Cryptopay Review

Cryptopay

cryptopay.me

Cryptopay Review Guide: Is It Legit and Worth Your Crypto?

Ever tried buying a quick coffee or booking a last-minute flight with crypto, only to find yourself frustrated by complex steps or hidden fees? You're definitely not the only one! As a passionate crypto user myself, I often wonder: why isn't cryptocurrency spending simpler, faster, and frankly—more practical?

What's Keeping Crypto Users From Easy Spending?

Let's be real: crypto was built to free us from financial headaches, yet daily transactions aren't always the seamless experience promised. I can't count how often I've faced issues like:

- Limited merchant acceptance: Imagine entering your local grocery store or cafe ready to spend crypto, only to hear: "Sorry, we don't accept cryptocurrency." Frustrating, isn't it?

- Sluggish transactions: Waiting several minutes, sometimes even hours, for a single crypto transaction to clear can drive anyone crazy, especially if you're in a hurry.

- Hidden and confusing fees: Ever been surprised by unexpected transaction fees that weren't clearly explained? It's definitely happened to me—and I bet you've been there too.

Could Cryptopay Be the Answer?

This leads me to a question I often get asked by friends, colleagues, and readers alike: Is there a simple but effective payment solution for cryptocurrency users? Could Cryptopay be what we've been waiting for to effortlessly turn Bitcoin or Ethereum into everyday spending power?

Considering how many promising platforms I've seen and tested, I can understand your hesitation. Nobody likes falling for empty promises—and especially not when your crypto is at stake. That's why in this thorough review, I'm going to honestly look into Cryptopay to figure out whether it genuinely solves the common pain points I've mentioned.

We'll take a transparent and no-nonsense look to see whether Cryptopay can truly simplify crypto spending, make transactions quicker, and clearly communicate fair fees. After all, I believe that when it comes to spending our hard-earned crypto, there should be no surprises.

Will Cryptopay finally make everyday spending with crypto as effortless as it should be? Keep reading, as the answer might surprise you.

What Exactly is Cryptopay and How Does It Work?

Imagine you've got your crypto safely stacked away inside a wallet—but how convenient is it really for everyday shopping or grabbing lunch with friends? We've all dreamed about crypto being as simple as pulling out a debit card at a checkout or clicking "Pay Now" without a hitch. Well, the good news is—that's exactly what Cryptopay aims to offer.

Brief Overview of Cryptopay

Cryptopay isn't just another crypto company; it's a solution born out of a real-world need. Launched back in 2013, their goal was simple yet profound: bridge the frustrating gap between owning cryptocurrencies and actually spending them in your daily life. No jargon, no fuss—just make it fast and easy to buy, hold, and spend your crypto.

The heart of Cryptopay is its cryptocurrency debit card, but it goes beyond that. They've created a one-stop platform providing secure wallets, smooth exchange between crypto and fiat currencies, and easy management of your funds. Whether you're buying groceries at your favorite local store or ordering a birthday gift online, the idea behind Cryptopay is to put crypto spending into your comfort zone.

It hits an emotional spot too—as someone using crypto frequently, don't we all just want usability without complicated hoops to jump through? Cryptopay appeals directly to that desire.

"Crypto is the people's money. Our mission is to empower everyone to spend, send, receive, and hold cryptocurrencies effortlessly every day." – Cryptopay's Mission Statement.

Understanding How Cryptopay Works in Practice

So, practically, how does Cryptopay manage to make crypto spending seamless? The answer: by giving you a debit card experience that's just like your traditional bank-issued one—with some crypto-friendly twists.

- Crypto-Loaded Debit Cards: You simply load your Cryptopay card with cryptocurrency from your wallet. Once loaded, you use it just like a regular debit card at Visa-accepting merchants around the world.

- No Crypto acceptance? No problem: When you swipe your card at your local café that doesn't even understand what crypto is, their system receives fiat currency instantly, with your crypto automatically performing real-time exchange in the background. You get your coffee—they get regular currency—everybody wins!

- Supporting Easy, Secure Spending: Cryptopay supports contactless payment options and includes 3D Secure protection—giving reassurance for both online and offline purchases.

- Simple-To-Use Wallet App: You manage all this with their user-friendly app that's effortlessly intuitive, with quick exchanges between Bitcoin, Ethereum, Litecoin, XRP, and traditional currencies like EUR or GBP.

For example, imagine you're heading to Rome for the weekend—a quick click converts your BTC or ETH into Euros instantly, letting you comfortably meet expenses without battling hefty exchange rates and without your favorite Italian gelato stand even realizing they're serving a crypto-friendly customer.

This sounds pretty ideal, right? But of course, it’s essential to ask: is Cryptopay really as good as it seems? Can you genuinely trust it with your crypto funds? Let’s check this carefully—I’ll explore deeper to find out exactly how legitimate and safe Cryptopay is for you. Are they really protecting your assets as well as their own? We'll discover the answer together next.

Is Cryptopay Legitimate and Trustworthy?

Trust is everything when it comes to crypto, isn't it? With countless scams popping up nearly every day, choosing a reliable crypto service feels like walking through a minefield. I totally get it—keeping your cryptocurrency safe is your number one priority, as it should be. So let's talk honestly about Cryptopay. Is it genuinely trustworthy, or should your crypto wallet stay far away?

Analyzing Cryptopay's Reputation and User Safety

Before I personally recommend any crypto service, reputation is always the first thing I look into. After checking user feedback across numerous communities like Reddit, Trustpilot, and cryptocurrency discussion forums, I found some key insights about the reputation and safety track record of Cryptopay:

- User Satisfaction Score: Cryptopay has earned generally positive feedback, showing encouraging signs of trustworthiness. Trustpilot ratings put Cryptopay in the 'Good' category, with 4.0 out of 5 ratings, citing smooth experiences, responsive support, and reliable functionality. Of course, occasional complaints exist, mainly about verification delays, not surprising given the strict KYC (Know Your Customer) procedures many crypto services employ.

- Community Discussions: Real-life Cryptopay users frequently appreciate the smooth transaction process and hassle-free payments. Negative comments do occasionally surface, typically around customer service responsiveness rather than reliability issues.

- Regulatory Compliance: Cryptopay clearly boasts compliance with regulations. They are registered with the UK's Financial Conduct Authority (FCA). This regulatory alignment indicates a solid commitment to transparency, fair practices, and consumer protection.

"Trust is like a paper, once it's crumpled it can't be perfect again." - Unknown

Cryptopay seems to understand that perfectly, continuously working to build trust and minimize complaints.

Security Features

Now let's talk security. Losing your crypto due to poor security is the crypto-user's worst nightmare—one nobody wants to experience. How well does Cryptopay play this crucial aspect? Here are some substantial measures they have implemented:

- 3D Secure Transactions: Cryptopay cards use 3D Secure authentication, adding an extra layer of security when shopping online. You aren't just relying on standard card details—a verification step is built in, helping ensure transactions are genuinely yours.

- Strong Account Protection: Cryptopay implements Two-Factor Authentication (2FA), ensuring the user authorization process isn't just a simple password input. This significantly enhances protection from unauthorized account access.

- Data Encryption: Your personal data and financial information are encrypted using advanced encryption standards, safeguarding your transactions and personal details from cyber threats.

- Instant Card Freezing: One security feature I particularly appreciate is Cryptopay's ability to instantly 'freeze' the card through the app if it's misplaced or stolen.

These essential security protocols indicate Cryptopay doesn’t just claim security—they actually practice it, seriously addressing user safety and secure crypto spending.

But while reputation and security look promising, the golden question remains: Is Cryptopay affordable enough to make it your go-to crypto spending service? Nobody loves hidden costs or surprise fees, right? Find out clearly what to expect in the next part—so you don’t spend a penny more than you have to.

Cryptopay Fees and Charges - Worth the Cost?

No one ever likes surprises—especially when it comes to those dreaded hidden fees we often discover too late. Cryptocurrency platforms sometimes promise transparency but leave us digging through deep pages or fine print just to get clarity. Let's put Cryptopay's fees in the spotlight and break down exactly what it's going to cost you—so there's no second-guessing later.

Card Issuing and Maintenance Costs

First things first—the Cryptopay debit card comes with some straightforward charges:

- Issuing Cost: Cryptopay charges €15 / £15 for the issuance of a physical card (Virtual cards are slightly cheaper at €2.50 / £2.50).

- Card Maintenance: Keeping your Cryptopay card actively running costs €1 / £1 monthly. It may sound insignificant, but these minor recurring charges can add up over time. It's worth benchmarking your typical card usage against this cost.

"Beware of little expenses, a small leak will sink a great ship." – Benjamin Franklin

Transaction and Currency Conversion Fees

Now let's get realistic and talk about regular card use. Cryptopay comes with clear-cut transactions fees—and yes, they're essential to know beforehand:

- 1% Loading & Unloading Fees: Every time you add crypto funds to your card wallet (or remove unused funds), Cryptopay charges a simple yet critical 1%. This might seem small, but frequent transfers can quickly add up.

- Currency Conversion Fee (2%): Spending overseas is convenient, but there's a price—Cryptopay adds a 2% fee for currency conversion in foreign transactions. How often do you travel or shop internationally? This fee matters if you're a frequent global spender.

- ATM Withdrawals: Expect ATM withdrawal fees of €2.50 or £2.50 domestically, and €3.50 or £3.50 internationally (per withdrawal). It's a substantial charge if you frequently prefer cash withdrawals abroad.

Identifying your spending habits clearly beforehand can truly help you judge whether these costs constitute minor inconveniences or deal-breakers.

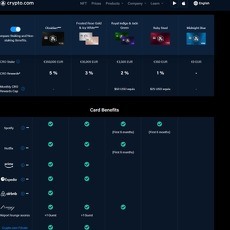

How Do Cryptopay's Fees Stack Up Against Competition?

Let's place Cryptopay side-by-side with its closest rivals and see where it stands:

- Crypto.com Visa Card: Crypto.com doesn't charge monthly card-keeping fees, but the upfront staking requirements that unlock perks can be costly for some users. They also often waive currency conversion fees, making them noticeably attractive to international spenders.

- Wirex Card: Wirex offers lower currency conversion fees, typically around 0.5%–1%, beating Cryptopay’s flat 2%. Wirex also has no regular monthly maintenance charges.

- Coinbase Card: Coinbase charges 2.49% per transaction, significantly higher than Cryptopay’s 1% loading/unloading fee, yet has no monthly maintenance costs.

You can clearly see how fees vary depending on your specific spending needs and lifestyle. Cryptopay's simplicity and predictability are valuable—but if you're constantly abroad converting currencies on-the-go or withdrawing often at ATMs, other options may offer substantial savings.

Understanding fees is just the tip of the iceberg. But what else do you really need to know about how easily your funds can move in and out on Cryptopay? Could minor hidden transaction restrictions hold you back from fully enjoying your crypto assets? Don't guess—I've covered the next important answers clearly in this upcoming section!

Deposits and Withdrawals on Cryptopay: Everything Clearly Explained

Getting quick, stress-free access to your crypto funds is something all crypto fans like me genuinely care about. If you're like most people, unclear deposit limits or complicated withdrawal processes can drive you crazy—something I'm definitely familiar with. So, how easy does Cryptopay make moving money in and out? Let's get crystal clear about it:

Minimum and Maximum Deposit Limits: How Little Can You Start With?

Ever had that awkward moment when you're trying to send crypto but face confusing minimum limits? With Cryptopay, there's good news here! Deposits start incredibly small, allowing almost everyone the freedom to begin instantly:

- Bitcoin (BTC): 0.00000001 BTC (approximately 0.00026 USD at current rates—yes, it's that tiny!)

- Litecoin (LTC): 0.00000001 LTC

- Ethereum (ETH): 0.00000001 ETH

- Ripple (XRP): 0.000001 XRP

These ultra-low minimum deposit amounts remove entry barriers, making Cryptopay incredibly beginner-friendly. It feels genuine and thoughtful—exactly what you'd want from a modern crypto platform, right?

Withdrawal Process and Limits: Is It Easy to Get Your Crypto Out?

This is a biggie. Whether you're spending or investing, nobody enjoys complicated or sluggish withdrawals, myself included.

With Cryptopay, withdrawals are straightforward without hiding behind confusing conditions or shady small print. Here's how clear their withdrawal limits are:

- Bitcoin (BTC) & Ethereum (ETH): minimum withdrawal limit starts from just 0.0001 BTC/ETH (around $2.60 at current BTC price). Easy to manage for regular users.

- Litecoin (LTC) & Ripple (XRP): minimum withdrawal of 0.001 LTC/XRP—also very user-friendly limits.

In addition, withdrawal steps are simplified nicely—you won't have to jump through hoops to get your crypto into your personal wallet.

"Peace of mind isn't expensive, it's priceless," and seamless processes like these are precisely what bring peace of mind when dealing with crypto.

As someone who spends a ton of time reviewing platforms, I've noticed how critical smooth deposits and withdrawals truly are—making clear limits and ease-of-use top priorities. Cryptopay certainly meets these standards, delivering comfort and convenience for everyday crypto users.

But are deposits and withdrawals everything? Or could the real charm of Cryptopay lie in its flagship crypto debit card feature? If you're intrigued, you'll love what's next...

Cryptopay Card: Does It Actually Make Crypto Spending Easier?

If you're like me, you've probably imagined how amazing it would feel to walk into your local coffee shop, pick up your favorite latte, and effortlessly pay with crypto. No waiting, no confusion, no fuss. Cryptopay promises precisely this: the ease of regular spending with the powerful freedom of cryptocurrencies. But does it really deliver? Let's find out.

Everyday Usage and Practicality

The Cryptopay card is pitched as the crypto user's everyday debit card, emphasizing practical, straightforward spending. The big question, of course, is: Can I really use this card everywhere I would an ordinary card?

The good news: from online shopping at popular retailers to local restaurants, gas stations, grocery stores, and even booking flights or Airbnb accommodations—it's worked seamlessly. It supports contactless payments, just tap-and-go, a big convenience when you're in a hurry. Cryptopay also leverages the trusted Visa network, making acceptance virtually universal (Visa reports over 70 million merchant locations worldwide!).

"The joy of paying with crypto at my local store felt surreal at first, now it feels just normal. Can't imagine life without Cryptopay" – Alex, Cryptopay user

Whether it's paying your Netflix subscription online, buying a new pair of sneakers from Nike, or a burger from McDonald's, the card fits effortlessly into everyday life scenarios.

Wallet Flexibility: Storing and Spending Various Cryptos with Ease

A good crypto card doesn't just make spending easy—it simplifies storing and managing your crypto too. Cryptopay shines here also, supporting popular cryptocurrencies such as Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), and Ripple (XRP). The wallet platform is easy and intuitive; exchanging between cryptos or loading money onto the debit card from your wallet takes seconds.

This convenience can’t be overstated. Imagine crypto prices rising suddenly: you can quickly access your gains, load them to your card, and immediately spend at your favorite merchant. No delays, no complicated exchanges—just instant, smooth crypto spending.

- Supports BTC, ETH, LTC, XRP securely within a unified wallet.

- Instant exchanges to fiat currencies with competitive rates.

- Easily load and unload your card balance on-the-fly.

Real-Life User Experiences (Pros & Cons)

Hearing directly from users is always insightful. Here’s what some everyday crypto enthusiasts think about Cryptopay:

Pros users commonly praise:

- Wide acceptance due to Visa integration

- Easy-to-use interface for exchanging crypto to fiat

- Reliable for daily online and offline purchases globally

Cons and areas of criticism from users:

- Some complain about currency conversion fees (around 2%)

- Occasionally slower top-ups during peak network usage

- Limited cryptocurrency choices—users seeking niche cryptos might miss out

It's a mixed bag, but overall users highlight how Cryptopay has literally transformed the practicality of using crypto day-to-day.

Sure, easy spending is vital—but what happens when you run into an unexpected hitch? How does Cryptopay's support fare at helping users out fast? Keep reading, and I'll let you know exactly what to expect from Cryptopay customer support in real-life situations.

Cryptopay Customer Support: Is Support Helpful When You Need It?

We've all been there: you urgently need help with your crypto card or wallet, and there's nothing worse than feeling stranded. Smooth customer support can be the deciding factor between frustration and satisfaction, especially when finances and security come into play. A famous saying goes:

"A customer service apology is stronger with a personal touch and quick resolution."

I couldn't agree more. So let's put Cryptopay's support under the microscope and see if they're really there for you when you need them the most.

Customer Service Quality and Helpfulness

Cryptopay offers several channels to get help, ensuring they're reachable when trouble shows up. Here's how you can reach their support:

- Email: Ticket-based email support through their official contact page.

- Live Chat: Available directly on the website—responsive during working hours.

- Phone support: Not directly provided; customers usually handle urgent issues via live chat.

- Extensive FAQ section: Easily searchable for common questions and step-by-step guides.

But here's what matters most—what real users are experiencing. How has Cryptopay's customer support performed in real-world scenarios?

- Several Trustpilot reviews noted impressive friendliness and helpfulness of support representatives, emphasizing that speaking to "real people" made them feel valued.

- Some customers highlighted thorough follow-ups by Cryptopay's team, making sure their issue was fully resolved before closing the ticket.

- Negative experiences were rare but typically focused on limited live chat hours or occasional delayed email responses.

Availability and Speed of Response

Fast, responsive customer support can genuinely turn an issue around. According to user reviews I've scanned on platforms like Trustpilot and Reddit, most customers seemed fairly satisfied with Cryptopay's response times:

- Email responses: Typically within hours, though in some cases it could stretch up to a day, especially during peak times.

- Live chat: Speedy replies in minutes when available during business hours. However, many users wished it was available 24/7 to better suit global crypto customers.

One Trustpilot user described their experience:

"I contacted Cryptopay support via live chat as my crypto transfer got delayed. Honestly, their agent solved my anxiety in less than 10 minutes—quick, professional, and stress-relieving. Couldn't ask for more!"

Studies suggest that 87% of crypto customers rank customer support availability as critical for their trust in platforms (Source: Deloitte Crypto Report, 2021). Cryptopay seems reasonably aware of this need, though there is room for growth, especially to align better with a global user base.

Have you ever faced any challenges with crypto support? You might wonder what resources are quickly accessible when you're stuck or need fast answers. Trust me; you'll want to see what helpful resources Cryptopay offers for quick self-help troubleshooting—let’s check them out next.

Important Resources You'll Need When Considering Cryptopay

When you're getting serious about a crypto-related service like Cryptopay, having quick and helpful references at your fingertips can save major headaches. Believe me, sorting through online forums or sifting through outdated Reddit threads can be frustrating—that's why I've compiled two valuable resources that can make your experience 10x smoother.

Cryptopay Official FAQ Page

First things first—Cryptopay's own FAQ page is essential. I always recommend jumping straight to the source when you've got basic questions about a platform. Thankfully, Cryptopay have laid out answers to common queries clearly and concisely. Whether you're trying to figure out how to activate your crypto debit card, resolve transaction issues, or simply learn about security specifics, this page is your go-to resource.

Cryptopay Fees and Limits Resource

Let's be real, nobody likes hidden surprises when it comes to fees. I've personally seen the frustration of a hidden cost when I was just about to make a purchase—spoiler alert: it doesn't feel good! Thankfully, Cryptopay offers a dedicated fees and limits section that clearly outlines exactly what you're being charged.

Here are the direct links I'd recommend bookmarking right away if you plan on using Cryptopay:

- Cryptopay Fees and Commissions

- Cryptopay Limits Explained

You'll find transparent details about fees associated with currency exchange, withdrawals, deposits, and everything else. Plus, staying within transaction limits becomes much easier when all the numbers are laid out clearly ahead of time.

Trust me, every potential Cryptopay user should keep these two resources handy. After all, who wants to lose time or stress out over unclear fees or procedures?

But wait... do you still have burning questions about Cryptopay that these resources may not fully answer? I thought you'd say yes! Keep reading—because next, I’ll directly address the top urgent Cryptopay questions I see users asking most frequently. You won’t want to miss it!

Quick FAQ about Cryptopay: Answering Top User Questions

After covering so many aspects of Cryptopay, let's quickly recap some of the most commonly asked questions I hear from crypto users all the time. I'll answer these directly, clearly, and honestly to help remove any lingering doubts.

How does Cryptopay Work Practically?

The Cryptopay debit card works just like an ordinary prepaid debit card but with some extra perks. You simply load your cryptocurrency onto the card, and then you’re free to spend it practically wherever Visa is accepted—online and offline.

In practice, this means you can tap your card at your local coffee shop, order items online, and even withdraw cash at ATMs. The card comes integrated with contactless payments and advanced 3D Secure features, adding extra layers of security to protect your funds anywhere you go.

How Much is the Minimum Deposit and Withdrawal at Cryptopay?

The minimum deposit amount at Cryptopay is incredibly low, making it accessible even for those micro-deposits:

- Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH): 0.00000001 (practically next to nothing!)

- XRP: 0.000001 XRP

As for withdrawals, minimum limits are simply:

- Bitcoin and Ethereum: 0.0001 BTC/ETH

- Litecoin and XRP: 0.001 LTC/XRP

This flexibility is fantastic if you prefer having control over even small crypto transactions with ease.

Is Cryptopay Real and Safe to Use?

Yes, absolutely! Everything I've researched and learned about Cryptopay shows it's a legitimate platform that's designed to offer safe and secure crypto payments. Cryptopay is regulated and compliant with financial security standards. Additionally, they employ robust systems for account protection, transaction security, and fraud prevention, making sure your crypto isn't compromised.

Still skeptical? Well, you're not alone. But I've seen plenty of positive user reviews validating Cryptopay's reliability and security—many crypto users trust this service daily without worry.

Final Thoughts & My Personal Opinion About Cryptopay

After carefully exploring Cryptopay up close, I'm honestly impressed by how user-friendly and convenient they've made crypto spending. It's refreshing to see a crypto debit card delivering on its promises, allowing straightforward spending of popular cryptocurrencies with minimal hassle.

Would I recommend it to everyone? Well—not exactly everyone. If you're someone who is looking for the simplest way possible to spend and use your crypto without worrying about merchant acceptance or complicated conversions, Cryptopay’s card is a fantastic option. It's particularly useful when traveling internationally or regularly making online payments in different currencies.

That said, if you're hyper-sensitive to fees or rarely need real-world crypto spending, there might be better ways for you.

Personally, I've found Cryptopay works wonders for everyday crypto spending, convenience, and ease of use. It smoothly bridges the gap between crypto and traditional finance, solving the everyday challenges crypto enthusiasts like us often experience.

In short, if convenience, practicality, and security in crypto payments resonate with your goals, then Cryptopay is genuinely worth giving a shot.

Don’t let your crypto sit idle—turn it into spending power today! Explore more trusted tools like Cryptopay at CryptoLinks.com.