The Beacon Chain: A Pivotal Moment in The Ethereum 2.0 Narrative

Following the launch of the Ethereum 2.0 deposit contract, the crypto space is poised to witness one of the most important events of 2020. The possibility of a December 1st launch date for Phase 0 of Ethereum’s upcoming series of upgrades has sparked worldwide hysteria as participants watch in anticipation of the implementation of staking on the Ethereum ecosystem. Behind all these excitements are shades of doubt stemming from the fact that despite the promise of mouthwatering benefits, the world’s second most popular network must journey into the unknown. In this article, I will explore all the variables involved, as well as highlight the worst-case scenario.

What is Ethereum 2.0?

Ethereum 2.0 is a sequential series of upgrades that look to evolve the infrastructures of the Ethereum blockchain to improve its operations. Simply put, Ethereum 2.0 is an advanced model of the existing mainnet poised to mitigate recurring shortcomings. One of the frailties targeted by this upgrade is the lack of scalable infrastructures. Hence, if all goes to plan, these upgrades will put an end to recurring cases of congestion and high transaction fees. In particular, Ethereum 2.0 hopes to extend the network’s capacity to 10,000 transactions per second from the meager 15 TPS established as the maximum speed of the Ethereum 1.0 blockchain.

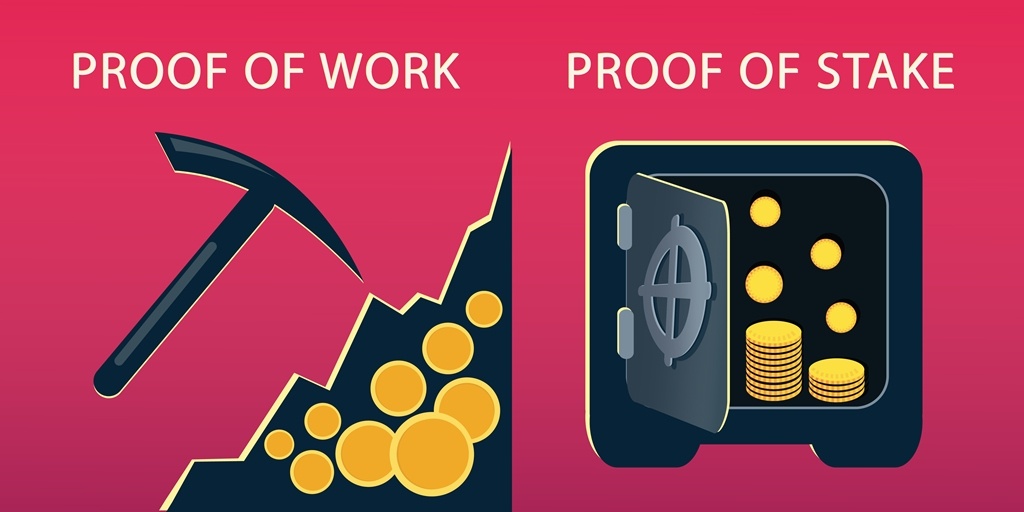

One of the systemic changes projected to make this lofty goal achievable is the switch to a staking-powered validation system. In other words, the Ethereum network, which currently utilizes the Proof-of-Work consensus mechanism, will gradually introduce the Proof-of-stake model and eventually phase out mining operations. As such, starting from the 1st of December, projected as the genesis of Ethereum 2.0, participants of the Ethereum ecosystem can stake ETH for variable rewards.

Why is Ethereum 2.0 Introducing Staking?

The most potent reason why staking is an integral implementation of Eth2 is that it is a relatively faster process of validating transactions. Unlike the PoW model, which only allows a consecutive mode of validation, PoS offers a system where validators can perform their duties synchronously. Another reason is that it is a cheaper approach as validators do not need to purchase specially designed expensive and power-consuming mining hardware. Instead, participants can run an Ethereum staking operation from a consumer personal computer.

However, for this to be fully operational, the first phase of the Ethereum 2.0 upgrade will implement what the core development team calls the beacon chain. According to the information available on https://Ethereum.org/en/eth2/, the beacon chain will usher in Proof-of-staking functionality by registering and coordinating validators. The document reads:

“The first part of Eth2 to ship will be the beacon chain. It won’t be fully operational right away because there won’t be any shard chains, so there’ll be nothing to keep in sync other than itself. Remember, the beacon chain’s main role in Eth2 is making sure all the shards have the most up-to-date data. At first, the beacon chain will be responsible for registering validators and coordinating everyone’s staked ETH. This is foundational to the rest of Eth2 and lays the groundwork for the shard chains. In other words, once the beacon chain is live, you’ll be able to stake your real ETH. However, staking in Phase 0 is a one-way transaction. You won’t be able to withdraw your ETH until the current chain becomes a shard of Eth2 in Phase 1.5. That’s because staking in Phase 0 will be handled by a smart contract on mainnet (the Ethereum we use today).”

As noted in this statement, once staking commences, validators will not have access to their funds until phase 1.5 launches. Hence, this may induce some level of reluctance on the part of participants.

DeFi Poses Serious Threats to Ethereum 2.0

Tim Ogilvie, CEO of Staked, echoed this sentiment in a recent article where he explored the factors that could spur or limit participation in Ethereum staking. In the article, Ogilvie explained that the introduction of staking offers true believers of the Ethereum a chance to show their commitment to the network. He stated:

“These true believers, who were in at the ground floor when Ethereum’s ICO launched, finally have an opportunity to help the network progress to the next level of security. Long-term ETH holders no doubt believe a secure network can support the health of the blockchain – and with it the price of their prized assets. All the while, they can earn some yield along the way.”

However, Ogilvie warned that staking is not for everyone because it requires a long-term commitment as rewards are irredeemable until the latter phases of Ethereum 2.0 go live:

“Standing up nodes in multiples of 32 ETH and running them with barely any downtime while the assets are locked up for what could be years won’t be for everyone – and it shouldn’t be. Whether staked alone or via a pool, once an asset is put on the Beacon chain, there is no going back to the original. Stakers whose ETH will remain locked up until a later phase must be willing to be locked into a long-term commitment.”

A similar point was raised by Consensys in a recent report. The authors noted that DeFi and its high-yielding liquidity farming opportunities remain a potent threat to the success of Ethereum 2.0. The report reads:

“The logic is that Ethereum 2.0 needs ETH holders to lock up their funds in a deposit contract for a variable return and more disconcertingly, a currently unspecified amount of time. If various DeFi protocols offer higher returns than Eth2 staking, ETH holders may elect to direct their ETH elsewhere, thus leaving Eth2 without the threshold of staked ETH required to render it sufficiently secure and decentralized. It is not unreasonable to worry that ETH holders would (at best) wait to see how early staking returns compare to DeFi returns, or (at worst) decide altogether not to “risk” locking up ETH until Phase 1.5 (which is likely at least a year away) in case another similar bull run occurs in the meantime.”

Nonetheless, as highlighted in this report, there is a high possibility that the DeFi landscape will usher in projects designed to tokenize the assets and rewards locked on Ethereum 2.0. Despite the emergence of such solutions, it is impossible to predict users’ propensity for locking ETH in the just-launched deposit contract:

“But just as the Q3 DeFi ushered in the concept of a derivative token that represents a user’s pooled tokens, we anticipate that providers could offer liquid tokens that represent the value of their staked ETH. Only time will tell what choice ETH holders will make and what will drive their decision-making process in deciding whether to stake or not. Despite the programmable rationality of Ethereum, humans are not driven to decision-making by the bounds of a smart contract, and considerations like the amount of liquidity an ETH holder can access, the volatility of Eth1.x vs Eth2, and the evolving user experience of being an ETH holder are all factors playing into the decision of whether to lock funds in a deposit contract.”

This observation is coherent with Ogilvie’s take on the risk/reward factor that could mold the decision-making of potential validators:

“Stakers need to weigh the complexity of running nodes on a major chain with the risk of being slashed for failing to stay up persistently or for other issues such as double-signing. Ethereum 2.0 staking requires the commitment and hassle of maintaining a node for years. Those inclined to support network security and earn steady yield may still shy away from the obligations of regularly tending to their servers.”

While there are still doubts surrounding the attractiveness of Ethereum staking, the requirement that at least 16,384 validators must lock ETH 7 days before the proposed launch date for the beacon chain still holds. The deposit contract must hold at least 524,288 ether for staking to commence. At the time of writing, the total amount of ether locked in the deposit contract is 49,185 ETH, which is equivalent to $22,559,192.

How Viable Is the Upcoming Ethereum 2.0?

For almost a year now, a vast number of Ethereum development teams have initiated a series of tests to ensure that Ethereum 2.0 is free from bugs or glitches. However, not all has gone to plan. Ben Edgington, a core contributor to Ethereum 2.0 upgrades, noted this fact in a recent post on Coindesk, where he identified some of the challenges encountered during the last 2 months. He wrote:

“Progress has not all been smooth. A few days after the start of the Medalla testnet, one of the clients suffered a critical issue that disrupted the chain for a few days. But this is what testnets are for. We kept the chain running and were able to bring it back to full health, with a slew of lessons learned.”

Furthermore, Edgington explained that these setbacks taught the team some vital lessons. More importantly, as highlighted by Danny Ryan, a core researcher at the Ethereum Foundation, “the incident on Medalla was significantly amplified by the failure of the dominant Prysm client, and as we move toward mainnet, we, as a community, must consciously seek to remedy this.”

Despite these setbacks, Edgington believes that it is time to deploy the beacon chain as this myriad of testing and scrutiny has helped the team develop a sturdy infrastructure for Ethereum 2.0:

“This is why it is now time to go live with the beacon chain. We have tested everything else in every way we can: the deposit contract has been formally verified; the deposit tools have been audited; the specification has been audited; the beacon chain has been formally modeled; the node discovery protocol has been audited; the networking protocol has been audited; the crypto-economics have been simulated; we are running incentivized attack nets; we’ve been doing fuzz testing; every client has undergone at least one third-party security audit. Hundreds of pairs of eyes have scrutinized the whole process over the last year.”

Besides, he warns that the requirements for joining the elite team of validators may be quite demanding. However, he reiterated his resolve and that of his team to champion the Ethereum 2.0 narrative. He also revealed that there are tools available to meet the infrastructural and economic requirements of Ethereum 2.0 staking:

“Staking, from the start, will not be for everyone. One reason for is it can be quite demanding technically. Stakers need to keep a server running as close to 24/7 as possible. They need to keep their systems secure and stay on top of client software updates. For those not confident about hosting a staking node themselves, there are plenty of third-party services becoming available. Within ConsenSys, we are offering Codefi Staking, a white-label, turnkey solution for businesses that want to stake on Ethereum 2.0.”

Like Edgington stated, there are suites of services that can help validators keep up with the demands of Ethereum staking. If it turns out that the technicality involved in staking Ethereum is too difficult to scale, aspiring validators can switch to the more flexible and accommodating staking pools and services.

Life After Phase 0 Of Ethereum2.0

Once phase 0 goes live, the next stage entails the deployment of shard chains to enable a robust blockchain ecosystem. Shards are synchronously operating chains that run parallel to the beacon chain. Transactions executed on each shard chain are transmitted to the beacon chain to ensure that the data across all shards are coherent. However, there is no specific timeline for the implementation of this phase. While this is a given, as Ogilvie wrote, the most important thing is that the pieces are coming together nicely:

“Whatever the decision participants make at this point, it is a pivotal moment for Ethereum and the blockchain community in general. As Ethereum 2.0 moves through its phases, the network should be able to achieve real scale. A blockchain with a current sluggish speed of 14 transactions per second has obvious limitations. But Ethereum 2.0, with the potential of reaching 100,000 transactions per second, could help the network realize its stated ambition of becoming a world computer.”