Aggregated Cryptocurrency Web News Latest and Comprehensive Crypto News Updates: All You Need to Know from the Digital Currency World

First, 50.

Then, 25.

Eventually, 12.5.

After that, 6.25.

And now, 3.125.

Four halvings later, we enter the fifth of 33 epochs of Bitcoin. The first 32 epochs, in Bitcoin-terms, last 210,000 blocks, with the 33rd lasting until the heat death of the universe.

At 10 minutes per block, on average, that means just about every four years, Bitcoin cuts its supply issuance in half. The specific numerical finite-ness that comes downstream of this mechanism –– that defines bitcoin’s scarcity in a nearly infinite universe –– is ultimately irrelevant. Satoshi could have started at a 100 bitcoin block reward and we would have arrived at just about the same place today. But there are some statistical conveniences of starting at 50, such as that 50% of all bitcoin to ever be issued are during the first epoch. And thus, 25% of all bitcoin to ever be issued were issued in the second, and so on, and so forth.

Speaking of fourth, the fourth epoch terminates in the fourth month of 2024 at the completion of the fourth halving at block 840,000. A lot happened the fourth time around: El Salvador making bitcoin legal tender, Wall Street’s ETF play, the Taproot-enabling softfork, and even Ordinals.

Every new halving brings up the legitimacy of cycle theory, of whether or not supply issuance can be “priced in”.

Each halving is a time of self-reflection for bitcoiners and the culture they curate. Not only is Bitcoin arguably no longer a counter-culture with nation-state and Wall-street adoption (co-option?), but it is no longer a mono-culture. While many things were born during this epoch, it is perhaps the death of the homogenous bitcoiner that is the most apparent.

Bitcoin is for anyone; Salvadorans, Larry Fink, Bored Apes, and ESG’ers.

Welcome to the Fifth Epoch.

The Editors

SATOSHI’S THOUGHT PROCESS

Have you ever wondered what it must have been like for Satoshi Nakamoto back in 2008 when he published the Bitcoin Whitepaper? Spending countless hours in solitude, meticulously writing the code that would bring the world its first-ever successful attempt at creating a truly decentralized monetary network, the first of which our species has ever had the privilege of experiencing. The pseudonymous creator’s thought process is one we can’t picture - laying out Bitcoin’s framework and ironing out the innovation that is the network’s distributed ledger, the complex mining process that secures it. And then, one of the most fundamental, yet underappreciated, pieces of Satoshi's design was the pre-coded, fixed supply schedule with a 50% reduction in new issuance that happens quadrennially - the Bitcoin halving.

Hard-coded into Bitcoin’s core, this deflationary event called “the halving”, which enforces the reduction in the supply of the bitcoins being introduced into circulation, is undoubtedly a crucial technical element of the protocol and was a foundational design choice. The creation of a digital currency that would maintain its scarcity and by extension its value, over the long term. A digital currency that would exist beyond the reach of central banking policies and the whims of the hands that control them. That was Satoshi’s idea. And to properly execute this, it had to have a pre-programmed finite supply of 21 million units, with an engineered supply compression mechanism that gradually slows down the rate of issuance of new coins in a four-year cycle. I’m not going to get into too much detail about the Bitcoin halving and its technical aspects, because a lot of brilliant minds have already talked extensively about it, so why reinvent the wheel? Rather, let’s take a few steps back in time.

15 YEARS AGO

Let's go back a decade and a half, back to those grueling hours Satoshi Nakamoto must have spent working on Bitcoin. Hunched over, working tirelessly on the code, integrating the halving and all it was meant to represent for the network as a mechanism that ensures the long-term scarcity of this new digital currency. Theoretically, he must have known the profound impact the halving would have on the fiat value of Bitcoin. I mean, considering basic economics and how scarcity inversely correlates with value, it couldn’t have been hard to derive that conclusion. However, is it possible that he could have anticipated the significant cultural influence this pre-programmed technical process would take on?

In those early days, the Bitcoin community was a tiny one, comprising merely thousands globally - a few cypherpunks here and there, coders, and a handful of libertarian idealists tinkering in home offices, basements, and dorm rooms, securing the network while earning those block rewards. Unaware, of course, of the frenzy and excitement that would one day surround each approaching halving.

And yet, that obscure, humble beginning, was about to birth a cultural phenomenon unlike anything those first few miners nor even Satoshi could have envisioned. With the gradual emergence of Bitcoin into mainstream consciousness over its 15 years of existence, the 4-year hard-coded algorithmic ritual morphed from mere technicalities of a program, into a global celebration - an event that unifies Bitcoiners worldwide, no matter their creed, race, and political ideology and all other superficial ethnocultural and socio-economic classifications we have created - eagerly anticipating, planning parties, that have now come to mark the progression of this monetary revolution.

FROM MACRO EVENT TO QUASI-HOLIDAY

The once arcane, behind-the-scenes process of miners receiving fewer freshly minted bitcoin, blossomed into a veritable quasi-holiday for Bitcoiners and Cryptography enthusiasts. With its gradual emergence from the fringes, from the darker corners of the internet back in the days when it used to be seen as a tool for hackers, unscrupulous individuals, and bad actors, Bitcoin gained mainstream awareness, enabling the halving to take up a seemingly mystical significance. It became not just a routine supply shock in BTC issuance, but a chance for Bitcoiners around the world to unite in their shared commitment to a monetary protocol that at its foundation, possesses the core principles of decentralization, limited supply, and independence from government manipulation.

As we approach the 2024 halving - depending on when you’ll be reading this - it has become curiously impossible to ignore the growing cultural significance of this event. Halving countdowns have now become a recurrent element on social media. Bitcoin and Crypto news platforms, as well as mainstream media outlets and other financial news platforms, have published reports about the halving over the past few months. And then there are events and parties scheduled throughout April 2024. At these events, Bitcoiners will gather for halving-themed parties and events across the globe - from a "Bit-Rave" festival in San Salvador to themed happy hours in the pubs of Bedford, UK, and even a lakeside gathering in the California desert. There’s even talks of a bitcoin halving festival being held in Calabar, Nigeria. It's a fair bet that there must be a bunch of other such events either already past, or scheduled to hold within the month somewhere in the world.

Though admittedly not all of them are exactly “halving parties”, but, the fact that they are all scheduled for April when we expect the confirmation of the 840,000th block, tells all.

CEMENTING SATOSHI’S VISION FOR SCARCITY AND DECENTRALIZATION

As we look ahead towards the 2024 halving considering what it has grown to be these past decade-plus, one question comes to mind; will this quadrennial event continue to hold such profound significance? Bitcoin’s identity seems to have formed its base around the halving. It seems to have been ingrained in such a way that Bitcoin, as we know it today, will not be what it is without the event. That much is clear. It creates a reliable, as well as a predictable cadence for Bitcoiners to gather in a shared celebration of the protocol's core ethos. Each iteration reinforces the network's commitment to true digital scarcity, decentralization, immutability, and censorship resistance - the very principles that drew early adopters to this monetary revolution in the first place. The very same principles on which Satoshi’s vision - not the flawed BSV fork though - is based.

The halving can be said to be a self-fulfilling prophecy - each supply squeeze is expected to drive up bitcoin’s price, thereby further cementing its place as a store-of-value asset that transcends time. This “prophecy” has enabled analysts, traders, and institutions to develop entire frameworks around the halving’s anticipated impact. Which further emphasizes the point earlier alluded to; that it is ingrained in Bitcoin’s identity. This weaves it into the cultural fabric of the digital currency in a way that transcends its origins as merely a technicality.

CONCLUSION

As the 2024 Bitcoin halving approaches, its ever enduring significance may lie in its ability to consistently remind Bitcoiners of the network's unwavering principles. In an era marked by rapid technological shifts and widespread social upheaval, the halving's reliability and unchanging nature provides a sense of stability - a guidepost - so to speak - for this movement.

The halving serves as a totem, a rallying cry that unites Bitcoiners in their commitment to this monetary revolution, regardless of the fluctuations and disruptions that are unavoidable in the world we live in today. It will remain a quadrennial occurrence that will continue to hold an honored place in Bitcoin culture, reminding us of each passing cycle of the network's unshakable principles and the unstoppable force of Satoshi's infallible creation.

This event, this beacon of hope in unsettling times, represents an enduring constant, a touchstone that reinforces the immutable foundations upon which the Bitcoin network is built. As the celebrations surrounding the 2024 halving reach a fever pitch once more, we can be certain that this tradition will remain a vital part of the Bitcoin movement, serving as a guidepost for adherents weathering the storms of a rapidly changing technological, social landscape, geopolitical uncertainties, and global economic maelstrom.

This is a guest post by Emeka Ugbah. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

While to the greater Bitcoin culture, Bitcoin halvings are seen as a celebratory event, for miners, things tend to be a tad stressful. As Bitcoiners around the world gather to celebrate block 840,000, miners are hunkering down and preparing for their reward for mining blocks to decrease by 50%, while the cost of their operations remains the same.

With the next bitcoin halving scheduled to occur on April 19, one might imagine that Fred Thiel, CEO of Marathon Digital Holdings, the largest publicly-traded Bitcoin mining company in the world, might be worried. But after sitting down with Thiel just days before the halving, he doesn’t appear to be breaking a sweat.

Why’s that?

One of the reasons is that Marathon plans to generate alternative streams of revenue utilizing the heat emitted from its bitcoin mining rigs.

“Bitcoin mining in and of itself does something very efficiently, which is produce heat,” Thiel told Bitcoin Magazine. “50% of industrial energy spend is spent to heat things, so imagine if you could capture the heat from Bitcoin miners and Bitcoin miners could get paid for that. That would subsidize their cost of electricity.”

During a fireside chat with Senator Cynthia Lummis (R-WY) at the Bitcoin Policy Summit, held on April 9, 2024 in Washington, DC, Thiel shared an example of how Marathon plans to utilize the heat its miners produce.

“One of the things we’re doing in Nebraska actually is we’re starting to heat greenhouses and do shrimp farming using the heat from Bitcoin mining as a byproduct,” Thiel explained to Senator Lummis.

“I think you’re going to start seeing this as a way for people to grow proteins in areas of the disadvantaged world,” he added.

Utilizing the heat Marathon’s miners produce is one of the ways in which Thiel is looking to change the perception of Bitcoin mining from something that’s parasitic to something that’s productive.

This dovetails well with the fact that Marathon continues to improve its ability to use waste gas as fuel for its miners.

Toward the end of 2023, Marathon launched a pilot project in which it mined bitcoin with energy derived solely with landfill methane, a gas that’s 80x more potent as a greenhouse gas than CO2.

The project was a success, according to Thiel.

“It was a proof of concept that showed that you could successfully mine bitcoin using landfill methane gas,” he told Bitcoin Magazine. “Mining on landfills is very hard, but we were able to prove that you could do it quite successfully.”

Thiel expanded on these efforts in his conversation with Senator Lummis, tying together the ideas that Marathon could produce this heat it plans to use while having a positive impact on the environment.

“You generate energy with that by turning it into methane and then converting that into electricity and you create heat with the electricity,” he told Senator Lummis. “If you can take a waste product, turn it into energy and feed heat back into an industrial process, you do more for the environment than a lot of environmentalists want. And at the same time, your cost to mine bitcoin becomes very small because your energy cost is low.”

BlackRock, the world's largest asset management firm with over $10.5 trillion in assets under management, has unveiled a series of educational content aimed at explaining Bitcoin, the Bitcoin halving, and its implications, along with insights into its approved spot Bitcoin ETF.

"April is packed with rare events this year, with eyes set on the upcoming bitcoin halving - a unique process that only happens every 4 years," said U.S. Head of Thematic and Active ETFs at BlackRock, Jay Jacobs. "Tune in below to learn how this impacts bitcoin's value, and for more about investing in bitcoin ETFs."

JUST IN: BlackRock releases educational #Bitcoin video.

— Bitcoin Magazine (@BitcoinMagazine) April 17, 2024

pic.twitter.com/CLaMtQtzDS

In a series of four videos, available on BlackRock's official website, the asset manager discusses the fundamental aspects of Bitcoin as an investment, addressing common questions and concerns for investors looking to understand and navigate the Bitcoin landscape. Topics covered include the underlying technology of Bitcoin, its role in investment portfolios, keeping Bitcoin secure, and the significance of events like the Bitcoin halving.

"Bitcoin is the world’s most recognized and widely adopted cryptocurrency – and the first form of internet-native money to gain widespread global adoption," BlackRock stated on its webpage." "Bitcoin allows for peer-to-peer transactions outside of central intermediaries like banks."

With the recent approval of its spot Bitcoin ETF, $IBIT, BlackRock's educational initiative aims to take advantage the increasing mainstream acceptance and interest in Bitcoin, emphasizing the importance of education and informed decision-making for the new classes of investors entering this market. The ETF offers exposure to Bitcoin's price movements without requiring direct ownership of the digital asset, catering to more traditional investors seeking diversified investment opportunities.

Taproot Wizards released a cartoon yesterday called CatVM. I will not refer to it as a whitepaper, those are real academic documents for adults. In the cartoon, interspersed amongst the absurd childish narratives, were a few valuable technical insights regarding different scaling proposals in the Bitcoin ecosystem. Of course, in true cartoon fashion, buried between wild exaggeration and embellishment.

The end goal of the cartoon was to propose a new mechanism for moving in and out of scaling layers built on top of Bitcoin. To disentangle that actual proposal from the cartoon, we’ll have to break down the two pieces involved.

The Building Blocks

Rijndael’s first OP_CAT experiment was constructing a vault, a scheme that allows a user to create an intermediate “staging” transaction to withdraw their funds from the vault. This kicks off a timelock, during which they can at any time send their funds back to the vault or a secure cold storage wallet, and after the timelock the user can freely withdraw the funds to the destination they chose when beginning the withdrawal process. These are the only two ways bitcoin sent to the vault script can be spent.

Explaining the full mechanics of how this is accomplished is essentially an article in itself, so I’m going to do something I usually don’t and hand waive this away as “magic.” (Explained here by Andrew Poelstra) What this “magic” allows you to do, by creating non-standard Schnorr signatures and with the help of OP_CAT, is to build the transaction the signature check is against on the script stack. This lets you enforce that certain parts of the transaction are exactly as defined ahead of time. It also allows you to put the output from a previous transaction on the stack in the process of building the transaction spending it, meaning you can compare outputs from the spending transaction against outputs from the previous transaction. This allows you to guarantee by comparing them that certain parts of the previous transaction’s outputs match certain parts of the new outputs. I.e. the script, or an amount. So you can “carry forward” parts of the old outputs into the new ones, and enforce that.

Something else you can do with OP_CAT, which did not need Rijndael tinkering and experimenting with to prove, is verify merkle tree branches. Because you can CAT stack items together, and Bitcoin already supports hashing data on the stack, you can slowly build up a merkle tree root from a leaf node with the interior nodes. Hash two pieces together to get one hash, hash that with the pair hash, and so on. Eventually you get the root hash on the stack. You can then compare it with OP_EQUAL against a predefined root hash in the locking script.

Unilateral Withdrawal

These two building blocks are enough to facilitate a unilateral withdrawal mechanism from a group shared UTXO. A merkle root can be embedded in a transaction using OP_RETURN or another mechanism that commits to a leaf node for each user. The UTXO script can be structured so that any user with a balance can attempt to withdraw it. To do so they would provide the merkle branch committing to the amount they are entitled to, the authorization proof such as a public key to check a signature against, and construct the transaction on the stack to verify the appropriate conditions are met.

Similar to Rijndael’s OP_CAT vault, this withdrawal transaction would function as a staging point. User funds would be restricted by a timelock, and they would not be capable of completing the withdrawal until it expires. At any time before the timelock expires, any other user can create a fraud proof to stop the withdrawal and shove funds back into the group UTXO script. They can do this because of OP_CAT’s ability to verify merkle trees. If someone has used a specific merkle branch to withdraw funds from the UTXO before, then that was included in a block somewhere. By constructing a transaction containing the SPV proof of that transaction inside an actual block, which can use OP_LESSTHANOREQUAL to verify the blockheader meets some minimum difficulty, they can prove on the stack that the merkle branch was used before. This allows duplicate withdrawals to be prevented.

In addition to this, because you can use the “CAT on the stack” trick to ensure specific pieces of a previous transaction must be included in the next, you can guarantee that the current merkle root is carried forward into the next transaction after a successful withdrawal. You can also guarantee that change from the withdrawal goes back into the group sharing script. This guarantees that after one user withdraws their funds, the change UTXO is locked with a script that allows any remaining user to withdraw, and so on. Any user can unilaterally withdraw their funds at any time in any order, with the guarantee that the remainder of funds are still accessible to the rest of the users.

The VM Part

Readers should be familiar with the basic idea of BitVM. You can take an arbitrary computation and break it up into each of its constituent pieces and embed them in a large taproot tree, turning that computation into a back and forth challenge/response game. This allows you to lock bitcoin with more complicated conditions than is directly supported by bitcoin script itself. The only real shortcoming is the need to craft a massive amount of pre-signed transactions to facilitate this.

The requirement to use pre-signed transactions is so that in the challenge/response dynamic, you can guarantee that coins are spent back into the large taproot tree encoding it unless an exit condition one way or the other is reached. OP_CAT and the ability to “carry forward” data from previous transactions allows you to guarantee that without needing pre-signed transactions.

So not only does this scheme allow any user to unilaterally exit on their own, it also allows locking conditions supported by a second layer that are not supported by Bitcoin script to actually be enforced in the withdrawal process. I.e. if some coins were encumbered by a smart contract the base layer doesn’t understand, and then withdrawn from the second layer, those more complicated conditions could still be settled correctly on the base layer as the coins are withdrawn.

The Missing Piece

One thing that OP_CAT does not enable is updating a merkle tree root representing user balances off-chain verifiably. It can enable an already committed state to facilitate unilateral withdrawals, but that is because a whole section of the tree is actually put on-chain and verified. To update that root off-chain by definition means you are not putting the data on-chain. This represents a problem. There is no way with just CAT to efficiently verify that all changes to the merkle tree were authorized properly by the relevant users.

Someone(s) has to be trusted, and by the nature of things capable of spending the UTXO however and wherever they want, to efficiently replace an old state root with a new one to represent all off-chain balance changes. A new opcode in addition to OP_CAT, such as OP_ZKVERIFY, would be needed to do this in a trustless manner.

This wouldn’t be the end of the world without OP_ZKVERIFY though. The entity updating the merkle root for off-chain transfers could be an n-of-n multisig, with 100% of the participants required to sign off on any root changes. This boils down to the same trust model as BitVM based pegs, where as long as a single honest participant exists, no one's funds can be stolen. It is a stark improvement over existing BitVM designs however when it comes to the withdrawal process.

In BitVM pegs, users do not have a unilateral withdrawal mechanism. Peg operators must be trusted to fulfill user withdrawals, knowing that they can claim back funds they have spent doing so relatively trustlessly from the BitVM peg. While the incentives of this are very solid, it still does require users essentially getting permission from someone else to exit the system, they cannot do it on their own. With CatVM, users can claim back their funds unilaterally, and an operator is not required to front their own liquidity to process withdrawals.

Wrapping Up

Overall, the design is incomplete in terms of construction. This is not something I would call a Layer 2 in and of itself. It is the core of one, the mechanism and structure for how funds are locked into a Layer 2, and the process for how users can withdraw their funds. It definitely has a lot of flexibility and usefulness to it.

In the worst case scenario, users do not need anyone’s permission to safely claim their funds back on-chain. It also allows more flexible programmability of funds, while still carrying the enforcement of those conditions to the base layer in the event of worst case unilateral exits. If one day we do eventually get something like OP_ZKVERIFY, the off-chain state progression can become an actually trustless process.

I don’t expect any concrete demos in the near future, but it definitely is a sound idea in my opinion, and something worth considering. It also shows that the wizards are doing a little more than just pumping stupid jpegs.

The Bitcoin halving event, a pivotal occurrence, is scheduled for April, 19 2024. This quadrennial event will reduce the block subsidy for Bitcoin miners from 6.25 BTC to 3.125 BTC, thereby halving the reward that miners receive for their efforts. Such events have historically led to profound shifts in the mining landscape, potentially influencing various economic and operational facets of Bitcoin mining.

Economic Outlook and Market Predictions

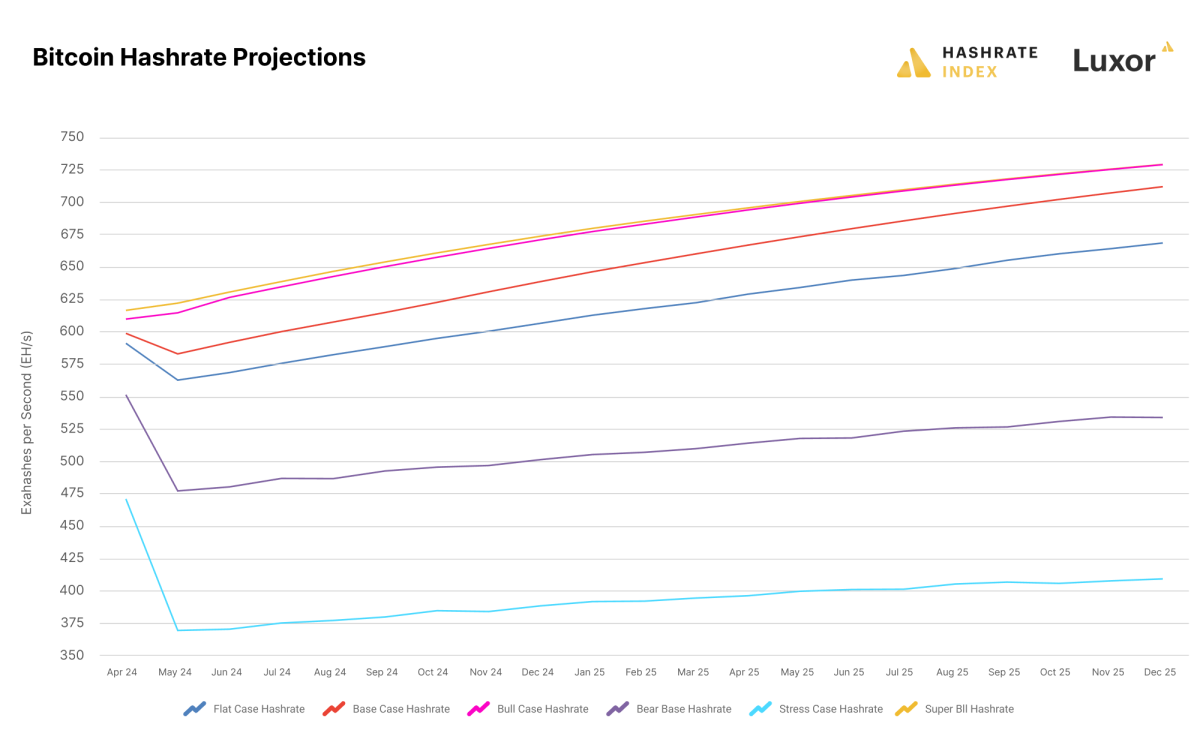

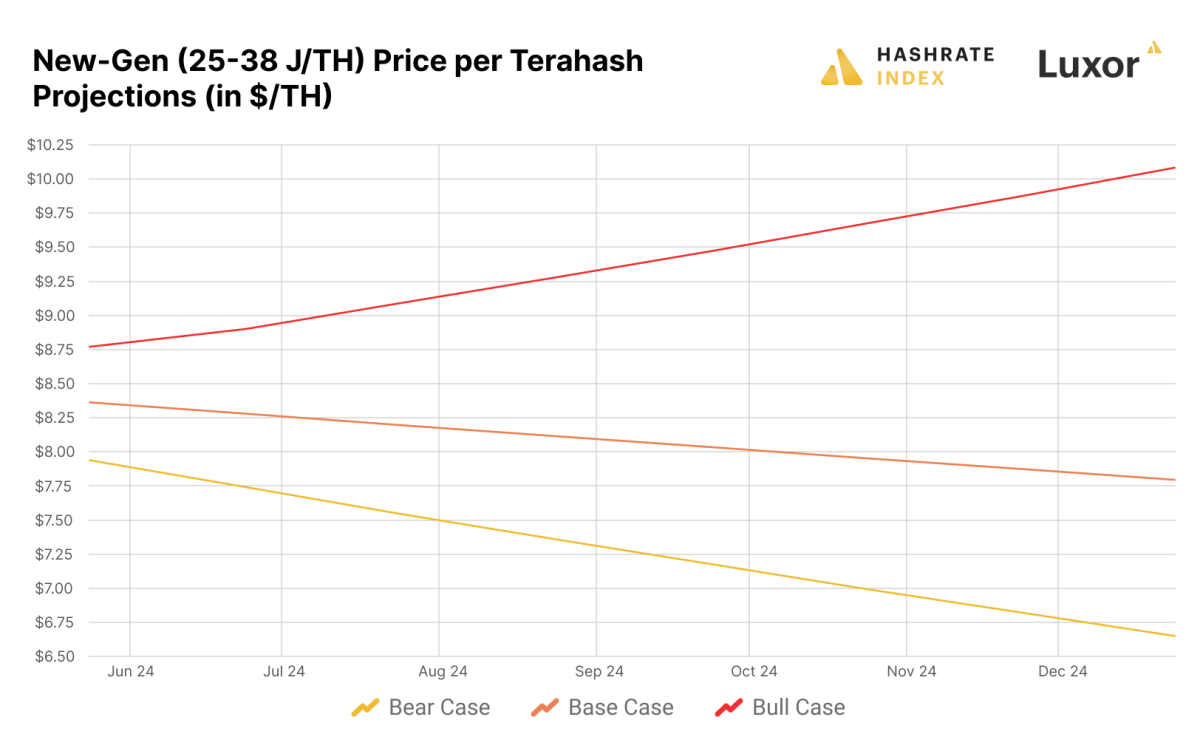

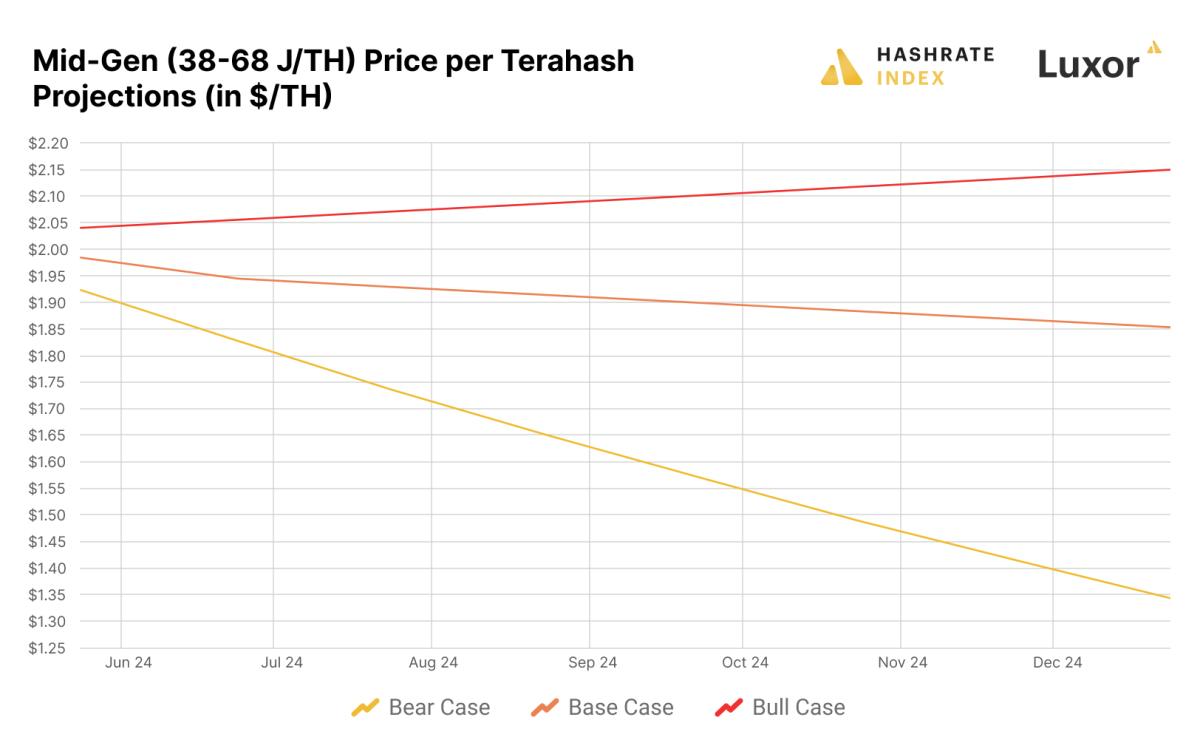

After the halving, the immediate impact is a considerable decrease in miner revenue due to the reduced block subsidy. This could lead to a decline in the hashrate as less efficient miners may turn unprofitable and exit the network. Luxor’s Hashrate Index Research Team projects about 3-7% of Bitcoin’s hashrate could go offline if Bitcoin’s price maintains its current level. However, if prices fall, up to 16% of the hashrate could become economically unviable, depending on the trajectory of Bitcoin prices and transaction fees post-halving.

The hashrate, a critical security measure for Bitcoin, might adjust along with difficulty levels to align with the new economic realities. Luxor’s analysis suggests different scenarios where the network's hashrate could end up ranging from 639 EH/s to 674 EH/s by year's end, reflecting adjustments to the new earning potential post-halving.

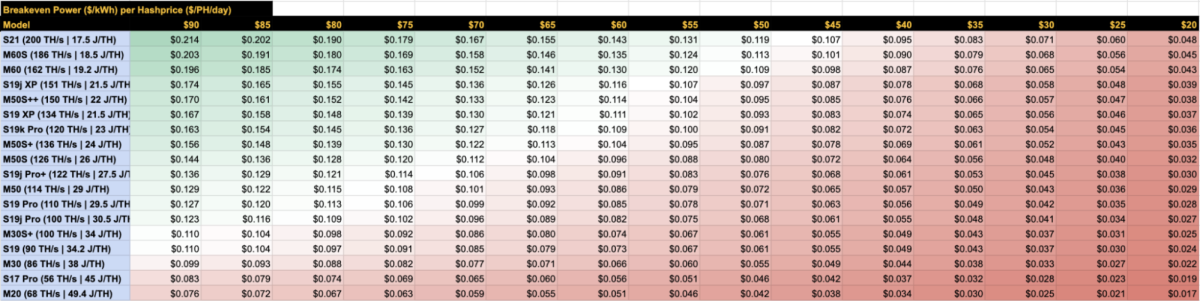

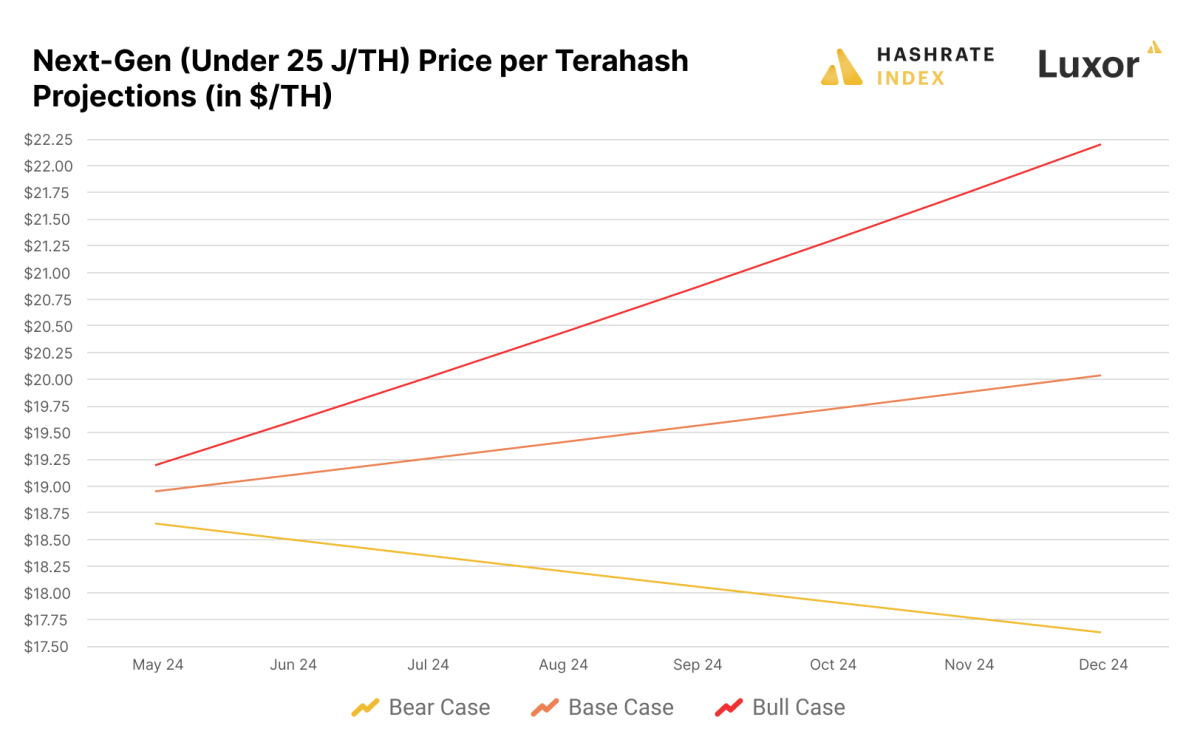

ASIC Pricing and Breakeven Points

Post-halving, the profitability of different ASIC models will become crucial as the mining reward drops. Lower rewards mean that only the most efficient machines will be able to operate profitably if the price of Bitcoin does not see a significant increase. For instance, according to Luxor’s projections, next-generation ASICs like the S19 XP and M30S++ might have breakeven power costs ranging from $0.07/kWh to $0.15/kWh, depending on post-Halving hashprice.

This shift in profitability will likely lead to a repricing of ASIC machines. Historical data suggests that ASIC prices are highly correlated with hashprice; therefore, the anticipated reduction in hashprice will prompt a downward adjustment in ASIC values. This will particularly impact older and less efficient models, potentially accelerating their phase-out from the market.

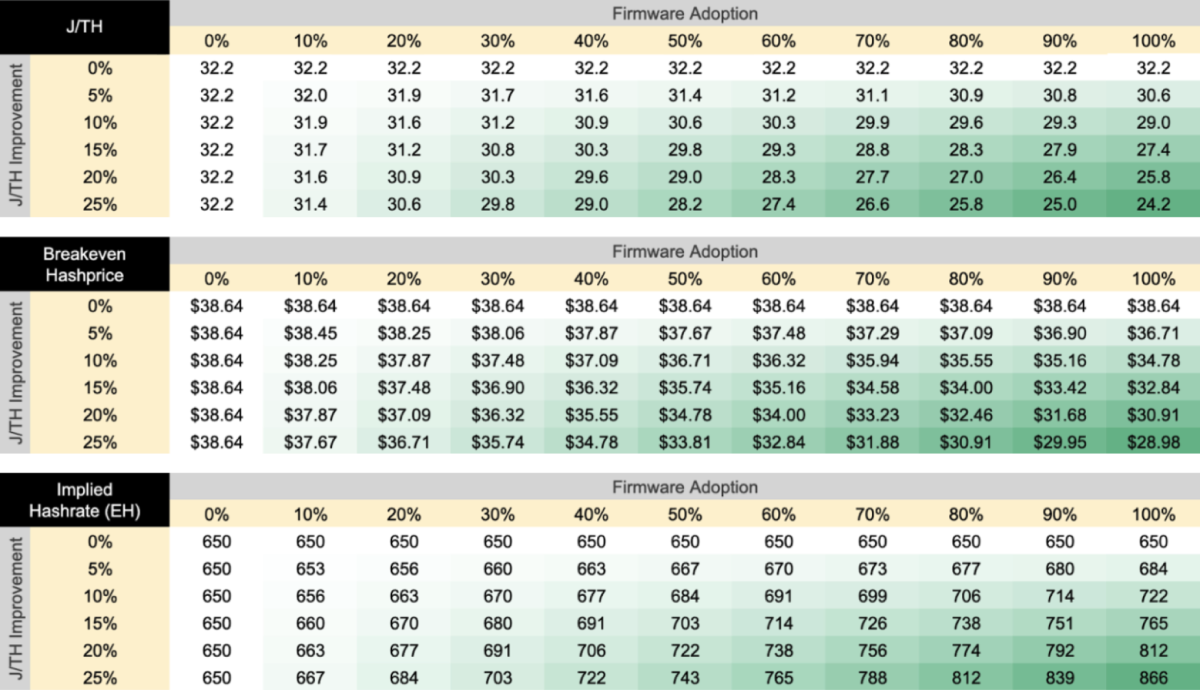

The Role of Custom ASIC Firmware Post-Halving

To combat reduced profitability, miners are increasingly turning to custom ASIC firmware to improve the efficiency of their hardware. Firmware like LuxOS and BraiinsOS can enhance the performance of machines by optimizing their power usage and hashrate output, thus lowering the breakeven point for electricity costs. For example, underclocking an S19 with custom firmware could extend its operational viability by reducing its power draw, thereby maintaining profitability even at lower hashprices.

Public miners, in particular, are adopting custom firmware to boost the efficiency of their fleets. Companies like CleanSpark and Marathon have reported using custom solutions to enhance their operational efficiencies. This trend is expected to grow as more miners seek to maximize their output and minimize costs in the face of decreasing block rewards.

2024 Bitcoin Halving and Beyond

The 2024 Bitcoin Halving is set to reshape the mining landscape significantly, just as previous halvings have. While the exact outcomes are uncertain, the event will undoubtedly present both challenges and opportunities. Miners who plan strategically, taking into account both economic forecasts and operational efficiencies, will be better positioned to navigate the post-halving environment. For those in the Bitcoin mining industry, staying informed and adaptable will be key to leveraging the halving event as an opportunity rather than a setback. With the right preparations, particularly in ASIC management and firmware optimization, miners can continue to thrive even under tightened economic conditions.

This is a guest post by El Sultan Bitcoin. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Hong Kong's highly anticipated spot bitcoin exchange-traded funds (ETFs) are slated to launch by the end of April, according to various industry sources.

NEW: 🇭🇰 Hong Kong #Bitcoin ETFs to start trading by 30th April and could bring in $25 billion: Reports

— Bitcoin Magazine (@BitcoinMagazine) April 17, 2024

Just a matter of time 🚀 pic.twitter.com/Y1Xo4JVrO7

The Hong Kong Securities and Futures Commission (SFC) recently approved several fund managers to offer spot bitcoin ETFs. Following this, OSL, a crypto infrastructure provider for some approved fund managers, stated that the bitcoin ETFs are aiming to go live as early as late April.

Markus Thielen, founder of research firm 10x, also stated that the Bitcoin ETFs could start trading by April 30th. The launch timeline will depend on finalizing details with regulators.

Once listed, analysts predict the accessible funds could attract significant capital inflows. Singapore-based Matrixport expects mainland Chinese investors to pour up to $25 billion into Hong Kong's Bitcoin ETFs via the Southbound Stock Connect program.

Thielen echoed this sentiment, stating the ETFs could yield $25 billion if fully accessible to Chinese investors. However, he noted that Chinese participation may take at least six months due to evolving regulations.

Nonetheless, the ETFs mark a milestone for Bitcoin adoption in Asia. They provide regulated exposure to bitcoin, opening the assets to a broader range of investors.

The funds' unique in-kind redemption feature also makes them competitive globally. This allows swapping bitcoin directly for ETF shares, increasing efficiency.

By approving the ETFs, Hong Kong cements its position as a rising Bitcoin hub. The city is moving swiftly to license Bitcoin companies and products amid growing demand.

With bitcoin's next halving just days away, the ETF launch timing is opportune. Many predict the supply shock event will propel Bitcoin to new highs, benefiting linked investment vehicles.

If successful, Hong Kong's spot ETFs could prompt other Asian jurisdictions to follow suit. The domino effect would boost regional participation and maturity for the Bitcoin market.

In the whirlwind of April 2024, with Bitcoin ETFs dominating headlines and halving celebration planning in full swing, the Bitcoin Policy Summit emerged as a pivotal moment for policymakers, industry leaders, and human rights champions. Against the backdrop of global discussions on Bitcoin regulation—and coinciding with a solar eclipse—the summit aimed to be a beacon of reason and a catalyst for action in the rapidly evolving world of digital assets.

The Bitcoin Policy Summit boasted a remarkable turnout, with more than 45,000 individuals tuning into the livestream. Among the 500+ in-person attendees were representatives from 26 universities, 75 government officials, and 250 public policy professionals. The summit also garnered attention from over a dozen media outlets. Notably, elected leaders from both major political parties were present, alongside representatives from prominent organizations such as the World Bank, World Economic Forum, International Monetary Fund (IMF), State Department, Department of Commerce, Treasury Department, Environmental Protection Agency (EPA), Department of Energy (DOE), Department of Defense (DoD), and the Commodity Futures Trading Commission (CFTC).

The summit, with its diverse mix of voices and perspectives, shed light on the pressing need for smart and informed decision-making in the realm of digital asset policy. While Bitcoin symbolizes financial freedom and empowerment, it also brings its fair share of challenges, from concerns about money laundering to energy usage. The summit tackled these complex issues head-on, offering insights into the multifaceted world of Bitcoin as it relates to mining, geopolitics, the future of money, and human rights.

The Bitcoin Policy Summit witnessed a significant turnout of policymakers committed to safeguarding the opportunities presented by Bitcoin and addressing its associated challenges. Figures such as Senators Marsha Blackburn, Kirsten Gillibrand, and Cynthia Lummis, alongside House members Wiley Nickel, Tom Emmer, and Patrick McHenry, lent their expertise and bipartisan support to the discussions. Their active involvement not only enriched the conversation but also signaled a united effort to ensure that digital asset policies foster innovation, protect consumers, and uphold transparency and accountability.

One of the most striking features of the summit was its focus on the intersection of Bitcoin and human rights, with speakers like Felix Maradiaga, 2024 Nobel Prize Nominee and prominent human rights advocate from Nicaragua; Anna Chekhovich, financial director of the Anti-Corruption Foundation (ACF) founded by Alexei Navalny; Roya Mahboob, Afghan entrepreneur and women's rights advocate; and Lyudmyla Kozlovska, Ukrainian human rights activist. Their combined emphasis on Bitcoin’s critical role in defending human rights and freedom of expression in the face of dictators and oppressive regimes shed light on broader roles for digital assets that many in the United States may not have previously considered.

Furthermore, the summit stressed the importance of taking a global perspective on digital asset regulation to protect human rights. In a world where digital assets know no borders, fragmented regulatory approaches risk creating loopholes and undermining financial integrity. Human rights activists stressed the need to protect privacy, free speech, and equal access to financial services for all, regardless of where they are.

The conference hall buzzed with anticipation as attendees dispersed into three specialized rooms for afternoon deep dive tracks: Mining & Energy, Geopolitics, and Future of Money. Concurrent programming featured keynotes such as “A Climate Scientist’s Perspective on Bitcoin” by Margot Paez, BPI fellow and PhD candidate at Georgia Institute of Technology. Fireside chats and panels included "Bitcoin & Financial Inclusion" with Chastity Murphy from the U.S. Treasury, and "Countering Digital Authoritarianism" featuring renowned writer Roger Huang, author of ‘Bitcoin and China’, and Jorge Jrsaissati, President of the Organization for Economic Inclusion.

One of my personal highlights from the Bitcoin Policy Summit was engaging in a fireside chat with Senator Marsha Blackburn from my home state of Tennessee. We explored the connection between Bitcoin and her advocacy for consumer rights and privacy. Additionally, we discussed Tennessee's growing prominence as a Bitcoin hub and her stance on CBDCs (spoiler: she’s not a fan). It's truly inspiring to witness elected leaders championing both monetary and digital freedoms, reinforcing their commitment to safeguarding these fundamental rights.

Another standout moment occurred during a post-summit dinner with Felix Maradiaga and his wife, Berta Valle. Felix, who endured four years of imprisonment under a Nicaraguan dictator, shared firsthand accounts of political dissent and activism. These experiences underscore the importance of Bitcoin as a decentralized monetary network, providing resilience against oppression.

The 2024 Bitcoin Policy Summit in Washington D.C. served as a crucial platform for educating policymakers and advocating for Bitcoin's role in shaping a freer and more sustainable financial future. Through candid dialogue, diverse perspectives, and collaborative efforts across sectors, participants witnessed the transformative potential of Bitcoin to advance global human rights, bolster national security, and accelerate renewable energy adoption. As we reflect on the insights garnered from the summit, let's seize this pivotal moment to shape a regulatory landscape that not only fosters innovation and economic growth but also champions human dignity, justice, and liberty.

This is a guest post by Stephen Pollock. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

This article is written in partnership with Unchained, the official US Collaborative Custody Partner of Bitcoin Magazine and integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

Bitcoin tumbled below $60,000 over the weekend, fueled by conflict between Iran and Israel, sparking fears that escalation could lead to Western involvement in a war in the Middle East—an all too common occurrence in the 21st century that would lead to increased inflationary pressures and disrupt global supply chains and commodity markets. While skeptics were quick to mock bitcoin’s near instantaneous selloff in reaction to the news of conflict, ironically bitcoin was one of the only global asset open for trading on the weekend, with equities, commodities, and bond strategists alike turning their eyes to the bitcoin chart in an attempt to assess what the damage might be to global markets upon the Sunday night trading open.

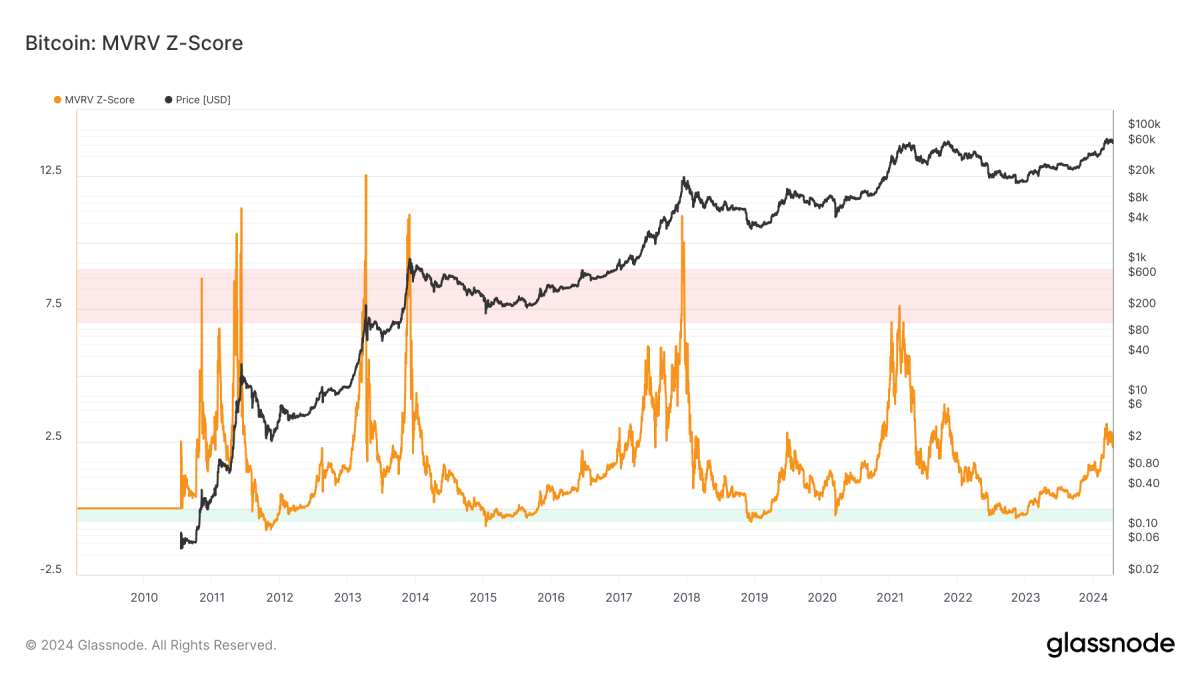

Turning away from geopolitics, this brief article will take a look at the latest in on-chain spending behavior and Bitcoin derivative markets, to analyze whether the current dip from the highs of $73,000 is typical of a standard bull market correction or more so a cyclical peak.

Many preconceived notions of a typical Bitcoin cycle have already been shattered with new highs being broken before the upcoming halving taking place on block 840,000. So let's evaluate and take a look at where we are, and how these conditions and investor behavior also inform what might come next.

We’ll be looking at both on-chain data, to analyze the actions of incumbent Bitcoin hodlers and new market entrants alike, before taking a look at the derivatives market to gauge whether there is anything worrisome in regards to the leverage currently present in the market.

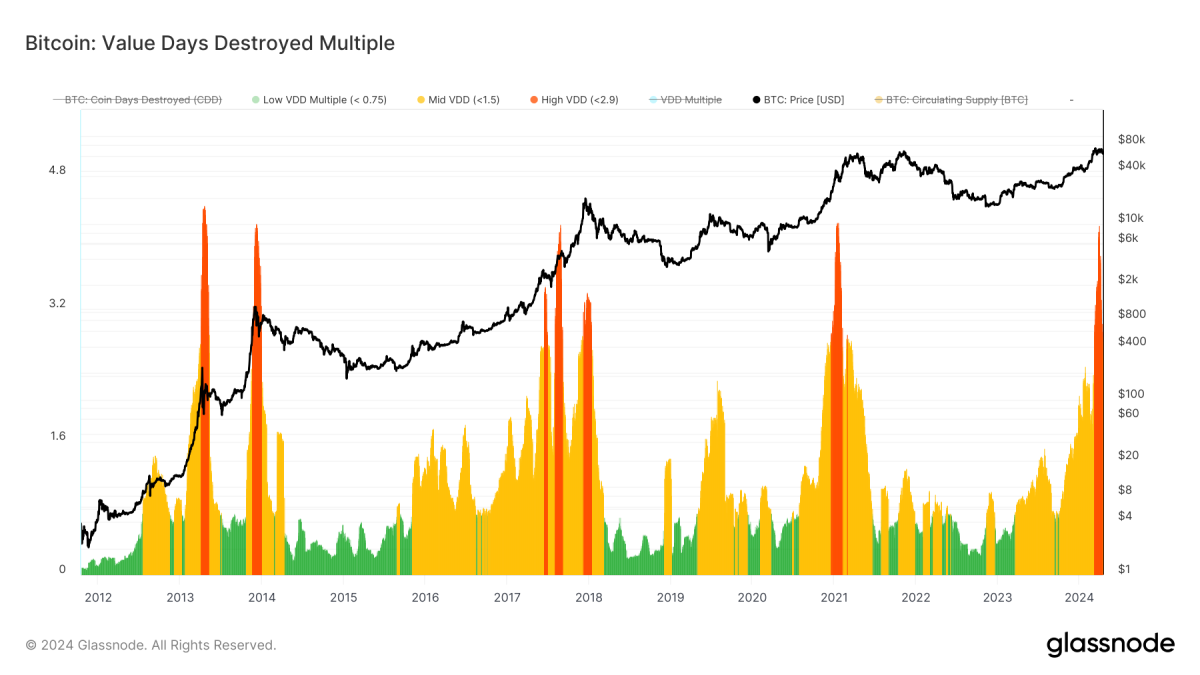

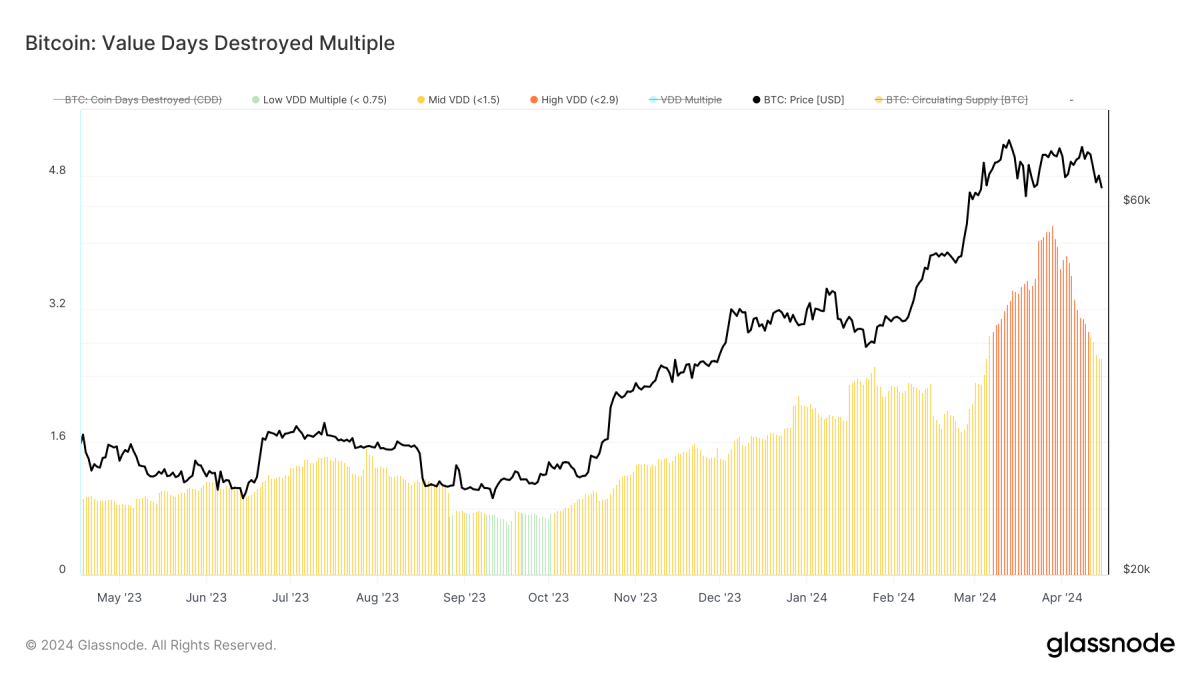

First, we’ll take a look at a metric called the Value Days Destroyed Multiple, coined and created by TXMC, which compares near-term spending behavior to the yearly average, as a means of detecting overheated and undervalued markets. A brief look at this signals that the bull market is well underway, and may have even peaked.

We can attribute approximately one third of the spending as a simple transfer of coins from the Grayscale Bitcoin Trust to new ETF participants like BlackRock, Fidelity, and Bitwise. However, the raw data is just that—the raw data, and we can see there has been a significant amount of spending that’s occurred with the push to new highs.

A closer look at the metric, however, shows that this spending activity is cooling off, and there is historical precedent for new highs in the market in both the 2017 and 2021 cycle - this is merely a data point to keep in mind.

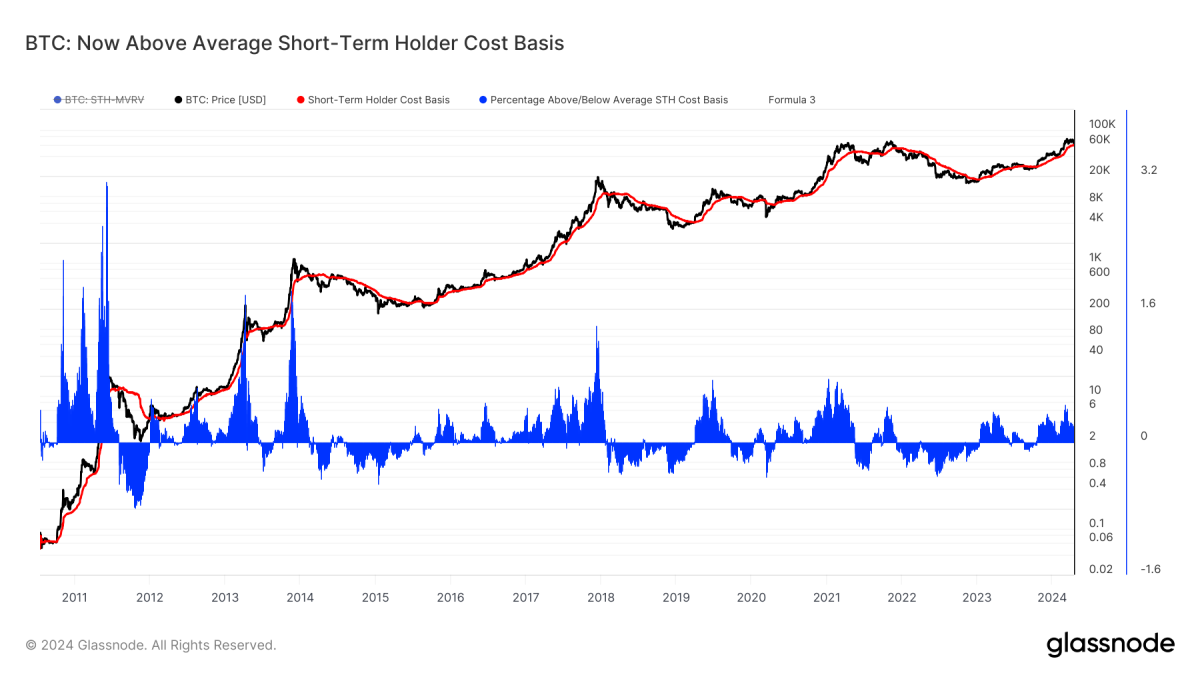

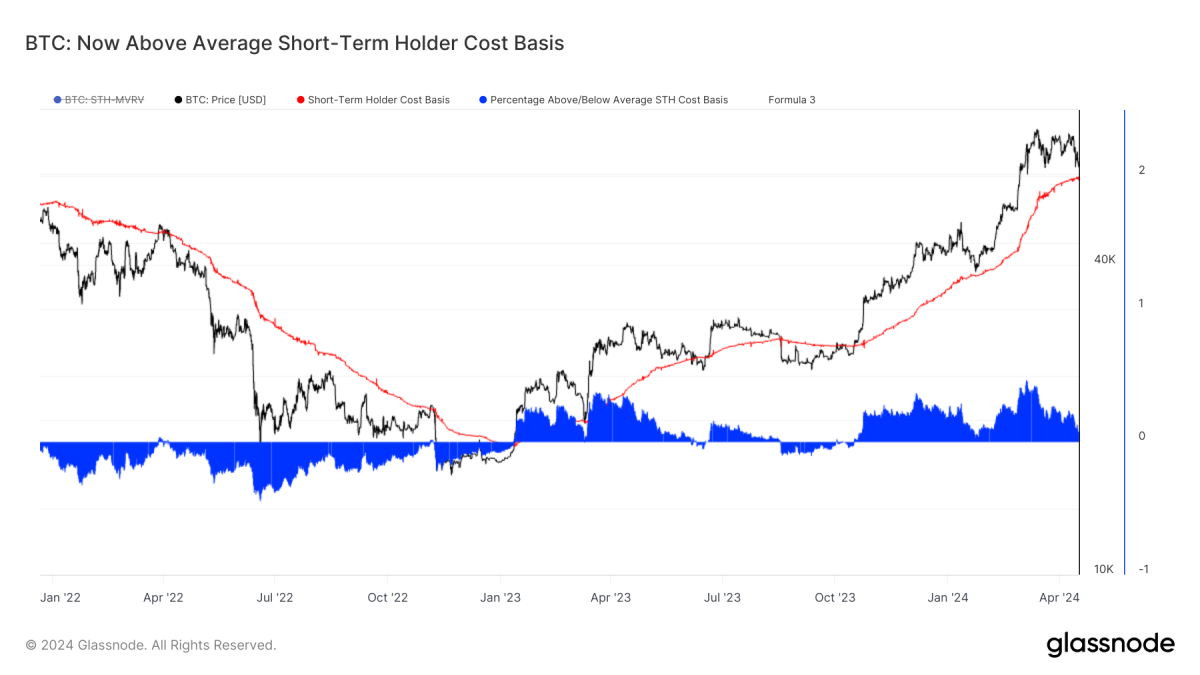

Next, taking a look at the interplay between HODLers and new entrants, viewed through the lens of short-term and long-term holders, we can see that during a typical bull market, revisits to the cost basis of short-term holders are not only typical but also quite healthy.

Additionally, the ability for this approximate price level to serve as support is a characteristic of bull markets, with the inverse being true in a bear market, where this psychological level of average short-term holder price (cost basis) often serves as ironclad psychological and technical resistance. As for where that level is today, approximately $58,500, which means that by no means is a visit to this level a guarantee or certainty, but rather it is something that is perfectly in the norm of expected activity in a bull market.

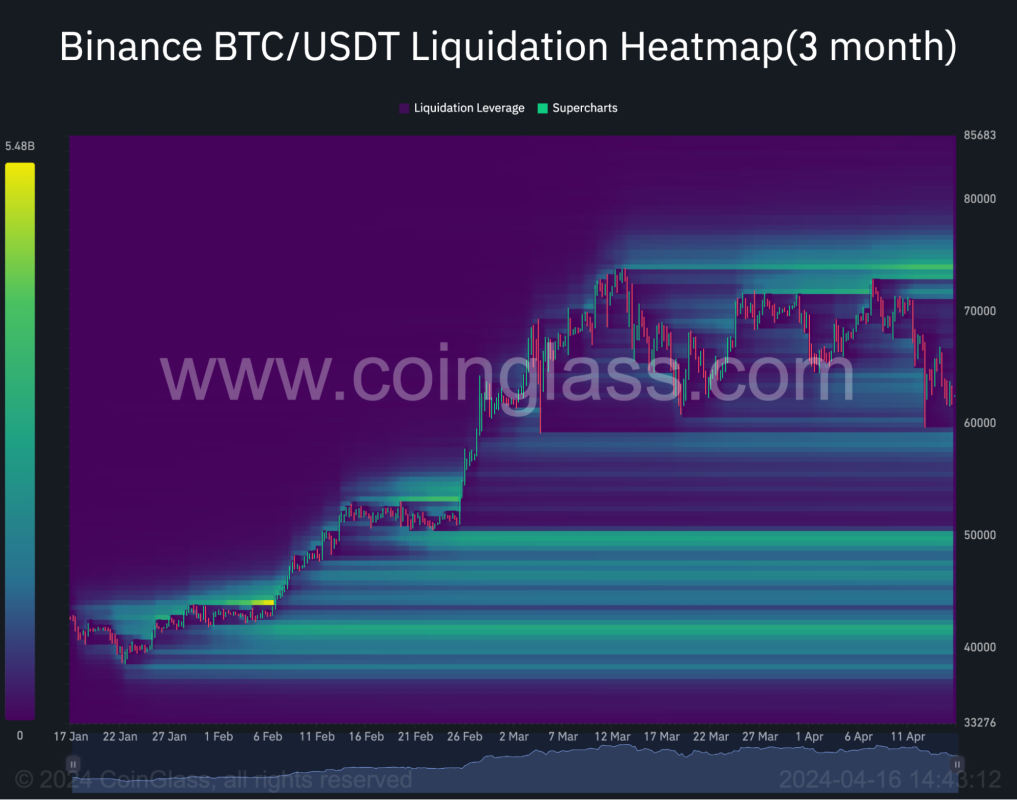

Turning our attention to the derivatives market, there has been a healthy flush of leverage and speculative froth across the market. Perpetual futures open in bitcoin terms are near the lowest levels seen since 2022, while futures have been trading at a slight discount to spot markets since the weekend flush lower. While there is no law or guarantee that this brings about higher prices immediately, similar positioning in the past has fostered the conditions for price appreciation, and when compared to the top-heavy speculative froth of a speculative premium in futures market pricing observed over the last month or so, it is a welcomed development.

In terms of points of interest when eyeing the derivatives landscape, the buildup of liquidatable leverage above $70,000 continues to grow, with emboldened shorts looking to push price meaningfully below $60,000. While there is some leverage to be purged under the $60,000 level, the real prize for bears is under the $50,000 level.

While certainly crazier things have happened in Bitcoin than a -33% pullback from all-time highs, spot demand is likely to be strong from $50,000, and a wipe of open interest and the start of a negative futures premium relative to spot markets hint at most of the pullback having already taken place. It would likely take a significant risk-off moment across the macro landscape for this to unfold, and any dip is likely to be fleeting given the perpetuating reality of the pace of fiscal deficit spending.

Conclusion: This bull market has legs, and the current pullback from the highs, along with any future dips in the exchange rate, should be a welcomed development for investors with a sufficiently long time horizon who understand where this is all headed. Bitcoin’s fundamentals continue to improve, and pullbacks serve to purge leverage and weak handed speculators during secular bull markets.

BTFD.

This article is written in partnership with Unchained, the official US Collaboartive Custody Partner of Bitcoin Magazine and integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

Company Name: Azteco

Founders: Alexander Fernandez and Paul Ferguson

Date Founded: 2014

Location of Headquarters: Santa Monica, CA

Amount of Bitcoin in Treasury: Not disclosed

Number of Employees: 12

Website: https://azte.co/

Public or Private? Private

When Alexander “Akin” Fernandez first conceptualized Azteco over a decade ago, he simply wanted to make bitcoin easier to obtain. He wanted people to be able to purchase bitcoin as seamlessly as they were able to buy a gift card, and so he developed a system in which people can purchase prepaid bitcoin vouchers for as little as $10, redeemable in a minute.

Azteco vouchers are now available in over 190 countries, purchasable online or with cash with in-person vendors. The main advantage to buying BTC via Azteco vouchers is the fact that you don’t have to disclose your identity to do so, not to mention the process of buying a voucher is quick and easy. Azteco offers both on-chain and Lightning capabilities, giving users the choice to redeem their BTC on either the Bitcoin base chain or the Lightning Network, a Layer 2 payments network built on top of the Bitcoin blockchain.

According to an estimate from Fernandez, over one million people have already purchased Azteco vouchers. But his aspirations are far beyond the already-impressive number of vouchers thus sold: he has his sights set on Azteco servicing a customer base of over 30 times that, as Azteco does its part in “normalizing” Bitcoin.

A transcript of our conversation, edited for length and clarity, follows below.

Frank Corva: Where did the inspiration for Azteco come from?

Akin Fernandez: It came from my own experience of finding out that getting bitcoin is very difficult. I realized it doesn't have to be like this. We could use a familiar system like a top-up voucher, which billions of people use to top up their mobile phones, and apply that process to getting bitcoin. All we have to do is build a software, put distribution in place, and then it should just work. And lo and behold, it does.

Corva: Did you have a particular customer base in mind when you designed Azteco?

Fernandez: Yes, I had myself in mind. I wanted to be able to get bitcoin without having to make any kind of fuss or effort to do it. I wanted to be able to go to the supermarket, buy $20 worth of bitcoin and put it straight onto my wallet. And I'm not unique. I could assume that there were other people who were like me who could understand the proposition and the ease of use and who would take to it like a duck to water.

You find that with inventions, many times they come about because people are solving problems for themselves, not as a means to get rich or for any reason other than to solve their own problems. And because people are similar, they solve other people's problems, too.

Corva: Speaking of your own experience. I’ve read that you were unbanked for a period of time. Is this true and could you expand on it, if so?

Fernandez: Well, I became unbanked for a reason that I, until this day, don't know. I went down to “my” bank to cash a check, and they couldn't find my account in the system. I had received no communication from them in writing or in any way. All of a sudden, I had no bank account. So, for many years after that I didn't have access to credit cards or anything that other people in the West take for granted.

This taught me a very, very big lesson about how difficult it is to do anything in the 21st century if you don't have access to banking facilities. You can forget shopping online. You can forget any kind of convenience of going into a store and paying with a card. All of that goes away.

So, when I was working on Azteco, it was made clear to me how powerful a tool it was going to be, because, with Bitcoin, you cannot be unbanked by any third party. You have control over your synthetic money.

Corva: I’ve heard you use this term “synthetic money” before, and you’ve discussed how we shouldn’t refer to bitcoin as actual money. Why is it important that we do this?

Fernandez: It's important because it's true. Bitcoin is not money — it's a database. Can it be used as money? Of course. It can be used as very, very good money. It's a good simulation of money. But it doesn't have to be money for it to be useful.

Also, if you call bitcoin money, all the regulations that the state has imposed on actual money can be superimposed or brushed over Bitcoin inappropriately, making it hard to use and slower to spread. So, it's very important to tell the truth about Bitcoin. Bitcoin has taken so long to get into every nook and cranny because there's been this misconstruing of it as money.

WhatsApp reached a billion people in four and a half years. That's the kind of spread into people's phones that we'd expect if the rails to get onto Bitcoin were frictionless, just like they are with WhatsApp.

The fact that Bitcoin has not reached that number of people indicates that there's something wrong in the way people are thinking about it, and so it's important for us to think about it correctly.

Corva: How many people is Azteco reaching? Put another way, how many vouchers did Azteco sell in Q3 or Q4 of 2023?

Fernandez: The actual numbers I don't have at hand being the CEO and not the CFO. But we had our biggest ever month last month. I was told this yesterday. The number of vouchers we're selling is increasing, and this is a direct result of our increasing our distribution and also the sentiment towards Bitcoin changing on a global scale.

We're the easiest way to get bitcoin. When people discover us, they say two things: “First of all, why isn't everything as easy as this?” and “How come I haven't heard of this before?”

Things are synergizing and coming together to bring us to a point where we're a global force for good and for getting Bitcoin to the people who need it the most — the unbanked and the people who don't have access to financial rails or people who just don't want to be the victims of the financial rails.

The old school crop of Bitcoin businesses that have been serving people over the last 10 years all believe that Bitcoin is money and make it very difficult to get an account. Everybody's so inured to the idea of having a bank account or an account of any kind, whether it's through email or anything else. The assumption immediately is, “Well, of course, I have to have an account in order to use this service.”

With Bitcoin, that's not true, though. No accounts are necessary. [Some] wallet companies are doing this correctly. One of them is Samourai Wallet and another is Wallet of Satoshi where you don’t need to open an account to use your own money.

They’re saying you shouldn’t be able to use bitcoin without having an account. That’s what they’re trying to do in the EU.

Corva: We’re doing it here in the US with the Digital Asset Anti-Money Laundering Act (DAAMLA), too, the bill that Elizabeth Warren drafted.

Fernandez: These people are oath breakers. They’ve sworn an oath to defend and uphold the Constitution, which guarantees the free speech of every single American. Bitcoin is speech. It's a database where speech is written down and stored and transmitted from one person to another.

And lest anyone think that I'm picking on the Democrats and not the Republicans, Cynthia Lummis has written an absolutely appalling bill that I took great pleasure in tearing to pieces on my blog.

They don’t understand what their role is as a public servant. A servant is not in control of its masters. A servant is obedient to the electorate. It’s not their business to tell people you have to KYC to use bitcoin.

Corva: On the topic of America and KYC-free bitcoin, do you see people using Azteco because they want KYC-free bitcoin?

Fernandez: In order for the American market to be cracked, the service has to be explained. People have to be deprogrammed. They don’t understand that bitcoin is not a vehicle to make you earn more fiat.

People need to be broken out of these bad habits to be shown that actually there are better ways to get things done. The perfect example of this is WhatsApp.

Before WhatsApp, people used to pay for SMS messages, while the idea of this is now unthinkable. A similar process has to happen with Bitcoin where you can send money to family members without having to go through a third party or pay exorbitant fees or identify yourself or anything like that.

With Bitcoin, you [also] get other subtle benefits. Hyperinflation is starting to kick in and people are starting to realize that there’s something wrong with the money.

People find it very difficult to go to the root cause of the prices going up at McDonalds. Let’s say they did find out the cause, what could they do about it? They could go and get bitcoin, but it’s several steps down before these people are going to see bitcoin as the answer.

Corva: I agree.

Fernandez: Also, the current crop of businesses — big businesses like Binance, Coinbase — are synonymous with bitcoin. Azteco needs to be synonymous with getting bitcoin. The vast majority of people on earth are not rich. They don't have $100,000 to spend on bitcoin. They live day to day.

Since these people are not investors and they don't have spare money to keep in bitcoin in the hopes that it's going to go up — which of course it will — they need to have bitcoin as daily money for everyday spending.

Once you start talking about these things, the business opportunities and models start to just fall out of the conversation. All of these Cynthia Lummises and Elizabeth Warrens prevent these business models from emerging because they're regulating something they have no business regulating.

Corva: Speaking of other businesses, I’ve heard you say good things about Machankura, a protocol that makes it easier for Africans to use bitcoin in a KYC manner, and that it serves as a compliment to Azteco. What other companies in the Bitcoin space are a compliment to Azteco?

Fernandez: Ethical Bitcoin wallets are a good compliment. By ethical, I mean Samourai Wallet and Wallet of Satoshi. I know that some people don’t like Wallet of Satoshi because the architecture on the backend is not to their liking, but these people don’t run businesses — they don’t know how difficult it is to do these things.

The newest entrant to this is the Bitkey wallet. This Bitkey wallet is absolutely unbelievable. They've thought about this properly. The user interface and user experience — it's going to make everybody change their game.

I've been saying for a long time that somebody like Apple, Microsoft or some other company is going to get into Bitcoin and bring all of that user experience thinking to the process of using Bitcoin. The current crop of companies have not thought about user experience.

Jack Dorsey’s Bitkey has been a kick in the backside to a lot of people who realize that we can't just carry on doing what we want to do and expecting people to just accept it — the idea that you have to write down your mnemonic before you receive your first transaction. It’s completely crazy.

If Apple developed its own Bitcoin wallet or clones one of the Bitcoin wallets out there, Bitcoin is going to be exposed to people in a way that's very easy to understand, very easy to consume. There will be the new generation of Bitcoin users for whom Bitcoin is totally normal — not threatening, intimidating or frightening.

Corva: The same way that using WhatsApp or Uber is normal now…

Fernandez: That's exactly right. Bitcoin has to become boring.

Discovering CryptoLinks.com: Your Ultimate Destination for All Things Cryptocurrency Related

Feeling swamped by the tsunami of crypto news flooding your screens daily? Navigating the cryptocurrency ecosystem can often leave you gasping for air, especially when every tick of the clock brings a new update that could make or break your next move. At CryptoLinks.com, I've constructed the life-raft you've been seeking—a streamlined, organized, and reliable source that does the heavy lifting for you. Picture this: a world where you're seamlessly connected to the pulse of the crypto sphere, swiping past the fluff and diving straight into the news that impacts your digital portfolio. From the latest coin launches to market-moving trends, CryptoLinks.com isn't just about handing you the news; it's about delivering a custom-tailored stream that aligns with what makes your wallet tick. Ready for that breath of fresh air? Let's take that plunge together and unlock the full potential of the crypto landscape—effortlessly.

Have you ever felt like you're drowning in a sea of endless cryptocurrency news and updates? Do you find it difficult to sift through the noise to find the information that matters to you? In the dynamic world of cryptocurrency, where news breaks at the speed of light, keeping up can be a herculean task.

The Problem: Too Many News, Too Little Time

Cryptocurrencies never sleep, and in a 24/7 market, news and updates proliferate round-the-clock. For enthusiasts and investors alike, staying informed is crucial, but the sheer volume of information can be staggering:

- New coin launches and tech innovations.

- Regulatory changes and legal updates.

- Market trends and investment tips.

With so much happening at once, how can you ensure you're not missing out on crucial information, without spending every waking hour glued to a screen?

Your One-stop Solution: CryptoLinks' Aggregated Web News Section

I understand the struggle, which is why CryptoLinks.com is designed to be your safe harbor in the tumultuous ocean of cryptocurrency news. Imagine a place where the most vital news comes to you, where the fluff is filtered out, leaving only the golden nuggets of crucial updates and trustworthy information.

Here's a glimpse of what CryptoLinks.com offers to transform your crypto news experience:

- A comprehensively curated collection of cryptocurrency web news from various verified sources.

- An easily navigable interface that quickly directs you to the day's most important headlines.

- A customizable feed that allows you to focus on news that aligns with your interests and investments.

With CryptoLinks.com, you'll no longer feel the need to scramble through dozens of tabs and sources. You'll have it all in one place, a streamlined, finely-tuned machine that keeps pace with the crypto market's heartbeat.

Are you curious about how we manage to provide such a high-quality selection of crypto news? Stay tuned, as the next segment will reveal the inner workings of CryptoLinks.com and how we've perfected the art of news aggregation.

How CryptoLinks.com Helps Simplify Your Crypto Journey

Finding credible news in the clamor of the cryptocurrency world can be as daunting as searching for a strand of truth in a digital haystack. But, amidst this informational whirlwind, CryptoLinks.com stands as a beacon of clarity, meticulously sifting through sources to bring you the essence of crypto news.

Quality Over Quantity: CryptoLinks' Approach to News Aggregation

What sets us apart is our steadfast commitment to quality. Our team operates with the kind of discernment only seasoned crypto enthusiasts can offer, ensuring that each piece of news on CryptoLinks doesn't just add to the noise but genuinely enriches your understanding.

- We prioritize authority and accuracy, steering clear of speculation and focusing on news that matters.

- We favor trusted sources with proven track records, so you can rest assured that the information is vetted.

- We're vigilant about relevance, ensuring that trends, updates, and insights reflect the current state of the market.

Imagine starting your day with a cup of coffee and a concise briefing that filters out the fluff, leaving you with pure, potent news. That's the CryptoLinks experience.

Streamlining Your Daily Reading Routines

Remember the days of having dozens of tabs open, bouncing from one website to another in a relentless quest for reliable crypto news? Those days are gone. Here's how we streamline your daily information intake:

- Curated Content: Our algorithm ensures you're exposed to the hottest topics and breaking news.

- User-Friendly Interface: A clean layout and intuitive design mean information is not just accessible but also digestible.

- Customizable Experience: Tailor your news feed to your interests, eliminating unwanted noise and honing your focus.

"In the age of information overload, clarity is power." This quote echoes our ethos, highlighting the transformative impact of refined data consumption.

"In the age of information overload, clarity is power."

With CryptoLinks, you tap into a stream of knowledge that's been distilled to empower, not overwhelm. But how do we ensure that this stream remains unpolluted by bias and misinformation?

Stay tuned to discover the intricate process behind our source selection in the next section, and uncover the secret recipe that keeps the CryptoLinks engine running smoothly. What kind of sorcery allows us to maintain objectivity in an often subjective market? Keep reading to find out.

The Nitty-Gritty: Understanding CryptoLinks’ Inner Workings

Ever wondered what goes on behind the scenes at CryptoLinks? As a platform that's become a lighthouse in the tumultuous sea of cryptocurrency information, it's time to pull back the curtain and show you the cogs and wheels of our operation. It's not just about presenting news; it's about presenting the right news in the right way.

Choosing the Right Source: CryptoLinks’ Secret Recipe

Our quest for curating the perfect content mix is akin to a master chef selecting the freshest ingredients for a signature dish. But what does this gourmet process involve?

- Depth of Research: We scour the digital landscape probing into every nook and cranny of the cryptoverse. Only the most reputable and insightful sources make the cut.

- Consistency and Reliability: Like the faithful tick of a Swiss watch, we evaluate how sources maintain a steady flow of accurate and timely information.

- User Perspectives: We listen to what you, our community, seek and appreciate. Your opinions help us prioritize sources that best align with your information needs.

This meticulous process isn't simply about algorithmic selections; it's a careful human curation to serve you a platter of the most relevant and enriching content.

Preserving Objectivity in the Most Subjective Market

In a market that thrives on speculation and sentiment, where hype can overshadow substance, preserving objectivity is our fortress. It's a commitment set in stone—a pledge to our readership. "Truth is ever to be found in simplicity, and not in the multiplicity and confusion of things," as Isaac Newton profoundly stated.

"I cannot afford to waste my time making money." – Louis Agassiz

Just like Agassiz prioritized his scientific pursuits over financial gain, we prioritize the essence of news over sensationalism. CryptoLinks is your compass in a landscape brimming with noise; we filter through the flurry, leaving you with undistorted and essential news segments:

- Critical analysis minus the sensational headlines

- Data-driven reports, stripped off any emotional bias

- Announcements and updates, delivered as they are, not as they're speculated to be

It's not just about delivering news; it's about upholding the integrity of information. In doing so, we've become more than just a platform; we've turned into a beacon of truth for our readers.

But, how does this unwavering commitment to truth translate into your everyday experience? Curious about how to leverage our unbiased insights for your personal crypto endeavors? Stay tuned for what's next, where I'll share some insider tips on making the most out of your daily CryptoLinks encounter.

Best Practices: Making the Most of CryptoLinks' Aggregated Web News Section

Understanding how to navigate the vast sea of information is crucial in making informed decisions in the fast-paced world of cryptocurrency. It all starts with knowing the best practices to enhance your user experience on CryptoLinks. Here's how you can optimize your visits to get what you need, quickly and efficiently.

Enhancing Your CryptoLinks Experience

Firstly, let’s talk about customization. Your interests in cryptocurrency are unique, and so should be your news feed. Make use of our category filters to tailor what news pops up on your screen. Are you passionate about blockchain technology, or perhaps ICOs and token sales are more your cup of tea? With just a few clicks, you can set your preferences and receive news related solely to those categories.

Another tip is to take advantage of the bookmark feature. If you stumble upon an article or a nugget of information that catches your eye but don't have time to read it at the moment, simply bookmark it for later perusal.

Also, don't forget to check out the comments section. The CryptoLinks community is knowledgeable and often experienced—engaging with them can provide additional insights and even different perspectives on the topic at hand.

Streamline Your Knowledge with CryptoLinks’ Press Section

Now, let me introduce you to a gem within the site—the press section, easily accessible at CryptoLinks' Press. The press section is where you’ll find an aggregation of official announcements and press releases from within the industry. It's essentially your direct line to the source without any third-party interpretations or potential bias. The benefits?

- Timeliness: Stay ahead with the most recent and official statements from crypto entities.

- Authenticity: Get the story straight from the horse's mouth, bypassing the noise that can sometimes distort news in the rumor mill.

- Depth: Press releases often dive deeper into the specifics that general news articles may gloss over.

Have you ever found a press release that touched on an up-and-coming blockchain project or a new coin launch and wished you could follow up on how it evolved? Save that page! This allows you to create a tapestry of knowledge, tracing developments as they unfold in real-time.

Now, with all these tools and knowledge at your disposal, you might be wondering, what's next? How else can you leverage CryptoLinks to stay on top of the crypto wave? Stay tuned, as the next article will not only quench your thirst for knowledge but will also illuminate the unique value CryptoLinks brings to your digital doorstep. Are you ready to become a savvy crypto navigator?

Answering Your Burning Questions

If you've ventured into the bustling alleyways of cryptocurrency news, you've likely grappled with an overload of information. This is where CryptoLinks strides in, and perhaps you're curious about how and why we are your go-to source. Let's tackle some of the queries stirring in your mind.

Why Choose CryptoLinks Over Other Aggregation Platforms?

You want a platform that's not just a random noise collector but a curated orchestra of relevant information – and that’s what sets CryptoLinks apart. We meticulously handpick sources that have proven their integrity and value over time. But we don't stop there; rigorous checks and balances ensure these sources remain on-point, consistent, and free from bias. Whether it's a breaking headline or a subtle market sentiment shift, you can trust that our aggregation reflects the true pulse of the crypto world. And it's not just about trust – it's about delivering a streamlined experience without the fluff and fillers other platforms may overlook.

Staying Ahead of the Game with CryptoLinks

Cryptocurrency waits for no one. It's a dynamic beast, with news and trends shifting by the minute. So, how do we ensure that you get the latest scoops before anyone else? Our secret lies in real-time updates and a responsive filtering system. The CryptoLinks potential to tap into the minute-by-minute fluctuations of the market keeps our community informed with lightning speed, without sacrificing accuracy. When your conversations turn to the latest crypto developments, you'll find yourself steps ahead, armed with insights gleaned from our up-to-the-minute news reports.

Wrapping It Up

Choosing CryptoLinks isn't just about simplifying your path through the cryptocurrency landscape; it's about augmenting your understanding and involvement with quality information. You've seen how our careful curation and real-time reporting can empower your decision-making. Quality, objectivity, and speed are the pillars of what we offer, and these aren't mere words. They are commitments to each user who trusts us as their compass in the crypto cosmos. Whether you're a beginner or a seasoned trader, the news we serve could be the difference between making a smart investment choice or missing out on an opportunity. At the end of the day, your success in this complex domain is the true measure of our value. So let those questions rest – CryptoLinks is your ally, guiding you through this ever-evolving space with clarity and confidence.