Aggregated Cryptocurrency Web News Latest and Comprehensive Crypto News Updates: All You Need to Know from the Digital Currency World

NFT platform Magic Eden recorded an NFT trading volume of $756.5 million in March, surpassing its rival Blur.

Need to know what happened in crypto today? Here is the latest news on daily trends and events impacting Bitcoin price, blockchain, DeFi, NFTs, Web3 and crypto regulation.

The Central Bank of Nigeria (CBN) has disavowed a letter that allegedly instructed financial institutions to sever ties with four global cryptocurrency exchanges. The central bank stated that the letter did not originate from its office and recommended that individuals interested in “authentic updates” refer to its official website. Fake Content The Central Bank of […]

The Central Bank of Nigeria (CBN) has disavowed a letter that allegedly instructed financial institutions to sever ties with four global cryptocurrency exchanges. The central bank stated that the letter did not originate from its office and recommended that individuals interested in “authentic updates” refer to its official website. Fake Content The Central Bank of […]Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

As a bitcoin miner, you have a lot to manage, from seeking out inexpensive electricity, to constructing facilities, to acquiring rigs and building a knowledgeable team that can keep them hashing. In speaking with mining companies over the years, we know that bitcoin custody is often an afterthought.

Here we’ll describe the process of securing your mined bitcoin in self-custody while managing a bitcoin treasury, CapEx, OpEx, OpSec, LP distributions, taxes, and more. Given the ever-present risks of hacks and suspended withdrawals, our goal is to explain the benefits and trade-offs of various approaches to bitcoin self-custody—regardless of the size of your operation.

Bitcoin self-custody considerations for miners

There are unique challenges miners face with self-custody in comparison to other types of bitcoin holders:

- Miners receive a high frequency of incoming deposits from mining pool payouts, which can increase transaction costs due to UTXO bloat (more on this below).

- Some portion of mined bitcoin must be sold to cover overhead.

Other challenges are similar to that of other businesses that hold bitcoin:

- Businesses may not have the in-house expertise needed to set up self-custody securely while minimizing complexity.

- Businesses generally have multiple operators and desire distributed control over bitcoin funds.

- Businesses want to minimize counterparty risk while eliminating the risks of malware, user error, storage media decay, phishing, physical attacks, and other security risks.

In all cases, holding the private keys to your organization’s bitcoin should be prioritized. As we’ll explain next, multisig can enhance the security of your bitcoin regardless of your organization’s size. While the details of your setup may vary, multisig helps to address many of the above concerns while allowing your bitcoin to touch exchanges only when necessary (e.g., for OpEx/CapEx).

Why miners need multisig

Better security than singlesig

Singlesignature (singlesig) wallets—controlled by a single key secured by a Trezor or Ledger hardware wallet, for instance—improve security, reduce counterparty risk, and remove exchanges as a single point of failure. With singlesig, however, your bitcoin is put at risk if a hardware wallet or seed phrase is lost or compromised. Just one or the other, in the wrong hands, could lead to permanent loss of funds.

Multisignature wallets, on the other hand, enable you to store bitcoin in a wallet controlled by multiple keys. They increase your security by ensuring more than one of those keys, held in different locations, are required to sign a transaction. If set up correctly, multisig can eliminate all single points of failure. For a miner, this means removing the risk of a single rogue employee moving funds, and creating redundancy so that the loss of a single hardware wallet or seed phrase cannot lead to a critical loss of funds.

Eliminates exchange custody risk

Exchanges can be a convenient place to send newly-mined bitcoin. They allow you to easily exchange bitcoin for your local fiat currency before sending funds to a linked bank account, and they even take care of things like UTXO management. In bitcoin, however, there is always a price to pay for convenience. The risks and potential downsides of using an exchange for key storage are numerous—the fact that they can cut you off at any time and the possibility of hacks and insolvency are only the beginning.

Flexibility to achieve an ideal balance of security and complexity

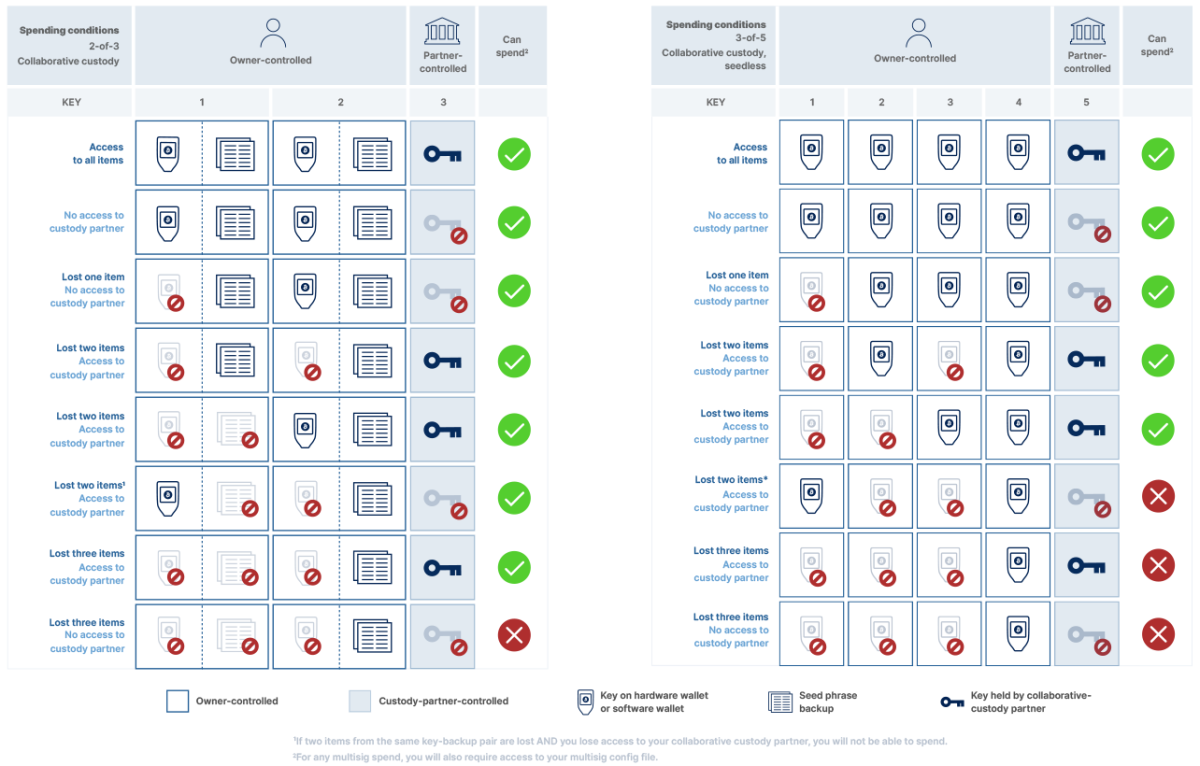

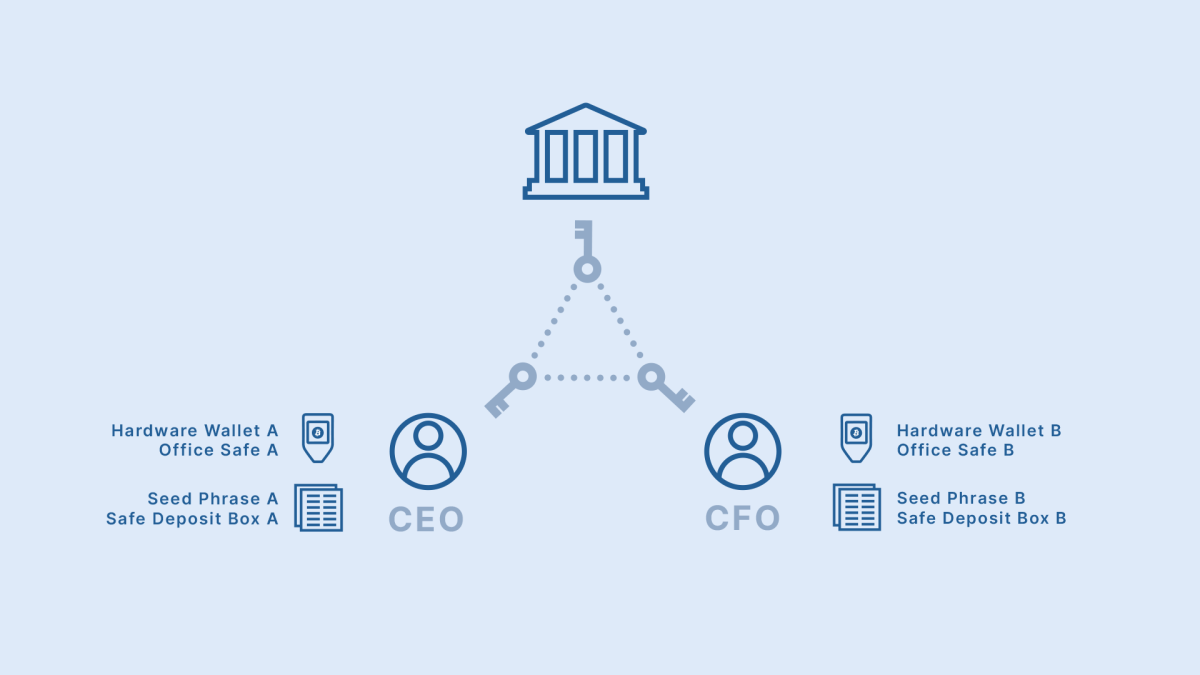

A 2-of-3 multisig quorum has three total keys where two are required to spend, which keeps your bitcoin secure even if one key is compromised. Many mining firms find that 2-of-3 multisig is the perfect setup for their corporate treasury because no single individual can compromise the entire treasury, while sending out LP payouts and monthly expenses is still kept straightforward (only two signatures required).

Higher-quorum multisig (e.g., 3-of-5, with five total keys and three required to spend) adds more keys and typically more individuals to the equation. This can technically improve the security of your bitcoin wallet in some cases—but also dramatically increases complexity. We wrote a comprehensive article explaining why this is the case, but for the purposes of this article, you just need to know the sweet spot for most individuals, organizations, and mining operations tends to be 2-of-3.

The benefits of collaborative custody

When using multisig for your mining company’s treasury, you might also benefit by including an institution (like Unchained) to hold one of three keys for your multisig setup.

In addition to the enhanced security that multisig provides, collaborative custody can also help with:

- Reduces the number of physical items (hardware wallets and seed phrases) you need to secure.

- Active monitoring over suspicious activity like unauthorized transaction signatures or account logins

- A partner that can help your team recover the wallet in the event where one of your keys has been lost or compromised.

Wallet management

Managing mining pool payouts

Every miner needs to make decisions on security, transaction cost, and counterparty risk when deciding which type of wallets to use for their newly mined bitcoin.

Below are four example workflows that may help you determine which model is the best for your mining operation.

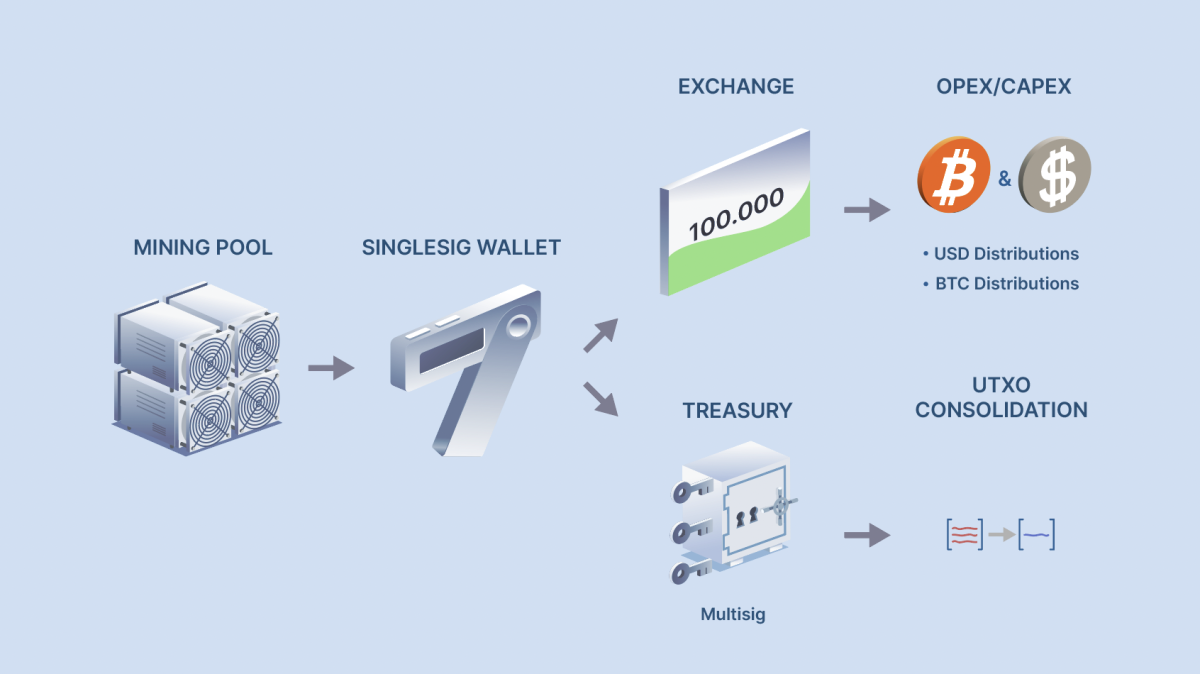

Workflow #1: Mining pool payouts sent to a singlesig wallet

In this popular workflow for smaller mining operations, you receive mining pool payouts directly to a singlesig wallet controlled by a single operator. Funds that need to be sold can then be sent to an exchange, while funds to be stored long-term are sent to a multisig wallet.

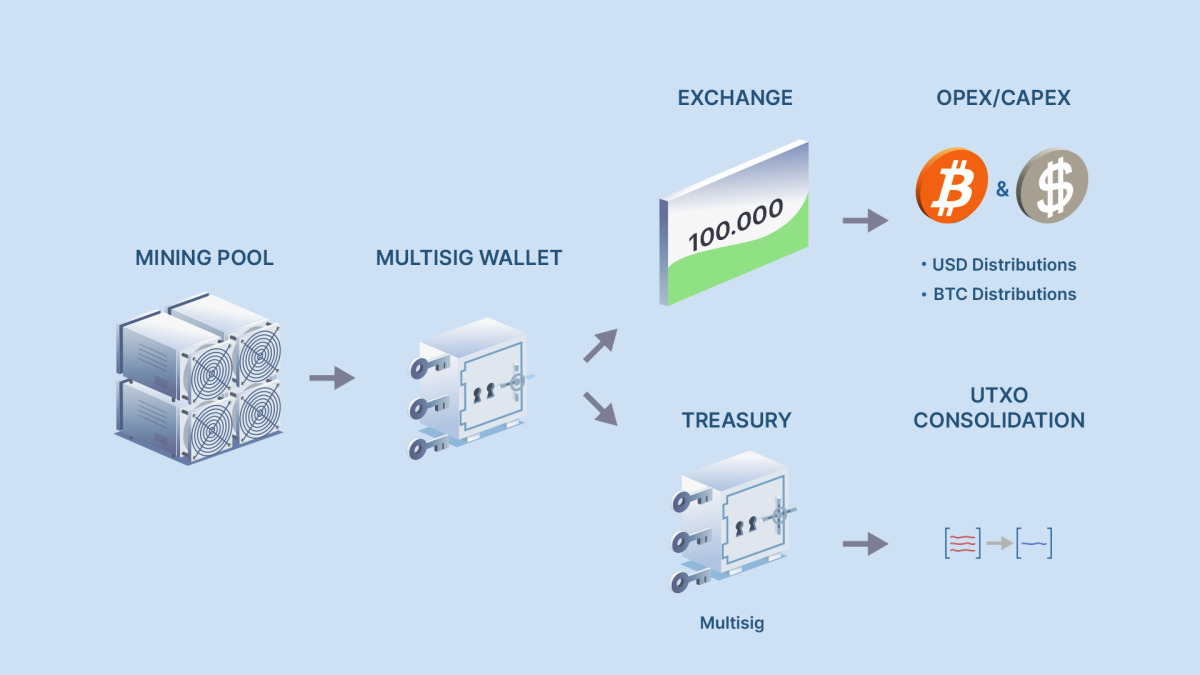

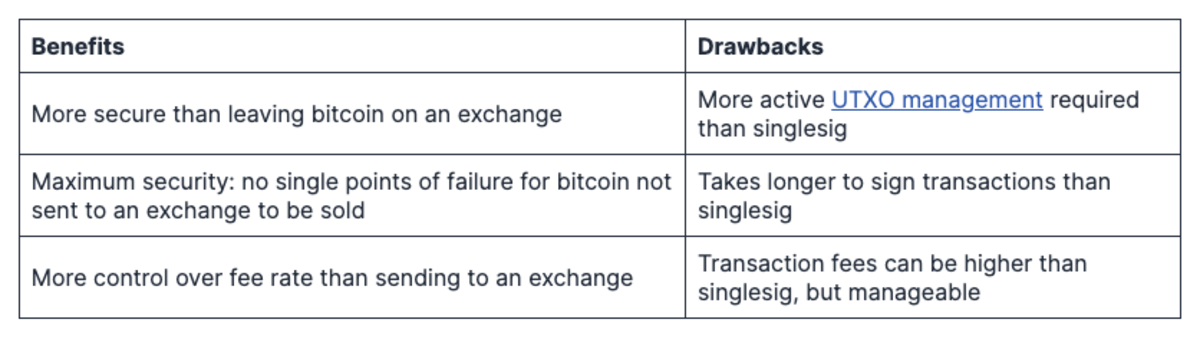

Workflow #2: Mining pool payouts sent to a multisig wallet

This workflow is the same as the workflow described above, except that mining pool payouts are sent to a multisig wallet instead of singlesig. A second multisig wallet is required for the corporate treasury.

Sending bitcoin payouts direct to multisig maximizes security throughout the workflow, but requires two people to approve each transaction to the exchange and treasury. As such, it is better suited for larger mining operations.

“With multisig you’re paying higher fees to remove counterparty risk.” – Griffin Haby, Mountain Lion Mining

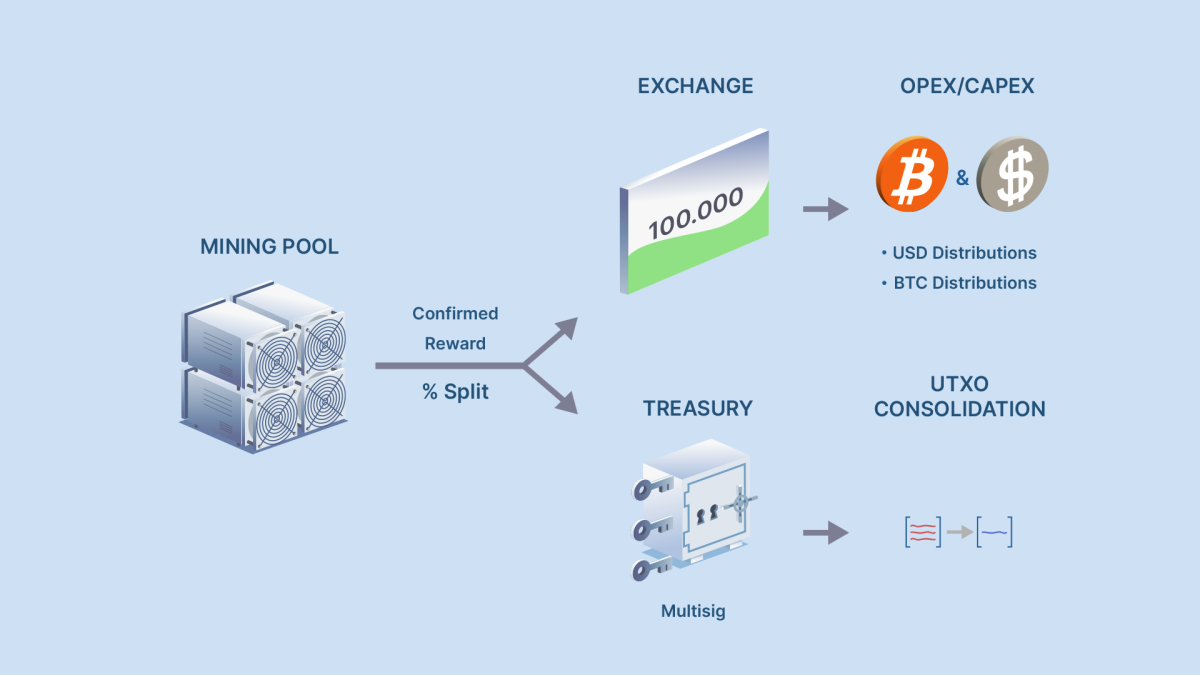

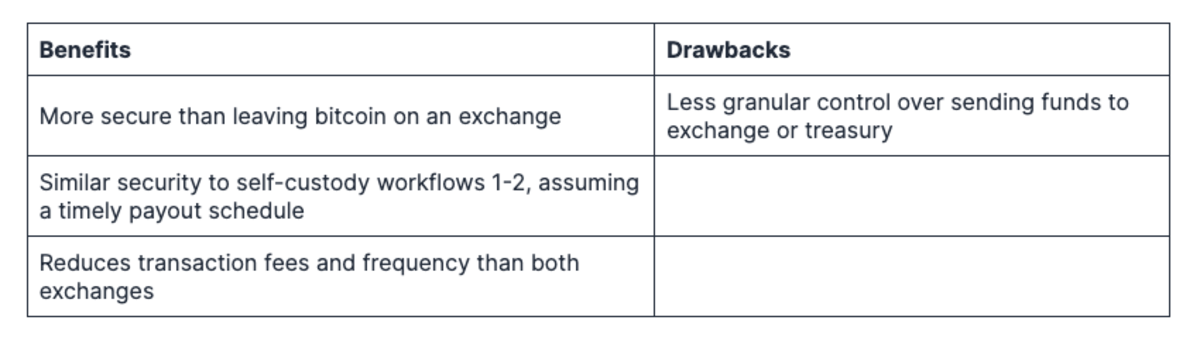

Workflow #3: Split payouts from the mining pool

Some mining pools allow miners to split payouts between two or more accounts. In this workflow, we show automating the payout process to send a fixed percentage directly to cold storage, and the rest to an exchange to sell to cover overhead.

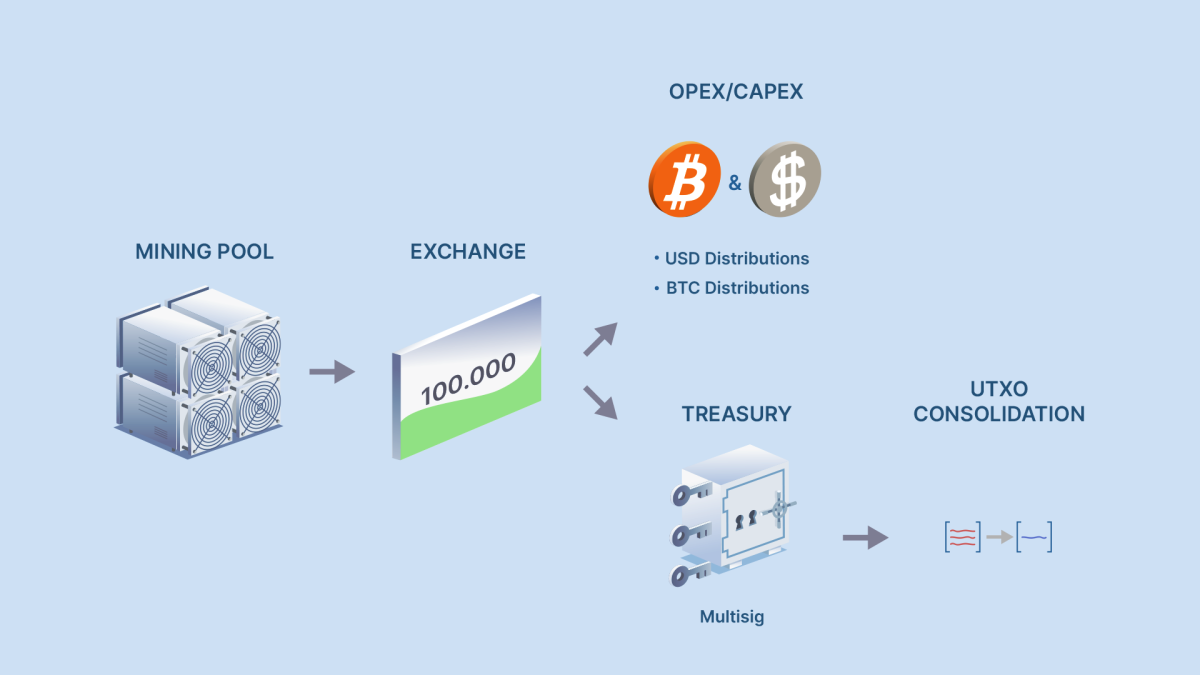

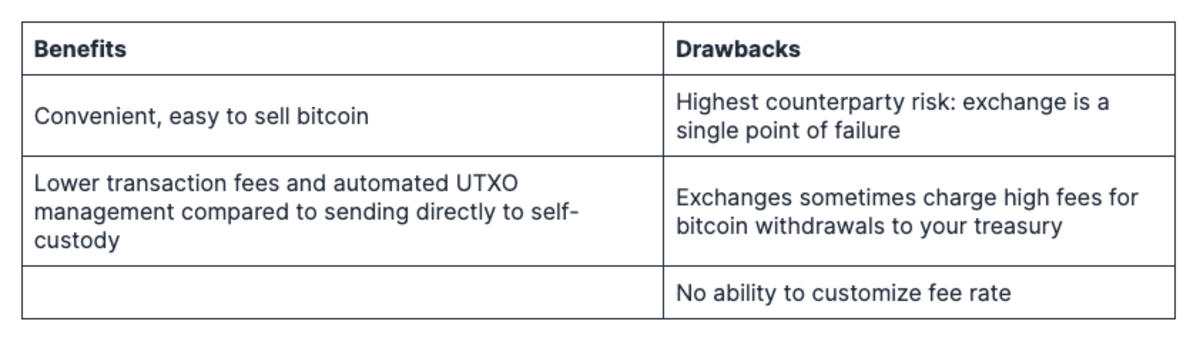

Workflow #4: Mining pool payouts sent to an exchange

In this workflow, bitcoin is mined directly to an exchange. This is far more convenient for the purposes of UTXO and fee management purposes, and allows immediate liquidation of funds, but leaves bitcoin in the most vulnerable state for the longest amount of time, with high counterparty risk.

Maintaining multiple fund buckets

Even within the above high-level approaches to bitcoin security, you may want to further separate wallets for separate purposes, like distributions, operating expenses, or corporate treasury. Keeping these buckets of bitcoin cryptographically separated from each other will make it far easier to keep track of your operation from a tax and accounting standpoint—and much easier to ensure those long-term satoshis aren’t being used for overhead!

Managing transaction fees

Miners are typically more concerned with collecting transaction fees from other users. However, when managing your bitcoin mining wallets, the fees you pay when sending bitcoin—whether to an exchange, cold storage, or investors/partners—should also be considered.

As we described in a previous article, bitcoin transaction fees depend on how congested the bitcoin network is at any given time and how much data is being processed in a transaction. One of the key factors behind the data size of a transaction is the number of UTXOs involved. Our article on the problem of too many UTXOs is a good primer on UTXO consolidations, payout thresholds, and how bitcoin transaction fees are calculated.

As a miner, there are four main ways you can reduce your transaction costs:

1. Increase payout thresholds from mining pools

If you use a mining pool, and take a high frequency of payouts, it’s going to result in a lot of small UTXOs in your destination wallet, which could be expensive to spend when the time comes.

To mitigate this, you can increase your pool payout threshold to reduce the number of deposits being made to your wallet (and therefore reduce the wallet’s UTXO count). This method is especially useful for future fee mitigation if you are pointing your payouts directly to a multisig wallet (which requires more data to make a transaction than a singlesig wallet).

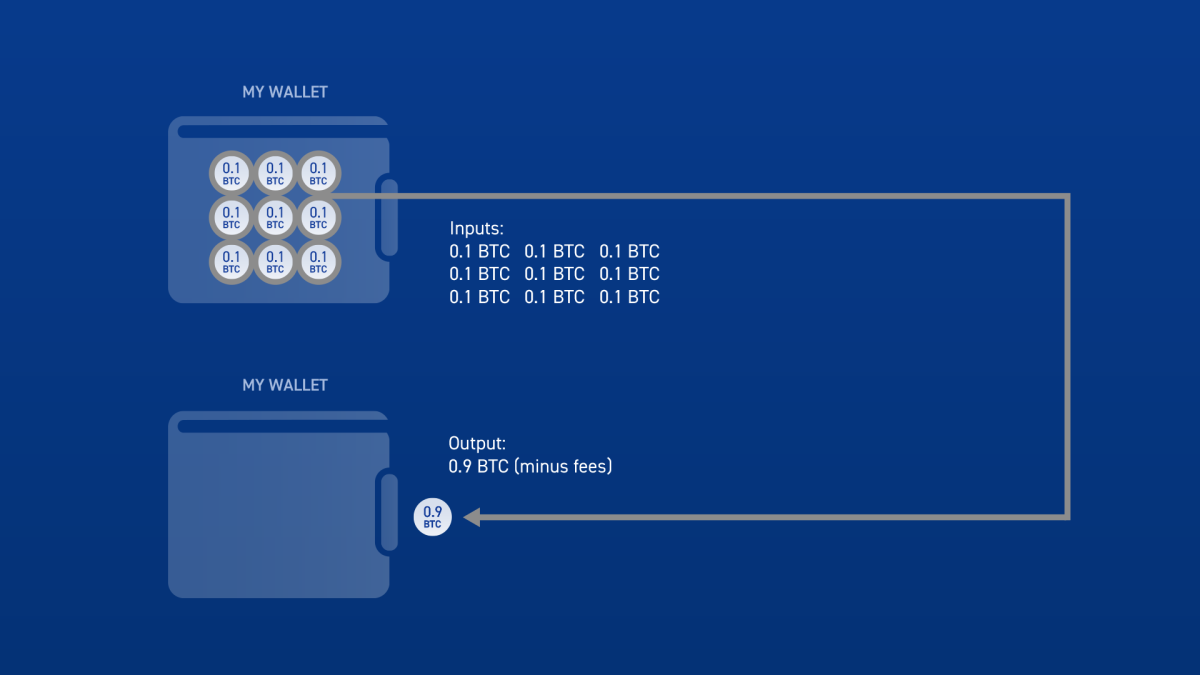

2. Manually consolidate your UTXOs

You can further reduce the number of UTXOs in your wallet by periodically consolidating. This is a relatively simple process; you just need to author a transaction containing the UTXOs you wish to consolidate, and send them back to yourself. You can learn more in our article covering strategies to manage too many UTXOs.

3. Set a low fee…and wait

Block space is limited by design—the higher the demand for space (increased quantity of transactions), the higher fees will be. If you don’t need a transaction to be processed immediately, consider setting a lower fee rate than recommended at the time of sending. This makes the transaction take longer to process, but can help you avoid paying excessive fees during periods of high demand.

At any given time, there is a minimum fee rate the mempool is willing to accept. Typically, this stays between one to three sats/vbyte. Current fees can easily be viewed on most block explorers, such as mempool.space.

4. Batched spending

Miners who need to send multiple payments at the same time can reduce transaction fees by sending them all at once using a transaction method called batching. This method of consolidating multiple payments can be performed with many popular bitcoin wallets (such as Bitcoin Core, Electrum, or BlueWallet) and can be helpful for LP distributions or any other time you need to make multiple transactions at once.

Key management

Identify your keyholders

When your company decides to hold the keys to its bitcoin you will need to determine who at the company will physically hold the keys.

The goal is to distribute control over keys and seeds evenly. This gives no one person the ability to sign a transaction or move bitcoin on their own. What this looks like for your organization will depend on your specific circumstances, such as the number of principals, the number of keys, and whether the wallet is for long-term storage or simply distributing control over spends.

In the above example where you’ve decided to use 2-of-3 multisig for your mining operation’s bitcoin treasury (we’d typically recommend this), you might select the company’s CEO and CFO to hold a key each, and a collaborative custody partner to hold the third key.

Properly secure your hardware wallets and seed phrases

There are typically two separate physical items to protect for each of your company’s bitcoin keys: a hardware wallet and a seed phrase. A critical element of implementing a secure multisig model is the geographical distribution of hardware wallets and seed phrases so that no single physical location is a point of failure for your bitcoin.

Seed phrases are worth particular attention because they are a physical and unencrypted copy of your bitcoin private keys. You should always retain seed phrase backups of your keys to reduce the reliance on sometimes finicky hardware wallets.

The location of the hardware wallets and seed phrases should only be known to individuals who will be expected to provide transaction signatures to move bitcoin. Keep in mind: When storing and securing these items, you may want to ensure that no single person at your organization has seen or knows the location of the necessary hardware wallets or seed phrases to spend—so that no single person can compromise your bitcoin treasury.

Ongoing key maintenance

Key hygiene

After you’ve properly stored your hardware wallets and seed phrases, there are a few best practices you should observe to keep the device and data on the device in proper working order:

- Keep the firmware up to date: This should be done roughly two to three times a year to ensure your hardware wallets have the best security, newest functionality, and will work to sign transactions when you need to.

- Perform key checks: At regular intervals, check that your hardware wallets are functional and check the physical security of your seed phrases. We recommend this should be done roughly four times a year.

Changing key holders

When a key holder leaves your mining operation, you should always replace their key as soon as possible. Don’t simply hand over the old key to a new key holder—that would be a a potential security hole. Even if the original key holder can be trusted and left in good standing, replacing the key reduces the risk that unauthorized signatures will be performed or attempted in the future.

Key replacements

To replace a key, you will need the new key holder to generate a new key, (if using multisig) create a new multisig wallet with the new quorum, and then (carefully) send all the company’s bitcoin to the new wallet.

If you’re using collaborative custody with Unchained Capital, our platform can safely guide you through the key replacement process. If you’re not using a collaborative partner, we’d recommend having someone technical on hand to help with the process.

- For Unchained Capital clients needing help with key replacements, reach out to your dedicated account manager or client services.

- If you are unsure whether or not you need to perform a key replacement, or if you would like to learn how key replacements for multisig work technically, you can refer to this article.

Other considerations

Bitcoin mining and taxes

Bitcoin miners are responsible for understanding and abiding by local and federal tax regulations. Taxes and accounting as they pertain to bitcoin mining are beyond the scope of this guide, but they are relevant considerations and you should consult with an accountant or tax professional to learn more.

For US-based miners, Unchained’s Head of Legal Jeff Vandrew briefly touched on the topic of mining and taxes in his piece covering what you need to know about bitcoin mining, IRAs, and taxes:

If a taxpayer obtains bitcoin through mining, they must recognize income in the amount of the fair market value in U.S. dollar terms of the bitcoin received on the date of receipt. That recognized income is subject to income tax at ordinary income tax rates. On top of income tax, the taxpayer may also be subject to self-employment tax.

Selling bitcoin

If you do need to convert bitcoin to your local currency to pay bills, taxes, or cover overhead, you may want to expedite the process by setting up an exchange account and linking an active bank account. Some exchanges can take days or weeks to approve new accounts, so plan accordingly, especially if you are up against a deadline like paying an invoice, payroll, or taxes.

Unchained Capital can help facilitate the purchase or sale of bitcoin straight to or from a multisig vault, within certain limits, for companies and individuals in the U.S. that reside in a state where our trading desk is active.

Collateralizing your bitcoin

Securing your bitcoin with a collaborative custody partner like Unchained Capital means you can easily use that bitcoin to access liquidity to reinvest in your mining operations—without ever selling your bitcoin. For more detailed information on bitcoin collateralized lending, visit unchained.com/loans.

Let Unchained Capital be your guide

Whether it be the daunting task of managing fees, advice on how to structure your bitcoin custody workflow, or access to a trading desk to buy and sell bitcoin, we’re here to help. Our multisig vaults for business give your organization complete control over your bitcoin while providing a trusted partner to guide you and your team through setup and to help with key replacements and wallet recovery if and when necessary.

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

Bitcoin and altcoins continue to be rocked by macroeconomic and geopolitical uncertainty, but data shows bulls continue to buy each dip.

After enjoying record profits during Bitcoin’s recent halving, miners now face a sharp decline in hash prices.

Analysts cite a classic trading pattern and growth in the altcoin total market capitalization index as proof of an upcoming altcoin season.

It was supposed to be his last film, but the project has been scrapped.

Discovering CryptoLinks.com: Your Ultimate Destination for All Things Cryptocurrency Related

Feeling swamped by the tsunami of crypto news flooding your screens daily? Navigating the cryptocurrency ecosystem can often leave you gasping for air, especially when every tick of the clock brings a new update that could make or break your next move. At CryptoLinks.com, I've constructed the life-raft you've been seeking—a streamlined, organized, and reliable source that does the heavy lifting for you. Picture this: a world where you're seamlessly connected to the pulse of the crypto sphere, swiping past the fluff and diving straight into the news that impacts your digital portfolio. From the latest coin launches to market-moving trends, CryptoLinks.com isn't just about handing you the news; it's about delivering a custom-tailored stream that aligns with what makes your wallet tick. Ready for that breath of fresh air? Let's take that plunge together and unlock the full potential of the crypto landscape—effortlessly.

Have you ever felt like you're drowning in a sea of endless cryptocurrency news and updates? Do you find it difficult to sift through the noise to find the information that matters to you? In the dynamic world of cryptocurrency, where news breaks at the speed of light, keeping up can be a herculean task.

The Problem: Too Many News, Too Little Time

Cryptocurrencies never sleep, and in a 24/7 market, news and updates proliferate round-the-clock. For enthusiasts and investors alike, staying informed is crucial, but the sheer volume of information can be staggering:

- New coin launches and tech innovations.

- Regulatory changes and legal updates.

- Market trends and investment tips.

With so much happening at once, how can you ensure you're not missing out on crucial information, without spending every waking hour glued to a screen?

Your One-stop Solution: CryptoLinks' Aggregated Web News Section

I understand the struggle, which is why CryptoLinks.com is designed to be your safe harbor in the tumultuous ocean of cryptocurrency news. Imagine a place where the most vital news comes to you, where the fluff is filtered out, leaving only the golden nuggets of crucial updates and trustworthy information.

Here's a glimpse of what CryptoLinks.com offers to transform your crypto news experience:

- A comprehensively curated collection of cryptocurrency web news from various verified sources.

- An easily navigable interface that quickly directs you to the day's most important headlines.

- A customizable feed that allows you to focus on news that aligns with your interests and investments.

With CryptoLinks.com, you'll no longer feel the need to scramble through dozens of tabs and sources. You'll have it all in one place, a streamlined, finely-tuned machine that keeps pace with the crypto market's heartbeat.

Are you curious about how we manage to provide such a high-quality selection of crypto news? Stay tuned, as the next segment will reveal the inner workings of CryptoLinks.com and how we've perfected the art of news aggregation.

How CryptoLinks.com Helps Simplify Your Crypto Journey

Finding credible news in the clamor of the cryptocurrency world can be as daunting as searching for a strand of truth in a digital haystack. But, amidst this informational whirlwind, CryptoLinks.com stands as a beacon of clarity, meticulously sifting through sources to bring you the essence of crypto news.

Quality Over Quantity: CryptoLinks' Approach to News Aggregation

What sets us apart is our steadfast commitment to quality. Our team operates with the kind of discernment only seasoned crypto enthusiasts can offer, ensuring that each piece of news on CryptoLinks doesn't just add to the noise but genuinely enriches your understanding.

- We prioritize authority and accuracy, steering clear of speculation and focusing on news that matters.

- We favor trusted sources with proven track records, so you can rest assured that the information is vetted.

- We're vigilant about relevance, ensuring that trends, updates, and insights reflect the current state of the market.

Imagine starting your day with a cup of coffee and a concise briefing that filters out the fluff, leaving you with pure, potent news. That's the CryptoLinks experience.

Streamlining Your Daily Reading Routines

Remember the days of having dozens of tabs open, bouncing from one website to another in a relentless quest for reliable crypto news? Those days are gone. Here's how we streamline your daily information intake:

- Curated Content: Our algorithm ensures you're exposed to the hottest topics and breaking news.

- User-Friendly Interface: A clean layout and intuitive design mean information is not just accessible but also digestible.

- Customizable Experience: Tailor your news feed to your interests, eliminating unwanted noise and honing your focus.

"In the age of information overload, clarity is power." This quote echoes our ethos, highlighting the transformative impact of refined data consumption.

"In the age of information overload, clarity is power."

With CryptoLinks, you tap into a stream of knowledge that's been distilled to empower, not overwhelm. But how do we ensure that this stream remains unpolluted by bias and misinformation?

Stay tuned to discover the intricate process behind our source selection in the next section, and uncover the secret recipe that keeps the CryptoLinks engine running smoothly. What kind of sorcery allows us to maintain objectivity in an often subjective market? Keep reading to find out.

The Nitty-Gritty: Understanding CryptoLinks’ Inner Workings

Ever wondered what goes on behind the scenes at CryptoLinks? As a platform that's become a lighthouse in the tumultuous sea of cryptocurrency information, it's time to pull back the curtain and show you the cogs and wheels of our operation. It's not just about presenting news; it's about presenting the right news in the right way.

Choosing the Right Source: CryptoLinks’ Secret Recipe

Our quest for curating the perfect content mix is akin to a master chef selecting the freshest ingredients for a signature dish. But what does this gourmet process involve?

- Depth of Research: We scour the digital landscape probing into every nook and cranny of the cryptoverse. Only the most reputable and insightful sources make the cut.

- Consistency and Reliability: Like the faithful tick of a Swiss watch, we evaluate how sources maintain a steady flow of accurate and timely information.

- User Perspectives: We listen to what you, our community, seek and appreciate. Your opinions help us prioritize sources that best align with your information needs.

This meticulous process isn't simply about algorithmic selections; it's a careful human curation to serve you a platter of the most relevant and enriching content.

Preserving Objectivity in the Most Subjective Market

In a market that thrives on speculation and sentiment, where hype can overshadow substance, preserving objectivity is our fortress. It's a commitment set in stone—a pledge to our readership. "Truth is ever to be found in simplicity, and not in the multiplicity and confusion of things," as Isaac Newton profoundly stated.

"I cannot afford to waste my time making money." – Louis Agassiz

Just like Agassiz prioritized his scientific pursuits over financial gain, we prioritize the essence of news over sensationalism. CryptoLinks is your compass in a landscape brimming with noise; we filter through the flurry, leaving you with undistorted and essential news segments:

- Critical analysis minus the sensational headlines

- Data-driven reports, stripped off any emotional bias

- Announcements and updates, delivered as they are, not as they're speculated to be

It's not just about delivering news; it's about upholding the integrity of information. In doing so, we've become more than just a platform; we've turned into a beacon of truth for our readers.

But, how does this unwavering commitment to truth translate into your everyday experience? Curious about how to leverage our unbiased insights for your personal crypto endeavors? Stay tuned for what's next, where I'll share some insider tips on making the most out of your daily CryptoLinks encounter.

Best Practices: Making the Most of CryptoLinks' Aggregated Web News Section

Understanding how to navigate the vast sea of information is crucial in making informed decisions in the fast-paced world of cryptocurrency. It all starts with knowing the best practices to enhance your user experience on CryptoLinks. Here's how you can optimize your visits to get what you need, quickly and efficiently.

Enhancing Your CryptoLinks Experience

Firstly, let’s talk about customization. Your interests in cryptocurrency are unique, and so should be your news feed. Make use of our category filters to tailor what news pops up on your screen. Are you passionate about blockchain technology, or perhaps ICOs and token sales are more your cup of tea? With just a few clicks, you can set your preferences and receive news related solely to those categories.

Another tip is to take advantage of the bookmark feature. If you stumble upon an article or a nugget of information that catches your eye but don't have time to read it at the moment, simply bookmark it for later perusal.

Also, don't forget to check out the comments section. The CryptoLinks community is knowledgeable and often experienced—engaging with them can provide additional insights and even different perspectives on the topic at hand.

Streamline Your Knowledge with CryptoLinks’ Press Section

Now, let me introduce you to a gem within the site—the press section, easily accessible at CryptoLinks' Press. The press section is where you’ll find an aggregation of official announcements and press releases from within the industry. It's essentially your direct line to the source without any third-party interpretations or potential bias. The benefits?

- Timeliness: Stay ahead with the most recent and official statements from crypto entities.

- Authenticity: Get the story straight from the horse's mouth, bypassing the noise that can sometimes distort news in the rumor mill.

- Depth: Press releases often dive deeper into the specifics that general news articles may gloss over.

Have you ever found a press release that touched on an up-and-coming blockchain project or a new coin launch and wished you could follow up on how it evolved? Save that page! This allows you to create a tapestry of knowledge, tracing developments as they unfold in real-time.

Now, with all these tools and knowledge at your disposal, you might be wondering, what's next? How else can you leverage CryptoLinks to stay on top of the crypto wave? Stay tuned, as the next article will not only quench your thirst for knowledge but will also illuminate the unique value CryptoLinks brings to your digital doorstep. Are you ready to become a savvy crypto navigator?

Answering Your Burning Questions

If you've ventured into the bustling alleyways of cryptocurrency news, you've likely grappled with an overload of information. This is where CryptoLinks strides in, and perhaps you're curious about how and why we are your go-to source. Let's tackle some of the queries stirring in your mind.

Why Choose CryptoLinks Over Other Aggregation Platforms?

You want a platform that's not just a random noise collector but a curated orchestra of relevant information – and that’s what sets CryptoLinks apart. We meticulously handpick sources that have proven their integrity and value over time. But we don't stop there; rigorous checks and balances ensure these sources remain on-point, consistent, and free from bias. Whether it's a breaking headline or a subtle market sentiment shift, you can trust that our aggregation reflects the true pulse of the crypto world. And it's not just about trust – it's about delivering a streamlined experience without the fluff and fillers other platforms may overlook.

Staying Ahead of the Game with CryptoLinks

Cryptocurrency waits for no one. It's a dynamic beast, with news and trends shifting by the minute. So, how do we ensure that you get the latest scoops before anyone else? Our secret lies in real-time updates and a responsive filtering system. The CryptoLinks potential to tap into the minute-by-minute fluctuations of the market keeps our community informed with lightning speed, without sacrificing accuracy. When your conversations turn to the latest crypto developments, you'll find yourself steps ahead, armed with insights gleaned from our up-to-the-minute news reports.

Wrapping It Up

Choosing CryptoLinks isn't just about simplifying your path through the cryptocurrency landscape; it's about augmenting your understanding and involvement with quality information. You've seen how our careful curation and real-time reporting can empower your decision-making. Quality, objectivity, and speed are the pillars of what we offer, and these aren't mere words. They are commitments to each user who trusts us as their compass in the crypto cosmos. Whether you're a beginner or a seasoned trader, the news we serve could be the difference between making a smart investment choice or missing out on an opportunity. At the end of the day, your success in this complex domain is the true measure of our value. So let those questions rest – CryptoLinks is your ally, guiding you through this ever-evolving space with clarity and confidence.