Best Crypto Mining Calculators (2026) – Profitability, Fees & Electricity

Everything You Need to Know About Cryptocurrency and Bitcoin Mining Calculators

Ever thought about starting your Bitcoin mining journey but stopped short because it seemed too complex? Maybe you're worried about those hefty electricity bills or investing in hardware that might not even pay off. Honestly, you're not alone – this is the first big hurdle for anyone thinking of mining cryptocurrency.

Here’s the deal: Bitcoin mining isn’t magic, but it does require doing some pretty serious math in the background. Don’t worry though—you won’t need to sit there crunching numbers or following complex formulas on a piece of paper. That’s where cryptocurrency and Bitcoin mining calculators come in, and they could save you from a lot of frustration (and cash). Let me break it down!

What’s confusing about Bitcoin mining and calculations

If you’re wondering what exactly miners are doing when they’re “mining” Bitcoin, welcome to the club. A quick online search about mining calculators often leads to a flood of unfamiliar terms like "hash rate," "mining difficulty," and "electricity costs." It can feel almost alien, right?

Let’s face it—nobody gets excited about math unless they’re already a wizard with numbers. Bitcoin mining calculations can feel confusing because they involve figuring out how variable costs like electricity and mining performance impact profit. On top of that, there’s mining difficulty, which is always changing, and that can make predicting your earnings tricky without the right tools in place.

The problem miners face

Imagine this: you spend a hefty amount to buy a top-tier mining rig, and you're raring to start your setup. But hold on... how do you actually know if you’ll make money? Will your monthly profits exceed your electricity bill? And what about future changes in Bitcoin’s price or mining difficulty?

Guesswork can lead to losses, which is why understanding those numbers upfront is so important. A lot of hopeful miners underestimate the complexity, and many jump in without a clear picture of which variables will determine their success. Spoiler alert: it’s not just about setting up a powerful machine.

The solution you’ve been looking for

Here’s some good news: you don’t need to be a financial analyst or a math nerd to figure out profitability. Bitcoin mining calculators solve this problem for you. These tools crunch the numbers, analyze the variables, and present the results in a way that anyone can understand.

- Got a hash rate? The calculator helps you figure out how fast your rig processes calculations.

- Not sure about electricity costs? Input your local rates, and the calculator handles the rest.

- Want to know your ROI? These tools give you estimates on potential earnings versus expenses.

Think of them as the GPS for cryptocurrency mining—they give you a clear direction instead of leaving you guessing.

Why this post matters

Let’s face it: mining isn’t something you can just “wing” anymore. With Bitcoin mining getting more competitive and costs constantly fluctuating, tools like calculators and other stat trackers are a must-have for success. Whether you’re planning to dabble in mining or put together a full-on farm, knowing how these calculators work will make all the difference between profits and losses.

So, how does Bitcoin mining actually work? What's being calculated behind the scenes that makes these tools so essential? Stick with me—we’re about to find out in the next part. Trust me, it’s worth understanding.

What is Bitcoin mining, and what are miners actually calculating?

So, let’s talk about what actually happens in Bitcoin mining. Most people hear “mining” and immediately think of pickaxes or digging gold out of the ground. But honestly, Bitcoin mining is nothing like that—it’s all about solving incredibly complex math puzzles. Yes, actual math... the brain-bending kind.

Now, why puzzles? Because Bitcoin relies on something called a proof-of-work system. Simply put, miners use computing power to crack a code, and that code is tied to processing Bitcoin transactions. Without miners, transactions wouldn’t be verified, and the whole Bitcoin network would collapse. Sounds essential, right?

The basics of Bitcoin mining

Imagine this: you’re trying to guess a password—but this isn’t your average password. With Bitcoin, it’s a cryptographic puzzle based on the SHA-256 hash function (just a fancy way to say it’s ridiculously complex). Miners compete to find this "winning hash," and the winner gets to add a new block of transactions to the Bitcoin blockchain.

For example, the miner doesn’t guess words or letters. Instead, computers generate trillions of “guesses” per second until one matches the required format. This “guess” is the magic key. And when you hear about mining machines being powerful, what that really means is they’re designed to make guesses insanely fast.

What’s with all the math?

Here’s the kicker—it’s not like miners solve equations for fun. They’re racing the clock because the work is essentially a competition. The Bitcoin network sets a target: miners need to find a hash (a very long string of numbers and letters) that’s lower than this target. But the tricky part? It’s impossible to predict the correct hash. Every guess is random.

Let’s break it down for a moment: think of a mining rig as a supercharged calculator running 24/7. The more powerful the setup, the more guesses it can produce—and the better the odds of hitting that golden number.

Here’s a fun fact to blow your mind: one mining machine can generate up to 100 trillion guesses in a single second! That’s how competitive this game gets.

Why all this effort?

This is the question everyone asks: why are people willing to spend so much to solve these puzzles? The answer lies in Bitcoin rewards. Every time a block is successfully mined, a miner (or a mining pool) earns Bitcoin as a reward. But here’s the catch—it’s not free money.

Mining rigs are power-hungry monsters. Depending on where you live, electricity costs alone can bleed your profits dry. For instance, in the US, mining with inefficient hardware could cost $0.09–$0.15 per kWh. In some cases, you'd spend more on power than you’d actually make in Bitcoin. That’s why calculators *and* careful planning are crucial.

“Success is where preparation and opportunity meet.” – Bobby Unser

You see, Bitcoin mining isn’t just about purchasing hardware and letting it run. There's strategy involved—balancing expenses like energy costs, estimating profitability based on difficulty rates, and deciding if it's worth the long-term risks. That’s where tools and insights come into play. If the math behind mining stresses you out, hang tight. Curious how mining calculators simplify this madness? Let me show you in the next section.

Why Use a Bitcoin/Crypto Mining Calculator?

Let’s be real—Bitcoin mining can feel like stepping into another dimension. When I first heard about it, it all sounded like magic: cryptographic puzzles, hash rates, mining pools. But when money's on the line, "guessing" if mining will be worth it isn't exactly a solid strategy. This is where Bitcoin and crypto mining calculators become your best friend. These tools take the uncertainty out of the game, giving you a clear glimpse of what lies ahead.

Predict Mining Profitability

Understanding profitability is the number one reason to use a mining calculator. Whether you’re running one rig in your garage or planning a semi-pro operation, these calculators show you the potential rewards of your setup based on critical factors:

- Hash rate: How powerful your mining equipment is.

- Electricity costs: The rate you’re paying for power in your area.

- Mining difficulty: How hard the Bitcoin network currently is to crack.

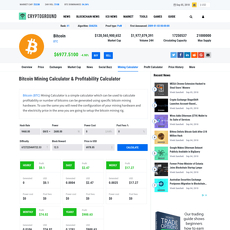

For example, let’s say you’re using an Antminer S19 Pro, which offers a hash rate of around 110 TH/s and consumes ~3250W. If your electricity rate is $0.12 per kWh and you mine under today’s network difficulty, tools like CryptoCompare will show your earnings, minus expenses. Whether you’re breaking even or seeing solid profits, the calculator does the heavy lifting so you don't have to.

No Guesswork Needed

Before mining calculators existed, miners like you and me had to crunch numbers manually—guessing all the way. Gone are those days. A mining calculator works like a cheat sheet, handing you accurate data so you know what you're signing up for before you invest in hardware, cooling systems, or deal with skyrocketing electricity bills. It’s like asking yourself, "Would I take a job without knowing its salary?" Of course not.

There’s a famous quote that says:

“In God we trust, all others must bring data.”

And trust me, in crypto mining, data is king. These calculators are your way of knowing exactly what the deal is, long before you plug in anything.

The Data Miners Live For

What truly sets mining calculators apart isn’t just the profit estimates but the in-depth stats they provide to help guide your decisions. You can see:

- Current Bitcoin price: It fluctuates, and these tools update pricing in real time.

- Difficulty levels: They reflect how competitive mining currently is.

- Block rewards: So you know exactly how much Bitcoin you'll potentially receive per block mined.

If you’ve ever wondered, “What if I switch to a different mining rig or tweak my setup?” these calculators provide the insights you need to test scenarios and make smarter choices.

So here’s the big question: How do you actually use one of these bad boys to optimize your mining strategy? Don’t worry, I’ve got you covered. Let’s get into that next...

How to Use Mining Calculators Like a Pro

Let’s be honest—cryptocurrency mining can feel like venturing into a complicated maze. But with the right tools, like mining calculators, it doesn’t have to be so intimidating. These tools are designed to make your life easier, but only if you know how to use them right. So, let’s unravel the mystery step by step. Trust me, it’s simpler than you think.

Input Your Key Data

First things first, your mining calculator is only as good as the information you feed it. Here’s the type of data you’ll need to input:

- Hash Rate: This is your mining hardware’s speed or performance. For example, the Antminer S19 Pro has a hash rate of 110 TH/s. Knowing this helps estimate how many calculations your rig can handle every second.

- Power Consumption: Every mining rig consumes electricity. For instance, that same Antminer S19 Pro uses about 3250 watts. Without adding this to the equation, your profits might look unrealistically good.

- Electricity Costs: What’s your local electricity rate per kilowatt-hour (kWh)? If you’re in Texas, it might cost you roughly $0.12/kWh, while someone mining in Venezuela pays significantly less. This is a deal-breaker in calculating profitability.

- Mining Pool Fees: If you’re mining through a pool (and most miners do), the pool will take a small percentage as fees—usually around 1%-3% of your earnings.

When you plug these numbers into a mining calculator, it does the math for you, saving you hours of head-scratching and incorrect guesses.

Get Results Instantly

Once you've added all your details, the calculator will spit out numbers that tell you exactly what to expect. Ever wondered how much you could make daily, weekly, or monthly? This is where you'll find out. Not only that, but these tools also give you an idea of when you’ll break even—how long it’ll take to recover the cost of machines and electricity. Pro miners know this is crucial before making any investments.

For example, if your rig costs $5,000 and your calculator tells you it’ll take nine months to recover that cost, you’ll know whether it’s worth jumping in—or if you need better hardware or cheaper electricity first.

Find the Calculator That Works for You

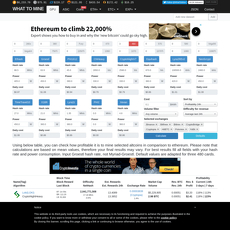

Not all mining calculators are created equal, and testing a few can go a long way in giving you a better sense of control. Here are a few great options to check out:

- CryptoCompare: This one’s super user-friendly. In addition to profitability, it shows real-time prices and block rewards.

- NiceHash Calculator: Tailored for miners using NiceHash’s services, but works well for others too.

- WhatToMine: Perfect if you’re into GPU mining or want to compare different coins—not just Bitcoin.

Here’s an important tip: use at least two or three different calculators with the same data. Why? Because each platform uses its own underlying assumptions about mining difficulty and network changes. Comparing results helps you see a clearer picture of your potential earnings.

“Knowledge is power, and with mining calculators, you take control of your mining game before spending a single cent.”

Now that you’ve got your calculator running and your results in hand, you’re halfway to becoming a more confident miner. But what about keeping track of your mining performance and the ever-changing network stats? Can you spot inefficiencies before they drain your wallet? There's more to uncover just around the corner—let’s check out some must-know statistic tools that’ll level up your game.

Spotlight on Mining Statistics Tools

Alright, let’s talk about something that goes hand in hand with mining calculators but takes it a step further—mining statistics tools. If you’ve ever wondered whether your mining setup is working as efficiently as it could, or if you’re curious about how the global mining landscape is shifting, these tools are exactly what you need.

Keeping It Efficient

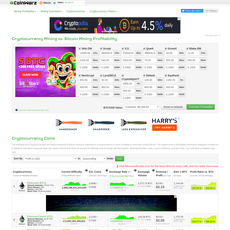

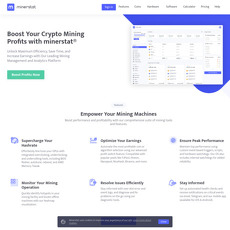

No one wants their mining rigs overheating, underperforming, or worse, wasting precious energy. Tools like Minerstat and Hive OS can change the game here. They don’t just track performance—they dissect it. You’ll know if your GPUs or ASICs are maxed out or underutilized, giving you the chance to make adjustments before you start losing money.

For example, Minerstat offers real-time updates on temperatures, fan speeds, and energy consumption. Ever feel like your rig isn’t pulling its weight? This tool will tell you exactly where the problem lies, so you can fix it fast. Think of it as a doctor’s checkup, but for your mining hardware.

“You can’t manage what you don’t measure.” Keeping your equipment optimized is not just smart—it’s essential for profitability.

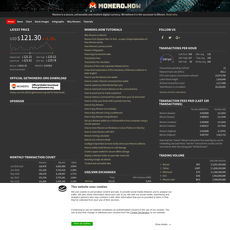

Track Global Mining Stats

Beyond your own setup, wouldn’t it be cool to have your finger on the industry’s pulse? If you’re keeping an eye on Bitcoin mining trends like difficulty levels or hash rate movements, tools like oxt.me or miningpoolstats.stream are perfect companions.

Want a real-world example? Say you’re mining Bitcoin, and suddenly difficulty spikes. A quick glance at these tools will show you how the network is trending. Maybe it’s time to rethink your strategy or switch to a different cryptocurrency with a better profitability margin. These stats, provided in real time, save you from blindly guessing your next move.

Compare Mining Rigs

Ever felt overwhelmed by all the hardware options out there? ASICs, GPUs, and so many different brands—it’s enough to make anyone freeze. Luckily, some stat tools allow you to compare mining rigs side-by-side. You can see details like hash rates, power efficiency, and costs, which helps you figure out which one gives you the best bang for your buck.

As an example, let’s say you’re stuck between an Antminer S19 Pro and a Whatsminer M30S++. These tools let you stack the two models against each other, breaking down everything from their raw output to energy consumption. It’s a great way to dodge buyer’s remorse and make sure your investment pays off.

But here’s the kicker—how do you handle the unpredictable factors that even these tools can’t foresee? How do you deal with something like fluctuating Bitcoin prices slashing your revenue? Let’s figure that out next.

Common Challenges in Mining Calculations

Let’s face it—mining can feel like trying to run on a treadmill that keeps speeding up, and while calculators might be your secret weapon, they’re not perfect. There are some real-world hurdles you need to watch out for. Ignoring them? That’s the fast track to frustration.

Fluctuating Bitcoin Prices

One of the trickiest parts of mining is the rollercoaster ride of Bitcoin prices. A calculator might say your setup is making $10 a day, but what if Bitcoin’s price drops by 20% next week? It’s entirely possible because cryptocurrency markets are notoriously unpredictable. "The unpredictability of Bitcoin is its charm and its curse," as the saying goes.

For example, in December 2017, Bitcoin prices skyrocketed to nearly $20,000. Who wouldn’t want to mine then? But fast forward to early 2018, and the value plummeted to under $7,000. If you’d invested heavily based on the high price, you could’ve felt the financial whiplash. Keep this in mind as you run your calculations. These tools project possibilities, not guarantees.

Rising Difficulty Levels

Have you heard the phrase, "The harder the game, the better the reward?” That’s Bitcoin mining in a nutshell. As more miners enter the network, it gets tougher to crack each block—and this increase in mining difficulty is something no calculator can predict.

Think of it like this: Today, your hardware might be doing a stellar job mining blocks. But six months down the road, if the network’s difficulty has surged, your once-reliable setup might be crawling instead of running. It’s why continuous upgrades and staying updated on trends are essential for long-term success in mining.

Overlooked Costs

Here’s a little secret even experienced miners sometimes ignore: costs don’t stop at electricity bills. Your mining rig doesn’t run on dreams—it heats up, wears out, and needs cooling and occasional repairs. And don’t forget about depreciation. That shiny new miner you bought at $3,000 won’t hold its value forever.

I’ve seen too many beginners get carried away by their calculator's projected profits, only to realize later they’re spending hundreds each month on cooling fans or replacing dying GPUs. For context, some studies estimate that cooling alone can add 20% to your overall energy costs. That’s huge, right?

What About the "Hidden Unknowns"?

The reality is, mining calculators are an amazing starting point but not a crystal ball. They don’t know what Bitcoin’s price will be next month. They can’t predict if mining difficulty will double next year. And they certainly won’t warn you to include those sneaky little extras in your budget.

So, how can you outsmart these challenges? Is there a way to make mining calculations smarter, or maybe tools that go even deeper? Keep reading—I’ve got something interesting waiting for you in the next section that just might surprise you.

Resources for Better Mining Insights

If you’re serious about Bitcoin or crypto mining, then you already know there's a lot to keep track of. Profits, expenses, network stats—it's a full-time gig just managing all that data. That’s why having the right resources at hand is not optional; it’s essential. Let me show you a few tools I rely on to keep my mining game on point.

Mining Calculators That Actually Work

Let’s face it—shooting in the dark with mining can burn your wallet faster than any blockchain's speed. These calculators are here to give you clarity:

- CryptoCompare: A must-have for miners who want detailed profitability reports. Just enter your hardware, power consumption, and electricity costs, and it spits out everything you need to know.

- NiceHash Calculator: Perfect if you’re exploring multiple mining algorithms and want to compare earnings potential in real-time. Bonus feature? It’s incredibly beginner-friendly.

- WhatToMine: A favorite for GPU and ASIC miners. Plug in your setup, hit calculate, and see which coins are most profitable to mine right now.

These tools feel like having a GPS for mining—who wouldn’t want that kind of direction?

“In mining, knowledge outweighs hardware. Use the tools; leave less to chance.”

Performance and Stat Tracking That Saves the Day

Mining stats are like a miner’s heartbeat. You can’t afford NOT to track them. And when it comes to tracking tools, these are the heavy hitters:

- Minerstat: Think of it as a productivity dashboard for your mining rigs. It pinpoints inefficiencies, monitors temperatures, and even tells you when something’s off. If staying efficient is your goal, Minerstat is like your personal coach.

- Hashrate.no: This one’s all about giving you hash rate trends and rig profitability insights. It’s a great way to see if any changes in the market or network affect your setup.

- MiningPoolStats.stream: Curious about pool statistics or global mining trends? Boom, here’s your answer. It’s an essential website for understanding the broader mining ecosystem.

Imagine trying to mine without knowing if your setup is performing at 100%. That’s like driving a car with no speedometer. These tools make sure you’re not just mining harder, but smarter.

Your All-in-One Toolkit for Mining Insights

With these resources, you can cut through the crypto chaos and find clarity. They aren’t just for tech pros—they’re designed for anyone who wants to make informed decisions. And honestly? They’re lifesavers when you’re constantly chasing profitability in a game with rapidly moving parts.

Now, here’s something to think about: Is all this enough to make Bitcoin mining a profitable venture in 2024? What’s the real secret sauce that separates winners from the rest? Stick around—you’ll find out in the next section.

Should you get into Bitcoin mining in 2024?

Let’s face it—Bitcoin mining isn’t what it used to be. There was a time when you could set up your rig in your basement, let it chug away, and rake in the rewards. But now? The game has changed. Massive players with super-efficient equipment dominate the space. Still, that doesn’t mean the door is completely closed for smaller miners like you and me. The big question is: should you even bother mining Bitcoin in 2024? Let’s break it down.

The cost factor

First things first: mining isn’t cheap. Between hardware, electricity, cooling, and other operational costs, it can add up fast. Miners operating mega farms benefit from economies of scale—they invest in bulk hardware deals and often find ways to access discounted electricity.

But don’t get discouraged just yet. If you live in a place with cheap electricity or renewable energy sources, this could work in your favor. For example, miners in places like Iceland and parts of Canada rely on renewable hydro or geothermal energy. Consider whether you can keep electricity costs below $0.05 per kWh, which is often the ideal threshold to make things worthwhile for smaller setups.

Passive or professional?

Deciding whether to mine as a casual side hustle or go all-in is key. If you’re looking to just test the waters, a single GPU or small ASIC rig could be enough. This approach is more about learning the ropes and earning small rewards while minimizing upfront costs.

On the other hand, if you’re seriously considering scaling up to a professional operation, get ready for major investments. ASIC miners like the Antminer S19 XP are currently among the best in terms of energy efficiency, but they aren’t cheap. You'll also need to factor in the potential costs of cooling systems and space to house your rigs. It's not just about power—it’s about managing heat and maximizing uptime.

Whatever route you choose, tools like CryptoCompare's calculator here or MiningPoolStats here can give better clarity on what kind of setup pays off in today’s market.

Risks involved

Here’s the part many beginners overlook: Bitcoin’s price and mining network difficulty are constantly changing. Sure, the calculators can crunch today’s numbers, but they can’t predict next month’s market conditions. What happens if the price of Bitcoin drops significantly before you break even? It’s a harsh reality, but it’s something you must prepare for.

Then there’s the rising mining difficulty. Every time more miners join the network or powerful rigs come online, the difficulty increases. This forces your current setup to work even harder, which can shrink your profits unless you upgrade your hardware consistently. On top of that, don’t forget hidden costs like maintenance, cooling, and even hardware breakdowns. These aren't dealbreakers, but knowing the risks upfront can help you approach mining with realistic expectations.

Of course, all this begs the question: how do you stack up against the competition in such a cutthroat environment? And more importantly, is there a winning formula for making mining profitable? *Stick around—there’s more to this story as we explore the tools and strategies that can give you the edge.*

Wrapping it Up: Your Crypto Mining Toolkit

Let’s be real—crypto mining can feel like stepping into a maze with hidden traps. On one side, there’s the promise of profits, while on the other, unexpected costs and fluctuating conditions can ruin the game. That’s why having the right kit isn’t just helpful—it’s downright essential. Trust me, I’ve been down this road before, and the difference between “just mining” and “mining smart” is massive.

Take Action Today

If you’re serious about mining, don’t let “what ifs” hold you back. Run the numbers. Use a tool like CryptoCompare or NiceHash Calculator to figure out your potential profits based on the hardware you’re eyeing, your power costs, and other key factors. It only takes a few minutes to do, but the impact on your decision-making? Huge.

For example, let’s say you have a rig capable of 100 TH/s and are paying $0.10/kWh for electricity. A mining calculator will tell you exactly how much Bitcoin you could earn in a day, a week, or a month—minus expenses. It’ll even give you insights into your breakeven point, so you know how long it’ll take to pay off your investment. That’s powerful data, and it’s right there waiting for you to use.

Conclusion: Stay Informed and Stay Profitable

Mining isn’t what it used to be when people could set up their gaming PCs and rake in Bitcoin. Nowadays, the stakes are higher, and so are the costs. But here’s the thing—it can still be worth it, if you’re smart about it. Tools like Minerstat or MiningPoolStats don’t just simplify calculations; they give you the edge you need to adapt to changes and maximize your results.

Whatever stage you’re at, whether you’re planning to buy a rig or you’ve already got one humming away, the rule is simple: stay informed. The combination of mining calculators, real-time stats, and efficient tracking tools is like having a top-tier GPS for your crypto journey. It cuts through the fog, pointing you in the right direction every step of the way.

So, here’s my advice: don’t just hope for the best. Use the tools, crunch the numbers, and build a strategy that works for your unique situation. The mining game isn’t just for the daring—it’s for the prepared. And if you’re prepared, the rewards can be oh-so-sweet.