BRC-20 Tokens Explained (Bitcoin Ordinals) (2026)

BRC-20 Explained

Let me break it down for you. BRC-20, also known as Bitcoin Request for Comment 20, is like the cool cousin of ERC-20 (Ethereum Request for Comment 20). Our mysterious developer friend, Domo, introduced it in March 2023. Think of BRC-20 as Bitcoin's own version of ERC-20, but with a few differences (no smart contracts, my friend).

Now, here's an interesting fact: Unlike Bitcoin's BIP process for changes, there haven't been any other "BRC" numbers. It's all about Bitcoin Improvement Proposals, you know? So forget about BRC-1 or BRC-2.

Let's talk about ERC-20. It's the Ethereum token standard that lets developers create tokens that work seamlessly within the Ethereum network. These tokens can represent all sorts of assets and rights, like ownership interests or access rights. You might even be surprised to know that popular cryptocurrencies like Tether and Shibu Inu coin are actually ERC-20 tokens in disguise.

Our buddy BRC-20 takes inspiration from ERC-20, thanks to Bitcoin's Taproot upgrade in November 2021. This upgrade introduced ordinal inscriptions, the fancy tech stuff that makes BRC-20 tokens possible.

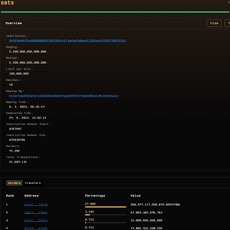

Here's the deal: Ordinals assign a unique serial number to a tiny unit of bitcoin called a satoshi. This serial number, along with the ordinal's data, is tucked into the witness signature field of a bitcoin transaction. It's like a secret code that verifies ownership and prevents double spending. Sneaky, huh?

But hold on, not all ordinals are BRC-20 tokens, my friend. That's why we have millions of ordinals but only around 14,000 BRC-20 tokens. BRC-20 tokens make use of JSON ordinals inscriptions to get things rolling. They're not as fancy as smart contracts yet, but they can create and move tokens around.

Now, let's get real. BRC-20 is still in its early stages, so its functionality is pretty limited compared to ERC-20. For now, you can only mint, deploy, and transfer tokens. Keep that in mind.

Oh, and there are a few differences between BRC-20 and ERC-20. Unlike ERC-20, BRC-20 isn't officially approved yet—it's still in the proposal phase, my friend. And guess what? BRC-20 tokens aren't as easily tradable on exchanges right now. But hey, the future holds great things for BRC-20!

BRC-20 tokens and how they impact Bitcoin fees and transactions

Fascinating world of BRC-20 tokens and how they impact Bitcoin fees and transactions. This is the inside scoop you've been waiting for, and I'll make sure it's SEO-optimized to dominate those search results!

Here's the deal: When it comes to BRC-20 tokens, things get a bit more complex compared to regular peer-to-peer transactions. Creating and transferring these tokens requires additional space on the blockchain. While a typical bitcoin transaction is measured in kilobytes, an ordinal inscription—where a BRC-20 token resides—can be as hefty as 4MB in size. That's right, we're talking about some serious blockchain real estate here!

Now, what sets an ordinal inscription apart from traditional non-fungible tokens (NFTs) on Ethereum and other blockchains? Well, with ordinals, all the data is stored directly on-chain. That means any images or token instructions embedded within the inscription become an integral part of the transaction itself. In contrast, traditional NFTs often only contain links or data pointing to external services where the artwork is stored. It's a whole new level of on-chain awesomeness!

But here's the catch: All this fancy inscription business increases the competition for block space, which can result in higher transaction fees. Users who want faster confirmation times might have to cough up more satoshis to get their transactions prioritized. Meanwhile, the mempool, the collective storage space for unconfirmed transactions, keeps growing larger and larger. In early May, it reached its peak, forcing some traders to employ a nifty trick called "replace-by-fee." They basically bid to replace an existing unconfirmed transaction with a new version that offers nodes a higher transaction fee. Smart move, right?

Even Binance, a major player in the crypto world, faced a couple of withdrawal pauses during this peak. The reason? Their usual transaction fees didn't align with the fees required to get their transactions picked up by the blockchain. It's all about finding that fee sweet spot, my friends!

Now, let's talk about those transaction fees. They go to the nodes on the blockchain, usually the miners, who facilitate the transactions. Think of it as a supply-and-demand situation. Nodes are a fixed resource, and the demand for their time can fluctuate. As demand increases, fees rise accordingly. These nodes are the backbone of Bitcoin's blockchain, and they need incentives to keep doing their thing. That's where block rewards and transaction fees come into play—motivating the nodes to keep the blockchain running smoothly.

Now, why are BRC-20s causing a stir?

Well, there are two main reasons that have sparked some controversy in the crypto community. First, these tokens and ordinals have been accused of clogging up the network and driving up fees. Some folks aren't thrilled about that, let me tell you. But wait, there's more!

The second objection raised by certain individuals is that BRC-20 tokens and ordinals "pollute" the blockchain. You see, some argue that these additions don't align with Satoshi's original vision of a peer-to-peer system for transferring money. According to the Bitcoin maximalists, anything other than pure, simple transactions is seen as an inappropriate use of the Bitcoin blockchain. Controversial, right?

Now, let's talk about the technical side. Unlike NFTs on Ethereum that store files on external servers, Bitcoin's ordinal NFTs take a different approach. They pack the entire data file within the witness signature field of Bitcoin transactions, ensuring that all information resides directly on the blockchain. This design makes them more immutable compared to other NFTs, which enhances the integrity of the assets. But there's a trade-off, my friends—they can be quite large. We're talking really large here.

In fact, Bitcoin Core developer Luke Dashjr sees ordinals as an "attack" on Bitcoin due to the congestion caused by these large file sizes. Some folks share his concerns, no doubt about it. However, let's not forget that miners, who have faced challenges during the bear market, are reaping benefits from the BRC-20 boom.

As ex-Kraken executive and long-time Bitcoiner Dan Held tweeted, "Ordinals = NFTs on Bitcoin. This is good for Bitcoin." There's excitement in the air, my friends! Some Bitcoin miners are actually earning more from processing transactions on the blockchain than from mining new BTC—a shift attributed in part to BRC-20 tokens and ordinals. Talk about a turnaround!

Analysts I've spoken with believe that this development could potentially offset the decreasing profitability of Bitcoin mining due to the planned halving of mining rewards. It's a positive twist in the story, wouldn't you say? Even MicroStrategy's Michael Saylor shared his enthusiasm, stating in an interview that ordinals and NFTs have taken us from a bearish scenario to a bullish one. Miners must be ecstatic!

And you know what? Noted Bitcoiner Nic Carter shares a similar view. In an op-ed for CoinDesk, he expressed being "heartened" by the newfound demand for block space that ordinals have unlocked. According to him, miners need to be compensated somehow, and as the miner subsidy dwindles, fees will have to make up for the lost revenue. It's all about finding that balance, my friends!

Overall conclusion on BRC-20 Tokens

The introduction of these tokens and ordinals has ignited debates surrounding network congestion, rising fees, and the perceived "pollution" of the blockchain. Bitcoin maximalists argue that these additions deviate from Satoshi's original vision, casting doubt on their appropriateness within the Bitcoin ecosystem.

On the technical front, the immutability and on-chain storage of ordinal NFTs are both praised and criticized. While some appreciate the enhanced integrity of assets, others view the large file sizes as an attack on the Bitcoin network, leading to congestion concerns.

Amidst these debates, it is worth noting the positive impact BRC-20 tokens and ordinals have had on miners. The shift towards transaction processing becoming more profitable than mining itself has breathed new life into the industry, offering a glimmer of hope for miners during a bear market.

Ultimately, the future of BRC-20 tokens remains uncertain. As the Bitcoin community grapples with the delicate balance between innovation and adherence to the core principles of the network, it is clear that further discussions and adjustments are needed.

Stay informed and navigate the ever-evolving crypto landscape with critical thinking and an open mind. Only by embracing constructive dialogue can we drive the industry forward and shape a future that aligns with the values of decentralization, security, and inclusivity.

Remember, as the crypto space continues to evolve, it's crucial to stay informed, seek different perspectives, and make well-informed decisions. Keep exploring, my fellow crypto enthusiasts, and let's shape the future of digital finance together!