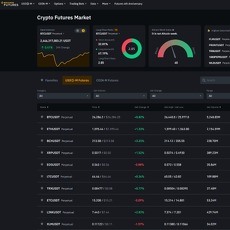

Best Crypto Futures & Derivatives Exchanges (2026) – Fees, Leverage, Risk Tools

Mastering Crypto Futures and Derivatives: A Comprehensive Guide

If you've been exploring the exciting world of cryptocurrencies, you've probably come across the term "crypto derivatives." These financial instruments are a crucial part of the crypto landscape, offering unique opportunities and challenges. In this article, we're going to dive deep into the realm of crypto futures and derivatives, exploring how they work, the choice between centralized and decentralized platforms, and the inherent risks involved.

How Do Derivatives Work?

Futures Contracts

One of the most common types of crypto derivatives is the futures contract. Picture this: You see potential in Bitcoin, and you want to lock in a purchase price for the future. That's where futures come in. These contracts commit two or more parties to buy or sell an asset at a specified time and price down the road.

For instance, let's say you buy a "10AUG2022 BTC" futures contract at $20,000. This means you agree to purchase one contract's worth of Bitcoin on August 10, 2022, for $20,000. If the market price is above $20,000 at that time, you make a profit; if it's below, you incur a loss. Importantly, futures contracts don't necessarily track the underlying asset's current price. Instead, they trade based on market expectations for the future price.

Perpetual Futures

Now, here's where it gets interesting. Perpetual futures, often called "perps," are a unique breed of futures contracts. Unlike traditional futures, perps don't have an expiry date. You can hold these contracts indefinitely. Consequently, the price of perpetual futures closely mirrors the spot price of the underlying asset.

Perpetual futures have become increasingly popular due to their flexibility and ease of trading. Their perpetual nature means you can maintain positions without the pressure of an impending expiry date, making them a favorite among traders.

Options

Options are another fascinating derivative in the crypto space. Unlike futures, where contracts obligate parties to buy or sell the asset, options provide the buyer with the right, but not the obligation, to make the transaction by a specific date at an agreed-upon price. The seller of an option, however, still commits to the transaction and receives a fee or premium for providing this service.

Options can be a valuable tool for managing risk and hedging positions in the crypto market, offering a different dimension of flexibility compared to traditional futures.

Centralized or Decentralized Crypto Derivatives?

Centralized Exchanges

In the early days of crypto, centralized exchanges (CEXs) dominated the derivatives landscape. They offered liquidity and a responsive trading environment, crucial for short-term derivatives trading. However, CEXs have faced criticism for allegedly trading against their own customers and, at times, going offline during major market events, resulting in forced liquidations.

Centralized exchanges remain popular among traders due to their convenience, but it's essential to acknowledge the associated risks, particularly related to trust and reliability.

Decentralized Finance (DeFi) Platforms

The rise of decentralized finance (DeFi) has introduced a new player in the crypto derivatives game. While DeFi derivatives platforms may not match the liquidity and responsiveness of CEXs yet, they represent a shift towards a more transparent and decentralized ecosystem.

DeFi platforms aim to eliminate intermediaries, enabling users to trade directly from their wallets. As DeFi matures, we can expect increased competition and improvements in liquidity depth and responsiveness, narrowing the gap with centralized exchanges.

Risks

Inherent Volatility

It's crucial to understand that derivative trading is inherently riskier than holding the underlying asset. Cryptocurrencies are notorious for their volatility, and derivatives magnify this volatility. Prices can swing wildly, resulting in substantial gains or losses in a short period.

Leverage Amplifies Risks

One of the unique features of derivatives is the ability to use leverage. While leverage can multiply profits, it also amplifies losses. Beginners and even intermediate traders are strongly advised against using leverage until they have a solid grasp of derivative markets.

Conclusion

As we wrap up our journey through the world of crypto futures and derivatives, it's clear that these financial instruments offer both incredible opportunities and significant risks. Whether you choose to trade on a centralized exchange or explore the decentralized DeFi platforms, always remember to approach derivatives with caution, especially if you're new to the game.

In the ever-evolving crypto space, staying informed and continuously learning is key to mastering the art of derivatives trading. So, keep your finger on the pulse of the crypto world, and who knows, you might just become the next crypto derivatives guru!

Frequently Asked Questions (FAQ) about Crypto Futures and Derivatives

Welcome to our Crypto Futures and Derivatives FAQ section. Here, we'll address some of the most common questions and concerns related to crypto futures and derivatives. Whether you're a seasoned trader or a curious beginner, this guide will help you understand this fascinating aspect of the cryptocurrency market.

Can you explain what crypto futures and derivatives are in simple terms?

Certainly! Crypto derivatives are financial contracts that derive their value from an underlying cryptocurrency or digital asset, like Bitcoin. Futures, options, and perpetual contracts are some common types of crypto derivatives. These contracts allow traders to speculate on the future price movements of cryptocurrencies without owning the actual assets.

What's the difference between crypto futures and regular futures?

Crypto futures work similarly to traditional futures. When you buy a crypto futures contract, you agree to buy or sell a specified amount of cryptocurrency at a predetermined price on a set date in the future. Unlike spot markets, where you own the asset, futures allow you to profit from price fluctuations without owning the underlying cryptocurrency.

What sets perpetual futures apart from regular futures contracts?

Perpetual futures, often referred to as "perps," are a unique type of futures contract. Unlike traditional futures, perps don't have an expiry date. Traders can hold these contracts indefinitely. Perpetual futures are designed to closely track the spot price of the underlying asset, making them ideal for speculative trading.

I've heard about options in the context of crypto derivatives. What exactly are they?

Crypto options give you the right, but not the obligation, to buy or sell a specific amount of cryptocurrency at a predetermined price on or before a specified date. The buyer of the option pays a premium to the seller for this right. Options provide flexibility and can be used for hedging and risk management.

What's the difference between trading crypto derivatives on centralized exchanges (CEXs) and decentralized platforms?

Centralized exchanges offer convenience and liquidity but may face concerns related to trust and reliability. Decentralized exchanges (DeFi platforms) aim to eliminate intermediaries, providing more control over your funds. However, they may have lower liquidity and responsiveness. Your choice depends on your trading preferences and risk tolerance.

Are crypto derivatives riskier than holding the actual cryptocurrency?

Yes, trading crypto derivatives is inherently riskier due to their price volatility and leverage options. Prices can change rapidly, leading to significant gains or losses. Using leverage amplifies these risks. It's essential for beginners to approach derivatives cautiously and avoid using leverage until they have a solid understanding.

Where can I find resources to learn about crypto derivatives?

You can start by reading educational materials, watching video tutorials, and following reputable crypto news sources. Additionally, many online courses and forums offer valuable insights. Practicing with a demo account on a crypto derivatives platform can help you gain hands-on experience without risking real capital.

Do you have any trading strategies for crypto derivatives?

Several strategies are commonly used in crypto derivatives trading, such as hedging, arbitrage, and trend following. It's crucial to research and understand these strategies thoroughly before applying them. Additionally, risk management and staying informed about market developments are essential for successful trading.

Are there regulations governing crypto derivatives trading?

Regulations for crypto derivatives vary by country and jurisdiction. Some regions have established rules to govern these markets, while others have limited or no regulations. It's essential to be aware of the legal requirements and compliance measures in your jurisdiction when trading crypto derivatives.

Do I need a separate account to trade crypto derivatives, or can I use my existing crypto exchange account?

It depends on the exchange. Some crypto exchanges offer both spot and derivative trading within the same account, while others may require you to create a separate account for derivatives trading. Check with your chosen platform for specific account requirements.

Remember that crypto derivatives can be complex, and it's crucial to educate yourself, practice responsible trading, and only invest what you can afford to lose. If you have more questions or need further guidance, don't hesitate to reach out to your chosen crypto exchange or seek advice from experienced traders. Happy trading!