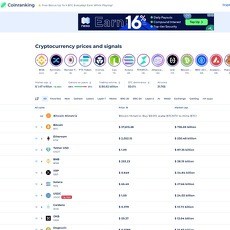

Best Crypto Price Trackers (2026) – Prices, Charts, Market Cap & Alerts

When it comes to the crypto market, volatility reigns supreme, even as startups continue to introduce new coins and list them on crypto exchanges. Therefore, tracking the activities of the crypto market has increasingly become humanly impossible. At best, all a trader can do is fixate on a coin or two and gather as much data that would help him or her make the right trade. However, for those that are particular about monitoring the entirety of the crypto market and forming perceptions based on a broader understanding of how the market works, crypto coin tracker are invaluable tools.

Crypto price trackers are essential tools for savvy investors who are looking to identify and invest in quality coins. Owing to the importance of these services, we at Cryptolinks have gone ahead to review the price tracking niche of the crypto industry, identify market standards, and handpick the best platforms availing such services. In this review guideline, we will introduce you to the concept of crypto price trackers, highlight their benefits, and outline some of the integral factors to look out for when looking to choose the best cryptocurrency price tracker.

Crypto price trackers are platforms that monitor the prices of cryptocurrencies available for trading on crypto exchanges. While this is the primary function of price trackers, we have, however, seen them take up more roles to ensure that their users are rightly informed. Hence, crypto price trackers now monitor the activities of crypto exchanges and avail tools that allow users to remain attuned to updates relating to the coins on their portfolio. And so, modern crypto price trackers have slowly established themselves as must-have tools for crypto participants.

As explained in the section above, crypto price trackers monitor the prices of cryptocurrencies and offer various metrics, which users can use to determine the viability of cryptocurrencies or current price movements. With the information garnered on the prices of cryptocurrencies, investors can make decisions as regards the right time to sell or buy digital assets.

While noting the correlation between market trends and the general outlook of the crypto exchange market, some crypto price trackers have gone the extra mile to incorporate exchange trackers as one of their core features. Thus, users do not just only have access to the information to determine the right trades to make, they also have the opportunity of researching the best place to execute such trades.

Ever wondered how successful traders almost always make profitable trades? The answer is that they don’t just focus on the current state of the market. Instead, they compare present price movements with historical data to give their technical analysis that all-important credibility. It is an amateur move to engage with the crypto market without considering the correlation between similar events and the plausibility of identical outcomes. In light of this, crypto price trackers provide the historical charts of each coin dating back to the moment the asset first became available for trading. This feature is useful for crypto researchers and analysts that tend to form ideologies based on the history of a coin or the crypto market as a whole.

In a bid to facilitate the above-outlined functions, top crypto price tracking websites incorporate several features and metrics that make it easier to interpret and gauge market trends. These features, as well as metrics, show where the market is, at the time of pooling data from different exchanges.

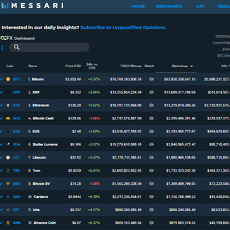

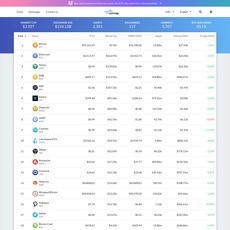

In most cases, the tracked value of a cryptocurrency’s market capitalization, circulating supply, daily trading volume, and current valuation is enough data to determine its performance. For one, the circulating supply of a cryptocurrency reveals the number of coins available in the crypto market. The market cap, on the other hand, is simply the valuation of the total circulating supply. Analyzing these metrics, and comparing them with the daily trading volume, makes it easier to identify when crypto holders are selling off or buying.

When it comes to assessing the viability of crypto exchanges, it is imperative to base your analysis on the liquidity and trading volume. Why is this so? The liquidity of a crypto exchange shows how easy or fast it is to execute trades without triggering a volatile change in the price of the asset. And so, examining liquidity provides ample information about the stability of crypto exchanges. On the other hand, trade volume is a metric that highlights the number of trades an exchange records through a given period. Together, liquidity and volume offer participants a broader view of the activities generated on each exchange. It is important to state here that volumes had initially served as the major metric for assessing exchange platforms’ performances. However, due to incessant cases of manipulations on the part of exchanges, price trackers have begun to see the validity of liquidity as the de facto crypto exchange metric.

As stated earlier in this guide, crypto price trackers provide the historical chart of each cryptocurrency listed on their websites. The essence of this move is to give users a chance of comparing past price movements with current trends, especially if there is a correlation between two events. Finding recurring themes is a great way of understanding how the market works, and the historical charts available on crypto price trackers is undoubtedly a great addition to the websites.

Besides, users can tweak charts to reflect recent price movements. For example, you can choose to focus on the last data that the bitcoin price tracker gathered in the past 7 days to analyze fluctuations and see how real-world events affect the price of bitcoin. Historical charts are vital tools for technical analysts, crypto pundits, and traders in general.

Having explained the fundamentals of crypto price-tracking websites, it is imperative to explore some of the factors that would help you pick the right one.

There are lots of crypto price tracking websites available in today’s expanding crypto space, and just a handful have what it takes to keep up with the fast-paced crypto market. Before adopting a crypto price tracker, the first thing you should do is check its accuracy. Here, you ought to ascertain the platform’s capacity to give you up-to-date figures, while doing away with errors and data manipulations. Note that the accuracy and promptness of the figures gotten from price trackers have significant bearings on your market analysis. You can’t base your technical analysis on wrong values and expect to arrive at quality signals. Hence, we advise that you take the time to assess the efficiency of price trackers before basing all your crypto activities on the data garnered from such platforms. That said, the viability of a price tracker depends on a plethora of factors, such as the efficacy of the platform’s algorithm and the number of exchanges it monitors.

Crypto price trackers house a lot of information. Therefore, it is standard that they fixate on user experience. In our list of top crypto price trackers, you will find that a majority of the sites on our list have opted for simple designs that make navigation a less complex. Then there is the issue with the site’s speed, which has a say on how fast you can access the information you need. Being able to access data on time without experience low loading speed is the very essence of adopting these platforms.

Apart from the loading speed, it is crucial to ascertain that your favorite crypto price tracker has infrastructures to ensure that you access the platform on the go. It is a plus if the tracker has a mobile app for android and iOS users. If this is not the case, then a mobile-friendly interface would do. In other words, try as much as possible to opt for the best crypto tracker with aesthetically-pleasing and intuitive interfaces that are compatible with any screen size. Needless to say, all these factors come together to determine the user experience of the website.

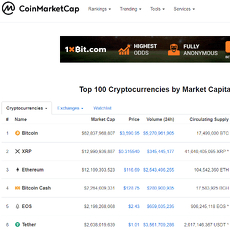

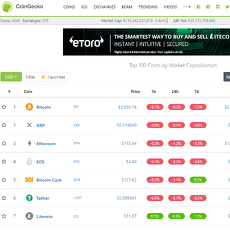

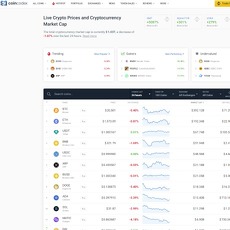

The crypto market is expanding at a frantic pace, and only a few price trackers have provided resources that encapsulate the scope of the market. A majority of price trackers tailor their services to the top 100 cryptocurrencies or majorly function as a btc price tracker, which might not bode well for investors. Savvy investors are constantly prowling the crypto landscape searching for undervalued digital assets or promising, but lowkey crypto projects. Therefore, limiting their search to the top 100 or 200 cryptocurrencies is not enough. They have to access the data of all the cryptocurrencies available in the market. As such, it is advisable to ensure that crypto price trackers support a broad array of cryptocurrencies.

In the same way, it is vital for crypto price trackers to cover the global crypto exchange market, instead of focusing on the popular ones. At times, you might need to incorporate lesser-known crypto exchanges to access more trading pair options. Thus, adopting a crypto price tracker with data regarding the performance of small exchanges is imperative.

Earlier in this guide, we extensively explained some of the metrics you will encounter on crypto price tracking sites. Note that each metric has its importance, and it is advisable to go for trackers with enough metrics to help you boost the efficiency of your analysis. Metrics, like circulating supply, market cap, and daily trading volume, are important. Moreover, it is preferable to rely on crypto price trackers, which have adopted liquidity as a metric to gauge the viability of crypto exchanges. Also, historical charts are another data analysis tool that you should consider. Ensure that the websites provide easy to interpret and full historical charts.

Crypto price trackers have evolved over the years, and this has multiplied the range of features available to users. So, it is common for a crypto market tracker to function as currency converter, crypto compare tool, and portfolio tracker. Regardless of the number of tools a price tracker has, be sure to check that they align with your crypto profession and impact your day-to-day activities.

We, at Cryptolinks, have decided to showcase the best performing crypto price tracking websites out there. We strived to establish the efficacy of this review by relying on an organic approach that explores all of the recommendations listed in this guide. As such, we had to determine the accuracy of each website, as we understand the importance of providing accurate data in a timely fashion. To do this, we assessed how long it took each platform to reflect the updated prices and data of cryptocurrencies.

Next, we analyzed the user experience. Here, we checked the design and its mobile-friendliness. While analyzing user experience, we did extra work to determine the load speed of each site, knowing fully well that speed is a prerequisite to offering users a smooth experience. Also, sites that were thoughtful enough to provide night mode interface scored high in this section of our research. The same is true for crypto price trackers with mobile apps.

After we had examined the user experience of each crypto price tracker, we factored the number of cryptocurrencies, as well as crypto exchanges, listed on the sites. Following the completion of this process, we assessed the metrics available on each, as it determined the relevance of the data logged on price trackers. More importantly, we took extra care to see if these platforms have begun to value the importance of liquidity as a useful metric to judge the efficacy of crypto exchanges. Lastly, we explored the array of tools found on each crypto tracking website and ensured that they are of real use to crypto participants.

In the end, we found 9 crypto price trackers that did well across all boards. We advise that you peruse the review of each platform mentioned in the list below before opting for one.

Crypto price trackers are essential tools for savvy investors who are looking to identify and invest in quality coins. Owing to the importance of these services, we at Cryptolinks have gone ahead to review the price tracking niche of the crypto industry, identify market standards, and handpick the best platforms availing such services. In this review guideline, we will introduce you to the concept of crypto price trackers, highlight their benefits, and outline some of the integral factors to look out for when looking to choose the best cryptocurrency price tracker.

What Are crypto coin tracker?

Crypto price trackers are platforms that monitor the prices of cryptocurrencies available for trading on crypto exchanges. While this is the primary function of price trackers, we have, however, seen them take up more roles to ensure that their users are rightly informed. Hence, crypto price trackers now monitor the activities of crypto exchanges and avail tools that allow users to remain attuned to updates relating to the coins on their portfolio. And so, modern crypto price trackers have slowly established themselves as must-have tools for crypto participants.

What Are the Popular Applications of Crypto Portfolio Trackers?

They Primarily Track Crypto Prices?

As explained in the section above, crypto price trackers monitor the prices of cryptocurrencies and offer various metrics, which users can use to determine the viability of cryptocurrencies or current price movements. With the information garnered on the prices of cryptocurrencies, investors can make decisions as regards the right time to sell or buy digital assets.

They Are Ideal Exchange Trackers

While noting the correlation between market trends and the general outlook of the crypto exchange market, some crypto price trackers have gone the extra mile to incorporate exchange trackers as one of their core features. Thus, users do not just only have access to the information to determine the right trades to make, they also have the opportunity of researching the best place to execute such trades.

They Avail Historical Performances of Cryptocurrencies

Ever wondered how successful traders almost always make profitable trades? The answer is that they don’t just focus on the current state of the market. Instead, they compare present price movements with historical data to give their technical analysis that all-important credibility. It is an amateur move to engage with the crypto market without considering the correlation between similar events and the plausibility of identical outcomes. In light of this, crypto price trackers provide the historical charts of each coin dating back to the moment the asset first became available for trading. This feature is useful for crypto researchers and analysts that tend to form ideologies based on the history of a coin or the crypto market as a whole.

What Are the Basic Components of a Crypto Price Tracking Website?

In a bid to facilitate the above-outlined functions, top crypto price tracking websites incorporate several features and metrics that make it easier to interpret and gauge market trends. These features, as well as metrics, show where the market is, at the time of pooling data from different exchanges.

The Market Cap, Circulating Supply, And the Price of The Cryptocurrency?

In most cases, the tracked value of a cryptocurrency’s market capitalization, circulating supply, daily trading volume, and current valuation is enough data to determine its performance. For one, the circulating supply of a cryptocurrency reveals the number of coins available in the crypto market. The market cap, on the other hand, is simply the valuation of the total circulating supply. Analyzing these metrics, and comparing them with the daily trading volume, makes it easier to identify when crypto holders are selling off or buying.

Liquidity and Market Volume

When it comes to assessing the viability of crypto exchanges, it is imperative to base your analysis on the liquidity and trading volume. Why is this so? The liquidity of a crypto exchange shows how easy or fast it is to execute trades without triggering a volatile change in the price of the asset. And so, examining liquidity provides ample information about the stability of crypto exchanges. On the other hand, trade volume is a metric that highlights the number of trades an exchange records through a given period. Together, liquidity and volume offer participants a broader view of the activities generated on each exchange. It is important to state here that volumes had initially served as the major metric for assessing exchange platforms’ performances. However, due to incessant cases of manipulations on the part of exchanges, price trackers have begun to see the validity of liquidity as the de facto crypto exchange metric.

Historical Charts

As stated earlier in this guide, crypto price trackers provide the historical chart of each cryptocurrency listed on their websites. The essence of this move is to give users a chance of comparing past price movements with current trends, especially if there is a correlation between two events. Finding recurring themes is a great way of understanding how the market works, and the historical charts available on crypto price trackers is undoubtedly a great addition to the websites.

Besides, users can tweak charts to reflect recent price movements. For example, you can choose to focus on the last data that the bitcoin price tracker gathered in the past 7 days to analyze fluctuations and see how real-world events affect the price of bitcoin. Historical charts are vital tools for technical analysts, crypto pundits, and traders in general.

What Are the Integral Factors to Consider Before Opting to Adopt A Crypto Price Tracker? ?

Having explained the fundamentals of crypto price-tracking websites, it is imperative to explore some of the factors that would help you pick the right one.

The Accuracy of The Price-Tracking Website

There are lots of crypto price tracking websites available in today’s expanding crypto space, and just a handful have what it takes to keep up with the fast-paced crypto market. Before adopting a crypto price tracker, the first thing you should do is check its accuracy. Here, you ought to ascertain the platform’s capacity to give you up-to-date figures, while doing away with errors and data manipulations. Note that the accuracy and promptness of the figures gotten from price trackers have significant bearings on your market analysis. You can’t base your technical analysis on wrong values and expect to arrive at quality signals. Hence, we advise that you take the time to assess the efficiency of price trackers before basing all your crypto activities on the data garnered from such platforms. That said, the viability of a price tracker depends on a plethora of factors, such as the efficacy of the platform’s algorithm and the number of exchanges it monitors.

The User Experience, The Website’s Speed, And Mobile-Friendliness

Crypto price trackers house a lot of information. Therefore, it is standard that they fixate on user experience. In our list of top crypto price trackers, you will find that a majority of the sites on our list have opted for simple designs that make navigation a less complex. Then there is the issue with the site’s speed, which has a say on how fast you can access the information you need. Being able to access data on time without experience low loading speed is the very essence of adopting these platforms.

Apart from the loading speed, it is crucial to ascertain that your favorite crypto price tracker has infrastructures to ensure that you access the platform on the go. It is a plus if the tracker has a mobile app for android and iOS users. If this is not the case, then a mobile-friendly interface would do. In other words, try as much as possible to opt for the best crypto tracker with aesthetically-pleasing and intuitive interfaces that are compatible with any screen size. Needless to say, all these factors come together to determine the user experience of the website.

The Range of Cryptocurrencies and Exchanges Listed on The Platform

The crypto market is expanding at a frantic pace, and only a few price trackers have provided resources that encapsulate the scope of the market. A majority of price trackers tailor their services to the top 100 cryptocurrencies or majorly function as a btc price tracker, which might not bode well for investors. Savvy investors are constantly prowling the crypto landscape searching for undervalued digital assets or promising, but lowkey crypto projects. Therefore, limiting their search to the top 100 or 200 cryptocurrencies is not enough. They have to access the data of all the cryptocurrencies available in the market. As such, it is advisable to ensure that crypto price trackers support a broad array of cryptocurrencies.

In the same way, it is vital for crypto price trackers to cover the global crypto exchange market, instead of focusing on the popular ones. At times, you might need to incorporate lesser-known crypto exchanges to access more trading pair options. Thus, adopting a crypto price tracker with data regarding the performance of small exchanges is imperative.

The Metrics Available on The Website

Earlier in this guide, we extensively explained some of the metrics you will encounter on crypto price tracking sites. Note that each metric has its importance, and it is advisable to go for trackers with enough metrics to help you boost the efficiency of your analysis. Metrics, like circulating supply, market cap, and daily trading volume, are important. Moreover, it is preferable to rely on crypto price trackers, which have adopted liquidity as a metric to gauge the viability of crypto exchanges. Also, historical charts are another data analysis tool that you should consider. Ensure that the websites provide easy to interpret and full historical charts.

The Suites of Extra Features and Tools

Crypto price trackers have evolved over the years, and this has multiplied the range of features available to users. So, it is common for a crypto market tracker to function as currency converter, crypto compare tool, and portfolio tracker. Regardless of the number of tools a price tracker has, be sure to check that they align with your crypto profession and impact your day-to-day activities.

How Did Cryptolinks Go About Compiling Its List of The Best Crypto Price Tracking Websites? ?

We, at Cryptolinks, have decided to showcase the best performing crypto price tracking websites out there. We strived to establish the efficacy of this review by relying on an organic approach that explores all of the recommendations listed in this guide. As such, we had to determine the accuracy of each website, as we understand the importance of providing accurate data in a timely fashion. To do this, we assessed how long it took each platform to reflect the updated prices and data of cryptocurrencies.

Next, we analyzed the user experience. Here, we checked the design and its mobile-friendliness. While analyzing user experience, we did extra work to determine the load speed of each site, knowing fully well that speed is a prerequisite to offering users a smooth experience. Also, sites that were thoughtful enough to provide night mode interface scored high in this section of our research. The same is true for crypto price trackers with mobile apps.

After we had examined the user experience of each crypto price tracker, we factored the number of cryptocurrencies, as well as crypto exchanges, listed on the sites. Following the completion of this process, we assessed the metrics available on each, as it determined the relevance of the data logged on price trackers. More importantly, we took extra care to see if these platforms have begun to value the importance of liquidity as a useful metric to judge the efficacy of crypto exchanges. Lastly, we explored the array of tools found on each crypto tracking website and ensured that they are of real use to crypto participants.

In the end, we found 9 crypto price trackers that did well across all boards. We advise that you peruse the review of each platform mentioned in the list below before opting for one.

» All Best Cryptocurrency Websites List (5000+ Top Cryptocurrency Sites) «Biggest and most up-to-date best Cryptocurrency websites list that you can find in Crypto World!