stepping up your strategies, there’s no better time than now. Start small. Maybe tackle a tool like TradingView to familiarize yourself with chart reading, or dig into sentiment analysis with LunarCrush to see how public opinions are shaping trends.

It’s okay to take things at your own pace. No one becomes a crypto expert overnight. But remember, the sooner you start, the sooner you’ll be able to react confidently when the next bull or bear market strikes. The key is to stay informed and be proactive in learning.

So here’s the challenge: Pick one platform from this guide and give it a try today. Explore its features, play around with its tools, and see how it can help you achieve your goals. The crypto market is unpredictable, but equipped with the right tools and insights, you’ll find yourself ahead of the curve more often than not.

The journey to mastering cryptocurrency might seem daunting, but you’ve got this. Start where you are, use what you have, and keep learning every step of the way.

What Are Cryptocurrency Charts?

As earlier mentioned, the crypto market is a burgeoning ecosystem housing an enormous list of assets and projects vying for prominence via the adoption of crypto and blockchain technology. While this is a given, every crypto practitioner needs the means to track happenings in the extremely volatile crypto market to have insight into market trends and price movements. Accessing accurate and prompt information encapsulating the entirety of the digital assets market is vital to the decision-making processes of crypto practitioners, especially those looking to trade or invest in certain coins.

It is the above-stated challenge that brought to the fore the importance of charting systems ideal for crypto assets. These systems come with the necessary tools to identify current price trends, analyze historical market movements, and project future price swings. Hence, a chart for cryptocurrency enables tools, which include visual representations of the performance of crypto assets, to help crypto practitioners determine the current or past performances of digital assets.

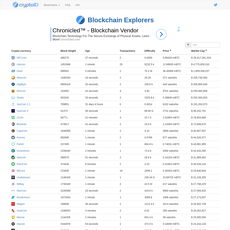

Needless to say, crypto chart systems have become one of the most important tools for crypto participants, and this is evident in the number of websites providing charting services. Although crypto exchange websites often enable these tools, there are, however, sites solely designed to provide charting systems to users. These sites come with extensive data and visual representations of price performances of selected cryptocurrencies to ensure that users have access to all they need to identify market anomalies and recurring trends.

What Are the Benefits of Using A Cryptocurrency Chart Website?

They Offer Accurate Insight into Market Trends

With the tools made available on a crypto chart site, it becomes easier to fathom the present stance of crypto assets in the market. There are ample resources to determine the performance of digital assets and decide whether it is wise to invest in them. Simply put, using crypto charts is one of the acceptable ways to research the viability of cryptocurrencies and ensure that you are not allocating your funds to a lost cause.

They Are Good Price Prediction Tools

You will often notice that experienced traders take cryptocurrency charting endeavors seriously. This is because it avails an accurate means to predict price movements via the identification of current price trends. In other words, charts for cryptocurrency are vital tools for crypto traders looking to determine short term price movements and profit from projected price trends.

Crypto Charts Make It Easier to Research the Historical Performances of The Crypto Market

Crypto chart websites that have enough data to provide visual representations of the complete history of cryptocurrencies are the ideal research tools for people looking to analyze the performance of digital assets from the moment they became available in the crypto market. This functionality is priceless to crypto analysts who explore the short histories of cryptocurrencies, determine events that might have caused certain market trends, and explore scenarios that might trigger similar market movements in the future.

What Are the Differentiating Factors of Crypto Chart Websites?

Although crypto chart websites provide similar services, there are, however, unique functionalities that we can identify as their differentiating factors. For one, while some sites strictly chart cryptocurrency, others offer services to participants of traditional markets. For the latter, the crypto chart section is just one of the plethora of trading options available on such sites.

Likewise, it is possible to segregate crypto chart platforms based on the range of data sets or crypto index provided. Note that some platforms might prefer to focus on peripheral data sets. On the other hand, some websites offer an extensive range of data, which you can use to create a more in-depth visualization of market trends.

Also, there are various types of market indicators made available to users. As per our differentiating model, some crypto chart websites offer multiple market indicators to users. Some limit traders to one or two indicators, which could stifle the efficacy of technical analysis carried out on cryptocurrencies. However, note that the more the tools and options available on the platform, the less probable it is for new entrants to find it easy to utilize the website.

Having discussed the benefits and differentiating factors of crypto chart websites, how then can traders and analysts determine the best charts for cryptocurrency?

What Are the Factors to Consider When Choosing A Crypto Chart Website?

Although there are several things to consider when looking to identify the best crypto chart websites, however, for this guide, we have highlighted the most integral ones. These factors include:

The Range of Cryptocurrencies Supported

There are over 3,000 cryptocurrencies and tokens traded in the crypto market. And chances are the crypto chart website you are considering will only provide stats and data for a fraction of the digital assets available in the market. Hence, it is up to you to research the number of cryptocurrencies supported and determine if it encapsulates the scope of the research or crypto chart analysis you intend to carry out. Likewise, you should ensure that the list of crypto supported includes all of the digital assets in your portfolio. It is not worthwhile to adopt a cryptocurrency chart website that can not provide data sets for cryptocurrencies that are critical to you.

The Range of Data Sets Available for Each Cryptocurrency

After you must have verified that the crypto charts you are reviewing have data sets for your chosen cryptocurrencies, it is advisable to assess the metrics and market parameters logged for each cryptocurrency. It is preferable to opt for crypto chart websites with an extensive range of metrics, which will help you perform flexible analysis. Similarly, a comprehensive price index for cryptocurrencies offers users a vantage outlook of the economic states of digital assets.

The Niche of The Chart Website

As mentioned earlier when discussing the differentiating factors of crypto chart websites, some chart websites cater to the cryptocurrency market while others encompass a broad array of trading niche. In light of this, you ought to decide whether you are comfortable with adopting a chart system restricted to crypto indexes or opting for one that allows you to switch trading options effortlessly. We suggest that traders strictly trading cryptocurrency to go for crypto chart websites. On the other hand, multi-trading niche charting systems are the ideal choices for traders participating in multiple markets.

With the ability to switch between different charting systems, traders do not have to register on multiple chart websites before they can access charting tools suitable for all of the markets they engage with. However, in this case, you should ensure that the section dedicated to crypto technical analysis is as good as the charting systems of websites solely catering to the crypto niche. On the downside, choosing multi-market charting websites might limit you to tools compatible with popular coins alone.

The User and Mobile-Friendliness of The Crypto Chart Website

There is no doubt that analyzing charts and exploring statistics come with complexities, which often deter less-experienced traders. As such, crypto chart websites ought to try as much as possible to enable a platform that improves user experience. Incorporating a simple design and an aesthetically-pleasing interface will help users focus on the task at hand. This framework is more ideal, particularly for websites that house as much information and data as crypto chart sites.

Another important detail to consider when exploring the user-friendliness of chart websites is the availability of tutorial resources depicting how to go about utilizing the various functions provided on the site. It is advisable to choose crypto chart websites that have blog sections where you can access articles explaining complex processes relating to charting tools.

Also, ensure that the crypto chart platform of your choice does not implement ad policies that might stifle your activities. Here, it is imperative to ascertain that the ads on the website do not come in the way of your technical analysis. More importantly, viable crypto chart websites either adopt mobile-friendly designs or provide mobile apps to allow users to access charting tools on the go. Thus, we suggest that you only opt for crypto chart platforms compatible with mobile device interfaces or have well-functioning apps to enable accessibility.

The Customer Support System

Once you are okay with the user experience of the crypto chart website under review, you should assess its customer support culture. This review is important because it showcases the service provider’s propensity to deliver premium customer support mechanisms. Here, we suggest that you adopt websites with 24/7 customer service support and different channels for logging one’s complaints and feedback. The availability of this will determine how quickly you will access solutions to issues relating to processes involved in utilizing one or two charting tools.

The Fees Policy of The Chart Website

Not all chart websites offer free services. Some have monetized their platform through the segmentation of charting services into tiered-subscription plans. Hence, these websites might allow users to enjoy specific charting services for free but will classify some tools under premium packages accessible only to paying clients. In light of this, we suggest that you take the time to explore the subscription plans and fees policy of chart websites beforehand. By doing so, you can prevent yourself from registering for exorbitant subscription plans or choosing a package that does not suit your charting needs.

To ensure that you are not being shortchanged, we advise that you consider the fee policies of similar websites and determine its conformity with market standards. Also, check the payment options accepted on the website. Ensure that your preferred method appears on the site, especially if you intend to pay with crypto.

Alerts and Notifications

The essence of adopting a majority of charting websites lies in their capacity to alert you whenever market trends match pre-configured data or stats. As such, it is imperative to ascertain that the crypto chart website on your radar has quality alert systems, which include various channels of notifying you of market movements. While researching the availability of quality notification systems, ensure that the site supports email alerts, in-app alerts, SMS alerts, or any other notification channel that you prefer.

The Accuracy of The Website

Since crypto charting requires the logging of live data from the volatile crypto market, it is, therefore, vital to verify that the crypto chart website you eventually choose relies on accurate data. Needless to say, the accuracy of the data logged on the website has an integral bearing on the quality of signals generated with its charting tools. Apart from accuracy, it is also advisable to check that you access real-time stat figures and visual representations.

The Security of The Crypto Chart Website

Some chart websites sync with crypto exchanges and allow users to enter trades directly through APIs. While this in itself is a good feature, it, however, exposes users to a lot of risks. Hence, you ought to do security-based research on chart websites that provide this feature or those that require you to submit private data. We suggest that you assess the encryption protocols and security measures adopted to protect the privacy of users.

How Did Cryptolinks Research Its List of The Best Crypto Chart Websites?

Knowing fully well that the crypto chart niche is littered with options, we at Cryptolinks have, therefore, highlighted the best cryptocurrency charts. To achieve this daunting task, we adopted the recommendations listed in this guide and utilized an organic research methodology. First, we identified the range of data sets available for each supported cryptocurrency. Then we verified the user experience of the crypto chart websites reviewed. In this section, we ensured that they are user and mobile-friendly.

Thereafter, we explored and compared the customer support system as well as the fee policies of each website. Next, we assessed their notification systems and determined the accuracy of the data on which the platforms base their charts and stats. In the end, we found 39 crypto chart websites good enough to feature on the Cryptolinks website. We suggest that you take the time to peruse the review articles below before making a definite choice.