SoFi Credit Card Review

SoFi Credit Card

sofi.com

SoFi Credit Card: A Closer Look

As a guy knee-deep in the world of cryptocurrency and digital finance, I know all too well the importance of getting the right credit card to complement my digital-focused lifestyle. One such card that recently caught my eye is the SoFi Credit Card. Now, you may know SoFi more for their banking and investment services, but they have quietly introduced a credit card that is worth noting. This review will give you a detailed analysis, and unlike other SoFi Credit Card reviews you'll find on Google, I'll be telling it like it is.

Understanding the SoFi Credit Card

Those familiar with SoFi's banking and investment accounts anticipated a big splash when the SoFi Credit Card was announced. However, I feel it has not quite lived up to the hype. That's not to say it's a weak product. Far from it. The SoFi Credit Card offers 2% unlimited cash back on purchases and 3% unlimited cash back on SoFi Travel bookings, with zero annual fees. Quite solid, but nothing groundbreaking in the world of credit cards.

Salient Feature Overview

Here's a quick glance at its key characteristics:

- Welcome Bonus: N/A

- Annual Fee: $0

- Regular APR: 17.99%

- 29.99% variable

- Credit Score: Good Standout

Features include:

- Unlimited 2% cash back on eligible purchases and unlimited 3% cash back on SoFi Travel bookings

- Complimentary cell phone insurance coverage up to $1,000

- No annual fee or foreign transaction fees

Digging Deeper into the SoFi Credit Card

Like several others, the SoFi credit card offers unlimited 2% cash back on purchases, redeemable in various ways to a qualifying SoFi account. It prides itself on a no-nonsense approach—no purchasing category limits, no cash-out minimums—a simple, straightforward card, ideal for customers who prefer to "set it and forget it." This card is an easy fit in your wallet, primarily due to SoFi's platform, allowing you to manage all your financial products, including banking, investments, loans, and credit card, all in one place.

Targeted Customers

The SoFi Credit card specifically targets customers keen on building savings, paying down loans, or getting started with investing. It offers 2% back per eligible dollar spent as points, which are worth half a cent each in cash back if redeemed as a statement credit. However, if you use your rewards to offset loans held with SoFi or deposited into Banking or investment accounts with SoFi, then points are worth 1 cent each—a unique characteristic aimed at encouraging customers to use and engage with SoFi's other services.

Unique SoFi Features

This is where I think the SoFi Credit Card stands out in the crowd. The ability to redeem your rewards for cryptocurrency via a SoFi Investment account is a feature crypto enthusiasts like myself can appreciate. And of course, transferring rewards to your SoFi banking account means you can use your balance towards bills, spending, or cash withdrawals. Handy.

A Look at the Ratings

At Forbes Advisor, a rigorous methodology is used to rate credit cards. This card's rating is the result of considering a variety of criteria, including annual fees, welcome bonus offers, ongoing earning rates, value of individual points or miles, included travel or merchant credits, and additional cardholder benefits. Card features expected to be used the most by cardholders carry more weight in the ratings. Therefore, this rating is the amalgamation of these factors, creating a unique star rating for each card.

Final Thoughts

In the crowded world of credit cards, the SoFi Credit Card can be a sound option for anyone wanting a straightforward credit card coupled with the ability to manage all financial products within the same digital space. The card's offer may not set the world on fire, but its simplicity, lack of annual fees, and rewards system can make it a suitable choice for a newcomer in the world of credit. And let's not forget the feature that caught my eye: the option to redeem rewards for cryptocurrency. So, here's the deal. Don't just go for the hype. Dive deep into it. The SoFi Credit Card may or may not be the card for you, but understanding what it offers will keep you one step ahead in this ever-evolving financial landscape. Stay smart, stay informed, and remember—your choice in credit card should sync seamlessly with your lifestyle and financial goals.

SoFi Credit Card Review: Is It Worth It?

Hello crypto buddies! Today, we're taking a much closer look at the SoFi Credit Card - an offering from the financial technology and services company that made a big impression with banking and investment accounts.

What Can You Expect with the SoFi Credit Card?

The SoFi Credit Card is a pretty straightforward product. It offers unlimited 2% cash back on all purchases, and if you're a travel enthusiast, you get 3% back on bookings. On top of that, it comes with no annual fee, which means you can keep more of your hard-earned cash.

SoFi Credit Card Key Features

This card has some unique features that set it apart from others in the market. Some key highlights include: * Unlimited 2% cash back on purchases * 3% unlimited cash back on SoFi Travel bookings * Up to $1,000 cell phone insurance coverage * No annual fee * No foreign transaction fees Hopefully, you're starting to see why this could be a great addition to your wallet.

SoFi Credit Card APR and Credit Score

The card comes with a variable APR ranging from 17.99% - 29.99%. You’ll need a good credit score to qualify. Despite not boasting a welcome bonus, it does come with a 0% APR introductory offer for the first 12 months.

The Perks of the SoFi Credit Card: No Restrictions and No Minimums

This card is a hassle-free card. It doesn't come with any category restrictions. You earn the same percentage of cash back, no matter what you're purchasing. Also, there are no cash-out minimums – a relief for those tired of waiting to accrue points before they can cash out. Who doesn’t love no fine print, right?

The Convenience of All-in-One Banking With SoFi

Having all your finances in one place is another benefit of this card. With SoFi, you can have your banking, investment, loan, and credit card all in one spot, making managing your money quick and simple. If you’re the 'set it and forget it' type of person, you’re going to love using the SoFi website or app since you can manage all your SoFi accounts in one place.

Who is the SoFi Credit Card For?

This card is designed for the savers, the borrowers, and the beginning investors among you. You'll earn rewards at a much better rate if you redeem them into SoFi accounts like banking or investment. Moreover, you can pay down your SoFi loans with your rewards! If you love the idea of investing, this could be a game-changer for you - especially when you consider that you can redeem your rewards for cryptocurrency via a SoFi investment account. Now we're talking, aren’t we?

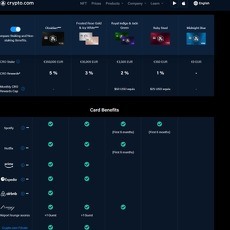

How Does The SoFi Credit Card Compare?

When comparing cards and giving them ratings, I take a lot of factors into account, including annual fees, initial welcome bonuses, ongoing earning rates, extra benefits, and more. While the SoFi card doesn’t offer a welcome bonus, its simple structure, no annual fee, and no category restrictions make it a viable contender in the market.

Final Thoughts on the SoFi Credit Card

Overall, the SoFi Credit Card is a solid offering. While it doesn’t offer any unique benefits compared to the competition, it holds its own as a no-fuss, straightforward rewards card with decent cash back rates and financial consolidation benefits, especially for those already utilizing other SoFi services. So there you have it, your one-stop resource for everything you need to know about the SoFi Credit Card. I hope this enhanced understanding will help you in making an informed decision about whether or not this card meets your financial needs. Remember, knowledge is power, especially when it comes to personal finance! Cheers, fellow cryptomaniacs! Happy investing.

Pros of SoFi Credit Card

Unlimited Cash Back

As an avid crypto enthusiast, one of the most striking benefits of the SoFi Credit Card is the ability to earn unlimited 2% cash back on all eligible purchases, and 3% cash back on SoFi Travel bookings. This broad earning potential gives me a distinct advantage when it comes to accumulating points that I can then convert into cryptocurrencies in my SoFi investment account.

No Annual Fee and Foreign Transaction Fee

Strikingly, SoFi Credit Card does not impose an annual fee or foreign transaction fee. This is a significant advantage, especially for someone like me that constantly transacts in different countries for crypto assets without having to worry about extra charges.

Diverse Rewards Redemption

The SoFi Credit Card gives me diverse options for redeeming my rewards. I can choose to either pay down loans with SoFi, deposit into SoFi Banking or investment accounts or convert into cryptocurrencies via a SoFi investment account. The flexibility to utilize rewards in the way I perceive most beneficial is a huge plus.

All-in-One Financial Management

SoFi Credit Card is more than a credit card; it's a financial tool. It allows me to host my banking, investment, loan, and credit card, eliminating the need to use different platforms. This integrated approach to managing finances simplifies my budgeting and financial planning processes considerably.

Cons of SoFi Credit Card

Potentially High APR

While the benefits of the SoFi Credit Card are significant, it's crucial to mention that the card's APR ranges from 17.99% - 29.99%. This can be steep if I carry a balance from month to month, negating the benefits of the rewards I stand to earn.

Rewards Value Dependent on SoFi Accounts

Although the rewards offered are impressive, they are halved if not redeemed via an eligible SoFi account. This limitation restricts the value I can derive from my rewards since I have to use them within SoFi’s platform.

No Welcome Bonus

Unlike many credit cards on the market, the SoFi Credit Card does not offer a welcome bonus. This is a considerable downside, especially for someone like me who understands the value of a good head start in the crypto world.

Good Credit Score Requirement

It's also worth noting that the SoFi Credit Card requires a good credit score. As someone who might have experienced volatility in crypto markets, this could pose a hurdle if my credit score has taken a hit during trying times. Discover the SoFi Credit Card's pros and cons! Rack up unlimited 2% cash back on purchases and 3% for travel bookings, pay no annual fee, and enjoy free cell phone insurance. Manage all your finance accounts in one place with SoFi, where you can even redeem points for cryptocurrency. SoFi Credit Card caters to the money smart.

For more insights on how to maximize your crypto rewards with the SoFi Credit Card, visit CryptoLinks.com—your gateway to the best financial tools for the digital age. Stay ahead in the crypto game with the right resources!