notsofast Review

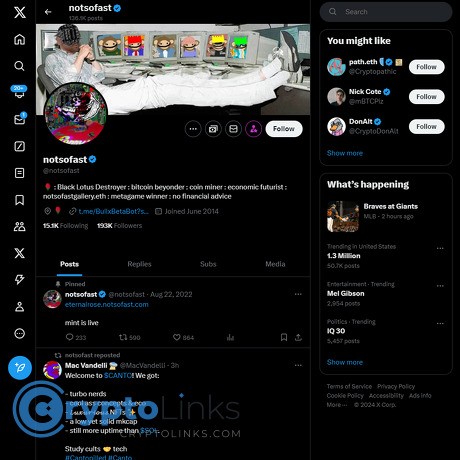

notsofast

x.com

notsofast (@notsofast) on X Review Guide: Everything You Need to Know + FAQ

Are you trying to figure out if following @notsofast on X is actually worth your time—or just another way to get stuck in hopium and hot takes?

I’ve watched this account for years and learned one simple truth: if you set up the right system around his posts, you can turn his feed into real signal without getting dragged into FOMO. This guide shows you exactly how to do that—what to expect from his content, how to filter it fast, and how to act only when it makes sense for you.

Why people get burned on crypto X (and how this guide avoids that)

It’s easy to see a smart thread get passed around and think, “I need to act now.” Then real life hits: you’re not sure if the take is legit, whether there’s a hidden promo angle, or if you’re just late.

- Noise vs signal: Valuable posts get buried under hype and engagement bait. A 2018 MIT study showed false news spreads faster than facts on X. Good info often loses the attention war.

- Shills and foggy disclosures: Promotions exist everywhere on crypto X. Sometimes disclosed. Sometimes vague. Sometimes not at all.

- Impersonators: Accounts pretending to be the real thing will nudge you toward fake links or DMs. One wrong click ruins months of work.

- Time sink: The average person spends hours per day on social media. If you chase every tweet, you’ll never sit down to build an actual plan.

The result? You bounce between “maybe this is genius” and “I’m probably late,” then exit with less conviction than you started.

What you can expect from this guide

I’ll show you how to treat @notsofast as a smart input—nothing more, nothing less. You’ll set up a clean workflow, learn how to quickly verify claims, and use his posts to make better moves in mining, alt cycles, and security. You’ll also get a simple checklist and a fast FAQ that answers the questions people actually search for about this account.

Rule of thumb: treat every post as an input, not an order. Use it to ask better questions, not to skip your homework.

How I approach reviews like this

I focus on three things: practical value, reputation over time, and safety. I keep a running rubric for accounts I follow—consistency, clarity, bias awareness, and whether their takes help you build a repeatable process. I don’t care about viral moments. I care about whether you can win quietly using their ideas.

Who this is for

- Curious beginners who want reliable signal without being glued to the feed.

- Miners who appreciate grounded takes and operational awareness.

- Altcoin hunters who want frameworks, not blind calls.

- Security-conscious users who prefer caution and checklist thinking.

What you’ll walk away with

- A clear picture of what @notsofast posts and why it matters.

- A smart follow strategy: Lists, alerts, and bookmarks set up so you consume on your schedule—not the algorithm’s.

- A quick verification flow: check sources, timestamps, and context before acting.

- Action pointers: how to turn posts into steps for mining, airdrops, and alt cycles—without betting the farm.

- A short FAQ that tackles the common questions people ask on Google about this account.

A quick example of “signal, not FOMO” in action

Let’s say you see a thread from @notsofast about a small-cap alt gaining attention:

- Don’t buy first. Bookmark it. Add a note like “check token unlocks + liquidity.”

- Cross-check: read the token’s docs, look for unlock schedules, market depth, and on-chain activity. If liquidity is thin or unlocks are near, that’s a yellow flag.

- Decide calmly: if it still fits your plan, test tiny and set clear exit rules. If not, move on. Zero FOMO.

This is the kind of workflow that keeps you safe while still capturing upside when it’s actually there.

Ready to make the most of his feed without wasting hours or taking blind shots? Good. Next up: who @notsofast really is, what he focuses on, and why his perspective stands out when the market gets loud—curious to see how his background shapes his edge?

References for context:

MIT study on misinformation spread on X,

Global social media usage data.

Who is @notsofast? Background, focus, and what he’s known for

@notsofast is a longtime miner and altcoin veteran who’s been around for multiple crypto cycles. He comes from the trenches—GPU rigs, hashrate swings, weird forks, and those forgotten coins that quietly 50x when the crowd is asleep. That background matters. It gives him a nose for distribution, sustainability, and risk rather than hype.

While loud “moon” accounts push screenshots and promises, his posts tend to be practical and cycle-aware. He talks about what keeps you solvent: costs, liquidity, unlocks, difficulty, and the trade-offs behind “fair launch” versus VC-backed tokens. If you’ve ever FOMO’d into a coin at 3 AM and regretted it by sunrise, his threads feel like a cold splash of water—steadying, not scolding.

“The goal isn’t to catch every move; it’s to avoid the stupid ones.”

Content pillars you’ll see on his feed

Mining insights: Notes on GPU vs ASIC realities, why electricity price is your true P&L, and how difficulty/issuance changes ripple into alt profitability. Expect reminders that “revenue ≠ profit,” and that survivability through the dull months wins the cycle.

Altcoin commentary: Frameworks for looking at token supply, liquidity depth, market structure, and whether a narrative actually has buyers outside of CT. He often frames things as trade-offs—speed vs security, decentralization vs convenience, grassroots vs VC.

VC vs grassroots angles: How early distribution shapes incentives. Grassroots launches can build stronger communities but slower listings; VC-backed coins might ship faster but carry unlock overhangs. He’ll nudge you to look at who gets paid and when.

Security hygiene: OPSEC reminders that cut through complacency: hardware wallets, phishing patterns, fake support, permissions hygiene, and not keeping “play money” on hot wallets you actually care about.

Lessons from past cycles: Posts that sound like a mentor: don’t oversize, don’t chase, and treat catalysts as probabilities, not guarantees. Timing and patience matter more than bravado.

Humor that hints at sentiment: When he pokes fun at trends (airdrop mania, chain rotation, “next ETH killer”), it’s often a soft signal that the crowd’s getting loud—useful for gauging heat.

There’s research to support why this approach works. Traditional markets show attention-driven buying leads to poor outcomes for retail traders (Barber & Odean, 2008). Crypto is even more attention-sensitive, so voices that slow you down and focus on process can literally save you money.

Tone, cadence, and audience fit

Tone: Straightforward and practical. Skeptical when needed, never theatrical. Less “win in 24 hours,” more “here’s how survivorship actually happens.”

Cadence: Not a firehose. You’ll see steady commentary, occasional threads, and timely replies when something material changes. Expect thoughtful bursts rather than minute-by-minute trade calls.

Who benefits most:

- Miners who want reality checks on profitability and hardware decisions.

- Investors who think in cycles, liquidity, and risk sizing.

- Curious generalists who want frameworks, not spoon-fed entries/exits.

- Not ideal for pure degen signal-chasers who want daily scalp calls.

Historical context: early mining roots shape today’s views

Mining is where scarcity and cost meet markets. That’s the lens he brings. Miners live in spreadsheets—electricity rates, breakevens, heat, downtime, pool variance. When you’ve survived bear markets by squeezing pennies from hashrate, you don’t romanticize shiny narratives. You ask:

- Who holds the initial supply and what’s their cost basis?

- How will emissions or unlocks affect price pressure?

- Is this a fair launch with broad distribution or a thin float with cliff risks?

- Can the network attract sustained demand beyond a weekend of hype?

That’s why his takes often track distribution quality, miner economics, and the lifespan of a narrative. This isn’t cynicism—it’s survival training. Post-halving margin compression and miner rotation are real, and they ripple into alt markets. If you get that, you stop chasing noise.

What he’s not

- Not a signals group leader or a daily scalp feed.

- Not into PnL flexing or “DM for whitelist” antics.

- Not your risk manager—he’ll give you a map, but you still drive.

- Not a maximalist of any single chain or style; pragmatism beats purity tests.

In short, expect frameworks over hand-holding. If you want to learn how this game actually works, it’s refreshing. If you want lottery numbers, look elsewhere.

How to vet claims without wasting hours

Check timestamps: Was the post before or after the move? Context matters. A sharp move can make any take look prophetic or foolish—don’t fall for hindsight bias.

Follow sources: If a post mentions releases or forks, check the official repo or announcement. For on-chain claims, confirm via explorers (Etherscan, Solscan, Blockchair). For supply and unlocks, use trackers like TokenUnlocks or team docs.

Cross-reference market structure: Liquidity depth on Dexscreener, exchange listings, hourly volume, and slippage. Thin pools make narratives dangerous, no matter how bullish they sound.

Look at holder distribution: Top-10/Top-100 wallets, contract age, and mint/burn events. Concentration + upcoming unlocks = potential cliff.

Read the whole thread and replies: Tone, caveats, and updates often live in the replies. One isolated screenshot can miss the entire risk framing.

This simple filter can save you from emotional trades. In fact, studies on attention-driven markets suggest that slowing down to verify reduces impulse errors—exactly the kind of behavior his posts encourage.

Curious whether he’s truly legit and how to spot red flags across crypto X (promos, conflicts, impersonators) before they bite you? That’s up next—want the checklist I use to separate real signal from paid noise?

Is @notsofast legit? Trust, bias, and red flags to watch

Short answer: yes—his long runway on crypto X and miner-first mindset give him credibility. Long answer: treating any influencer as a trade signal is how people get wrecked. I treat everything from @notsofast as inputs, never orders. He’s earned trust by being consistently skeptical and cycle-aware, but nobody—nobody—posts with zero bias.

“Trust isn’t a switch you flip; it’s a process you repeat.”

What I look for:

- Consistency over years: tone that doesn’t swing wildly with every pump.

- Process > predictions: frameworks, caveats, and “don’t over-size this” reminders.

- Receipts when it matters: links, screenshots, or on-chain pointers—not vibes.

Bias check you should assume for any crypto voice (including him):

- Time-in-market bias: early miner lens = strong grasp of costs, dilution, and sustainability, sometimes less patience for pure momentum trades.

- Bag bias: everyone has positions or past associations; good accounts disclose when relevant, but you should still assume incentives exist.

- Cycle bias: survivors of prior cycles often lean cautious in euphoria and curious in despair—useful, but not a substitute for your plan.

Spotting paid promos and conflicts (in general)

Crypto X is full of pitches dressed as opinions. That doesn’t automatically make a post useless—it just means weigh it correctly.

Common disclosure patterns you’ll see across the industry:

- #ad / sponsored / partner / paid / collab / advisor: clear, conspicuous tags are what regulators expect (see the FTC’s Endorsement Guides).

- “I hold,” “I mined early,” “I’m an angel”: useful signals of alignment, but they’re also signals of bias.

- Referral links: not evil—just note the incentive and look for non-ref alternatives.

How I read between the lines without assuming bad intent:

- Is the risk spelled out? Real analysts mention token unlocks, emissions, and liquidity—not just upside.

- Is there a timestamped trail? Threads that evolve with new info beat hot takes that vanish.

- Is the call replicable? If you can’t reproduce the logic with public data, it’s marketing, not analysis.

Useful backdrop: research on social platforms consistently shows sensational content spreads faster than sober analysis. A widely cited 2018 study in Science found false news traveled “significantly farther, faster, deeper” on Twitter. Translation for your feed: viral ≠ true. Slow down when something explodes overnight.

Impersonators and scams

If you only memorize one thing, memorize the real handle: https://x.com/notsofast. Scammers will copy everything except the exact handle.

Quick verification routine I use:

- Exact handle check:notsofast (no zeros, double letters, or accents). Beware lookalikes like n0tsofast, notsofást, or notsofast_.

- Account history: scroll the Replies tab for years of consistent voice. New accounts with old-looking banners are red flags.

- Link hygiene: he’s not asking for your seed phrase, “small test deposit,” or to connect your wallet to claim airdrops via DM. No legit creator needs that.

- URL sanity: hover links. Watch for Punycode (xn--), extra dots, or misspellings. Open in a sandbox browser if unsure.

- Reporting impostors: use X’s impersonation report flow (official form). It actually works when many reports stack up.

Pro move: search X for profile mentions with terms like “airdrop,” “giveaway,” or “support” near the handle. Impostors love those keywords.

Track record vs. cherry-picking

The most common trap I see is judging someone by a single viral screenshot. Don’t. Open the full thread and the replies. Look for:

- Context: Was it part of a longer cautionary thread? Was there a follow-up after the dust settled?

- Time horizon: Was the point about weeks, months, or cycles? Short-term chop often gets misread.

- Edge cases: Good analysts flag “if X then Y” conditions. Meme accounts don’t.

If the original is deleted, I check with Wayback or Archive.today. If it’s misquoted, I use a thread reader or Nitter to rebuild the context.

Receipts matter: links, screenshots, on-chain proofs

When a claim touches money, I want receipts:

- On-chain:Etherscan/Solscan/Blockchair links for supply, unlocks, emissions, or suspicious flows.

- Docs/GitHub: whitepaper or repo commits if a technical claim is involved.

- Credible data: token unlock trackers, order book/liquidity snapshots, or mining profitability calculators.

- Screenshots with timestamps: especially when exchanges or teams “said” something.

Patterns that raise my eyebrow:

- No links, just certainty.

- “Only 10 mins left” urgency + wallet-connect link.

- Graph with no axis labels or cherry-picked windows.

Personal responsibility: never outsource thinking

Here’s the checklist I mentally run on any high-signal post (including from @notsofast):

- Source: Is the handle real and the post authentic?

- Scope: Trade idea, framework, or general observation?

- Timeframe: Hours, weeks, or cycle-level?

- Conflicts: Any declared holdings, advisory roles, or refs?

- Verification: Can I confirm with one independent source?

- Downside: What’s the failure case if I’m wrong today?

- Sizing: If I act, is it a test size I can ignore emotionally?

- Exit: What invalidates the idea—price, time, or new data?

I’ve seen smart people lose five figures to a fake airdrop because urgency turned off their prefrontal cortex. Don’t be that story. Your best edge is a calm checklist and a habit of asking for receipts.

Want the practical part—how to plug posts into a simple, low-noise system you can run in 15 minutes a week? Keep going: I’m about to show you the exact setup I use with Lists, alerts, and bookmarks that kills FOMO and turns good threads into clean actions.

How to get real value from following @notsofast (without FOMO)

Scrolling isn’t a strategy. The way to win here is simple: turn his posts into a calm, repeatable workflow you trust—one that helps you learn, verify, and act without chasing. I use the system below so I’m never glued to the feed and never forced into a rushed decision.

“Slow is smooth. Smooth is fast.”

If you’ve ever felt that twitch to buy something the second it hits your timeline, this is your antidote.

Setup: X Lists, notifications, and bookmarks

First, make X work for you, not against you. This keeps your head clear and your hands off the panic button.

- Create a tight “Crypto Signal” List (10–15 max). Include notsofast and a few complementary accounts (security researchers, on-chain data, one macro voice). Small = signal. If you add everyone, you hear no one.

- Use notifications with discipline. Turn on alerts for that List, but only check in set windows (for example, lunch + end of day). Research from the University of California, Irvine shows it takes about 23 minutes to regain focus after an interruption. Your edge is attention, not urgency.

- Bookmark with intent. When a post matters, bookmark it and add one sentence to remind your future self why it’s worth reviewing. If you have Bookmark Folders, sort by “Mining,” “Alt Thesis,” “Security.” No folders? Use a notes app with the link.

- Mute the noise. Mute “gm,” “airdrop when,” and any meme terms that derail you. You’re building a research lane, not a vibe feed.

From idea to action: a mini playbook

Here’s how I turn one of his posts into a concrete decision—without the drama.

When he mentions a mining angle

- Hardware and electricity reality check: note your kWh cost and your rig specs. A 1 kW rig uses ~24 kWh/day. At $0.12/kWh, that’s ~$2.88/day in power.

- Profitability: run numbers on WhatToMine (GPU) or a Bitcoin ASIC calculator; cross-check with Luxor’s Hashprice Index for BTC context. Profit = (coins/day × price) − power cost. If profit is $0.50/day on a $1,000 rig, that’s a 2,000-day payback—pass.

- Pool and network sanity: check MiningPoolStats. If one pool controls 80%+ of a tiny network, that’s a risk. Verify hashrate trends and difficulty—spikes often front-run price… and sometimes rug it.

- Software safety: download miners from official repos, verify SHA256/PGP, and run on a dedicated machine. Malware-laced “miners” love impatient people.

When he floats an alt take

- Float vs FDV: 5% float and giant FDV = exit liquidity risk. Example: 50M circulating on 1B total at $2 = $100M mcap / $2B FDV. That’s fine for tiny tests, not hero trades.

- Unlocks and emissions: check TokenUnlocks or similar. A 20% unlock next month + thin liquidity = likely volatility. Put it on a calendar and size accordingly.

- Liquidity depth: look at top pools/market makers. If 90% of liquidity sits in one pool with $3M depth, a 6-figure order can move price more than you think.

- Narrative fit: is the story riding current demand (L2 scale, restaking, data availability, privacy) or is it last cycle baggage? A strong story with weak float can work—briefly.

- Team and shipping: scan GitHub activity, docs, and recent posts. Builders ship; marketers tweet.

When he flags a security issue

- Implement now: switch to an authenticator app (TOTP) or a hardware key; kill SMS 2FA today.

- Wallet hygiene: move funds to a hardware wallet; use a fresh address if approvals are messy.

- Approvals and phishing: review token approvals (Etherscan/portfolio tools) and revoke what you don’t use. Confirm URLs via official links before connecting a wallet. One impatient click can erase a year of gains.

Risk sizing and timelines: test small, scale slow, decide before you act

- Starter size: 0.25%–1% portfolio test position. If it requires luck to work, it’s too big.

- Scale only on validation: add when your thesis proves out (shipping, liquidity improves, unlock passes, or hashprice stabilizes)—not because price goes up.

- Pre-commit exits: choose either a price-based stop, a time-based stop (e.g., “out if no progress in 30 days”), or a thesis break (e.g., “if unlock doubles float, reduce to half”).

- Event calendar: log catalysts (unlocks, halvenings, hard forks). Review 3/7/30 days before the event, not after.

- Optional: half‑Kelly sanity: if you model edge and variance, use half-Kelly or less. If that sentence sounds exotic, stick to fixed tiny sizes and sleep well.

Note-taking that actually gets used

Every interesting post becomes a one-line note with a link. That’s it. The goal is recall, not prose.

- Template: Date — Link — One-sentence thesis — Action — Next check.

- Example: “Apr 12 — link — ‘PoW microcap showing rising hashrate without price’ — Test mine for 48h, monitor pool stability — Reassess after difficulty update.”

- Tools: Notion, Obsidian, or a simple spreadsheet. I also tag notes by “Mine,” “Spec,” “Security.”

Advanced X search to resurface gold

Older threads can be the best education. Use search operators to find them fast.

- By topic: from:@notsofast mining filter:links

- By time: from:@notsofast since:2021-01-01 until:2022-12-31

- Cut noise: from:@notsofast -is:reply -is:retweet

- Bookmark your best hits and add that one-sentence takeaway. You’re building your own mini library.

The “no FOMO” checklist I keep taped to my screen

- 1-minute pause: if it feels urgent, I wait 60 seconds.

- One fact I can verify: unlock schedule, liquidity depth, or power cost… something objective.

- Tiny test or no trade: if I can’t size it small, I pass.

- Pre-written exit: I write how I’ll get out before I get in.

- Calendar the review: if it’s not on the calendar, it’s not a plan.

People overtrade when they feel behind. In classic finance research, Barber and Odean showed that excessive trading often reduces returns—being “active” isn’t the same as being effective. This workflow flips that script: less chasing, more clarity.

Curious what to watch for in his timing—those subtle “tells” that often hint at a phase change before the crowd notices? That’s exactly what I break down next.

Content patterns and “tells” that matter

When I scroll @notsofast’s feed, I’m not hunting for the loudest take—I’m listening for rhythm. His timing, phrasing, and topic shifts usually say more than any single post. If you watch those patterns against the market backdrop, you can align your moves without chasing every shiny thing.

“In crypto, patience is a position.”

Here’s how I read his “tells” across market phases and how I map them to different goals—whether you build, mine, invest, or just want to learn without getting wrecked.

What I watch in different phases

- Early accumulation (quiet uptrend starting): You’ll see curiosity and exploration words: “watching,” “interesting,” “curious if…,” and threads on overlooked infra or fairer token distributions. Mining talk leans toward feasibility and optionality, not urgency.

How I act: Builders and miners test small; investors start lists, not positions. Learning mode on, FOMO off. - Mid-trend (trend confirmed, still rational): Practical posts and selective enthusiasm. He’ll highlight process wins and remind you to protect gains.

How I act: Scale what’s working, set stops or take-profit brackets. Miners re-check ROI as difficulty climbs. - Euphoria (everything “only up”): Expect more caution, sometimes via humor or irony. If he’s posting after a narrative hits mainstream, that’s your “don’t chase” siren.

How I act: Harvest profits, reduce leverage, keep new positions small and short-dated. - Late bear (fatigue, apathy, low engagement): He shifts to security hygiene, survival checklists, and mental models. This often precedes bottom formation.

How I act: Build systems, refresh OPSEC, gather long-term watchlist entries. Miners plan hardware and power upgrades while prices are depressed.

Recurring formats that pack value

- Educational threads: Frameworks on mining economics, unlock overhangs, or liquidity traps. These age well and help you avoid impulse trades. Research backs this approach: overtrading is consistently linked to worse performance (Barber & Odean).

- Caution-after-hype posts: When a narrative peaks, he’ll often highlight the unpriced risks (supply unlocks, VC stacks, mercenary liquidity). That timing tends to save more than any moon-call ever makes.

- Reflective cycle commentary: Lessons from prior tops and bottoms. They don’t tell you when to trade, but they keep you from repeating expensive mistakes.

These formats outperform quick pump mentions because they equip you to make fewer, better decisions. There’s even data showing social mood can mislead fast money while patient, process-led approaches win more often (Bollen et al., Twitter mood; Da, Engelberg & Gao, investor attention).

Sentiment checks and cycle signals

His tone is a sentiment feed. Pair it with simple, public data so you’re not guessing:

- Funding and open interest: If his tone turns cautious while perp funding gets aggressively positive, risk is elevated. Learn the mechanics here: BitMEX on funding, Binance Academy.

- Profit-taking on-chain: A skeptical tone during high realized profit spikes = distribution risk. Reference: Glassnode: Net Realized P/L.

- Stablecoin flows and liquidity: If he’s curious but stablecoin inflows are flat and volumes thin, it’s probably early—good for research, not full-size bets. Track with free newsletters like CoinMetrics SOTN and sentiment tools like Santiment Weighted Sentiment.

My quick read-three-act:

1) Tone (cautious/curious/ironic) → 2) Metric (funding, realized P/L, liquidity) → 3) Action (size down, watchlist, or scale).

Case notes: when patience paid off

- Post-euphoria harvests: After the top-end mania of 2021, cautionary posts lined up with overheated funding and record net realized profits. Trimming risk there preserved months of grind.

- Building through the 2022–2023 winter: While hype vanished, the focus shifted to security, process, and low-cost optionality. Those who accumulated knowledge and small positions then were prepared when liquidity returned.

- Mining windows: During difficulty resets and price drawdowns, threads on electricity costs and pool viability turned into quiet alpha. The edge wasn’t speed; it was discipline and math.

When to ignore (yes, sometimes scroll past)

- Outside your lane: If a post requires dev skills or enterprise mining setups you don’t have, save it for learning—don’t force trades.

- Too late for your setup: If something’s already run hard and the post is reflective, it’s often a lesson, not a signal.

- Low signal/no receipts: If there’s no link, no data, and it conflicts with your plan, you owe yourself a pause. Attention-chasing hurts returns—again, see investor attention research.

Phrase-level tells I pay attention to

- “Watching,” “curious,” “keeping an eye on” → Early-stage exploration.

- “Protect wins,” “humble yourself,” “don’t chase” → Take-profit mindset.

- Humor/sarcasm about invincibility → Euphoria warning.

- Security reminders and process threads → Either late bear or a mid-cycle reset prompt.

Save the evergreen stuff (build your mini-library)

The best posts are timeless checklists and mental models. I keep a “Timeless” bookmark folder for:

- Security hygiene: wallet setups, phishing tells, OPSEC essentials.

- Mining frameworks: ROI math, power cost breakpoints, pool due diligence.

- Cycle rules: position sizing, unlock awareness, liquidity traps, exit brackets.

Evergreen threads reduce impulsive decisions because they give you a ready script when markets get loud. That aligns with evidence that fewer, higher-conviction actions beat constant tinkering (overtrading study).

Micro-checklist before acting on any post

- Is this new information or just new to me?

- Does it fit my plan (miner, builder, investor), or am I stretching?

- What makes this idea wrong, and where do I exit?

- What’s the timeframe and the smallest size I can test?

Want to turn these tells into a reliable edge with zero guesswork? Up next, I’ll share the exact tools I use to verify tone with data—on-chain dashboards, unlock trackers, sentiment gauges, even mining profitability checks. Which one would help you most right now: funding/futures metrics or a clean security checklist?

Tools and resources to pair with @notsofast’s feed

When a post sparks an idea, I want to confirm, quantify, and act without guesswork. Here’s the exact stack I keep open while reading his threads—organized by what you’re trying to do: verify claims, track narratives, check mining numbers, and lock down security. Use these like a control panel so you never rely on a single voice.

Verification and research helpers

Watchlists and alerts (fast triage):

- TradingView — build watchlists and set price/volume alerts to test “attention spikes” after a post. A simple 20/50 EMA crossover plus volume alert keeps you honest.

- CoinGecko and CoinMarketCap — quick market overview, exchanges, and liquidity depth via the Markets tab; add tokens to Watchlist to revisit later.

- CoinMarketCal — upcoming events to cross-check catalysts mentioned on X.

- Google Alerts — set keywords for narratives (“modular data availability,” “GPUs post-halving,” “restaking risk”).

- X Advanced Search — find older posts or prior takes using “from:@notsofast + keyword.”

Token unlocks, supply, and holders (supply-side reality):

- TokenUnlocks — check vesting schedules and upcoming cliffs before touching an alt. If a post has you curious, look at the next 90 days of unlocks first.

- Etherscan, Polygonscan, Arbiscan, SnowTrace, Solscan, Blockchair — holder distribution, contract verification, top wallets, and real flows, not vibes.

Tip: On Etherscan, open the token’s Holders tab and check concentration and exchange wallets. High unlock + concentrated holders = size smaller, if at all.

Liquidity, funding, and market structure (is it even tradable?):

- GeckoTerminal, DEXTools, Birdeye (SOL) — on-chain liquidity, pools, and slippage reality. Thin liquidity? Treat any “alpha” as educational, not executable.

- Coinglass — funding rates, open interest, and liquidation heatmaps. If he sounds cautious and funding’s elevated, that corroboration matters.

- Laevitas (options) — term structure and skew to gauge hedging and directional bias (free tier is limited but useful for big caps).

Narratives, TVL, and dev reality (signal over slogans):

- DeFiLlama — TVL flows by chain/category; watch sustained inflows instead of chasing day-one pumps.

- L2Beat — security model, TVL, and risk notes for rollups and bridges.

- Dune — community dashboards. Search the exact protocol and validate stats yourself.

- Electric Capital Developer Report — independent annual data linking developer ecosystems with long-term health. I use this to sanity-check hyped chains with thin dev counts.

Sentiment and cycle gauges (macro context):

- Crypto Fear & Greed — simple but effective guardrail for sizing (extremes call for patience).

- Glassnode and Santiment — free tiers offer useful MVRV, exchange flows, and supply dynamics. Pair with his cycle-aware tone.

Mining profitability and network economics (his home turf):

- WhatToMine, Minerstat — plug in hashrate, power draw, and $/kWh. If a post hints a shift in GPU viability, test it here before touching hardware.

- Hashrate Index — ASIC prices, hashprice trends, and curtailment risk; excellent for post-halving realities.

- MiningPoolStats — pool share and hashrate concentration; hunt for decentralization and fair payouts.

- NiceHash Profitability Calculator — quick profitability sanity check for retail rigs.

Mini example: If electricity is $0.12/kWh and your GPU rig draws 900W, you’re paying about $2.59/day in power. If WhatToMine shows $2.10/day revenue for your best coin, you’re subsidizing the network and should stop or repurpose the rig. His posts often nudge you to run this math, not guess.

Security hygiene you actually implement (now, not later):

- WalletGuard — real-time transaction and site risk scanning in browser.

- Revoke.cash and Etherscan Token Approval Checker — strip dangerous token approvals after interacting with new dApps.

- Bitwarden + YubiKey — password manager and hardware 2FA to shut down SIM-swap/OTP risks.

- Have I Been Pwned — check email exposures; move hot wallets off compromised addresses.

- VirusTotal — scan suspicious links/files before you click.

- Ledger / Trezor — hardware wallets for long-term funds; sign on a dedicated device only.

Security sprint (5 minutes):

1) Revoke stale approvals. 2) Turn on U2F on X, email, and exchanges. 3) Export seed phrase checks to a secure, offline location. 4) Lock DMs and disable link previews where possible.

Find alternate viewpoints (by design)

Balance any hot take with three angles: builders, security, and data. Add a handful of sources that challenge your assumptions so you don’t overfit to one perspective.

- Builders: Follow core dev accounts and project GitHubs; confirm if roadmaps are shipping (commit frequency via CryptoMiso).

- Security: Watch auditors and exploit trackers to sanity-check risk before “trying” a new protocol.

- Data: Pin dashboards on Dune and flows on DeFiLlama to contrast narrative vs. numbers.

Why it matters: Electric Capital’s report consistently finds ecosystems with more full-time devs attract longer-term capital and resilience across cycles. Pair that with TVL persistence and you’ll filter out a lot of noise fast.

Archiving for receipts (and accountability)

When you see a strong claim, save it. If the info changes later, you’ll have a record to compare.

- Wayback Machine — snapshot docs, token pages, and blog posts before they’re “updated.”

- Archive.today — quick, permanent copies of X threads and sites for quoting later.

Workflow: Archive the source page, then add the archive link to your bookmark note. When you revisit in a week, you’ll know exactly what changed.

Mirrors and clean readers for quick lookups

- Nitter — a fast, clean mirror for public X content when you just need text and timestamps.

- Thread Reader — unroll long threads into a single page; excellent for saving and annotating.

Putting it all together (real-world example)

Say there’s a post hinting that GPU miners could see a fresh window on a niche PoW chain:

- Profitability: Run numbers on WhatToMine and Minerstat with your hardware and $/kWh.

- Network health: Check pools and hashrate dispersion on MiningPoolStats.

- Markets: Confirm DEX liquidity on GeckoTerminal and CEX listings on CoinGecko.

- Supply risk: Look at vesting on TokenUnlocks and top holders on Etherscan or Solscan.

- Execution: If it checks out, run a 48-hour test with tiny size, log power costs, and compare real yields vs. estimates before scaling.

One-screen checklist:

1) Unlocks 2) Holders 3) Liquidity 4) Funding/OI 5) TVL/devs 6) Security approvals 7) Position size + stop/exit.

Want the quick-hit answers everyone keeps Googling about him—legit or not, promos, how to avoid impostors, and the best way to follow without FOMO? That’s exactly what I’m tackling next in the FAQ—ready for the receipts?

FAQ and final take: answering what people ask about @notsofast

Here are straight answers to the questions I get most about @notsofast—no fluff, just what matters so you can use his feed safely and productively.

Quick-hit answers you can trust

Who is @notsofast?

A veteran miner and altcoin observer who’s been active across multiple cycles. Expect frameworks, caution, and market context over “buy now” calls.

Is he legit?

Yes—long, consistent public presence and a reputation for sober takes. Treat his posts as inputs to your process, not trade instructions.

Does he post trading signals?

No. He shares observations on mining, alt cycles, security, and behavior. If you want a signals feed, you’ll be disappointed—and that’s a good thing for most people.

Does he do paid promos?

Like most of crypto X, it’s possible to see occasional collaborations or mentions from any account. Your job is to look for disclosure language, links, timing, and consistency with past views. When in doubt, assume potential bias and verify independently.

What’s the smartest way to use his content?

Save threads that teach you something timeless (security, risk sizing, cycle frameworks). For timely ideas (airdrops, mining tweaks), verify on your own stack before acting.

Where is the official account?

Here: x.com/notsofast. Bookmark it. Don’t click “lookalikes” in replies or DMs.

How do I avoid impostors and scams?

See the checklist below—never download files or connect wallets from links sent in DMs, and remember blue checks aren’t proof of legitimacy.

What if I’m new to crypto?

You’ll learn a lot from the cycle awareness and security notes. Just keep your position sizes tiny while you learn. Overconfidence is the fastest way to blow up.

How to confirm you’re following the real account (and not getting phished)

- Go directly to x.com/notsofast and bookmark it.

- Check the handle spelling, follower age, and long reply history. Impostors usually have thin timelines or recycled content.

- Be skeptical of DMs, giveaways, and “urgent” links. Legit accounts don’t need your seed phrase or to “verify” your wallet.

- Hover on links to confirm the domain; prefer reading through known sites or tooling you already trust.

- Use Archive.today or Wayback to record key posts and reduce the chance of bait-and-switch edits.

- Report obvious fakes; impostor networks often spam replies on viral posts.

Why this matters:Chainalysis reports that crypto scammers net billions annually, often through social media lures and phishing. Source: Chainalysis 2024 Crypto Crime Report.

How to read promotions and potential conflicts (in general)

- Disclosures: Look for “sponsored,” “partner,” or “we invested.” Lack of disclosure doesn’t prove anything, but it means you need to dig deeper.

- Timing: Did the mention appear near a listing, unlock, or influencer campaign? Check token calendars and on-chain flows before acting.

- Consistency: Does the take line up with the account’s long-standing views? Sudden reversals can be a yellow flag.

- Receipts: Prefer posts with links, data, or code. Vague claims are cheap; verifiable info ages better.

Sanity check: Overtrading on social cues hurts performance. Classic research shows frequent traders underperform due to overconfidence and costs (Barber & Odean, 2000). Summary: “Trading Is Hazardous to Your Wealth”.

“Can I actually act on what he posts?” Yes—here’s the guardrail approach

- Security items: act immediately (hardware wallet, 2FA, phishing drills). Low effort, high impact.

- Mining notes: verify with profitability calculators, power costs, and pool stats you trust. Test with small allocations before scaling.

- Altcoin commentary: cross-check tokenomics, unlocks, liquidity, and team execution. Don’t chase a narrative without sizing rules and exit criteria.

Pro tip: If a post triggers FOMO, wait 24 hours, then re-evaluate with fresh data. Panic decisions are expensive; patience rarely is.

Extra context: Multiple papers show social sentiment can correlate with short-term crypto price moves, but the effect is noisy and degrades fast—good reason to prioritize process over impulses. Example: Stenqvist & Lönn (2017).

Where else to follow him?

- Primary: X.

- Everything else: If other platforms are listed, they’ll be linked in his X bio or posts. Assume fakes by default unless explicitly linked from the official handle.

Who should follow him (and who shouldn’t)

- Great fit: miners, altcoin generalists, cycle-aware investors, security-conscious learners, and anyone who prefers frameworks over hype.

- Maybe not for you: pure day-trade signal chasers, people who want spoon-fed entries/exits, or those unwilling to verify claims and manage risk.

Checklist to stay safe while you learn:

- Follow the official account and mute obvious reply spam.

- Use watchlists, bookmarks, and scheduled reviews—avoid doomscrolling.

- Cross-check claims with data sources you trust (on-chain explorers, unlock trackers, mining tools).

- Start small, define exits, and journal decisions. If it isn’t written down, it’s not a plan.

Final take

Verdict: @notsofast is a worthwhile follow for grounded insights—especially if you care about mining, alt cycles, and staying safe. Use a clean workflow, verify before you act, and size risk like you expect to be wrong half the time. Do that, and his feed becomes a genuine edge rather than another distraction.

If this helped, share it with a friend who’s new to crypto X. And if you found a great thread worth saving, bookmark it now—you’ll thank yourself next cycle.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.