Top 25 Most Profitable Cryptocurrencies

In the last decade, we have come to embrace the viability of Bitcoin as an investment instrument. The sheer disparity between the price of Bitcoin in its early stage of existence and its current valuation is indicative of the massive profit-generating capacity of the digital asset. As such, it comes as no surprise that investors are increasingly adopting Bitcoin as their reserve asset.

However, there is more to the crypto movement than just Bitcoin. There is a horde of other profitable cryptocurrencies out there that are equally profitable. To shed more light on this, we have decided to highlight the top 25 cryptocurrencies with the highest ROI. Here, we will explore the digital assets that have generated the highest returns to early investors. But first, let us discuss factors that contribute to the long-term viability of crypto assets.

What Makes Digital Assets Profitable?

Using Bitcoin as a case study, it is clear that quality digital assets tend to increase in valuation over the years. What separates Bitcoin and other high performing cryptocurrencies from those that have faded away is that the successful ones possess real-world utilities that resonate with consumers. As an investor, the goal is not to indiscriminately invest in crypto projects so long they incorporate blockchain infrastructures and functionalities. Instead, successful crypto investors often seek out quality assets with the potential of contributing immensely to the crypto movement. It is such digital assets that tend to generate the highest return in the long run.

In other words, it is advisable for intending investors to opt for quality projects by ascertaining their long-term viability. This task may entail thorough analysis to understand the scope of crypto projects, the application of their digital assets, the industry they target, and their propensity for short-term or long-term price gains. It becomes easy to handpick the most viable cryptocurrencies the moment your analysis covers all these caveats. This brings us to the next section, which discusses the second most vital factor to consider when searching for crypto investment with remarkable returns.

Crypto Hodling Is the Appropriate Strategy

The validation of this article’s pursuit to determine the most profitable cryptocurrencies rests on the assumption that some investors are still holding on to the stash accrued at the early phases of crypto projects. For instance, we assumed that there are individuals who continue to hold Bitcoin purchased when the digital asset was still selling below the $1 price range. The sheer size of profits generated over the years exemplifies the investment power of high performing cryptocurrencies, including Bitcoin. Hence, bearing in mind the price disparities of some crypto assets today and what they sold for when they launched, it is clear that a long-term strategy remains the best way to approach crypto investments.

This notion is evident in the list of digital assets curated below. The highest yielding digital assets, as seen above, have existed for a year or more. The only exception is Yearn.Finance, which only came on board this year.

How Did We Compile This List?

To ensure that this guide reflects the investment viability of cryptocurrencies accurately, we decided to estimate the return-on-investment ROI by factoring in the initial cost of investing in each token and its current market price. Also, note that we have limited our search to the top 200 cryptocurrencies as ranked by Coinmarketcap. Without further ado, here are the top 25 most profitable cryptocurrencies in the digital asset market.

The Challenge of Spotting High-Return Cryptocurrencies

The crypto market is flooded with thousands of coins and tokens, each promising to be the next big thing. This overwhelming number makes it tough to sift through and identify which ones might truly take off. Investors often find themselves drowning in information, unsure of where to place their bets.

Adding to the complexity is the hype surrounding new projects. It’s difficult to separate genuine potential from fleeting trends. The fear of missing out on life-changing gains is real, especially when hearing stories of overnight millionaires. But with so many options, how do you pinpoint the ones with massive profit potential?

Revealing the Top 25 Most Profitable Cryptocurrencies

To help navigate this vast landscape, I’ve put together a ranked list of the top 25 most profitable cryptocurrencies by percentage gain. Starting from 25 down to the ultimate profit leader, this list aims to shed light on coins that have truly made their mark. Whether you’re an investor or just curious, understanding these success stories can be a valuable tool.

Why This List Matters to You

Learning from past successes can offer invaluable insights. By examining the factors that propelled these cryptocurrencies to incredible heights, we can glean lessons for future investment decisions. Historical data isn’t just numbers; it’s a roadmap showing how market dynamics, technology, and timing intersected to create explosive growth.

Ready to discover which coins made the cut and why they soared? The answers might surprise you and could even guide your next move in the crypto world.

Rankings #25 to #22: Unearthing Hidden Gems

When we think about profitable cryptocurrencies, it’s easy to focus on the big names. But sometimes, it’s the hidden gems that quietly make significant waves in the market. These are the stories that spark excitement and make us wonder, “What if I had found this coin sooner?” Let’s take a look at the cryptocurrencies ranked from 25 to 22, which, despite being lesser-known, have offered impressive returns to their investors.

#25: VeChain (VET)

VeChain started as a blockchain project aimed at enhancing supply chain management and business processes. Launched in 2015, VeChain has worked towards bridging the gap between blockchain technology and the real economy. From its inception to its peak, VeChain saw a total percentage gain of over 6,000%.

Several factors contributed to VeChain’s profitability:

- Strong Partnerships: Collaborations with renowned companies like PwC and BMW boosted investor confidence.

- Real-World Use Cases: VeChain’s practical applications in tracking goods and preventing counterfeits appealed to businesses.

VeChain made its market debut in 2015, aiming to revolutionize supply chain management through blockchain technology. Its adoption rate soared as businesses recognized the value of transparent and tamper-proof tracking systems. With strong community backing and continuous developer support, VeChain formed partnerships with giants like BMW and Walmart China. These collaborations boosted confidence among investors, contributing to its steady ascent.

#24: Golem (GLM)

Golem is an innovative platform that aims to create a decentralized supercomputer. By allowing users to rent out their computing power, it taps into unused resources globally. Since its launch in 2016, Golem experienced a remarkable percentage gain of around 8,000% at its peak.

Significant milestones impacting its price include:

- Mainnet Launch: The release of the mainnet signaled a functional product, attracting more investors.

- Increasing Demand for Computing Power: As industries seek more computational resources, Golem’s solution became more attractive.

#23: Basic Attention Token (BAT)

BAT is the native token of the Brave browser, designed to revolutionize digital advertising by rewarding users for their attention while protecting their privacy. Launched in 2017, BAT’s unique approach set it apart from other cryptocurrencies. It achieved a total percentage gain of over 9,000%.

Market events that led to its substantial gains include:

- User Adoption: The growing user base of the Brave browser increased demand for BAT tokens.

- Advertising Partnerships: Collaborations with advertisers willing to embrace privacy-centric models boosted BAT’s utility.

#22: Nano (NANO)

Nano, formerly known as RaiBlocks, is a cryptocurrency focused on delivering instant transactions with zero fees. Its innovative block-lattice architecture offers scalability and efficiency. From its launch in 2015 to its peak, Nano achieved a staggering percentage gain of approximately 12,000%.

Reasons behind its profitability include:

- Technological Advancements: Nano’s unique technology addressed scalability issues prevalent in other cryptocurrencies.

- Community Support: A passionate community helped promote Nano’s benefits across social platforms.

- Notable Partnerships: Endorsements and integrations with exchanges increased its visibility.

Nano is another lightweight version of Bitcoin that focuses on simplifying and speeding up transaction processes. To achieve this, the network opted for an alternative design to the commonly used blockchain architecture. Here, the infrastructure relies on a distributed ledger-modeled system, called Directed Acyclic Graph (DAG), which offers a faster, cheaper, and energy-efficient transaction validation process. As such, Nano does not require mining but instead utilizes a voting mechanism called Open Representative Voting (ORV). This approach entails network participants to vote for representatives that take up the role of validators. Since these representatives are not rewarded for their contributions, all transactions executed on the Nano network are free.

Remarkably, NANO, originally called XRB, launched in 2015 via a public faucet, which rewarded individuals with tokens for completing a captcha challenge. Although this shows that early investors got NANO for free, we adopted Coinmarketcap’s historical price data to determine the returns generated over the years.

These hidden gems show that with innovation and community backing, even lesser-known cryptocurrencies can offer impressive returns. It makes you think, doesn’t it? If these coins delivered such gains, what about those that have shown consistent growth over time?

Rankings #21 to #18: The Steadfast Performers

As we continue exploring the most profitable cryptocurrencies in history, I want to shine a light on the steadfast performers. These are the coins that have shown consistent growth over time, steadily climbing the ranks and leaving a lasting impact on the crypto world. They might not always grab the headlines, but their contributions are undeniable.

#21: Litecoin (LTC)

Tagged the silver to Bitcoin’s gold, Litecoin is one of the earliest versions of Bitcoin that strived to improve on the performance of the original cryptocurrency protocol. The goal was to deliver faster transactions and scalable infrastructures. Like Bitcoin, Litecoin has become a popular crypto payment method even as major merchant crypto sites continue to integrate its network. However, unlike Bitcoin, it uses a consensus mechanism, called Scrypt Proof of Work mining algorithm, which allows users to mine with GPU and CPUs.

Due to Litecoin’s knack for innovation, the price has trailed Bitcoin’s success and delivered impressive returns to early investors. For a more detailed analysis, we estimated the ROI to be around 2,635% since the initial cost for investing in 1 unit of Litecoin was $4.30, and the current price is $117.

#20: NEO (NEO)

NEO, often dubbed the “Chinese Ethereum,” introduced innovative solutions for creating decentralized applications. Its focus on smart contracts and digital assets set it apart, attracting significant investor interest. By offering cutting-edge technology that catered to developers and entrepreneurs, NEO carved out a substantial market share. This approach resonated with those looking for scalability and efficiency, fueling its growth.

NEO has delivered mouth-watering returns to investors who were wise enough to bet on the offering as far back as 2014 when it was still known as Antshares. Neo describes itself as an ecosystem where digitized payments, identities, and assets converge. The network, commonly tagged as the Chinese version of Ethereum, offers smart contract infrastructure for decentralized applications and looks to become the acceptable template for future internet architectures.

NEO is a pre-mined digital asset with a maximum supply of 100 million coins. Of this total supply, 75 million NEO is already in circulation. We estimated the ROI of NEO to be 57,000% if early investors who had bought it at the original ICO price of $0.032 sell at the current market value of $17.50. Note that those who sold their NEO stash at the peak price of $196 of January 2018 would have generated over 600,000% ROI.

#19: Monero (XMR)

Entering the crypto scene in 2014, Monero prioritized privacy and security above all. Its journey has been marked by a commitment to anonymous transactions, appealing to users who value confidentiality. Key events like the implementation of Ring Confidential Transactions (RingCT) enhanced its privacy features, sparking increases in its price. Monero’s dedicated community has played a pivotal role in its ongoing development and success.

Like Verge and Dash, Monero focuses on enabling anonymity and facilitating privacy-enhanced transactions. To this end, the network uses advanced cryptography to obscure the identities of recipients and senders. It is worth mentioning that in 2014 Monero forked from an existing blockchain network named Bytecoin. And unlike the majority of other privacy-focused coins, it sets its privacy-feature as default. In other words, all transactions executed on the platform automatically evokes the identity protection feature of the network.

A majority of competing networks are selectively transparent as users may or may not choose to implement the obfuscation protocol. One more unique advantage that Monero has is the decision to ensure that mining is democratized, unlike what we have in the Bitcoin network. Mining on the Monero blockchain does not require any specialized equipment. At the time of writing, there are over 17.7 million XMR priced at $156.36 in circulation. Individuals who invested when the coin was selling for $1.49 in May 2014 have accrued 10,390% ROI in the long run.

#18: Stellar (XLM)

Stellar set out to connect financial institutions with blockchain technology, focusing on fast and affordable cross-border transactions. Its unique selling point of facilitating seamless international payments attracted attention during times when global remittances were on the rise. Market conditions that emphasized the need for efficient payment solutions contributed to Stellar’s rise in profitability and market presence.

When Stellar launched in 2014, the core goal of this offering was to create a global payment and asset storage system for the unbanked. Soon afterward, the network reinvented itself as a blockchain bridging infrastructure for inter-bank transactions. With its native coin, Lumen (XLM), Stellar provides fast and cheap cross border payments. These functionalities are similar to what XRP offers since Stellar was originally a fork of the Ripple Protocol before the development team rewrote the code. Per the notion of core contributors, Stellar creates a functioning convergence point between fiat currencies and digital assets, as it aims to allow fluid conversion between the two commodities.

There are over 20 billion Lumens in circulation, which is about half of the maximum supply. Owing to the quality of Stellar, the price of XLM has surged to $0.182249 from an initial cost of $0.0031 in August 2014. We estimated the ROI to be nothing below 5,500%.

These steadfast performers remind me that consistent effort and innovation often pave the way to success. They’ve steadily built their foundations and continue to influence the crypto landscape in meaningful ways. But the journey doesn’t end here. Ever wondered which cryptocurrencies are making significant leaps and rapidly climbing the ranks? In the next part, we’ll meet the rising stars that are turning heads and shaking up the market. Trust me, you won’t want to miss it!

Rankings #17 to #14: The Rising Stars

As we continue our journey through the most profitable cryptocurrencies in history, let’s take a look at the rising stars that have made remarkable leaps in profitability. These coins didn’t just make waves; they shaped currents that influenced the broader market.

#17: Chainlink (LINK)

Chainlink burst onto the scene with a mission to bridge the gap between blockchain smart contracts and real-world data. Its technology allows smart contracts to securely interact with external data sources, APIs, and payment systems—a game-changer for decentralized applications.

Chainlink caught my eye with its clever solution to a big problem: connecting blockchain smart contracts with real-world data. Their strategic partnerships with industry leaders like Google Cloud and Oracle gave them a significant boost. During the DeFi boom in 2020, LINK’s market performance was outstanding, hitting new highs and rewarding early believers.

Chainlink thrives because it functions like a tokenized oracle network poised to eliminate the siloed nature of blockchain networks and smart contracts. Therefore, Chainlink connects smart contracts with offline or real-world entities. Think of it as the bridge between contracts and real-world applications. In essence, it has become one of the platforms that benefited from the explosiveness of the decentralized finance landscape that solely relies on smart contracts for the execution of financial processes. With Chainlink Oracle, smart contracts can track off-chain parameters, like temperature, price, and time, for smooth operations as soon as parties meet the predefined terms of contrasts. The network distributes LINK tokens to node operators who provide accurate data to requesting contracts.

Chainlink held its ICO in September 2017 and raised $32 million. Each token valued at $0.19 during the ICO sale now costs $13 today. Hence, early investors have now recorded a remarkable 8,000% ROI in 3 years.

Investor sentiment around Chainlink has been overwhelmingly positive. Media coverage highlighted its innovative approach, and partnerships with tech giants like Google only fueled the excitement. The buzz wasn’t just hype; it translated into substantial growth, catapulting LINK into the portfolios of savvy investors.

#16: Polkadot (DOT)

Polkadot set out with an ambitious development roadmap: to enable a completely decentralized web where users are in control. Its unique multi-chain framework allows for interoperability between different blockchains, tackling one of the most pressing challenges in the crypto space.

From the get-go, Polkadot exceeded expectations. As milestones were hit, such as the launch of parachains, the community’s confidence soared. The team’s consistent delivery on their promises kept investor interest high, and DOT’s price reflected this steady ascent.

#15: Solana (SOL)

Solana entered the market touting high-speed transactions and low fees, positioning itself as one of the fastest blockchains out there. Its competitive advantages lie in its scalability and efficiency, addressing problems that have plagued other networks.

But the journey wasn’t without challenges. Network outages and scalability tests pushed Solana to its limits. Yet, each obstacle was met with swift solutions, reinforcing investor trust. This resilience paid off, with SOL achieving significant gains and solidifying its place among the top performers.

#14: Stratis STRAX

Stratis is a blockchain-as-a-service platform that offers enterprise end-to-end solutions for the development, testing, and deployment of their blockchain solutions. Launched in 2016, Stratis provides an enabling environment for the development, maintenance, and running of permissioned and decentralized blockchain infrastructures. The goal is to make the processes involved in the creation and maintenance of blockchains as seamless as possible. To this end, the network permits entities to launch their projects on sidechains that interact with its core chain and native token, STRAT.

While this functionality propelled the project to stardom, Stratis further introduced a new blockchain with added features that expand the scope of its ecosystem. Subsequently, the platform has reinvented its tokenomics by deploying STRAX as the native token of its ecosystem. Starting from October 2020, Stratis implemented a token exchange process that allows STRAT holders to swap their tokens for the newly introduced STRAX coin at a one-to-one ratio. According to Cointelegraph, each STRAT token had an initial price of $0.007 when it launched. And judging by the current valuation of STRAX, the project has generated an 8,600% ROI for early investors.

Rankings #13 to #10: Breaking into the Big League

We’re getting to the really interesting part now. These are the coins that moved from obscurity to prominence, capturing the crypto community’s attention in remarkable ways. They show how innovative ideas can turn underdogs into major players.

#13: Ripple Coin (XRP)

XRP has one of the most controversial crypto architectures, but that has not stopped it from emerging as the third most popular digital asset with a $25 billion market size. Some argue that the payment platform possesses elements of centralization that are in contrast to the fundamentals of cryptocurrency. While this has remained a bone of contention, XRP has since emerged as a unique blend of fast, scalable, and affordable payment infrastructures. XRP looks to develop a viable replacement for established but inefficient digital asset networks and traditional remittance systems alike. Like many of the projects mentioned so far, XRP did not incorporate blockchain as its underlying technology. In contrast, it adopted a distributed ledger makeup that is void of cumbersome, expensive, or energy-consuming consensus mechanisms. Here, assigned validators, including financial institutions and universities, ascertain the validity of transactions.

Since XRP launched, it has enjoyed a significant following that has propelled both the value and market size to record-breaking status. According to Coinmarketcap, the price of 1 XRP was $0.005 in August 2013. Investors who had cashed in on this opportunity would have generated around 10,000% ROI.

#12: IOTA (MIOTA)

IOTA, stylized from the word “Internet of Things,” is not a blockchain platform per se. Instead, it uses a proprietary infrastructure called Tangle to solve scalability issues. Tangle looks to establish a payment model compatible with the ultra-fast IoT technology by implementing a network of nodes to confirm the validity of transactions. As a result of this architecture, IOTA neither supports mining activities nor does it impose fees on users. The core goal is to enable a seamless payment network for smart devices purported to be the template for present and future technology designs.

The ICO campaign of IOTA, which was held in 2015, was a critical success. Investors reportedly bought all the 1 billion tokens put up for sale at $0.001 each. Considering the initial cost for investing in 1 MIOTA, we estimated the ROI generated over the years to be around 33,000%. The viability of this token as an investment vehicle and the uniqueness of the project’s scope have positioned IOTA as the 32nd most valuable digital asset network in the crypto industry.

#11: Tezos (XTZ)

Tezos stood out with its self-amending blockchain, allowing upgrades without disruptive forks. Its adoption by businesses and platforms, especially for security token offerings, showcased its practical use cases. The strong community support and active engagement have been key factors in XTZ’s impressive journey.

#10: Dash (DASH)

Like Neo, Dash is focusing on improving on Bitcoin by fostering privacy-enhanced features and faster transactions. Dash launched as a fork of Litecoin in 2014, and ever since, it has gone to reinvent its operations by introducing unique features that provide more flexibility to users. Following these implementations, participants now have access to privacy-enabled transactions, a two-layered network that incentivizes nodes, a security integration that establishes the immutability of Dash blockchain, and so on.

The cryptocurrency’s market cap is slightly over $1 billion, making it the 27th most valuable digital asset network in the world. While using data showing $0.0257 as the original price and $106 as the current value of DASH, we estimated that the cryptocurrency has a 40,000% ROI. As expected, this comes nothing close to the revenue generated when the price of DASH peaked at $1,642 in December 2017.

These stories just go to show how dynamic and unpredictable the crypto world can be. As the saying goes, “Fortune favors the bold.” And speaking of bold moves, the next set of rankings features the heavy hitters who’ve not only grown enormously but have also pioneered groundbreaking applications in blockchain technology. You won’t want to miss what’s coming up next.

Rankings #9 to #6: The Titans of Growth

“The ones who are crazy enough to think they can change the world are the ones who do.” — Steve Jobs

Now we’re stepping into the realm of the heavy hitters—the Titans of Growth. These cryptocurrencies didn’t just rise; they soared, delivering massive percentage gains that left early investors astounded. They’ve not only rewarded their backers but also played pivotal roles in pioneering blockchain applications that have shaped the crypto world as we know it.

#9: NEM (XEM)

NEM, which stands for New Economy Movement, brought something unique to the table with its Proof-of-Importance consensus mechanism. Unlike other consensus algorithms, NEM’s approach considered the amount of coins held and the number of transactions made, promoting active participation within its network.

This technology solved a significant market problem by enhancing scalability and security without compromising on decentralization. By introducing features like multi-signature accounts and encrypted messaging at the blockchain protocol level, NEM appealed to both individual users and enterprise solutions, driving its remarkable growth.

#8: Yearn.Finance

Yearn.Finance is one of the most promising additions to the crypto market in 2020. The protocol presents aggregating tools for a network of investors interested in participating seamlessly in the yield farming Landscape of DeFi. Yearn.Finance simplifies yield farming to a broader investor sector. By doing so, it has become the de facto DeFi portal for entities and individuals looking to capitalize on the opportunities available on platforms like Curve, Compound, and Aave. For its operation, Yearn.Finance provides advanced aggregating tools to generate the highest possible yields. For its troubles, the protocol charges withdrawal fees and gas subsidization fees.

Introduced in August of 2020, Yearn.Finance’s native token, YFI, has performed impressively so far. According to the Coinspeaker, the token debuted at $32. Its current price is $27,777, which exemplifies the viability of the project since it went live. Using this data, we estimated the ROI to be 70,000%.

#7: Verge (XVG)

Originally named Dogecoindark, Verge is another project that delivered one of the most profitable digital assets ever. Its native coin, XVG, has generated 89,175% ROI since it launched in 2014 as a fork of Peercoin. The mineable digital asset functions like Bitcoin, albeit with added privacy-focused applications. The founder of Verge, Justin Valo, designed the network to enable a series of privacy-enhanced features including, routing of transactions on the VergePay wallet through the Tor network. Other functionalities include dual-key stealth addresses, which allow senders to create temporal addresses for recipients, and trustless peer-to-peer transactions across multiple blockchains.

The price of XVG is currently hovering around the $0.007220 range, while its market cap is just above the $118,000,000 mark. The asset registered its peak price in December 2017 when 1 XVG sold for $0.3.

#6: Ethereum (ETH)

Second on our list of the most profitable cryptocurrencies is Ethereum, with around 212,000% ROI generated as at the time of writing. Ethereum, in its 5 years of existence, has proven beyond any reasonable doubt that it is as viable as Bitcoin as an investment vehicle. Much of Ethereum’s viability stems from its ability to power programmable decentralized applications called dapps. More recently, it has emerged as the hub for the critically acclaimed DeFi market. The level of innovation that Ethereum powers has often played a decisive role in the growing demand for crypto assets. For instance, let us consider the highly documented bull run of 2017. Experts believe that the influx of decentralized applications and Initial coin offerings (ICO) helped propel the prices of crypto assets to new highs.

At the peak of this bull cycle, the price of ETH rose to $1,400, which still stands as the record. Early investors who had the foresight to cash out at this point would have generated a whopping 450,000% ROI. Note that we consider early investors as individuals or entities who had bought Ethereum for $0.311 during its ICO campaign in 2014.

As we reflect on these titans of growth, it’s clear that innovation, adaptability, and community support are key drivers of success in the crypto world. But the journey doesn’t end here. Ever wondered what it takes for a cryptocurrency to leap from impressive gains to staggering returns? We’re about to uncover the giants of profitability that reshaped investor expectations.

Rankings #5 to #3: The Giants of Profitability

You know that feeling when you spot something big before everyone else does? That’s exactly what happened with these next cryptocurrencies. They didn’t just offer impressive returns—they completely reshaped how we think about crypto investments. Let’s explore these giants that took profitability to a whole new level.

#5: Cardano (ADA)

When Cardano launched in 2017, it was priced at around $0.02. Fast forward to its peak, and it soared above $3.10. That’s a staggering return of over 15,000%! So, what fueled this astronomical growth?

Cardano was built with a scientific philosophy and a research-first driven approach. Founded by Charles Hoskinson, one of Ethereum’s co-founders, Cardano aimed to create a more secure and scalable platform for smart contracts. Its commitment to peer-reviewed academic research gave investors confidence in its long-term potential.

Market trends also played a part. As the crypto community began seeking more energy-efficient alternatives, Cardano’s proof-of-stake mechanism positioned it as a sustainable option compared to traditional proof-of-work systems. This alignment with global sustainability goals attracted a wave of eco-conscious investors.

#4: Binance Coin (BNB)

Ever heard the saying, “Success usually comes to those who are too busy to be looking for it.” That’s BNB in a nutshell. Launched in 2017 at around $0.10, BNB reached an all-time high of nearly $690. That’s an eye-popping return exceeding 689,000%!

BNB’s success is closely tied to the meteoric rise of the Binance exchange. As the native token of the Binance ecosystem, BNB offered users benefits like discounted trading fees and access to exclusive offerings. This utility created a strong demand for the token as Binance grew to become one of the world’s largest crypto exchanges.

Binance Coin is one of the many exchange cryptocurrencies we have today. The BNB ICO crowdsale kicked off 11 days before the official launch of Binance Exchange in 2017. It is worth mentioning that BNB was initially an ERC-20 token (or Ethereum-based coin). However, after the Binance Chain went live in 2019, all existing Ethereum-based BNBs were swapped for the current BEP2 modeled BNB, which is native to the Binance blockchain. As it is with all major exchange cryptocurrencies, BNB functions as the economic anchor for the Binance ecosystem. In other words, it is the primary means of settling fees on the platform and the portal to access various token sale campaigns on Binance Launchpad.

The introduction of Binance Smart Chain (BSC) was another game-changer. BSC enabled smart contracts and decentralized applications, turning BNB into a key asset in the booming DeFi space. This expansion into decentralized services significantly boosted investor interest and drove up the token’s value.

#3: Dogecoin (DOGE)

If there’s a crypto that embodies the phrase “from meme to mainstream,” it’s Dogecoin. Starting as a joke in 2013 with a price so low it’s hard to quantify, DOGE skyrocketed to about $0.74 in 2021. That’s a mind-blowing increase of over 300,000%!

Dogecoin‘s rise is anything but typical. It gained popularity through internet culture and social media buzz, capturing the hearts of a community that values fun and generosity. High-profile endorsements, especially from Elon Musk, catapulted DOGE into the spotlight. His tweets often sent the price soaring, showcasing the power of social influence in the crypto market.

The coin also benefited from the surge of retail investors entering the market via platforms like Robinhood. The accessibility and low price point of DOGE made it an attractive entry point for newcomers looking to get into crypto trading without significant investment.

As for the future, Dogecoin continues to surprise us. There’s ongoing development to improve its technology, and discussions about more real-world use cases are heating up. Whether it will maintain its momentum is uncertain, but one thing’s for sure—Dogecoin has left an indelible mark on the crypto world.

What started as a joke quickly turned into a global phenomenon. Early adopters shared stories of unexpected windfalls, as Dogecoin’s value skyrocketed seemingly overnight. Its influence in the niche market of meme coins can’t be overstated.

Dogecoin’s rise was fueled by a combination of internet culture and high-profile endorsements. Its community is one of the most vibrant and dedicated, often rallying around charitable causes. The coin’s journey is a testament to the unpredictable nature of crypto markets, reminding us all that sometimes, it’s about more than just technology.

“In the world of cryptocurrency, those who dare to dream can sometimes change the world—or at least, the market.”

Feeling inspired by these rising stars? If you’re curious about which coins broke into the big league, offering even more staggering returns, you’re in for a treat. The next part of our exploration uncovers how some cryptocurrencies transitioned from obscurity to prominence. Ready to meet the heavy hitters?

The journeys of these giants highlight just how unpredictable and exciting the crypto space can be. But we’re not done yet. Wondering which cryptocurrencies have claimed the top two spots with even more astonishing returns? Trust me, you won’t want to miss what’s coming up next.

Rankings #2 and #1: The Ultimate Profit Leaders

We’re down to the final stretch, revealing the two cryptocurrencies that have not only shattered records but also redefined what’s possible in the crypto world. These aren’t just coins; they’re phenomena that have turned modest investments into life-changing fortunes. Let’s dive into their incredible journeys and see how they’ve left an indelible mark on the market.

#2: Bitcoin (BTC)

It all started with an idea. Back in 2009, Bitcoin was introduced by the mysterious Satoshi Nakamoto as a decentralized digital currency. Its mission was simple yet revolutionary: to enable peer-to-peer transactions without the need for intermediaries like banks or governments. Little did we know, this would spark a financial revolution.

In the early days, Bitcoin was practically worthless. You might have heard stories of people buying pizzas with thousands of Bitcoins—that’s how little value it had. Fast forward to its peak in November 2021, Bitcoin soared to an astonishing $69,000 per coin. Imagine that—what was once less than a penny transformed into a small fortune for early adopters.

Unsurprisingly, Bitcoin tops this list with an estimated 90799990% ROI generated for investors who had bought the digital asset for $0.025 as far back as 2010. The digital asset launched in 2009 in response to the perceived freewheeling approach of governments to the global economic crisis of 2008. Satoshi Nakamoto, the creator of Bitcoin, described it as an alternative to traditional monetary systems, which continue to impose economic policies that threaten to cause inflation. In contrast to conventional methods, Satoshi ensured that Bitcoin had a fixed supply of 21 million BTC and a trickling minting model that reduces the number of coins mined every four years.

These incorporations, to an extent, have had a significant influence on the price trajectory of Bitcoin since it launched in 2009. Individuals and corporations that are aware of the inflation-hedging capacity of Bitcoin have begun to allocate a share of their portfolio to the digital asset. Expert believe that this is the main contributing factor to Bitcoin’s recent price rallies. Subsequently, the cryptocurrency has surpassed its previous all-time high as its price broke beyond the $20,000 mark for the first time. Notably, the market value of Bitcoin has surged by over 200% since the year began.

Several factors propelled Bitcoin’s extraordinary gains. Its finite supply of 21 million coins created a sense of digital scarcity, enticing investors looking for a hedge against inflation. The growing acceptance of Bitcoin by major companies and financial institutions legitimized it in the eyes of skeptics. Plus, the media frenzy and word-of-mouth buzz played significant roles in its meteoric rise.

Bitcoin didn’t just create wealth; it created a paradigm shift. It introduced blockchain technology to the world, paving the way for thousands of other cryptocurrencies and countless innovations. Its impact on the market is immeasurable, setting the stage for digital assets to become a mainstay in investment portfolios.

#1: Shiba Inu (SHIB)

And now, the moment we’ve all been waiting for—the most profitable cryptocurrency ever is none other than Shiba Inu, affectionately known as SHIB. Launched in August 2020, this meme-inspired token started as an experiment in decentralized spontaneous community building. But what happened next was beyond anyone’s wildest dreams.

SHIB entered the scene with a price so low it was almost immeasurable—a fraction of a fraction of a cent. Early investors might not have thought much of it, perhaps tossing in spare change just for fun. But by October 2021, SHIB had skyrocketed by over 70,000,000%! Yes, you read that right. An initial investment of just $1 could have grown to a staggering $700,000.

The journey from inception to its peak was fueled by a perfect storm of factors. The power of social media cannot be underestimated here. Platforms like Twitter and Reddit buzzed with excitement as communities rallied behind SHIB. High-profile figures hinted at its potential, and the fear of missing out drove more and more people to jump on the bandwagon.

SHIB’s appeal wasn’t just its low price or meme status; it tapped into the zeitgeist of accessible investing. In a world where Bitcoin seemed out of reach for many, SHIB offered a chance to own millions of tokens with minimal investment. This psychological allure played a significant role in its adoption and explosive growth.

Early investors in SHIB didn’t just see significant returns—they witnessed a financial miracle. Stories abound of individuals who transformed modest sums into life-altering wealth. It’s the kind of success that fuels the dreams of every crypto enthusiast and serves as a testament to the unpredictable nature of the market.

As we reflect on these ultimate profit leaders, it’s clear that the crypto landscape is full of surprises. But what can we learn from their stories? Is there a way to spot the next big opportunity? Well, that’s exactly what we’ll explore next.

Making Sense of the Profits: Insights and Takeaways

Looking back at the most profitable cryptocurrencies, certain patterns start to emerge. One thing that stands out is how these top performers often brought something new to the table. They weren’t just copies of existing coins; they offered innovative solutions or improved upon the limitations of earlier technologies. This uniqueness attracted attention and drove adoption.

Another common thread is strong community support. Cryptocurrencies that fostered active and engaged communities tended to thrive. When developers and users are passionate about a project, it creates a positive feedback loop that can propel a coin’s growth. These communities also contribute to the coin’s development, enhancing its features and usability over time.

Timing and market conditions played crucial roles as well. Many of these coins gained momentum during bullish periods when investor interest in crypto was peaking. However, their sustained success often depended on real-world utility and continuous development rather than market hype alone.

Resources to Deepen Your Crypto Knowledge

If you’re eager to learn more and expand your understanding of the crypto world, there are plenty of resources available. I’ve compiled a comprehensive list of tools and platforms that can help you dive deeper into cryptocurrency research.

These resources cover everything from market analysis and educational content to community forums where you can engage with other crypto enthusiasts. Leveraging these tools can enhance your decision-making process and keep you informed about the latest trends and developments.

Finding the next high-profit cryptocurrency isn’t easy, but there are ways to increase your chances. Here are some tips that I’ve found helpful:

- Do Your Homework: Before investing, thoroughly research the cryptocurrency. Understand its technology, purpose, and the problem it aims to solve.

- Assess the Team: Look into the developers and leadership behind the project. A strong, experienced team can make a significant difference in a coin’s success.

- Check Community Engagement: Active communities can indicate a healthy interest in the project. Engage in forums and social media to gauge sentiment.

- Monitor Market Trends: Stay updated on market news and trends. Sometimes, external factors can significantly impact a cryptocurrency’s performance.

- Evaluate Real-World Applications: Coins with practical use cases are more likely to have lasting value. Consider how the cryptocurrency is being applied in real scenarios.

- Be Cautious with Hype: While it’s tempting to jump on trending coins, not all live up to the excitement. Balance enthusiasm with critical analysis.

Remember, the crypto market is highly volatile. Making informed decisions and staying updated can help you navigate it more effectively.

Final Thoughts on Crypto Profitability

Reflecting on these success stories, it’s clear that crypto investing can be both thrilling and challenging. The potential for significant rewards is balanced by the risks inherent in a fluctuating market. I’ve learned that patience, research, and a level-headed approach are invaluable.

Approach the world of cryptocurrencies with curiosity, but also with caution. Stay informed, ask questions, and don’t be afraid to seek out knowledge. The crypto community is vast and full of individuals willing to share insights and experiences.

I’d love to hear your thoughts and experiences as well. Let’s keep the conversation going and continue exploring the fascinating landscape of cryptocurrencies together.

Additional coins that made a great ROI through the years (Some disappeared from the crypto world some still making good progress)

Sia SC

Sia is a blockchain-powered distributed cloud storage platform. By implementing blockchain as the underlying technology of these applications, Sia has successfully established a trustless and secure architecture for cloud storage. The project adopted a token-based economy for its marketplace where users can lease out unused storage space and earn Siacoin, the native digital asset. Sia believes that its implementations give it an added edge over established cloud storage solution providers like Amazon, Google, and Microsoft. One of the advantages it has over its competitors is that its decentralized architecture offers users competitive rates and an extra layer of security.

Launched in 2015, Sia has generated impressive returns to early investors, thanks to the price performance of Siacoin. According to data collected from Coinmarketcap, the cost for purchasing 1 Siacoin in August 2015 was $0.000047. Based on its current price of $0.0037, the ROI stands at 7,772%.

THORChain

THORChain is a non-custodial and decentralized asset swapping solution. The project prides itself on offering a unique infrastructure that provides permissionless cross-chain liquidity pools. In turn, these pools enable easy access to on-chain exchange without having to wrap or peg assets. As a result, participants can stake their cryptocurrencies on the liquidity pool for the chance of earning trading fees. The benefit of using this project is that it exposes users to a manipulation-resistant price feeding system. Likewise, users can make withdrawals in any cryptocurrency, thanks to the cross-chain functionality of the protocol.

To ensure that this system operates smoothly, the protocol has its native token, Rune, which according to the information made available, makes up a 50:50 ratio of all pools. Launched last year, RUNE debuted on Coinmarketcap on the 24th of July 2019, priced $0.016 per token. With a current valuation of $1.09, early investors have enjoyed 6,712% ROI.

Ark (ARK)

Like many of the cryptocurrencies highlighted in this guide, ARK focuses on establishing interoperability between a horde of blockchains to power an ecosystem with a wide array of use cases. The interesting thing about this project is that the system is fully customizable and void of the commonly used smart contract system. In place of the autonomous contract feature, the platform utilizes custom transactions, a broad range of programming languages, and logic. Along with this unique model came added functionalities like multi payment and multi-signature.

From all indications, it appears that ARK’s architecture has been convincing enough to lure investors. During its ICO campaign, 1 ARK sold for just $0.01. However, at the time of writing, the price now hovers around the $0.42 mark. After analyzing the revenue generated over the years, the ROI stood at 4,100%.

Reddcoin (RDD)

Reddcoin is essentially a cryptocurrency designed for tipping and other social payments. It powers the Redd ecosystem, which primarily functions as a platform where users can fund or raise money for various causes. The digital asset, which launched in 2014, comes with a low-cost transaction capability that provides a simple and effective means of transferring funds on the Redd network. As a fork of Litecoin itself, Reddcoin solves some of the issues prevalent with other networks. Ultimately, it presents the possibility to monetize content on the Redd network and fund social activism.

Coinmarketcap started tracking Reddcoin on the 10th of February 2014 when the price was hovering around $0.000026. with a current price at $0.001055, early investors have generated close to 3,900% ROI in 6 years.

Kusama (KSM)

Self-acclaimed as the wild cousin of Polkadot, Kusama core functionalities offer a scalable and interoperable ecosystem for blockchain developers. This team adopted a blockchain development kit introduced by Parity Technology. With this design decision, Kusama shares similar functionalities with Polkadot in that it enables interoperable features that are absent on established blockchain networks. Due to the innovative power of this project, developers tend to utilize it as a preparatory testbed for their applications and blockchain solutions.

Another similarity between Polkadot and Kusama is that they both feature on-chain governance. In other words, entities or individuals holding Kusama (KSM) tokens have voting rights to influence changes. Interestingly, Kusama launched as an airdrop to Polkadot’s early investors. For every DOT token they purchased, they receive an equivalent number of KSM. Others obtained KSM via a frictional faucet that has since been decommissioned. According to Coinmarketcap, Kusama has an ROI of 3,272%, if calculated from December when the token first featured on its site.

Syscoin (SYS)

According to the platform’s website, Syscoin “provides trustless interoperability with Ethereum ERC-20, token & asset microtransactions, and Bitcoin-core-compliant merge-mined security.” Hence, this blockchain network uses a security system similar to the Proof of Work mechanism utilized by Bitcoin. However, the only difference is that it is not as power demanding as Bitcoin, and even miners can use the energy spent on mining Bitcoin to merge-mine Syscoin. More importantly, Syscoin reportedly interoperates with any ERC-20 based token, which is remarkable in itself. These functionalities make Syscoin a viable payment network with high throughput, low transaction cost, and formidable security systems.

When calculating the ROI of Syscoin, we found that early investors paid $0.0018 for the purchase of 1 SYS in August 2014. With this Being the earliest tracked price of Syscoin on Coinmarketcap, we estimated the return on investment to fall within the 3,300% range.

Decred (DCR)

Decred hopes to become a sustainable store of value the same way Bitcoin has become the go-to choice for institutional and individual investors. To achieve this, Decred adopted a community-based cryptocurrency architecture with in-built governance systems. This design incorporates a hybrid consensus mechanism that combines the Proof of Work (POW) and Proof of Stake (PoS) models of achieving transaction validity. The long-term goal for Decred is to emerge as an adaptable, flexible, and sustainable treasury where a Decentralized Autonomous Organization (DAO) funds all the stakeholders of the network accordingly.

Taking the initial price ($1.13) and the current price ($33.70) of Decred into account, we estimated the ROI generated to fall within the 2,882% range. At the time of writing, Decred, with a market size of $417 million, ranks as the 53rd most valuable cryptocurrency.

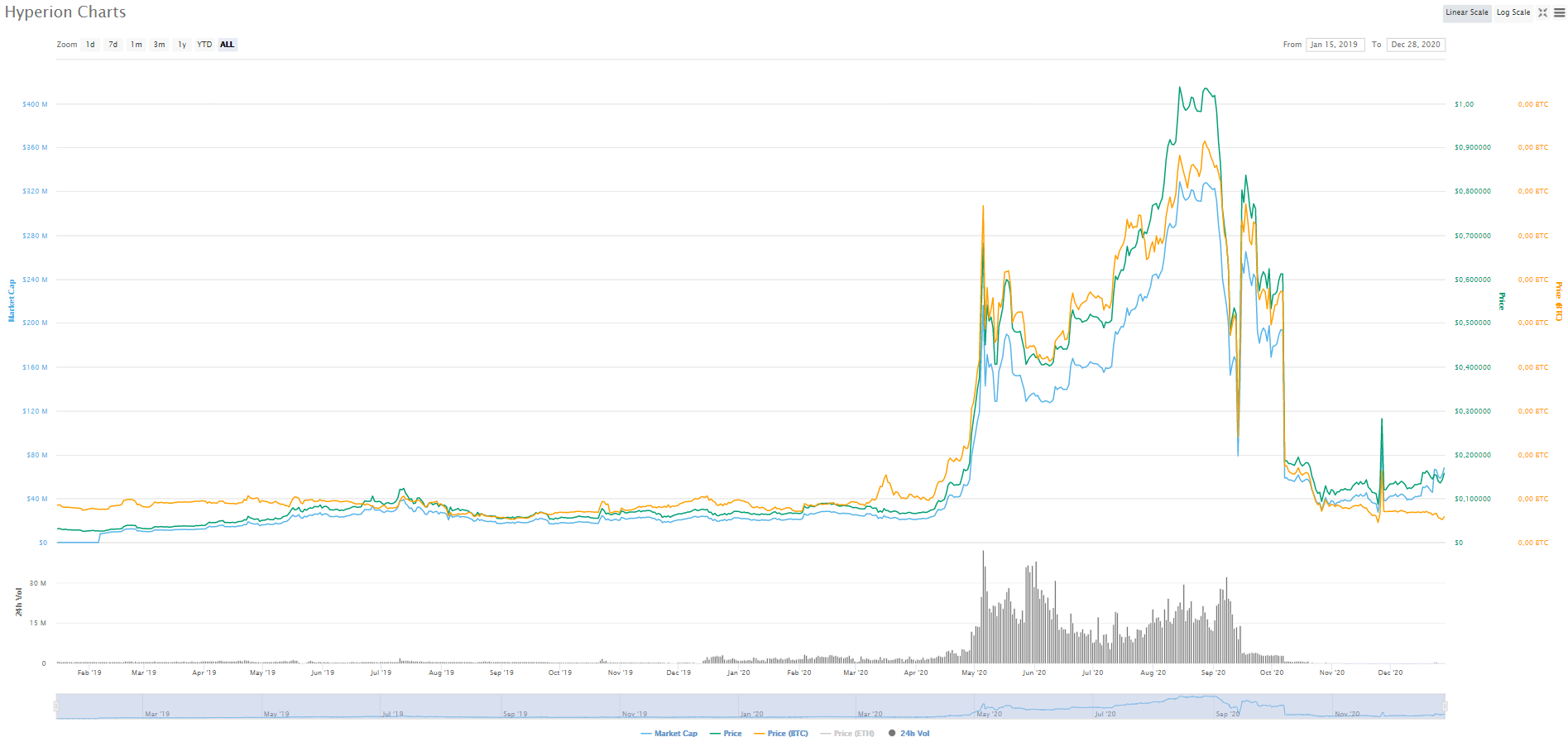

Hyperion (HYN)

Hyperion hopes to provide improved mapping services to over 7 billion people and 10 billion devices. To this end, Hyperion is using a decentralized map infrastructure that supports cryptography for added security. By adopting blockchain as its building block, Hyperion has established itself as a self-governing and sustainable map economy. This architecture offers access to unique map sharing technologies securely. As a result of cryptography implementations, the map information or locations of users are encrypted. More so, the platform incentives users to contribute accurate and useful map data. Subsequently, participants reach consensus to maintain the coherency of the map economy. Hyperion believes that this methodology is a viable replacement for existing mapping technology.

As for its investment viability, the cryptocurrency has generated around 2,824% ROI per the data available on Coinmarketcap.

Maker (MKR)

MakerDAO is another DeFi-based project that has done enough to emerge as one of the most profitable cryptocurrencies. This platform functions both as a decentralization organization and a stablecoin issuance system for DAI. In its most basic form, MakerDAO oversees the DAI ecosystem by ensuring that the stablecoin remains pegged to the US dollars. MKR, the governance token, democratizes the voting system of the platform. In essence, MKR holders can contribute to the governance of the DAI. As the DAI economy grows, so also will the value of MKR surge.

Per the data on Coinmarketcap, the debut price of MKR is $22.10, while it has a current value of $574.91 per unit. Due to this impressive price performance, the ROI has risen to 2,500% in just under 4 years.