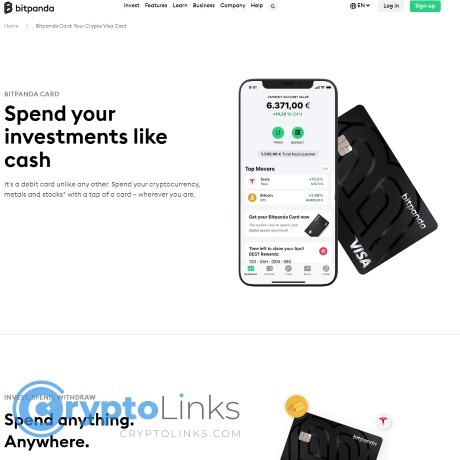

Bitpanda Visa Card Review

Bitpanda Visa Card

bitpanda.com

Decoding the Features and Benefits of Bitpanda's Visa Debit Card

As Bitpanda expands its portfolio to meet the dynamic needs of its users, it’s time to shed some light on a new innovation that's sure to skyrocket your crypto game – the Bitpanda Visa debit card. Bitpanda's groundbreaking move of merging the digital and physical world of payments is one of the talking points in the crypto sphere. A bridge between crypto assets and traditional finance, it revolutionizes our day-to-day transactions. So, let me put on my crypto-guy hat and delve into the nuances of what promises to be a game changer. Engulfed in the digital asset universe and customary fiat, Bitpanda has exponentially expanded its range, featuring Bitcoin, Altcoins, Stablecoins, and tokenized assets such as gold, silver, and palladium. It even teases the introduction of other tokenized assets like shares and real estate in the near future.

How Does the Bitpanda Visa Debit Card Work?

When you swipe your Bitpanda Visa debit card for a payment, Bitpanda effectively sells your digital assets held on Bitpanda in the background to make that payment. What fascinates me is the flexibility where you get to choose the order of assets to be sold. Whether it's your bitcoin or altcoins, or maybe your tokenized gold holdings, you take the call. Their VIP clientele are entitled to a further perk: a Bitcoin cashback of up to 2% on the disposal value. Now, that's a win-win! The cashback is contingent upon the number of BEST (Bitpanda Ecosystem Token) you own, which also opens up other user benefits. The card itself is a steal as its costs zero, while the regular trading commissions that Bitpanda levies stays the same.

Unveiling the Tax Implications

As a savvy digital asset holder, it's crucial to comprehend the tax implications when transacting with the Bitpanda Visa debit card. The innovative cooperation between Bitpanda and Blockpit facilitates the seamless exchange of information for optimized use of the debit card. Through a straightforward API interface that grants reading permissions, all tax-relevant activities triggered by transactions made with the card are documented at Blockpit. That includes the 2% Bitcoin cashback!

Navigating the Speculation Period

If you've used crypto for payment and sold it within the 1-year speculation period (this holding duration is applicable to cryptocurrency owners in the DACH area), you'll generate taxable profits or losses according to tax guidelines in your country. For the Bitcoin received as cashback, a new counting process takes effect at the time of receipt. It is best that this process be documented by Blockpit.

Understanding the Function and Fiscal Effects of the Card

The introduction of the Bitpanda Visa debit card represents a significant stride on crypto’s path to mainstream adoption. Ensuring broad awareness and understanding of the card's technical background is crucial to making the most out of its extensive features. Once we have unearthed all details surrounding the fiscal consequences and functioning of this card, be ready to dive into a comprehensive and pragmatic guide.

Conclusion

The unique Bitpanda Visa debit card sets lofty standards for the growing intersection of cryptocurrency and traditional finance. With a seamless, user-friendly approach to digital assets, Bitpanda is broadening horizons for currency diversity in everyday life. Stay tuned for more intriguing updates and in-depth guides on this exciting innovation. There you have it, my crypto comrades, a comprehensive look at the intricacies of the Bitpanda Visa debit card. As always, it's me, your crypto guy, asking you to ponder, invest wisely, and stay crypto savvy.

Bitpanda Visa Debit Card FAQ

What Is the Bitpanda Visa Debit Card?

As a crypto enthusiast, the Bitpanda Visa Debit card is an interesting and innovative financial tool. In essence, the card allows me to make payments using my digital assets that I hold on Bitpanda. This card is quite a game-changer, allowing for a smooth, seamless transaction not just with traditional fiat money but a wide array of cryptocurrencies, including Bitcoin, Altcoins, Stablecoins and even tokenised assets such as gold, silver and palladium. More tokenised assets like shares and real estate are expected to be added in the near future.

How Does The Bitpanda Visa Debit Card Work?

The Bitpanda Visa debit card works in an impressive way - every time a payment is made through the card, your chosen asset is sold in the background. Essentially, the card serves as a bridge between digital and physical commerce by selling your chosen digital assets at the time of transaction.

What Order Are The Assets Sold In?

What's even more exciting is that you, as a customer, can determine the order in which your assets are sold. This means that you have complete control over your holdings and their disbursement. It makes the Bitpanda experience even more manageable and user-friendly.

Are There Any Incentives To Using The Bitpanda Visa Debit Card?

Absolutely, there are some very impressive incentives. Bitpanda gives its VIP customers a fantastic cashback of up to 2% on the disposal value in the form of Bitcoins. The cashback you get hinges on the amount of Bitpanda's house tokens (BEST, or Bitpanda Ecosystem Token) you hold. These tokens offer further user benefits too!

Are There Any Fees Associated With The Bitpanda Visa Debit Card?

The great news is there shouldn't be any fees for the card itself! The standard trading fees that Bitpanda charges for its various assets will remain the same. This means the Bitpanda Visa debit card is not just user-friendly and convenient, but affordable too.

Are There Any Tax Implications When Using The Bitpanda Visa Debit Card?

As cryptocurrency enthusiasts, we're all concerned about the potential tax implications. Here's how it works: When you make a payment via your Bitpanda Visa debit card, a taxable event might occur. This depends on whether the sold asset was held for less than the 1-year speculation period, a concept that applies to cryptocurrency owners in the DACH area. Cashbacks in bitcoin form also initiate a new count-relevant process. Thankfully, the technical integration between Blockpit and Bitpanda ensures that all of this is taken care of at the backend. With this, you now have a good overview of the Bitpanda Visa Debit Card and why it is such an exciting development. It blends the best of the crypto and traditional financial worlds, granting users increased flexibility, control, and profit opportunities. To sum it up, the future of cross-platform commerce is here, and it's looks great!

Bitpanda Visa Debit Card Pros

1. Wide Range of Digital Assets

One significant advantage of the Bitpanda Visa Debit Card is that it allows for the use of an expansive variety of digital assets. I'm not just limited to conventional cryptocurrencies like Bitcoin or Altcoins, but also Stablecoins, tokenised assets such as gold, silver, and palladium. This flexibility makes it one of the most inclusive cards of its kind in the market.

2. Real-Time Asset Exchange

With this card, I never have to worry about having to manually exchange my digital assets for fiat currency before making a payment. The card automatically sells the required amount of my chosen digital assets at the point-of-sale, making it seamless to use my digital wealth in everyday transactions.

3. Cashback Rewards

As a Bitpanda VIP customer, I'm awarded a cashback of up to 2% on every transaction I make with the card. What makes it even more attractive is that the cashback is given in the form of Bitcoins, further increasing my digital asset portfolio.

4. No Card Fees

I also find it quite beneficial that there are no extra fees charged for using the card itself. The standard trading fees that apply when buying or selling my digital assets on Bitpanda are the only charges I incur.

Bitpanda Visa Debit Card Cons

1. Complex Tax Implications

One significant downside to the Bitpanda card is that each transaction, including cashback, can trigger a complex tax event depending upon the user's country specific tax guidelines. This could potentially necessitate significant record-keeping to remain compliant with fiscal regulations.

2. Reliant on Bitpanda Ecosystem

To make the most out of the Bitpanda Visa Debit Card, especially the cashback feature, I need to hold a certain amount of Bitpanda's own Ecosystem Token (BEST). This essentially ties users to Bitpanda's ecosystem, which may not appeal to everyone.

3. Limited Control Over Asset Sales

Although the automatic sale of digital assets to facilitate payments can be a benefit, it may also be a drawback. The card/user determines which assets were sold to make a direct payment, potentially selling off assets at a less than optimal market rate.

4. Card Availability

Currently, the Bitpanda Visa Debit Card can only be applied for by Bitpanda customers. This excludes potential users who utilize other digital asset platforms and limits the accessibility of the card. Experience the future of finance with Bitpanda Visa debit card! Unlock seamless payments with digital assets like bitcoin, altcoins, and even tokenised assets like gold, silver. Enjoy up to 2% cashback in Bitcoin form. No fees on card, just standard Bitpanda trading fees apply.

Want the best crypto card? Compare Bitpanda with 10+ alternatives at CryptoLinks.com.