DeFi Pulse Review

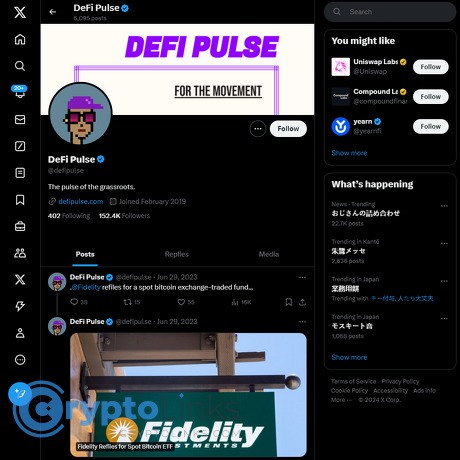

DeFi Pulse

x.com

DeFi Pulse review guide: what it is, how to use it, and the must-know FAQ

Still wondering what DeFi Pulse actually does, whether the DeFi Pulse Index (DPI) is worth your attention, and if following DeFi Pulse on X helps you make better decisions—without the hype?

If you read my blog, you know I keep things simple and practical. Let’s set up a clean foundation so you can spot signals, ignore noise, and protect your time and capital.

The real problem: DeFi info is noisy, late, and designed to distract you

DeFi changes fast. The loudest voices often push narratives, not facts. I see three repeat issues that block people from learning and acting with confidence:

- Hype over context: Screenshots of “TVL up only” or flashy APYs tell half the story. Without knowing update frequency or methodology, those numbers can mislead.

- One-off claims without history: A single chart during a market pump can hide long drawdowns and fee declines. In DeFi, history matters.

- The same questions never get straight answers: “Is this token worth it?” “How do DeFi loans really work?” “Can I earn with just a wallet?” People deserve clear, short, testable answers.

This isn’t just a content problem—it’s a risk problem. Independent research has shown that DeFi risks cluster around a few themes: smart contract bugs, oracle pricing errors, and liquidation cascades. Chainalysis has repeatedly found that a large share of stolen crypto value in recent years came from DeFi protocols—especially during 2021–2022—and while 2023/2024 saw improving security in places, attackers still target on-chain liquidity and bridges (Chainalysis Crypto Crime Reports). When the data you follow is noisy or late, you can’t see those risks building.

Rule of thumb: if a DeFi metric can’t be reproduced or cross-checked, treat it as a headline, not a signal.

Here’s my promise to you

I’ll show you how I use DeFi Pulse and the DeFi Pulse Index (DPI) in plain English, answer the questions people ask every week, and give you a repeatable way to judge risk and opportunity. No fluff, no shortcuts—just what actually helps.

- How to separate timely updates from marketing noise

- What DPI really represents and why that matters to your watchlist

- Simple mental models for lending, collateral, and yield—so you don’t chase ghosts

- A quick, practical framework to evaluate any DeFi token before you touch it

Who this is for

- Newcomers: You want a clean map and less jargon.

- Active users: You care about update cadence, fees, and risk controls.

- Cautious investors: You want a repeatable framework and you’ll stick to it.

What you’ll take away

- Clear steps to use public sources like DeFi Pulse without getting spun by headlines.

- Tools to track category trends and spot when something is off.

- Risk checklist you can run in minutes before touching a new protocol or token.

- FAQ answers to the questions everyone actually asks—kept short and useful.

Quick disclaimer

Educational only. This is not financial, legal, or tax advice. Crypto is risky. Never risk money you can’t afford to lose. Always verify data from multiple sources.

Ready to cut through the noise? Next, let’s answer a simple question that saves hours: what is DeFi Pulse today, how does its X account help, and what exactly is inside DPI? You might be surprised by what matters—and what doesn’t. Want the fast version or the full story?

What DeFi Pulse is today: site, X account, and the DeFi Pulse Index (DPI)

DeFi moves fast, and the tools we use have to keep up. DeFi Pulse was the first place many of us learned to read TVL (total value locked) and compare categories like lending, DEXs, and derivatives. These days, newer trackers may move faster, but DeFi Pulse still offers useful context—especially through its history and its index tie-in, the DeFi Pulse Index (DPI). Here’s how I use it without getting lost in the noise.

“What gets measured gets managed.” — Peter Drucker

Fast background: DeFi Pulse popularized TVL tracking and category breakdowns; how it fits alongside newer trackers

Back in 2019–2020, DeFi Pulse helped everyone understand what mattered by ranking protocols by TVL on Ethereum and grouping them by function. That simple dashboard gave us a shared language. It wasn’t perfect—and it focused mainly on Ethereum at the time—but it set the standard.

Today, you’ll find:

- Historical context: If I want to remember when Aave or Uniswap broke out in early DeFi, DeFi Pulse’s old rankings are a handy snapshot of the market’s “memory.”

- Category intuition: The way it framed lending vs. DEX vs. assets is still a clean way to think about the stack.

- Slower updates vs. newer tools: For real‑time, multi‑chain coverage, I cross‑check with alternatives (I’ll flag them below). That doesn’t make DeFi Pulse irrelevant—it just means I use it as part of a pack, not the only source.

Tip: Always check the last updated time and chain scope. If a dashboard doesn’t cover L2s or other chains, the big picture can look smaller than reality.

DPI explained: a market‑cap weighted token index of leading DeFi assets by Index Coop—how it’s built, rebalanced, fees, and risks

DPI is an ERC‑20 index token designed to track blue‑chip DeFi performance. It’s issued by Index Coop and historically curated with the DeFi Pulse methodology—hence the name. Think of it as a basket of major DeFi tokens you can hold as one position.

How it works in plain English:

- What’s inside: Large, liquid DeFi tokens across lending, DEX, derivatives, and asset management. Examples over time have included names like Aave, Uniswap, Maker, Compound, Synthetix, and Yearn. The exact mix changes with the rules.

- Weights: Generally market‑cap weighted (often float‑adjusted). Bigger protocols get a bigger slice.

- Rebalances: Scheduled (historically monthly). Weights shift to reflect updated market caps and any additions/removals based on the published methodology.

- Mint/redeem: You can buy DPI on DEXs/CEXs, or mint/redeem against the underlying components through Index Coop’s infrastructure (powered by Set Protocol) if you want primary market mechanics.

- Fees: DPI has a streaming (management) fee that accrues inside the token. Check the current rate on the official page—fees change over time.

Main risks to keep front of mind:

- Index drift vs. your thesis: Market‑cap weighting can overweight hype or underweight rising, smaller protocols. If the sector gets dominated by a few tokens, your exposure concentrates.

- Fee drag: Management fees compound quietly. Over a multi‑year hold, that matters, especially if underlying tokens lack strong cash flows.

- Smart contract + component risk: DPI inherits risks from the index infrastructure and from each underlying token’s protocol. A failure in a big component hurts the basket.

- Liquidity and slippage: Depending on where you trade it, large orders can move price. Mint/redeem helps but requires on‑chain execution and gas.

- Sector beta: DPI is pure DeFi sector exposure. In some cycles, DeFi underperforms ETH or BTC. Historically, multi‑token baskets can trail the top winners due to dilution and emissions. That’s not “bad”—it’s just the tradeoff for diversification.

If you want diversified DeFi exposure without hand‑picking tokens, DPI is a clean instrument—just align it with your time horizon, fee sensitivity, and sector conviction. Always read the methodology and docs before clicking buy.

How to use DeFi Pulse on X for timely updates

The X account isn’t a firehose. That’s fine—I treat it like a curated feed for milestones rather than minute‑by‑minute alerts.

- Turn on notifications only if you want high‑signal headlines; otherwise, add it to a DeFi List with devs, risk teams, and index issuers.

- When they post about category shifts or notable protocol changes, use it as a prompt to check the data on your primary dashboards.

- For DPI news, also follow @IndexCoop and the product page for the freshest details.

Reading TVL trends and category shares

TVL is simple to look at and easy to misread. Here’s how I keep it honest:

- Price‑adjusted lens: If ETH is up 10% this week, most USD‑denominated TVL charts will “rise” even with zero net inflows. I often sanity‑check in ETH terms.

- Category share, not just totals: If lending’s share of total DeFi climbs while DEX share is flat, leverage demand is rising relative to trading. That can foreshadow fee changes and risk buildup.

- Net flows vs. emissions: Rising TVL on a protocol with heavy token incentives might be rented liquidity. When incentives fade, TVL can leave fast.

- Watch the leader board churn: If the top 5 names shuffle quickly, the market is risk‑on and rotating. If the board is static, we’re in a consolidation phase.

There’s research to back this caution: multiple industry analyses (e.g., Messari reports and exchange research desks) have shown that TVL alone doesn’t predict token performance. It’s a piece of the puzzle—use it with fees, users, and retention.

Methodology notes and why update frequency matters

Data is only as good as the rules behind it. Before I act on a chart or tweet, I check:

- Coverage: Is it Ethereum‑only or multi‑chain/L2? If L2s are excluded, you’ll undercount leading protocols.

- Timestamp: How fresh is the update? In fast markets, a 24‑hour lag can be a lifetime.

- Double counting: Some aggregations count staked assets twice (e.g., LP tokens deposited elsewhere). Good methodologies try to net this out.

- Oracle and price assumptions: If prices are stale or pulled from illiquid markets, TVL can look off.

- Definitions: “TVL,” “active users,” and “fees” vary by source. Read the fine print once, then you’ll know how to compare apples to apples.

When update frequency is slower, the data is great for trend context but not for day‑trading decisions. I treat it like a weekly weather report, not a wind sock.

When to cross‑check with alternatives

I cross‑reference whenever:

- A headline feels too good (or too bad): If an X post says “new all‑time‑high TVL,” I check a second source before I celebrate.

- I’m about to allocate: For DPI or single‑protocol positions, I check comparable metrics on at least two dashboards.

Useful complements:

- DeFiLlama for chain‑level TVL, fees, and multi‑chain coverage.

- Token Terminal for fundamentals (fees, revenue, P/F ratios).

- Dune for community dashboards—transparent SQL means you can inspect calculations.

- Index Coop DPI page for the official methodology, fee schedule, and historical performance.

The goal isn’t to nitpick one tool. It’s to build a quick mental model: what’s trending, what’s lagging, and where risk might be stacking up.

Now, if TVL and DPI tell us “what’s big” in DeFi, the next question is the one everyone actually asks: how do lending and borrowing really work under the hood—who pays whom, who sets the rates, and what can go wrong? Let’s crack that open next.

How DeFi lending and borrowing actually works

Smart contracts set the rules

Under the hood, DeFi lending is just a set of smart contracts doing what banks used to do with paper and a back office:

- Deposits form liquidity pools. When I deposit USDC into a protocol like Aave or Compound, it joins a shared pool. I get a receipt token (aUSDC or cUSDC) that auto-accumulates interest.

- Interest rates float with supply and demand. The higher the pool utilization (borrowed/available), the higher the borrow APR, and the higher the lender APY. Each market has a curve that ramps up rates as utilization approaches a “kink” or cap.

- Governance can tweak parameters. Communities (often via token votes and risk partners) can change collateral factors, rate curves, or even freeze assets. This is how protocols defend against volatility.

Quick example: If utilization on a USDC market goes from 50% to 85%, you’ll usually see borrow APRs jump and lender APYs rise, sometimes within minutes. It’s algorithmic, not a person changing knobs.

Collateral and liquidations: the important moving parts

DeFi loans are over-collateralized. You typically post $1.00–$1.50 of assets to borrow $0.50–$0.75, depending on each asset’s risk.

- LTV and health factor. Each collateral has a Loan-to-Value (LTV) and a liquidation threshold. Protocols show a “health factor” (HF). Above 1.0 = safe, near 1.0 = danger.

- Price oracles. Feeds (often Chainlink) update collateral prices. If your collateral drops or borrow asset rises, your HF falls.

- Liquidations. If HF hits 1.0, liquidators can repay part of your debt and buy your collateral at a small discount (the “liquidation bonus”). You pay a penalty via that discount—it’s the cost of being rescued too late.

Why stablecoins matter: Most borrowers take out stablecoins (USDC/DAI/USDT) against volatile collateral like ETH. That way you’re not shorting your own collateral. But remember stablecoins can wobble too (USDC briefly depegged in March 2023)—that also affects health factors.

History lesson: On March 12, 2020 (“Black Thursday”), gas spiked and auctions failed on MakerDAO, causing extreme liquidations and some “zero-bid” events. Maker later updated mechanisms, but the takeaway is clear—liquidity and infrastructure matter during stress.

Where yields actually come from

- Borrowers pay lenders. The core yield is borrower interest flowing into the pool. If demand to borrow USDC is strong, USDC lenders get paid more.

- Protocol incentives. Some pools add token rewards. Nice bonus, but these emissions can dry up fast and whipsaw APRs.

- Fees and treasuries. Certain fees go to protocol treasuries or insurance modules (e.g., Aave’s Safety Module), not directly to depositors—always check who earns what.

“There’s no free yield in DeFi—only fairly priced risk.”

Key risks you must acknowledge

- Oracle problems. Bad or delayed prices can trigger wrongful liquidations or missed ones. Cross-check oracle setups for major markets.

- Smart contract bugs. Even audited code can break. Examples exist of rewards miscalculations and edge-case insolvencies. Keep allocations sane.

- Rate volatility. Variable borrow rates can spike when utilization surges, flipping a strategy’s PnL quickly.

- Liquidation cascades. Rapid price drops can push many accounts to HF ≈ 1 simultaneously.

- Stablecoin/asset depegs. A depeg on your borrow or collateral side can nuke health factors.

- Governance changes. Risk teams and token holders can reduce LTVs or pause markets. This is usually protective, but it can impact your plan.

If you like receipts: firms like Gauntlet publish risk reports showing how parameter changes can reduce insolvency probabilities under simulated stress. That’s why I watch risk updates before touching collateral ratios.

Simple workflow I use to lend/borrow safely

- Pick a major protocol, on a cost-effective chain. Aave/Compound on Ethereum L2s (Arbitrum/Optimism) keeps gas small and liquidity deep.

- Confirm risk parameters. Check LTV, liquidation threshold, liquidation bonus, oracle type, and any recent governance posts.

- Start with a small stablecoin deposit. Deposit a small USDC/DAI amount and watch the interest tick for a week to learn the feel of rate moves.

- Borrow cautiously. If ETH collateral has an LTV around ~70% and threshold ~80% (live values vary), I keep my health factor comfortably above 1.5–1.7. That buffer absorbs overnight swings.

- Stress test. Ask: “If collateral drops 30% fast, am I safe?” If not, lower utilization.

- Automate alerts. Use tools like DeFi Saver or Instadapp to set up alerts and optional automation. At minimum, set price/oracle alerts on your phone.

- Mind net APY after costs. Borrow at 7% to deploy into a 9% lend? After gas, slippage, and volatility, your real edge might be 0–1%. Be honest about that number.

- Keep records. Track deposits, borrows, and timestamps. You’ll thank yourself during tax season and when reviewing PnL.

Concrete numbers example: Deposit 10,000 USDC, borrow 4,000 DAI at 5% variable, and lend that DAI at 3%. Your gross spread is negative (-2%) before fees—so that’s a no for me. If I can borrow stablecoins at 3% and rotate them into a very reliable 6% with limited extra risk, then it’s a “maybe,” with small size and alerts.

Answering “How do DeFi loans work?” in plain English

You lock collateral into a smart contract, the protocol tells you how much you can borrow, rates move with live demand, and if your collateral value falls too much (per the oracle), you get partially liquidated to protect the pool. It’s instant, transparent, and ruthless—in a good way—because rules are code, not a clerk.

So the big question on everyone’s mind: if lending and borrowing are this transparent, can you actually turn that into steady wallet income without getting wrecked? I’ll show you what’s realistic, what I skip, and how I size positions—ready for that next?

Can you make money with a DeFi wallet? What’s realistic vs hype

Short answer: yes, but only if you treat yield as a business, not a lottery. Screenshots of 300% APRs come and go. What sticks is steady, compounding edges, tight risk control, and knowing when to sit in stable, boring positions. As I often remind myself:

“Markets pay you to be patient and paranoid at the same time.”

Common strategies: what they pay you in and why APRs move

Here’s the simple menu and what drives the numbers you see on your wallet.

- Staking (e.g., ETH via Lido, native chain staking): You earn protocol rewards (ETH for ETH staking). Rates float with base issuance, MEV, and network activity. ETH staking tends to sit in the ~3–4% APR lane; check live data on Lido’s dashboards or independent trackers.

- Lending (e.g., Aave, Compound): You deposit assets and earn variable APR paid in the asset you supplied. Rates move with utilization (borrow demand vs. supply). Stablecoin supply APRs often range ~2–8% on L2s in normal markets.

- Liquidity Providing (LP) (e.g., Uniswap, Curve): You earn trading fees (and sometimes token incentives). APR moves with volume, volatility, and fee tier. Beware impermanent loss (IL)—you’re long volatility of price divergence.

- Yield aggregators (e.g., Yearn, Beefy): They route your funds into the best strategies and auto-compound. You pay a fee for convenience, so always compare net APY to doing it yourself.

Why yields jump around:

- Utilization shifts: When borrowers rush in, lenders’ APRs rise; when they leave, APRs fall.

- Token incentives: Programs start/stop and cause big swings. Emissions decay over time.

- Volatility and fees: LP fees balloon in choppy markets and shrink in calm ones.

- Chain fees: Gas spikes eat into net returns; this is why L2s matter.

Costs and gotchas: the stuff that quietly kills returns

- Gas fees: On Ethereum mainnet, harvesting tiny rewards is a net negative. Use L2s (check current costs on l2fees.info) and batch actions.

- Impermanent loss: LPing volatile pairs can underperform simply holding. Studies and dashboards (e.g., APY.Vision IL calculator) show how IL can offset fee gains, especially during trending markets.

- Token emissions: “Extra” rewards paid in a farm token can look juicy until unlocks and sell pressure crush price. Always chart the emissions schedule and liquidity depth.

- Security risk: Smart contract/oracle exploits are real. Chainalysis reported that 2022 was the worst year on record for hacks with the majority by value hitting DeFi protocols (Chainalysis Crypto Crime Reports).

- Tax and tracking: Compounded rewards, LP positions, and token swaps complicate accounting. Sloppy records = lost money.

- Rugpulls and governance risks: Admin keys, questionable multisigs, or rushed upgrades can nuke a vault overnight.

Realistic example:

- $1,000 USDC on Aave v3 (L2) at 4% APR nets ~$40/year before fees. If each move costs $0.50 on L2, monthly claims/adjustments are fine; on mainnet at $20 per transaction, it’s a losing game. Scale and fee awareness decide your outcome.

- LP ETH/USDC, 0.05% tier: You might see 5–15% from trading fees in busy weeks, but a 20% ETH uptrend can cause IL that eats much of those fees. A 50/50 pool wins in mean-reverting chop; it lags hard in one-way markets.

Beginner-friendly path that actually works

- Start with stablecoin lending: USDC/DAI on Aave or Compound, ideally on Arbitrum/Optimism/Base to keep fees tiny.

- Keep approvals tight: Set spending caps, not “infinite approvals.” Revoke unused approvals monthly via a tool like revoke.cash.

- Size to your learning pace: Begin with an amount where a 50% drawdown would sting, not crush you. Scale only after two full cycles of lend/withdraw/track.

- Stick to audited, battle-tested protocols: Check audits and bug bounties; prefer projects with active risk managers and public forums.

- Compound smartly: Harvest when gas < rewards and re-deposit. Don’t over-harvest.

How I track PnL without going nuts

- Daily sanity check: DeBank or Zerion for a quick portfolio view.

- LP performance: Use APY.Vision to quantify IL vs fees—don’t guess.

- Cost basis and taxes: Open-source Rotki for serious tracking. If you need a tax tool, look at Koinly/CoinTracker and export monthly.

- Notes > memory: A simple sheet with: date, strategy, amount in, APR at entry, fees paid, rewards claimed, net value. One row per action kills confusion.

What to record for each position:

- Asset, chain, protocol, pool/market link

- Entry value and entry gas cost

- Quoted APR/APY at entry and why (fees vs emissions)

- Reward tokens and their vesting/unlock mechanics

- Exit value, exit gas, net PnL in base currency

When I pause or rotate (rules that saved me)

- APR cliff: If emissions end next week or rewards halved, pre-plan an exit. Don’t be the last liquidity.

- TVL exits: A 25–40% TVL drop in a few days is a red flag—check forums, oracles, and governance posts before staying put.

- Oracle alerts: Any oracle depeg/latency issue? Move to stables or to a market with robust feeds.

- Rate spikes: If borrow APR jumps, the supply side can look great until liquidation cascades hit. Harvest, reduce size, and wait for stability.

- Chain congestion: If gas shoots up, small strategies get unprofitable—batch, pause, or shift to L2.

- Narrative shifts: Incentives moving to a new chain or product? Rotate only after you confirm audits, TVL quality, and real users—not just APY banners.

So… can you actually make money on a DeFi wallet?

Yes—by stacking small, repeatable wins and avoiding blowups. Think in quarters, not days. A very workable mix looks like this:

- Core: Staked ETH or liquid staking tokens (LSTs) for base yield.

- Cash: Stablecoin lending on Aave/Compound for steady returns.

- Selective LP: Only when fee volume is strong and you understand IL; use tools to verify.

- Opportunistic boosts: Short-lived incentive programs with strict position sizing and exit rules.

Final thought for this section:

“In DeFi, the boring 5% you can keep beats the flashy 50% you can’t withdraw.”

If steady yield is the engine, the asset you hold is the chassis. The next question is the one everyone asks when the APRs look great: which tokens are actually worth owning while you farm? I’ll show you the exact framework I use to judge a DeFi coin—utility, cash flows, supply, and real traction—so you can sort signal from noise before you click “approve.” Ready?

Is a DeFi coin a good investment? A simple framework I actually use

“In crypto, the line between conviction and cope is data.” When I assess a DeFi token, I don’t start with narratives or influencer threads. I start with three pillars: utility and cash flows, supply dynamics and liquidity, and real on-chain traction. If those look solid, I keep digging. If not, I move on—fast.

Utility and cash flows: does the token actually do anything that users pay for?

I ask one question first: what problem does this token solve, and does it capture any of the value it helps create?

- Governance with teeth. If the token controls real parameters (fees, incentives, listing risk, collateral settings) and those decisions matter, that’s a plus. If governance is ceremonial or ignored, it’s noise.

- Fee capture or “real yield.” Do token holders or stakers earn a share of protocol cash flows (in ETH/USDC/etc.), or are they only receiving more of the same token? External cash flows > emissions.

- Security utility. Does staking the token secure the network or insurance pool (and can it be slashed)? Skin-in-the-game can be a real utility—if it’s matched with demand.

Real-world snapshots:

- Uniswap (UNI): Enormous usage and fees, but the protocol fee switch is not broadly enabled; UNI holders don’t directly earn trading fees today. You’re betting on governance value and Uniswap’s moat, not current cash flow to UNI.

- GMX (GMX): Stakers receive a share of protocol fees in ETH/AVAX. That’s clear value capture and has historically tracked activity cycles. Still, watch for changes between versions and per-market risk.

- Maker (MKR): Surplus from DAI stability fees and RWA income has funded MKR buy-and-burn at times. That’s direct support—tempered by macro rate cycles and collateral health.

- Curve (CRV) / veCRV: Lockers share admin fees (typically in 3CRV) and control emissions. There’s utility, but emissions have diluted holders during periods of weak demand.

- Aave (AAVE): StkAAVE backstops the protocol via the Safety Module. Fees accrue to the collector; value to AAVE holders depends more on governance and system health than direct dividends.

- dYdX (DYDX): The v4 appchain routes fees to validators/stakers; token utility is clearer after the transition. Still, exchange volume and market share drive the story.

- Lido (LDO): LDO governs stETH parameters and node operators. Strong product-market fit, but LDO holders don’t directly capture staking yield; it’s a governance asset with indirect value.

Why this matters: Multiple independent research shops (Messari, Token Terminal, academic papers on crypto “cash-flow” valuation) have found that tokens with direct, sustainable fee linkage tend to show more durable fundamentals during downturns. It’s not a guarantee—just a clear edge.

Supply dynamics: emissions, unlocks, buybacks, and liquidity depth

Great utility can be smothered by bad supply. I want fewer surprises and a clean path to reduced sell pressure.

- Emissions schedule: How much new supply hits the market weekly? If APR is mostly paid in the token and emissions are high, expect ongoing sell pressure unless demand is growing faster.

- Unlocks and cliffs: Big unlock calendars (team/VC/airdrops) can dominate price action. I check whether market makers and liquidity are in place before the cliff.

- Buybacks/burns: Are they rules-based and funded by real revenue (MKR example), or discretionary marketing headlines? The former is stronger.

- Treasury runway: Can the project fund 18–24 months of ops at current spend if markets cool? The best teams share budgets and revenue sources transparently.

- Liquidity depth: Is there enough on both DEX and CEX to enter/exit without 2–5% slippage? Thin liquidity + big unlock = a nasty combo.

Recent lessons worth remembering:

- High-emission models (classic “yield farming”) can create circular demand that collapses once incentives fade.

- Founder/insider overhangs and forced sellers can distort price for months—healthy fundamentals won’t instantly overcome a poor cap table.

- Rules-based buybacks tied to protocol surplus are more credible than ad-hoc announcements.

Team, audits, and security posture

I weigh execution history and risk controls as heavily as I weigh charts.

- Shipping record: Do they hit roadmaps, ship upgrades, respond to incidents? Look at GitHub activity and governance forums.

- Audits and verification: Multiple reputable auditors (e.g., OpenZeppelin, Trail of Bits), formal verification (Certora), public reports, and timelocked upgrades.

- Bug bounty and disclosures: Active programs on Immunefi/Hats, transparent post-mortems, and emergency playbooks signal maturity.

- Admin keys and multisigs: Who can upgrade contracts? Is there a timelock and community oversight? A 2/3 multisig controlling everything is a red flag for me.

“Survival is alpha.” Tokens attached to teams that plan for bad days are the ones I’m still able to buy on the good days.

Competitive moat: why users and liquidity stick

A token can be fine, but the protocol needs a reason competitors can’t copy-paste users away.

- Network effects: Liquidity begets liquidity (AMMs, money markets). Early, deep pools are hard to unseat.

- Switching costs: Integrations, SDKs, and builder mindshare keep users anchored.

- Brand/regulatory readiness: For exchanges, stablecoins, and RWA protocols, relationships and compliance can be a moat.

- Unit economics: Better fee-per-liquidity or capital efficiency than peers? That’s a real edge you can measure.

On-chain traction you can actually measure

I keep a short list of repeatable metrics:

- Fees and take-rate: Daily/weekly fees, and how much accrues to token holders or treasury.

- Retention: New users vs. returning users; are cohorts sticking around?

- TVL stability vs. incentives: Does TVL persist when rewards drop? If not, it’s “mercenary.”

- Capital efficiency: Fees/TVL or volume/TVL. Higher is usually better (with risk controls).

- Oracle and liquidation health (for lenders): Fewer toxic liquidations and safer collateral parameters signal good risk engineering.

Red flags I avoid (even if the chart looks cute)

- APRs paid mostly in the native token with no path to reduce emissions.

- Thin liquidity relative to daily volume or upcoming unlocks.

- Opaque treasury and no public budgets/runway.

- Centralized admin keys without timelocks or disclosures.

- “New chain, same code” forks with minimal audits or bug bounties.

- TVL that evaporates the moment incentives rotate—classic mercenary capital.

How I score a token in 90 seconds

- Utility: 0–2 points (governance with fee power or direct security value)

- Cash flows: 0–2 (real, external revenue to holders/treasury beats emissions)

- Supply: 0–2 (clean emissions, manageable unlocks, credible buybacks)

- Liquidity: 0–1 (can I size in/out without getting chopped?)

- Security: 0–2 (audits, bounties, timelocks, incident response)

- Moat/traction: 0–2 (sticky users, integrations, capital efficiency)

7+ is watchlist.9–11 is size small and monitor. Anything ≤6 goes in the “pass” bucket unless something structural changes. Simple beats clever.

Position sizing and expectations

Not financial advice. I size based on how wrong I can be and still sleep.

- Small caps: starter size only, scale on proof (cash flows, users).

- Blue chips: larger size only if liquidity, governance, and security are top-tier.

- Always plan exits: time-based trims around unlocks, fee drops, or governance misses.

If you’ve ever felt stuck in a token while “waiting for the story to play out,” you know the pain. Data turns waiting into a decision.

Want to see the exact dashboards and alerts I use to check fees, unlocks, liquidity depth, audits, and governance in minutes instead of hours? That’s up next—what I open every morning and how I keep my feed clean so I don’t miss the signal. Ready to copy my setup?

My go-to tools to track DeFi Pulse data and the wider market

I keep a small, tight toolkit that gives me signal fast. The goal: understand the DeFi Pulse context, sanity-check it against multiple sources, and spot risks or opportunities before they hit my feed. Here’s exactly what I use and how I use it day to day.

Dashboards I check

DeFi Pulse (X account) for historical category context: I treat DeFi Pulse on X like a quick sector read—who’s leading, which categories are waking up, what narratives are resurfacing. It’s great for context, and I pair it with the tools below for fresh numbers.

- DeFiLlama — My baseline for TVL, fees/revenue, and chain/category share. I check:

- Dashboard — Topline TVL and chain flows (is liquidity rotating to L2s/Solana today?).

- Fees & Revenue — Which protocols actually earned in the last 24h/7d/30d.

- Stablecoins — Net inflows/outflows can warn of risk-off moves.

- API — I pull TVL and fees for my watchlist sheet so I don’t log in.

How I use it: If sector TVL is up but fees are flat, I’m cautious—capital might be mercenary or farming emissions rather than real usage.

- Dune — Community dashboards for protocol internals:

- Maker DSR/DAI flows — Shows how sticky DAI demand is and the income Maker is paying out.

- Aave utilization & borrow rates — Lending health, utilization spikes, liquidation risk pockets.

- Uniswap v3 fees — Real fee capture by pool and chain.

How I use it: When I see fees jump on DeFiLlama, I confirm which pools/markets on Dune are driving it.

- Token Terminal — Fundamentals and ratios in one place:

- Protocol revenue & P/S — Quick glance whether revenue moves justify price moves.

- Contributor metrics — Dev activity over time (not perfect, but helps separate momentum vs maintenance).

How I use it: If a DPI component’s price rips while 30d revenue stalls, I tighten risk or wait for the fundamentals to catch up.

Why this mix? DeFi Pulse gives me the long-view sector framing, DeFiLlama gives me live TVL/fees, Dune explains the “why,” and Token Terminal puts a valuation lens on top. Four angles, fewer mistakes.

Security and research stack

Most DeFi losses still come from contract-level issues and poor ops, not “bad luck.” I treat security data as first-class:

- Block explorers — Etherscan, Arbiscan, Optimism, Polygonscan, Snowtrace

- Check contract verification, recent upgrades/proxies, top holders, and unusually large approvals.

- Follow the protocol’s multisig on Safe to watch queued transactions.

- Audits & bounties

- DeFiSafety — Process and transparency scores for protocols.

- Immunefi, Code4rena, Sherlock — Active bounties and contest results.

- Trail of Bits, OpenZeppelin — Public audit reports to read common failure patterns.

- Risk dashboards

- Gauntlet risk portals and Chaos Labs — Parameter tuning, liquidation backtests, VaR.

- L2BEAT risk framework — Bridges and L2s: upgrade keys, fraud proofs, time to finality.

- Chainlink Status — Oracle disruptions or chain-specific incidents.

- Realtime incident/MEV monitors

- Forta — Bot alerts for unusual protocol-level activity.

- Phalcon (BlockSec) — Live exploit monitoring and incident posts.

- EigenPhi — MEV/sandwich detection and profit spikes that hint at pool instability.

- Tenderly — Simulate transactions; set alerts for function calls or reverts.

Case in point: During the Euler incident (March 2023), on-chain monitoring and incident feeds flagged abnormal borrow spikes before the full story hit social. If your stack watches pool utilization + governance multisigs + incident feeds, you’re likelier to step aside early. For a breakdown, see Chainalysis’ recap of the Euler hack.

Why I care: Chainalysis’ crime reports have repeatedly shown DeFi protocol exploits account for a large share of stolen crypto in recent years, which makes risk dashboards and bounties more than “nice to have.” They’re your stop-loss before the trade.

How I set alerts and keep a clean daily feed

I don’t want 100 notifications—I want 10 that matter.

- Morning (5–7 minutes)

- DeFiLlama: 24h TVL change, fees/revenue winners, stablecoin flows.

- Token Terminal: 7d revenue trend for my watchlist protocols.

- L2BEAT: Any risk status changes or new warnings.

- X list: @defipulse, @DefiLlama, @L2beat, @gauntletnetwork, @immunefi — scan pinned alerts.

- Price/vol alerts (low-noise)

- TradingView — Set alerts at weekly levels for DPI components (not every 1% wiggle).

- CoinGecko — Email/mobile price alerts for only 5–8 tickers.

- On-chain behavior alerts

- Dune webhook: utilization > 85% on Aave’s major markets; Maker DSR big moves; Uniswap fee spikes on key pairs.

- Forta/Phalcon: “unusual function call” or “large transfer” alerts for watched contracts.

- Safe multisig watchers: notify on queued transactions for protocol treasuries (spend, parameters, pausing).

- Governance

- Tally + Snapshot subscriptions for Aave, Uniswap, Maker, Synthetix, Curve.

- Only enable alerts for “proposal created” and “proposal passed.” Everything else is noise.

Pro tip: If you’re getting more than ~15 alerts/day, you won’t act on them. Tighten thresholds or remove whole categories until you actually click through.

Building a watchlist for DPI components

The DPI basket changes, so I always fetch the current constituents from Index Coop’s page before I set anything up. Then I track a few repeatable signals, not 50 indicators I’ll never check.

- Get the list: Pull current DPI holdings from Index Coop (weights, rebalance notes, and any exclusions). Bookmark it and review monthly.

- Create a simple sheet with these columns and sources:

- Price (TradingView/Coingecko), plus weekly support/resistance levels.

- 30d protocol revenue and P/S (Token Terminal).

- TVL and 30d TVL change (DeFiLlama API).

- Active users/tx count (relevant Dune dashboard link per protocol).

- Emissions/unlocks next 30–90 days (TokenUnlocks).

- Governance calendar (Tally/Snapshot links).

- Oracle status (Chainlink status page or protocol docs).

- What I actually watch per name (examples):

- AAVE — Utilization spikes, liquidation volume, Safety Module coverage, parameter changes (Gauntlet/Chaos Labs posts).

- UNI — Fee generation on v3 pools, governance around fee switch, cross-chain volume shifts.

- MKR — DSR changes, RWA share of collateral, DAI supply growth (Makerburn is handy too).

- SNX — Perps volumes, open interest, fees to stakers (Synthetix Stats).

- CRV — Protocol fees and gauge/bribe dynamics relative to token emissions.

How it ties back to DeFi Pulse: when DeFi Pulse’s sector context shows, say, lending dominance creeping up, I lean into Aave/Compound metrics in my sheet. If DEX share rises, I watch UNI/SUSHI fees and liquidity depth. The point is to move from “sector narrative” to “protocol numbers” quickly.

One more sanity check: If a token’s price is trending up while TVL, users, and revenue are flat-to-down across DeFiLlama, Dune, and Token Terminal, I assume I’m late—or liquidity is thin. Either way, I size smaller or wait for a better entry.

Want the most-asked answers about DeFi Pulse, DPI, and what the sector metrics actually mean in plain English? I’m about to break it down with quick yes/no guidance and simple frameworks—what’s the one question you still don’t have a straight answer to?

FAQ: DeFi Pulse, DPI, and the big DeFi questions

What is “Pulse DeFi” or DPI?

DPI stands for the DeFi Pulse Index—an ERC‑20 token built by Index Coop that tracks a basket of leading DeFi tokens. It’s market-cap weighted, rebalanced on a set schedule, and charges a streaming fee (historically ~0.95% per year). Think of it as an easy way to hold a diversified slice of “blue-chip” DeFi without picking individual coins.

The underlying basket changes over time based on liquidity, safety screens, and methodology criteria (historically guided by the original DeFi Pulse team and later methodologists like Scalara). Typical constituents over the years have included names like UNI, AAVE, MKR, COMP, SNX, CRV, BAL, YFI—but always check the current list on the official DPI page before you buy.

Is DeFi Pulse still worth following on X?

Yes—if you want a quick read on sector mood, category trends, and notable protocol moves. I follow @defipulse for timely highlights, then I cross‑check charts on DeFiLlama, fundamentals on Token Terminal, and risk posts from protocol forums. One feed won’t give you the full picture, but it’s a useful signal in the noise.

How accurate is TVL and how should I read it?

TVL is helpful but imperfect:

- It can be inflated by recursive borrowing (deposit, borrow, redeposit) and double-counting across bridges.

- It can be sticky on the way down until a catalyst hits. Example: Anchor/UST showed huge TVL right up to the 2022 collapse, then it vanished.

- Context beats one number: combine TVL with fees/revenue, active users, and risk disclosures.

Tip: Compare a protocol’s TVL trend with its fees and revenue on Token Terminal. If TVL is flat but fees are growing, usage quality might be improving.

How often does DPI rebalance, and what changes?

DPI typically rebalances monthly under governance-approved rules. Tokens can be added or removed based on liquidity, safety, free float, and market-cap thresholds. Weights shift with market moves and liquidity screens. Always review the most recent methodology notes before entering a position—your exposure can change without you trading.

What are the fees for DPI—and where does slippage bite?

Streaming fee: ~0.95% annually, charged continuously inside the token (you don’t see a line‑item deduction, performance is net of fees).

Trading costs: DEX swap fees, gas, and potential slippage when buying/selling. If you’re moving size, consider routing through deep Uniswap v3 pools or an RFQ aggregator, and always check price impact before confirming.

What could go wrong with DPI?

- Constituent risk: if a token inside DPI faces a bug, governance drama, or regulatory heat, it hits DPI too.

- Smart contract + oracle risk: DPI and its components rely on contracts/oracles. While audited, risk never goes to zero.

- Methodology risk: changes in screens or liquidity conditions can shift exposure faster than you expect.

- Underperformance vs ETH: in some cycles, DeFi tokens lag ETH. Historical returns have been very cyclical since launch in 2020.

Where do I buy and custody DPI?

Most activity is on Ethereum. You can buy DPI on DEXs like Uniswap or via the Index Coop UI. It’s a standard ERC‑20, so you can self‑custody in a hardware wallet. Always verify the contract on Etherscan from the official site before swapping.

Is a DeFi coin a good investment?

Use a simple, no‑excuses checklist:

- Utility + cash flows: does the token govern something that users truly pay for (fees, interest parameters, emissions, staking)?

- Supply map: emissions, unlocks, incentives. No hidden cliffs. Clear runway.

- Liquidity depth: can you enter/exit without 2–5% price impact?

- Team, audits, bug bounties: mature repos, open risk disclosures, active bounty programs.

- On‑chain traction: sticky TVL, growing fees, real users—not just incentives.

If those boxes aren’t mostly green, I pass or size tiny.

How do DeFi loans work—fast version?

Depositors supply assets into a pool; borrowers take loans against collateral; smart contracts set variable rates based on utilization. If your loan health falls (price drops or rates spike), liquidators repay your debt and take a penalty from your collateral. Oracles feed prices; governance can tweak risk parameters. That’s it.

Can you make money with a DeFi wallet?

Yes, but you need a plan. Realistic paths include:

- Lending stables on Aave/Compound when rates are decent (watch utilization and caps).

- Staking or vaults that pay in native rewards you’re willing to hold or auto‑sell.

- Selective LPing if you understand price ranges and impermanent loss.

Notably, research shows LPs often underperform simple holding when fees don’t cover volatility. See the Topaze Blue study on Uniswap v3 LP outcomes and related follow‑ups—results vary by pair, volatility, fee tier, and active management. Start small, track PnL after gas, and scale what’s working.

What should I watch on the DeFi Pulse X feed?

- Category shifts: lending vs DEX vs LSDfi share—tells you where attention and fees are moving.

- Incident alerts: pauses, oracle events, liquidations—pair with risk dashboards and alerts.

- DPI notes: rebalances, constituent changes, and methodology updates.

How does DPI compare to building my own basket?

- DPI pros: one token, monthly maintenance handled for you, rules‑based exposure.

- DPI cons: streaming fee, you inherit any methodology quirks, and you can’t overweight favorites.

- DIY pros: custom weights, fee‑free holding.

- DIY cons: more trades, more gas, more tracking, higher chance of mistakes.

Any data‑driven ways to spot DeFi risk early?

- Utilization + borrow spikes in lending markets can precede rate surges and liquidation waves. Gauntlet’s risk posts for Aave/Compound are worth watching.

- Fee/TVL ratio: rising fees with flat TVL is healthier than rising TVL with flat fees.

- Oracle spread monitors: keep an eye on price deviations; MEV/liquidations often cluster around oracle updates (Flashbots has good primers).

What about taxes?

In many jurisdictions, swaps are taxable events and yield is income. Index tokens don’t distribute dividends; the fee is internal. Use a tracker (e.g., Koinly/Accointing) and export from Etherscan to avoid headaches. This is general info—talk to a professional for your location.

Quick answers people ask

- Is a DeFi coin a good investment? Sometimes—if it has real utility, sensible supply, deep liquidity, strong team, and proof of usage. If you can’t explain the value path in two sentences, it’s speculation.

- How do DeFi loans work? Pools set rates by supply/borrow demand; you post collateral; if your health drops, you get liquidated. Always monitor your health factor.

- Can you make money with a DeFi wallet? Yes, through lending/staking/LPing, but fees, volatility, and smart‑contract risk can erase returns. Size positions, use alerts, and track PnL after costs.

Rule of thumb: if your edge needs a 40‑tweet thread to explain, it’s probably not an edge.

Wrap‑up

Follow DeFi Pulse for fast context, know what DPI actually gives you, and keep a risk‑first toolkit: cross‑check TVL with fees, monitor utilization and oracles, and stick to a simple framework for picking coins. Set a few alerts, save this FAQ, and keep your wallet allowances tight. I’ll keep sharing what actually works on cryptolinks.com. Stay sharp.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.