Ledger Review

Ledger

x.com

LedgerStatus (@ledgerstatus) on X Review: How to Use His Feed for Real Crypto Edge (Not FOMO)

Ever scroll X, see a spicy chart from @ledgerstatus, and feel the itch to click “market buy”? What if you could turn that same feed into clear market context, smarter alerts, and fewer impulsive trades?

The problems most people face when following crypto accounts on X

Let’s be real: Crypto X is a double-edged sword. You can pick up sharp insight fast—or cut yourself with noise, FOMO, and scammers. Here’s what usually trips people up:

- It’s noisy. High-volume feeds bury the good stuff under memes, hot takes, and drama. Pew Research has tracked growing “news fatigue” from social platforms—our brains get tired filtering endless updates.

- FOMO triggers bad execution. Research has linked social media use with stronger FOMO responses, which can distort decision-making and risk control. One well-cited study on FOMO found it pushes people toward impulsive behavior when they feel they’re “missing out.”

- Signals vs. context gets blurred. A tweet can be a smart idea—but it’s not a trade plan with invalidation, sizing, and time horizon.

- Impersonators prey on big handles. Scammers use lookalike usernames and fake giveaways. The FTC has repeatedly warned about social media impostor scams, and crypto is a favorite target.

- Time sink. Without a system, “quick check” turns into 45 minutes of scrolling.

The result? You get more noise than signal, a jumpier trigger finger, and zero improvement to your actual process.

My promise: a simple system to follow @ledgerstatus for insight, not signals

Goal: Use @ledgerstatus to sharpen your read on the market and narratives—without turning your feed into your PnL.

In this guide, I’ll show you how I turn his posts into an advantage with a lightweight routine:

- Profile the account fast: Know what he’s good at so you know what to look for.

- Set up alerts and lists: See key posts without drowning in replies or side-convos.

- Extract context, not entries: Turn a tweet into an idea, then build your own trade plan.

- Risk rules on standby: A quick checklist that stops timeline-induced trades.

- Impostor hygiene: Spot fakes and shut down scam angles instantly.

It’s straightforward, repeatable, and takes minutes to maintain.

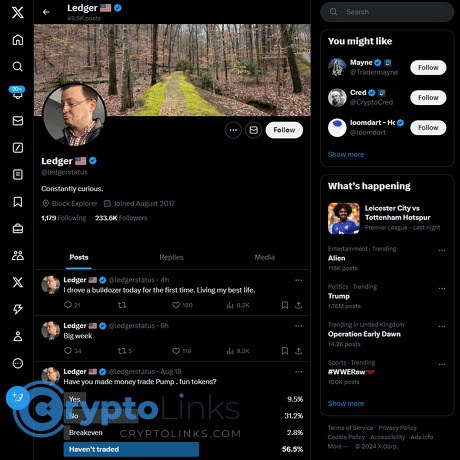

Who runs @ledgerstatus and what he posts

@ledgerstatus is Brian Krogsgard—most people in crypto know him simply as “Ledger.” He’s been around multiple cycles and is widely followed for level-based market commentary and steady, seasoned reads. You might know him from shows like UpOnly with Cobie, where he’s been a consistent voice on trader mindset and market structure.

What shows up on his feed:

- Markets: BTC/ETH levels, trend context, and “what matters now.”

- Macro takes: How rates, liquidity, or risk-on/off spills into crypto.

- Builder/industry notes: Signals from exchanges, infra, and dev activity.

- Charts and quick comments: Snapshot views that frame the next 1–3 moves.

- Community tone/humor: Enough to keep it human without becoming a meme feed.

Translation for your workflow: you get context you can stress-test. Think “watch these levels and narratives,” not “buy this now.” That’s the value.

What you’ll learn in this guide

- Notifications without fatigue: Set Highlights and Lists so you only catch the key posts.

- Signal vs. noise: What to read first, what to archive, what to ignore.

- Tweets → ideas (not trades): How to add invalidation, size, and timing before you act.

- Risk guardrails: A quick pre-trade checklist so you don’t take timeline bait.

- Protection from impostors: Handle checks, lookalike traps, and DM hygiene.

- Alternatives and tools: Accounts and platforms that pair well with his feed.

- Common confusion: People mix him up with Ledger hardware wallets—we’ll clear those FAQs later so you don’t fall for brand-name bait.

Quick verdict upfront

Bottom line: @ledgerstatus is a strong follow if you want market context, not copy trades. He’s best for traders and researchers who can think for themselves and want a steady lens on levels, trend, and narrative shifts. If you need spoon-fed entries and exits, this isn’t that—and that’s exactly why it’s valuable.

Want the short profile, what kind of “alpha” is realistic, and how often he posts so you can pace notifications right? That’s next—ready to see how to set expectations before you hit “Follow”?

What is @ledgerstatus and why people follow it

When I open @ledgerstatus, I’m not looking for hand-holding. I’m looking for calm, seasoned context in a market that loves to shout. The handle belongs to Brian Krogsgard—most people know him as “Ledger”—a trader and media host who’s been through multiple crypto cycles. The tone is steady, the posts are human (sometimes funny), and the value is simple: get cleaner reads on where we are and what actually matters.

“Context beats calls.” When the chart decides, not the timeline, you keep your PnL and your sanity.

You won’t get low-timeframe scalps spoon-fed to you. You will get the kind of “this is the level, here’s why it matters” perspective that helps you think like a trader instead of chasing whatever’s trending.

Bio and track record in crypto

Ledger is a long-time market participant who built a following by doing the work publicly—charts, streams, and market talk anchored in experience rather than hype. He co-hosted well-known shows in the space (including the high-visibility bear-and-bull-era interviews traders still reference) and has run market-focused podcasts that prioritize signal over theatrics.

Why do many traders pay attention to him?

- Cycle-tested voice: He’s been present across multiple boom-and-bust phases, which shows in how he frames risk and patience.

- Clear communication: He turns messy markets into “here’s the key level and the bigger picture,” which is gold when everything feels noisy.

- Skin in the game: He trades, he builds, he watches narratives form and fade—so you get perspective grounded in practice.

There’s also a practical reason: research shows social sentiment can move crypto more than most assets. Academic work on Bitcoin and social media—from early studies on mood and price relationships to newer papers on crypto Twitter sentiment and abnormal returns—keeps showing the same thing: attention has impact. That’s why who you follow matters.

Content types you’ll see

- Market levels and ranges: Horizontal levels, weekly opens/closes, range highs and mids. Example: a “BTC acceptance above X is constructive, lose Y and it’s a different story” type of post that helps you mark lines in the sand.

- Narrative shifts: Notes on when a theme (L2s, RWA, ETH beta, SOL momentum, ETF flows) starts to matter or lose steam—useful for screening your watchlist.

- Macro tidbits: CPI/Fed day reminders, liquidity notes, and why a macro print might change risk appetite without pretending crypto lives in a vacuum.

- Charts and context: Clean snapshots with a sentence or two that highlight the key idea instead of twelve indicators screaming at once.

- Occasional humor and community notes: Light posts that keep the feed human—great for sanity, not necessarily for entries.

- Links to long-form content: Streams, interviews, or posts that unpack the “why” behind a thesis so you’re not acting on one-liners.

If you’re the type who journals, these posts are perfect prompts: “What does this level mean for my plan? Where am I wrong? What’s my timeframe?” That’s the real alpha.

Posting cadence and timing

Expect a balanced pace—enough updates to stay useful, not so many that you mute in a week. You’ll see:

- Burstiness during volatility: When markets move, posts come faster with relevant levels and context.

- Steadier cadence in quiet periods: A few thoughtful updates rather than force-fed takes.

- Time-zone spread: Most activity overlaps major market hours, with quick reactions to catalysts when it matters.

To avoid notification fatigue, I treat this as a “check for context” feed rather than an always-on siren. The value compounds when you read it intentionally instead of living inside the replies.

Transparency, conflicts, and context

Assume opinions, not financial advice. That applies to every big account. People have positions, sponsors, friends, and preferences—it’s human. The right mindset:

- Treat takes as inputs: Ideas to test on your chart and in your system, not marching orders.

- Expect bias: If someone discusses an asset, they might own it or be aligned with it. That doesn’t make the take wrong—it makes your cross-check essential.

- Look for framing, not certainty: Good posts tell you what would confirm or invalidate a view. That keeps you from anchoring to a single outcome.

It’s worth repeating: several peer‑reviewed and working‑paper studies have linked crypto returns and volume to social media sentiment surges. That influence is exactly why you want clear, well-framed context from accounts like @ledgerstatus—and why you should still verify everything on your own chart.

If you’ve ever wondered which posts are worth acting on and which ones to scroll right past, want me to show you how I set up alerts and lists so the good stuff finds you instead of the other way around?

How to actually get value from following @ledgerstatus (without wasting time)

Here’s the plan I use so posts from @ledgerstatus help my process instead of hijacking it. It’s simple, fast, and built to protect your attention from the endless scroll.

“Your job isn’t to react to tweets; it’s to execute your plan.”

Set notifications and lists the smart way

I keep the signal tight with two moves: a curated list and filtered notifications.

- Create a “Market Minds” list: On X, go to Lists → New List → name it “Market Minds” → add @ledgerstatus. Pin the list for one-tap access. This becomes your clean market lane—no replies, no random For You detours.

- Use the bell on “Highlights,” not “All Tweets”: On his profile, hit the bell and pick Highlights. You’ll catch the important posts without turning your phone into an air raid siren.

- Turn off Retweets (per account): Tap the three dots on his profile → “Turn off Retweets.” This trims some noise without losing primary thoughts.

- Mute junk words globally: Settings → Privacy and safety → Mute and block → Muted words. I mute terms like “giveaway,” “airdrop,” “wen,” and a few meme phrases. You can unmute during calmer phases.

Why this matters: research from the University of California, Irvine, shows it takes ~23 minutes to regain focus after an interruption. If your notifications trigger FOMO every hour, you’re paying an attention tax that compounds faster than APR.

Signal vs. noise: what to read, what to ignore

Not every post deserves your time. I skim for specific value cues:

- Read: Clear level updates (e.g., “BTC weekly open holding above X”), narrative pivots (“ETH strength vs. BTC”), macro catalysts (CPI/Fed/ETF flow), and any post that frames risk/reward or context.

- Ignore: Drama, bait, victory laps, dunk threads, and long debates that don’t change positioning. If it can’t be translated into a level, a scenario, or a risk boundary, it’s entertainment.

There’s data behind this. Attention-driven trading is a known bias (Barber & Odean, 2008). Social feeds amplify “attention spikes,” which push traders into crowded, late entries. The fix: treat posts as context, then go back to your chart.

Use posts as ideas, not signals

When a post resonates, I translate it into a plan in 60 seconds or less:

- Example post: “Watching BTC above 63k; lose it and I’m cautious, hold and 66–67k is in play.”

- My translation:

- Bias: Long above 63,000 only.

- Invalidation: 62,800 (hard stop).

- Entry trigger: Reclaim 63,200 with rising 15m volume or a clean retest of 63k as support.

- Target zone: 66,000–67,000; scale out 50% at 1.5R, trail remainder.

- Size: Risk 0.5% of equity; no add-ons if invalidation narrows.

- Time horizon: 24–72 hours; kill trade before major macro prints.

One more sample for alts:

- Post: “ETH/BTC basing; ETH showing relative strength.”

- Plan: If ETH/BTC breaks base high and BTC is stable, I’ll rotate a slice from BTC to ETH with invalidation at the base midpoint; re-evaluate if BTC volatility spikes.

Never trade off a tweet alone. Use it to ask: “What’s my invalidation, size, and clock?” If you can’t answer in one minute, it’s not a trade—it’s a temptation.

Pair with a risk checklist

I run this checklist every time a post tempts action. Checklists reduce errors; in high-stakes fields they’re shown to cut mistakes dramatically. Trading isn’t surgery, but the cognitive pitfalls are real.

- Trend: Does my timeframe (H1/H4/D1) align with the idea?

- Location: Are we at a clear level, not mid-range?

- Invalidation: Is the stop obvious and mechanical?

- Risk: Is position size right for current volatility?

- Catalyst: Any upcoming event that can nuke the setup (CPI/FOMC/ETF flows/unlocks)?

- Liquidity/time: Am I trading liquid hours, or forcing it in chop?

- Confirmation: One objective confirmation (volume/funding shift/RSI divergence break) before entry.

Personal rule: if two or more checklist items fail, I pass. If I feel rushed, I pass. If I’m seeking to “make back” a loss, I shut the app.

Set alert rules for breaking posts

Don’t wait for a new post—let price tap you on the shoulder when it matters. I mirror mentioned levels in my charting tools so I react to price, not the timeline.

- TradingView setup:

- Open the chart (e.g., BTCUSD).

- Add a horizontal line at the key level (e.g., 63,000).

- Right-click → Create alert → Condition: Price crossing → Value: 63,000 → Notifications: App + email.

- Name it clearly: “BTC reclaim 63k — look for retest/volume.”

- Exchange/terminal fallback: Use native price alerts if you don’t have TradingView. Same rule: precise labels so your future self knows the intent.

- Pro tip: Pair level alerts with a second alert for invalidation (e.g., 62,800). This keeps you honest when the market fakes and fades.

A lot of crypto Twitter alpha is simply “level awareness at the right time.” Alerts give you that without emotional drift. Also worth noting: sentiment-driven posts can nudge short-term flows, but outcomes are still decided on the chart—multiple studies link social mood to returns, yet the edge decays fast once price confirms. Tools > timelines.

If you use this system, you’ll get the best of @ledgerstatus—context, levels, mindset—without getting dragged into noise. But is the follow actually worth it for your style, and when does it backfire? Let’s weigh the real pros and cons next… what matters most to you: clarity or constant action?

Pros, cons, and who @ledgerstatus is best for

Some follows make you louder; a few make you sharper. @ledgerstatus is in the second camp when you use the feed for context, not cues. Here’s what actually helps, what can trip you up, and whether this follow matches the way you trade and research.

“Tweets are clues, not commands. The edge is in your process, not in someone else’s post.”

Pros

- Clear market levels without hype. When he posts a chart with weekly or daily levels, it’s succinct. I mark them on my chart and set alerts—no need to agree or disagree on the spot. The point is to notice critical areas others will react to.

- Seasoned outlook that compresses noise. You’ll see comments like “still a range” or “trend until broken” instead of elaborate narratives. That kind of framing cuts down on paralysis and keeps you honest about structure.

- Healthy skepticism on narratives. He’ll acknowledge narratives (ETFs, L2 hype, macro prints) but won’t marry them. This helps you step back and ask, “What would price have to do to prove this right?”—a mindset most beginners miss.

- Context that improves timing. You’ll get “where we are” in the cycle vibes: strong hands vs. weak hands, liquidity pockets, reaction to macro releases. I pair that with my own triggers so I don’t chase.

- Builder/industry signal. Every so often he highlights what founders and long-timers are watching. Even if you’re a trader first, understanding builder attention is alpha for narrative-driven moves.

Quick example: If he notes price testing a prior weekly close around a major data print, I’ll tag it as “reaction zone” and let the alert pull me back. If the first reaction fades and structure flips, I have a plan; if it doesn’t, I stay flat. You keep the context, skip the impulse.

Cons

- It’s not a signal service. No step-by-step entries/exits. If you don’t have your own invalidation and sizing rules, you’ll either freeze or overtrade. Fix: write a two-line rule for every idea you like—“invalid if X; risk Y.”

- Occasional dry spells or memes. The feed isn’t a constant ticker. That’s fine for sanity, but if you expect real-time handholding, you’ll be disappointed. Fix: use lists/alerts so you catch the important stuff and skip the filler.

- Context can be early. Sometimes a “this looks heavy/extended” comment is right but not yet. If you treat it as a trade, you’ll fight trend. Fix: let price confirm; no confirmation, no trade.

- Bias risk (like any strong voice). If you already have a directional tilt, a confident take can reinforce it. Research shows social feeds amplify FOMO and herd behavior; see the FOMO work by Przybylski et al. (Computers in Human Behavior, 2013). Fix: build a pre-trade checklist that forces trend, volume, and invalidation checks before you click.

- Reply threads can be a time sink. Smart quips, debates, and jokes are fun but can drag you off-plan. Fix: read the top post, skip the replies, execute on your own platform.

Why this matters: Even regulators have warned that social media hot takes can push risky decisions for retail investors—see the ESMA consumer risk notes on crypto hype (ESAs risk warning). Treat commentary as a weather report, not a GPS.

Best for

- Intermediate traders who want market structure and sentiment cues, then execute on their own rules.

- Builders and researchers who appreciate cycle context and industry-relevant signals without constant noise.

- Independent thinkers who like to hear a seasoned take and still trust their homework.

Not ideal for

- Beginners looking for call-and-response entries and exits.

- Anyone prone to FOMO who struggles to separate commentary from execution—your PnL will reflect your impulse, not his post.

- Leverage-chasers who want a high-frequency feed of trade setups.

If your heart rate spikes on every post, that’s a sign to slow down. Want a simple way to make this follow safer—spotting impostors, fake giveaways, and too-good-to-be-true “opportunities”—before they hit your wallet? Let’s look at that next.

Safety first: impostors, scams, and how to cross-check claims

I love smart crypto commentary, but I love keeping my coins even more. High-visibility accounts attract copycats and grifters—especially on X. Here’s exactly how I keep my feed clean, my wallet safe, and my brain calm while following @ledgerstatus.

“Trust is not a strategy. Verification is a habit.”

Verify the handle and watch for lookalikes

Impersonators don’t always scream “fake.” They whisper it with subtle typos and unicode tricks. Before you engage, I do a 10-second check:

- Open the profile URL directly: it should be https://x.com/ledgerstatus. Don’t rely on search or replies—scammers buy ads and game the algorithm.

- Check the handle letter-by-letter: common fakes include swapped characters like Iedgerstatus (capital i), ledgerstatυs (Greek upsilon), ledgerstatūs (accented) or ledger_státus.

- Cross-link sanity check: does the profile link back to a known domain or long-standing media? Real accounts leave a breadcrumb trail across platforms.

- History and replies: scroll a bit—years of posts, consistent voice, and replies from well-known traders are strong signals. Honeypot accounts feel “fresh” or off-tone.

Why so strict? The FTC reports social media is the top initial contact point for reported fraud, and crypto “giveaway”/impersonation scams remain a major slice of losses. Attackers don’t need to be brilliant—just early to your notifications.

No DMs, no “send funds,” no giveaways

Here’s my standing policy that has saved me from every scam since 2017:

- No DMs = no problem: public figures almost never cold-DM you for anything legit. If you get a “support” DM, assume it’s a trap.

- Never send funds first: there are no guaranteed multipliers, private rounds, or emergency refunds in your inbox.

- Giveaways are theater: if a “giveaway” asks you to connect a wallet, sign a message, or pay a “verification” fee, it’s designed to separate you from your coins.

- Kill the reply-bait: scammers drop fake “help desk” links under popular posts. I mute keywords like “airdrop,” “support,” and “claim now.”

Want to go nuclear-safe? I set X to only allow DMs from people I follow, and I run a dedicated wallet for interacting with random links. Funds never sit there—think of it as a burner, not a home.

Cross-check in two clicks

Good info survives verification. If a post feels urgent, I slow it down with a quick filter:

- Chart it: if someone mentions “$BTC lost 200WMA,” I pull up TradingView and confirm on the weekly. No chart, no action.

- Second reputable source: I look for another credible account or a known desk noting the same thing. Independent alignment = confidence.

- Original document or post: for news, I go to the source—court filing, blog, or exchange notice. Screenshots are easily faked.

- Time buffer: I wait 5–10 minutes. If it’s real, it’ll still be real. If it’s fake, the crowd exposes it fast.

Data backs the pause: scam campaigns thrive on urgency and scarcity. Chainalysis and FTC analyses repeatedly show the “act now, or miss out” framing correlates with losses. My rule: if a trade only works when I rush, it doesn’t work.

Legal and ethical basics

Big accounts share opinions, not obligations. To keep my head clear and my liabilities clean, I keep these rules front and center:

- Treat commentary as opinion: not financial advice, not a signal. I make my own plan with my own invalidation.

- Never share seed phrases: not with “support,” not with a bot, not with anyone. A seed phrase equals total control. If someone gets it, funds are gone.

- Hardware hygiene: I confirm addresses on-device, keep firmware updated, and I never sign unknown transactions from random links.

- Personal responsibility: I size positions so a bad day is a bruise, not a broken bone.

One last habit I love: I screenshot any “too good” offer and ask myself, “Would I be proud seeing this in a scam museum?” If the answer is yes, I close the tab.

Curious which tools and accounts I pair with @ledgerstatus to make all of this smoother—and which alerts keep me from scrolling myself into mistakes? That’s exactly what I’m covering next.

Alternatives, useful tools, and resources to round out your feed

If you want consistent signal from X, don’t anchor your decisions to one account—no matter how good it is. Echo chambers breed blind spots, and urgency bias sneaks in when a single voice dominates your screen. A 2018 MIT study showed false stories spread faster and wider on Twitter than true ones, especially when they’re emotionally charged. That’s exactly why I build a feed that cross-checks narratives with data, macro context, and builder insight—so I’m not reacting to noise, I’m confirming it (or rejecting it) with receipts.

Also, limit context switching. Research from UC Irvine found it takes about 23 minutes to regain focus after an interruption. If your workflow relies on “just scrolling a bit,” you’re paying that tax all day. I set tools and alerts to bring the market to me, not the other way around.

Complementary accounts and feeds

Here’s how I round out the takes I get from @ledgerstatus with other lenses. These aren’t “follow everything” suggestions—pick two or three per bucket that match your style.

- On-chain and flows (evidence over vibes)

- Glassnode and CryptoQuant for exchange flows, realized caps, miner behavior.

- Santiment for on-chain + social metrics in one place.

- Coinalyze and CoinGlass for funding rates, open interest, and liquidation maps.

- Dune dashboards from reputable analysts for protocol-level health.

- Macro and liquidity (why risk-on/risk-off flips)

- Lyn Alden for clean macro frameworks and liquidity cycles.

- Alfonso Peccatiello (MacroAlf) for rates, curves, and data-driven macro positioning.

- Liz Ann Sonders for equities/macro pulse that often front-runs crypto risk appetite.

- Builders and protocol teams (what’s shipping)

- Ethereum, Solana, Base for roadmap and upgrade timelines.

- Paradigm and a16z crypto for research threads and primitives getting traction.

- DeFiLlama for TVL shifts that often precede narrative rotations.

- Newswire and “what just happened?”

- The Block, CoinDesk, and DLNews for verified headlines.

- Tier10k for fast, curated breaking items (still verify before acting).

Rule I use: “One voice for narrative, one for data, one for news.” If two disagree, I pull up a chart and let price/volume settle the tie.

Tools that pair well

You’ll get more from any feed when your stack is wired for decisions instead of scrolling. Here’s what earns a permanent spot for me:

- TradingView for price alerts and charting

- Set alerts at key levels mentioned on X (e.g., “BTC weekly close above 200W MA”).

- Label alerts by intent: “breakout,” “failure,” “retest.” It reduces impulsive clicks.

- Webhook to a private Discord or Telegram so you don’t need the X feed open 24/7.

- A terminal/scanner for flows and news

- CoinGlass or Coinalyze for funding, OI, and liquidations; glance before acting on any hot take.

- Cryptowatch or TradingView screener for volume spikes across majors and sectors.

- Dexscreener for fast-moving DEX pairs when narratives shift to long tail.

- Options and volatility monitors

- Laevitas or Greeks.live to see term structure, skew, and open interest in options—great for catching “event volatility” setups.

- Portfolio and risk

- DeBank, Zapper, or privacy-first Rotki to keep exposure visible across chains.

- Notion, Obsidian, or Edgewonk for journaling. Brief note after reacting to a post: “What did I see? What was my plan? What did price do?”

Journaling isn’t busywork. The Journal of Finance famously showed that frequent traders underperform due to overconfidence and churn (Barber & Odean, 2000). Writing down why you acted—and how a tweet influenced you—helps cut that habit fast.

Handy resources to keep nearby

I keep a lightweight bookmark folder called “First Checks.” When a big post hits my feed, I open two or three of these—seconds, not minutes:

- Economic calendar: CPI, FOMC, payrolls—macro surprises move crypto. Try ForexFactory or Investing.com.

- Funding and OI dashboard: Is the move supported by derivatives, or is it spot-led?

- On-chain health: Exchange inflows/outflows, realized profits/losses, and stablecoin flows.

- Narrative board: A simple Notion page tracking sectors (L2s, DePIN, RWA, restaking) with key catalysts and dates.

How this fits into your crypto info stack

Here’s the simple loop I follow to keep my head clear and my process intact:

- Morning: Glance at overnight range, macro calendar, and derivatives posture. Skim narrative/account highlights (including @ledgerstatus) for context only.

- Set traps, not hopes: Drop alerts on your levels. If price gets there, you’ll know. If it doesn’t, your day isn’t hijacked.

- During the session: Let alerts drive attention. If a post claims a big shift, open your “First Checks” bookmarks and verify in two clicks.

- Execution: If an idea still makes sense, translate it into your own plan: invalidation, size, time horizon. Hit the journal with a one-liner.

- End of day: Quick recap. What influenced you? What was noise? Nudge your list/tools accordingly.

One-liner I remind myself: “Use X for context; use charts, alerts, and rules for action.” It’s amazing how much PnL that sentence protects.

By the way, a lot of people still mix up market commentary accounts with hardware wallet brands. Confused about the “Ledger” name overlap and worried if that affects your security setup? I’ll clear that up next—and answer the wallet questions I get every week.

FAQ: @ledgerstatus vs. Ledger hardware, plus common wallet questions

Is @ledgerstatus related to Ledger hardware wallets?

No. @ledgerstatus is Brian Krogsgard, a trader and media voice on X. Ledger (the company) makes hardware wallets like the Nano S Plus and Nano X. Different entities, same word in the name—that’s it.

If you want the hardware brand’s account, look for @Ledger. When in doubt, check the bio, external links, and what they talk about. A trader account posting charts is not the team that builds your device.

How long does a Ledger device last?

There’s no hard “expiration date.” The secure element is designed for long-term key storage, but physical parts do age:

- Nano X battery: like any Li‑Po battery, it loses capacity over time and charge cycles. If it weakens, you can still use the device while plugged in.

- Buttons/port: heavy use and rough handling can wear them down. Keep it dry, avoid drops, and use the protective case.

- Firmware/app writes: flash memory has finite write cycles, but normal updates won’t hit practical limits for most users.

The real “lifespan” that matters is your backup. As long as your 24‑word recovery phrase is safe, you can replace the device anytime and restore access. I suggest a quick annual checkup: confirm you can still read your words clearly and do a tiny test restore on a spare device or a watch‑only setup to be sure your backup works before you need it.

Reminder: Your coins don’t live on the device. They live on the blockchain. The device (or any restored device) just proves you own them by signing transactions with your keys.

Can crypto be stolen from a Ledger?

The hardware wallet protects your private keys, but it can’t protect against you authorizing a bad transaction or exposing your recovery phrase. The biggest risks I’ve seen:

- Seed phrase exposure: If someone gets your 24 words, they can drain your funds without the device. This is by far the most common failure in the real world. Keep it offline, never type it into a website or app, and don’t take photos.

- Malicious signing: You can be tricked into approving a transaction that looks harmless. Always read the address, network, and amounts on the device screen. Avoid “blind signing” unless you fully trust the app and know why it’s needed.

- Phishing and fake support: After well‑publicized customer data leaks in the broader crypto space, scammers bombard inboxes with fake “security updates” or “airdrop claims.” If anyone asks for your 24 words, it’s a scam. Period. See Ledger’s guidance here: Security bulletins and data breach FAQ.

- Compromised supply chain: Buy only from official channels and run the genuine check in Ledger Live before use.

If you want extra protection, advanced users consider a BIP39 passphrase (the “25th word”) or a multisig setup with multiple devices. Both add complexity—don’t use them until you’ve practiced restores.

Can I use Ledger Nano X without a computer?

Yes for daily use. The Nano X pairs with Ledger Live Mobile via Bluetooth, letting you manage accounts and sign transactions on iOS or Android. Firmware and app updates can also be done on mobile for Nano X, though I still keep a desktop handy for troubleshooting or cases where Bluetooth updates fail. For Nano S Plus, you’ll need USB (desktop or Android with OTG).

How do I unlock my Ledger if it’s locked?

Here’s the flow I keep pinned:

- Enter your correct 6‑ or 8‑digit PIN.

- After three wrong attempts, the device auto‑resets by design.

- Restore with your 24‑word recovery phrase using the device’s restore flow or via Ledger Live prompts.

No recovery phrase = no recovery. That’s the whole point of self‑custody. Ledger’s official guides: PIN code basics and restore steps.

Bonus sanity checks I actually use

- Genuine check before first use: Open Ledger Live → Settings → My Ledger → run the check. If it fails, stop and contact support.

- No “urgent” actions from messages: If a DM or email pressures you to update or claim a drop, I stop, open Ledger Live directly (not via links), and confirm there.

- Device screen is the source of truth: If the address or amount on the device doesn’t match what you expect, cancel—no exceptions.

Conclusion: My final take and next steps

Follow @ledgerstatus for market context and trader mindset—not copy trades. Keep your guard up against impostors and anything asking for your 24 words. Use lists, alerts, and your own rules to act with intention instead of emotion.

If this helped, keep an eye on the roundups on Cryptolinks. Build a feed that serves your process, protect your keys like your life depends on them, and remember: the device is replaceable—your recovery phrase is not.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.