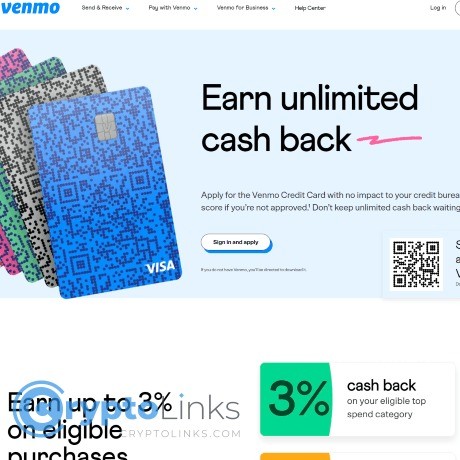

Venmo Visa Credit Card Review

Venmo Visa Credit Card

venmo.com

Welcome to the Future of Credit Cards: A Comprehensive Review of Venmo Visa Credit Card

It was only a matter of time before I jumped on the Venmo Credit Card bandwagon. However, even if you're not as into crypto as I am, trust me, this card is a real game-changer. But let's not get cryptic here. If you are considering the Venmo Credit Card, stay tuned, I'm about to unpack all the details you need to know.

What is the Venmo Credit Card all about?

Venmo, a well-known mobile payment service app, has more than just person-to-person transactions. They also offer a no-annual-fee, contactless Venmo Credit Card. Venmo Credit Card goes beyond the traditional credit card perks by integrating seamlessly with its existing Venmo ecosystem, offering a unique rewards system and even an option to buy crypto.

Rewards, Fees and the Fine Print

Let's cut to the chase, you're probably wondering about the rewards, fees and all that really matters. There is no annual fee, no foreign transaction fee and the interest rate falls between 15.24% to 24.24% variable. The rewards program is pretty unique too, giving 3% cash back on the category where you spend the most, 2% cash back on the second-highest category, and 1% cash back on all other purchases. However, note that it's currently only available to some Venmo customers who've had an account for at least 30 days and have been active in the past 12 months. There is no welcome bonus or introductory APR offer.

Perks of the Venmo Credit Card

Beyond the cash back rewards, the Venmo Credit Card brings even more to the table. It comes with auto-calculating rewards based on personal spending habits, making it a highly adaptable card tailored to your personal spending. On top of that, it provides instant access with a virtual card number making transactions swift and easy. The Venmo Credit Card also comes with Visa Signature® card benefits including a zero liability policy, lost or stolen card replacement, emergency cash assistance, and 24/7 Visa Concierge service, amongst others. Not stopping there, the Venmo Credit Card doubles as a social statement. Friends can simply scan the QR code on your credit card to "Venmo" you or request a payment.

Earning and Redeeming Cashback with the Venmo Card

With the Venmo Credit Card, you can potentially earn roughly $371 in your first year, depending on your annual spending habits. Even better, you need not trouble yourself with the math, Venmo will calculate your cashback rewards for you. You can redeem your cash back in a number of ways. For instance, it can be used to make purchases with authorized Venmo merchants, pay off your credit card bill, complete Venmo requests, or even deposit it directly into your bank account. The 'cherry on the cake' of cash back rewards is the fact that you can buy crypto with it. Given my love for digital currency, the fact that I can do this without any transaction fee is pretty much music to my ears.

Who is the Venmo Credit Card Ideal For?

The Venmo Credit Card is ideal for frequent Venmo users wanting to streamline their finances in one app. Having your debit card, credit card and the ability to receive direct deposits to your Venmo account all from the same app is, as I see it, a huge win. It's also great for those who want their rewards to adapt to their monthly spending habits.

The Final Take

As a whole, the Venmo Credit Card is a strong contender among the cash-back credit cards. It's especially useful for those who frequently use Venmo and favor the convenience it provides. However, people who don't often use Venmo can consider other cash-back cards available on the market. End of the day, one thing's for sure, the Venmo Credit Card is a welcome disruption in the credit card arena, opening up a thrilling new chapter for Venmo users like me. If you resonate with this perspective, it might be worth giving the Venmo Credit Card a shot. After all, in this digital age, keeping up with the times can sometimes mean embracing currencies of the future, one crypto at a time.

FAQ to Venmo Visa Credit Card

I've been fascinated by the increasing intersection of cryptocurrency and traditional banking methods. When I stumbled upon the Venmo Visa Credit Card, I knew I had to share my review with my fellow crypto enthusiasts. This card is not just about buying your buds a pizza or splitting gas money; it's a tool that integrates seamlessly with the Venmo mobile payment service and even offers opportunities to invest in cryptocurrency.

Why Should I Consider the Venmo Visa Credit Card?

Navigating the modern world of finance can be daunting. To help make it easier, the Venmo Visa Credit Card comes with plenty of features and benefits that can improve your spending habits. Plus, it has no annual fees and allows contactless payment, proving itself as a strong contender in the credit card world.

Personalized Rewards Program

The most attractive feature of this card is its cash-back rewards program. You can earn 3% cash back on your top spend category, 2% on your second-highest, and 1% back on all other purchases. The flexible nature of this reward system means you can earn significant cashback by tailoring your spending habits.

Crypto Purchase

For those of us in the crypto universe, Venmo allows cardholders to use their cashback rewards to buy cryptocurrency. It's an exciting way to get a foot in the door of the crypto world without investing any extra money.

Global Usability

The ability to use your Venmo Visa Credit Card wherever Visa® credit cards are accepted makes this card highly versatile. It's also a godsend for world travelers; there are no foreign transaction fees when used outside the U.S.

Is the Venmo Visa Credit Card Right for Me?

The Venmo credit card isn't for everyone. It's currently only available to a selected percentage of Venmo customers who've had an account for at least 30 days and have been active in the last 12 months.

Lack of Welcome Bonus and Introductory APR

The card does not offer a welcome bonus or an introductory APR (Annual Percentage Rate) offer. If you're after a big upfront incentive, this might not be the card for you.

How Cash Back Rewards Work

The Venmo credit card reward system is refreshingly simple. The cash-back rewards you earn are calculated automatically and credited to your Venmo account at the end of each statement period. You can use your cash-back earnings to make purchases to authorized Venmo merchants, pay off your credit card bill, complete Venmo requests, or even deposit them directly into your bank account. If you're a crypto enthusiast like me, you can use these rewards to invest in the four cryptocurrency tokens available in the Venmo app.

How Does the Venmo Visa Credit Card Affect My Rating?

With a regular variable APR ranging from 15.24% to 24.24%, the Venmo Visa Credit Card sits quite comfortably within the industry standards. Nonetheless, it's good to remember that late payment fees can be as high as $40.

Is It Ideal for Venmo Users?

The credit card might appeal to frequent Venmo users who want to centralize their financial lives within the app. The ability to manage your Venmo balance and credit card all in one place is convenient and efficient.

Final Thoughts

It's worth considering the Venmo Visa Credit Card if you're an avid Venmo user or a budding crypto investor. It offers a flexible rewards program that's tailored to your spending habits and opportunities to venture into cryptocurrency. However, if you’re not a frequent Venmo user or after welcome bonuses and introductory APR offers, there are other cash-back credit cards available in the market that might better suit your needs. Venmo’s card is one of several innovative offerings out there — you just need to pick the one that aligns with your lifestyle and financial goals.

Venmo Visa Credit Card Pros and Cons

I value financial flexibility and freedom, which has naturally led me to review the Venmo Visa Credit Card. This product has a lot of interesting features worth exploring, especially those that appeal to Venmo users. Here are my thoughts on this credit card.

Pros of Venmo Visa Credit Card

No Annual Fee

One of the greatest advantages is the lack of an annual fee. With the Venmo Credit Card, I'm not going to be hit with an unexpected bill for the mere privilege of owning the card.

Rewards That Adapt to Spending Habits

One unique feature of this card is the rewards program that adjusts to my spending patterns. For instance, if I spend most of my money on groceries and entertainment, Venmo’s algorithm will learn to give me more cash back in these areas. This level of customization is a nice touch that sets it apart from other credit cards.

No Foreign Transaction Fees

When I go gallivanting across the globe, it's important for me to have a card that won't charge me for each transaction I make overseas. The Venmo Credit Card doesn't charge foreign transaction fees, making it a great companion on international trips.

Crypto Buying Feature

Yes, I can actually use this card to buy crypto! This is major, especially considering not many credit cards out there offer this feature. I can use my cashback rewards to directly purchase cryptocurrency, which is a huge plus for me.

Cons of Venmo Visa Credit Card

Availability

Unfortunately, Venmo is currently only offering its credit card to a random selection of existing customers. This means that if you're new to Venmo or aren't one of the lucky chosen ones, you won't be able to take advantage of this card.

No Welcome Bonus

Another downside is the lack of a welcome bonus. A lot of credit cards out there throw in a nice fat bonus when you sign up, so it's a bit disappointing to see Venmo not offer any kind of sign-up perk.

No Introductory APR Offer

Lastly, there's no introductory APR offer, which could be a deal-breaker for some. Many credit cards offer a period of low or even zero interest as an introductory offer. Venmo's card has no such introductory offer, which could make it less appealing for those who carry a balance.

High Regular APR

Although Venmo's credit card has a range of 15.24% to 24.24% APR, depending on your creditworthiness, the upper end of this range is still quite high. If you often carry a balance on your credit card, the high APR could result in significant interest charges over time. In conclusion, the Venmo Visa Credit Card offers a unique array of features, especially for those who are already avid users of the Venmo app. The lack of certain bonuses and offers may be a drawback for some, but its crypto-friendly perks and customizable rewards could easily make it a favorite among crypto enthusiasts like myself. Join the crypto currency movement with Venmo's Visa Credit Card. Maximize your wealth with up to 3% cashback on most spent categories. Ideal for seasoned Venmo users, enjoy no annual fees and the ease of instantly buying crypto with your cashback rewards.

For more ways to merge your credit card rewards with the crypto economy, explore the best tools and strategies at CryptoLinks.com—where smart finance meets the future of digital currency.