Curve Finance Review

Curve Finance

curve.fi

Curve Finance - A Deep Dive into Decentralized Finance

I'm a crypto enthusiast. I'm obsessed with Decentralized Finance (DeFi), and not many things are as thrilling as diving deep into the intricate universe of blockchain technologies. In my tireless exploration of the newest and most innovative platforms, one project that I've been keen on lately is Curve Finance.

What the Heck is Curve Finance?

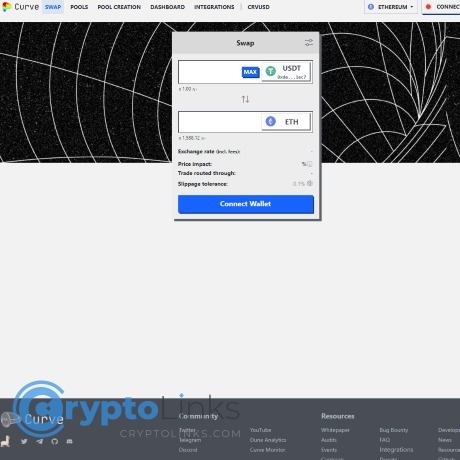

For the unaware, Curve Finance is an automated market maker (AMM) protocol specifically designed for stablecoins and wrapped Bitcoins. Intriguing? Damn right! The protocol is built on Ethereum and allows users to trade between different stablecoins with a low-cost algorithm designed for stable liquidity.

Why Should You Care?

Are you one of those jazzed by ultra-efficiency and minimal slippage losses during transactions? If yes, then you should care. Curve finance acts as a blessing in disguise for traders like you, offering you the ability to perform large trades with a radically low on-chain impact.

Curve Finance in Practice

Inclining my gears towards an experimental approach, I explored Curve's promising features. I played around with some USDT, USDC, and DAI on the y-pool, one of the various pools available on Curve, and I'm sharing my no-nonsense insights here.

Low Slippage:

Large trades often come with the peril of slippage. Curve Finance, with its liquidity-focused approach, slashes this issue significantly. The results were commendable when I experienced substantially low slippage than other DeFi protocols like Uniswap or Balancer.

High-Yield Returns:

Curve Finance isn't just about swapping stablecoins; it's also about staking them in yield farming. By participating in Curve's liquidity pools, I earned CRV tokens, which gave me some satisfying APYs— talk about a win-win!

The Innovation Called CRV

Did you notice the mention of CRV tokens? Well, introducing CRV tokens, native to Curve. They are designed for governance and bonuses. I must say, it’s a smart move by Curve Finance, encouraging user participation and decentralizing decision-making.

So, Is Everything Hunky-Dory With Curve?

Nope, not all that glitters is gold. Curve isn't without its perils. For instance—Impermanent Loss. Even though Curve Finance lessens the risk of extreme impermanent losses due to its stablecoin-to-stablecoin exchanges, it’s not foolproof. Moreover, platform dependency on Ethereum and scalability issues cannot be overlooked.

My Verdict on Curve Finance

As an active crypto evangelist, I find Curve Finance to be a notable layer in DeFi’s universe offering a secure and efficient system for stablecoin liquidity. Weighing the pros and cons, my bend is towards the affirmative. Curve beautifully elucidates Ethereum’s potential and DeFi's promise, thus marking its place well in the DeFi space.

A Final Note

Curve Finance might not be perfect, but who is in this dynamic crypto world? While it’s engaging and prospective, always remember, cryptocurrency investments come with inherent risks. So, tread carefully. Until next time, this is your crypto guy, signing off, reminding you to stay curious and keep exploring.

Unrivaled Frequently Asked Questions (FAQs) About Curve Finance From a Crypto Guru

I've fallen in love with crypto, just like you. We're in the right place at the right time to take advantage of digital currencies. Being a crypto guy, I know how confusing it can be to get your head around new concepts, and that's why I'm here to narrate everything about Curve Finance. So buckle up, let's jump right in!

What is Curve Finance?

Curve Finance is a Decentralized Finance (DeFi) protocol designed to facilitate efficient and seamless stablecoin swaps. It optimizes for low slippage and low fees, creating a robust environment for high frequency trading.

How is Curve Finance different from other exchanges?

Unlike other Decentralized Exchanges (DEXs), Curve Finance isn’t trying to be the jack of all trades. Its niche specialization in stablecoins and wrapped assets means that it provides highly optimized and efficient trades for these types of assets.

Can I earn with Curve Finance?

Absolutely! One of the best parts of Curve Finance is the opportunity to earn. You can deposit your preferred stablecoin into the liquidity pool and earn rewards. You're paid in CRV tokens, Curve's native token, and your pool's underlying crypto assets.

How do I start earning with Curve Finance?

First, connect a wallet like Metamask or Coinbase Wallet that has the stablecoin you intend to deposit. Next, select the pool you'd like to participate in, deposit your coins, and voila, you're a liquidity provider earning rewards!

How safe is Curve Finance?

Security is a high priority in the crypto world, and Curve Finance has made its stance clear by utilizing time-locked smart contracts and external security audits. However, like any DeFi platform, it's not free of risks, and I always advise doing your own research.

What is the CRV token and what does it do?

CRV is the native governance token of Curve Finance. Holding CRV grants you voting rights within the protocol. Besides, you earn CRV tokens as rewards for providing liquidity, and you can stake them to earn more rewards.

What are the fees associated with Curve Finance?

Curve Finance charges a 0.04% fee on trades. However, the fees are directly distributed to liquidity providers, not the protocol. It's interesting to note that the more liquidity you provide, the larger your share of the fees.

What is yPool in Curve Finance?

The yPool is one of the most interesting pools in Curve Finance. It consists of yTokens, which are yield-earning tokens from the Yearn Finance ecosystem. This means that besides the trading fees and CRV rewards, you also earn yield from Yearn Finance.

Can I lose money with Curve Finance?

Crypto, including DeFi protocols like Curve Finance, inherently involves risks. While rare, events like smart contract failures, or significant imbalances in stablecoin prices (known as impermanent loss) can lead to losses. I recommend staying informed and risk-aware.

Can I use Curve Finance on my mobile?

You can use Curve Finance from the comfort of your mobile device. Connect to a web3 enabled mobile browser like Metamask or Trust Wallet, and you’re ready to go.

What is the future of Curve Finance?

With the exponential growth of DeFi and Curve's focus on stablecoin optimization, the future looks promising. However, as a real crypto guy, I would caution you to keep an eye on updates and improvements in the space, as the crypto world is always evolving. I hope this FAQ provides a deeper understanding of Curve Finance. Remember, crypto is not just an asset; it’s a lifestyle, a community. Let's explore it together.

I didn't cover your question? Feel free to drop a comment or reach out, and I'll do my best to answer. Let's keep the crypto conversation going!

Curve Finance: An In-depth Look at Pros and Cons

As a Crypto-enthusiast, I am always on the lookout for the most promising DeFi protocols on the market, and one such platform that has recently caught my attention is Curve Finance. But just like any other platform, Curve Finance has its unique array of pros and cons which every prospective user must look into.

Pros of Curve Finance

Optimized for Stablecoin Trading

Curve Finance distinguishes itself from other DeFi protocols through its optimized environment for stablecoin trading. Its design is intentionally low-risk, allowing me to carry out large trades with little slippage. This assurance is a significant pro for anyone looking for a reliable trading platform.

Highly Competitive Fees

In comparison to its DeFi counterparts, Curve Finance offers competitively low fees. Trading costs that eat into my profits are off-putting, so the lower fees provided by Curve Finance are a clear advantage.

Yield Farming Opportunities

Curve Finance boasts an impressive yield farming mechanism. By employing Curve’s native token – CRV, I have the chance to lower my trading costs further and even earn additional income from lending and borrowing activities.

Cons of Curve Finance

Complex Interface

One issue that I, as a user, am faced with is Curve Finance's complex user interface. For beginners in the crypto world, the dense, information-rich layout might seem daunting. An interface simplification would make Curve Finance more accessible and user-friendly.

Limited Asset Diversification

As a platform primarily focused on stablecoins, the room for diversification in assets is relatively limited. This constricts traders like me who prefer a wide range of assets in their trading portfolios.

Impersonation Risk

Curve Finance, like other DeFi protocols, is susceptible to impersonations and spoofing attacks. I always have to be cautious while interacting with the protocol to avoid falling victim to such attacks. All in all, Curve Finance emerges as an efficient platform for optimized stablecoin trading, offering low fees and excellent yield farming opportunities. However, a more user-friendly interface, diversified assets, and safer interactions are areas where the platform can significantly improve. Like all things crypto, one’s foray into Curve Finance should be marked by a careful consideration of these pros and cons.