Best Exchanges for Altcoins (2026) – Fees, Security & Coin Selection

Best Exchanges for Altcoins: Sites You Need to Know + Tips for Choosing the Perfect One

Got altcoins in your wallet but don’t know where to trade them safely? Or maybe you’re just venturing into the altcoin world and wondering which exchange has the best features? With hundreds of options out there, figuring out the right one can be like trying to find a needle in a haystack.

But let me ask you this—how much are you willing to risk by choosing the wrong exchange? Picking the wrong platform could cost you in hidden fees, bad security, or worse, losing access to your funds entirely. It’s a jungle out there, but don’t worry. Let’s tackle it together.

Common Problems Faced When Choosing Altcoin Exchanges

Choosing where to trade your altcoins isn’t just about convenience. A poor choice could lead you straight into a tech or financial headache. Here’s a quick snapshot of the common issues crypto traders face when picking an exchange:

- High trading or withdrawal fees: It’s often the fine print that gets you. You might think you got a good deal on trading fees until you realize withdrawing your funds costs a fortune.

- Limited altcoin options: Imagine signing up for an exchange, only to find out they don’t support your favorite altcoin. Frustrating, right?

- Security risks: Hacks, phishing attacks, or sketchy platforms can lead to one thing—losing your funds. And trust me, you don’t want to join the long list of people who’ve fallen victim to this.

- Poor user interfaces: If a platform feels like it’s built for rocket scientists, chances are you won’t enjoy your trading experience.

- Fake or scammy platforms: Even in 2024, scammers are getting craftier with fake exchanges that look legit. One wrong click, and your money could disappear.

How Can You Overcome This Challenge?

The good news: there’s a way to avoid all that. Finding a secure, reliable altcoin exchange isn’t rocket science when you know what to look for. Based on the key criteria below, I’ve explored the top exchanges out there, and trust me, the list is worth sticking around for.

- Security: Look for features like 2FA (Two-Factor Authentication) and cold storage of funds. The exchange’s track record also tells you a lot about whether it’s safe.

- Altcoin variety: A great exchange should make sure you have access to both popular coins and off-the-radar gems.

- Fair fees: Transparent and low trading fees are key—after all, those small percentages can chip away at your profits quickly.

- User experience: You shouldn’t need a PhD in computer science to execute a trade. Beginner-friendly is always a plus.

So, how do you know which exchange truly fits the bill? That’s exactly what this guide is about to uncover. But before we get to the best picks, let’s address a crucial question.

Why Should You Trust This Guide?

There’s no shortage of advice when it comes to picking cryptocurrency exchanges, but here’s the problem—most of it is outdated, biased, or just scraping the surface. What you need is unbiased information you can use to make confident decisions. That’s exactly why I’ve gone the extra mile in researching, testing, and vetting these exchanges for you.

When it comes to trading your hard-earned altcoins, you don’t just need a website—you need peace of mind. Stick with me, because up next, we’re about to explore what truly makes an altcoin exchange "the best". Are you ready to find out?

What Makes an Altcoin Exchange "The Best"?

What separates an okay exchange from one you’d call "the best"? It’s not just about flashy interfaces or claims of having “low fees” plastered everywhere. There’s a bigger picture. With altcoins booming, you need an exchange that ticks all the right boxes—because honestly, settling for less might cost you more than just money.

Security Above Everything Else

"If you don’t make security a priority, you’re essentially leaving the front door to your house wide open." It’s a bold statement, but it’s true. The crypto space is enticing for hackers, and exchanges have been prime targets in the past. From the infamous Mt. Gox breach to smaller recent mishaps, millions of dollars have been lost.

So, what should you prioritize?

- Two-Factor Authentication (2FA): This is a must. Look for exchanges that enforce 2FA to help safeguard your account.

- Cold Storage: The best platforms hold most of their funds offline, making it harder for hackers to access your assets.

- Audit Trails: Platforms with verifiable security audits (such as Kraken) show they take safety seriously.

Exchanges like Binance and Coinbase also have a proven record of responding to security threats quickly, giving peace of mind. Why leave safety to chance when you don’t have to?

Altcoin Variety Matters

Got your eyes on that niche token everyone’s buzzing about? Great—but not every exchange will have it. Finding the right altcoin exchange means knowing their roster matches your needs.

For example:

- Binance lists over 350 coins, giving you access to mainstream and rare projects alike.

- KuCoin often serves as “the early bird” platform for new, lesser-known projects before they hit bigger exchanges.

When choosing, think about this—does the exchange lean heavily on major projects like Ethereum and XRP, or does it open the floodgates for altcoin hunters looking for gems? If you’re serious about variety, this should be a top priority.

Trading Fees: Small Savings Add Up

Trading fees might seem like pennies at first, but let me tell you—they pile up faster than you’d expect. Whether you're a day trader or someone who trades occasionally, ignoring fees is like leaving money on the table.

Here’s what to look for:

- Transparent Fee Structures: Many exchanges charge taker and maker fees. Binance, for instance, keeps its trading fees among the lowest at just 0.1%, with discounts available if you use their native token.

- No Hidden Fees: Withdrawal fees, deposit fees, or even conversion fees—be sure to check all fine print. Some platforms aren’t as upfront as you’d hope.

A simple tip? Don’t just compare the trading fees—factor in things like withdrawal costs for your favorite altcoins. You’ll thank yourself later.

User Experience = Less Stress

Let’s be real. Trading crypto can already feel complicated, so why add to the stress with confusing interfaces? A user-friendly exchange can make the difference between confidently trading and pulling your hair out.

Signs of good user experience:

- Intuitive Design: Coinbase is often praised for this. Even for beginners, it’s as simple as choosing your coin, clicking, and you’re good to go.

- Mobile Apps: Let’s not ignore convenience. Platforms like Binance and Gemini have apps that let you track, trade, or just check your portfolio while on the move.

Your experience matters. If you feel overwhelmed every time you log in, it’s time to rethink.

So, which of these features do you think your go-to altcoin exchange has nailed? But wait, you might ask… how do these recommendations stack up against real platforms? I've got just the answer you’re looking for next. Keep scrolling to see which exchanges make the cut!

Best Exchanges for Altcoins in this year: My Top Recommendations

Alright, let’s cut to the chase—when it comes to trading altcoins, not all exchanges are created equal. You want a platform that's secure, gives you access to your favorite coins, and doesn’t gouge you with unnecessary fees. So, here’s a shortlist of some of the best ones you should consider in 2024.

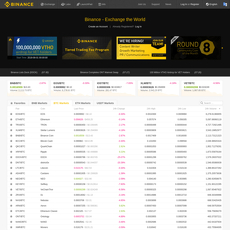

Binance: The Giant With Everything You Need

If you’ve been around the crypto space for even a day, you’ve probably heard of Binance. There’s a reason it’s one of the most popular exchanges on the planet—it just works. With Binance, you get access to literally hundreds of altcoins, ranging from mainstream options like Solana and Cardano to hidden gems that are gaining traction.

- Fees: Some of the lowest in the market, starting at just 0.1%. Plus, if you use Binance Coin (BNB) to pay transaction fees, you get additional discounts.

- Features: Advanced trading tools, staking options, and a super user-friendly mobile app.

- Security: Two-factor authentication, cold wallet storage, and a stellar reputation for protecting user funds.

Whether you’re a beginner or an advanced trader, Binance fits the bill. A quote I’ve always believed in applies perfectly here: “Don’t put all your eggs in one basket—unless that basket is ridiculously secure, reliable, and overflowing with altcoins.”

KuCoin: The Altcoin Lover’s Paradise

If you’re the type who gets excited about finding rare, low-cap altcoins before they explode in value, you’re going to love KuCoin. Unlike some other platforms that stick to the top 50 coins, KuCoin goes all out and lists a massive range of projects—even the under-the-radar ones.

- Fees: As low as 0.1% for trading, and if you stake KCS (KuCoin’s native token), you can score even better deals.

- Altcoin Selection: Think of a project, and there’s a pretty solid chance KuCoin has already listed it.

- Extras: Staking, lending, and even an NFT marketplace. It’s like a playground for serious traders.

Pro tip? If you’re researching a newly launched coin, there’s a good chance it’ll hit KuCoin before bigger exchanges pick it up. It’s perfect for catching those hidden opportunities—but don’t ignore security. Always use the exchange's features like withdrawal whitelisting for added peace of mind.

Kraken: Built for Security Lovers

If "safety first" is your motto, Kraken will feel like a warm blanket in a cold crypto world. Known for its robust security features and a no-nonsense approach, Kraken is perfect for anyone who values transparency and trust above all else.

- Altcoin Focus: While it doesn’t have as many coins as Binance or KuCoin, Kraken shines with its carefully curated list of quality altcoins.

- Fees: Trading costs sit around 0.16%-0.26%, and their platform is ultra-transparent with no hidden surprises.

- Security Perks: They keep most user funds in cold storage, utilize 2FA, and offer account recovery options if something goes wrong. It’s designed to protect your funds like a fortress.

Kraken might not have the flashiest interface, but what it does give is bulletproof reliability. If you’re the cautious type who doesn’t like taking unnecessary risks, this exchange is made for you.

Other Noteworthy Mentions: Coinbase, Gemini, and More

Let’s not forget the heavy hitters that make altcoin trading less intimidating for beginners. Coinbase, for example, is great for anyone starting out in the crypto space. Its clean design, instant fiat conversions, and beginner tutorials are second to none. But—and this is a big one—it lacks the variety of altcoins you’d find on Binance or KuCoin.

Then there’s Gemini, which focuses heavily on security but serves a more limited selection of tokens. Still, their regulated, US-focused approach wins over many cautious investors. They’re worth checking out, especially if you're new to the game and don’t mind paying slightly higher fees for peace of mind.

In addition, keep an eye on smaller exchanges that specialize in specific niches. Platforms like Gate.io and ByBit are doing an awesome job of bringing fresh options to the table. Experimenting with these might just land you early access to the next big altcoin trend.

So, how do you know which one fits your needs? Is it the giant variety of Binance or the laser-focused security of Kraken? Keep reading to find out exactly how to pick the best exchange for you. Trust me—you don’t want to make this decision lightly. I’ll let you in on the key criteria in the next section.

Criteria For Choosing The Right Altcoin Exchange For You

Choosing an altcoin exchange isn’t a one-size-fits-all situation. Your preferences, goals, and habits play a massive role here. So how do you zero in on the perfect platform for your needs? Let me break it down for you step by step.

What Altcoins Are You Trading?

This one’s a no-brainer: the altcoins you’re interested in should dictate which platform you choose. Some exchanges cater to mainstream favorites like Ethereum, Solana, and Polygon. But what if you’re chasing low-cap gems or niche projects? That’s when platforms like KuCoin become clutch because they specialize in listing these hidden treasures.

Here’s the thing: not all altcoin communities are created equal. Some coins thrive on liquidity and active markets, while others are nearly impossible to trade. For example, if you’re keen on an up-and-coming DeFi token, make sure the exchange you pick has decent trading volume for it. No one likes waiting forever for an order to fill, right?

Do You Value Security or Convenience More?

Let’s be honest—convenience often clashes with security in the crypto world. A user-friendly platform that makes everything a breeze might compromise on advanced safety features. On the flip side, a security-driven exchange could feel overly complicated for beginners.

If you lean towards tighter safety, look into platforms like Kraken. They’re known for their obsession with security measures, like storing assets in cold wallets. Prefer something more intuitive, where you can start trading in a few clicks? That’s where platforms like Binance save the day.

"Balance is the key to everything, even in trading. Aim for what gives you peace of mind." — Unknown

Now, ask yourself, which one matters more to you—maximum safety or ease of use? Because the answer will guide your choice.

How Often Do You Trade?

Your trading activity isn’t just a ‘nice-to-know’ detail—it’s probably the most practical point to weigh in. Casual traders might barely notice fees or lack of trading tools, but frequent traders? You bet those small details like fee structures, trading terminals, and order types matter.

- Active Trader? You’ll need a platform with low fees and charts you can customize, like Binance or Bitfinex. High-frequency traders should also check for advanced features like futures or leveraged trading.

- Occasional Trader? Prioritize simplicity. Exchanges like Coinbase or Gemini might not offer endless options but nail the basics beautifully for when you trade once in a while.

Here’s a pro tip: if you’re frequently trading, you’d want to dig into maker/taker fee models or any volume-based discounts the exchange offers. These can save you more than you think.

Still unsure how to narrow it all down? Wondering how to compare exchanges quickly? Well, don’t worry. In the next section, I’ll share a simple and effective strategy to make this a breeze. Ready to save some serious decision-making time?

My Secret for Comparing Exchanges Quickly

"Time is money." You've probably heard this a million times, but when it comes to picking the right altcoin exchange, it's not just about saving time—it's also about avoiding costly mistakes. If you're like me, you don't want to waste hours researching only to end up frustrated or, worse, scammed. Let me share a few tricks I use to compare exchanges in no time.

Check Reviews and Ratings

Honest reviews are like golden tickets in the crypto world. Before signing up for any exchange, make it a habit to check what others are saying. Are people raving about their experience, or does the platform have a pattern of complaints? Look for reviews on trusted sources like Cryptolinks. A good review can often uncover hidden gems—or red flags—you might miss otherwise.

Quick Tip: Look for specific details like ease of use, customer support responsiveness, and withdrawal speeds. Generalized "this exchange is good" comments don’t help much.

Look Into Volume and Liquidity

Numbers never lie. High trading volume equals good liquidity, which means you can enter and exit trades without much price slippage. An illiquid exchange will not only frustrate you but could cost you money if your trade moves the market price. Platforms like Binance, for instance, often top the volume charts, making them a solid choice for active traders.

Pro Tip: Use platforms like CoinMarketCap or CoinGecko to track exchange volume data. It’s quick, easy, and reliable.

Test With Small Transactions

This one's personal to me. Anytime I’m trying out a new platform, I always start with a small transaction. Think of it as testing the waters. Deposit a small amount, make a trade, and try to withdraw. How was the process? Were there surprise fees? Did the platform handle everything smoothly? If it passes this mini “stress test,” then it earns my trust.

A friend once jumped into a new exchange based on hype. He deposited $5,000, only to find out it took weeks to withdraw due to “technical issues.” Don’t make that mistake—start small!

Warning! Don’t Let FOMO Cloud Your Judgment

The crypto market moves fast, and when that new altcoin exchange is all over Twitter, it’s tempting to dive right in. But take a breath. Quick choices driven by fear of missing out can backfire. Instead, trust the process. Research, test, and ensure the platform can handle your goals.

“The best decisions in crypto trading are the ones that don’t let hype get in the way of logic.”

If you’ve made it this far, you’re clearly serious about choosing the right platform. So, let me ask you: Have you ever thought about the worst mistakes traders make when choosing exchanges? Stick around, because what’s coming next could save you from falling into those traps.

Common Mistakes to Avoid When Picking an Altcoin Exchange

Getting started with altcoin trading is exciting, but it's alarmingly easy to make the kind of mistakes that could cost you your hard-earned money—or worse, your trust in crypto altogether. Let's talk about these critical missteps and how to avoid them like a pro.

Falling for Scams

Ever heard the phrase, "If it seems too good to be true, it probably is"? Well, in the crypto world, ignoring this advice can be downright dangerous. Scammers prey on beginners with flashy promises of zero fees, massive signup bonuses, and skyrocketing profits.

For example, in 2020, reports of crypto scams shot up by over 40%, according to FBI statistics. One common scam is fraudulent exchanges that vanish after collecting deposits. A good rule of thumb? Stick to well-established, reviewed platforms like Binance, KuCoin, or Kraken. If a platform doesn’t have much written about it or feels "off," walk away. Your money's too valuable for guesswork.

"The biggest risk you can take is trusting the wrong platform. Play it safe, and don't let greed cloud your judgment."

Ignoring Fees Until It’s Too Late

Here’s a killer mistake: focusing on low trading fees and forgetting about hidden costs. Withdrawal fees, deposit charges, and even conversion fees can pile up and quietly eat into your profits without you noticing.

- For instance, did you know some exchanges charge up to 5% on withdrawals for certain tokens? Ouch.

- Platforms like Binance keep fees transparent and relatively low, while others may bury the actual costs in fine print. Always check the fee schedule before committing.

The trick? Look beyond "headline" trading fees. Are there discounts for using their native tokens to pay fees? Are withdrawal amounts capped unless you pay premium rates? These details matter and can add up fast if you’re not careful.

Skipping the Security Features

If there’s one thing I’ll never stop repeating, it’s this: secure your account like your life depends on it. Many traders lose funds not because the platform was bad, but because they left their account vulnerable.

Picture this: you deposit a fat stack of crypto but don’t enable two-factor authentication (2FA). A hacker breaches your email, accesses your account, and wipes you out in minutes. I don’t want that to happen to anyone, yet it’s a far-too-common story. Don't let it be yours.

Here’s what you should do immediately on any exchange:

- Enable 2FA (Google Authenticator is a solid option).

- Never reuse passwords across platforms.

- For ultimate safety, consider using a hardware wallet for long-term storage instead of leaving funds on the exchange.

Remember, even the most secure exchange can’t protect you if your own account is an easy target. Security isn’t a one-time action; it’s a mindset.

Are You Making These Mistakes?

It’s easy to make these errors when you're just starting out—or even if you’re an experienced trader who thinks, "That’ll never happen to me." The key is recognizing these potential slip-ups before they cost you.

Now, this naturally leads to an important question: how can you stay ahead and keep improving your trading journey? Let me show you some groundbreaking resources in the next section that’ll make sure you’re always informed and one step ahead. Ready to discover them?

Resources to Help You Stay Informed

Knowledge is power, especially in the fast-moving world of crypto. If you want to trade altcoins smartly and confidently, staying in the loop isn't just helpful—it's essential. The right resources can be the difference between making a savvy decision and regretting a costly mistake. Let me share some tools and platforms I regularly check to make informed moves.

Cryptolinks.com’s Exchange Reviews

"The man who stops learning is the man who stops growing." This quote fits cryptocurrency trading perfectly. A single uninformed decision can ripple through your portfolio like a tidal wave. To prevent this, we’ve curated detailed reviews of exchanges on Cryptolinks.com. Instead of spending hours figuring out what exchange fits your needs, this collection does the homework for you.

For example, wondering if Binance is worth the hype or if a lesser-known platform like KuCoin is safe for your funds? Each review breaks it down—for security features, supported coins, fees, usability, and much more. Bookmark it. Trust me, it'll come in handy.

CoinMarketCap and CoinGecko

If you’re ever unsure about an exchange’s actual performance, analytics platforms like CoinMarketCap and CoinGecko are lifesavers. They let you check an exchange’s rankings, liquidity, and supported coins. Want proof that an altcoin is booming? Feel like double-checking an exchange’s transparency metrics? These sites have solid data points that keep you from relying on guesswork or gut feelings alone.

As an example, if a platform suddenly ranks high with suspiciously low trading volumes, that's a red flag. These tools are your "behind-the-scenes look" at what's really going on.

Reddit and Twitter Communities

Social platforms might surprise you with their effectiveness. While they’re not your one-stop-shop, they can be your real-time feeds for insider tips, expert opinions, and breaking news. Subreddits like r/cryptocurrency or even altcoin-specific communities are where traders dish out honest experiences with exchanges. Did someone report a security glitch? Is there overwhelming praise for a new feature? Reddit spills the tea, often before mainstream sources.

Then there’s Twitter. Following well-known crypto influencers, analysts, and projects can give you insights within seconds. In fact, during market pumps or dumps, Twitter feels like the town square—buzzing with updates that could help (or warn) you in the moment.

Stay Curious, Stay Ahead

Here’s the deal: when you combine trusted review sites, data-driven tools, and live feedback from communities, you reduce your chances of being blindsided. But are these enough to guarantee your safety when trading altcoins? What else should you know to avoid rookie mistakes and big pitfalls?

Frequently Asked Questions About Altcoin Exchanges

Let’s cut right to it—if you’re here, you're buzzing with some burning questions about altcoin exchanges, right? Good! I’ve got answers for the questions I see popping up the most. Let’s make things crystal clear so you feel more confident navigating the crypto world.

What is the best exchange to trade altcoins?

Ah, the golden question! The short answer is: it depends on your priorities. If you want access to an insane range of coins with advanced trading features, Binance has got you covered. But let’s say you’re on the hunt for those hidden gems—those niche coins that seem hard to find—then KuCoin might just become your best friend.

Need rock-solid security and transparency instead? Kraken is like the Fort Knox of crypto exchanges. Remember, the “best” platform is all about what fits your style and goals. And don’t forget—you can always explore more details via trusted reviews on sites like this page.

Which platform is better for beginners?

If you’re just getting started and don’t want to be hit with overwhelming charts, tools, and features, simpler platforms like Coinbase and Gemini are excellent choices. Why? Their interfaces feel like using a banking app—clean, intuitive, and easy to follow. Both platforms also have fantastic educational tools that can get you up to speed in no time.

But keep in mind, you might outgrow them if you start trading frequently or dabble in coins outside of the mainstream. Coinbase, for example, is a pro at beginner-friendliness but doesn’t have the sheer number of altcoin options that Binance or KuCoin offer. Start simple, and scale up once you're comfortable.

Can I trust cryptocurrency exchanges?

Let’s face it: scams are everywhere, especially in crypto. But can you trust exchanges? The answer is yes—if you stick with platforms known for their trust and security. Binance, Kraken, and Coinbase are some of the most popular platforms, with robust measures like two-factor authentication, cold storage for funds, and insurance policies to help keep your assets safe.

But always do your own research. Check reviews, dig into their track record, and even start small to test the waters. Don’t skip these steps—you don’t want to learn this lesson the hard way.

What’s the safest way to store my altcoins after trading?

Here’s the thing: even the most secure exchanges aren’t 100% foolproof. Storing large amounts of coins directly on an exchange is risky because platforms have been targeted by hackers in the past (cough Mt. Gox). So, what do you do?

- Get a hardware wallet like Ledger or Trezor. These keep your coins offline, protected from online attackers.

- If you’re trading smaller amounts and need some flexibility, opt for wallets with strong reputations like Trust Wallet or MetaMask.

Keeping your funds safe boils down to limiting exposure. Trade on exchanges but store long-term holdings in a private, secure wallet.

But hey, I know that’s not every question bubbling in your mind. There's one crucial piece that pulls it all together: how to actually get started trading your first altcoin. Wondering where to begin? Stick around for the next section where all the puzzle pieces come together—it’s about to get practical.

How to Start Your Altcoin Trading Journey Today

Alright, so you’re ready to jump into the altcoin world and start trading like a pro. Let’s keep it simple and practical so you can take action right away. Here’s how you can kickstart your altcoin trading journey today without feeling overwhelmed.

Pick the Right Exchange

The first step? Choosing the right exchange. Think about what matters most to you. Is it a wide variety of altcoins, low fees, or top-notch security? For instance, if you're hunting for rare altcoins, you might want to try a platform like KuCoin which lists lower-cap gems. On the other hand, if you care about simplicity and trust, a platform like Coinbase might have what you need, even if it offers fewer altcoins.

Let your goals guide you. For example, if keeping fees low is a high priority for frequent trading, Binance is an excellent choice with its competitive rates. Read some reviews, compare options, and make an informed decision before you sign up. Trust me, getting this first step right makes everything smoother.

Stay Safe as You Trade

This step is not optional. Safety should always come first when you’re dealing with crypto (or anything that involves your hard-earned money). Start by securing your account with strong passwords and two-factor authentication (2FA). Avoid lazy practices like reusing passwords—it’s just asking for trouble.

Another important tip is to avoid holding large amounts of cryptocurrency on any exchange. While platforms like Kraken or Binance have robust security measures, it’s still a good habit to move your funds to a private wallet for long-term storage. Remember, the golden rule in crypto: not your keys, not your coins.

Lastly, watch out for shady platforms or phishing scams. Double-check URLs before logging in, and never click on random links sent to your inbox claiming to be your exchange. A little caution goes a long way in protecting your investments.

Final Thoughts

Starting your altcoin trading journey might seem complex, but it really doesn’t have to be. By finding the right exchange, taking safety seriously, and keeping an eye on fees, you'll already be ahead of many beginners who rush into trading without a game plan. Altcoin trading isn’t just about chasing the next big profit—it’s about doing it smartly and securely.

You have all the tools now. It’s time to take that first step confidently. Whether you choose Binance, Coinbase, or another platform that fits your goals, just remember—it’s a learning journey. Take it one trade at a time. Good luck, and happy trading!