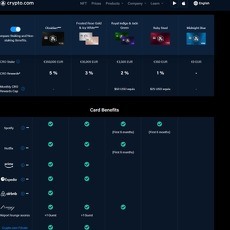

Coinbase Visa Card Review

Coinbase Visa Card

coinbase.com

A Deeper Look into the Coinbase Visa Card: An In-Depth Review

I've been on a constant search for the perfect platform to not only store and trade my digital assets, but also maximize their benefits in the financial landscape. Among the numerous options available, a product that caught my attention was the Coinbase Visa Card. I've decided to dig deeper into its features, benefits, and potential drawbacks, and provide you with an exhaustive review of this crypto card. Let's delve into everything you need to know about this innovative financial tool.

Introduction to the Coinbase Visa Card

Launched in 2019, the Coinbase Visa Card offers an interesting bridge between the crypto and fiat worlds. Essentially, the card allows you to spend your cryptocurrencies just like normal money, converting your virtual assets into fiat on the go. The card is directly linked to your Coinbase wallet, which means whenever you swipe it, the equivalent amount of cryptocurrency is automatically converted into the relevant fiat currency. You can also cash out at ATMs or make conventional retail purchases. Additionally, the Coinbase crypto debit card comes with a few impressive perks. You can earn up to 4% back in crypto rewards on every purchase, designate which cryptocurrency is used for transactions, and enjoy top-notch security features. An additional bonus is a mobile app that helps to track your spending in real-time.

Advantages and Disadvantages of the Coinbase Visa Card

Advantages

- Universal Acceptability:As it's a Visa card, one can use it almost everywhere globally.

- No Annual Fees:Unlike many credit cards, the Coinbase Card doesn't levy any annual fees, thus, increasing its allure for users.

- Choice of Cryptocurrency:Card users are offered the luxury to choose the cryptocurrency they wish to spend.

- Crypto Rewards:With up to 4% back on all purchases, the card serves as an investment tool.

- Instant Spending:The card allows users immediate access to spend their crypto.

- Supports Various Cryptocurrencies:The Coinbase Visa Card supports multiple digital assets, thereby offering diversity.

Disadvantages

- ATM Withdrawals:Unfortunately, the reward program doesn't apply to ATM withdrawals.

- Conversion Fees:A big clinging point is the conversion fee charged by Coinbase.

- Lack of Credit Card Protections:Being a debit card, it doesn’t offer the consumer protections typically seen with a credit card.

Getting and Activating Your Coinbase Debit Card

Currently available in the UK, EU, and the US (excluding Hawaii), obtaining a Coinbase card involves a simple process. To begin, you must have an active and valid Coinbase account, complete the KYC steps, and accept the Coinbase card legal agreement. Once the aforementioned stages are completed, you can order your card via the 'Pay' tab in the Coinbase website or mobile app. As soon as your card application is approved, you’re able to use the card for online purchases. Activating the physical card is equally straightforward – follow the prompts in the card section of your account.

Delivery Time, Fees, and Limits of the Coinbase Card

The delivery time, fees, and limits of Coinbase's crypto card are quite straightforward. For the UK and EU users, the card generally arrives within 5-7 working days, while for US residents, it might take up to 10 working days. As for fees, expect a nominal Card Issuance Fee and a Conversion Fee. For domestic and international cash withdrawals or point-of-sales transactions, there's an associated fee, which increases after crossing specified thresholds. In terms of card usage limitations, the daily spending limit is capped at 10,000 GBP or its equivalent, with a daily ATM withdrawal limit of 500 GBP.

Coinbase's Reward System

The cornerstone of the Coinbase Visa Card is its comprehensive reward structure. Depending on the cryptocurrency used for purchases, customers can earn up to 4% in rewards. You can get these enticing crypto cashbacks in Stellar Lumens, The Graph, Bitcoin, Ethereum, Dogecoin, or Dai.

Final Verdict on the Coinbase Visa Card

The Coinbase Visa Card provides a convenient and efficient way to utilize your cryptocurrencies. Its strong suite of security features, seamless supportability, and formidable rewards system certainly sets it apart from many competitors. However, like all financial products, it’s not a one-size-fits-all solution. While the card's merits are noteworthy, it’s important for potential users to assess their specific financial needs and circumvent issues like conversion fees. At end the Coinbase Visa Card does serve as an impressive tool, bridging the gap between cryptocurrencies and day-to-day financial transactions. If this equilibrium between the digital and real-world economy aligns with your needs, then this card could well be a worthwhile choice. Remember, with the crypto world being so dynamic, one should always stay updated and don't miss out on new cards that could potentially offer better features and rewards.

Coinbase Visa Card FAQ

I have prepared this detailed FAQ to cover all your doubts about the Coinbase Visa Card.

What is the Coinbase Visa Card?

The Coinbase Visa Card is a kind of debit card issued by Coinbase that links directly to your Coinbase wallet. When you use this card for payments, your cryptocurrency gets automatically converted into the local fiat currency of the region where you are using it.

What are the additional features of the Coinbase Visa Card?

The Coinbase card offers quite a good deal regarding other attractive features. Let's list them out: - You can earn back as much as 4% in crypto rewards on every purchase. - You have the flexibility to choose which cryptocurrency gets converted for making payments. - It provides top-tier security features that protect your crypto while you spend. - The card comes with a mobile app where you can monitor your spending.

Pros and Cons of Coinbase Visa Card

Posting glowing praises without pointing out the potential pitfalls isn't quite my style, so let's get real and discuss both the advantages and disadvantages of the Coinbase Visa card.

What are the pros of the Coinbase Visa Card?

Here are some of the strengths of the Coinbase card:

- It's a Visa card, so it has almost universal acceptance.

- There are no yearly fees countering it.

- You get the luxury to choose the crypto you wish to spend.

- On purchases, you can earn 4% back.

- Your crypto can be spent instantly.

- It supports a broad variety of cryptocurrencies.

What are the cons of the Coinbase Visa Card?

Where there are pros, there are cons. Here are some:

- Unfortunately, the rewards program doesn't extend to ATM withdrawals.

- The card does come with conversion fees.

- As it's a debit card, consumer protections akin to a credit card are absent.

The Application and Activation Process

Alright, let's get to the brass tacks. If you want in on the Coinbase card action, you'd probably want to know how you can get and activate one.

How can you apply for a Coinbase Visa Card?

Applying for a Coinbase Visa Card is quite hassle-free and gatekept by a few basic requirements. You should: - Have a valid Coinbase account. - Complete the KYC (Know Your Customer) steps. - Read and accept the Coinbase Card legal agreement.

How can you activate the Coinbase Visa Card?

Once you run the postman ragged and finally get your physical card, activation is a breeze. You just have to navigate to the card section on your Coinbase app or website and follow the given instructions.

Fees and Limits of the Coinbase Visa Card

Before you start swiping your new card away, there are some fees and limits that you should be aware of.

What fees does the Coinbase Card have?

Here's a summary of the fees that come along with the Coinbase Visa Card:

- Conversion Fee: 2.49%

- Card Issuance Fee: 4.95 EUR/GBP

- Domestic Cash Withdrawal Fee

- Up to 200 EUR/GBP per month: Free

- Any amount over 200 EUR/GBP per month: 1.00%

- International Cash Withdrawal Fee

- 200 EUR/GBP or currency equivalent per month: Free

- Any amount over 200 EUR/GBP: 2.00%

- Intra-EEA Purchase Transaction Fee: 0.20% of any POS transactions

- International Purchase Transaction Fee: 3.00% of any POS transaction

- Card Replacement Fee: 4.95 EUR/GBP (per Card issued)

- Chargeback Processing Fee: 20 EUR/GBP

What are the limits of the Coinbase Visa Card?

The Coinbase Visa Card comes with some spending and withdrawal limits:

- Daily spending limit: 10,000 GBP (or equivalent).

- Monthly purchase limit: 20,000 GBP (or equivalent)

- Yearly purchase limit: 100,000 GBP (or equivalent)

- Daily ATM withdrawal limit: 500 GBP (or equivalent)

Reward Programs of Coinbase Visa Card

Who doesn't like rewards, right? Collectively, the rewards of the Coinbase Visa card offer a great deal. The percentage of what you get back does however, depend on the cryptocurrency you spend. Here's a snapshot of the rewards:

- 4% in Stellar Lumens (XLM)

- 4% in The Graph (GRT)

- 1% in Bitcoin (BTC)

- 1% in Ethereum (ETH)

- 1% in Dogecoin (DOGE)

- 1% in Dai (DAI)

The thing to remember is that every good thing has its flaws. The Coinbase Visa card, for all its advantages, isn't perfect. If you want a versatile cryptocurrency-spending solution with a good mix of security, convenience, and rewards, the Coinbase Visa card can be a solid player. But if you prioritize cashback in your card, you might want to dive deeper into the crypto card sea for other options.

Pros of the Coinbase Visa Card

Universal Acceptance

Being a Visa card, it is accepted at countless merchants across the globe. I can spend my stored crypto anywhere Visa is accepted, making for a seamless transaction experience.

No Annual Fees

The Coinbase Visa card is a pleasure to have because alongside providing convenience, it costs me zero annual fees. This makes it cost-effective, considering the number of perks it provides.

Selective Crypto Spending

Cryptos aren't all the same, right? Coinbase seems to understand this as the card allows me to choose which cryptocurrency I wish to spend when making a transaction. This added layer of control is a valuable feature for me.

Crypto Back on Purchases

Earn while I spend? Yes, please! With 4% back in crypto on purchases, the Coinbase Visa card offers an attractive rewards program that adds to the appeal of this card.

Instant Crypto Spending

Timing is everything in the volatile world of crypto. The fact that I can instantly spend my cryptocurrency gives me the edge in this fast-paced world.

Support for Multiple Cryptocurrencies

Coinbase doesn't limit me when it comes to the type of cryptocurrency I can store and use. It supports a wide variety of cryptocurrencies, multiplying the functionality of the card.

Cons of the Coinbase Visa Card

No Crypto Back on ATM Withdrawals

While the rewards program is enticing, I feel a bit left out when it comes to ATM withdrawals. The 4% cash back doesn't apply at ATMs, and as someone who frequently withdraws cash, this feels like a missed opportunity.

Conversion Fees Apply

With each use of the card, a conversion fee is required to switch the cryptocurrency into fiat currency. Despite the convenience it provides, these costs can add up over time and become a bit of a turn-off.

It's a Debit Card

The Coinbase card is a debit card and therefore doesn't offer the consumer protections that come with owning a credit card. This means that in the unfortunate event of fraud or theft, I may not be wholly covered.

Variable Crypto Back Rate

While the idea of earning cryptos while spending sounds exciting, the rate of return depends on the type of cryptocurrency. Some cryptos only give back at a 1% rate, which can be a bit disappointing.

Limited Availability

Being based in Hawaii, I'm unable to get this card, which is a bummer. In the ever-inclusive world of crypto, geographic limitations seem to be a letdown.

Currency Conversion Fees for International Transactions

As an international traveler, the 3% fee charged on international purchase transactions is a significant drawback for me. Currency conversion for payments could be significantly cheaper using various other services. In conclusion, if you're investigating crypto card options, the Coinbase Visa card should be consideration. It provides a great deal of convenience and a decent rewards program. However, do keep in mind the conversion fees and the lack of consumer protections typically provided by credit cards. Every crypto enthusiast’s mileage may vary. Get hands on the popular Coinbase Visa Card! Instantly spend your crypto in real-world, earn up to 4% back on purchases, and enjoy top-notch security! It's a revolution enabling you to be in control of your crypto finances. No more boundaries, only possibilities!

For more expert comparisons of crypto debit cards—including rewards programs, fee structures, and alternative card options—explore in-depth guides at CryptoLinks.com.