Should I Invest in Bitcoin?

The price performances of crypto assets, particularly Bitcoin, in 2020 so far dwarfs what investors are accruing in traditional markets. The sheer volume of opportunities presented by digital assets is enough to attract the attention of even the most conservative of investors. So, it is perfectly normal to feel pressured to explore Bitcoin investment. In this article, we will highlight the rudimentary of Bitcoin and then make available all the information required to make an informed decision on whether to invest in Bitcoin or not. But first, let us clear up some of the misconceptions about Bitcoin.

What Is Bitcoin?

Bitcoin, like several other cryptocurrencies, is an innovative iteration of money. This is why it is popularly known as a digital asset since it functions as a means for executing transactions, albeit via a virtual infrastructure called the Bitcoin blockchain. While this architecture may seem cumbersome at first, it becomes easier to comprehend when you picture Bitcoin, also called BTC, as a digital form of cash and the Bitcoin blockchain as the bank. The only way this analogy works if we assume that the bank in this context connotes a distributed and decentralized network of users who are responsible for ensuring that the entire system works as it should.

Hence, instead of having a single entity tasked with the responsibilities for conducting checks and confirming transactions like conventional banking systems, the Bitcoin blockchain network relies on a distributed model of governance. Here, some network participants partake in the payment verification process through specialized machines for the chance of earning rewards in the form of newly minted Bitcoins. In other words, the verification process does not only ascertain the validity of transactions but also contributes to the supply of new Bitcoins.

What Are the Core Applications of Bitcoin?

According to the creator, the core reason for creating Bitcoin is to have a viable alternative to traditional money with censorship-resistant features and deflationary mechanisms. The main goal is for Bitcoin to become as accessible as cash or fiat currencies. For this to come to fruition, there is the need to implement user-friendly Bitcoin-powered systems that newbies can navigate easily. While this has been the core pursuit of most crypto firms, investors have begun to utilize Bitcoin in ways that contradict its primary function as a payment method.

Following Bitcoin’s impressive price performance over the years, it has become fashionable to incorporate the digital asset as a store of value. The lack of a correlation between Bitcoin and other traditional assets is reminiscent of gold’s longstanding status as a hedge against inflation. In light of this, some argue that Bitcoin is digital gold and that it possesses the right attributes to achieve a viable portfolio diversification strategy. Herein lies the growing interest of institutional investors in Bitcoin.

How Does Bitcoin Get Its Value?

Bitcoin’s inherent value lies in the fact that individuals or entities that believe in the system are willing to invest their computer resources and time in its daily maintenance. The viability of the network automatically plays into the demand for Bitcoin. Network participants ensure that the infrastructures powering the Bitcoin network remain effective. In turn, the digital asset, which is the economic representation of the network, is subject to the fundamentals of supply and demand. The higher the demand relative to the supply of BTC, the higher the price of the asset. Also, when the supply surpasses the demand, the value of Bitcoin will plunge.

What Is the Supply of Bitcoin?

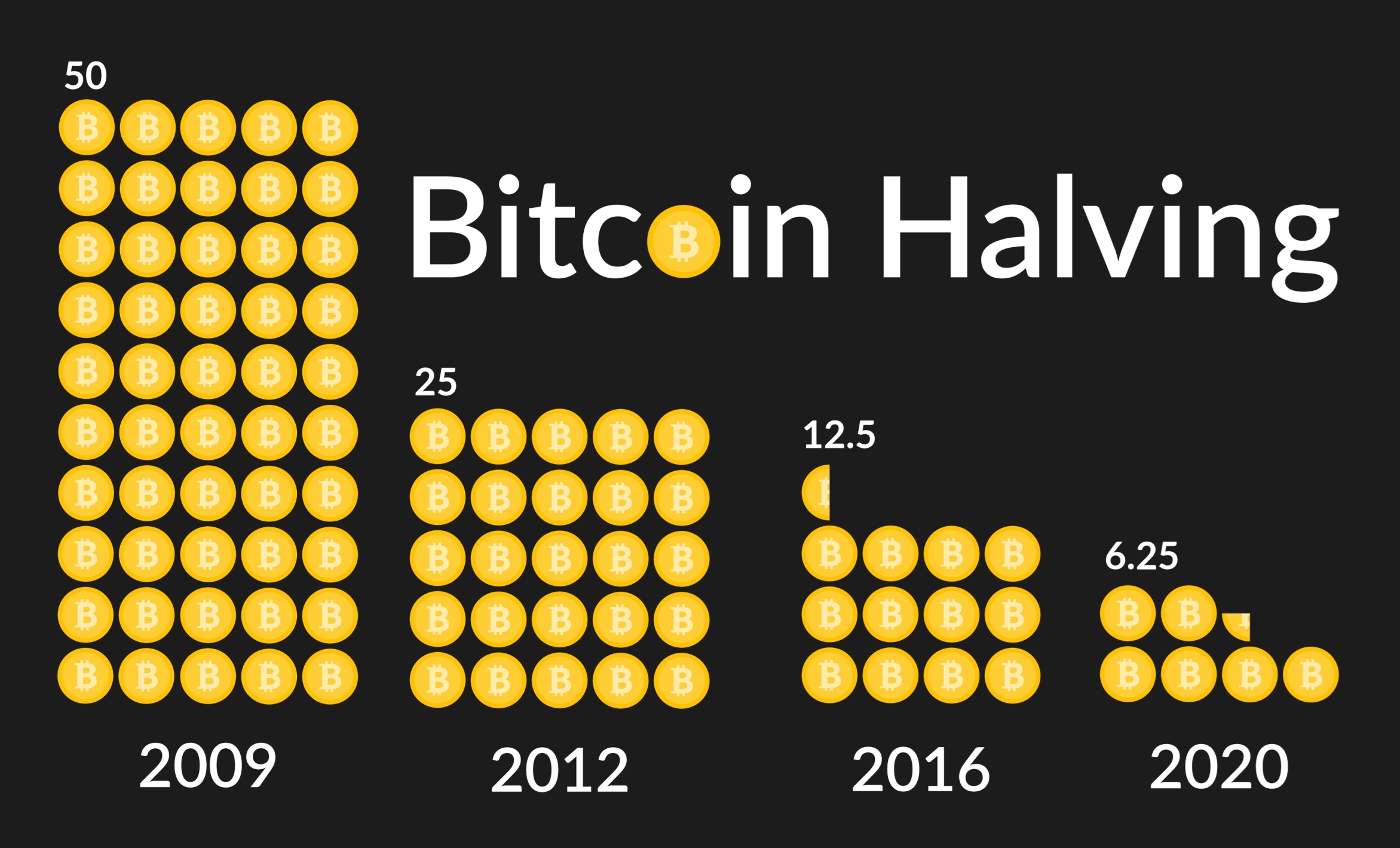

Remember that we mentioned that Bitcoin has deflationary mechanisms that give it an added advantage over fiat currencies? The common approach used to establish this state revolves around the supply of Bitcoin. In total, there are 21 million BTC that can ever exist. Of the total, we have a little over 18.5 million BTC circulating currently. What this means is that BTC relies on a fixed supply cap system. Hence, the digital asset is bound to become scarce, and this will effectively propel its value to increase, so long the demand remains on the high side.

The second approach introduces a reward halving mechanics that regulates the supply of Bitcoin over time. Even though there is a supply cap for BTC, there is an implementation, called Bitcoin halving, that comes into effect roughly every four years. This protocol reduces the frequencies at which newly minted Bitcoins are rewarded to individuals or entities that scrutinize the transaction validation processes. If you will recall, there was a Bitcoin halving event in May 2020. According to insight generated from the thorough analysis of the historical data regarding the effects of previous Bitcoin halving implementations, expect this event to spur the price of Bitcoin to new highs. This projection stems from the above-stated demand and supply theory deemed to play a vital role in the valuation of Bitcoin.

How to Gauge Bitcoin’s Performance?

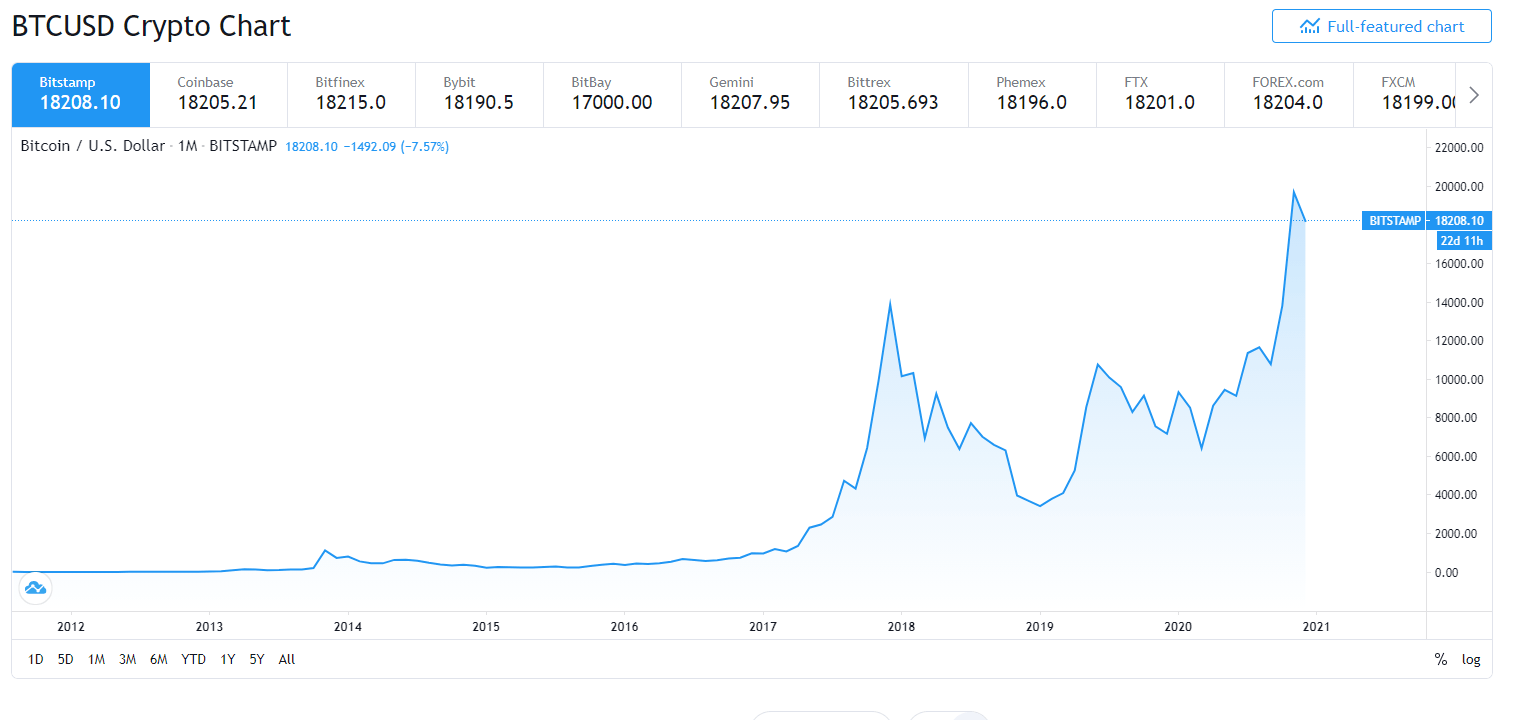

Like every other asset, it is vital to understand the price pattern of Bitcoin and how it reflects in the returns generated by investors. Since Bitcoin became available to trade some 10 years ago, the digital asset’s ROI for early investors has risen to over 9000%. This performance makes it the most profitable investment vehicle in the last decade. In 2020 so far, the year-to-date return is hovering around 160%. When you compare this performance with that of established markets, it is clear that Bitcoin is in a league of its own. At the time of writing, the S&P 500’s year-to-date return is 13%, while that of gold stood at 19%.

One more thing to consider when gauging the profitability of Bitcoin is the type of investment strategy that you as an investor favor. Here, it is vital to determine whether you plan on investing for the long-term or the short-term.

Types of Bitcoin Investment Strategies?

There are two options that investors majorly adopt. The first is the long-term strategy, while the second requires short exposure to Bitcoin investments.

Long-Term Strategy: Some investors are in for the long haul because they believe that the fundamentals of Bitcoin and its innovative architecture are the bedrock of the future of money. Long-term investors are, to an extent, sure of the longevity of Bitcoin and are certain that as it becomes scarce, so also will its value rise. Therefore, they are very much comfortable with acquiring and holding on to Bitcoin for extended periods. The plan is to set a price target and sell their stash as soon as the digital asset reaches or surpasses the predefined milestone. For investors opting for this strategy, the volatility of BTC is inconsequential, as long as the asset and its underlying infrastructure retain its viability. It could take 10 years for investors to cash out.

Short-Term Strategy: Unlike the long-term investors, those opting for short-term plans are predominantly on the lookout for market indicators that suggest a short price surge. Such investors need to consider the right time to buy Bitcoin and the perfect moment to exit. It is advisable to purchase Bitcoin at the beginning of a price rally and sell as soon as it begins to lose steam. From the explanation, it is clear that short-term investors have to conduct thorough market research to predict price movements. This type of investment could extend beyond 6 months.

When to Buy Bitcoin?

As mentioned in the last section, some investment strategies require thorough research to determine when to buy Bitcoin. The best time to buy Bitcoin is at the point where the asset bottoms out. For instance, the price of Bitcoin crashed below the $4,000 mark in mid-March. This is the lowest dip recorded in the past 52 weeks. Investors that bought this dip would generate the highest returns when the price of Bitcoin hit a new peak during the next bull run. Hence, it is advisable to be on the lookout for price slumps that do not reflect the real value of Bitcoin and its network.

Whenever the Bitcoin market records new lows, the probability of fast recovery is high. More often than not, investors that accumulate during price downturns position themselves as the biggest winners when the market is in full throttle.

Is Bitcoin A Bubble?

On many occasions, pundits and respected investors have come out to downplay the efficacy of Bitcoin. They often compare this nascent market and its explosive growth to the dot.com bubble and warn that it lacks the sort of elements that govern established and mature alternatives. It was no surprise that this argument became a common sentiment when the price of Bitcoin fell from the all-time high of $19,700 in 2017 to $3,000 within 12 months. However, seeing that the digital asset has since recovered and even surpassed its previous record, it is safe to conclude that Bitcoin is more than just another poorly-conceived technology. Hence, it is fallacious to connote Bitcoin with the term “bubble.” The historical data of the asset shows that the market obeys common price cycle concepts like bear and bull runs.

Bear and Bull Bitcoin Markets

Without any doubt, the concept of bull and bear cycle applies to the Bitcoin market. A Bitcoin bull market is defined as an extended period when the price of BTC shows an unrelenting upsurge. Notably, bull markets set new price records. On the other hand, a bear run connotes market cycles where the value of Bitcoin continues to depreciate or undergo what experts call a price correction. It is vital to understand these cycles and identify them before investing in Bitcoin. Successful investors are always looking to capitalize on the price dips of bear markets to accumulate BTC.

Are We in A Bitcoin Bull Market?

Having understood the dynamics of the Bitcoin market, there is a need to apply these concepts in the present timeline. For some weeks now, the price of Bitcoin has hovered around the $19,000 price mark. It even surged above its previous price peak momentarily. Therefore, there are reasons to believe that the market is experiencing a bull run. This market cycle has attracted several investors and spurred an increase in demand for digital assets. Once the price peaks, the cycle automatically switches to a bear market as the value of Bitcoin steadily falls till it bottoms out.

While this is a given, no one knows what to expect or can unequivocally predict how long the current bull run will last. What experts, however, revealed is that we may be at the early stage of a bull market. In essence, there is a strong possibility that the value of Bitcoin will continue to rise. Nonetheless, this does not mean that there won’t be short-lived price corrections along the way.

Why Do Experts Think That We Are Still in The Early Stage of a Bitcoin Bull Market?

According to the historical data of Bitcoin, every bull market results in new price peaks. Most importantly, these bullish price swings dwarf previous records. Since the price of Bitcoin has only been able to match its all-time high, there is the potential for an even steeper price ascent.

What Are the Things to Consider Before Investing Bitcoin?

As an investor, it is vital to ascertain that your decisions are not influenced by greed or FOMO (fear of missing out). Although Bitcoin seems like a viable investment at the moment, you must determine the right time to invest and recoup profit, especially if you intend to adopt a short-term strategy. Hence, carry out extensive analysis and gauge market sentiments before purchasing Bitcoin. Another factor to consider is the security of your Bitcoin stash (read more on this topic in the storage and security section below).

The Volatility of Bitcoin

The price of Bitcoin tends to fluctuate several times a day. As stated earlier, long-term investors should not concern themselves with Bitcoin’s volatility as it has no immediate effect on their predefined goals. On the contrary, traders, as well as short-term investors, ought to track these fluctuations to determine the appropriate time to exit or enter the market. Although the volatility of Bitcoin has become the subject of scrutiny, a recent report by VanEck revealed that a significant percentage of stocks on the S&P 500 index is more volatile than Bitcoin. The authors discovered that a total of 112 stock assets experienced more price fluctuations than Bitcoin in the last 90 days.

Why Is the Price of Bitcoin Not Uniform?

You must have noticed that the price of Bitcoin lacks the sort of uniformity attributed to traditional assets. Much of these discrepancies stem from the distributed nature of the crypto market. There is currently no single entity governing the market. Instead, the value of the Bitcoin market relies on several exchanges, which set prices based on the activities of users or traders. In other words, the last price at which Bitcoin was purchased on an exchange determines the real-time value of the digital asset on that platform. Now take into account the thousands of Bitcoin exchanges available today, and you will understand why you may encounter different prices for the same digital asset.

To establish some sort of sanity, crypto metric sites like Coinmarketcap and Coingecko pool real-time price data from several exchanges and showcase the average. With this, you can get an idea of the price of Bitcoin at all times. For accurate pricing metrics, you can access the data on the Bitcoin exchange of your choice.

How to Store and Secure Bitcoin?

To make Bitcoin storage as simple as possible, we will stick to the bank analogy used to explain the Bitcoin network. We all know that usernames and passwords still play critical roles in the traditional banking system. Individuals are issued bank numbers and allowed to choose a password to sign transactions. A similar architecture applies to Bitcoin as every user needs two sets of keys to receive and send funds.

The first key, called Public Address, is a string of random numbers, characters, and alphabets that functions as the bank number of Bitcoin holders. Hence, others need to access your public address to input a valid destination when sending Bitcoin to you. The same also applies to you as Bitcoin payment systems require the public addresses of recipients to execute transactions. On the contrary, the second key, called Private Key, is used to sign transactions. Bitcoin holders must secure their private keys just as they would safeguard the passwords for their banking applications because, without it, they will lose access to their funds. Why is this so?

Bitcoin storage infrastructures, widely known as wallets, do not necessarily store the digital asset per se. Private keys provide the only valid claim to cryptocurrencies. And so, wallets secure private keys to maintain ownership of a said amount of coins. With this explanation, it becomes easy to differentiate between the two main types of wallets.

Types of Bitcoin Wallets

There are two types of Bitcoins. They are custodial and non-custodial wallets. From their names, it is clear that the latter offers some level of control while the former strips away this privilege. Custodial wallets issue public addresses to users and store the private keys on their behalf. Crypto exchange wallets commonly adopt this model. Non-custodial wallets, on the other hand, allocate the responsibility of private keys’ safekeeping to users. In other words, users have full autonomy over their assets. As you would have noticed, both types of Bitcoin wallets have their strengths and weaknesses. However, for this guide, we will focus on the benefits of opting for a non-custodial wallet.

Benefits of Non-Custodial Wallets

The main advantage that non-custodial wallets have over the custodial storages is that it eliminates some of the security risks associated with hacks and Bitcoin thefts. It is worth mentioning that exchanges are primary targets for hackers because they control large online wallets as a result of their custody-based Bitcoin storage facilities. In the event of a successful hack, users’ funds worth millions of dollars are automatically prone to theft. And when it comes to Bitcoin, the chances of recovering lost assets are low. This is why investors should opt for non-custodial wallets that provide offline storage infrastructures for private keys. Some of the non-custodial wallets you should consider are hardware wallets like Ledger and Trezor.

However, this does not mean that non-custodial wallets do not have their disadvantages. Topping the list of downsides is the added responsibility it places on users to ensure that their private keys do not fall into the wrong hands. In light of this, we have begun to see a more advanced model of Bitcoin storage services emerge. They are crypto custodial services.

What Are Crypto Custodial Services?

Due to the security concerns trailing the ascent of Bitcoin, companies have begun to provide insured and institutional-based storage services to investors. These specialized platforms store Bitcoin in offline wallets on behalf of their clients. In the event of a hack, investors do not have to worry about losing their digital assets. Herein lies the advantage of adopting crypto custodial platforms with insured wallets.

Should I Invest in Bitcoin?

Now that you understand some of the fundamentals of Bitcoin and its pricing system, you have enough information to decide whether it is worth investing your resource and time in Bitcoin. Before you make this decision, ensure that you read the security and storage requirements detailed above extensively, and understand the factors that propel the price of Bitcoin. Also, choose a strategy and stick to it. There is no sense in going in with the mindset of investing long-term and back out at the first sign of trouble. Remember that the price of Bitcoin and cryptocurrencies as a whole are prone to wild fluctuations. It is crucial to carefully analyze the market and determine the real value of Bitcoin regardless of volatile price swings.

If you have considered all these factors thoroughly and concluded that you are up for the challenge, then you can go ahead to explore the steps involved in Bitcoin investing.

How Do I Invest in Bitcoin?

The most common approach for investing in Bitcoin is to purchase and own the digital asset physically. This requires that you undergo the process involved in the storage and acquisition of Bitcoin. The other option is to buy Bitcoin exchange-traded products that do not entail investors to own the digital asset physically. Depending on your location, you can have access to investment vehicles pegged to Bitcoin. These products track the price of Bitcoin without investors having to undergo cumbersome or expensive storage procedures. You could opt for any of the two options, based on your preference, the reliability of the issuer of the exchange-traded product, and the possibility of long-term involvement in the Bitcoin market.

How Do I Purchase Bitcoin?

Thanks to the proliferation of Bitcoin investment, there is a growing number of avenues to access the digital asset market. The most common Bitcoin gateways are exchanges. That said, more traditional platforms are incorporating new features designed to make Bitcoin accessible. Some of the established payment gateways that have adopted Bitcoin in recent times are Cash App and PayPal.

How to Buy Bitcoin with Cash App?

As a result of the incorporation of a Bitcoin portal on Cash App, it has become a lot easier to buy Bitcoin. All you need do is to follow the steps below:

- Download Cash App on Apple Store or Google Play and enter your details to complete the signup process.

- Part of the signup procedure entails that you link your bank or a payment method to the app. You can do this by selecting your bank and entering your details in the appropriate section. Likewise, you can link a debit card as a payment method.

- Once you have completed the signup procedure, you can then choose a Cashtag, which is the name other users would use to send money to your account.

- Go back to the home screen and tap “Bitcoin” to complete the KYC requirements imposed for Bitcoin transactions. Cash App’s Bitcoin portal is strictly governed by the Financial Industry Regulatory Authority (FINRA) compliance rules. Hence, you must scale anti-money laundering regulations by verifying your identity. This verification can take as long as a day to complete. You can go ahead to buy Bitcoin once you receive a notification of confirmation.

- After verifying your identity, navigate to the “Investing” tab at the bottom of your screen and tap on “Bitcoin.” The app will direct you to the Bitcoin gateway, where you will see the current price of Bitcoin. Click “Buy” and choose the amount of Bitcoin you intend to purchase. Note that Cash App has a $100,000 weekly purchase limit.

- Click “Next” to see the overview of your purchase, the fees, and the amount of BTC that will be sent to your wallet. Press “Confirm” to complete the transaction, and Cash App will credit you with the amount of Bitcoin purchased. You can track your holdings on the home screen.

Additionally, it is advisable to withdraw this Bitcoin or transfer it to an external wallet for security reasons. As mentioned earlier, investors ought to have a level of control over their assets. And the only way to do this is to transfer holdings to non-custodial wallets. To make a withdrawal, enter the address of your external wallet, input the amount you want to send, and click on “Withdraw.”

How to Buy Bitcoin on PayPal?

Although the process involved is almost similar to the outlined steps for purchasing Bitcoin on Cash App, there are some peculiarities that you should note. The most notable is that PayPal only allows U.S. users to buy and sell Bitcoin for now. Another is that it is impossible to receive or send Bitcoin on PayPal. The activities permitted are the purchase and withdrawal of Bitcoin and other selected cryptocurrencies. In other words, your Bitcoin will remain in PayPal’s custody until the moment you execute a withdrawal request. You can follow the step below to buy Bitcoin on PayPal.

- Signup on PayPal by inputting your details and linking a payment method.

- Go to the home screen and tap the “Buy Bitcoin and more” banner. This action will take you to the crypto section of the platform.

- Select Bitcoin as the digital asset of your choice and set the amount you want to buy. Once you have inputted the value, press “Buy.” Here, you will see a price chart and a brief description of Bitcoin.

- However, to continue, you will have to submit additional information and accept PayPal’s terms and conditions for cryptocurrency purchases. Once you scale this step, you can enter an amount in USD that you want to purchase and select “Next” to continue.

- Select a payment method or add a new one to finalize your purchase. Note that the review of your transaction reflects the charges deducted by PayPal. After confirming the purchase, you can track your holdings and their current value.

What to Consider Before Buying Bitcoin from An Exchange?

There are a myriad of options when it comes to Bitcoin exchange. Despite the volume of options available, you must take into account the type of Bitcoin exchange that suits you, the amount of Bitcoin you intend to buy, and your present location. You can find a comprehensive list of the factors to consider below:

The Types of Bitcoin Exchange

Based on the governance model adopted, we can classify Bitcoin exchanges into at least three classes. The first set of exchanges are brokers, which have a crypto portal with fixed prices. Most often than not, Bitcoin brokers come with simple user interfaces and are the top choice for newbies who are just trying to get set up their crypto investment portfolio. Another reason why this type of exchange thrives is that they support popular payment methods like PayPal, credit cards, and debit cards. As such, these exchanges enable familiar payment gateways and attract new investors. On the downside, the price of Bitcoin on these platforms is non-negotiable and at a premium. Examples of Bitcoin exchanges that fall under this category are Coinbase, CoinMama, and eToro.

The second class of Bitcoin exchange utilizes automated order matching facilities. The exchange lets users set the prices they want to buy or sell Bitcoin and automatically matches their orders. This approach is a bit more technical than other exchange models and is suitable for individuals with some level of understanding of trading terminologies and concepts.

Lastly, the third class of Bitcoin exchanges is p2p networks where individual traders can set preferred prices and mode of payments as well as match orders manually. Such exchanges only function as intermediaries and provide escrow services for the smooth-running of transactions. The main upside of this model is that it is possible to access competitive rates and a wide array of payment methods. However, this depends on the size of the exchange and the volume of trades executed daily. Some of the Bitcoin p2p exchanges available today are Paxful and LocalBitcoins.

How to Buy Bitcoin on An Exchange?

For those opting for Bitcoin brokers, the procedure for purchasing Bitcoin is simple and straightforward. All you need do is register on the site, scale the KYC procedures, link a valid payment method, and buy Bitcoin. As always, we advise that you send the Bitcoin purchased to a hardware wallet immediately. Also, check the deposit and withdrawal policy of the website to ascertain that the exchange has no daily or weekly limits for the amount of Bitcoin available to each user.

If the Bitcoin P2P network is your preferred gateway, then you either search for suitable offers or create a new one. Ensure that you capitalize on the escrow services of such exchanges to minimize the risks of falling victim to fraud. It is worth mentioning that whichever type of exchange you pick, you may need to verify your identity and comply with anti-money laundering regulations.

Apart from the set of Bitcoin portals explained above, interested buyers can access Bitcoin via Bitcoin ATMs. These are specially designed to process Bitcoin transactions. You can use physical cash to buy Bitcoin and have it transferred to your wallet automatically. Importantly, this is an expensive Bitcoin gateway and is majorly beneficial to investors that prefer to avoid KYC requirements imposed on other crypto gateways.

What Other Digital Assets Apart from Bitcoin Can I Invest In?

Understandably, a majority of investors have their eyes set on Bitcoin as a result of its unrivaled dominance in the crypto market. Although one of the propelling factors of Bitcoin is its growing acceptance in the mainstream investment landscape, other digital assets are generating even more impressive returns to investors. One of such is Ether, the second most popular cryptocurrency in the world.

Just as the BTC market represents the economic value of the Bitcoin network, the value ETH market reflects the economy of the Ethereum ecosystem. However, unlike Bitcoin, whose core utility is payment and store of value, Ethereum powers programmable blockchains solutions focused on introducing decentralized and transparent alternatives to conventional applications. More importantly, it is emerging as the hub of new paradigms threatening to disrupt the financial industry. Tagged decentralized finance or simply DeFi, these suites of solutions are capitalizing on the innovative nature of blockchain to develop autonomous financial applications with high-yielding markets. Other notable mentions are Ripple, Litecoin, and Bitcoin Cash.

Article infographic: Simple short Questions & Answers to – Should I invest in Bitcoin?