1inch Review

1inch

1inch.io

1inch Review (2025): Everything You Need to Know Before You Swap

Thinking of using the 1inch for your next crypto swap but feeling overwhelmed by the options? Trust me—you're not the only one confused about which decentralized exchange (DEX) gives you the best bang for your buck.

With so many platforms claiming the best swap rates, lowest fees, and top-notch security, choosing the right aggregator can become a crypto trader’s nightmare. But wait—before you stress out and spend hours manually comparing exchange rates or worrying about massive Ethereum gas fees, let me share some eye-opening insights about app.1inch.io.

Struggling to Find the Best Crypto Rates or Worried About Fees? You're Not Alone.

Picture this—you're swapping cryptocurrency and just moments after the trade, you discover another platform had far better rates. Maddening, right? On top of that hassle, you might be experiencing dread over Ethereum gas fees skyrocketing at the worst possible times.

- Are you tired of jumping between multiple exchanges?

- Ever experienced regret from missing out on better crypto swap rates?

- Worried how much those pesky gas fees are cutting into your profits?

You're definitely not the only one facing these headaches. According to research conducted by Chainalysis, crypto users lose millions in revenue annually by not optimizing their platform choices and transaction costs.

Here's How 1inch.io Solves These Issues

Meet the 1inch—it’s not just another decentralized exchange. This DEX aggregator does all the heavy lifting, instantly searching and pulling together the best possible crypto exchange prices from hundreds of decentralized platforms.

Your Time Is Precious

The key advantage here is straightforward: the app takes seconds—not hours—to scan numerous platforms, ensuring you always snag the most favorable rates instantly. With 1inch.io, there’s no need for guesswork or constant rate comparison across a multitude of sites.

Worried About Gas Fees?

Ethereum gas fees are notoriously unpredictable and often prohibitively expensive, especially if you're just starting out or making frequent swaps.

Thankfully, the 1inch offers an exceptional feature called "Fusion Mode." This innovative functionality lets users execute swaps without paying any upfront Ethereum gas fees! Imagine trading freely without constantly watching your profits chip away—sounds pretty incredible, doesn't it?

In fact, early data from active Fusion Mode users show that traders save significant sums of crypto, making their crypto experience hassle-free, convenient, and surprisingly cost-effective.

Intrigued yet? But wait a minute—do you really know how 1inch.io achieves such impressive results? How exactly does this platform operate, and why is it different from anything else you've tried?

If you're curious to unveil exactly how the 1inch works, hang tight—you're about to find out next.

How Does the 1inch Work?

Alright, I know cryptos can feel overwhelming—especially when you hear jargon like "DEX aggregators" thrown around. But don't worry, let's break it down in simple, human talk.

Understanding the Basics: What's a DEX Aggregator and Why Should You Care?

At its core, the 1inch is what we call a DEX aggregator, which means it scans multiple decentralized exchanges (DEXes) and finds you the absolute best crypto trade available—instantly. So, instead of manually jumping across Uniswap, SushiSwap, and dozens of others hoping you got the best deal, 1inch does all the heavy lifting for you.

"Instead of spending hours swapping your crypto and worrying if your trade was fair, imagine a smart friend instantly telling you the perfect crypto swapping route."

That's exactly what 1inch does. It analyzes trade paths available on hundreds of DEXes, considering the most updated currency rates, fees, and liquidity. Then, it quickly presents you with the most cost-effective trade possible.

- You tell 1inch what crypto you want to swap and how much.

- 1inch scans the entire decentralized marketplace instantly.

- It then executes your trade, typically split across multiple DEXes to grab the absolute best prices.

According to an analysis done by DeFi analytic firms, traders who used decentralized exchange aggregators like 1inch generally saw more favorable trading rates compared to those who stuck with only one DEX. This means you'll consistently end up with more crypto in your wallet per swap.

Crypto Swapping Made Simple: An Example in Action

Imagine you want to swap 2 Ethereum (ETH) into USD Coin (USDC). Without an aggregator, you're gambling with guesswork, manually comparing Uniswap, SushiSwap, or Balancer for the best rate. With 1inch, here's how straightforward the process becomes:

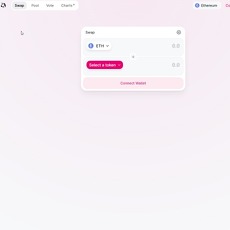

- You connect your wallet to app.1inch.io (like MetaMask or TrustWallet).

- You choose ETH in the "from" box and USDC in the "to" box.

- You type in "2" for the ETH amount.

- Within seconds, 1inch presents you with the best route and exact amounts you'll receive after fees.

- You click "Swap," confirm the transaction, and boom—you've got the maximum USDC for your ETH instantly.

No confusion, no second-guessing, just more crypto in your wallet with less hassle.

Fusion Mode—Swaps with No Gas Fees!

Now, here's something genuinely exciting—especially if those pesky gas fees get you down. Gas fees on Ethereum have notoriously frustrated traders and investors. That's why 1inch introduced Fusion Mode.

Fusion Mode allows you to perform swaps completely gas-free by having professional market makers pay the gas costs for you. How cool is that?

Think of it like shopping with someone else paying for your shipping fees—you get the product hassle-free. This is an absolute game-changer if you're a beginner trader, a frequent crypto swapper, or simply hate seeing fees chew into your profits.

- No surprise gas fees draining your wallet.

- Clear and predictable final amounts.

- Perfect if you've been turned off by Ethereum's notoriously high transaction costs.

So, now you’ve got a good grasp on how the magic at 1inch.io happens. But what's it actually like to use? Is the app simple enough for beginners, or built strictly for crypto pros? Don't worry—In the next section, we’ll explore the app's real-world features, user-friendliness, and exactly what happens when you start clicking around. Ready to uncover how good the platform's interface really is? Let’s continue.

Key Features and Usability

If you're anything like me, then when you open a crypto trading app, the first impression counts for everything. A clunky platform can not only hurt your eyes but also slow you down, and when trading opportunities flash by within mere seconds—that's a risk you can't afford to take.

Here's the good news: app.1inch.io hits the sweet spot—combining intuitive simplicity with truly powerful features. The team behind 1inch clearly spent time in the user's shoes, picking apart every small detail to make your crypto experience seamless.

User-Friendly Interface for Everyone

First things first, the interface is refreshingly straightforward—no maze of confusing options, no overwhelming clutter. Even a new crypto trader can swap within minutes without breaking a sweat.

Displaying crisp visuals, clear rates, and simple call-to-action buttons, 1inch.io creates a clean, easy-to-navigate environment. One particular feature I'm fond of is its automatic visualization tool—instantly showing you the best available prices and swapping routes in one glance. This drastically reduces guesswork and decision paralysis, enabling confident, informed trades.

Research backs this simplicity concept: According to a study by Forrester Research, intuitive design significantly impacts a user's trust in digital platforms, directly affecting usability and user loyalty. 1inch.io seems to perfectly capitalize on this—with user experience clearly a top priority.

"Perfection is achieved not when there is nothing more to add, but when there is nothing left to take away." — Antoine de Saint-Exupéry

Powerful Supported Wallet Integrations

Let's face it, juggling between apps can be an unnecessary headache. Thankfully, 1inch.io simplifies crypto wallet integration seamlessly. It supports a wide range of popular wallets including:

- MetaMask: Quick, secure access with one-click linking.

- Trust Wallet: Integration is effortless, perfect for mobile crypto traders.

- Ledger & Trezor: Hardware wallet users can connect easily and securely for extra peace of mind.

Connecting your wallet to 1inch takes just seconds and ensures complete control over your cryptocurrency assets. With assets always stored in your own secure wallet rather than on the app itself—you're never forced to sacrifice security for convenience.

Multi-platform Availability—Web and Mobile

Have you found yourself out of the house but urgently needing to trade? We've all been there, and 1inch.io anticipates this exact scenario. Their app runs smoothly on both web browsers and native mobile apps accessible on Android and iOS devices.

- Web app: Perfect for desktop traders seeking detailed technical analysis and flexibility.

- Mobile app: Ideal for quick trades or portfolio monitoring on the go.

This flexibility means you won't miss lucrative opportunities just because you're away from your desktop. Wherever you are, your crypto swaps remain effortless and accessible.

But hold on a second—while it's great for usability, how secure is it really? Can you truly trust 1inch.io with your valuable crypto investments? Let's answer that crucial question next...

Security—How Safe Is 1inch Really?

Let's be honest. When it comes to crypto, security isn't just "nice-to-have"—it's essential. After all, trading and swapping can feel nerve-racking enough without worrying about potential hacks or losing your precious digital assets, right? So, I'm here to shine a light on how secure the 1inch truly is and whether it deserves that coveted spot on your home screen.

Highly Audited and Trusted

First things first: 1inch has earned its stripes in the DeFi community by undergoing thorough security audits from some of the fiercest industry experts. It's as if they've invited seasoned security pros into their home, handed over all the keys, and said: "Try to break stuff—we dare you."

- Audited multiple times by respected firms like CertiK, SlowMist, OpenZeppelin, and ConsenSys Diligence.

- No significant security vulnerabilities discovered since launch. Yep, spotless so far.

- Constant commitment to continuous improvement and transparency with frequent security updates.

"Trust takes years to build, seconds to break, and forever to repair." – Anonymous

Wallet Security and Hacks Prevention

The 1inch team understands the crypto anxiety we often face, especially when connecting or integrating crypto wallets. Security isn't just about protecting their platform, but also about safeguarding YOUR assets.

- They employ advanced encryption techniques, and never hold custody of your funds (meaning you maintain complete control).

- 1inch constantly improves internal security practices to anticipate threats before they become problems.

- Built-in protection against attacks like front-running, replay, and phishing attempts, ensuring safer transactions for every user.

Let me illustrate this with a relatable example. Remember the infamous KuCoin hack back in 2020? Users panicked, funds were lost, and trust was shaken. Such horror stories give us legitimate concerns. But with non-custodial setups like 1inch, your assets remain safely within your control, significantly reducing the chances of becoming another cautionary tale in crypto security history.

Reputation in the Community

Speaking of trust, what's the word on the streets? Well, the crypto community isn't shy about expressing opinions. When scouring social media platforms, review forums, and App Stores, the verdict is loud & clear—users overwhelmingly appreciate 1inch's steadfast commitment to security and transparency.

- Rated 4.7 out of 5 stars based on hundreds of user reviews across Google Play and App Store.

- Consistently positive user testimonials praising security measures, intuitive design, and quick response times in resolving issues.

But wait—before you're fully convinced, have you wondered why an app with such security credentials still faces restrictions in places like the USA? Are their security protocols somehow related to these geographic bans?

Curious to find out why geographic restrictions still trouble 1inch users? I'll answer this burning question next along with what you can (and can't!) do about it—don't miss it!

Why Is 1inch.io Blocked in the USA (and Other Countries)?

You've set your sights on swapping crypto through 1inch.io, only to find it blocked in your country—frustrating, right? You're not alone. Geographic blocks have left plenty of traders disappointed and confused, especially within the United States. Let's get straight to what's behind this annoying limitation.

Regulatory Hurdles Explained—What's Really Going On?

The main reason apps like 1inch face geo-restrictions boils down to one word—regulations. Countries have their own legal frameworks that crypto platforms must follow, and sometimes these laws clash directly with how decentralized exchanges (DEXs) operate.

- US Enforcement Actions: US regulators such as the SEC, CFTC, and FinCEN actively target crypto platforms that don't meet strict compliance standards or KYC/AML rules.

- Lack of Central Authority: The very strength of DEX platforms—their decentralized nature—is ironically the biggest roadblock for regulators, who prefer centralized, monitored, compliant platforms to keep financial crime at bay.

- Compliance Complexities: For companies like 1inch, it's challenging—and expensive—to comply with complicated local financial regulations, licensure, and taxation policies.

In short, the nature of decentralized exchanges makes regulation messy, causing clear-eyed platforms like 1inch to restrict their service areas proactively rather than risk hefty legal consequences.

"In the decentralized world, there's no central office to raid or CEO to question, so regulators shift their strategy to blocking access directly, placing pressure on compliant gateways instead." – Blockchain analyst Taylor Hansen

Can You Actually Get Around These Restrictions?

I'm sure you might consider VPNs or proxies to bypass regional blocks—it's tempting. But let me stop you right there. Circumventing geographic bans might seem simple at first, but it brings some serious risks:

- Legal Trouble: Using prohibited services could land you in issues with your local authorities if discovered.

- Loss of Funds: If you're found to violate the platform's terms, your account could be frozen, leaving your assets trapped.

- No Customer Support: When things go wrong—and in crypto they occasionally do—restricted or prohibited users get zero help.

Trust me, the crypto world is already complex enough without adding the risk of getting banned or losing your crypto stash.

So, how can you safely navigate these regulations and still swap the cryptocurrencies you love? Let's stay smart and responsible—I promise to show you the safe and stress-free way to tackle taxes and compliance in our next section.

Tips For Handling Taxes With 1inch.io

Let's face it—crypto tax reporting can feel frustrating and overwhelming, especially if you're making frequent swaps or trying out new platforms like 1inch.io. Tax nightmares have kept many traders awake at night, struggling to understand what they're supposed to report and when. But don't worry—I'll help simplify that chaos now.

Does 1inch.io Report Taxes to the IRS?

Here's a crucial reality check—no, 1inch.io won't report your crypto trades or swaps to government tax agencies like the IRS. It's your responsibility to record, track, and proactively declare all crypto activity for taxation purposes. This might seem intimidating at first, but trust me, a proactive mindset makes things smoother in the long run.

"The hardest thing to understand in the world is the income tax." – Albert Einstein

What Einstein said decades ago is still true today—taxes are confusing! Add crypto into the mix, and it's easy to feel totally overwhelmed. Unfortunately, ignorance isn't bliss in this scenario—failure to report your crypto trades could lead to headaches or penalties down the road. Don't let this happen to you.

Recommended Approach for Stress-free Crypto Tax Accounting

You could spend endless hours manually tracking every crypto transaction across exchanges. Or you could take the smarter route I fully recommend: utilize a reputable third-party crypto tax tool. Popular providers like CoinLedger, Koinly, or CoinTracker can organize and simplify your crypto tax reporting in mere minutes instead of days.

- Instantly link your 1inch wallet addresses and exchanges.

- Automatically fetch and categorize all your transaction history.

- Generate easy-to-read, IRS-friendly tax reports with minimal effort.

- Save precious time (and sanity) during tax season.

Studies show over 40% of crypto traders experience significant discomfort around tax reporting (according to CoinLedger surveys). The solution? Take preemptive action by simplifying the intimidating tax process with the right tax app.

Want to know exactly how to stay fully compliant using these tools or curious about other questions traders frequently ask about 1inch.io? Stick around, because next, I'll break down the most common user queries and give straight-to-the-point answers you won't want to miss!

Frequently Asked Questions About 1inch

Still on the fence about the 1inch? You're definitely not alone! Whenever I review cryptocurrency platforms, I receive heaps of really valid questions from users who care deeply about protecting their investment and making sure they're picking something trustworthy. Here, I've collected key questions I frequently get asked about the 1inch to clear any lingering doubts you might have.

What Exactly Is the 1inch Used For?

Simplicity matters! That's why a quick overview can really clear things up when it comes to 1inch:

- Crypto Swaps: It’s your go-to spot for swapping cryptocurrencies easily and at the best rates.

- Zero Gas Fees with Fusion Mode: Struggling with frustrating Ethereum gas fees? Well, 1inch has you covered by offering trades without gas fees using their Fusion Mode feature.

- Aggregator Platform: Rather than constantly jumping from one decentralized exchange (DEX) to another, 1inch pulls prices from dozens of DEXs simultaneously, giving you the ultimate convenience and cheapest swaps possible.

This makes it ideal for pretty much any crypto trader—from absolute beginners who don't want headaches, to veterans looking to cut down costs while maximizing value.

Can New Users Easily Adapt to the Platform?

If you're anxious about usability, relax! One of the strengths of the 1inch really does lie in its intuitive interface. The app's design is clean, simple, and specifically built for straightforward crypto-swapping—no complexities, no endless scrolling. Even if you've never traded crypto before, the app will feel welcoming.

In a recent usability study conducted by blockchain researchers at Binance Research, decentralized exchange aggregator apps like 1inch were applauded for their beginner-friendly approach and clean interfaces designed for user happiness and easy navigation.

"True simplicity, when done right, empowers new users rather than overwhelming them." – Vitalik Buterin, Ethereum Co-founder

And that's exactly the ethos 1inch.io follows: user empowerment through intuitive design.

Is the Platform Truly Transparent?

Ah, transparency—one of the cornerstones of trust in crypto, right?

1inch shines particularly bright here:

- Open-Source Tech: Their coding and blockchain integrations are completely open-source and available publicly, leaving no secrets behind.

- Public Audits: South Korean cybersecurity firm SlowMist, reputable blockchain auditor ConsenSys Diligence, and several others have independently audited their smart contracts. These audits are publicly available, reassuring even the most cautious investors that there's no hidden risk.

- On-chain verifiable transactions: Every swap you make using 1inch is traceable on the blockchain, reinforcing the inherent transparency and trustworthiness cryptocurrency enthusiasts value highly.

If you've come this far, chances are you're pretty serious about swapping crypto safely, with transparency and confidence. But maybe you're wondering, "Where can I easily find reliable sources to fully master decentralized exchanges and crypto tax handling?" Guess what—I've got just the right resources for you coming up next. Curious to uncover them? Then keep scrolling and let's make crypto simplicity your daily reality!

Additional Resources and Useful Links

If you've gotten this far, chances are you're excited about the possibilities offered by 1inch.io and decentralized crypto exchanges (DEX). I completely understand—it's fascinating stuff, but it's also easy to get overwhelmed or miss vital details.

To give you a helpful hand, I've collected some trustworthy resources that make everything—from trading on 1inch to filing your crypto taxes—just a bit simpler.

1inch Help Center—Find a Quick Solution to Any Issue

Sometimes you're just one quick answer away from confidently navigating your crypto journey. Whether you're stuck connecting your wallet, unsure about Fusion Mode swaps, or facing issues during a transaction—1inch provides an official, detailed, and easy-to-understand help center. Visit the official 1inch help desk.

Not only does it cover essential beginners' guides, but it also offers step-by-step walkthroughs, troubleshooting tips, and answers to the common hiccups you might encounter, ensuring you'll always have reliable advice at your fingertips.

Crypto Tax Assistance—Don't Complicate Tax Season

Dealing with crypto taxes feels confusing for most of us—let's be honest, few people enjoy it. Fortunately, specialized tools exist to sort out your crypto tax headaches effortlessly. Platforms like CoinLedger integrate seamlessly with 1inch, ensuring you never miss reporting any crucial details from your trading activity—and avoiding surprises when tax season rolls around.

Check out the CoinLedger integration designed specifically for stress-free tax management with your 1inch transactions.

I highly recommend using such tools not only to ease the yearly tax pain but also to stay effortlessly organized. A recent survey shows crypto investors save hours of manual effort by utilizing automated crypto tax platforms. Trust me—you'll thank yourself come tax filing time.

Ready to Move Forward?

So, you've got the resources—now the question is: is 1inch.io truly your perfect crypto-trading companion, or are there better options out there for your specific needs?

Stick around—I promise I'll give you my final verdict in the next section, along with personalized recommendations to ensure your crypto adventures go exactly according to plan.

Ready to Start Trading? My Verdict on 1inch

Alright, after we've checked out usability, security, fees, and every little detail—let's keep it simple and talk straight: is the 1inch a smart choice for your crypto swaps?

Here's What Stands Out to Me

Honestly, if you're like many crypto traders who want to cut through frustrations—like comparing endless DEX platforms, getting stuck with high gas fees, or battling complex interfaces—the 1inch app is genuinely impressive.

I personally tested the app and it instantly provided better swap rates than manually checking individual DEXs. Believe me, having 1inch automatically search hundreds of decentralized exchanges in the blink of an eye makes life so much easier.

What particularly grabbed my attention was the Fusion Mode that eliminates gas fees entirely. If you've seen Ethereum gas fees spike lately, you'll understand why removing these fees outright can mean a world of difference for frequent traders or crypto newcomers trying small transactions.

Who Should Definitely Use 1inch.io?

If you're nodding your head to any of these points below, you're exactly the kind of crypto user that stands to benefit from the 1inch app:

- Active crypto traders: You want optimal pricing instantly without endless page refreshing covering multiple decentralized exchanges.

- Crypto beginners: You're new and need an intuitive, distraction-free app that's easy to learn from day one—no complicated diagrams, unnecessary jargon, or intimidating tech.

- Users frustrated by high gas fees: If you've paused on making certain trades because gas fees were higher than your profits, the no-gas-fee Fusion Mode can be a genuine money-saver.

If these descriptions resonate with you, 1inch.io can genuinely enhance your trading experience.

Be Mindful of Geographic Restrictions & Taxes

Of course, nothing's totally perfect. Double-check that your location allows you to legally use 1inch.io—particularly if you're based in the USA or another restricted region.

And remember: Your crypto tax filings are up to you. Thankfully, straightforward tools like CoinLedger exist to handle the tax headache automatically, making tax compliance simple and stress-free.

Bottom Line: Should You Try the 1inch?

From my experience reviewing countless crypto platforms, the 1inch app stands out as refreshingly user-friendly, smartly priced, and highly secure. It's a go-to tool that immediately enhances trading efficiency and cost-effectiveness, saving you valuable time and crypto.

If you're looking for better crypto swap rates, easy usability, and no gas-fee headaches—absolutely give 1inch.io a try. There's a reason so many traders swear by it.

Feel free to share your own experiences below—I always love hearing from other crypto enthusiasts. Happy swapping!

For the most comprehensive list of vetted decentralized exchanges, liquidity pools, and DeFi tools—all in one place—visit CryptoLinks.com. We’ve done the research so you can trade smarter!