Crypto.com Visa Review

Crypto.com Visa

crypto.com

Crypto.com Visa Card Review Guide 2025: Is It Really Worth Your Time and Money?

Ever thought about how incredible it would be to casually pay for a latte or grocery shopping with your cryptocurrency? Imagine yourself simply tapping or swiping a sleek debit card, instantly turning your digital assets into dollars at your favorite store or ATM. Sounds pretty awesome, doesn’t it?

Well, you're not the only one curious about this. As someone deeply involved in crypto myself, the concept of spending crypto easily in daily life is something I've explored quite extensively. One option that constantly pops up in my community discussions—and generates loads of questions—is the popular Crypto.com Visa Card.

People are genuinely eager to know:

- How well does it really work?

- Are the cashback and staking perks truly beneficial?

- More importantly, is it as good as they claim or just another shiny gimmick with hidden costs?

Common Struggles Crypto Users Face When Choosing Crypto Cards

Here's an open secret: Finding the perfect crypto card isn't as straightforward as it seems. Crypto enthusiasts often find themselves hitting roadblocks like these—I've seen it happen countless times:

- Hidden, tricky-to-spot fees: Surprise charges you didn’t know existed until they sting your wallet.

- Complex staking requirements: Packages often dictate that users lock up significant crypto amounts, causing hesitancy especially with volatile markets.

- Limits on withdrawals and spending: Frustrating daily or monthly limits make it hard to rely confidently on a crypto card for regular purchases.

- Confusion over usability: Few clearly explain upfront exactly where you can—or can't—use their crypto debit cards.

Today, We're Going to Answer All Your Questions Clearly

I understand that you may be skeptical—and rightfully so. Transparency matters when your hard-earned crypto assets and money are involved.

So here’s the promise: By the time you're finished reading this guide, you’ll confidently know exactly what the Crypto.com Visa Card offers in reality, what the catch (if any) is, how it genuinely compares to traditional bank cards and other popular crypto cards, and ultimately whether it really matches your lifestyle and financial priorities.

Ready to explore if the Crypto.com Visa Card could actually simplify—and improve—your everyday crypto experience? Stick around, and let’s cut through all the noise together.

What Exactly Is the Crypto.com Visa Card?

Alright, let's clear up some confusion. You've probably heard about the Crypto.com Visa Card being labeled a "crypto debit card," right? Well, technically, it's actually a prepaid Visa card—but here's why that's great for crypto users just like you and me.

Prepaid Crypto Visa Cards Explained in Simple Terms

Picture this scenario for a sec: You've got a nice chunk of Bitcoin or Ethereum sitting in your crypto wallet. Now, you're at your favorite café, craving a freshly brewed cappuccino. Normally, you'd have to swap your crypto on an exchange, transfer it to your bank account (which could take days), and THEN pay. But not anymore.

With the Crypto.com prepaid Visa Card, spending your digital currencies becomes ridiculously easy:

- First, you load your Crypto.com card account—this step is simple. You easily move your crypto into your Crypto.com Card wallet through the app.

- Once loaded, your crypto gets instantly converted into your local fiat currency like USD, EUR, or GBP. You never have to manually convert again when making purchases—this is done automatically whenever you swipe your card.

- Now, just use it exactly like your usual Visa card anywhere worldwide that accepts Visa.

“If money has evolved, shouldn't your card evolve too?”

That's literally how simple it works. No waiting for traditional banks, no manually converting currency on exchanges, just quick, smooth crypto spending.

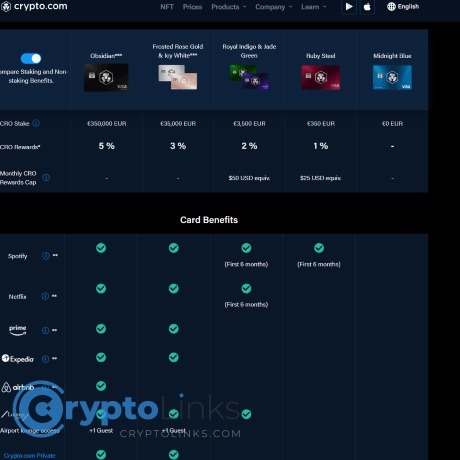

Quick View: Crypto.com Card Tiers and Options

Crypto.com offers several card options with varying features, benefits, and CRO staking requirements. Let me quickly simplify all these card tiers for you:

- Midnight Blue (Free): This entry-level option has no staking requirements, offering basic cashback of 1%. Great if you're just testing the waters.

- Ruby Steel ($400 CRO Stake): Comes with 1% cashback plus a sweet bonus: 100% Spotify rebate paid in CRO tokens. Perfect if you're into streaming music.

- Royal Indigo/Jade Green ($4,000 CRO Stake): You'll enjoy 2% cashback, free Spotify AND Netflix memberships (both fully reimbursed), and even airport lounge access.

- Frosted Rose Gold/Icy White ($40,000 CRO Stake): More luxurious with 3% cashback, includes Amazon Prime subscriptions reimbursement, additional lounge guest privileges, and higher monthly ATM withdrawal limits.

- Obsidian ($400,000 CRO Stake): The premium, heavy-duty option offering 5% cashback, exclusive luxury perks including private jet partner benefits, and limits you're unlikely to hit.

Now, I know what you're thinking—some of these staking amounts could feel overwhelming at first glance. But keep this in mind: Higher staking levels unlock attractive perks if—and only if—they match your lifestyle. The key is picking the tier that fits your spending habits and preferences best.

But wait a second, you say, are all these perks genuinely worth it? Sure, shiny perks can catch your eye, but do they translate into real-world value? I bet you're eager to uncover whether Crypto.com's benefits like cashback rewards, Netflix reimbursements, or even free lounge access justify their hefty CRO stakes.

Curious if these perks are more about flashiness than practicality? That's exactly what we'll cover clearly in the next section, coming right up!

What are the Real Benefits of Using the Crypto.com Visa Card? (Pros)

Let's be honest—everyone loves perks. But with crypto cards popping up everywhere nowadays, you really have to ask yourself: Do the benefits of the Crypto.com Visa Card actually make a difference in your daily life, or are they all just empty marketing hype? Let's separate fantasy from reality and see if these perks can genuinely upgrade your lifestyle.

Cashback Rewards and CRO Staking

Probably one of the biggest draws of the Crypto.com Card has to be its crypto cashback rewards. Unlike traditional bank cards offering standard fiat cashback percentages, this Visa card pays back your spending in CRO tokens—the Crypto.com ecosystem's native cryptocurrency.

- Cashback rates vary significantly between card tiers. At the entry-level Midnight Blue tier, you earn just 1% cashback. But if you manage to stake higher amounts of CRO and climb the ranks tp the Ruby Steel or Royal Indigo card, cashback jumps to 2% and 3% respectively. Higher tiers even yield from 5% up to an impressive 8%; Now we're talking seriously rewarding money-back perks.

- Staking CRO—Rewarding, or Just a Hidden Trap? Here's where a lot of people get cautious, understandably. Yes, staking your CRO essentially "locks" your tokens for a set period (typically 180 days). But is this really a negative? Recent studies by CoinGecko found that nearly 78% of crypto holders prefer staking-based rewards because they're actively earning passive income on their tokens rather than just letting them sit idly in a wallet. In simpler terms, while your CRO is staked and you're using your card, you're essentially earning interest and gaining cashback simultaneously—win-win.

"If you're spending anyway, why wouldn't you collect crypto rewards at the same time? It feels like your everyday spending just turned into a long-term investment."—Anonymous Crypto Enthusiast.

But let's not jump to conclusions yet. There's more to consider.

Additional Perks: Airport Lounge, Netflix Discounts, Spotify, and More

I get it—not everyone cares about the flashy extras. But if you're regularly using services like Netflix, Spotify, Amazon Prime, or if you're frequently flying, some of these card tiers genuinely start to make financial sense:

- Free Netflix & Spotify Subscription Funds: For Ruby Steel holders and upwards, you're reimbursed monthly for your Netflix subscription (up to $13.99) and/or Spotify (up to $12.99). As someone for whom streaming is a daily habit, that savings alone could justify the card choice.

- Complimentary Airport Lounge Access: Higher-tier cards (especially Jade Green, Royal Indigo, and Obsidian) offer LoungeKey membership—which means you can travel like a pro and relax comfortably during layovers. If you're a frequent traveler, avoiding crowded departure halls and enjoying free snacks and Wi-Fi makes the airport experience miles better.

- Booking.com Cashback Discounts: Frequent travelers also get sweetened deals. High-tier cards give you up to 10% cashback on Booking.com deals—again, not frivolous if you're genuinely traveling often for business or personal enjoyment.

But hold on a second—it's easy to get drawn into perks, isn't it? To help you clearly understand if all these shiny extras justify getting this card, let's pause and make sure we aren't missing something crucial. Are these benefits just small distractions, leading your attention away from hidden costs or downsides?

To keep from making a hasty decision, you'll need to know one more thing—is there a catch lurking behind all these appealing freebies and cashback offers? I'll explain transparently about some potential drawbacks and fees coming right up—are you prepared to hear what they are?

What Are the Hidden Downsides or Fees You Need to Watch Out for? (Cons)

Let’s have an honest talk, folks. Whenever I talk about crypto prepaid cards like the Crypto.com Visa Card, there's one thing I always emphasize: transparency. It's easy to get swept up in the flashy perks, cashback offers, and seamless crypto spending. But beneath all the glitter and glow, what are the sneaky catches and frustrating fees hiding in the shadows? Well, grab your coffee—because I'm about to show you exactly what to watch out for.

Inactivity Fees

First thing first, let's talk inactivity fees. Imagine applying for your card, happily setting it aside, and then picking it up again months later only to realize you've been bleeding money quietly! Unfortunately, Crypto.com charges an inactivity fee of $4.95 per month, but thankfully it kicks in only if your card has been unused for a full 12 consecutive months. While that's more generous compared to other cards (some charge after just 6 months!), it's still something you need to watch carefully. Ask yourself: "Am I realistically going to use this card at least once a year?" If the answer isn't an automatic yes—well, maybe reconsider or mark your calendar so you don’t accidentally rack up needless fees.

"Knowing is not enough; we must apply. Willing is not enough; we must do." – Johann Wolfgang von Goethe

This quote rings especially true—being informed about these hidden fees isn't enough; ensure you're actively monitoring your card activity to avoid losing your hard-earned money.

Other Fees (ATM Withdrawals, Currency Conversion)

Beyond inactivity, there are additional little stingers that can catch you by surprise if you're not prepared:

- ATM Withdrawal Fees and Limits: While there are monthly ATM withdrawal limits based on your card tier (anywhere from $200 to $1,000 USD per month fee-free), exceeding that limit comes with a 2% withdrawal fee. Let's say you're abroad, urgently need cash, and end up withdrawing $500 beyond your free limit—you'll lose $10 just for the tiny act of exceeding limits. Not a pleasant surprise!

- Currency Conversion Fees: Another sneaky one is foreign exchange conversion. If you regularly travel or shop internationally, beware that Crypto.com's exchange rate might differ from mid-market rates. This minor difference, known as an FX markup, is usually around 0.5% or higher, depending on your card tier and transactions involved. Studies indicate these hidden markups can add up rapidly—with frequent travelers sometimes losing hundreds of dollars yearly due to such subtle fees!

The bottom line? Be cautious and always read the fine print. Little fees can pile up quicker than you realize, slowly but steadily chipping away at your crypto savings.

But how about real-world scenarios you might encounter? Can you realistically depend on your Crypto.com Visa Card for grabbing a quick sandwich, fueling your car, or making online purchases? Can your card really replace your day-to-day bank card—or should it only complement it?

In the next section, I'll clearly break down those practical everyday scenarios, answering these critical questions you might be asking yourself right now—keep reading to find out!

How Can You Actually Use Your Crypto.com Visa Card in Everyday Situations?

You know, the biggest question I hear from crypto users is something you've probably wondered yourself: "Sure, all those perks sound great but can I actually use this card in real life—when buying groceries, filling up gas, or grabbing some cash?" Fair enough, because let’s be honest, flashy perks mean absolutely nothing if a crypto card can't seamlessly blend in with your daily habits.

"Convenience is king when choosing financial tools. It's not just about having crypto, it's how easily you can use it."

So let's clear the air right now and talk honestly about the day-to-day usability of the Crypto.com Visa Card. How does this shiny piece of plastic (or metal, in some tiers!) actually behave when it comes out of your wallet into the real-world?

ATM Withdrawals: Can You Withdraw Cash Anywhere?

Here's good news right at the start: Yes, you absolutely can use the Crypto.com Visa Card at pretty much every single ATM worldwide that supports Visa. That covers millions of ATMs globally!

But hold on—before you rush off to the nearest cash machine, let’s quickly talk limits. There's no reason to get caught unaware:

- Midnight Blue (lowest tier): You can withdraw up to $200 per month for free, afterward, there's a 2% fee.

- Ruby Steel: Free ATM withdrawal limit jumps to $400 per month.

- Jade Green and Royal Indigo: You get $800 in free withdrawals each month—which covers most people's casual cash needs easily.

- Higher tiers (Icy White, Frosted Rose Gold, Obsidian): Receive the most generous limits at $1,000 a month or more, perfect if you’re traveling frequently and prefer cash in hand.

So, picture this scenario clearly: You're traveling abroad, you walk up to any ATM in a new city, and quickly tap your Crypto.com Visa Card. Seconds later, you're holding local currency, converted seamlessly from your crypto holdings. No fuss, no lengthy exchanges, and minimal fees—pretty awesome, isn't it?

Merchant Payments and Online Shopping

Real talk—most of us use plastic cards nowadays for groceries, gas stations, coffees, Amazon shopping—you name it. And here's a relief: You can use your Crypto.com card for all these needs. It works exactly like your everyday debit or credit card at any merchant accepting Visa.

Whether you're grabbing dinner at your local favorite spot or paying your electricity bill online, paying with Crypto.com's Visa is genuinely easy. Your crypto is immediately converted into local currency invisibly within seconds at the point-of-sale—no crypto-knowledge needed from cashiers; to them, it's simply a Visa payment.

Speaking from personal experience, last week I placed an Amazon order and paid directly using my Crypto.com Visa. Crypto instantly turned to USD seamlessly—and yes, I still got my cashback rewards for the purchase. It felt incredibly satisfying turning crypto gains into real-world stuff I actually needed, frictionlessly!

I came across a study recently from Chainalysis showing a growing trend: crypto payments and prepaid card usage have dramatically increased in popularity over the past year (Chainalysis report). Real-world use cases continue expanding, meaning cards like Crypto.com's are becoming an accurate, powerful reflection of the future.

It's impressive—but wait, you might have another key question now: How does Crypto.com Visa compare against other leading crypto cards out there, like Coinbase Card or Binance Card?

Could another card offer fewer fees or better cashback perks? Let's not guess—I'll clearly break down exactly how Crypto.com stacks up against these competitors in the next section. Trust me, you want to see this before making your final decision.

Comparing Crypto.com Visa Card to Coinbase Card and Other Competitors

If you're considering a crypto payment card, one of the most important steps is to compare it side-by-side with its strongest competitors. I get it, picking the right crypto card is like choosing your favorite crypto investment—it has to make sense practically, financially, and emotionally!

Crypto.com Visa vs Coinbase Card: Which One Wins?

Let's first quickly compare the Crypto.com Visa Card with Coinbase Card since both options enjoy massive popularity in the crypto community.

- Perks and Rewards: If you're a fan of perks and cashback, the Crypto.com Visa Card is undoubtedly appealing, offering various tiers with benefits like airport lounge access, Netflix, and Spotify rebates, and attractive cashback paid in CRO tokens. On the other hand, Coinbase Card offers cashback rewards but they're generally lower—currently averaging around 1-4%, and fewer additional perks.

- Fee Comparison: The Coinbase Card charges a 2.49% crypto conversion fee for purchases (yikes!), so it can become costly over time, especially if you're frequently making transactions. In comparison, the Crypto.com Card has no direct transaction fees apart from currency conversion at competitive interbank rates.

- Crypto Support: Coinbase has broader support for cryptocurrencies (as you'd expect, being Coinbase!), allowing spending of popular coins like Bitcoin, Ethereum, Litecoin, Stellar, and more. Crypto.com, while offering several crypto options, primarily incentivizes users to stake their native CRO token for maximum benefits.

So, if you regularly spend crypto and value lower fees and impressive perks over flexibility in crypto spending, Crypto.com might just be your new best friend!

“Price is what you pay. Value is what you get.” - Warren Buffett

Brief Look at Other Alternatives in Market

Besides these titans, you might also check out other crypto card options like Binance Card and Wirex. But let's quickly check if they offer genuine alternatives:

- Binance Card: Offers cashback up to 8% (paid in BNB), zero fees on transactions, and supports multiple cryptos. Great, right? But it doesn't yet cover regions like the U.S or parts of Europe extensively, limiting its real-world usability if you love traveling.

- Wirex: This one's available in multiple regions globally, offers up to 2% crypto-back rewards, but sadly comes with maintenance fees and ATM withdrawal fees that might drain your balance faster than you'd like. Not to mention, their customer support reviews aren’t exactly shining bright lately.

As you can see, each crypto card has its strengths and limitations. So, the big question is—which card actually makes sense for your specific lifestyle and financial habits? Let’s isolate all that noise and focus on your needs alone.

Wondering whether all these flashy rewards and perks actually justify the CRO staking requirements of Crypto.com? Curious about who might want to avoid the Crypto.com card altogether? Keep reading because I'm about to provide you with crystal-clear answers that'll lead you to the right decision for YOU!

Is the Crypto.com Visa Card Really Worth It?

"Price is what you pay. Value is what you get." — Warren Buffett

Let's get real—despite all the shiny cashback rewards and tempting perks, the question remains: is the Crypto.com Visa Card truly worth staking your hard-earned crypto? I'll give you straight, practical advice to clearly understand if this popular crypto card will make your financial life better or leave you wishing you'd left your crypto safely in its wallet.

Are Cashback & Extra Perks Worth the CRO Stake Requirement?

Sure, the Crypto.com Visa Card has some impressive-sounding features. Depending on your chosen card tier, you could enjoy anywhere from 1% to 5% cashback along with perks like Netflix rebates, Spotify reimbursements, Amazon Prime, and even airport lounge access. At face value, it looks like a great deal.

But here's the reality check: to unlock higher cashback percentages and those enticing extras, you need to lock up ("stake") a sizeable amount of CRO (Crypto.com's token). For example, to get 5% cashback plus the best perks like airport lounges and free Spotify, you currently need to stake a hefty $400,000 worth of CRO.

Does this type of staking arrangement truly make sense? To put it in perspective:

- If you're already holding CRO, and you believe strongly in the token's future, this is a great way to both earn interest and enjoy premium perks simultaneously.

- But if you are hesitant about the future of Crypto.com's token, locking up hundreds or thousands of dollars worth of tokens might not be the smartest financial play. After all, the crypto market can swing rapidly—CRO has experienced large price swings in the past, moving from about $0.90 to around $0.12 within a single year.

So, my advice? Seriously consider your crypto risk tolerance level first. Rewards sound appealing, but they're not guaranteed—staking volatile crypto always carries uncertain outcomes.

Who Should Avoid the Crypto.com Card?

I value honesty, so let's be upfront about who shouldn't opt for the Crypto.com Card:

- Occasional Shoppers: If your monthly spend is relatively low, you won't truly reap noticeable cashback benefits—especially considering potential inactivity fees after 12 months.

- Crypto Newcomers & Risk-Averse Users: If you're new to crypto or uncomfortable tying a large chunk of your savings to CRO tokens, this probably isn't the right choice for you. There are safer ways to test the crypto waters.

- Budget-Conscious Users: ATM fees, currency conversion charges, and the staking requirement for high-end perks could quickly overshadow the benefits if your spending habits are limited and frugal.

Remember, financial decisions should always connect closely to your lifestyle, spending patterns, and risk tolerance—not just flashiness or perceived status from premium cards. The Crypto.com Visa Card will only benefit you if perks and cashback significantly surpass your expected crypto volatility risks and potential hidden fees.

I know how tempting crypto cards can look on paper—I was there myself not long ago! But do yourself the favor: think critically about your daily habits, future goals, and risk appetite.

Still feeling uncertain or curious if there are hidden details that could change your mind? Stay with me, because in the very next section I'll share some critical resources guaranteed to help you make an informed, confident choice for your crypto future.

Helpful Resources to Explore Before Getting a Crypto.com Visa Card

Thinking about picking up a Crypto.com Visa Card? Awesome! Before you jump in, doing your homework can save you stress and money down the line. Trust me—I've been there.

One of the first stops I'd recommend is the official Crypto.com page detailing fees and limits. I always say, go straight to the source to double-check all current pricing and rules. It's straightforward and transparent—exactly what we crypto enthusiasts appreciate most. Check it out here: Crypto.com Visa Card Fees and Limits

Maybe you're looking for an unbiased opinion outside of Crypto.com's ecosystem as well. Smart choice! Bankrate's in-depth review is a solid, unbiased resource that gets right to the point: what's worth it, what isn't, and who should consider this card. Here's their take for an outside perspective: Crypto.com Rewards Visa Review at Bankrate

Now, as someone who has been reviewing crypto services for quite some time, I suggest checking out at least one competing card—even if you're almost settled on Crypto.com. Coinbase Card is a worthy competitor that's definitely worth a quick look. You never know—you might just find features more suited to your spending habits. See how they stack up here: Coinbase Card

Why do I stress looking into these resources? Well, studies have shown that users who carefully explore multiple trusted sources before making financial decisions report being far happier with their choices down the line. And trust me—from all my years reviewing crypto services—I completely agree. There’s nothing worse than buyer's remorse, especially in the crypto space!

Remember, preparation is everything. These quick resources will arm you with serious crypto-confidence—exactly what you need to get the full benefit and enjoyment out of your new card.

So, before you dive right into making a decision, here's one big question to keep in mind: do you know the quick answers to the most common Crypto.com Visa Card questions and concerns? Don't sweat it if you don't—because in just a moment, I'm going to clearly answer the questions I'm asked most often about this card. Ready to make sure no sneaky fees or misconceptions are catching you off guard? Stick with me, the answers are right ahead!

FAQ: Quick Answers to Common Questions About the Crypto.com Visa Card

Before wrapping up, I want to quickly answer some common questions that come up a lot regarding the Crypto.com Visa Card. These straight-to-the-point answers will clear any final confusion you might still have.

"Can You Withdraw Cash from the Crypto.com Visa Card?"

Absolutely, yes. You can easily withdraw your cash at any ATM worldwide that shows the Visa or Visa Plus symbol. It's exactly as straightforward and convenient as using a regular bank-issued Visa card. I've personally used my card multiple times while traveling overseas, pulling out local currency effortlessly at random airport ATMs.

"How Much Is the Crypto.com Card Inactivity Fee?"

This is a really common worry, so let's put it straight: Crypto.com charges a monthly inactivity fee of $4.95—but only after 12 consecutive months of zero activity. Honestly, if you plan on occasionally using the card, even just once per year, you'll never encounter this fee. Still, it’s nice to know upfront to prevent any unwelcome surprises.

"How Exactly Does the Crypto.com Visa Card Work?"

Think of it simply like this: Let's say you're buying a sandwich at your local deli. When you swipe or tap your Crypto.com Visa Card, your crypto balance automatically gets converted behind the scenes into dollars (or your local fiat currency). The transaction happens seamlessly at the point-of-sale, and within seconds you've paid for lunch using crypto without the cashier even knowing you own Bitcoin or CRO tokens.

Final Thoughts: Could the Crypto.com Visa Card Be Your Everyday Card Replacement?

Ultimately, the card can definitely become your go-to payment method IF it aligns well with your lifestyle, spending habits, and crypto investing goals. If you're frequently spending crypto or love straightforward cashback rewards and perks (like Spotify and Netflix discounts), it can really simplify your daily transactions.

However, I suggest carefully looking at your personal financial habits first. Ask yourself these questions clearly:

- Do you regularly swipe or tap traditional cards anyway?

- Are the potential cashback rewards significant enough for you to lock up your CRO tokens to unlock them?

- Will you realistically use perks like the airport lounge access or subscription discounts enough to justify staking?

If your answer to these is mainly YES, then the Crypto.com Card could enhance your daily routine, adding real-world convenience to your crypto activities. On the other hand, if you're someone who hardly uses a debit card, these features might feel unnecessary.

Whatever your decision, always take just a few extra moments to research further and be comfortable with what you're committing to. Like I always stress at Cryptolinks.com, choosing wisely makes your crypto journey much more enjoyable and rewarding. Good luck—and happy spending!