Aggregated Cryptocurrency Web News Latest and Comprehensive Crypto News Updates: All You Need to Know from the Digital Currency World

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

As technical director on the Concierge team at Unchained, I’ve fielded countless client questions about bitcoin multisig. If you’re just beginning to understand the benefits of multisig and how it works in a collaborative custody context, I hope these ten tips will address some of your questions.

Bitcoin doesn’t live on your device

The phrase hardware wallet might make it seem like your bitcoin live inside the wallet itself, but that’s not the case—bitcoin is never in your device at all. In actuality, your wallet generates and stores your keys only. Your wallet also makes accessing the keys user-friendly by either plugging your device into a general-purpose computer or sharing information with your computer via a microSD card.

So where does bitcoin live, then? The bitcoin blockchain is a ledger that keeps track of every transaction that has ever occurred and the balances of every address on the network. Instead of storing your bitcoin, your hardware wallet protects and stores the keys used to unlock—or spend—bitcoin from those addresses.

You can restore your seed phrase to another hardware wallet

When you set up a bitcoin hardware wallet that respects best current practices, you should be prompted to back up your wallet using 12 or 24 words, typically on a slip of paper that the manufacturer suggests you protect in case something happens to your wallet. These 12 or 24 words are your seed phrase, as established in Bitcoin Improvement Proposal 39, or BIP39.

Your seed phrase is like the “key to the castle,” it contains everything you need to recover and use a key to all of the addresses protected by the seed phrase.

The nice thing about BIP39 seed phrases is that they are interoperable among hardware wallets that support the standard, which means you can recover your bitcoin wallet backup (seed phrase) to another brand of hardware wallet. If you initially set up your bitcoin wallet on a Trezor and want to move to a Coldcard, it’s as simple as importing those 12 or 24 words.

Read more: How to replace or upgrade a bitcoin hardware wallet

You don’t need your hardware wallet with you to receive

With physical cash, you have to be physically present to trustlessly and securely transact with another party. Bitcoin fixes this for the digital world. If you want to receive bitcoin but don’t have your hardware wallet at hand, you can still have a payment sent to the appropriate address.

As mentioned above, bitcoin does not live on your hardware wallet; it lives on the bitcoin blockchain. For that reason, as long as you or someone else sends bitcoin to an address that you hold the private keys to control, you’ll always be able to move those funds regardless of whether you have physical access to your device. If bitcoin is sent to an address you know you control, it will arrive perfectly fine in the background without your involvement.

What this means for you: If you create a multisig wallet and store your hardware wallets or seed phrases in secure locations, you don’t need to have physical access to them to deposit funds.

A device used as a key in multisig can still be used as a singlesig wallet

Multisig involves constructing a multisig wallet using the public keys of multiple devices, each of which could also serve as a standalone singlesig wallet without any issues. When you create a multisig wallet following the emerging standard processes, the preexisting singlesig counterparts have no idea the multisig wallet exists.

You could think of it as a group email address that forwards to multiple individual email addresses.

This means that, if you wanted, you could store smaller amounts of bitcoin on a singlesig wallet—all while keeping your primary wealth in a multisig wallet constructed using that device as one of the keys.

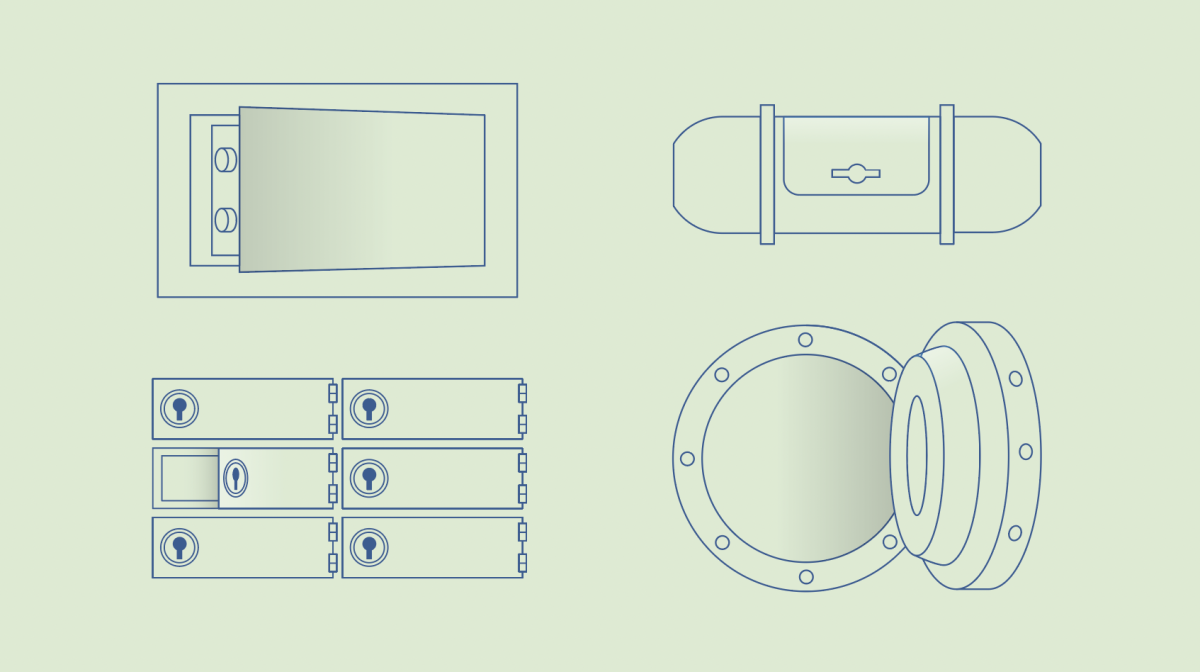

Confirm your multisig deposit address

Bitcoin transactions are completely irreversible, which means if you send your bitcoin to the wrong address, it can be lost permanently. Thankfully, you can use hardware wallets to check your multisig bitcoin address on the device before sending funds.

Checking your address on your device confirms three things:

- that the address was built correctly (i.e. that it’s 2-of-3 multisig, for example, and not 2-of-5 where an attacker has added two keys and actually controls the funds)

- that the computer you’re working on isn’t compromised with malware that finds and replaces bitcoin addresses with an attacker’s address, and

- that your device holds a key to the address.

Checking the address on your device should be done before sending meaningful amounts of funds to any address, whether singlesig or multisig. As of this writing, Trezor and Coldcard support checking multisig deposit addresses in the Unchained platform.

Read more: How do I verify the receiving/deposit address on my hardware wallet?

You don’t need your devices physically together to sign

With multisig, you don’t need to have all your keys in the same place at the same time to spend bitcoin. That means you can sign a transaction in Austin with one key and sign a day later in Dallas with the other. The transaction can only be broadcast after all the necessary signatures have been collected (two in a 2-of-3 multisig scheme, for example).

This is a significant advantage over other bitcoin custody models like Shamir’s Secret Sharing Scheme, which allows you to distribute control over your bitcoin private key by splitting it into multiple parts (secrets), but requires all parts to be present at the same time to recompile a single key and author a transaction.

You can make a mistake in multisig and still recover your funds

In all bitcoin multisig setups where m (the number of keys required to sign) is less than n (the total number of keys in the quorum), you are protected from single points of failure and can still recover your funds in the case that one or more critical items are lost, stolen or otherwise compromised.

There are scenarios in 2-of-3 multisig (with a collaborative custody partner like Unchained holding the third key), where as many as three items could be compromised before it becomes impossible to recover your funds.

Even though fault-tolerance in multisig provides peace of mind, all of these scenarios should still be protected against at all costs by following seed phrase and hardware wallet storage best practices, and you should always regain full control as soon as possible in the event that any of your critical items are lost or compromised. And that leads us to number eight…

Read more: The ultimate guide to storing your bitcoin seed phrase backups

You can replace a key in your multisig setup if needed

When using bitcoin multisig, if you ever lose a wallet or misplace a seed phrase, it’s important to replace this key in your multisig m-of-n scheme. You can do this with any of the popular multisig wallets.

Even if a single compromised key does not alone jeopardize your funds in most common multisig m-of-n schemes, replacing a compromised key will ensure that you regain complete control over your funds and eliminate the possibility that the key could ever be used against you in the future.

In a collaborative custody model like the one we use here at Unchained, replacing a key is straightforward. You can simply log in to our platform, choose the key that has been compromised, and quickly replace it with a new one. You can read the full process for replacing or upgrading a hardware wallet at the link below, and if you’re already an Unchained client, check out our Knowledge Base article.

Read more: How to replace or upgrade a bitcoin hardware wallet

You can construct multiple multisig wallets using the same devices

As we mentioned in number four on this list, using your hardware wallets/seed phrases for both a singlesig wallet and to construct a multisig wallet doesn’t cause any issues. Similarly, using your hardware wallets/seed phrases for more than one multisig wallet doesn’t cause a conflict among those wallets as long as you aren’t using the same extended public keys (xpubs). This is typically represented as a multiple accounts feature in most bitcoin wallets.

Hardware wallets allow you to use different xpubs from different derivation paths, which is a technical way of saying a different set of bitcoin keys on your hardware wallet generated by the same 12- or 24-word seed phrase. This means you can create multiple multisig wallets that stem from the same set of seed phrases/devices, like using the same devices for a personal vault and an IRA vault. Maybe even a loan vault as well!

Collaborative custody doesn’t introduce a single point of failure

When getting started with multisig collaborative custody at Unchained, one concern I hear a lot relates to dependence on our platform. If Unchained were to cease to exist or have significant downtime, how would you recover your funds if your wallets were constructed using our tools?

Our multisig platform is designed to eliminate all single points of failure, and that includes ourselves. As our platform is fully interoperable with established bitcoin standards, you can always recover access to your vault outside the Unchained platform with compatible software like our open-source multisig coordinator, Caravan, or bitcoin wallets like Sparrow or Electrum. Just make sure to safely back up your wallet configuration file!

Read more: How can I recover my vault funds using Caravan?

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

The exchange is optimizing operations after acquiring ErisX on the eve of crypto winter and expects to save millions.

Bitcoin market inertia is dragging on, and a BTC price drop over the next fortnight would correspond to classic post-halving behavior.

Attendees at Token 2049 in Dubai shared their personal stories on how they became rich.

PRESS RELEASE. Solama, one of the most captivating Solana meme coin 2024 craze, is partnering up with two essential platforms for a crypto project, such as BingX and AssetDash, as BingX mentioned on their X (Twitter) account. As a result of this team-up, all $SOLAMA enthusiasts could benefit from extensive accessibility, catering to all investors […]

PRESS RELEASE. Solama, one of the most captivating Solana meme coin 2024 craze, is partnering up with two essential platforms for a crypto project, such as BingX and AssetDash, as BingX mentioned on their X (Twitter) account. As a result of this team-up, all $SOLAMA enthusiasts could benefit from extensive accessibility, catering to all investors […] On Friday, the cryptocurrency trading platform crypto.com unveiled a new advertisement set to debut at the forthcoming Lakers NBA playoff game in Los Angeles. Additionally, the ad was highlighted on the social media site X by the hip-hop icon Marshall Mathers, also known as Eminem. Marshall Mathers Amplifies Crypto.com Ad Ahead of NBA Playoff Showcase […]

On Friday, the cryptocurrency trading platform crypto.com unveiled a new advertisement set to debut at the forthcoming Lakers NBA playoff game in Los Angeles. Additionally, the ad was highlighted on the social media site X by the hip-hop icon Marshall Mathers, also known as Eminem. Marshall Mathers Amplifies Crypto.com Ad Ahead of NBA Playoff Showcase […]

Bull flags are historically associated with more upside momentum, but Bitcoin price could still use a catalyst before rallying to new highs.

Slim Shady was the latest celebrity to advertise “fortune favors the brave” for Crypto.com following Matt Damon’s ad spot in October 2021.

Discovering CryptoLinks.com: Your Ultimate Destination for All Things Cryptocurrency Related

Feeling swamped by the tsunami of crypto news flooding your screens daily? Navigating the cryptocurrency ecosystem can often leave you gasping for air, especially when every tick of the clock brings a new update that could make or break your next move. At CryptoLinks.com, I've constructed the life-raft you've been seeking—a streamlined, organized, and reliable source that does the heavy lifting for you. Picture this: a world where you're seamlessly connected to the pulse of the crypto sphere, swiping past the fluff and diving straight into the news that impacts your digital portfolio. From the latest coin launches to market-moving trends, CryptoLinks.com isn't just about handing you the news; it's about delivering a custom-tailored stream that aligns with what makes your wallet tick. Ready for that breath of fresh air? Let's take that plunge together and unlock the full potential of the crypto landscape—effortlessly.

Have you ever felt like you're drowning in a sea of endless cryptocurrency news and updates? Do you find it difficult to sift through the noise to find the information that matters to you? In the dynamic world of cryptocurrency, where news breaks at the speed of light, keeping up can be a herculean task.

The Problem: Too Many News, Too Little Time

Cryptocurrencies never sleep, and in a 24/7 market, news and updates proliferate round-the-clock. For enthusiasts and investors alike, staying informed is crucial, but the sheer volume of information can be staggering:

- New coin launches and tech innovations.

- Regulatory changes and legal updates.

- Market trends and investment tips.

With so much happening at once, how can you ensure you're not missing out on crucial information, without spending every waking hour glued to a screen?

Your One-stop Solution: CryptoLinks' Aggregated Web News Section

I understand the struggle, which is why CryptoLinks.com is designed to be your safe harbor in the tumultuous ocean of cryptocurrency news. Imagine a place where the most vital news comes to you, where the fluff is filtered out, leaving only the golden nuggets of crucial updates and trustworthy information.

Here's a glimpse of what CryptoLinks.com offers to transform your crypto news experience:

- A comprehensively curated collection of cryptocurrency web news from various verified sources.

- An easily navigable interface that quickly directs you to the day's most important headlines.

- A customizable feed that allows you to focus on news that aligns with your interests and investments.

With CryptoLinks.com, you'll no longer feel the need to scramble through dozens of tabs and sources. You'll have it all in one place, a streamlined, finely-tuned machine that keeps pace with the crypto market's heartbeat.

Are you curious about how we manage to provide such a high-quality selection of crypto news? Stay tuned, as the next segment will reveal the inner workings of CryptoLinks.com and how we've perfected the art of news aggregation.

How CryptoLinks.com Helps Simplify Your Crypto Journey

Finding credible news in the clamor of the cryptocurrency world can be as daunting as searching for a strand of truth in a digital haystack. But, amidst this informational whirlwind, CryptoLinks.com stands as a beacon of clarity, meticulously sifting through sources to bring you the essence of crypto news.

Quality Over Quantity: CryptoLinks' Approach to News Aggregation

What sets us apart is our steadfast commitment to quality. Our team operates with the kind of discernment only seasoned crypto enthusiasts can offer, ensuring that each piece of news on CryptoLinks doesn't just add to the noise but genuinely enriches your understanding.

- We prioritize authority and accuracy, steering clear of speculation and focusing on news that matters.

- We favor trusted sources with proven track records, so you can rest assured that the information is vetted.

- We're vigilant about relevance, ensuring that trends, updates, and insights reflect the current state of the market.

Imagine starting your day with a cup of coffee and a concise briefing that filters out the fluff, leaving you with pure, potent news. That's the CryptoLinks experience.

Streamlining Your Daily Reading Routines

Remember the days of having dozens of tabs open, bouncing from one website to another in a relentless quest for reliable crypto news? Those days are gone. Here's how we streamline your daily information intake:

- Curated Content: Our algorithm ensures you're exposed to the hottest topics and breaking news.

- User-Friendly Interface: A clean layout and intuitive design mean information is not just accessible but also digestible.

- Customizable Experience: Tailor your news feed to your interests, eliminating unwanted noise and honing your focus.

"In the age of information overload, clarity is power." This quote echoes our ethos, highlighting the transformative impact of refined data consumption.

"In the age of information overload, clarity is power."

With CryptoLinks, you tap into a stream of knowledge that's been distilled to empower, not overwhelm. But how do we ensure that this stream remains unpolluted by bias and misinformation?

Stay tuned to discover the intricate process behind our source selection in the next section, and uncover the secret recipe that keeps the CryptoLinks engine running smoothly. What kind of sorcery allows us to maintain objectivity in an often subjective market? Keep reading to find out.

The Nitty-Gritty: Understanding CryptoLinks’ Inner Workings

Ever wondered what goes on behind the scenes at CryptoLinks? As a platform that's become a lighthouse in the tumultuous sea of cryptocurrency information, it's time to pull back the curtain and show you the cogs and wheels of our operation. It's not just about presenting news; it's about presenting the right news in the right way.

Choosing the Right Source: CryptoLinks’ Secret Recipe

Our quest for curating the perfect content mix is akin to a master chef selecting the freshest ingredients for a signature dish. But what does this gourmet process involve?

- Depth of Research: We scour the digital landscape probing into every nook and cranny of the cryptoverse. Only the most reputable and insightful sources make the cut.

- Consistency and Reliability: Like the faithful tick of a Swiss watch, we evaluate how sources maintain a steady flow of accurate and timely information.

- User Perspectives: We listen to what you, our community, seek and appreciate. Your opinions help us prioritize sources that best align with your information needs.

This meticulous process isn't simply about algorithmic selections; it's a careful human curation to serve you a platter of the most relevant and enriching content.

Preserving Objectivity in the Most Subjective Market

In a market that thrives on speculation and sentiment, where hype can overshadow substance, preserving objectivity is our fortress. It's a commitment set in stone—a pledge to our readership. "Truth is ever to be found in simplicity, and not in the multiplicity and confusion of things," as Isaac Newton profoundly stated.

"I cannot afford to waste my time making money." – Louis Agassiz

Just like Agassiz prioritized his scientific pursuits over financial gain, we prioritize the essence of news over sensationalism. CryptoLinks is your compass in a landscape brimming with noise; we filter through the flurry, leaving you with undistorted and essential news segments:

- Critical analysis minus the sensational headlines

- Data-driven reports, stripped off any emotional bias

- Announcements and updates, delivered as they are, not as they're speculated to be

It's not just about delivering news; it's about upholding the integrity of information. In doing so, we've become more than just a platform; we've turned into a beacon of truth for our readers.

But, how does this unwavering commitment to truth translate into your everyday experience? Curious about how to leverage our unbiased insights for your personal crypto endeavors? Stay tuned for what's next, where I'll share some insider tips on making the most out of your daily CryptoLinks encounter.

Best Practices: Making the Most of CryptoLinks' Aggregated Web News Section

Understanding how to navigate the vast sea of information is crucial in making informed decisions in the fast-paced world of cryptocurrency. It all starts with knowing the best practices to enhance your user experience on CryptoLinks. Here's how you can optimize your visits to get what you need, quickly and efficiently.

Enhancing Your CryptoLinks Experience

Firstly, let’s talk about customization. Your interests in cryptocurrency are unique, and so should be your news feed. Make use of our category filters to tailor what news pops up on your screen. Are you passionate about blockchain technology, or perhaps ICOs and token sales are more your cup of tea? With just a few clicks, you can set your preferences and receive news related solely to those categories.

Another tip is to take advantage of the bookmark feature. If you stumble upon an article or a nugget of information that catches your eye but don't have time to read it at the moment, simply bookmark it for later perusal.

Also, don't forget to check out the comments section. The CryptoLinks community is knowledgeable and often experienced—engaging with them can provide additional insights and even different perspectives on the topic at hand.

Streamline Your Knowledge with CryptoLinks’ Press Section

Now, let me introduce you to a gem within the site—the press section, easily accessible at CryptoLinks' Press. The press section is where you’ll find an aggregation of official announcements and press releases from within the industry. It's essentially your direct line to the source without any third-party interpretations or potential bias. The benefits?

- Timeliness: Stay ahead with the most recent and official statements from crypto entities.

- Authenticity: Get the story straight from the horse's mouth, bypassing the noise that can sometimes distort news in the rumor mill.

- Depth: Press releases often dive deeper into the specifics that general news articles may gloss over.

Have you ever found a press release that touched on an up-and-coming blockchain project or a new coin launch and wished you could follow up on how it evolved? Save that page! This allows you to create a tapestry of knowledge, tracing developments as they unfold in real-time.

Now, with all these tools and knowledge at your disposal, you might be wondering, what's next? How else can you leverage CryptoLinks to stay on top of the crypto wave? Stay tuned, as the next article will not only quench your thirst for knowledge but will also illuminate the unique value CryptoLinks brings to your digital doorstep. Are you ready to become a savvy crypto navigator?

Answering Your Burning Questions

If you've ventured into the bustling alleyways of cryptocurrency news, you've likely grappled with an overload of information. This is where CryptoLinks strides in, and perhaps you're curious about how and why we are your go-to source. Let's tackle some of the queries stirring in your mind.

Why Choose CryptoLinks Over Other Aggregation Platforms?

You want a platform that's not just a random noise collector but a curated orchestra of relevant information – and that’s what sets CryptoLinks apart. We meticulously handpick sources that have proven their integrity and value over time. But we don't stop there; rigorous checks and balances ensure these sources remain on-point, consistent, and free from bias. Whether it's a breaking headline or a subtle market sentiment shift, you can trust that our aggregation reflects the true pulse of the crypto world. And it's not just about trust – it's about delivering a streamlined experience without the fluff and fillers other platforms may overlook.

Staying Ahead of the Game with CryptoLinks

Cryptocurrency waits for no one. It's a dynamic beast, with news and trends shifting by the minute. So, how do we ensure that you get the latest scoops before anyone else? Our secret lies in real-time updates and a responsive filtering system. The CryptoLinks potential to tap into the minute-by-minute fluctuations of the market keeps our community informed with lightning speed, without sacrificing accuracy. When your conversations turn to the latest crypto developments, you'll find yourself steps ahead, armed with insights gleaned from our up-to-the-minute news reports.

Wrapping It Up

Choosing CryptoLinks isn't just about simplifying your path through the cryptocurrency landscape; it's about augmenting your understanding and involvement with quality information. You've seen how our careful curation and real-time reporting can empower your decision-making. Quality, objectivity, and speed are the pillars of what we offer, and these aren't mere words. They are commitments to each user who trusts us as their compass in the crypto cosmos. Whether you're a beginner or a seasoned trader, the news we serve could be the difference between making a smart investment choice or missing out on an opportunity. At the end of the day, your success in this complex domain is the true measure of our value. So let those questions rest – CryptoLinks is your ally, guiding you through this ever-evolving space with clarity and confidence.