WhatToMine Calculator Review

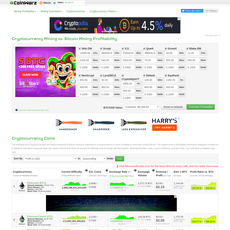

WhatToMine Calculator

whattomine.com

Whattomine.com Review: Your Go-To Guide for Maximizing Mining Profits

Ever looked at your mining rig humming away and wondered, "Am I really mining the most profitable coin right now?" You're not alone. With the crypto landscape packed with countless coins, figuring out which one will give you the best return can feel like finding a needle in a haystack. That's where Whattomine.com steps in to make life easier. Let me share how this tool has helped me make smarter mining choices and boost my earnings.

The Challenge of Choosing the Right Coin to Mine

Let's face it—crypto mining isn't just about setting up some hardware and watching the profits roll in. Between fluctuating coin prices, changing network difficulties, and those pesky electricity costs, it's easy to feel overwhelmed. Picking the wrong coin can be the difference between making a profit and operating at a loss.

How Whattomine.com Can Be a Game-Changer

Whattomine.com simplifies the whole process by providing real-time profitability data tailored to your specific hardware. It takes the guesswork out of mining, letting you focus on what matters most—maximizing your returns.

What You'll Gain from This Review

I'll walk you through the key features of Whattomine.com, share my experiences with its accuracy, and offer tips on how to get the most out of it. Whether you're a seasoned miner or just starting out, there's something here that can help enhance your mining strategy.

Ready to find out how to make your mining more profitable? Let's get started!

Understanding Whattomine.com and Its Features

Before jumping into any tool, it's crucial to know what it offers. Whattomine.com caught my eye as a miner's best friend, simplifying the way we approach cryptocurrency mining. Let's take a closer look at how it can assist you on your mining journey.

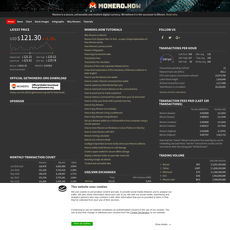

An Overview of Whattomine.com

Whattomine.com is like having a personalized advisor in the ever-changing world of crypto mining. It's a comprehensive profitability calculator that pinpoints which cryptocurrencies are most profitable to mine based on your specific hardware setup. No more second-guessing or scouring forums for advice—this tool brings the information right to your fingertips.

Key Features That Make It Stand Out

- Real-Time Profitability Calculations: The crypto market doesn't sleep, and neither does Whattomine.com. It continuously updates to reflect the latest market data, so you're always working with current information.

- Customizable Inputs: Whether you're running a single GPU or a farm of ASICs, you can input your exact hardware details, hash rates, and electricity costs. This means the results you get are tailored specifically to your setup.

- Wide Range of Supported Coins: From household names like Ethereum and Bitcoin to emerging coins that might just be the next big thing, Whattomine.com covers a vast array of options.

Navigating the User Interface

When I first landed on the site, I half-expected to be greeted by complicated charts and data overload. Instead, I found a clean, intuitive layout that made sense right away. The inputs are straightforward—you select your hardware, enter your specifics, and hit calculate. For example, I selected my NVIDIA GTX 1070, input my hash rate, and within seconds, I had a list of the most profitable coins to mine.

Even if you're new to mining, the site doesn't overwhelm you with jargon. The results are displayed in an easy-to-read format, showing profitability per day, week, and month. It's a refreshing change from some tools that seem designed only for the tech-savvy elite.

"The simplest tool can empower the most complex of tasks."

That quote rings true here. Whattomine.com takes the complex variables of crypto mining and presents them in a simple, accessible way. It feels like having a trusted friend guiding you through the maze.

But understanding its features is just the beginning. How accurate is it really? And how does it stack up against real-world mining results? These were the questions on my mind as I explored further.

Assessing the Accuracy of Whattomine.com

When it comes to mining, accuracy isn't just important—it's everything. If the numbers are off, even by a little, you could end up burning electricity for pennies or missing out on more profitable opportunities. So, does Whattomine.com deliver reliable data that we can trust? I decided to put it to the test.

Putting Whattomine.com to the Test

I took a hands-on approach. Over the past few weeks, I've been running my mining rigs—an NVIDIA RTX 3080 and an AMD Radeon RX 6800 XT—and meticulously comparing my actual earnings with the profitability estimates provided by Whattomine.com.

I entered all the specifics into the calculator: hash rates, power consumption, electricity costs—the whole nine yards. According to Whattomine.com, my RTX 3080 should earn around $5.50 per day after expenses. In reality, I was seeing daily earnings fluctuating between $5.30 and $5.70. That's pretty darn close!

With the AMD Radeon RX 6800 XT, the site estimated daily profits of about $4.80. My actual results were in the ballpark of $4.60 to $4.90 per day. Again, not a perfect match, but certainly within a reasonable margin.

These findings showed me that while Whattomine.com might not nail it to the cent every time—let's face it, the crypto market is a wild ride—it's reliable enough to base decisions on. It's like having a weather forecast that's accurate enough to know whether to bring an umbrella.

Comparing with Other Mining Tools

Curiosity got the better of me, and I decided to see how Whattomine.com stacks up against other calculators like NiceHash's profitability tool and CoinWarz. Using the same data from my mining setups, I compared the estimates.

NiceHash suggested that my RTX 3080 would earn about $5.20 per day, slightly less than Whattomine.com's estimate. CoinWarz came in with a prediction of $5.40 per day. Interestingly, my actual earnings aligned more closely with Whattomine.com's numbers.

What does this tell us? Each platform uses its own algorithms and data sources, which can lead to different estimates. But in my case, Whattomine.com provided figures that were more in tune with reality. Plus, I found its interface more user-friendly for tweaking variables and seeing instant updates.

Community Feedback and Trustworthiness

Of course, my experience is just one piece of the puzzle. I headed over to some popular mining forums and Reddit communities to see what other miners had to say about Whattomine.com's accuracy.

One seasoned miner mentioned, "Whattomine.com has been my go-to for years. It’s not perfect, but it's the closest thing we've got to a crystal ball."

"The strength of the team is each individual member. The strength of each member is the team." — Phil Jackson

Reading through countless threads, the consensus seemed clear: while no calculator can predict the future, Whattomine.com is trusted by many in the mining community for its reliable estimates and comprehensive data.

Knowing that others share my positive experience adds another layer of confidence. It's like being part of a team where everyone is contributing to the collective knowledge.

But even with accurate tools at our disposal, the burning question remains: are we mining the most profitable coins available, or is there something we're missing?

What's the Most Profitable GPU Mining Coin Right Now?

Ever caught yourself staring at your rig, thinking, "Am I really mining the best coin today?" You're not alone. The crypto mining landscape changes faster than you can say "blockchain," and keeping up can feel like chasing shadows. But don't worry—we're in this together, and I've got some insights that might just boost your bottom line.

"The secret of getting ahead is getting started." – Mark Twain

So let's get started on finding out which coins could be padding your wallet right now.

Top Coins According to Whattomine.com

So, what's shining brightest on Whattomine.com today? Here are some contenders making waves:

- Zano (ZANO): This coin has been outperforming many others, offering impressive returns for GPU miners. Its unique privacy features and active development team have attracted a lot of attention.

- Neurai (XNA): A newcomer that's quickly gaining traction. Its lower network difficulty makes it an attractive option for those looking to maximize earnings.

- Clore (CLORE): Don't overlook this one. Clore's recent market movements have positioned it as a profitable choice, especially for those with mid-range GPUs.

These coins have bubbled to the top due to a mix of market demand, technological innovation, and favorable mining conditions. Keeping an eye on them could make a noticeable difference in your mining profits.

Factors Influencing Profitability

Now, you might be wondering why these coins are currently more profitable. Here's what's at play:

- Market Trends: Sudden spikes in coin value can make a previously unprofitable coin into a goldmine overnight.

- Network Difficulty: A lower difficulty means your hardware can solve blocks faster, leading to higher returns.

- Coin Value: Higher coin prices directly translate to more earnings when you exchange your mined coins.

Understanding these factors is key. It's not just about what you're mining, but also when you're mining it.

Balancing Immediate Gains with Future Potential

Here's the big question: Should you chase today's most profitable coins, or mine coins that might be worth more down the road?

Chasing immediate gains can be lucrative, but it's a bit like surfing—you have to catch the wave at just the right moment. On the flip side, mining coins with strong long-term potential is like planting seeds for future harvests. It's all about your goals and how much risk you're willing to take.

Personally, I like to mix it up. I'll allocate some of my hashing power to coins that are hot right now and reserve a portion for those under-the-radar projects that could explode in value later. It's like having the best of both worlds.

Feeling a bit overwhelmed? Don't sweat it. Navigating these choices is part of the mining adventure. But what if there was a way to make this process even smoother? In the next section, I'll share some strategies on how to use Whattomine.com to its fullest potential, so you can make informed decisions with ease.

Maximizing Your Mining Profits with Whattomine.com

Ever feel like you're missing out on better mining opportunities? I've been there, wondering if tweaking a few settings could boost my returns. Let's take a look at how to use Whattomine.com effectively to enhance your mining profits.

Customizing for Your Setup

The first step is making Whattomine.com work for you by tailoring it to your specific hardware and costs. Here's how I do it:

- Input Your Hardware: Select the exact GPUs or ASICs you're using. This ensures the hash rates are accurate for your equipment.

- Adjust Hash Rates: If you've overclocked your hardware, update the hash rates to reflect the increased performance.

- Set Electricity Costs: Enter your local electricity rate per kilowatt-hour. This factor can significantly impact your profitability calculations.

By personalizing these inputs, the site provides a realistic snapshot of which coins will maximize your earnings based on your unique setup.

Staying Updated with Market Changes

The crypto market moves at lightning speed. Prices fluctuate, network difficulties adjust, and new coins emerge. To stay ahead, I make it a habit to:

- Check Regularly: I visit Whattomine.com multiple times a day to catch any sudden shifts that could impact profitability.

- Monitor Trending Coins: Keep an eye on coins that are gaining traction. A sudden spike in a coin's value can mean higher profits if you start mining it early.

- Stay Informed:Join crypto communities or forums. Sometimes, insider knowledge or news can alert you to upcoming changes before they're reflected on mining calculators.

Remember, timing is everything. Being proactive can make a significant difference in your mining returns.

Tips and Tricks I've Learned

Over the years, I've picked up some helpful strategies for getting the most out of Whattomine.com:

- Explore Niche Coins: Don't shy away from lesser-known cryptocurrencies. They often have lower mining difficulty and can be surprisingly profitable.

- Combine Tools: While Whattomine.com is powerful, using it alongside other platforms can provide a more comprehensive view. For instance, tracking live coin prices or setting up price alerts can complement your mining strategy.

- Keep an Eye on Fees: Some coins come with higher transaction fees or might be harder to sell on exchanges. Factor this into your decision-making process.

As they say, "Knowledge is power." The more informed you are, the better choices you can make.

Feeling equipped to boost your mining profits? There's more to uncover. Ever wondered how Whattomine.com compares to other tools out there? Let's see what's next.

Exploring Alternatives to Whattomine.com

While I've found Whattomine.com incredibly helpful in navigating the crypto mining landscape, it's always worth checking out what other tools are available. Different platforms offer unique features that might align better with your specific needs or preferences. Here are some alternatives I've explored.

How Does NiceHash Compare?

NiceHash isn't just a mining calculator—it's a comprehensive platform that connects miners and buyers of hashing power. Unlike Whattomine.com, which focuses solely on profitability calculations, NiceHash allows you to sell your hashing power to others or purchase it to mine different coins yourself.

The interface is user-friendly, and they offer a simple profit calculator where you can input your hardware details. One standout feature is their QuickMiner, which optimizes your mining settings automatically. However, keep in mind that because you're part of a marketplace, your earnings might fluctuate based on demand.

Other Noteworthy Mining Calculators

There are several other tools that can help you assess mining profitability:

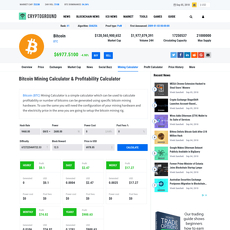

- CoinWarz: This platform provides real-time profitability data for a wide range of cryptocurrencies. You can input your hardware specs, and it will show you the potential profits, taking into account factors like network difficulty and current prices. The site is straightforward, making it easy to compare different coins quickly.

- CryptoCompare: Known for its extensive crypto data, CryptoCompare also offers a mining calculator. It allows for detailed inputs, including power consumption and fees, giving you a comprehensive view of potential earnings. Additionally, the site offers charts and historical data if you're into analyzing trends.

Choosing the Right Tool for You

So, which tool should you use? It really depends on what you're looking for:

- If you want a simple, easy-to-use calculator with a focus on various altcoins, CoinWarz might suit you best.

- If you're interested in in-depth data and analytics, CryptoCompare offers more detailed insights.

- If you're looking to sell your hashing power or prefer an all-in-one platform, NiceHash could be the way to go.

Personally, I like to cross-reference multiple tools to get a balanced view. Each platform has its strengths, and combining their insights can lead to better decision-making.

Still trying to figure out which tool can really give you that edge in mining profits? I've got more thoughts to share, so let's keep the conversation going!

Wrapping Up: Is Whattomine.com Worth Your Time?

After spending a good chunk of time with Whattomine.com and seeing how it fits into the bigger picture of crypto mining, I wanted to share my final thoughts.

My Personal Verdict

In my book, Whattomine.com is a valuable tool for anyone serious about crypto mining. Its real-time data and the ability to customize based on your own hardware make it stand out. I've found that it takes a lot of the guesswork out of deciding what to mine, which is a huge plus. Instead of manually crunching numbers or relying on outdated info, I can quickly see where the best opportunities are.

Staying Ahead in a Fast-Paced World

The crypto mining scene changes rapidly. New coins pop up, algorithms get updated, and what was profitable yesterday might not be today. Whattomine.com helps me keep up with these changes without feeling overwhelmed. By regularly checking in, I can adjust my mining strategy to align with the latest trends and maximize my returns.

Let's Hear Your Thoughts

I'm always eager to learn from others in the community. Have you tried out Whattomine.com or other mining tools? What have your experiences been? Maybe you've got tips or tricks that could help the rest of us out. Feel free to share in the comments—after all, we're all in this together, navigating the exciting world of crypto mining.

Final Thoughts

At the end of the day, tools like Whattomine.com can make a real difference in your mining journey. They simplify complex data and help you make informed decisions without needing a degree in advanced mathematics. By taking advantage of these resources, you're putting yourself in a better position to succeed in the ever-changing crypto landscape. So go ahead, give it a try, and happy mining!

Frequently Asked Questions about WhatToMine.com

How Does WhatToMine.com Work?

I remember the first time I stumbled upon WhatToMine.com—it was like finding a compass in the confusing world of cryptocurrency mining. But how does this tool actually help you navigate towards profitability?

Entering Your Hardware Details

First things first, you need to let WhatToMine.com know about your mining setup. Whether you're using GPUs, CPUs, or ASICs, you'll input details like your hash rates, power consumption, and electricity costs. Think of it as telling the tool what kind of car you're driving before it maps out the best route.

Real-Time Data Analysis

Once your specs are in, WhatToMine.com gets to work by crunching real-time data. It considers current coin prices, network difficulties, block rewards, and even market trends to calculate potential profits. It's like having a personal analyst who never sleeps, always keeping an eye on the market for you.

Customizing Your Mining Options

But it doesn't stop there. You can customize your results by selecting specific algorithms or coins. Maybe you're particularly interested in Equihash coins or you want to avoid certain algorithms—just adjust the filters. This personalization helps you focus on options that align with your goals and equipment.

"Knowledge isn't power until it is applied." – Dale Carnegie

That quote hits home because having all this data means nothing if you don't use it to make smarter mining choices.

Real-Life Example

Let's say you're running a rig with a few NVIDIA RTX 3070 GPUs. You input your hash rate for various algorithms, note your electricity cost (maybe around $0.10 per kWh), and hit calculate. WhatToMine.com might reveal that mining Ravencoin is currently more profitable than other options. But here's where the tool really shines—it shows you the projected daily, weekly, and monthly profits, factoring in your electricity costs. This tangible data helps you decide if it's worth switching coins or sticking with your current plan.

Just imagine waking up to see a new coin has spiked in profitability overnight. With WhatToMine.com, you're always in the loop and can adapt quickly to maximize your earnings.

Curious about which coins are leading the pack right now? Let's check out what's currently the most profitable mining option in the next part.

What Is the Most Profitable Mining Right Now?

You might be wondering, "What's the most profitable coin to mine at this moment?" Trust me, you're not alone. The crypto landscape is always shifting, and it's tough to pin down the best options without the right tools. That's where WhatToMine.com shines, offering fresh insights to help us make the most profitable choices.

The Big Players: Bitcoin and Ethereum

Bitcoin has been the go-to for many due to its high market value. But let's be real—it demands a significant investment in ASIC hardware, which isn't feasible for everyone. Ethereum was another hot pick, but since it moved to proof-of-stake, traditional mining is off the table.

Alternative Coins Worth Considering

Don't let that discourage you. There's a whole world of alternative coins that might be a perfect fit for your setup.

- Litecoin: Often called the silver to Bitcoin's gold, it's still a solid option for miners.

- Monero: Great for those concerned with privacy, and it's friendly to CPU mining.

- Raptoreum: An up-and-comer that's gaining attention, especially for CPU miners.

These coins can offer profitable opportunities, especially if you're working with GPUs or CPUs.

Finding Profitable Coins with WhatToMine.com

So how do you zero in on the most profitable coin for you? By regularly checking WhatToMine.com and entering your hardware details, you get an up-to-date list tailored to your situation. It's like having a personal advisor who's always on top of the market.

"Opportunities don't happen. You create them." – Chris Grosser

That's the beauty of mining—you have control. By staying informed and proactive, you're not just waiting for profits to come your way; you're taking steps to make them happen.

But with so many options out there, how do you choose the right coin to mine? Let's look into that next.

What Coin Should I Mine?

Choosing the right coin to mine can feel like standing at a crossroads with countless paths ahead. Each option has its own set of rewards and challenges, and making the wrong choice might mean missing out on potential profits. As the old saying goes:

"Don't put all your eggs in one basket."

This couldn't be truer in the world of cryptocurrency mining.

Factors to Consider

When deciding which coin to mine, I always start by looking at a few key factors:

- Hardware Compatibility: Not all coins are suitable for every type of mining hardware. If you're using GPUs, some coins will be more profitable than others compared to ASICs or CPUs.

- Electricity Costs: Mining consumes power, and the cost of electricity can eat into your profits. It's important to calculate how much you're spending versus how much you'll earn.

- Market Potential: Beyond immediate profitability, consider the future of the coin. Is it gaining traction? Does it have a strong community? These factors can affect long-term value.

Utilizing WhatToMine.com's Recommendations

One of my go-to strategies is using WhatToMine.com to get personalized recommendations. By inputting my hardware specifics, the site generates a ranked list of coins that are currently the most profitable for me. It's like having a personal advisor who crunches the numbers and tells me where my mining efforts will pay off the most.

Staying Flexible

In the ever-changing crypto landscape, flexibility is key. What might be the top coin to mine today could change tomorrow due to market volatility. I make it a habit to regularly check for updates and adjust my mining focus accordingly. Staying adaptable ensures I'm always aligned with the best opportunities.

Wondering how to maximize your GPU or CPU mining potential? Let's explore that next and uncover the options that could boost your mining game.

What to Mine with GPU or CPU?

If you're like me, you've probably wondered, "With my GPU or CPU, what's the best coin to mine right now?" It's a common question, and getting the answer right can make a big difference in your mining returns. Let's take a look at some options tailored for your hardware.

GPU Mining Options

For GPU miners, there's a range of cryptocurrencies that could be profitable. Coins like Ethereum Classic, Ravencoin, and Vertcoin are popular choices. These coins are designed to be ASIC-resistant, meaning they're optimized for GPU mining.

Take Ravencoin, for example. It uses the KawPoW algorithm, which is well-suited for GPUs. Many miners have reported good results using mid-range GPUs like the NVIDIA GTX 1660 Super or the AMD Radeon RX 580. These cards are more affordable and consume less power, making them a cost-effective option.

Another coin to consider is Ethereum Classic. After Ethereum's transition to proof-of-stake, Ethereum Classic has become a go-to for GPU miners. Its Etchash algorithm is friendly to a wide range of GPUs, and with the right setup, you can achieve a decent hash rate.

CPU Mining Possibilities

While CPU mining isn't usually as profitable as GPU or ASIC mining, there are still some coins that make it worthwhile. Monero and Raptoreum are two examples that favor CPU miners.

Monero uses the RandomX algorithm, which is specifically designed to be CPU-friendly and resistant to specialized mining hardware. This levels the playing field, allowing those with decent CPUs to participate effectively. I've personally tried mining Monero on my home computer, and while it's not a huge moneymaker, it's a good way to get started in mining without a big investment.

Raptoreum is another coin optimized for CPUs, leveraging the GhostRider algorithm. Some miners have reported that certain AMD Ryzen CPUs perform exceptionally well with this coin, offering higher returns compared to other CPU-mineable cryptocurrencies.

Using WhatToMine.com for Hardware-Specific Suggestions

This is where WhatToMine.com becomes invaluable. By entering your specific GPU or CPU models into the platform, you get a customized list of the most profitable coins to mine with your hardware.

For instance, if you have a few NVIDIA RTX 3060 Ti GPUs, you can input that information, and WhatToMine.com might suggest mining Ethereum Classic or Ergo, complete with estimated profits after electricity costs. Similarly, if you're running an AMD Ryzen 9 CPU, the site might recommend mining Raptoreum, showing you potential earnings based on current network conditions.

I can't stress enough how helpful this tool is. It takes the guesswork out of the equation, letting you focus on the coins that maximize your mining efficiency and profitability.

But how can you ensure you're always making the most out of your mining rig? Is there a way to stay ahead of market fluctuations and consistently boost your returns? Stick around, because up next, I'll share some strategies to help you do just that.

Maximizing Your Mining Profits with WhatToMine.com

So, we've talked about how WhatToMine.com can help answer your burning mining questions. Now, let's explore how to squeeze the most out of this handy tool.

Keep Your Inputs Fresh

First things first—make sure your hardware specs and electricity costs are always up to date in the calculator. Hardware performance can change with updates, and electricity rates can fluctuate. Accurate inputs mean accurate profit calculations.

Stay Ahead of Market Swings

The crypto market moves fast. Coin prices go up and down, and network difficulties shift. Keep an eye on these trends so you can tweak your mining strategy when needed. WhatToMine.com uses real-time data, so checking it regularly can give you an edge.

Join the Community

Don't go it alone. Jump into mining forums, join Discord groups, or follow mining subreddits. Other miners often share valuable insights about new coins, software tweaks, and hardware tips that can boost your profits.

Use Multiple Tools

While WhatToMine.com is a fantastic resource, it's not the only one out there. Tools like CoinWarz and Minerstat offer additional features and data. Comparing information from multiple sources can give you a more complete picture.

Experiment and Adapt

Don't be afraid to try mining different coins. Sometimes lesser-known coins can be hidden gems that offer better returns. Keep experimenting and adapting your approach based on what you learn.