Gemini Credit Card Mastercard Review

Gemini Credit Card Mastercard

gemini.com

Introducing the Power of Crypto: A Critical Review of Gemini Credit Card Mastercard

In recent times, cryptocurrency has become a financial revolution. As a crypto enthusiast, and always eager to unearth tangible investment channels in the crypto world, I was fascinated when I discovered the intriguing features of the Gemini Credit Card Mastercard. Tagged as the Mastercard for cryptocurrency devotees, let's put those claims to the test.

Understanding the Gemini Credit Card Mastercard: Features & Benefits

The Gemini Credit Card Mastercard enters the market with a princely promise: earn cryptocurrency as a reward rather than traditional cash back. What piqued my initial interest was the unique proposition of this card. Cash is converted into a cryptocurrency of your choice in real-time. This stands in contrast to many other cards, where the cash-back is converted to cryptocurrency at the end of the month. This automatic, real-time conversion feature gives the Gemini Credit Card Mastercard a clear edge over its competitors. Yet, I must caution that despite its advantages, the card may only appeal to those fully invested in the cryptocurrency environment. The card’s highlight lies in its rewards scheme: 3% rewards on dining (capped at $6,000 in annual spending before reverting to 1%), 2% on groceries, and 1% on all other purchases—exclusively in the form of cryptocurrency. A key benefit, from my perspective as a crypto enthusiast, is the avoidance of exchange fees while receiving your rewards. In this regard, the Gemini Credit Card Mastercard clearly stands out among other credit cards purportedly designed for crypto aficionados.

Drawbacks of the Gemini Credit Card Mastercard

However, like any other product in the market, the Gemini Credit Card Mastercard is far from perfect. One of its main limitations is the relatively low earning rate on most spending categories. Specifically, the card has only two bonus categories—dining and groceries. This, combined with the absence of a welcome bonus and introductory annual percentage rate (APR), makes it less appealing to those with varied spending habits. On balance, the Gemini Credit Card Mastercard seems poised as a decent – but not exceptional – instrument for earning cryptocurrencies. For those intrigued by the convenience of direct crypto rewards and are not deterred by the absence of an annual fee, this card may be suitable. However, to maximize returns, purchasing with a cash-back credit card and converting it into the cryptocurrency of your choice might be a more ideal strategy, albeit necessitating additional efforts.

Additional Features of the Gemini Credit Card Mastercard

The Gemini Credit Card goes beyond basic features and offers additional benefits like an option to manage and freeze your card from the app, thus adding an extra security layer. This valuable feature enables users to control their credit cards, providing peace of mind and fostering trust in digital transactions. Moreover, according to government spending data, a typical family in the 70th percentile of income earners spends approximately $32,072 each year on a credit card. If used judiciously, the rewards earned from this spending could be substantial, making the Gemini Credit Card Mastercard lucrative for crypto enthusiasts.

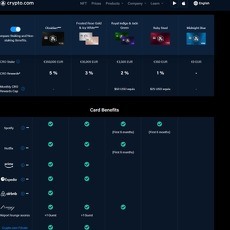

A Comparative Review: Gemini Credit Card vs. SoFi Credit Card and Crypto.com Visa Card

To offer a comprehensive review, it’s imperative to compare the Gemini Credit Card with other crypto-friendly cards like the SoFi Credit Card and the Crypto.com Visa Card. The SoFi Credit Card, like the Gemini Credit Card, has no annual fee but offers higher rewards of 2% unlimited cash back on purchases and 3% on bookings. Therefore, for frequent flyers and big spenders, the SoFi Credit Card potentially offers more value. Alternatively, the Crypto.com Visa Card operates as a prepaid debit card that provides direct access to your crypto funds, allowing real-time spending. If the aim is to spend your crypto, then the Crypto.com Visa might be a better choice. However, for those wanting credit access, the Gemini Card outweighs its counterpart.

Is the Gemini Credit Card Mastercard for You?

The Gemini Credit Card has made quite an entry into the cryptocurrency-rewards credit card market. The card’s real-time rewards earning and automatic nature of crypto rewards might fascinate a crypto devotee. However, a closer look reveals that a 2% cash-back card with cash conversion into crypto could yield higher returns. In essence, the Gemini Credit Card Mastercard could hold significant potential for a niche group of users – that group being steadfast cryptocurrency believers. But for the average consumer, there may be better credit card alternatives in the financial market.

In conclusion, as a Crypto Guy

As a die-hard crypto guy, I appreciate the innovative concept of the Gemini Credit Card Mastercard. However, with Bitcoin’s ongoing volatility and the risk embedded in crypto investments, I believe a well-balanced approach is essential. This might involve mixing traditional cash-back credit card spending with cryptocurrency investments. Nevertheless, for the unwavering crypto believers, the Gemini Credit Card Mastercard could be a potentially lucrative tool when used effectively.

Gemini Credit Card Mastercard FAQ

1. What is the Gemini Credit Card Mastercard?

As a direct result of growing interest in cryptocurrency, the Gemini Credit Card Mastercard®* was developed. This credit card offers up to 3% back in any cryptocurrency available on Gemini's platform in real time with each eligible purchase. So instead of waiting for the end of the month to convert cash back to crypto, you get real-time rewards, eliminating transaction delay and making the most of your gains.

2. What are the benefits of the Gemini Credit Card Mastercard?

As a Gemini Credit Card holder, you can earn 3% back on dining (worth up to $6,000 in annual spending; then 1%), 2% back on groceries, and 1% back on all other purchases. These rewards are granted in bitcoin or any other cryptocurrency available on the Gemini platform and are added to your account immediately following qualifying purchases. This method not only cuts out the need for exchange fees when obtaining your rewards, but also lets you manage and freeze your card using the app, and bonus—it has no annual fee!

3. Are there any drawbacks of the Gemini Credit Card Mastercard?

Although the crypto rewards system of the Gemini Credit Card is appealing, it has a few disadvantages. The two bonus categories are limited only to dining and groceries. Additionally, there is no welcome bonus or introductory APR, which lowers its attractiveness for people seeking upfront perks.

4. What makes the Gemini Credit Card different from other crypto cards?

Unlike many other crypto-earning cards where cash back is converted to cryptocurrency at the end of the month, with the Gemini Credit Card, your rewards are earned and transferred to your crypto account immediately after a qualifying purchase. This makes the Gemini Credit Card a practical and convenient option for individuals focusing on crypto rewards.

5. Who can benefit from the Gemini Credit Card MasterCard?

Anyone interested in the potential growth of cryptocurrency but also seeking reward benefits of traditional credit cards may find the Gemini Credit Card an appealing option. If you frequently dine out or buy groceries, the reward percentages might also be a significant encouragement to choose the card. However, if you're not a cryptocurrency enthusiast or prefer more upfront perks, this card may not be the best fit for you.

6. How does the Gemini Credit Card rewards work?

With the Gemini Credit Card, you earn real-time cryptocurrency for any cryptocurrency available on Gemini's trading platform. Here’s the breakdown: you will get 3% back on dining (on up to $6,000 in annual spending; then 1%), 2% back on groceries, and 1% back on all other purchases.

7. How can I redeem rewards with the Gemini Credit Card?

Your rewards from eligible spending will be automatically transferred to your digital assets account within Gemini. You can transfer your rewards to other wallets, trade your cryptocurrency, or even withdraw to your bank account. The power lies in your hands on how you manage and utilise your rewards.

8. What is the potential rewards gain with the Gemini Credit Card Mastercard?

According to government spending data, a typical family in the 70th percentile of wage earners spends around $32,072 annually on a credit card. With a breakdown of $4,511 on restaurants and $6,322 on groceries, this could mean earning $261.77—converted in real time to crypto of your choice—plus, $212.39 from the remaining expenditure for a total of $474.16 in crypto.

9. Are there other benefits with the Gemini Credit Card Mastercard?

Yes, you can gain instant access to your Gemini credit card number as soon as you're approved. You have the ability to manage and freeze your card directly from the app. Moreover, the card can be used wherever Mastercard is accepted, offering worldwide spending.

10. How does the Gemini Credit Card Mastercard compare to other cards?

When compared to cards like the SoFi Credit Card* or the Crypto.com Visa Card*, the Gemini Card appears to fill a unique niche. The SoFi Credit Card* may offer higher cash back rewards but requires converting points to cash. The Crypto.com Visa card, on the other hand, acts as a prepaid debit card for your crypto funds. So, if your goal is to accumulate and spend cryptocurrency, the Gemini Card is a robust choice.

11. Should I get the Gemini Credit Card Mastercard?

If you're a strong believer in cryptocurrency and want your card rewards to go directly into crypto, the no-annual-fee Gemini Credit Card could be just what you need. However, if you'd rather spend more on a cash-back credit card and convert that cash into your chosen cryptocurrency, you may find better value elsewhere. It all depends on what you prioritize in a credit card.

Pros of Gemini Credit Card Mastercard

Earn Crypto on Every Purchase

The biggest advantage of the Gemini Credit Card Mastercard is that it allows you to earn cryptocurrency on every purchase you make. Rather than giving you traditional cashback as typical cards do, you can earn up to 3% in real-time on dining, 2% back on groceries, and 1% on all other purchases, which are automatically converted into crypto and deposited into your Gemini account.

No Exchange Fees

Another major benefit of this card is that there are no exchange fees. Unlike some other crypto-reward credit cards that convert your cashback into crypto at the end of the month and thereby subjecting you to the exchange rate of the day, Gemini’s credit card sees you earning your rewards directly and in real-time without any hassles of exchange fees.

Real-Time Rewards

This is where the Gemini Credit Card outshines its competitors; its real-time reward system. This means you earn and hold your crypto immediately after your qualifying purchases rather than having to wait till the end of the month. Thus, you get to immediately benefit from any price appreciation.

Manage your Card from Gemini App

Gemini’s credit card gives you the ability to manage and freeze your card directly from the app, giving you direct control over your card and overall increased security.

No Annual Fee

Not having to worry about any annual fees is also a significant advantage of the Gemini credit card.

Cons of Gemini Credit Card Mastercard

No Welcome Bonus or Intro APR

The Gemini Credit Card Mastercard does not offer any welcome bonuses or introductory APR for new cardholders. This lack might be a breaking point for persons who typically value such perks.

Limited Rewards Categories

The Gemini Credit Card has only two bonus categories - dining and groceries - limiting the range of purchases where cardholders can earn boosted rewards. In an already low-earning rewards card, this factor may deter prospective users.

Best for Cryptocurrency Believers

The Gemini credit card might only appeal to true cryptocurrency enthusiasts as the rewards system is entirely crypto-based. Thus, individuals who are not fully invested in or understand crypto might not fully appreciate or benefit from the reward system that Gemini offers.

Variable APR

Gemini’s credit card has a variable APR that can get as high as 30.24%. For cardholders who carry a balance from month to month, this could prove to be quite expensive.

Missing Traditional Credit Card Benefits

The Gemini Credit Card does not offer the traditional credit card benefits like travel insurance, extended warranty, and more. This might reduce its appeal for potential users looking to make the most out of their credit card benefits. As a crypto enthusiast, I'm excited about the Gemini Credit Card Mastercard! Earn up to 3% back in any cryptocurrency on Gemini's platform. No annual fee, real-time crypto rewards, and 0 exchange fees. This card sets itself apart by offering crypto back instead of just cash back. Perfect for true crypto believers like me!

Want better crypto rewards? Compare Gemini with top cards at CryptoLinks.com.