The Ultimate Beginners Guide For New DeFi Users

Are you hearing the buzz about DeFi and wondering how to get started? Here’s how you can!

If you’ve ever felt curious about “earning passive income with crypto,” or had a friend mention insane returns through yield farming, you’re probably wondering: “What is DeFi and how do I even begin?” Maybe you’ve come across intimidating terms like bridges, wrapped tokens, and liquidity pools, and immediately thought, “Nope, too complicated!”—and honestly, that’s fair. DeFi can seem overwhelming at first.

But here’s the catch: once you understand how it works, it’s not as scary as it looks. In fact, it’s incredibly empowering to have full control over your own finances—no banks, no middlemen, just you and the system.

So, let’s slow things down and tackle this step by step.

Why does DeFi feel so confusing for beginners?

The issue with DeFi is that it’s a whole new world with its own language. Some of these terms—like “liquidity pool” or “staking“—don’t naturally make sense unless you’re already familiar with crypto. Here’s a peek at what confuses most new users:

- Technical jargon: Terms like “bridges” and “AMM (automated market maker)” sound super complicated when you’re just trying to figure out how to deposit $20.

- Too much information: A quick search about DeFi will lead you to hundreds of blogs, YouTube videos, Reddit threads … and not all of them are consistent or trustworthy.

- Fear of losing money: Let’s be real—no one wants to accidentally make a mistake and lose their funds after just trying one transaction.

Does any of this feel familiar? If it does, you’re not alone. Every experienced DeFi user started from this exact stage.

What’s holding most people back?

Here’s the thing—a lot of people never even take the first step because they’re stuck in one (or more) of these situations:

- Fear of losing funds: A survey by Chainalysis showed that scams within crypto are on the rise, and sadly, this keeps many people away from legitimate opportunities. But don’t worry—we’ll sort out how to stay safe later on in this guide.

- Paralysis from over-researching: With a million tools, apps, and platforms out there, you might think, “What’s the best wallet? Which app is the easiest? Is this beginner-friendly?” and never actually try anything.

- Lack of structure: Random tutorials may teach one part of DeFi but never connect the dots. If you don’t know where to start (or what’s next), it’s like attempting a puzzle without the box picture as a guide.

Sound relatable? Well, this stops here. You don’t have to figure this out alone.

Here’s exactly what we’ll tackle together

Instead of jumping into advanced topics like yield farming or high-risk investments upfront (that can come later!), we’ll go through the essentials in plain, understandable terms.

- Understanding the basics: Learn what DeFi is, why it exists, and how it flips traditional banking on its head.

- Platforms and tools made for beginners: Trust us, not every DeFi app is user-friendly, so don’t waste time signing up for complicated ones. I’ll help you choose the right ones.

- How to stay safe: The DeFi space has scammers trying to trick users who are new. I’ll show you how to protect your funds like a pro without overthinking it.

By the time we finish, you’ll know how to confidently start exploring DeFi while steering clear of costly rookie mistakes. Feeling excited yet?

Wait until you see what’s next

But first, here’s the real challenge—why is DeFi even worth your time? Why are millions moving their funds into decentralized finance, and how can it change the way you earn, trade, and save? The answer is just ahead…

It is common knowledge that decentralized finance (DeFi) has revitalized the crypto narrative so much so that it has become fashionable for entrepreneurs and developers to incorporate elements of DeFi in their offerings. Seeing that this explosive trend is showing no signs of slowing down anytime soon, it is imperative to understand the many moving parts that make up the DeFi landscape before going all out to adopt it as an investment instrument or in your daily operations. Hence, we have created a comprehensive beginner’s guide on everything DeFi. Here, we will provide all the answers to your DeFi-related questions.

What Is the Historical Background of Decentralized Finance?

Decentralization is not a new concept, neither has it just begun to feature in the financial realm. The introduction of Bitcoin in 2009 birthed the concept of decentralized finance and marked the start of its rise to prominence. Buoyed by the emergence of Ethereum and other smart contract blockchains, decentralized finance became a mainstay in the financial industry in 2017. And it sparked a plethora of solutions designed to eliminate some of the hurdles of traditional payment and monetary services. Although many of these solutions failed to make a mark, the successes of a few protocols set the stage for the ongoing DeFi boom. Today, the DeFi narrative is stronger than ever and promises to propel the crypto industry to the next phase of growth.

What is DeFi?

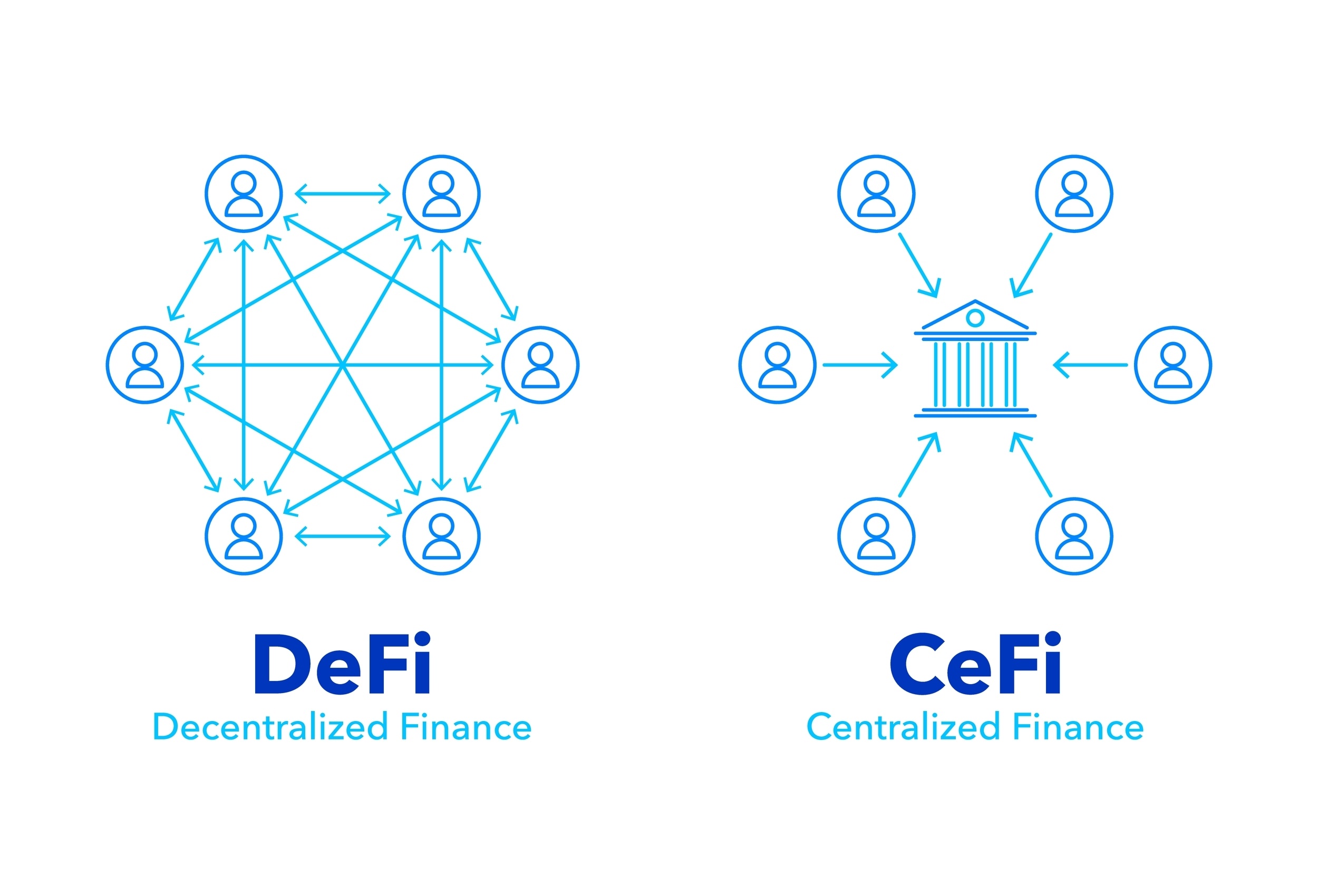

Having explored the history of DeFi, it is worth mentioning that the concept is a compelling financial experimentation that has begun to yield good results. From its name, it is clear that the core propelling factor for DeFi is its framework, which rids financial networks and applications of the influences of centralized entities. In other words, decentralized finance looks to eliminate intermediate processes and enable a financial order powered by open, permissionless, and autonomous systems. The goal is to employ blockchain to create borderless services free from the political, systemic, and regulatory hurdles prevalent in traditional alternatives. As a result of the focus on finance, DeFi has developed innovative financial iterations for exchanging, borrowing, and lending assets, processing payments, creating stablecoins, trading synthetic assets, insuring funds, and much more.

Developers have identified ways to optimize these operations by incorporating smart contracts at the heart of DeFi applications. Ordinarily, smart contracts are automated systems that execute transactions when certain terms have been met by the parties involved. The incorporation of smart contracts in DeFi applications draws from this capacity to offer automated transactions as long as the terms and conditions are met. However, note that the DeFi community has found new ways to expand the functionalities of smart contracts such that decentralized platforms can take on more complex financial processes.

What Are the Characteristics of DeFi?

Although our definition encapsulates the core workings of DeFi, a closer look at the characteristics of this financial order breaks the concept a little further. Below are some of the factors responsible for the innovative nature of DeFi.

Non-Custodial

One of the factors that separate DeFi from conventional financial systems is its non-custodial framework. Every participant has autonomy over his or her assets. Hence, when you opt for a Defi application, be rest assured that no bank or financial institution has control over your funds. The same cannot be said of conventional financial systems that overly rely on centralized custodial solutions for even the most basic operations.

Open

Apart from adopting a non-custodial architecture, DeFi also promotes an open landscape. In simpler terms, DeFi permits borderless transactions and financial deals. Thus, the applications are available globally. This characteristic of DeFi solves the restrictiveness of the traditional financial order. By incorporating DeFi, users do not encounter restrictions or fall victim to a lopsided monetary policy designed to favor a region, a race, or people with specific backgrounds or political leanings.

Transparency

The DeFi terrain has established a transparent culture by creating open-source platforms. Therefore, anyone can inspect the viability of DeFi applications as the codes which make up these protocols are publicly available. With this, investors and users can track their funds, search for vulnerabilities, and criticize the design decisions of developers.

Composability

Since DeFi protocols are open-source, it is possible to build new applications on top of them for even more robust functionalities. The endless possibilities brought about by the composability of DeFi has accelerated innovation and inspired the term, “Money Legos.” Each application is just a piece of a jigsaw connecting users to more value providing features. The integrative architecture of DeFi is far more advantageous than the siloed design of established cryptocurrencies.

Decentralization

As its name implies, DeFi upholds a decentralized landscape that puts up various measures to ensure that the governance of protocols is distributed among users. More importantly, thousands of nodes spread out across the world run these applications. As such, financial institutions or banks cannot take up the roles of gatekeepers like they commonly do in the traditional finance market. Likewise, it makes it difficult for attackers to alter or cripple DeFi networks successfully.

What is DeFi and Why Should You Care?

Let’s be real. Why are so many people excited about DeFi? What makes it so special? If you’re new to the space, the hype might feel overwhelming. But beneath all the buzz is a defining idea that’s shaking up finance as we know it. Let me break it down for you.

Understand the Key Idea of DeFi

The heart of DeFi—or Decentralized Finance—is all about replacing banks and middlemen with technology that lets YOU control your money. Imagine lending or borrowing money directly, trading assets without needing an exchange, or earning interest without relying on traditional institutions. That’s the magic of DeFi. No office hours. No slow approvals. No massive fees.

Let me give you an example—remember how banks make billions from savings account interest? You get about 0.01% while they keep the lion’s share. In DeFi, you could lend your crypto assets directly using platforms like Aave or Compound and earn real returns. We’re talking rates that are 5%, 10%, even higher depending on the risks you’re comfortable with. Doesn’t that sound empowering?

What Makes DeFi Unique?

The secret sauce behind DeFi is blockchain technology. Every transaction is recorded on an open, distributed ledger. This means:

- Transparency: You can always see what’s happening. No shady backroom deals.

- Control: Nobody locks your money away. You decide where it goes and when.

- Better returns: Smart contracts eliminate middlemen, allowing you to benefit directly.

Imagine being able to track every dollar’s journey through a financial system. That’s the kind of clarity blockchain provides. Compare that with traditional finance, where you’re often in the dark about what’s really happening to your funds. That’s why people are excited—this isn’t just an upgrade; it’s a revolution.

Why is DeFi Exploding in Popularity?

If you think DeFi is just a passing trend, think again. According to a report by ConsenSys, over $200 billion was locked in DeFi protocols during the 2021 bull market. That’s a lot of trust being placed in the system—and for good reason.

Here’s why millions of people are jumping on board:

- Financial freedom: No more asking for anyone’s permission to use your money.

- High returns: Through features like yield farming or staking, users are seeing opportunities that traditional banks could never offer.

- Global access: Got internet? Congratulations, you have access to DeFi! No matter where you live.

One more angle to think about: DeFi also makes you rethink trust. You no longer need to blindly trust a bank will “do right” by you. DeFi uses smart contracts—codes that automatically execute your agreements. As long as the code works (and is audited), you’re all set.

“DeFi isn’t just about making money; it’s about taking your money back into your own hands.” – Anonymous Crypto Enthusiast

The excitement is real, but so is the challenge of navigating this world for the first time. Which tools should you pick to begin? What’s the safest step forward? All of that is just around the corner. Ready to get set up for your first DeFi experience? Let’s keep going.

Open Finance VS Decentralized Finance?

From the characteristics listed above, it is clear that DeFi itself is a standard framework for developers. While these are the accepted attributes of DeFi on paper, the majority of developers have found it hard to meet all these requirements. In particular, decentralization has been the hardest to replicate.

Developers often decide against giving up control over their protocol completely, especially at the early stages of developments. Running a fully decentralized protocol makes it almost impossible for developers to react quickly to issues since they have to consult the community and reach a consensus before any changes can take effect on the network. Hence, a majority of developers tend to retain a degree of control over their projects. However, more often than not, they set a roadmap for the establishment of fully decentralized applications. This milestone entails a series of updates, which allows the developers to relinquish control to users gradually.

Although decentralization has remained a controversial topic in the DeFi scene, no one can downplay the openness of these protocols. Hence, some choose to call this financial order “Open Finance” instead of “Decentralized Finance.”

How Large Is the DeFi Market?

Due to DeFi’s unique makeup and the nascency of the technology, it is hard to track the real size of the market. Some of the metrics used to showcase the performance of the sector are the total market capitalization and total value locked TVL. The latter, in particular, has emerged as a widely used metric because it connotes the value of the capital invested in the market. A lot of DeFi metrics sites use this standard to calculate the market performance of DeFi.

However, it is critical to note that some metric sites like DeFi Pulse limit the scope of their operations to Ethereum-based DeFi protocols. The data from such websites may not accurately represent the size of the market since the DeFi landscape is much more than the Ethereum ecosystem.

At the time of writing, the DeFi sector had a total market cap valued at over $30 billion, according to Coinmarketcap. Likewise, DeFi Llama pegged the TVL at $32 billion. Considering that TVL was a little under $1 billion at the start of last year, it is safe to say that a large share of the funds locked in the market today was generated in 2020. The explosive increase of the TVL tells the story of how attractive DeFi has been against the backdrop of a pandemic-induced financial crisis.

Is DeFi a Bubble?

Owing to the explosiveness of the DeFi sector and its semblance with the ICO boom of 2017, it is easy to see why skeptics believe that the sector is nothing but hype. The bubble tag has often been used to connote the ecosystem. Critics have gone ahead to downplay the achievements recorded so far and even suggested that the sector is bound to crash. And so, it has become necessary to reevaluate the current state of the DeFi market and to an extent determine the sustainability of the technology.

The first argument that we need to examine is the claim that DeFi shares a similar framework with ICO, and so may suffer a similar fate. While this notion is the most rehashed argument against the long-term viability of the crypto market as a whole, it is far from the truth. First and foremost, the ICO era produced a plethora of applications that were only good on paper and not necessarily functional.

In contrast, the DeFi boom stems from the performance of a long list of projects that already have working products. Hence, investors are not just buying and holding tokens with the hope of eventually generating returns in the not-too-distant future as they did in the ICO era. Instead, they are putting their funds into functioning applications and are generating value immediately. However, this counterargument does not exonerate the DeFi sector from all suspicions. Like every newly introduced innovation, DeFi tends to attract individuals and companies hoping to bankroll half-baked projects and make money off the DeFi hype. As such, every intending investor and user must carry out extensive research to separate viable projects from mediocre ones. Nonetheless, the activities of these illicit entities do not take anything away from the efforts put into establishing the DeFi sector.

DeFi Terminologies and Concepts

When exploring the DeFi world, you will most likely encounter unfamiliar terminologies used to describe certain activities or processes. Some these concepts include:

DEX

Whenever you see DEX, just have it at the back of your mind that it is the short form for decentralized exchange. DEXs are platforms designed to allow token swaps and exchanges without requiring users to transfer control of their digital assets to them. Also, new users do not need to scale KYC procedures to have full access to the exchange’s features. As a result of their decentralized nature, the transaction fees are low compared to what centralized exchanges usually charge.

DAO

DAO is the shortened form of Decentralized Autonomous Organization, which connotes a company powered by an automated governance system. In other words, there are no staff or employees. Instead, the organization relies on open-source protocols programmed to initiate automated management functions without any human elements or influence from centralized institutions. Also, it is censorship-resistant.

Gas Fees

For every transaction executed on the Ethereum blockchain, the sender pays a processing fee in ETH called Gas Fees. The volume of transactions executed on the blockchain determines the amount paid as gas fees. As such, network congestions usually attract high Gas fees.

Liquidity Mining/ Yield Farming

Liquidity mining and yield farming is a DeFi process that requires users to deposit funds on liquidity pools on DEX or decentralized applications for the chance of earning rewards. This opportunity is only applicable to platforms that distribute tokens to users as rewards for staking their holdings and providing liquidity to other users.

Liquidity pools

This is a feature of DEXs and other platforms that permit liquidity mining or yield farming. The goal is to encourage investors to lock funds in pools and create liquidity for exchanges executed on DExs. In turn, liquidity providers earn a share of the transaction fees generated by the pool.

Non-fungible tokens (NFTs)

NFT is a token standard that represents unique digital and real-world assets. This framework is becoming a vital crypto implementation used to tokenize physical or virtual items and facilitate their trades and establish ownership. NFTs are becoming particularly useful in creating complex DeFi products.

Automated Market Makers (AMM)

This concept eliminates the human elements from trading and the process involved in borrowing or lending cryptocurrency. Rather than communicating or making agreements with another user, users interact with smart contracts.

Flash Loan

This is an advanced means of lending and borrowing that enable loans without borrowers having to deposit collateral. However, borrowers must repay instantly, or else the protocol may cancel the transaction.

Governance Token

For many decentralized apps, the best way to establish decentralization is to distribute the voting rights to users via governance tokens. By owning the governance token of a particular DeFi protocol, you can unlock the opportunity to have a say in the running of the project and other vital issues like upgrades and transaction fees policies.

Deflationary Tokens

A fair share of DeFi projects favors a deflationary architecture to ensure that the value of their native digital assets maintains an upward trajectory. And so, they implement systems that reduce the number of such tokens in circulation over time. DeFi networks that adopt this economic model issue deflationary tokens.

What Are the Applications of DeFi?

As mentioned earlier, developers have begun to infuse the concept of DeFi to a broad range of financial services. While some are simple and straightforward, others are somewhat complex and suitable for experienced users and investors. Below are some of the common use cases of DeFi.

Borrowing and Lending

Open lending platforms have become the most popular DeFi protocols as they offer a broad range of opportunities to participants via blockchain-based credit systems. These protocols encourage investors to lend crypto out to borrowers to earn interest rates. Borrowers, on the other hand, can collateralize their crypto holdings and access loans, albeit with a system free from the cumbersome processes associated with traditional loan systems. In some cases, these protocols go a step further to distribute governance tokens to active participants.

Ultimately, DeFi-based borrowing and lending platforms promote trustless ecosystems, cryptography-powered verification systems, cheap loan facilities, and faster services. More so, they reduce counterparty risks and enable borderless lending and borrowing networks.

Stablecoins

In addition to enabling open lending protocols, DeFi has also excelled as a system for establishing unconventional but functioning monetary banking services like the generation of stablecoins. Before the advent of DeFi, the crypto market had relied solely on centralized stablecoins, which are not big on transparency. The core workings of centralized stablecoins hinges on the ability of the issuer to convince users that the value of the token is pegged to a real-world asset as advertised. You will agree that a lot could go wrong, most especially when a system heavily relies on the human factor. As such, it made sense to create trustless versions that suit the decentralization narrative nicely and are free from bureaucracies of central authorities. Herein lies the importance of decentralized stablecoins. They are digital assets that provide the much-needed stability to the crypto market and yet retain an open and trustless framework.

Decentralized Exchanges

As discussed earlier, decentralized exchanges are peer-to-peer trading or coin swapping smart contract-based platforms. Dexs provide non-custodial and privacy-focused exchange facilities. They incorporate automated contracts at the heart of their offerings and do not impose compliance requirements on users. Over the years, decentralized exchanges have taken up a strategic position in the DeFi landscape as they permit unrestricted listings for obscure or new projects. In other words, it is way cheaper and more seamless to onboard new tokens on decentralized exchanges than on the centralized counterparts.

Derivatives and Synthetic Asset Issuance

Like the case of centralized exchanges, DeFi also offers a means to trade derivatives without the inputs of trusted intermediaries. In essence, there are DeFi protocols that allow users to trade contracts that draw their value from underlying assets. This use case has emerged as one of the more complex applications of DeFi. This possibility exposes users to a wide array of investment instruments, including traditional assets, albeit in a decentralized and open manner.

Decentralized Insurance

Insurance has become a touchy subject in the DeFi landscape. A fair share of this controversy stems from the risks associated with DeFi opportunities. Recall that the sector is still very much in its experimental phase. Therefore, users are prone to all sorts of risks. In response to this prevalent threat, developers have begun to design decentralized insurance and risk management protocols to reduce the effects of unforeseen events like smart contract failure, hacks, market dump, and so on. More importantly, these protocols incorporate public smart contracts to ensure that all participants can access the terms of payouts. This insurance framework is more transparent than the traditional alternative, which is often riddled with loads of paperwork.

Prediction Markets

This is another marketplace powered by decentralized infrastructures to provide users with a high level of autonomy. Here, users can bet on future events like the outcome of a presidential election. However, unlike the conventional method of running prediction markets, the DeFi alternatives try as much as possible to introduce processes that eliminate the need for intermediaries.

Asset Management

Owing to the explosiveness of DeFi and the rate at which new tokens flow into the landscape, it has become imperative for users to own asset management tools like dashboards where they can track all their holdings. As with most DeFi-based applications, these tools and systems should incorporate decentralization as their core theme. Hence, DeFi asset management tools are decentralized protocols that provide interfaces for easy access to portfolios and other DeFi platforms.

Setting Up Your First DeFi Wallet

Let’s be real—getting started in DeFi can feel like stepping into an entirely new universe, and trust me, it all begins with one major tool: your wallet. Think of it as your gateway to this decentralized world where YOU are in control, not the banks. Without a proper wallet, you simply can’t explore DeFi, trade, or stake your way to those juicy rewards. But don’t worry, setting it up is simpler than you think.

Choose the Right Wallet

The first step is choosing a wallet that’s beginner-friendly and built for DeFi. The good news is, there are great options out there that are tailored to new users.

- MetaMask: A browser-based wallet that’s also available as a mobile app. It’s a go-to for many in the DeFi space because of its simplicity and compatibility with most apps.

- Trust Wallet: Perfect if you’re more mobile-focused. It’s secure, works with tons of tokens, and connects smoothly to decentralized applications (dApps).

Both of these are free, highly popular, and easy to get started with. If you’re the “visual learner” type, download the app and follow their setup guide step by step. “One small step for downloading, one giant leap for your DeFi journey,” right?

“A good wallet is like a fortress for your funds—secure it wisely, and you’ll feel unstoppable.”

Add Crypto to Your Wallet

Once you’ve got your wallet installed, the next question is: what’s a wallet without any crypto in it? Empty. To fuel your DeFi adventures, you’ll need to transfer funds. Often, this means getting Ethereum (ETH) since most DeFi apps run on the Ethereum blockchain. Here’s how you do it:

- Buy ETH or stablecoins (like USDT) on a trusted exchange like Coinbase or Binance.

- Copy your wallet address from MetaMask or Trust Wallet—this is a long string of letters and numbers (don’t worry, it’s unique to YOU).

- Transfer the funds from your exchange to your wallet. Most exchanges make this straightforward—look for the “Withdraw” option.

Pro tip: Always double-check your wallet address when transferring funds. One small typo could send your crypto into the void, and getting it back? Forget it.

Stay Secure

Let me break it to you—no matter how fancy or beginner-friendly your wallet is, security should be your top priority. If you lose access, it’s game over. Follow these steps to keep your funds safe:

- Use a strong password: No birthdays, no easy-to-guess phrases. Make it something impossible to crack.

- Enable two-factor authentication (2FA): Most wallets support this feature. It adds an extra step for anyone trying to hack your account.

- Never share your private key: This is crucial. Your private key is like the password to your entire wallet. Share it, and you could lose everything.

- Backup your seed phrase: When you set up your wallet, you’ll get a series of random words—write them down and store them in a safe place (not digitally).

Here’s a quick stat for perspective: According to Chainalysis, over $3 billion has been stolen in DeFi hacks in 2022 alone. I don’t say this to scare you, but to remind you that a little caution goes a long way.

Ready to Use That Wallet?

You’ve got the wallet, loaded it with crypto, and secured it like Fort Knox. Now, you’re ready to step into the fascinating world of DeFi apps. But where to begin? What’s worth exploring first? Here’s a hint: decentralized exchanges make for an incredible starting point. Want to know why? Let me tell you in the next part…

Beginner-Friendly DeFi Activities to Try

Starting your DeFi journey doesn’t mean jumping straight into complexity. There’s no need to rush into advanced strategies right away—there are some simple yet exciting activities you can try as a beginner. Let’s explore the first steps you can take to get a feel for decentralized finance without feeling overwhelmed.

Use a Decentralized Exchange (DEX)

Have you ever wondered what it feels like to trade without relying on a third-party intermediary? That’s the magic of decentralized exchanges (DEXs). Platforms like Uniswap or PancakeSwap allow you to swap cryptocurrencies directly with other users.

Here’s a quick suggestion: start with a small amount of crypto like Ethereum (ETH) or Binance Coin (BNB) and experiment with swapping for a popular token like MATIC or LINK. Not only is it intuitive, but it also helps you understand key concepts like gas fees and transaction times. Trust me, understanding these firsthand gives you a sense of confidence when navigating the DeFi world.

Someone once said, “Tell me, and I forget. Teach me, and I may remember. Involve me, and I learn.” Trading on a DEX is your chance to learn by doing!

Explore Staking Options

If you’ve heard people say “make your money work for you,” it’s not just a motivational phrase—it’s actually possible in DeFi! Staking is one of the simplest ways to earn passive rewards while holding onto your favorite tokens.

For example, if you own an asset like ETH or a stablecoin such as USDC, you can stake it through platforms like Lido or Curve Finance. Staking does multiple things: it supports the efficient functioning of blockchain networks while offering you rewards based on the percentage of funds you’ve staked. Pretty cool, right?

The risk level? Low, especially if you’re staking well-established tokens. The reward? A steady stream of returns while you hold onto your crypto. Staking works particularly well if you’re not keen on trading aggressively but still want to earn something extra in a secure way.

Participate in Testnets

How about a chance to practice without using real money? That’s where testnets come in. Testnets are like sandbox environments where you can engage with DeFi protocols without risking actual funds. Ethereum’s Goerli testnet and Optimism are great places to get started.

You can even earn rewards (sometimes free tokens!) for participating in testnet activities. Resources like Gitcoin offer guides to help you discover projects that welcome beginners. Want to experiment with staking, trading, or swapping—worry-free? Testnets are the answer to practicing until you feel confident enough to try the same things with your real crypto portfolio.

Why Does This Matter for You?

Starting simple is the best way to build your skills and confidence without getting discouraged or overwhelmed. By trying basic activities like trading on a DEX, staking, or using testnets, you’re ensuring your journey into DeFi is solid.

So, what’s next? You’ve dipped your toes in with these beginner-friendly options, but what about unlocking bigger earning potentials like yield farming or understanding how liquidity pools work? Trust me, this is when things get really exciting.

Ready to take your next step? Let’s see how you can start earning real rewards while managing risks—it’s easier than you think. Curious? Let’s find out!

The Magic of Yield Farming and Liquidity Pools

Have you ever wanted your money to work for you? Like, really work for you while you, well… just live your life? This is where the magic of yield farming and liquidity pools comes into play. What if I told you that by simply holding and utilizing your crypto, you could earn extra rewards daily? Sounds like a fairy tale, right? But trust me, it’s real. Let me explain how it works.

What is Yield Farming?

Think of yield farming as renting out your assets—only instead of property, you’re providing cryptocurrency to decentralized platforms. In return, these platforms reward you with more crypto. It’s like growing a fruit tree: you plant a seed (your crypto), and with a little care (choosing the right protocols), you reap the rewards (profits or governance tokens).

For example, when you provide liquidity to platforms like SushiSwap or Curve, you’re essentially becoming the backbone of decentralized financial activity. These platforms reward you for making their ecosystem work smoothly by sharing transaction fees or bonus tokens with you.

Did you know? DeFi platforms like Uniswap processed over $1 trillion in volume in 2022 alone, largely thanks to liquidity providers like you and me!

Start Small and Manage Risks

Let’s address the elephant in the room—risk. “What if I lose my funds?” This fear is common but manageable. Yield farming doesn’t have to be scary if you approach it cleverly and cautiously.

My advice? Start small. Perhaps begin with stablecoin pairs like USDT-USDC on trusted platforms—these pools are great for beginners since they minimize the risk associated with crypto price swings. Picture it as dipping your toes in a calm, shallow pool before attempting the deep end.

- Stablecoins: Cryptocurrencies pegged to traditional assets like the US dollar. They reduce price volatility, making them safer for beginners.

- Beginner-friendly Platforms: Explore pools on systems like Aave or Compound—we’ll talk more about safety in the next section.

Pro tip: If you see a farming pool advertising ridiculously high annual percentage yields (APYs), proceed with caution! Sometimes these pools are traps (eyeroll at rug-pull scams), or the rewards don’t outweigh other hidden costs.

Watch out for Fees

Now, you might think, “If this is so good, why isn’t everyone doing it?” Well, one hurdle can be transaction fees, also known as gas fees in Ethereum-based DeFi ecosystems. Trust me, these costs can sneak up on you like a thief in the night, eating into your profits if you’re not careful.

Picture this: You’re farming USDC-ETH pairs on Uniswap, and Ethereum is super congested. Every small action you take—depositing tokens, withdrawing rewards, or even checking contract stats—will cost you ETH (sometimes over $20 per transaction during busy hours!). Now imagine doing this regularly. Ouch, right?

But here’s the solution:

- Batch Your Transactions: Avoid frequent tiny transactions. Instead, wait and consolidate actions whenever possible.

- Use L2 Solutions: Layer 2 platforms like Optimism or Arbitrum dramatically cut fees while still keeping your operations on Ethereum chains.

- Look for Low-Fee Chains: Binance Smart Chain (BSC) and Polygon offer DeFi farming opportunities with fractions of the costs compared to Ethereum.

Here’s a golden nugget: Tools like Etherscan Gas Tracker or DeBank show when gas fees are lower—you can plan your transactions around quieter times!

“Do not save what is left after spending, but spend what is left after saving.”—Warren Buffett

In the DeFi world, replace “saving” with “efficiency.” The more mindful you are of these transaction fees and risk management, the more profitable your journey will be.

So, now that you know the core of earning through yield farming and liquidity pools, how do you protect yourself from getting tricked? What should you watch out for when safeguarding your newfound profits? We’re about to unlock those secrets—keep reading!

How to Stay Safe in DeFi

Entering the world of DeFi is thrilling, but let’s be real—there are risks, and nobody likes losing hard-earned money. Staying safe isn’t just a suggestion; it’s the rule of the game. Without the right precautions, it’s easy to fall into traps like scams or hacks. So, let’s break down how to protect what’s yours while exploring this decentralized frontier.

Recognize Common Scams

It’s staggering how creative scammers can be in DeFi. They come at you with promises of massive returns, fake websites, or phishing emails that look scarily legit. But you don’t have to be the next victim.

- Phishing attacks: You might receive an email or message pretending to be from a trusted platform. These will often include malicious links. Always double-check the URL and avoid clicking links sent to you directly.

- “Rug pulls”: A project lures users to invest in its liquidity pool, then the developers disappear with the funds. This has happened on flashier platforms before, even where audits existed. Vet the team behind any protocol—public, reputable figures? Good start.

- Pump-and-dumps: Some tokens are artificially hyped, leading to skyrocketing prices. Once enough people buy in, the scammers cash out, and the price plummets. If a token’s growth looks too good to be true, it probably is.

“Trust is good, but verification is better.” Always question what you see—especially in finance. Scammers prey on excitement and greed. Don’t let your guard down.

Stick to Verified Protocols

There’s no shame in starting with established projects. In fact, it’s smart. Platforms like Aave, Compound, and MakerDAO are well-known for having strong reputations, outstanding track records, and being pioneers in the DeFi ecosystem. With major players like these, you’re reducing your risk of walking into shady territory.

To make your life easier, focus on protocols that have undergone audits from respected blockchain security firms like Certik or OpenZeppelin. Sure, nothing is 100% guaranteed in DeFi, but verified platforms have much lower chances of failing you.

Another tip? Keep an eye on community activity. Protocols with vibrant developer and user communities usually scream legitimacy. If the discussion boards or Telegram channels for a project seem dead silent, take a step back.

Keep Your Wallet Secure

If you lose access to your wallet, it’s game over, period. Your private keys are your digital fortress, and there’s no customer service hotline to call in DeFi. Here’s how to secure your wallet like a pro:

- Use a hardware wallet like Ledger or Trezor for storing higher amounts. These keep your keys offline, away from potential hackers.

- Write your private key or seed phrase on paper (yes, old-school pen and paper). Never store it digitally, as your device can be compromised.

- Enable two-factor authentication (2FA) wherever possible. A tool like Google Authenticator can make your wallet significantly harder to breach.

- Avoid accessing your wallet on public Wi-Fi—it’s a hunter’s paradise for cybercriminals.

Just imagine the heartbreak of losing everything because you didn’t take security seriously. It’s not worth it. Treat your wallet like an online vault because that’s exactly what it is.

Here’s something else you should think about: how much risk is too much? Is that 200% APY farm really worth it if there’s a chance you could lose everything overnight? Maybe not. But what if I told you there are safer, sustainable ways to profit in DeFi? Curious? Let’s keep going—you might just find your golden answer in the next section.

Can you really make money with DeFi?

Let’s cut to the chase—can DeFi actually bring you profits, or is it just hype? The answer lies in how you approach it. DeFi is like a toolbox for earning in ways that traditional banking could never offer. The question isn’t just “can you make money?” but “are you doing it the right way?” Let’s break it down together and see what’s realistic.

The different ways to earn

One of the best parts of DeFi is its variety. Whether you’re just dipping your toes into crypto or have been around for a while, there’s something for everyone. Here are some ways people are growing their assets:

- Staking: You “lock up” your tokens on a platform to help secure the network. In return, you earn rewards, often in the form of crypto. For example, staking Ethereum (ETH) on platforms like Lido could earn you a passive return of around 4-5% annually.

- Lending: With platforms like Aave or Compound, you can lend out your cryptocurrency and earn interest. Imagine being your own bank but with better rates than any financial institution offers.

- Yield Farming: Essentially, you provide liquidity to a decentralized platform like Uniswap or Curve and get rewarded for your contribution. While it sounds complex, some beginner-friendly pools are less risky and still profitable.

The beauty here is that everything happens without a third party. It’s between you, blockchain protocols, and anyone else using them.

What’s realistic vs. what’s hype

“If it sounds too good to be true, it probably is.” This phrase has never been more applicable than in DeFi. Let’s be honest: you’ve probably stumbled across insane claims of 1,000% Annual Percentage Yields (APY), promising you riches overnight. While the concept seems tempting, chasing these flashy promises often ends badly. Why? Unsustainable models and potential scams.

Instead, look for reliable platforms with steady returns. For instance:

- Ethereum staking: Consistent, minor rewards but safe and long-term.

- Stablecoin lending: Earn interest in ranges of 5-8% annually without worrying about market dips.

Sure, these aren’t “get rich quick” schemes, but they let your money work for you without the unnecessary drama. Remember, slow and steady often wins the race in DeFi. Keep an eye on reviews, check analytics on sites like DeFi Llama, and always read through protocols’ tokenomics before committing.

Learn and adapt

DeFi is a fast-moving space. What worked three months ago might not be as fruitful today. If you want to thrive, staying informed is crucial. Find resources, follow updates, and keep challenging yourself to understand how new features or protocols work.

Being here reading this already puts you ahead of the curve. Platforms like Cryptolinks.com help you cut through the noise by providing clear, straightforward advice.

“The illiterate of the 21st century will not be those who cannot read and write, but those who cannot learn, unlearn, and relearn.” – Alvin Toffler

DeFi rewards those who are curious and flexible. Every mistake you make along the way teaches you something valuable.

So, where does DeFi take you next? Are you ready to explore the essential tools and communities that could turbocharge your results? If yes, keep scrolling, because the next bit might just be the secret weapon you’ve been waiting for.

What Are the Examples of DeFi Projects?

Having listed the core utilities of DeFi, the next section explores projects, which are crucial to the DeFi narrative. These platforms have emerged as some of the most viable DeFi protocols today and unlocked new possibilities for decentralization in the financial sector.

MakerDAO

MakerDAO ignited the DeFi movement in 2015 by offering an alternative issuance model for stablecoins. With decentralization as the main propelling factor for their offering, the founders of MakerDAO introduced DAI, a US dollar-pegged stablecoin. In contrast to the intermediate design of centralized stablecoin, Maker accepts digital assets as collaterals and rely on smart contracts to ensure that DAI retains a 1:1 peg with $1. More importantly, the smart contract implementations establish the censorship resistance attributes of DAI.

Users must deposit collateral worth 150% of the number of DAI they intend to borrow. For example, To borrow 20 DAI, you will need to deposit $50 worth of supported coins as collateral. Besides, you will also pay a stability fee, which functions as the borrowing interest rates. Note that the protocol adjusts the fees based on the demand for DAI loans. Also, you must ensure that the value of your collateral does not drop below the 150% ratio. If you cannot fulfill this requirement, the protocol will automatically liquidate your loan, sell off the collateral at a discount, and impose a fine on you.

Alternatively, you can buy DAI on exchanges and save yourself from the stress of borrowing on the Maker platform. Once you borrow or buy DAI, you can use it to unlock other monetary services on secondary markets. Another core component of the MakerDAO ecosystem is the MKR token. Unlike DAI, the value of MKR fluctuates. It primarily serves as the governance token of the Maker protocol. As such, holders have voting rights to alter or upgrade the network.

Compound Finance

Compound Finance has built formidable lending and borrowing protocol on the Ethereum blockchain and incorporated incentive-based innovations to spur engagements. Launched in 2018, Compound adopts an open financial model and utilizes financial contracts to regulate and execute loans. Like Maker, Compound does not base the eligibility of users to access loans on credit scores. Instead, the ability of the borrower to deposit the required collateral to a large extent determines the success of loan requests. Also, it implements an over-collateralization model to reduce the risk involved and ensure that the entire process remains automated.

The interest rates generated from borrowers are distributed to lenders. Remarkably, lenders do not necessarily have to wait for a lockup period to lapse before withdrawing their earnings and original investment. This is due to the absence of restrictions. It is worth mentioning that lenders receive the derivatives, called cTokens, of their funds and earnings. For example, if you deposit DAI on Compound, the protocol issues cDAI tokens with a value equivalent to the worth of your initial deposit and the interest earned. Subsequently, you can collateralize this token to receive a loan or sell it for other cryptocurrencies.

Notably, Compound launched its governance token, named COMP, in 2020. As expected, this token offers voting rights to holders, and it is a critical shift on the part of the development team to cede control of the Compound ecosystem to users.

Uniswap

Uniswap is fast becoming one of the most critical protocols in the DeFi market because it provides a suitable pooling system to facilitate trades and coin swaps in a decentralized manner. It is one of the pioneers of the automated market maker, which eliminates the need for order books. This innovative approach makes it a lot easier to trade obscure tokens because users do not have to wait for the exchange to match their orders before successfully executing trades. The automated market maker system initiates liquidity pools specially designed for tokens paired with Ethereum.

The AMM system uses a special formula introduced by Vitalik Buterin in 2018 to determine the appropriate size of the reserves of each token available in the liquidity pool. Apart from its reliance on mathematics for sustainable liquidity, Uniswap also automates the process involved in listing new tokens. There are no listing fees imposed on developers. Hence, it has become an integral exchange facility for newly issued coins. There is also no form of restrictions imposed on traders residing in a specific country, as is commonly found on centralized exchanges. The absence of KYC or AML requirements makes Uniswap a truly borderless crypto infrastructure. Lastly, anyone can provide liquidity on Uniswap for a chance of receiving a share of revenues generated from trading fees.

Synthetix

Founded in 2017, Synthetix has played a pivotal role in the emergence of DeFi-based synthetic assets or synths. It allows the minting and trading of tokens designed to mimic the value of non-crypto assets. Some of the assets that fall within the scope of synthetic assets are tokenized forex, commodities, and indexes. Already, over 50 tradable pairs, ranging from gold synths to UK’s FTSE stock index, are available on the platform.

As practices on most permissionless and open protocols, you do not need to give up your personal details to use Synthetix. As such, the platform is rightly placed to democratize the process of accessing and trading securities. To create new synths, users deposit the platform’s native token, SNX, in smart contracts, and in turn, Synthetix enables automated contractual-based trades for other synths. The protocol pays liquidity providers a share of the generated exchange fees. However, note that it is not mandatory to hold SNX to trade synths.

Furthermore, the project team kicked off a plan in 2020 to reduce the influence of Synthetix Foundation on the governance of the platform. In place of the foundation, Synthetix looks to cede control to three on-chain DAOs. It is safe to say that this decision is vital to the establishment of a fully decentralized governance system for Synthetix.

Curve Finance

Like Uniswap, Curve Finance is also a decentralized exchange. However, it focuses on creating liquidity pools for stablecoins. Since the supported digital assets have a stable value, the risks involved are reduced significantly. For one, traders rarely incur impermanent losses caused by the volatility of DeFi tokens against ETH on Uniswap. Another difference between Curve and Uniswap is that the former allows users to lend out tokens in liquidity pools to decentralized money markets. Hence, liquidity providers have the option of earning trading fees and interest rates.

Unsurprisingly, Curve also introduced its governance token, called CRV, to reward liquidity providers and distribute the governing power among active users.

Yearn.Finance

Yearn.Finance functions as a DeFi aggregating platform which redirects users to the most profitable crypto lending and liquidity pools. Yearn.Finance integrates with established DeFi protocols like Dydx, Compound, and Curve. Users stand a chance of unlocking an array of DeFi opportunities through Yearn. All you need to do is deposit one of the supported coins on Yearn and receive a derivative token like you would on Compound. For example, if you deposit Dai, you will get yDAI. Subsequently, you can use these ytokens on liquidity pools of the supported protocols and generate earnings accordingly.

In July 2020, Curve began to issue its governance token, YFI, to users staking ytokens on selected pools. This token has managed to break price records and spurred developers to create similar platforms.

Yam Finance

Yam Finance is one of the spin-offs inspired by the success of Yearn.Finance. The protocol rewards users for contributing liquidity to pools. In addition to interest rates, users earn the platform’s native token, YAM, as rewards. Although the platform managed to attract investors following the initial release of its token, the discovery of a bug in the code was detrimental to its long-term viability. This bug complicated the governance of Yam Protocol and forced the development team to create a new version.

What Are the Challenges of DeFi?

Like every other nascent sector, DeFi has its fair share of challenges. While some of these limitations currently reduce the efficacy of the technology, it is imperative to note that DeFi is still in its early stage of development, and there is enough room for improvements. Below are some of the challenges you may encounter while using DeFi products.

Slow Performance

Every now and then, the hurdles of blockchain technology tend to limit the performance of DeFi protocols. This observation is common on protocols running the Ethereum blockchain, which is the bedrock of the present DeFi landscape. In light of this, some developers are launching their DeFi products on alternative blockchain infrastructures. For those who are not considering this option, the launch of Ethereum 2.0 slated for 2022 serves as the only viable solution to the unsavory speed of DeFi protocols.

High Risks

Like we mentioned earlier in this guide, the risks associated with DeFi are very high because it is still in the experimental phase. There are no market standards for running or securing products. alAso, the anonymity provided by DeFi has inspired lots of substandard projects, hacks, and scams. Users must research platforms extensively before investing in DeFi tokens or adopting their services.

Below Par User Experience

It takes a lot of effort on the part of users to understand and navigate the DeFi landscape. A majority of the top protocols are more suitable to technical savvy users. As such, DeFi still has a long way to go before it can replace the current financial order. Developers must create simpler iterations of DeFi products that focus on user experience, accessibility, and customer support.

What Does the Future Hold for DeFi?

Judging by the rate at which developers created innovative use cases for DeFi in the last couple of years, it is safe to say that innovation will continue to drive the growth of the landscape. In the coming months, expect unsustainable platforms to become redundant and replaced by advanced iterations. Also, strides achieved in the risk management and insurance sub sectors could propel the influx of new capital. All in all, DeFi must integrate with the conventional financial system to enable seamless gateways and attract institutional engagements.

What is your opinion about DeFi?

Share with us in a comment below. Thank you