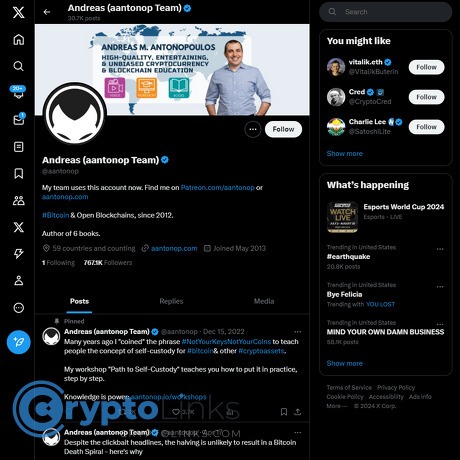

Andreas (aantonop Team) Review

Andreas (aantonop Team)

x.com

Andreas (aantonop Team) Review Guide: Everything You Need to Know About it + FAQ

Ever feel like crypto is one big loud room and you’re never sure who’s actually worth listening to? If you’re trying to learn Bitcoin without hype, you’ve probably heard the name Andreas M. Antonopoulos—aka @aantonop. But is following him (and his team) still worth it in 2025? What will you actually learn from his X account, books, talks, and courses—and how do you use them to get better, faster?

I’ve spent years trimming out noise and honing a handful of voices I trust. Andreas has been one of those steady, reliable sources for over a decade. If you want clear explanations that stick, practical security habits, and a grounded view of decentralization, you’re in the right place.

Why so many people get stuck learning crypto (and how to avoid it)

Crypto education often breaks down for simple reasons:

- Too many takes, not enough teaching. Your feed is full of hot opinions, but thin on explanations that actually help you make safer choices.

- Jargon without mental models. Terms like “keys,” “wallets,” and “consensus” get tossed around, but few explain them in a way you’ll remember a month later.

- Hype crowds out security. Chasing trends is easy; building good custody habits isn’t. That’s how people lose coins they meant to hold.

- Signal-to-noise is brutal on X. Even if you follow smart people, it’s easy to miss the good stuff in a sea of memes and tribal arguments.

These aren’t small issues. According to Chainalysis’ 2024 Crypto Crime report, scams remained the biggest source of illicit revenue in crypto, tallying billions in victim losses annually—even as total illicit flows fell year-over-year. The root cause is often education gaps: poor custody practices, trusting centralized intermediaries too much, and misunderstanding the basics of how Bitcoin actually works.

“Not your keys, not your coins.”

That line is famous for a reason. It’s simple, true, and lifesaving. But it only helps if you internalize what “keys” and “custody” really mean.

What I’m going to do for you

I’ll map out exactly what you can expect from Andreas and the aantonop team: the types of content they publish, who it best serves, and the fastest way to use it. The goal is simple—walk away with practical knowledge and better security, not just new buzzwords. I’ll show you how to turn his talks, threads, and books into a focused learning plan you can use this week.

Who this is for

- Beginners who want clear, no-BS explanations of Bitcoin and self-custody.

- Builders and dev-curious learners who want technical depth when they’re ready.

- Everyday crypto users who want to improve wallet hygiene, avoid scams, and understand decentralization without getting lost in hype.

What I reviewed—and how I judge it

Here’s the material I considered:

- X account: https://x.com/aantonop — educational posts, security reminders, and links to long-form resources.

- YouTube talks and Q&A: conference keynotes, classroom-style explanations, and audience questions that surface real-world problems.

- Podcast: Speaking of Bitcoin — ongoing context and stories from the ecosystem.

- Books:Mastering Bitcoin, Mastering Ethereum, and The Internet of Money series — from fundamentals to deep technical architecture.

And here’s the filter I use to judge whether someone’s worth your time:

- Clarity: Can a beginner follow along without feeling talked down to?

- Accuracy and nuance: No magic claims; honest trade-offs explained.

- Actionability: Can you take a concrete step today to be safer or smarter?

- Timelessness: Does the lesson hold up next year, not just next week?

- Signal-to-noise: Fewer posts, higher value—especially on X.

Quick example of the kind of value I look for: short, repeatable lessons that become habits. Things like “test small withdrawals before moving size,” “store seed phrases offline,” and “assume any link offering a giveaway is a scam.” Simple, yes—but these practices are the reason many people don’t become statistics in annual scam reports.

So, is Andreas still that rare educator who makes the complex feel doable and keeps your security top of mind? Let’s answer that step by step. First up: who he is, what the aantonop team actually does behind the scenes, and why their setup matters for your learning. Ready to keep going?

Who is Andreas and what’s the aantonop team about?

If you’ve ever felt lost in crypto noise, you’ve probably found relief in one of Andreas M. Antonopoulos’s talks or books. He made a name by explaining Bitcoin like a human being, not a marketing deck—clear, open, and anchored to first principles. He’s British-Greek, a long-time security and networks expert turned Bitcoin educator, and one of the few voices that consistently put users first.

His handle on X is aantonop, but he’s more than a social feed. He’s built a body of work—talks, books, courses—that’s helped millions understand money, autonomy, and the trade-offs of decentralized systems. Behind it is a small, capable team that makes sure everything gets produced, edited, translated, and easy to find.

“Not your keys, not your coins.”

That line isn’t meant to scare you. It’s meant to protect you.

Quick bio snapshot

- In Bitcoin since around 2012–2013, when most people still thought it was a joke; he didn’t—and he started teaching it full-time.

- Author of Mastering Bitcoin (O’Reilly) and co-author of Mastering Ethereum—both open-source and actively maintained on GitHub:

- Mastering Bitcoin repo

- Mastering Ethereum repo

- Curator of the talk collections The Internet of Money (Volumes I–III), a gateway for thousands of beginners who needed the “why” before the “how.”

- Long-time co-host of the Speaking of Bitcoin podcast (formerly Let’s Talk Bitcoin!)—ongoing context without the trading hype.

- Runs a strong education presence via YouTube (aantonop channel) and his website aantonop.com.

Real example: when major protocol changes or narratives hit the ecosystem—think SegWit activation, Lightning Network developments, or the Taproot upgrade—he’s known for publishing explainers and Q&A sessions that cut straight to how things work and why they matter.

Values and philosophy

Andreas isn’t neutral about the future of money—he’s principled. He pushes for open, decentralized systems because they hand power back to users and reduce single points of failure. That’s not a vibe; it’s a design choice.

- User sovereignty over custodial convenience. He repeats it because people keep getting hurt. History has receipts: from early exchange failures to recent high-profile collapses, losing keys has meant losing savings.

- Open access to knowledge. Much of his work is freely available. The technical books are open-source, translated by communities, and updated in public. That transparency builds trust and keeps the material current.

- Security and privacy as basics, not extras. He treats good security habits like seatbelts—no drama, just smart.

- Decentralization for resilience. Distributed networks remove choke points. If one piece fails, the system survives. That’s the whole point.

These values resonate for a reason. Independent research on institutional trust (for example, annual surveys like the Edelman Trust Barometer) has shown people increasingly doubt centralized gatekeepers. Andreas’s stance meets that anxiety with tangible tools: self-custody, clear mental models, and realistic expectations.

What the team actually does

Great teaching doesn’t scale by accident. His team turns ideas into structured learning, then gets them to you where you already are.

- Editorial and publishing — shaping talks into books like The Internet of Money, maintaining open-source book repos, and coordinating translations so non-English speakers aren’t left behind.

- Video and audio production — recording keynotes, Q&A sessions, and explainers; organizing them into playlists so you can go from “wallet basics” to “how Lightning works” in the right order.

- Course and workshop organization — live and recorded sessions for individuals, teams, and conferences, with materials that keep paying off long after the event.

- Distribution and community ops — posting timely updates on X, managing newsletters, captioning and transcripts for accessibility, and keeping everything verified and scam-free.

- Accuracy and maintenance — when the tech moves, they adjust. That means updated terminology, new examples, and current references instead of dusty slides.

One practical sample you’ll notice: the YouTube channel doesn’t just dump content. It’s curated into series—like rapid-fire Bitcoin Q&A, wallet and key management basics, and deeper protocol mechanics—so you can build knowledge step by step, not in random bursts.

If you’ve ever wished someone would just hand you the straight story—no token sales, no “number go up”—this is that. The ethos is simple: respect the learner, protect the user, and explain the trade-offs like an adult.

Quick thought: if you could adopt one security habit this week that might save you from a five-figure mistake later, would you take it? Up next, I’ll show exactly what he teaches—and how he makes those lessons stick so you don’t have to learn them the hard way.

What Andreas teaches (and how he makes it stick)

I keep going back to Andreas because his teaching isn’t just “what,” it’s why it matters and how to use it safely. He builds simple mental models that you remember when markets are loud and your wallet is open. Think in pictures, not jargon—and suddenly the whole Bitcoin stack starts to click.

Core topics he’s best at

Here’s what consistently stands out, with the kind of plain-language frames he’s known for:

- Keys and wallets: Your wallet doesn’t “hold coins”—it holds keys that unlock spendable outputs on the network. That one shift ends a ton of confusion about backups and migrations.

- Transactions and UTXO thinking: Treat unspent outputs like cash bills. Spend one, get change. This mental model fixes beginner mistakes like “sending the same Bitcoin twice” or misunderstanding fees.

- Consensus and game theory: Proof-of-Work aligns incentives so the cheapest, safest way to profit is to follow the rules. Attackers face real-world costs; honest miners earn block rewards. It’s economics baked into math.

- Security and operations: From seed phrases to multisig, he focuses on repeatable habits—less magic, more muscle memory. Your setup shouldn’t depend on luck or screenshots.

- Privacy basics: He explains why address reuse is a leak, how change outputs reveal patterns, and how simple practices improve privacy over time. Useful, not paranoid.

- Why decentralization matters: Fewer single points of failure means resilience. He connects this to human rights and financial self-determination, not just to memes and moon math.

Quick example you can use today:

- First 24-hour self-custody drill:

- Generate a new wallet on a reputable hardware wallet.

- Write your 12/24-word seed on paper (no photos, no cloud), verify the backup twice.

- Send a tiny amount from an exchange to your new wallet. Wait for confirmations; label the transaction.

- Practice a test restore on a second device or software wallet in airplane mode.

- Move the coins using coin control to a fresh receive address. Feel what UTXO “bills” are like.

If that felt easy, that’s the point—his mental models remove fear from the process.

The famous mantras

“Not your keys, not your coins.”

It’s more than a motto; it’s a safety gate you apply to every decision. A few other patterns he pushes that save people from pain:

- “Verify, don’t trust”: Check addresses, firmware, and backups. Treat QR codes and URLs like you treat unknown USB sticks—carefully.

- “Don’t roll your own crypto”: Use audited tools, standard derivation paths (BIP39/BIP32), and known wallets. Clever often equals fragile.

- “Hot for pocket change, cold for savings”: Keep spending funds in a hot wallet; store long-term value in hardware or multisig.

- “Fresh addresses are good hygiene”: Address reuse links your history. Studies show it makes deanonymization easier; see Meiklejohn et al., 2013.

These aren’t theories. When exchanges froze withdrawals in past crises, the people who had their own keys didn’t wait in line.

How he explains blockchain and scaling

Andreas is relentless about trade-offs. Global security is expensive and slow by design—that’s how you get censorship resistance. So you don’t force the base layer to handle every coffee purchase; you use layers and smart architecture.

- Base layer (L1): High assurance, global settlement, limited throughput. Think “final clearing,” not “tap to pay.”

- Layered payments: Use fast payment channels like the Lightning Network for everyday transactions, then settle back to L1 as needed. The original paper is worth a skim: Poon & Dryja, 2016.

- Design mindset: Ask, “What must be global and forever? What can be local and temporary?” He teaches you to classify problems before choosing tools.

His metaphor is sticky: the blockchain is a global, scarce billboard. You pay more to write there, so write only what must be true for everyone, forever.

Beginner to advanced pathways

He builds smooth ramps—no gatekeeping, no fluff. A practical way to learn with his material:

- Getting oriented: Start with story-driven talks that explain why Bitcoin exists and what problems it solves for regular people and businesses.

- Hands-on basics: Set up a wallet, send small transactions, practice a restore, and learn the difference between seed, passphrase, and PIN. Label everything.

- Power-user track: Learn UTXO selection, fee calculation, replace-by-fee (RBF), and how to read a transaction on a block explorer. Try a simple multisig with a coordinator you control.

- Technical depth: Study address derivation (BIP32/44), HD wallets, scripts, and how OP codes map to real spending conditions. If you’re code-curious, peek into the open-source repos he references in his books.

To keep the learning curve sane, he uses crisp analogies and incremental practice. It’s why his talks get quoted in dev forums and beginner groups alike.

Reality check from research: Address-linking heuristics and reuse patterns really do reduce privacy—see Biryukov, Khovratovich, and Pustogarov (2014). And for scaling, layered approaches have strong theoretical foundations in payment channel literature, starting with the work cited above. In short: the “layers, not magic” approach isn’t a hunch—it’s backed by math and incentives.

Here’s a small mental model I use thanks to him: “Coins live on the network; your wallet is the remote control.” Once that settles in, backups, migrations, and signing suddenly feel straightforward.

Want to see how these principles show up in his short-form posts and reminders—the kind you actually see in your feed day to day? Up next, I’ll show you exactly what to expect and the smartest way to use it without getting drowned in noise. Ready to make your feed work for you instead of against you?

Reviewing the X account:

When the market is loud and everyone’s shouting, I open Andreas M. Antonopoulos’ X feed for a reset. It’s grounded, practical, and focused on what actually keeps your coins safe. No hype, no tribal baiting—just signal.

“Not your keys, not your coins.”

That mantra isn’t a slogan; it’s a survival rule. His posts keep that front and center, especially when the industry spins up new risks and distractions.

What to expect in your feed

Think of this account as a north star for Bitcoin literacy. You’ll see:

- Security-first reminders: custody basics, seed phrase hygiene, multisig references, and what to watch out for when wallets or exchanges change policies.

- Clear context: level-headed explanations about decentralization trade-offs, privacy fundamentals, and why base-layer security is worth the cost.

- Timely warnings: during exchange failures or wallet-draining scams, expect concise posts that help you avoid predictable mistakes.

- Pointers to depth: links to long-form talks, Q&A sessions, and books. The feed often acts as your navigation hub to richer content.

- Low drama, high clarity: minimal memes and almost zero “team sport” content. If a topic doesn’t help you become safer or smarter, it rarely makes the cut.

Example of the tone you’ll see in your feed:

- “If you don’t control the private keys, you don’t control the coins.”

- “Backups matter: test recovery before you need it.”

- “Scaling is a set of trade-offs—keep base-layer security intact, and build in layers.”

Frequency and usefulness

This account isn’t spammy. Posts arrive when there’s something worth saying, which is exactly what you want for security and education. In a world where false or sensational news spreads faster than truth on social platforms (see the 2018 MIT study in Science: https://www.science.org/doi/10.1126/science.aap9559), a calmer cadence helps you learn without getting pulled into panic cycles.

You’ll get evergreen reminders—custody, privacy, threat models—plus brief commentary when an industry event exposes systematic risk (like overreliance on custodians or single points of failure). The value is compounding: the more you see these fundamentals reiterated, the more they become reflexes you act on, not just ideas you agree with.

Best ways to use it

Want to turn a good feed into a practical learning loop? Try this:

- Turn on notifications for threads that look like mini-lessons. Save them to revisit; don’t just scroll past.

- Bookmark smart: create a “Security” folder (if available to you) and stash posts on keys, backups, and wallet setups. Repetition beats forgetfulness.

- Build a focused List: add @aantonop, a few Bitcoin Core contributors, and reputable wallet maintainers. This gives you context without the noise of your main timeline.

- Use X search like an index: search queries such as from:aantonop keys, from:aantonop custody, or from:aantonop privacy to pull up exactly the threads you want.

- Click through to long-form: if a post links to a talk or a book chapter, queue it. The feed is often a launchpad to deeper learning.

- Act on reminders: when you see a custody warning, use it as a trigger to test recovery, rotate passwords, or review wallet settings. Small habits beat grand intentions.

Real-world example of how this pays off: after custodial blowups, his feed tends to emphasize immediate, practical self-custody steps. If you’ve been bookmarking those posts all along, you won’t scramble—you’ll already have a checklist ready.

Any downsides?

- No trading calls: if you’re hunting for charts or short-term signals, you won’t find them here.

- Bitcoin-first lens: expect Bitcoin-centric education with occasional broader context. If you want altcoin pumps or project hype, this account won’t scratch that itch.

- Less “news,” more principles: some days there’s nothing flashy—just strong reminders. That’s a feature, not a bug, but it’s different from the typical crypto feed.

Here’s the upside: consistency builds competence. And competence is what keeps you calm when everyone else is refreshing price feeds.

Want the full toolkit, not just the feed? Next up, I’ll show you exactly which talks, books, and courses to start with—so you don’t waste time. Curious which one will move you the fastest this week?

Books, talks, and courses: where to start based on your level

I’ve tested every format Andreas offers, and here’s the honest truth: his long-form material is where the real breakthroughs happen. Pick the right entry point for your level and you’ll skip months of confusion.

For total beginners

Start with the “why.” It’s the easiest way to build strong intuition before you touch keys, wallets, or code.

- Read:The Internet of Money (Volumes I–III). These are short, story-driven talks turned into chapters. They explain why Bitcoin exists, who it helps, and what decentralization changes in the real world. It’s not technical—on purpose. You’ll come away with language you can actually use to explain Bitcoin to friends and family.

- Watch: curated YouTube talks that land the big ideas fast:

- Introduction to Bitcoin — a plain-English tour of what Bitcoin is (and isn’t).

- Money as a System of Control — why self-custody matters beyond price charts.

- Infrastructure Inversion — a smart mental model for how disruptive tech flips the stack.

- Make it stick: after each chapter or talk, write a two-sentence summary from memory. Research in learning science shows that retrieval practice (testing yourself without notes) dramatically improves retention over re-reading (see Roediger & Karpicke, 2006). It’s simple and it works.

“Bitcoin is not money for the internet; it’s the internet of money.” — Andreas M. Antonopoulos

Pro tip: if you ever get stuck on jargon, hop back to one of these talks. The “aha” moments stack quickly when the “why” is clear.

For hands-on learners

If you like to poke at the code, build prototypes, or just see under the hood, this is your lane.

- Read (free online):

- Mastering Bitcoin (2nd ed.) — start with Chapters 1, 4, 5, and 8 (intro, keys/addresses, transactions, the P2P network). This book is the gold standard for accurate, deep Bitcoin knowledge.

- Mastering Ethereum — if you’re curious about smart contracts, this is your blueprint. Use it to understand accounts, gas, and contract patterns without learning bad habits.

- Build (safe environment):

- Run Bitcoin Core in regtest mode, generate a few blocks, and craft a simple raw transaction. You’ll see inputs/outputs in action—no real money at risk.

- Use a Bitcoin library (Python, JavaScript, or Go) to create and sign a transaction locally. Focus on key handling and never paste seeds online.

- For Ethereum, open Remix, deploy a simple storage contract to a testnet, and watch gas costs as you interact. Always use test ETH from a faucet, never mainnet funds during practice.

- Why this works: active learning consistently beats passive learning. A large meta-analysis (Freeman et al., 2014, PNAS) found that hands-on methods in STEM improve exam performance and reduce failure rates. Reading + doing is the fastest track to real competence.

If you’re moving into wallet development, security research, or protocol curiosity, pairing Mastering Bitcoin with small lab exercises will give you confidence quickly. Keep your experiments in test environments and practice responsible key management from day one.

Talks and podcast

When you want context that bridges the beginner and builder worlds, Andreas’s talks and Q&A sessions are a cheat code.

- Conference keynotes and Q&A: his YouTube channel is packed with evergreen talks and audience questions. The Q&A sections are especially useful because they surface real-world edge cases you haven’t thought about yet.

- Must-watch shortlist:

- The Internet of Money (live talks) — narrative-driven, perfect for mindset.

- Not Your Keys, Not Your Coins — a recurring, vital theme on custody.

- Five Pillars of Open Blockchains — the principles behind resilient networks.

- Podcast: search for Speaking of Bitcoin in your podcast app for ongoing commentary and interviews. It’s where nuanced takes live—especially around incentives, security trade-offs, and the human side of decentralization.

Listening tip: play at 1.25x and pause to jot down questions. When you force a short summary in your own words, you stack understanding. That’s not just opinion—retrieval beats passive exposure.

Is he a good speaker?

Yes, and here’s why it matters for you. He’s precise without being dry, opinionated without being tribal, and he turns scary-sounding topics into simple stories you remember. There’s a reason his talks have racked up millions of views and his Q&A clips keep circulating years later: clarity compounds.

Want a shortcut? Watch a single Q&A session about wallets and backups, then explain it to someone else an hour later. If they get it, you’re learning the right way.

Still wondering whether the books are “too old” for 2025—or which ones are worth your time first? I’ve got the quick answers to that next, plus a few surprises you might not expect…

FAQs: quick answers people actually want

What does Andreas Antonopoulos teach?

I keep it simple when people ask this: he teaches the stuff that keeps your coins safe and your brain sharp. Expect clear, repeatable lessons around:

- Bitcoin fundamentals: keys, addresses, UTXOs, transactions, mining, consensus.

- Security and self-custody: wallets, backups, hardware wallets, passphrases, multisig.

- Privacy basics: avoiding reuse, understanding metadata, practicing good opsec.

- Why decentralization matters: resilience, censorship resistance, and user control.

Real talk: most losses I hear about aren’t “hacks,” they’re avoidable mistakes—phishing, bad backups, or trusting the wrong custodian. Industry reports (think major annual security and crypto-crime reviews) keep showing the same pattern: human error and social engineering are top attack vectors. Andreas tackles this head-on with process and habit, not hype.

“Not your keys, not your coins.” The most valuable five-word risk management lesson in crypto.

Is Andreas Antonopoulos a good speaker?

Yes—consistently. He’s the rare educator who can teach a newcomer what a seed phrase is and, in the same hour, make a developer rethink fee markets and incentives. He uses sticky analogies (like treating Bitcoin as a public, global settlement network and keys as your personal control layer) so you walk away with mental models you’ll actually use. That’s why his talks keep circulating years later.

How does he explain blockchain and scaling?

He treats decentralization and security as intentional costs, not bugs to “optimize away.” Base layers serve as slow, global settlement with high assurance. Everyday experiences happen on layers and edges—payment channels, sidechains, and other L2/L3 tools—each with trade-offs you should understand before you trust them.

- Base layer: maximize neutrality and verification, accept limited throughput.

- Upper layers: optimize for speed/fees/UX, accept different trust or liquidity assumptions.

If you’ve ever wondered why some chains brag about speed but compromise on decentralization, his framework explains it in minutes. It’s the “no free lunch” of blockchains—clear, practical, and grounded in real-world system design.

Who is the “Greek Bitcoin guy”?

That’s Andreas M. Antonopoulos—the British-Greek Bitcoin educator behind Mastering Bitcoin and countless talks. If you’ve seen a clip about self-custody done right, odds are it came from him.

Is he biased?

He’s open about his stance: pro-Bitcoin and pro-decentralization. The key difference is he focuses on first principles and long-term resilience instead of price targets or tribal drama. If you want sober, security-first thinking, that “bias” is a feature.

Are his books still relevant?

For fundamentals and architecture, yes. Mastering Bitcoin and Mastering Ethereum remain rock-solid for understanding how things work. I always suggest pairing them with current talks and the official repos for updates and errata. That combo gives you both the stable foundation and the latest context.

Where to follow and support?

- X: https://x.com/aantonop

- YouTube (talks, Q&A, workshops): https://www.youtube.com/@aantonop

Tip: always verify links from his official profiles. Impersonation is a real thing in crypto, and threat actors go where the attention is.

Handy resources

- Mastering Bitcoin (official repo): https://github.com/bitcoinbook/bitcoinbook

- Mastering Ethereum (official repo): https://github.com/ethereumbook/ethereumbook

- X: @aantonop

- YouTube: @aantonop

One more quick one: what’s the single best lesson to put into practice today?

Set up a clean self-custody flow: use a hardware wallet, add a strong passphrase, test your recovery with a small amount, and document a simple “break-glass” process for a trusted person. Security studies across industries keep repeating the same truth—procedures beat memory. Write it down. Practice once. Then breathe easier.

Want my blunt verdict on whether you should follow Andreas—and a simple 7-day plan to make it worth it? Keep going; I’ll show you exactly how to get value without wasting a minute.

Verdict: Should you follow Andreas and lean on the aantonop team?

Yes. If you want clear, principle-first education with a relentless focus on security and decentralization, he’s still one of the best teachers to follow in 2025. Every time the market gets noisy, his material stays useful.

Real talk: when FTX imploded in 2022 and billions in customer funds went dark, the people who followed the self-custody first mindset were far less exposed. That isn’t theoretical. It’s the direct outcome of habits he repeats over and over.

“Not your keys, not your coins.”

That single mindset, applied consistently, reduces avoidable loss. It lines up with hard data too: Chainalysis reported crypto hacking losses fell to about $1.7B in 2023 (down from $3.8B in 2022), but smart contract exploits and user mistakes still dominate the biggest hits. Good custody habits remain the best defense you control yourself. Sources: Chainalysis 2024 Crypto Crime Report.

Who will get the most value

- Newcomers who want clear explanations without trading signals or hype. You’ll actually understand what you’re doing before you move money.

- Self-custody learners who want practical steps: seed phrases, test transactions, basic privacy, fee choices, and safer long-term storage.

- Builders and the dev‑curious who need accurate mental models and clean definitions. His technical work is a reliable reference, not a moving target.

How to get started this week

Keep it simple and consistent. Short sessions beat grand plans you’ll never finish. There’s solid research showing spaced practice boosts retention—small bursts spread over days outperform cramming. If you want the science, see Cepeda et al. (2008) on the spacing effect.

- Follow https://x.com/aantonop and set alerts for longer threads or key reminders.

- Queue one talk from his YouTube channel: youtube.com/@aantonop. Pick anything titled “Internet of Money” or a Q&A—great signal, zero fluff.

- Bookmark one chapter of Mastering Bitcoin on GitHub: github.com/bitcoinbook/bitcoinbook. Start with “Introduction” or “Keys, Addresses.”

- Do one practical action: withdraw a small amount (think coffee money) from an exchange to a self-custody wallet. Verify the address on your device screen, confirm the transaction, back up the seed phrase, and record what you learned. Next week, test a restore with an empty wallet to prove your backup works.

That four-step loop takes about 30 minutes a day. By the end of the week, you won’t just “know” more—you’ll have better habits under your belt. And that’s what actually prevents mistakes.

Final thoughts

He’s consistent, clear, and allergic to hype. If you’re building a crypto knowledge stack that lasts, this is time well spent. Start today—one talk, one chapter, one small transaction. You’ll feel the confidence shift fast, and you’ll keep more of what’s yours.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.