Best Crypto Debit Cards (2026) – Visa & Mastercard, Fees, Cashback

Best Crypto Altcoin Bitcoin Credit and Debit Cards: Everything You Need to Know in One Guide

Have you ever wondered if you could use your crypto as easily as swiping a regular credit or debit card? Wouldn’t it be exciting to spend your Bitcoin, Ethereum, or other altcoins on a cup of coffee, groceries, or online subscriptions without any hassle? That’s where crypto debit and credit cards enter the picture—they’re a real game-changer.

But let’s face it: choosing the right card feels like walking into a maze. Some promise enticing cashback rewards, others shine with low fees, and a few are integrated with popular crypto wallets like Coinbase or Binance. The options are endless, and the fine print? A nightmare to figure out alone.

In this guide, I’ll break down everything you need to know about crypto cards so you don’t blow money on high fees or settle for a card that doesn’t meet your needs. Imagine having a card that rewards you with crypto cashback, offers low fees, or aligns with your favorite wallet. Sounds perfect, right? Let’s first get to the heart of the matter—why even bother with a crypto card, and what should you look out for?

Why You Need a Crypto Card – The Benefits

Crypto debit and credit cards are the bridge between your digital assets and the real world. Here’s why people are making the switch:

- Seamless Everyday Spending: Forget about the “hold and hope” strategy. With a crypto card, you can use your Bitcoin or Ethereum today—just like cash or traditional fiat.

- Earn Rewards in Crypto: Some cards let you earn 1%-8% back in cryptocurrency on every purchase. Imagine buying a new laptop and earning back a stack of Satoshis—how cool is that?

- Universal Access: Accepted anywhere regular Visa and Mastercard work, these cards make your crypto spendable worldwide.

- No Hassle Conversions: You don’t need to worry about the technicalities of converting crypto to fiat. The card takes care of it instantly whenever you swipe.

Pretty compelling, right? That coffee shop on your corner or your favorite online store won’t even know you paid with crypto—it’ll seem like any traditional debit or credit payment.

What Could Go Wrong? The Challenges Await

Hold on, though. It’s not all smooth sailing in the crypto-card space. Let’s face the facts—no system is perfect, and crypto cards are no exception. Here are the key stumbling blocks to keep in mind:

Fees Can Add Up Fast

Crypto cards often come peppered with a bunch of fees you might not spot at first glance. For instance, most charge for crypto-to-fiat transactions. Want to make an ATM withdrawal? That's likely another fee on the list. Forget to check the exchange rates? You could find yourself losing more money than necessary. The devil is in the details, folks, so keep an eye on the fine print before you slap down your crypto card.

Limited Merchant Acceptance

Sure, crypto cards are usable just about anywhere regular Visa or Mastercard is accepted, but here’s the catch: not every merchant supports them directly. You may find they work offline at traditional retail chains, but when it comes to niche stores or online services in less crypto-friendly jurisdictions, you’re out of luck. Cryptocurrency adoption may be growing, but we’re not fully there yet.

Balancing Rewards vs. Usability

Who doesn’t love the sound of earning up to 8% cashback in Bitcoin? But here’s a curveball: Some cards require hefty staking amounts to unlock these perks. Staking 10,000 CRO tokens for their high-tier card may work for some people, but does it sit right with your finances? Balancing the tempting rewards against the usability challenges—the ease of spending without jumping through hoops—is something you’ll need to keep in mind.

So, where do you draw the line? Can the rewards justify the costs? And how do you decide between flashier cards with perks and standard ones with low fees? Don’t worry—these are questions we’ll explore further as we peel back the layers one step at a time.

Before figuring out which crypto card suits your needs, there’s a critical question to answer: Should you go for a debit card or a credit card? Curious about how they differ and what works best for you? Stay tuned; we’re breaking it all down next!

Crypto Debit Cards vs. Credit Cards: What’s the Difference?

Trying to choose between a crypto debit card and a crypto credit card? Let’s break it down together. Both types have their strengths, weaknesses, and pretty unique ways of working. Whether you're buying a coffee, shopping online, or even earning rewards, knowing the difference could save you a ton of confusion later.

How Crypto Debit Cards Work

Crypto debit cards are like your favorite prepaid gift card—just replace the cash with cryptocurrency. Here’s the deal:

- You preload your card with crypto from your wallet, like Bitcoin or Ethereum.

- At the moment you swipe or tap, the card converts your crypto into fiat currency. Easy, right?

- The merchant gets paid in their local currency—so no awkward “Do you accept Bitcoin?” questions at checkout.

For example, if you have a Coinbase Card or a Binance Card, you just load these cards with your crypto, and you’re set to shop. You don't even have to worry about exchange rates; the card handles everything in seconds. But watch out—those conversion fees can sneak up!

How Crypto Credit Cards Work

Now, crypto credit cards are more like the traditional credit cards you probably already use, but with a crypto twist. They’re a bit harder to come by, but the perks can be sweet:

- You’re spending fiat (government currency), and at the end of the billing cycle, you can repay the balance however you choose—yes, even in crypto!

- They often come with excellent rewards programs like Bitcoin cashback or crypto bonuses.

- You don’t need to convert your crypto in real time, which helps if you’re hodling during a market upswing.

Take BlockFi’s credit card as an example—it lets users earn Bitcoin cashback every time they swipe. Pretty cool for people who like stacking sats passively. However, just like any other credit card, you'll need to keep an eye on interest rates if you don’t pay off your balance on time.

Pros and Cons of Each Type

Let’s get real for a minute—neither card type is a one-size-fits-all. It depends on what you need and how you plan to use it. Here’s the lowdown:

- Debit Card Pros: No credit checks, easy to set up, and you can only spend what you load. This makes it great for budgeting and keeping things simple.

- Debit Card Cons: You’re paying conversion fees every time, and if your wallet runs out of funds, you're out of luck until you top up.

- Credit Card Pros: Earn rewards like cashback or crypto bonuses, use fiat without instantly dipping into your crypto, and there's usually better global acceptance.

- Credit Card Cons: Risk of overspending and potentially high-interest rates if you don’t clear the balance, not to mention eligibility requirements like credit score checks.

If you're someone who thrives on earning rewards and is disciplined about credit repayments, the credit card option might win you over. On the flip side, if you like the “no debt, pay as you go” vibe, stick with a debit card. Whatever you pick, think about how it fits into your overall strategy—you don’t want fees eating up your crypto swag.

"It’s not about how much crypto you spend. It’s how you spend it smarter."

Still torn between these two options? What if I told you there’s a way to cut through the noise? The features that make or break a great crypto card might surprise you, and I’ll reveal exactly what to look for next.

Features to Look for When Choosing a Crypto Card

Picking a crypto card is like picking the perfect pair of shoes—it has to fit your needs, your style, and, most importantly, your wallet! But with so many options out there, how do you know which one deserves a spot in your pocket? Let’s break it into the key features that make all the difference.

Supported Cryptocurrencies and Wallets

Imagine signing up for a crypto card only to find out it doesn’t support your main cryptocurrency. Frustrating, right? That’s why checking supported coins is non-negotiable.

Some cards, like the Volet Card, support heavyweights like Bitcoin, Ethereum, and Litecoin, while others extend compatibility to lesser-known coins such as DOGE or SOL. Think of it as a compatibility test: your portfolio vs. their list. The more coins accepted, the more flexibility you’ll have to spend the digital assets you actually own.

Don’t forget about wallet integration either. Cards tied to popular platforms like Coinbase or Binance make it seamless to link up your funds. If you’re using a non-mainstream wallet, though, double-check their card compatibility to avoid headaches later.

"The card you choose should speak the same language as your portfolio." – An informed crypto user, probably anxious but wise.

Rewards and Cashback Systems

Let’s be real—who doesn't love free money? Rewards and cashback programs can be the cherry on top of a great crypto card. But, not all rewards are created equal. Here’s what you should look for:

- High cashback percentages: Cards like Wirex offer up to 8% cashback in crypto. That’s real value every time you swipe.

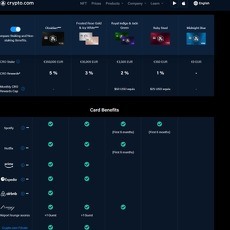

- Tiered or stake-based rewards: Some cards bump up cashback rates if you stake a specific crypto like CRO with Crypto.com. It can be totally worth it, but only if you don’t mind locking up your funds.

- Extra perks: Look out for bonuses like discounts on travel, subscriptions, or crypto trading fees. For instance, a few cards reward you with platform-specific tokens or access to premium membership tiers.

Here’s the trick: always read the fine print. Some cards only release rewards after hitting a certain spending threshold or staking amount. Ask yourself, are those perks worth the effort—or just marketing fluff?

Fees and Expenses to Watch Out For

Let’s talk about the sneaky part—fees. Even the best-looking crypto card can have hidden costs that quickly drain your funds if you aren’t careful. Here’s what you need to pay attention to:

- Transaction fees: Some cards charge you a percentage of every transaction, especially for crypto-to-fiat conversions.

- ATM withdrawal fees: Planning to grab some cash? Watch out for those hefty withdrawal fees that can creep up unnoticed.

- Inactivity fees: Didn’t use your card for a while? Surprise—some providers might penalize you with inactivity fees.

- Foreign currency conversion fees: If you’re a traveler, this one’s huge. Look for cards with no (or low) fees for spending abroad.

An interesting note: Forbes once highlighted that some crypto newbies lose hundreds of dollars annually, simply underestimating cumulative fees. That’s why a transparent fee structure should be at the top of your checklist.

So, now that you know the key features—compatibility, rewards, and fair fees—how do the top cards stack up against these criteria? Which ones shine, and which fall short? Let’s take a closer look at the absolute best crypto credit and debit cards next!

The Top Crypto Credit and Debit Cards

Let’s be real: picking the best crypto card can feel kind of like hunting for the perfect phone. Everyone has their favorite, but which one really fits your needs? Some cards are all about simplicity, others are focused on maximizing rewards, and a few are ideal for minimizing fees. After doing the research and putting these cards to the test, here’s my shortlist you’ll want to check out for this year.

Coinbase Card: Best for Simplicity

If you’re already hanging out in the Coinbase ecosystem, this card is a total no-brainer. You can seamlessly spend your crypto anywhere Visa is accepted, and the big bonus? Up to 2% cashback for every purchase. No complicated requirements, no jumping through hoops—it just works.

What I love most about this card is its super user-friendly integration with the Coinbase app. Everything is in one place: track rewards, toggle spending currencies, and manage your account with ease. It’s seriously designed for anyone just stepping into the crypto card game. Oh, and did I mention no annual fee?

“Simplicity is the ultimate sophistication.” - Leonardo da Vinci The Coinbase Card lives up to that hype for anyone looking to start small and scale up!

Volet Card: High Rewards for Power Users

Want to make your spending hustle work harder for you? The Volet card is bringing the heat with an impressive up to 8% cashback on purchases. Yes, you read that right—8%! For the heavy spenders or reward hunters, this one’s practically a goldmine.

If you’re fine with jumping into the Volet ecosystem and committing a bit of crypto, the rewards are totally worth it. Combine that with zero FX fees and multi-currency support, and this is truly a power user’s dream. Think global lifestyle? Volet totally has your back.

Nexo Card: Great for Credit or Debit

If flexibility is the name of your game, Nexo’s card is a jack-of-all-trades—and master of quite a few, too. With the option to use it as a debit or credit card, it’s suited for anyone who loves choice.

You’ll get cashback rewards of anywhere between 0.5% and 2%, depending on which of their supported cryptos you’re spending. Plus, the real kicker? No hidden fees sneaking up on you. You can manage your funds, take advantage of Nexo’s lending ecosystem, and spend as you go—all in one place. It’s not the flashiest in terms of perks, but it’s a safe, steady pick that gets the job done.

BitPay Card: Best for Low Fees in the US

If you’re constantly annoyed by fees eating into your crypto wallet, the BitPay card is what you’ve been waiting for. Known for its ultra-low fees, this card allows you to spend your Bitcoin and other cryptos with practically no friction.

It’s especially ideal for U.S. users who don’t want surprises with hidden costs. There’s no conversion fee when spending USD, and the card management interface is clean and intuitive. Whether you’re hitting up the local coffee shop or shopping online, BitPay makes it as smooth as swiping a regular card.

Now, while the rewards here aren’t as strong as something like Wirex, the savings on fees make it a standout for budget-conscious spenders who hate overcomplicating things.

Each of these cards has its own unique strengths—simplicity, rewards, flexibility, or low fees. But here’s the kicker: no card is perfect. Which leads me to this… have you ever thought about the potential problems that can pop up with crypto cards? Let’s talk about the real hurdles next!

Common Problems People Face with Crypto Cards

Crypto cards are a step closer to making cryptocurrencies part of our daily lives, but let’s be real—they’re not flawless. Like any financial tool, they come with their quirks and challenges. If you’re planning to grab one of these magical little pieces of plastic (or metal), here’s what you need to be aware of before you start swiping away.

Unstable Crypto-to-Fiat Conversion Rates

Ah, the unpredictable world of crypto! One minute you're spending Bitcoin valued at $30,000; the next, it's $29,700. That volatility might not seem like a big deal, but when crypto cards convert your digital assets into fiat at the point of purchase, those dips—or spikes—can hit your wallet hard.

For example, imagine you're buying a $100 dinner. If Bitcoin drops in value during the transaction, you might end up spending slightly more of your crypto than you expected. It’s an annoying little thing, especially if you’re actively keeping track of your portfolio.

Some card providers do offer locked-in rates for conversions to minimize surprises, but this feature isn’t universal. Always check how your selected card handles these conversions—it can save you a lot of frustration.

"The price of Bitcoin could rise 2x or fall 50% in a day, and your dinner will have no idea. Be prepared to make peace with crypto volatility." – Anonymous Crypto Enthusiast

Security Concerns

Crypto cards are connected to your digital wallets, and if you lose your card or it gets compromised, you’re not just facing the risk of stolen fiat cash. You’re exposing your crypto funds too, which can sting far worse considering the high value and permanence of blockchain transactions.

Some real-life horror stories from Reddit forums involve users whose cards, once stolen, were used to siphon crypto holdings before they could freeze their accounts. Yikes, right?

That’s why the best cards come packed with features like two-factor authentication (2FA), instant transaction alerts, and even dynamic security codes that change with every transaction. A little paranoia goes a long way—activate every single security option offered and consider enabling withdrawal limits or transaction caps where possible.

Regional Restrictions

Not every card loves the globe as much as we do. Some of the most hyped crypto cards on the planet are, unfortunately, not available everywhere. Regional restrictions can hold you back, especially if you don’t check the fine print.

For instance, the Coinbase Card works beautifully in the US and Europe but is simply unavailable in certain countries. Similarly, Wirex is well-loved in Asia and Europe but struggles to get a foothold in the US due to regulatory limitations. And let’s not even talk about countries with strict crypto bans—there, your shiny crypto card is nothing more than a useless accessory.

- Pro Tip: Always ensure the card supports your region before you get excited about cashback offers or rewards.

These limitations even extend to merchant acceptance. While crypto cards technically convert funds into fiat, some businesses may still refuse them. Why? Lack of understanding, outdated payment systems, or regulatory fears—it’s an issue that needs fixing but won’t happen overnight.

Feeling discouraged yet? Don’t worry; this isn’t the end of the road. But think—what if there was a roadmap to owning one of these crypto cards that suits your region and lifestyle perfectly? What should you have in hand to unlock the world of spending your crypto seamlessly? Stay tuned—I’ve got the answers coming up next!

How to Apply for a Crypto Card

So, you’re ready to get your hands on a crypto card? Awesome! The process isn’t as complicated as it might sound, and if you’ve ever applied for a traditional credit or debit card, you’re already halfway there. Let me walk you through everything you need to know to make this quick and stress-free.

Step-by-Step Process

The first step to making your crypto spendable is finding the right card. Once that’s done, it’s just a matter of applying, verifying your identity, and, of course, funding your card to start spending. Let’s break it down:

- Step 1: Choose Your Crypto Card – Start by picking a card that fits your lifestyle. Are you in it for the cashback? Low fees? Or a card synced with your favorite wallet like Binance or Coinbase? Take some time to research before settling on one.

- Step 2: Sign Up – Head over to the provider’s platform and create an account if you don’t already have one. This may be on a website or through their mobile app.

- Step 3: Verify Your Identity – This is where things get slightly official. To meet KYC (Know Your Customer) requirements, you’ll need to upload documents like a government-issued ID or proof of address. Most platforms approve this within minutes to a few hours.

- Step 4: Link Your Wallet or Account – Once approved, connect the card to a supported wallet or funding source. For example, use your Bitcoin wallet or a simple fiat deposit.

- Step 5: Fund Your Card – Time to load it up! Transfer crypto into your card's account or deposit fiat for immediate use. Cards often handle the crypto-to-fiat conversion for you, which is great because it makes checkout instant.

That’s it. Your crypto card will now be ready for use—whether swiping in-store or shopping online. It’s seriously that simple!

What Documents to Have Ready

Here’s where things can get sticky if you’re not prepared. Most providers follow strict KYC guidelines to ensure your identity is legit (and that no fraudsters sneak in). To save yourself frustration, here’s what you should keep ready before starting:

- Government-issued ID – This could be your passport, driver’s license, or national ID card. Make sure it’s not expired!

- Proof of address – Think bank statements, utility bills, or a rental agreement. Whatever you use, ensure it’s got your full name and current address clearly mentioned.

- A selfie photo – Yes, some platforms require you to snap a photo holding your ID. This ensures the person uploading the documents is actually you.

Easy enough, right? Also, don’t worry about security—most major crypto companies use encryption and advanced tech to make sure your details are safe.

Here’s an Example to Clarify

Imagine you’re applying for the Coinbase Card. First, you log in to your Coinbase account, head to their card section, and hit the apply button. Next thing you know, they’ll ask for your ID and verify it within minutes. Once approved, you just link the card to your Coinbase wallet, load up some Bitcoin, and voila—you’re all set. Want to grab a coffee at Starbucks? Just swipe the card and enjoy your latte while your crypto gets converted on the spot. It’s that seamless.

“The process of applying for a crypto card isn’t rocket science—think of it as your gateway to bringing your crypto to life in the physical world.”

Excited yet? Owning a card like this makes spending effortless while keeping you connected to your digital assets. But before you step too far ahead, let’s address the elephant in the room. How safe are these cards? Well, you’re going to want to check out what’s next—you’ll be surprised at how secure (or risky) they can be. Ready?

Is it Safe to Use Crypto Cards?

Let’s be real—handling your crypto with caution is non-negotiable. When it comes to crypto cards, security is a big deal, and for good reason. You’re connecting your digital assets to a payment system, and while the convenience is awesome, the risks can’t be ignored. So, how safe are these cards, really? Let’s check it out.

Built-In Security Features

The good news is that most crypto cards come packed with solid security measures. Here are some of the most common features:

- Encryption: Almost all crypto cards operate with high-end encryption to shield your transactions, ensuring no one can sniff around your personal data or spending details.

- Two-Factor Authentication (2FA): This requires two verification steps (like a password and a temporary code) before you can access your account or make purchases. It’s an added wall of defense.

- Instant Lock/Unlock: Lost your card? No worries. Apps linked to these cards usually let you freeze and unfreeze it at the tap of a button. This minimizes potential unauthorized use right away.

- Backup Mechanisms: Many services now provide recovery options for your account, such as backup codes or seed phrases. This ensures you won’t lose access to funds even if something unexpected happens.

It’s impressive what’s being done to keep users safe, but, just like with anything in crypto, these features are only effective if you use them wisely.

Best Practices to Keep Your Account Safe

Security isn’t just about what the card provider offers—it’s also about what you do. Here are some tips to make sure you’re not caught off guard:

- Enable All Security Features: This might sound obvious, but you’d be surprised how many people skip things like 2FA. Don’t cut corners—it’s your money on the line.

- Avoid Public Wi-Fi: Coffee shops are great, but their Wi-Fi? Not so much. Stick to private networks when making crypto transactions or checking balances.

- Use Strong, Unique Passwords: This isn’t the time to use "password123" (please don’t). Create complex passwords and store them in a reliable password manager.

- Keep an Eye on Your Transactions: Set up alerts if possible. The moment you spot a suspicious expense, you can take immediate action to block or report it.

- Be Mindful About Links: Phishing scams are everywhere. Always make sure you’re accessing your crypto card account through the official app or URL—no shady links from emails or texts.

There’s an old saying, “Trust but verify.” It applies here too. Your crypto card likely comes with great safety tools, but staying vigilant is what will truly keep your funds secure.

"The difference between losing your funds and keeping them safe often boils down to how prepared you are.”

Now, here’s the thing—how do you know if these measures are robust enough, and how can you explore your options for extra protection? Don’t worry, the next section covers some amazing additional resources that might just give you the confidence you’re looking for.

Resources to Learn More About Crypto Cards

Got questions or want to explore even more about crypto cards? I’ve got you covered. Sometimes, a single guide isn’t enough, so here’s a list of resources and ideas to help you dig in deeper. Knowledge is power, after all, and the more you know, the smarter your spending becomes.

How Crypto Communities Can Help

If you haven’t checked out Reddit’s r/cryptocurrency yet, what are you waiting for? This is one of the most active communities where people share their personal experiences with crypto cards—both the good and the bad. It’s a goldmine of real-world feedback.

Prefer something more interactive? Look into Telegram or Discord crypto groups that discuss rewards, offers, and issues as they happen. Sometimes the solution to a problem you’re facing might already be posted in one of these threads. Just be cautious about sharing identifiable info—always prioritize your security!

Tools for Monitoring Spending and Rewards

Managing crypto spending manually? That’s a headache you don’t need. Instead, consider using tools like Blockfolio to keep an eye on both your expenditures and rewards. This app simplifies tracking, so you know exactly how much cashback or crypto bonuses you’re earning over time. Plus, it keeps everything in one place, so budgeting becomes less stress and more “I got this.”

Think about it: wouldn’t you want to know if your rewards outweigh the fees you’re paying? Because that’s the whole point, right? To make sure your card is actually working for you, not against you.

There’s also Crypto.com App, which ties in nicely with their own card. It gives you full visibility into spending habits, rewards, and even staking requirements, all from your phone.

Spending smarter starts with tracking smarter.

What’s Next?

Now that you’ve got some solid resources to keep learning, are you feeling more confident about picking the right card? Or are you still weighing your options? You’re not alone—there’s a lot to unpack. Stay with me because in the next part, I’ll walk you through an actionable checklist to ensure you make the best choice for your lifestyle. Trust me, you won’t want to miss it.

Ready to Pick Your Ultimate Crypto Card?

Alright, we’ve been through all the nitty-gritty details of crypto credit and debit cards. Now it’s time to bring everything together so you can choose the one that fits your lifestyle. Whether you're in it for rewards, convenience, or just testing the waters, there's a perfect fit for everyone — if you know what to look for. Let me help you wrap it up with some actionable steps.

Final Checklist Before You Choose

Here’s a quick checklist to make sure you’re picking the right card:

- Supported Cryptocurrencies: Does the card work with your preferred coins or tokens? For example, if most of your holdings are in Ethereum and the card only supports Bitcoin, it’s probably not the best fit.

- Reward Systems: Are you after high cashback rates, travel rewards, or something else? Cards like Wirex pack up to 8% cashback — but only if you meet certain spending or staking requirements. Double-check what you’re getting for your usage.

- Fees: Know what you’ll be paying. Look out for hidden fees like conversion charges, ATM withdrawal fees, or annual costs. Fun fact: You could end up spending more on fees than what you’re saving with rewards if you’re not careful.

- Regional Restrictions: Is the card even available in your region? This one’s obvious but easy to overlook if you’re caught up reading about all the perks. Some U.S.-friendly cards, like BitPay, might not be available in the EU.

- Ease of Use: Can you navigate the app or dashboard without pulling your hair out? Look for user reviews to see how smooth the experience really is.

If all boxes check out, you're on the right track. If not, it’s worth exploring other options until you find something that truly fits your needs.

Start Spending Smarter with Crypto

This is where the fun begins. Owning a crypto card isn’t just about spending — it’s about unlocking value. Imagine grabbing coffee or paying for groceries while earning Bitcoin cashback or staking rewards. That’s a level of financial utility most of us could only dream about a few years ago.

The key here is to spend smarter. Don’t just focus on collecting cashback but also think about how the card matches your habits and goals. If you’re a frequent traveler, for instance, prioritize cards that waive foreign transaction fees or offer travel perks.

I’ve personally found that pairing crypto cards with traditional ones works wonders. For everyday purchases, I use crypto cards with solid cashback or low fees. When it comes to rare situations where crypto cards fall short (like unsupported merchants), I switch to a standard card. You get the best of both worlds without missing out on rewards or convenience.

My Personal Recommendation?

If you’re asking me for a favorite, I’d say it depends on your priorities:

- Want simplicity? Go with the Coinbase Card. It’s straightforward and offers reliable usability paired with up to 2% cashback for everyday spending.

- Looking to maximize rewards? You can’t go wrong with the Volet. You’ll need to meet their staking requirements to unlock those top-tier benefits.

- Prefer more flexibility? The Nexo Card hits a sweet spot between a debit and credit system, with solid cashback options and no annual or hidden fees.

If I had to choose one all-rounder, it would be the Coinbase Card for its blend of ease and usability. But honestly, the best card for you might be different depending on how you plan to use it. Take your time to review your options and match them with your lifestyle. After all, spending crypto should feel as seamless as spending cash.

Oh, and if you’ve enjoyed this guide, why not share it with your friends or bookmark the page for later? There’s so much misinformation floating around about crypto cards — let’s help more people spend smarter and actually get the most out of their digital coins.

Best Binance Visa, Top Binance Debit Card Visa Alterntitives

Cryptocurrency's main use case is the facilitation of transactions and payments, while other utilities come second. The aim is to have a cup of coffee at your favorite coffee shop and pay with bitcoin or any other cryptocurrency you own. While this is the goal, as regards mainstream recognition, the crypto space is, however, still far from achieving it. Crypto is struggling to experience a mainstream breakout that will usher in an era where using crypto for everyday purchases is a possibility.

Regardless of how slow the mainstream movement has seemed lately, there are, nonetheless, emerging solutions looking to bridge the gap between the crypto world and conventional establishments. One of such is the crypto Coin Card. Owing to their growing popularity, we have chosen to explore the core functionalities of crypto debit cards and highlight some of the crypto fintech firms providing related service to crypto practitioners. Also, we will introduce you to some of the integral factors to look out for when choosing a crypto debit card.

What Is A Cryptocurrency Plastic Card?

A crypto plastic card has similar functions with conventional bank cards, albeit with a special affinity for cryptocurrencies. In other words, crypto plastic cards are essential tools for making payments at retail stores or e-commerce websites. They look just like traditional debit or credit cards. While this is a given, crypto plastic cards facilitate crypto payments, as they offer a swifter way to make payments with cryptocurrencies, and it does not matter if the retailer accepts crypto or not.

This assertion stems from the fact that crypto plastic cards exchange cryptocurrencies to fiat currencies before facilitating payments. Hence, users do not need to go through the long process of executing crypto-to-fiat exchanges on trading platforms before eventually paying for services and products with fiat money. They only need to adopt a system that seamlessly deducts your crypto balance and pays merchants the deducted value of coins in fiat currency. Note that card providers charge service fees whenever you use their cards.

Note that a large percentage of crypto debit card providers operating today offer multi-coin payment infrastructure, which allows users to pay for services and products with a variety of coins. That said, it is up to the provider to pick the preferred combination of cryptocurrencies to offer users. And in most cases, they stick to popular coins and offer BTC card services, as opposed to adopting lesser-known coins. Moreover, crypto card providers are majorly established crypto entities diversifying their businesses to include payment solutions. In other words, wallet providers often dabble into the crypto plastic card market. The same is true for fintech firms looking to capitalize on the growing appeal of crypto in the mainstream world.

There are two variations of crypto cards, and they are as follows:

Crypto Prepaid Cards

These are older variations of cryptocurrency plastic cards, as they entail users to pay card providers an amount of cryptocurrency to access a Visa/Mastercard loaded with an equivalent amount of traditional money. Once you set this up, you can use the card just as you would a normal bank card. As earlier stated, this model is somewhat obsolete, considering it requires you trust that the card provider’s manual exchange system for volatile assets is credible. You will agree that it is a tad difficult to predict the price swings of crypto, which might prove challenging for providers who adopt a model where they have to load debit cards with the fiat equivalence of the clients’ crypto deposit.

Crypto Debit Cards

Crypto debit cards are currently the widely-used variation. Like the crypto prepaid cards, users would have to deposit their cryptocurrencies with the provider. However, this is done via a web app, which makes the process a lot easier. Besides, a crypto debit card provider does not exchange cryptocurrency to fiat ahead of when it is needed. Instead, these providers opt to incorporate an instant exchange system that activates instant exchange whenever the card is in use. Hence, crypto to fiat exchanges take effect at the exact moment the user executes a payment order. Needless to say, this model bypasses the challenges of crypto debit cards relating to price tracking and accurate valuation of assets. And, they offer a swifter and more accurate crypto to fiat exchange.

Why Are Crypto Debit Cards Not Yet as Huge as They Should?

Crypto debit cards are yet to break glass ceilings because a majority of cryptocurrencies are still battling scalability and expensive transaction fees. Take bitcoin as a case study. It takes an average of 10 minutes for the bitcoin network to verify transactions, which defeats the essence of utilizing a bitcoin debit card. Also, transaction fees tend to skyrocket whenever there is network congestion, which also hurts transaction speed. While there are cryptocurrencies that boast impressive transaction speed, a majority of these assets, nonetheless, do not have market capitalizations that come close to what those with scalability issues have. In light of this, there are still limitations that cryptocurrency card providers, and crypto networks as a whole, must resolve before crypto debit cards can attain mainstream adoption.

How Easy It Is to Get A Crypto Debit Card?

From what we have witnessed so far, we can conclude that crypto debit cards are readily available and easy to adopt. You can simply search the web to access the list of crypto debit card providers operating in the crypto industry. Nevertheless, it is advisable to carry out due diligence before trusting your funds with debit card wallets. This assertion stems from the fact that crypto debit cards are new technologies finding their footings in a nascent market. Therefore, it is imperative to consider integral details that would help you ascertain the efficacy of card providers.

What Are the Factors to Consider When Choosing A Crypto Debit Card?

As mentioned earlier, some factors could help you pick the crypto debit card that best suits you. In this section, we will highlight some of the integral ones that you ought to consider before reaching a decision.

The Supported Jurisdiction

Crypto regulation is still a dicey topic in a lot of regions. Therefore, the onus falls on you to determine the status of cryptocurrency in your location before deciding on owning or spending crypto. For people living in countries where legislators are yet to legalize crypto activities, the chances of finding a crypto debit card provider willing to cater to their jurisdictions are slim. And even if they do, circumventing regulations to utilize crypto cards might come back to hurt them.

On the other hand, people living in crypto-friendly nations ought to do some digging as regards the card provider’s penchants for remaining compliant to defined crypto regulations. Besides, since these entities bridge the crypto and fiat money economy, they also have to comply with regulations governing traditional financial institutions. Owing to the regulatory obligations of running a legal crypto debit card facility, it is, therefore, common for credible providers to restrict their services to countries or regions where they have successfully scaled regulatory requirements. Hence, you ought to unravel details relating to the supported jurisdiction of a card provider before opting for it.

The Ease of Use

The goal is to someday have access to seamless crypto debit card services that could compete with traditional bank cards, in terms of ease of use, or even surpass conventional standards. Until then, you should ensure that the services of the crypto credit card provider under consideration is as straightforward as possible. Note that your crypto debit card account is linked to an exchange, so it is advisable to research the processes undertaken in the background, the speed of these processes, and how it contributes to your experience. All these factors are noteworthy and would determine whether you would enjoy utilizing the debit card or might eventually stop using it out of frustration.

The Security Status of The Crypto Debit Card

Security is one factor that you shouldn’t take lightly, especially when the issue at hand involves your crypto holdings. As such, we suggest that you ascertain that the crypto debit cards under review have standard security measures, which will shield your details and assets from nefarious entities. Here, you should emphasize on two-factor verification system, site encryption, and email alerts. You should sideline a crypto card service that does not have the infrastructure in place to facilitate these security requirements. Also, it is advantageous to opt for providers who have partnered with market leaders like Mastercard and Visa. Note that service integration allows users to access topnotch security protocols found in established card services like 3D Secure. For instance, a Visa cryptocurrency card comes with all the security perks alluded to Visa cards.

The Credibility of The Crypto Debit Card Service

Although crypto debit card services are new concepts, there are, however, several factors that can help you determine the longevity and credibility of a crypto debit card service. First, you should gauge the provider’s experience in the crypto fintech space and its proactiveness in the crypto space. Likewise, you should check that the company has done enough to ensure compliance and is working closely with regulators to guarantee the safety of their users. There is an aura of credibility linked to crypto debit card providers that have sealed collaborative projects with mainstream market leaders. The same is true for services with impressive feedback mechanisms and top-notch customer support.

Service Fees and Transaction Limits

Recall that we mentioned earlier in this guide that crypto debit card providers deduct service charges on all crypto transactions. As such, you should analyze the fee structure of the card provider under review before going all out to register for its services. Ensure that the service offers a competitive price rate, unrestrictive fees structure, and flexible transaction limits. You can do this by researching the price framework of other card providers and comparing them with the one you at the verge of adopting.

Additional Features Available to Users

There are various ways you can use a crypto debit card. You could use them to make atm withdrawals, online and offline purchase, or facilitate fund transfer. Regardless of the card you eventually choose, ensure that it offers these core functions. Other features that you should look out for are foreign exchange, instant remittance service, and multi-coin support. For example, a bitcoin debit card could also function as a bitcoin atm card, which bodes well for individuals searching for services that offer a broad array of crypto card services.

The Incentives Offered to Users

Since the crypto debit card terrain is very much competitive, it is, therefore, common to encounter services that offer incentives to users. Debit card providers, which are keen on attracting new users and expanding their customer base, often adopt incentive programs. Hence, they provide cashback rewards, referral programs, and discounts. Needless to say, rewards are almost always impossible to decline. However, we advise that you do not forego the quality of the service rendered for a chance of earning freebies.

How Did Cryptolinks Compile Its List of The Best Crypto Debit Card Providers Operating in The Industry?

Knowing fully well that the successes of crypto cards have adversely affected the push for mainstream adoption, we have, therefore, chosen to extensively research the niche and provide the resources you will need to choose the best cryptocurrency debit card. To do this, we adopted an organic research methodology while using the above-mentioned recommendations as our guide.

In light of this, we explored the jurisdiction that each crypto card provider support and how well it has gone about ensuring full compliance with existing regulations. Thereafter, we examined how easy it is for users to navigate their features and functions. We expect crypto debit card providers to offer infrastructures and protocols that sidestep the challenges associated with crypto payments in an innovative manner. Also, we tested each card provider for credibility. Here, we used information, ranging from customer support culture to service integration, as the template to score the platforms under review.

Next, we assessed the security measures accessible on each credit card facilitator as well as the security history. Then, we compared the policy of the debit card providers listed and gauged its flexibility as regards competitive price frameworks and restrictions. The platforms’ customer rewarding system also came under the spotlight, and we explored the core and added features of each.

In the end, we found 9 crypto debit card services that met our criteria and deserve a mention on our website. We suggest that you make the effort to research each platform with the help of our unbiased review articles.