The Top 17 Altcoins to Watch: Potential Gems in the Crypto Market

I’m always on the lookout for the next big thing in the ever-evolving world of cryptocurrencies. In 2023, the crypto market has continued to surprise us with its resilience and innovation. Several altcoins have made headlines by posting remarkable gains, and the excitement surrounding the crypto space is palpable. In this article, I’ll introduce you to the top 10 altcoins that are poised to shine in September 2023.

What Is an Altcoin?

Before we dive into the exciting world of altcoins, let’s clarify what exactly an altcoin is. An altcoin is any cryptocurrency other than Bitcoin. While Bitcoin ($BTC) remains the king of the crypto world, altcoins have carved out their own niche. These digital currencies offer unique features and use cases that differentiate them from Bitcoin. Some of the most well-known altcoins include Ethereum ($ETH), Solana ($SOL), Litecoin, and XRP ($XRP).

Altcoins are known for their smaller market capitalization compared to Bitcoin, but they often offer specialized functionalities, such as compatibility with decentralized finance (DeFi) applications or lightning-fast transaction speeds. Now that we’ve covered the basics, let’s explore the top 10 altcoins to keep an eye on in September 2023.

10. Shiba Inu ($SHIB)

SHIB

Market Capitalization: $4.6 billion

YTD Gains: -8%

Price: $0.00000796

Shiba Inu ($SHIB) enjoyed a significant bull run earlier in the year. However, challenges with the launch of its Shibarium blockchain led to a double-digit price decline in recent months. According to the Shiba Inu team, the issues related to the Shibarium launch have been resolved, potentially paving the way for upside in September.

Changelly expects $SHIB to gain 10% by the end of the month, while Coincodex forecasts modest growth in the range of 1-5%. While $SHIB has faced its share of volatility, its community remains active and hopeful for a resurgence.

9. Dogecoin ($DOGE)

DOGE

Market Capitalization: $8.9 billion

YTD Gains: -13%

Price: $0.06

Dogecoin ($DOGE) is the iconic meme coin and one of the most valuable cryptocurrencies by market capitalization. While it has experienced intermittent price surges this year, it has yet to establish a stable upward trend. Recent news of X (formerly Twitter) acquiring a crypto-related payment license has generated optimism about $DOGE’s potential for a September surge.

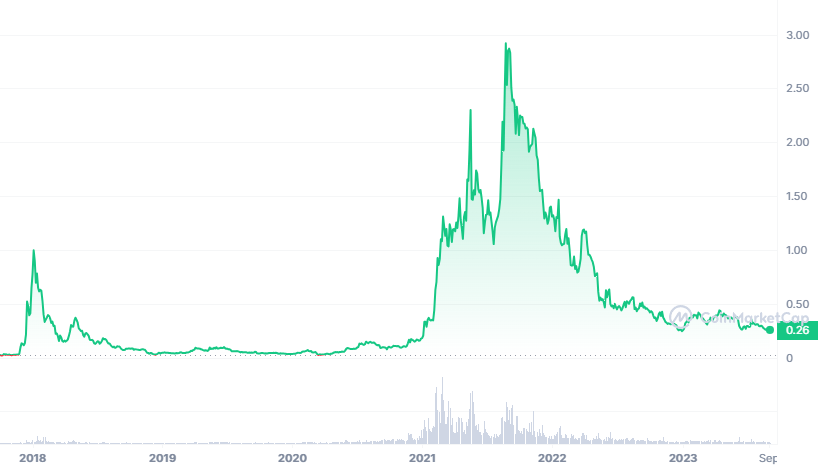

8. Cardano ($ADA)

ADA

Market Capitalization: $9 billion

YTD Gains: -13%

Price: $0.25

Cardano ($ADA) has faced challenges gaining momentum this year, despite maintaining its position as a top-ten cryptocurrency by market capitalization. However, its total value locked has been on the rise, and several technical upgrades have enhanced its usability.

Changelly and Coincodex anticipate modest gains for $ADA in September, with expectations of more significant returns in the long run. Cardano’s commitment to improving its blockchain infrastructure and expanding its ecosystem could lead to a brighter future.

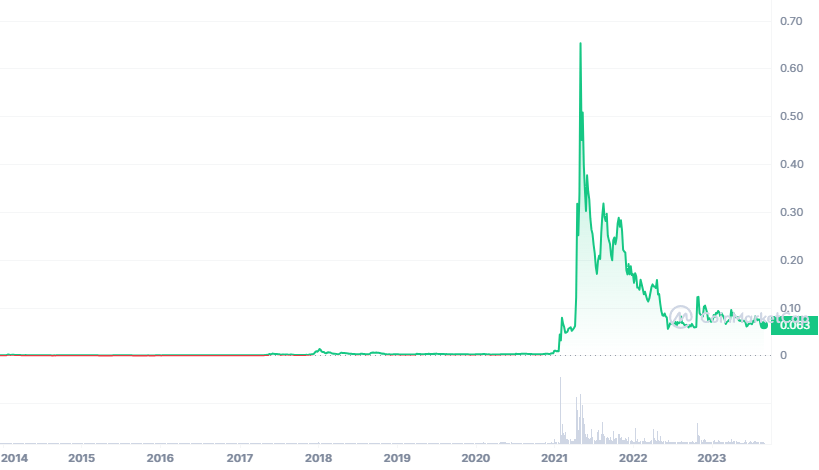

7. XinFin Digital Contract ($XDC)

XDC

Market Capitalization: $790 million

YTD Gains: 105%

Price: $0.056

XinFin Digital Contract ($XDC) has been one of the standout performers in the altcoin space this year. Its value has surged by over 50% in the past month, driven by news of its use in the tokenization of bonds, which has sparked bullish sentiment.

While Cryptonewsz hasn’t provided a specific monthly price target, there is optimism that $XDC could rise to $0.70 by the end of the year. AMBcrypto, on the other hand, anticipates a minor pullback following the recent rally. XinFin’s growing utility in the world of finance positions it as an altcoin worth keeping an eye on.

6. Binance Coin ($BNB)

BNB

Market Capitalization: $33 billion

YTD Gains: -20%

Price: $214

Binance Coin ($BNB) is the native token of the Binance blockchain, offering various benefits to users of the Binance exchange and serving various use cases within the ecosystem. Despite recent price declines, $BNB boasts one of the highest market capitalizations among cryptocurrencies.

Both Coincodex and Changelly are extremely bullish on $BNB for September, setting price targets as high as $500. Binance’s continued dominance in the centralized exchange (CEX) industry and the ecosystem’s growth potential make $BNB an intriguing asset for investors.

5. XRP ($XRP)

Market Capitalization: $26 billion

YTD Gains: 50%

Price: $0.50

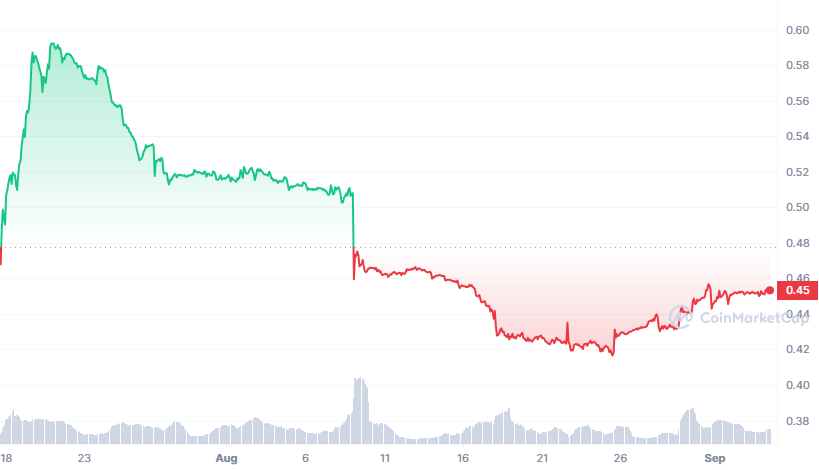

XRP ($XRP) is a layer-1 cryptocurrency created by the founders of Ripple Labs, primarily used for global payment solutions. It has been a topic of discussion throughout the year due to the SEC’s case against Ripple Labs regarding the sale of $XRP tokens. A favorable ruling in the case led to a surge in the altcoin market in July.

While $XRP has retraced some of its July gains, price predictions are generally optimistic for September. Coincodex expects $XRP to reach $0.055 this month, while AMBcrypto foresees a potential surge to $0.79. The resolution of regulatory uncertainty and the utility of XRP in cross-border payments contribute to its positive outlook.

4. Avalanche ($AVAX)

AVAX

Market Capitalization: $3 billion

YTD Gains: -8%

Price: $10

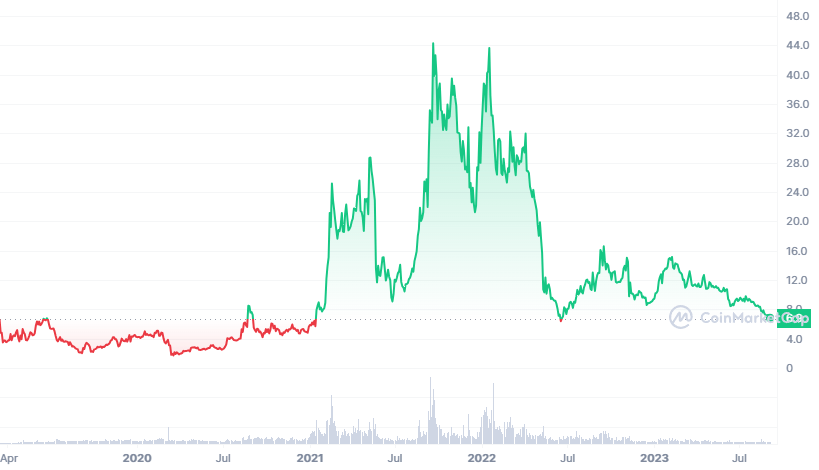

Avalanche ($AVAX) is another layer-1 blockchain known for its lightning-fast transaction speeds. The project has forged partnerships with global corporations and, during the 2021 bull market, saw its price soar above $120. However, in 2022, it experienced a significant price correction, currently trading at a 90% discount from its all-time high.

Several price predictions for $AVAX in September are bullish. AMBcrypto believes that $AVAX could rally to $18 this month, while Changelly and Coincodex are targeting more conservative gains in the range of 1-5%. Despite its recent struggles, Avalanche remains a project with substantial potential.

3. Solana ($SOL)

SOL

Market Capitalization: $17 billion

YTD Gains: 98%

Price: $19

Solana ($SOL) is a layer-1 blockchain designed to outperform Ethereum in terms of speed and developer-friendliness. Although it faced challenges during the 2021 bear market, $SOL has made a remarkable comeback, posting impressive year-to-date gains of 98%.

Coincodex anticipates solid gains for $SOL in September, with a move expected well beyond the $20 mark. Changelly is even more optimistic, forecasting double-digit gains for the month that could propel $SOL to $24. The project’s technical advancements and growing ecosystem make it an exciting altcoin to watch.

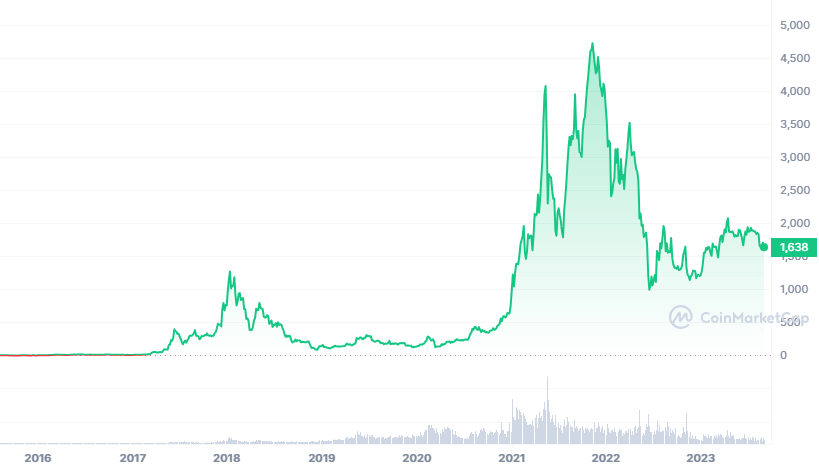

2. Ethereum ($ETH)

ETH

Market Capitalization: $201.45 billion

YTD Gains: +37%

Price: $1,640

Ethereum ($ETH) needs no introduction in the world of cryptocurrencies. As the first blockchain to support smart contracts, Ethereum gained an early advantage over its competitors. It boasts a massive ecosystem of decentralized applications (dApps), a substantial market cap, and a YTD return of nearly 40%.

Price predictions for Ethereum in September and the long term remain bullish. Coincodex expects $ETH to trade above $1,740 this month, while AMBcrypto predicts an average target price of over $2,000. Ethereum’s enduring popularity among developers and users alike positions it as a solid contender for continued growth.

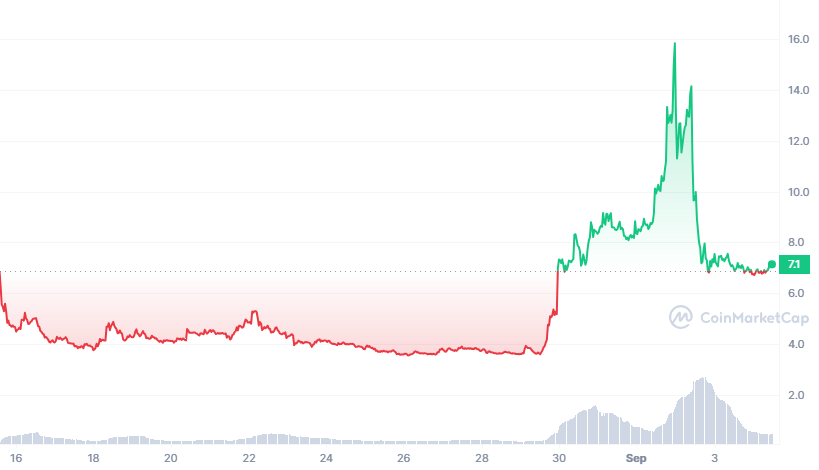

1. CyberConnect ($CYBER)

CYBER

Market Capitalization: $105 million

Year-to-Date (YTD) Gains: 600%

Price: $10

CyberConnect ($CYBER) is a relatively new entrant in the crypto market, but it has already started making waves. This innovative project is designed to provide the tools needed to build Web3 social media platforms. In the past month alone, $CYBER has exhibited remarkable performance, with a staggering 150% gain in just seven days.

Price predictions for $CYBER have been struggling to keep up with its rapid surge. Pickacrypto set an end-of-year target of $10 last month, but that mark has already been surpassed. Coincodex’s September target of $8.9 has also been exceeded, indicating strong investor confidence in $CYBER’s potential to play a significant role in the world of Web3 social media.

Altcoins to Watch Out For

The crypto market in 2023 has seen several altcoins achieve remarkable gains, with notable performers such as $CYBER and $XDC leading the charge. Conversely, some well-established names like $BNB and $ADA have faced challenges in maintaining upward momentum.

According to multiple price analysts, the altcoins featured in this list hold the potential to perform well in September. Notably, $BNB and $CYBER stand out as strong contenders for substantial gains. As the crypto market continues to evolve, staying informed and conducting thorough research remains key to making informed investment decisions in the ever-exciting world of cryptocurrencies.

Exploring More Altcoins with Exciting Potential

Always on the lookout for hidden gems and innovative projects within the cryptocurrency space. While we’ve already discussed the top 10 altcoins to watch in 2023, let’s expand our horizon and delve into a few more promising altcoins that have been gaining attention in the crypto world.

Kwenta (KWENTA)

KWENTA

Market Capitalization: 12 million

YTD Gains: Approximately 500%

Price: Varies

Kwenta is a decentralized derivatives exchange operating on the Optimism network. It offers a range of products, including perpetual futures and options. What sets Kwenta apart is its affiliation with Synthetix, one of Ethereum’s prominent derivative protocols. Synthetix enables the creation of synthetic assets representing both physical commodities like gold and silver and digital assets such as cryptocurrencies.

Kwenta has witnessed significant price growth in 2023, surging by nearly 500%. This remarkable performance can be attributed to its unique architecture, which leverages the Synthetix debt pool as its counterparty, as well as the incorporation of a funding rate mechanism.

At the beginning of 2023, KWENTA was valued at $128. However, it embarked on a significant rally in February, reaching its peak at $790.99 in March 2023. Subsequently, it experienced a slight dip, with prices hovering around $773 in April 2023. As of May 24, 2023, KWENTA is trading at $305. This price fluctuation may be attributed to the competitive landscape in the derivatives protocol sector, leading to shifts in user activity.

Kwenta’s Catalysts:Optimism‘s announcement of the Bedrock upgrade scheduled for June 6, 2023, has been a game-changer. This substantial upgrade promises enhanced network performance, drawing more attention to Optimism and its ecosystem. Consequently, Kwenta is well-positioned to benefit from this positive spillover.

Pendle Finance (PENDLE)

PENDLE

Market Capitalization: 146 millions

YTD Gains: Approximately 1,750%

Price: Varies

Pendle Finance has emerged as one of the most innovative DeFi protocols in the crypto market. It operates as a tokenized yield protocol utilizing an automated market maker (AMM) system for tokenizing and trading future yield.

The protocol allows holders of yield-bearing tokens to deposit their assets into Pendle Finance and mint two tokens: Yield token (YT), representing the future yield claim, and Principal token (PT), representing the underlying asset. This novel approach unlocks advanced yield strategies, fostering greater flexibility for market participants.

When PENDLE was initially launched in 2021, it experienced rapid price growth, reaching a high of $2.45. However, over the following year, its price dipped below $0.01 and remained relatively stagnant.

Since the start of 2023, PENDLE has shown renewed strength, surging by an impressive 1,750% from a low of $0.035 to a recent peak of $0.643550.

Pendle’s Catalysts: Pendle’s partnership with Magpie, resulting in the launch of Penpie on May 2, 2023, has generated significant interest. This collaboration aims to reduce PENDLE’s circulating supply and enhance yield for holders through veTokenomics. This development sets the stage for potential price surges in the future.

Curve (CRV)

CRV

Market Capitalization: 383 millions

YTD Gains: Varies

Price: Varies

Curve Finance is a decentralized exchange (DEX) tailored for stablecoin swaps. It specializes in offering low slippage and low-fee swaps between various stablecoins like USDT and USDC. This efficiency is achieved through an Automated Market Maker (AMM) model.

Curve further incentivizes liquidity providers (LPs) by offering them yield from the fees generated by trading on the platform. LPs deposit stablecoins into the Curve liquidity pool and earn rewards from the trading activity, creating a self-sustaining ecosystem.

The CRV token has experienced notable price fluctuations over the years. After launching at $15.37 during the DeFi Summer period, its price sharply declined, briefly dropping below $1. However, it rebounded to reach $6.51 in early 2022 before returning to sub-$1 levels amidst various DeFi challenges.

Curve’s Catalysts: Curve Finance’s introduction of its own stablecoin, crvUSD, represents a significant milestone. This stablecoin incorporates an innovative algorithm called lending-liquidating AMM algorithm (LLAMMA), designed to smooth the liquidation process during cryptocurrency price fluctuations. Such developments could attract substantial liquidity to the Curve protocol.

GMX (GMX)

GMX

Market Capitalization: 293 millions

YTD Gains: Approximately 480%

Price: Varies

GMX operates as a decentralized spot and perpetual exchange, offering users the opportunity to trade various derivatives with leverage of up to 50x. What sets GMX apart is its unique fee-sharing mechanism, benefiting both GMX token holders and liquidity providers (LPs). This incentive structure encourages LPs to participate, ensuring deep liquidity and attracting traders.

GMX has consistently experienced strong price growth since mid-2022, with prices hitting a new high of $91.07 on April 18, 2023, representing an approximate 480% increase since its launch. The chart illustrates GMX’s steady uptrend, with occasional price corrections along the way.

GMX’s Catalysts: GMX’s team is actively developing the protocol to enhance user experience and improve underlying capabilities. Two key developments in progress are the integration of Chainlink’s Low Latency Oracles and GMX v2. These enhancements are expected to attract more users to the platform and incentivize LPs to provide liquidity, driving organic demand for the GMX token.

Chainlink (LINK)

LINK

Market Capitalization: 3,3 billion

YTD Gains: Varies

Price: Varies

Chainlink operates as a decentralized oracle network, facilitating smart contracts’ interaction with external data sources. To ensure data reliability and minimize the risk of manipulation, Chainlink employs a decentralized oracle network mechanism involving multiple nodes fetching and delivering data.

In 2020, LINK emerged as one of the top-performing altcoins, surging from $1.76 to a peak of $52.70 in just over a year, representing a staggering price surge of approximately 2,894%. However, questions regarding LINK’s value accrual led to a steady price decline over the past year, currently trading at $6.70.

Chainlink’s Catalyst: One of Chainlink’s most anticipated developments is its cross-chain interoperability protocol (CCIP). This innovation enables developers to build cross-chain applications seamlessly, addressing the growing need for blockchain interoperability. Increased usage of Chainlink’s services could drive positive price action.

Mantle (formerly BIT)

MNT

Market Capitalization: 1,4 billion

YTD Gains: Varies

Price: Varies

Mantle is the first modular Layer 2 solution, offering superior performance through its innovative architecture. The network relies on EigenDA for data availability and leverages Ethereum’s security via EigenLayer. A decentralized sequencer enhances Mantle’s liveness, reducing censorship resistance.

When BitDAO (now transitioning to Mantle) was launched in early August 2021, BIT experienced significant price growth, rising from $1.25 to $3.10 within three months. However, this increase was not sustained, and BIT’s price gradually declined, reaching a low of $0.270167 late last year. Since the start of 2023, BIT’s price has been steadily increasing.

Mantle’s Catalyst: The launch of Mantle’s mainnet and its integration into the ecosystem is highly anticipated. With its innovative architecture and integrations with EigenLayer, Mantle has the potential to deliver outstanding scalability. The transition from BIT to the Mantle token is also expected to contribute to its growth.

Cosmos (ATOM)

ATOM

Market Capitalization: 1,4 billion

YTD Gains: Varies

Price: Varies

Cosmos operates as a decentralized blockchain network utilizing a hub-and-spoke model to enable interoperability among connected blockchains. The Inter-Blockchain Communication (IBC) Protocol facilitates asset and data transfer through the hub, fostering seamless connectivity.

ATOM performed impressively in 2021, with its price surging from $5.42 to a peak of $44.45 in less than a year, driven by its interoperability potential. However, concerns about value accrual led to selling pressure, causing its price to plummet to $6.10 by mid-2022.

Cosmos’s Catalyst: A recent key announcement in the Cosmos ecosystem is the launch of Neutron. This development allows chains wishing to build on Cosmos to leverage its existing validator network and benefit from enhanced security. The reduced resource and financial costs associated with bootstrapping a validator set could attract more builders to the Cosmos network, contributing to a robust ecosystem.

How to Choose an Altcoin to Trade in 2023

Selecting the right altcoin for your trading portfolio can be both exciting and challenging. Altcoins offer a wide range of functionalities and use cases, making it essential to align your investment choices with your beliefs about market demands and trends.

However, the cryptocurrency market is renowned for its volatility, so thorough research is crucial before making investment decisions. Here are some steps to help you choose the most suitable altcoin to trade in 2023:

- Research and Analysis: Begin by researching the altcoin market. Study the fundamentals of each project, including its technology, team, use case, and partnerships. Consider the problem it aims to solve and whether it has a competitive edge.

- Market Trends: Stay informed about current market trends and industry developments. Monitor news and announcements related to the altcoins you’re interested in. Understanding the broader market sentiment can influence your trading decisions.

- Technical Analysis: Use technical analysis tools to analyze price charts, identify support and resistance levels, and assess historical price movements. Technical analysis can help you make informed entry and exit decisions.

- Community and Adoption: Evaluate the strength of the altcoin’s community and its level of adoption. A strong and engaged community can contribute to the project’s success.

- Risk Management: Establish a clear risk management strategy before trading any altcoin. Set stop-loss and take-profit orders to limit potential losses and secure profits. Diversify your portfolio to spread risk.

- Liquidity and Exchange: Consider the liquidity of the altcoin and the availability of trading pairs on reputable cryptocurrency exchanges. High liquidity ensures ease of trading and price stability.

- Long-Term vs. Short-Term: Determine your trading strategy—whether you’re looking for short-term gains or long-term investment. Your strategy will influence your choice of altcoins.

- Security: Ensure the safety of your investments by using secure wallets and practicing good security habits. Protect your assets from potential threats.

How to Trade Altcoins

Trading altcoins requires a strategic approach to maximize your chances of success. Here are the basic steps to get started:

- Select a Cryptocurrency Exchange: Choose a reputable cryptocurrency exchange that supports the altcoins you wish to trade. Ensure the exchange offers security features and a user-friendly interface.

- Create an Account: Sign up for an account on the chosen exchange. Complete the necessary verification procedures, including identity verification, to comply with regulatory requirements.

- Deposit Funds: Deposit funds into your exchange account. You can typically deposit fiat currency (such as USD, EUR) or cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH).

- Place Orders: Use the exchange’s trading platform to place buy and sell orders for your chosen altcoins. You can place market orders (executed immediately at the current market price) or limit orders (executed when the price reaches a specific level).

- Monitor the Market: Keep a close eye on market trends, news, and price movements. Adjust your trading strategy as needed based on market conditions.

- Implement Risk Management: Set stop-loss and take-profit orders to manage your risk. These orders automatically execute trades when specific price levels are reached.

- Diversify Your Portfolio: Avoid putting all your funds into a single altcoin. Diversify your portfolio to spread risk and capture opportunities in different markets.

- Stay Informed: Continuously educate yourself about cryptocurrency markets and emerging trends. Stay informed about regulatory changes that may impact your trading activities.

Remember that cryptocurrency trading carries inherent risks, and prices can be highly volatile. It’s essential to trade responsibly and never invest more than you can afford to lose. Article is not a financial advice. Additionally, consider seeking advice from financial experts or professionals before making significant trading decisions.