PancakeSwap Exchange Review

PancakeSwap Exchange

pancakeswap.finance

PancakeSwap Exchange Ultimate Detailed Review: Everything You Need to Know

Have you ever wondered if PancakeSwap is worth your time and crypto investments? You’re not alone. With so many decentralized exchanges (DEXs) popping up, it’s hard to know which are worth exploring and, more importantly, which can be trusted.

If you're here, you’re probably looking for answers. Is PancakeSwap a secure choice? How does it compare to other platforms? What about fees, withdrawals, and availability for users in certain regions? Trust me, these are questions almost every crypto user has asked at some point—and it’s completely valid to want clarity before diving in.

What makes users hesitate about PancakeSwap?

Let’s address the elephant in the room: hesitation. Despite PancakeSwap’s growing popularity, certain doubts make users second-guess whether they should use it. Here are the main concerns I’ve noticed:

- Security: Is PancakeSwap safe to use? With news of hacks and scams in the crypto space, this remains a common worry.

- Fees: What’s the real cost of using PancakeSwap, and is it economical compared to alternatives?

- Availability: Can users in restricted regions, like the U.S., access its services without hassle?

These kinds of questions often hold people back from using decentralized platforms like PancakeSwap. It’s natural to feel cautious, especially when it’s your hard-earned crypto on the line. Don’t worry, I’ll keep everything straightforward as I walk you through these concerns.

You’re not alone with these questions

Trust me, you’re not the only one wondering about PancakeSwap. Many users hesitate when considering decentralized exchanges because they’re used to the familiar interface and perceived security of centralized platforms like Binance or Coinbase.

But here’s the thing—decentralized finance (DeFi) is growing fast, and PancakeSwap is at the forefront of this movement. That said, confusion around terms like "liquidity pools," "staking," or even understanding transaction fees can make new users hesitant to take the leap.

On top of that, how can you truly know if a platform is right for you until you’ve got answers to your specific concerns? Let’s untangle all the key points so you can move forward with confidence.

Here's what this article will give you

By reading on, you’re going to gain a crystal-clear understanding of PancakeSwap. I’ll help you make sense of its features, address all these common doubts, and give you practical tips for using it effectively. Consider this your one-stop guide to everything PancakeSwap has to offer.

Still debating whether it’s the right platform for you? That’s okay too. Questions like “What makes PancakeSwap different?” or “Is it really as user-friendly as everyone claims?” will all be addressed. Stick with me as I break this down step by step, clearing up any confusion along the way.

Up next, let’s figure out exactly what PancakeSwap is and why it’s gained so much popularity in the crypto world. Ready? Let’s keep exploring.

What is PancakeSwap?

Alright, let’s kick things off by understanding PancakeSwap. If you’re into crypto, chances are you’ve already heard the buzz about this platform. But what is it, really? Let’s break it down in the simplest way possible.

A brief introduction to PancakeSwap

PancakeSwap is a decentralized exchange (DEX) built on the Binance Smart Chain (BSC). Unlike traditional exchanges (which are more like middlemen), PancakeSwap lets you trade directly with others using a system powered by smart contracts. Imagine a world where your transactions don’t depend on a central authority—that's the idea here.

Think of it as a massive hub in the world of Decentralized Finance (DeFi), offering everything from token swaps to staking platforms. Oh, and did I mention the sweet theme? Yes, PancakeSwap's branding is all about, well… pancakes.

What sets it apart from other exchanges?

So, why all the hype? There are tons of DEXs out there, but PancakeSwap stands out for a few solid reasons:

- Token Swapping: With its automated market maker (AMM) model (don’t worry, we’ll explore that soon), PancakeSwap transforms the way you trade tokens. No need for buy/sell orders or centralized oversight—just quick, smooth swaps!

- Staking and Yield Farming: Ever heard of turning tokens into money while you sleep? That’s basically what PancakeSwap’s staking and farming options do.

- NFT Integration: PancakeSwap doesn’t stop at tokens. They’ve dipped into the world of NFTs (Non-Fungible Tokens). Imagine collecting cool artwork or unique tokens—all powered by blockchain.

Some exchanges stick to the basics. PancakeSwap? It’s more like an all-you-can-eat buffet of features (pun intended).

Why is it popular in the crypto world?

PancakeSwap rose to fame for a reason. When you look at what it brings to the table, you start to see why it’s become a fan favorite:

- Ultra-low fees: Because PancakeSwap operates on Binance Smart Chain, fees are much lower compared to Ethereum-based DEXs. If you’re tired of burning through your crypto for gas fees, this is a breath of fresh air.

- Easy-to-use interface: It may be decentralized, but PancakeSwap doesn’t confuse you with tech-heavy jargon. The interface is clean and user-friendly—perfect for beginners and pros alike.

- Community-first approach: PancakeSwap runs entirely on smart contracts, meaning there’s no corporate greed or outside influence dictating its processes. It’s built by the people for the people.

Plus, let’s not forget a fun fact—PancakeSwap overtook Uniswap as the most popular DEX back in 2021, according to CoinMarketCap. That’s huge!

"In a world stuck with complexity, PancakeSwap simplifies DeFi for everyday users." – A satisfied crypto enthusiast on Reddit

But here’s the real question: does it live up to its reputation now that the crypto market is way more competitive? What’s the magic sauce—or in this case, pancake syrup—that keeps users hooked?

Well, PancakeSwap truly shines in its mechanics and how it operates behind the scenes. So, how does it all work? What’s the deal with liquidity pools, token swaps, and farming? Trust me, it’s simpler than it sounds. Ready for the real action?

How Does PancakeSwap Work?

If you're wondering how PancakeSwap operates and why everyone keeps talking about swaps, liquidity, and staking, you're in the right place. Let’s break it down in a simple way so it actually makes sense. Trust me, it’s easier than it sounds, and once you get it, you’ll see why this platform is buzzing with activity.

The Basics of Token Swapping

You’ve probably swapped something before—maybe traded baseball cards, Pokémon, or even candy as a kid. PancakeSwap does something similar, just with tokens. It’s powered by what’s known as an Automated Market Maker (AMM). Instead of matching buyers and sellers like a traditional exchange, AMMs use liquidity pools. Think of a liquidity pool as a giant, token-filled treasure chest that anyone can access.

So, when you want to swap Token A for Token B on PancakeSwap, the platform uses the liquidity pool to make that happen instantly, with algorithms automatically calculating the rates. There’s no need for a middleman or centralized authority. Cool, right?

And here’s the kicker—it’s fast and cheap. Thanks to PancakeSwap being on Binance Smart Chain (BSC), fees remain ultra-low compared to Ethereum-based swaps. Need numbers? Typically, BSC transactions cost just a few cents, versus a few dollars (or more) on Ethereum. It’s great for people who want to trade frequently without draining their funds.

“Technology simplifies the impossible until it feels like magic.” Swap tokens, earn rewards, and grow your portfolio with ease so you don’t miss out.

How Liquidity Provision Works

Here’s where things get a bit more exciting because it’s not just about swapping. You can actually earn money by providing liquidity. Sounds fancy, but it’s pretty straightforward.

Imagine you have extra tokens sitting in your wallet. Instead of leaving them idle, you can put them into a liquidity pool. For example, let’s say you have some CAKE and BNB tokens. You can pair them together and deposit them into PancakeSwap’s CAKE-BNB pool. In return, you receive LP (Liquidity Provider) tokens. These tokens are proof that you’re a liquidity provider, and they let you earn a share of the trading fees whenever someone uses your pool. Cha-ching!

- Earn trading fees: Every time someone swaps tokens using your pool, you get a slice of the small transaction fee.

- Unlock more rewards: You can usually take those LP tokens and stake them in PancakeSwap’s farms for even more rewards. Double earnings? Yes, please.

This is great for passive income, but keep in mind there's something called impermanent loss, where if token prices fluctuate too much, you might see reduced earnings. Don’t worry, I’ll discuss risks soon enough.

Staking and Earning via Farming

Oh, staking—this is like the ‘lazy rich parent’ of DeFi tools. You simply deposit your CAKE tokens (PancakeSwap’s native token) into "Syrup Pools" for staking and let them multiply on their own.

- Auto CAKE Pool: It’s exactly what it sounds like. Deposit CAKE, and it automatically re-stakes itself for you, thanks to compounding. The result? Higher rewards over time without you lifting a finger.

- Earning in Farming: Farming works a little differently. You deposit LP tokens (which we just talked about) into farming pools, earning CAKE tokens as a reward. It's one of the most popular ways for users to maximize their PancakeSwap experience.

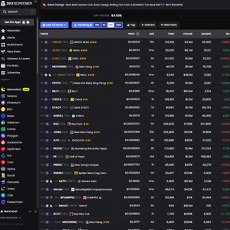

As of now, the APRs (Annual Percentage Rates) on farming and staking can be pretty high, making it attractive for those looking to grow their holdings quickly. According to data tracked on DeFi sites, some pools offer returns above 60% annually—certainly something to get excited about!

But let me keep it real with you—not all that glitters is gold. As enticing as these numbers are, you need to carefully research token pairs, market fluctuations, and your risk tolerance. A good rule of thumb? Never invest what you can’t afford to lose.

Now, is that all PancakeSwap has to offer? Not even close. But before getting into whether it’s truly the best exchange out there, let me ask you something: What do you consider essential when choosing a platform—low fees, earning potential, or safety? I’ve got plenty more to share about PancakeSwap’s upsides (and limitations) next.

Is PancakeSwap a Good Exchange?

Let’s face it—no one likes wasting time or money, especially in the fast-paced crypto world. PancakeSwap has gained a lot of attention, but is it the exchange you should trust with your tokens? Let’s explore what makes it a hit (or miss!) for users.

The Pros

What makes PancakeSwap special for so many users? Well, here are a few reasons:

- Low Costs: High gas fees are frustrating, right? PancakeSwap stands out by operating on the Binance Smart Chain (BSC), which keeps fees significantly lower compared to Ethereum-based alternatives. For instance, swapping tokens often costs just a few cents—practically a steal when compared to ETH's $15-$50 fees during peak activity.

- Multiple Ways to Earn: Got CAKE tokens? You can stake them in “Syrup Pools” or participate in yield farming to grow your holdings. Not to mention the lotteries and predictions games—users love the variety of earning opportunities here.

- Beyond Just Trading: Let’s not forget the additional features like NFTs. PancakeSwap gives you the chance to enter the NFT space with a simple interface—perfect for beginners and experienced collectors alike!

Honestly, it feels like PancakeSwap is built to engage users at every level, from the casual trader to the hardcore yield farmer.

The Cons

But hey, nothing’s perfect—there are always some risks and limitations to consider:

- Impermanent Loss: If you’re providing liquidity, beware of impermanent loss. That simply means your holdings might be worth less after swapping tokens depending on price volatility. It’s not unique to PancakeSwap but can feel like a nasty surprise if you’re not prepared.

- Decentralized, but Not Centralized: While decentralization is a huge plus for many users, it’s not for everyone. If you need advanced trading tools or fiat on-ramping features, you won’t find those here. Centralized exchanges like Binance offer those, so PancakeSwap might feel limited for traders with specific needs.

- Smart Contract Risks: While PancakeSwap has audits in place, smart contracts always come with the potential for bugs or hacks. Proceed with caution, and don’t invest more than you’re willing to lose.

As great as PancakeSwap can be, there's no getting around the trade-offs. Take a moment to weigh these factors and decide how it fits into your crypto strategy.

Real-World Usage Examples

Sometimes, the best way to understand how useful a platform is, is by seeing what others are doing with it:

- Passive Income Seekers: Take Marie from Spain, for example—she’s been staking her CAKE tokens in Syrup Pools for months and earns over 60% APY. It’s a “set it and forget it” strategy that works perfectly for her.

- New NFT Collectors: John from Canada used PancakeSwap to purchase his very first NFT. He found the low fees and simple process an ideal way to begin exploring digital collectibles without spending a fortune.

- Token Swappers: Crypto enthusiast Priya in India saves a bundle on fees by swapping tokens on PancakeSwap instead of Ethereum-based DEXs. For her, transferring cross-chain tokens quickly and cheaply is a game-changer.

These stories show how PancakeSwap fits into real lives for people around the world—and it’s just the tip of the iceberg.

"The key to choosing the right platform is understanding where it shines and where it could falter. Every decision should be an informed one."

The opportunities are endless, but is it worth the risk? So far, for many users, the benefits outweigh the downsides, but everyone’s financial goals and comfort zones are different.

Still worried about how safe PancakeSwap really is? You’re not alone—and it’s something we all think about when venturing into DeFi for the first time. But does PancakeSwap pass the safety test? Let me fill you in on that next.

Here’s how I would write that section: ---

Security: Is PancakeSwap Safe to Use?

If you’ve ever asked yourself, “Is my crypto actually safe on PancakeSwap?”—you’re definitely not alone. A platform can look flashy and promise the moon, but if security isn't solid, nothing else really matters, right?

Why PancakeSwap Is Considered Safe

The good news? PancakeSwap isn’t exactly flying blind when it comes to security. The platform has undergone multiple audits from trusted third-party firms like CertiK and SlowMist. Think of these as high-tech safety inspections for smart contracts. The goal? To sniff out vulnerabilities before hackers can.

Here’s something worth keeping in mind: Even with audits, no system is 100% immune to risks. However, PancakeSwap’s commitment to audits shows they’re serious about staying ahead of the game. That’s a huge green flag in a world where not all platforms bother investing in this level of scrutiny.

Best Practices for Staying Safe

Okay, so the platform does its part, but let’s talk about your role here. If you’re engaging with decentralized platforms like PancakeSwap, there’s a few rock-solid practices you should stick to:

- Use a hardware wallet: If you’re serious about security, pair PancakeSwap with a hardware wallet like Ledger or Trezor. This keeps your private keys offline—and safe from cyberattacks.

- Stick to official links: Yeah, this one’s huge. Scammers love spinning up fake sites and DEX links to steal your funds. Always double-check you’re on the official PancakeSwap site, or save it as a bookmark.

- Enable two-factor authentication (2FA): Got a Google account connected to your wallet? Protect it. With 2FA enabled, even if someone gets your password, they still can’t waltz into your email.

Here’s a quote worth remembering: “Safety is not a gadget, but a state of mind.” The same rule applies when navigating DeFi platforms, whether it’s PancakeSwap or any other exchange.

Common User Mistakes to Avoid

Even the best security systems won’t protect you if you’re making basic mistakes. Don’t be the person who learns the hard way—crypto mistakes can cost more than just money. Here are the biggest ones to avoid:

- Falling for phishing scams: Scammers are sneaky. They’ll send emails that look *exactly* like PancakeSwap’s—often telling you there’s an issue with your account. If you ever get a suspicious email, don’t click anything. Go directly to the trusted site through your bookmarks or manually type the URL.

- Skipping transaction checks: Every time you swap, approve, or stake tokens, double-check those transaction details. A single mistake—like sending funds to the wrong address—can mean saying goodbye to your crypto forever.

- Ignoring network fees: Sometimes users panic because transactions seem stuck. In many cases, it’s because you didn’t set the proper gas fee. Always make sure your wallet has enough BNB to cover transactions on the Binance Smart Chain.

By following these tips, you’ll save yourself a lot of stress—and potentially, a lot of money. Crypto mistakes can sting, but being informed is half the battle.

What’s Next?

Now that you’ve got a handle on PancakeSwap’s security and how to protect your funds, you might be wondering about another big question: What happens when you want to withdraw your money? Don’t worry; I’ve got a step-by-step guide on the way. Stick around, and we’ll make sure you know exactly how to take your funds out seamlessly.

Can You Withdraw from PancakeSwap? (Yes, But Here’s How)

If you're wondering, "Can I actually withdraw from PancakeSwap?" the short answer is yes. But like anything in crypto, there’s a process involved, and it’s crucial to understand what’s going on behind the scenes. So, let’s get straight to it.

Why Withdrawal Fees Exist

Here’s the thing: withdrawal fees on PancakeSwap aren’t something the platform itself charges you—but don’t breathe easy just yet. The fees you pay during withdrawals are actually blockchain transaction fees, commonly known as gas fees. This is how decentralized networks work. It’s not PancakeSwap being greedy; it’s the cost of using the Binance Smart Chain (BSC).

Gas fees can fluctuate based on network congestion. When lots of people are using the blockchain, fees can spike. It’s a good idea to check the current gas rates before making your transactions. A tool like BSC Gas Tracker can give you a heads-up.

"In crypto, understanding fees means saving yourself unexpected surprises later."

Step-by-Step Withdrawal Guide

Ready to withdraw your funds? Let me make it simple for you:

- Step 1: Open your wallet associated with PancakeSwap (popular ones like MetaMask or Trust Wallet).

- Step 2: Ensure you have enough BNB in your wallet to cover gas fees. No BNB, no withdrawal—it’s that simple.

- Step 3: Go to the PancakeSwap platform and access the Funds or Liquidity section, depending on what you're withdrawing.

- Step 4: Select the tokens or assets you want to transfer to your wallet. Double-check the token address to avoid issues with fake tokens.

- Step 5: Hit the "Withdraw" or "Unstake" option. You’ll then confirm the transaction via your wallet. This is where gas fees come in. Approve the transaction.

- Step 6: Once confirmed, funds will appear in your wallet. It typically takes just seconds to a few minutes!

Pro tip: Always keep tabs on your balance before hitting confirm. Liquidating with token values fluctuating can impact your final amount.

Troubleshooting Withdrawal Issues

Sometimes things don’t go as planned. Here’s how you can handle common withdrawal hiccups:

- Withdrawal stuck? Most often, this happens because the gas fees weren’t high enough to process the transaction quickly. Try increasing the gas fees and reattempting the transaction.

- Funds not showing up in your wallet? Double-check the token contract address in your wallet. If your wallet doesn’t automatically recognize certain tokens, you may need to manually add them.

- High gas fees? Wait it out. Network congestion slows things down during peak times—pick less busy hours (like early mornings) to save on costs.

And remember: The key to avoiding trouble is always verifying transaction details. Crypto isn't forgiving when it comes to mistakes.

What’s Next?

Now that you know how to withdraw, a question pops up—can you even use PancakeSwap if you’re in regions with stricter crypto regulations like the U.S.? Don’t worry, I’m about to tackle that. Keep reading to find out!

Is PancakeSwap Available in the USA?

Let’s talk about one of the most common questions I see about PancakeSwap: Can people in the USA actually use it? There seems to be a lot of confusion out there—and for a good reason. If you’re based in the U.S. and are eager to explore PancakeSwap, let me break it down for you.

The Current Challenge for U.S. Residents

Here’s the deal. PancakeSwap, as a decentralized exchange, is technically accessible from anywhere, including the U.S. However, the real challenge lies in acquiring CAKE tokens, which are key to unlocking many features of the platform. Why is that?

Well, it stems from certain restrictions surrounding Binance in the United States. Binance, the parent network of Binance Smart Chain (the foundation of PancakeSwap), faces regulatory hurdles in the country. As a result, directly buying CAKE tokens via Binance isn’t an option anymore for U.S. residents. Frustrating, right?

"Opportunities are never lost; someone will find a way around them."

And trust me, there are ways to work around these challenges without breaking any rules.

Creative Workarounds

So, what can you do if you’re in the U.S. and want to use PancakeSwap? Here are some clever strategies:

- Use a different platform to buy CAKE: While Binance may not be an option for U.S. users, you can still purchase CAKE tokens on other exchanges. Platforms like KuCoin or Gate.io often list CAKE and don’t have the same restrictions. Once you’ve purchased, you can transfer the tokens to your wallet to start using PancakeSwap.

- Leverage a non-custodial wallet: Wallets like MetaMask or Trust Wallet allow U.S. users to bypass the need for a centralized exchange entirely. You can connect your wallet directly to PancakeSwap and swap tokens for CAKE—or any other token—right from the platform.

- Bridge tokens: If you own tokens on a different blockchain (like Ethereum), consider using a bridge service to transfer them to Binance Smart Chain. From there, you can access PancakeSwap and participate freely.

- Peer-to-peer trading: Although less common, platforms that facilitate P2P trades allow you to buy CAKE directly from other users in the U.S., giving you access to the decentralized ecosystem without any institutional interference.

Keep in mind that each of these methods requires careful attention. For example, when transferring funds or swapping tokens, always double-check contract addresses to avoid mistakes. Also, be aware of fees, as they can vary depending on the swapping or bridging process.

One user I know shared their story about using this workaround successfully. They purchased CAKE on KuCoin, transferred it to their MetaMask wallet, and hopped onto PancakeSwap to explore staking. In their words: "It was like unlocking a treasure chest that I thought was out of reach."

If they can do it, so can you. The decentralized world isn’t locking you out—it’s just requiring a little extra creativity.

Still not sure how to get started? Don’t worry. I’ve got more resources to guide you. Ready to see where to find the best tools and tips for mastering PancakeSwap?

My resources for learning more about PancakeSwap

Alright, so you're interested in PancakeSwap and perhaps getting your hands on some CAKE tokens, maybe staking or exploring all those funky NFT options it offers. But let’s face it—sometimes, no matter how clear something seems, you just need a bit more info to feel *truly* comfortable, right?

That’s where resources come into play. Whether you need step-by-step guides, visual aids, or answers to even the tiniest questions, having the right tools can save time and keep you from making newbie mistakes. Let me show you some ways to stay ahead of the game.

Where can you find helpful PancakeSwap guides?

There are plenty of places to learn about PancakeSwap, but not all resources are created equal. Here’s a mix of my favorite go-tos for reliable info:

- PancakeSwap’s Official Docs: Their documentation is the holy grail for understanding the platform. It’s well-structured and covers practically everything, from beginner tutorials to advanced farming tips.

- Reddit Communities: Platforms like r/CryptoCurrency and even more niche threads focusing on BSC projects often have PancakeSwap discussions. Real users share experiences, tips, and sometimes solutions to issues you won’t even find in the official docs.

- YouTube Tutorials: Trust me, sometimes watching someone execute a token swap or staking process video-by-video is way better than reading a block of text. Just make sure the creator is legit and not trying to sell you some sketchy token.

- DeFi blogs and review sites: Blogs like Decrypt and CoinMarketCap’s Academy also frequently cover tools, updates, and features of PancakeSwap.

- Discord and Telegram Communities: Many DeFi projects, including PancakeSwap, maintain active social channels. You can interact with experienced users or mod teams ready to answer your questions directly.

Why are these my top picks?

Here’s the thing: If you’ve ever tried Googling random crypto queries, you’ve probably noticed that some sites are just trying to push affiliate links disguised as “reviews.” The resources I’ve mentioned above are either backed by trustworthy communities or directly come from PancakeSwap itself. The key is to stick to what’s reliable, especially in the wild, wild world of decentralized finance.

By starting with these sources, you’ll feel confident navigating PancakeSwap while reducing the chances of rookie errors or, even worse, scams.

One last tip—for now!

Remember, learning about PancakeSwap isn’t a one-time thing. New features, updates, and crypto trends pop up constantly. Keeping an eye on your favorite resources ensures you won’t fall behind.

So now I have to ask—what’s your take? Do these resources answer your biggest questions, or are you still wondering if PancakeSwap is worth using? Stick around; we’re almost at the end of this exploration, and trust me, you don’t want to miss the final thoughts in the next part!

Final Thoughts: Is PancakeSwap Worth It?

Alright, let’s wrap things up. We’ve unpacked quite a bit about PancakeSwap, from how it works to its pros and cons, and even its challenges. By now, you’re probably wondering: is it really worth your time and effort? Let me break it down for you one last time so you can walk away with a clear answer.

A Quick Recap

To keep it simple, PancakeSwap isn’t just another run-of-the-mill cryptocurrency tool. It’s a full-blown DeFi platform that offers an impressive combo of services. Want to swap tokens with low fees? PancakeSwap has you covered. Thinking about staking or farming to earn some extra? You’re in the right place for that too. Add in features like NFTs, lotteries, and liquidity pools, and you’ve got a platform that’s more versatile than many others out there.

Of course, no platform is without its challenges. The risks, like impermanent loss for liquidity providers or navigating occasional withdrawal hiccups, are worth keeping in mind. But with a little preparation and awareness, these issues are manageable for most users.

Why PancakeSwap Stands Out

So, what gives PancakeSwap the edge? For starters, its low fees are a game-changer, especially for anyone tired of paying excessive gas fees on Ethereum-based platforms. The platform does an excellent job of simplifying DeFi for both newcomers and seasoned users through its intuitive UI, while still offering advanced features for those who want to go deeper into the ecosystem (no fancy jargon needed). You get solid value without the fluff, which makes PancakeSwap so appealing to a wide range of users.

And let’s not forget, being built on the Binance Smart Chain gives PancakeSwap a unique advantage—it’s faster and cheaper compared to Ethereum-based competitors. According to a report by Binance in 2023, average transaction fees on PancakeSwap hover around $0.07. Compare that to Ethereum's $10 to $20 during high traffic, and you’ve got a clear winner for budget-conscious users.

This accessibility plays a big role in its growing popularity, as more people worldwide look for affordable yet effective decentralized options.

Should You Start Using PancakeSwap Today?

Here’s the deal, whether or not PancakeSwap is right for you depends on how comfortable you are with decentralized platforms. DeFi isn’t for everyone—it’s less hand-holding and more about being in control of your funds. But if you’re curious about exploring what’s beyond traditional cryptocurrency exchanges, PancakeSwap is a fantastic starting point.

My advice? Start small. Get a feel for its features by trying out token swaps or experimenting with staking CAKE tokens. You don’t have to jump in with your life savings—just test the waters and see if decentralized finance clicks with you. It’s a low-risk way to learn, and who knows? You might find yourself loving the flexibility PancakeSwap offers.

Ready to Give It a Shot?

The beauty of PancakeSwap lies in its versatility—it’s more than just an exchange. It’s an entire ecosystem that opens the door to so many opportunities in DeFi, whether that’s growing your assets, interacting with NFTs, or taking part in unique features like their lotteries or “Syrup Pools.” The platform is constantly evolving, and that makes it exciting to use.

If DeFi feels like where you want to be or you’re even just curious, PancakeSwap is absolutely worth checking out. Take it step by step and explore. Who knows what financial doors it could unlock for you?

Your decision, your journey—happy swapping!