muneeb.btc Review

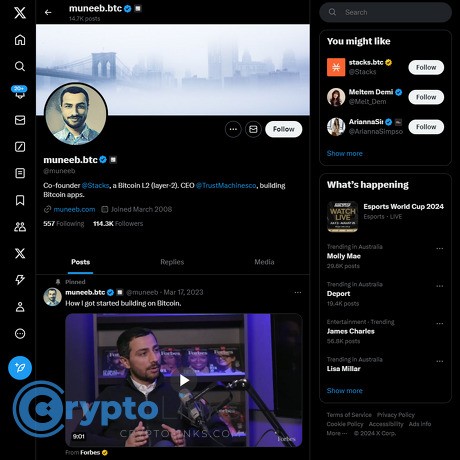

muneeb.btc

x.com

muneeb.btc and @muneeb on X: Real talk review and guide (with a clear FAQ)

Have you seen the “muneeb.btc” handle floating around and wondered if following @muneeb on X is actually worth your time? If you care about Bitcoin apps, the Stacks ecosystem, or just want straight info without the noise, you’re in the right place.

What’s messy right now (and why you might be confused)

“Bitcoin L2.” STX. .btc names. It’s a lot—especially when your feed is full of hot takes, impersonators, and links that look legit but aren’t.

- Bitcoin L2 confusion: People hear “Layer 2” and expect Ethereum-style UX. Reality: Bitcoin scaling has different tradeoffs, timelines, and vocab.

- STX vs BTC vs .btc: STX is an asset, BTC is Bitcoin, and .btc is a human-readable name in the Stacks/BNS naming system. Mix-ups are common.

- Impersonators and fake replies: On X, scammers clone profiles, reply quickly to popular threads, and drop “helpful” links that drain wallets.

- Wallet and timeline anxiety: Even legit updates can be hard to parse—what’s live, what’s testnet, and what needs a specific wallet?

“Social media is the top channel for scams, with crypto often used as the payout method.” — Public consumer protection reports have repeated this theme for years, which is why treating replies as untrusted is smart by default.

So if you’re trying to figure out whether following a Bitcoin builder like @muneeb is signal or noise, your concern is absolutely valid.

What I’m going to do for you

I’m keeping this simple and practical. I’ll map out who Muneeb Ali is, what muneeb.btc actually means, what kind of content you can expect on his X feed, and the safest way to engage without getting caught by scams or hype. You’ll get the essentials behind the posts (Stacks, STX, .btc), the right tools to follow along, and a quick FAQ for common questions like BTC withdrawal timing.

No fluff. No vague promises. Just what’s worth your attention and how to avoid what isn’t.

Who this is for—and what you’ll get out of it

- If you’re Bitcoin-curious: You’ll understand where Stacks fits, why “.btc” naming exists, and how it’s used.

- If you’re a builder or investor: You’ll know why @muneeb’s posts matter (roadmaps, funding, app launches) and how to separate product news from narrative games.

- If you’re just here for safety and clarity: You’ll get a clean checklist for following safely on X, what to ignore, and how to verify official sources.

Here’s the deal: you don’t need to become a protocol expert to get value from following the right people. You just need the right context and a few safety rules. I’ll give you both.

Ready to cut through the noise? Next up: Who is Muneeb Ali—and what does “muneeb.btc” actually represent? Let’s answer that clearly.

Who is Muneeb Ali and what is muneeb.btc?

Quick profile: Muneeb Ali is the co-founder of Stacks (a Bitcoin layer focused on smart contracts) and the CEO of Trust Machines, a company building on Bitcoin.

Muneeb Ali has spent years pushing one big idea: make Bitcoin the settlement layer for apps and smart contracts. He co-founded Stacks, helped design the system that anchors Stacks activity to Bitcoin, and now leads Trust Machines, a company building Bitcoin-powered applications. Trust Machines announced a $150M funding round in 2022 led by Breyer Capital and Hivemind, signaling real capital and long-term intent for Bitcoin apps.

- Builder first: Think product updates, network upgrades, and new app launches—not empty hype.

- Bitcoin-aligned: His work orbits Bitcoin’s security and final settlement, with Stacks enabling smart contracts alongside it.

- Team operator: He frequently spotlights other builders, funding, and roadmaps across the ecosystem.

“Follow builders, not buzz. Bitcoin rewards proof-of-work thinking.”

What “muneeb.btc” means: It’s a human-readable name in the Stacks/BNS naming system, often used for identity and addresses connected to Bitcoin and Stacks.

.btc names live on the Stacks blockchain via the BNS (Bitcoin Name System). Instead of copy-pasting long addresses, a name like muneeb.btc acts as a readable identity that apps and wallets can resolve to underlying addresses or profiles. It’s on-chain, portable, and tied to your keys—very different from Web2 usernames that platforms control.

- Human-readable identity: Use a name in supported wallets and apps instead of hex addresses.

- Records and profiles: A .btc name can store records (e.g., Stacks and sometimes BTC receive info), profile metadata, and app-specific settings.

- Anchored to Bitcoin: Because Stacks anchors to Bitcoin, BNS updates are ultimately secured by Bitcoin’s proof-of-work.

- Not DNS: It’s not a web domain. It’s an on-chain name managed by your wallet and recognized across Stacks apps.

Want to see it on-chain? You can look up names on the Hiro Explorer (example pattern): explorer.hiro.so/name/muneeb.btc.

Why his voice matters: He’s been building in Bitcoin for years, leads major projects, and shares product updates, roadmaps, and funding news that influence builders and investors.

Some people tweet opinions. Others ship software and fund teams. Muneeb’s posts tend to track what’s actually shipping—network upgrades (like the Stacks “Nakamoto” era), new Bitcoin-focused apps, progress on bridging Bitcoin liquidity, and grant/funding announcements that can change a builder’s trajectory.

- Network direction: Explains how Stacks aligns with Bitcoin and what new releases mean for developers and users.

- Product-first signal: Highlights repos, release candidates, and features (think: faster confirmations, better UX, or new primitives for Bitcoin apps).

- Ecosystem impact: Funding and hiring updates tend to correlate with bursts of new app experiments—useful if you build or invest.

There’s a reason this matters. Research in product communities shows that public roadmaps and transparent developer updates increase trust and reduce speculation-driven volatility. In crypto—where noise is constant—consistent shipping is the strongest signal.

How he communicates: Expect a mix of technical threads, ecosystem updates, and takes on Bitcoin scaling and apps.

If you’re allergic to memes and prefer “what’s the next release and why it matters,” his feed lands well. You’ll see:

- Technical threads: Plain-English explanations of why a change matters for Bitcoin-aligned apps.

- Ecosystem snapshots: What teams are building, who’s hiring, who raised, and which apps are going live.

- Principled takes: Notes on decentralization, Bitcoin security assumptions, and why user ownership must remain the default.

- Receipts: Links to repos, docs, or release notes when possible, so you can verify and learn.

Style-wise, it’s direct and builder-centric. Less chest-thumping, more “here’s what shipped and what’s next.” That’s rare—and refreshing—in crypto social.

What you can and can’t assume from a .btc name

A quick sanity check before you follow any identity:

- Owning a .btc name ≠ endorsement: Anyone can register a .btc, so treat it like an on-chain username, not a badge of authority.

- Identity vs. account: A .btc name is separate from social handles. The person behind muneeb.btc might also use @muneeb on X—but you should always verify the handle and history.

- Wallet context: Some wallets resolve .btc names to addresses; others show only profile data. Know what your wallet supports before sending funds.

So, if you’re going to follow along, what exactly will land in your feed—and how do you make sure you’re looking at the real account and not a lookalike? Let’s answer that next.

Following @muneeb on X: what to expect and how to verify

What you’ll actually see in your feed

When I scroll @muneeb’s feed, I’m not swimming through memes. I’m tracking roadmaps and shipped product. Here’s the pattern you can expect:

- Upgrade threads: Plain-English explainers of what’s shipping next for Bitcoin-aligned apps and the Stacks ecosystem, often with links to repos, SIPs (Stacks Improvement Proposals), and testnet notes.

- Builder signals: Retweets and comments on teams building real Bitcoin apps—identity, marketplaces, wallets, and infra. It’s a quick way to spot who’s actually shipping vs. who’s just talking.

- Scaling takes: Clear positions on Bitcoin L2s, decentralization tradeoffs, and user ownership. Less hot takes, more product framing.

- Company updates: Trust Machines news, hiring notes, partnerships, and ecosystem grants that matter for builders and power users.

- X Spaces and long-form: Announcements for technical AMAs and post-ship recaps. If you’re learning, these are worth bookmarking for the weekend.

Real sample you’ll recognize: threads that link to concrete artifacts—PRs, SIP numbers, preview docs, or release candidates—instead of “soon” tweets. That’s the litmus test.

Signal vs. noise: why this feed works

I look for accounts where the ratio of shipped code to hype is high. This one fits:

- Substance over sizzle: More roadmap, less rah-rah. If you care about Bitcoin apps, you’ll feel the difference within a week.

- Macro to micro: Big-picture views on Bitcoin’s path, then concrete steps teams are taking today.

- No casino energy: You’ll get product timelines, not “number go up” bait.

“The fastest way to lose money is to be in a hurry. Slow down, verify, then act.”

That mindset pays. A landmark MIT-backed study found false news spreads faster than true news on social platforms—especially in finance and politics. Source: Vosoughi, Roy, and Aral (Science, 2018). Add that to the FTC’s warning that social media is a leading vector for crypto scams, and being picky with your inputs stops being optional.

Make sure it’s the real @muneeb

Impersonators are everywhere. Spend 30 seconds to lock this down:

- Exact handle: Only follow https://x.com/muneeb. Watch for sneaky Unicode characters or extra letters.

- Cross-check from official sources:

- stacks.co and the official Stacks account: @Stacks

- trustmachines.co and the company account: @trustmachinesco

- GitHub footprint: github.com/muneeb-ali (long-lived, high-signal)

- History check: Years of posts, consistent topics, and replies from known builders are green flags. A brand-new account is not.

- Don’t trust the checkmark alone: The blue check is a paid feature on X. Treat it as one input, not a verdict.

Red flags: common scam patterns to ignore

- Unsolicited DMs: “Support” agents, grant forms, or recovery help are almost always fakes. No legit team asks you for keys or seed phrases.

- “Send 0.1 BTC to get 0.2 BTC back” giveaways: Classic theft. Screenshot “proof” is easy to fake.

- Reply-link traps: Lookalike handles replying under popular posts with airdrops, “urgent upgrades,” or wallet-drainer links. If the link didn’t come from the verified handle you follow, skip it.

- Domain tricks: Punycode and typos like wállet[.]com or stäcks[.]org. Hover to reveal the real URL. If X shortens it (t.co), copy and paste into a plain text note to see the full domain before clicking.

- Fake support forms: Google Docs or random forms asking for your seed = instant no.

Why I’m strict here: the FTC has repeatedly flagged social platforms as a top source of crypto scam losses. Scammers fish where attention is.

Pro tips to get value without wasting time

- Turn on “Posts” notifications for big updates; skip “All” to avoid reply noise.

- Use an X List: Create “Bitcoin Builders,” add @muneeb, official project accounts, and credible devs. Read that list daily; it strips out randomness.

- Search smarter: Save this query to jump to the good stuff:

from:muneeb (roadmap OR upgrade OR “release notes” OR SIP OR testnet OR mainnet) - Weekend catch-up: Bookmark threads with commit links, SIPs, or docs. That’s where the learning happens.

- Protect your keys:Hardware wallet for meaningful funds. Never approve a signature you don’t understand. “Not your keys, not your coins.”

I like accounts that make me smarter about the tech and the timing. Curious how the Stacks layer actually connects to Bitcoin, what STX does under the hood, and why a .btc name shows up in your wallet? That’s exactly what I’m covering next—want the no-BS version?

Stacks 101: the essentials behind the content

What Stacks is

Think of Stacks as a Bitcoin-aligned layer that adds smart contracts and apps without changing Bitcoin itself. It anchors to Bitcoin for security and finality, while running its own execution environment for apps and tokens. Fees are paid in STX, and contracts are written in Clarity, a language designed for predictability and auditability.

How it works in plain English:

- Anchored to Bitcoin: Stacks batches and settles activity to Bitcoin blocks, inheriting Bitcoin’s finality. When Bitcoin finalizes, Stacks finalizes.

- Proof of Transfer (PoX): Instead of energy-based mining, PoX uses Bitcoin to secure Stacks. Miners send BTC to compete for the right to produce Stacks blocks, earning STX in return. Learn the mechanics here: PoX overview.

- Fast user experience: Stacks introduces “microblocks” for quick confirmations between Bitcoin blocks, while still anchoring state back to Bitcoin for security.

- Clarity contracts: No silent “gotchas.” Clarity is decidable, so you can analyze what a contract will do before it runs—great for security reviews and audits.

“Don’t trust. Verify.” — the core Bitcoin rule Stacks leans on by anchoring to Bitcoin’s finality

Why this model matters: when you see an update about “Nakamoto” or “sBTC,” it’s about tightening the bond to Bitcoin. The Nakamoto upgrade is aimed at stronger Bitcoin finality and more reliable throughput; sBTC is designed to bring BTC itself into Stacks apps with Bitcoin-governed peg-in/peg-out. You can read the design goals at sbtc.tech.

Independent developer research (like Electric Capital’s Developer Report) has shown steady interest in Bitcoin smart-contract ecosystems, and Stacks is a key piece in that story—especially for builders who want Bitcoin-grade settlement with a flexible app layer.

What a Stacks wallet is

A Stacks wallet is your key to the Stacks ecosystem—holding STX, interacting with apps, and managing identities like .btc names. Popular options include Leather and Xverse. They’re self-custodial, meaning you hold the keys, not a company.

What you can do with a Stacks wallet:

- Pay fees in STX to use Stacks apps (similar to “gas”).

- Register and manage .btc names via the BNS naming system (for example, btc.us), so your identity is human-readable across apps.

- Connect to apps like ALEX (DeFi), Gamma (collectibles/marketplace), and other tools built for Bitcoin users.

- See Bitcoin context for Stacks actions, since Stacks activity ultimately anchors back to the Bitcoin chain.

Real example: registering a .btc name. You connect your wallet to a trusted registrar (e.g., btc.us), pick a name, and confirm a transaction that costs a small amount of STX. The result is an identity you can use across Stacks apps, with state secured by Bitcoin via Stacks.

Why this matters if you follow @muneeb

When you see posts about mainnet milestones, activation windows, or “Bitcoin finality,” they’re about how secure and ready apps are to handle real users and real BTC. Understanding the basics helps you read between the lines:

- Roadmap threads often mention activation epochs, validators/miners, and finality—that’s the heartbeat of Stacks syncing with Bitcoin’s cadence.

- sBTC updates point to letting you use BTC in apps (trading, lending, on-chain identity) without leaving Bitcoin’s security assumptions.

- App launches from teams like ALEX or Gamma frequently require protocol stability and clear fee economics. If fees in STX drop or confirmations accelerate, that’s meaningful for user experience.

In short, the posts aren’t hype for hype’s sake—they’re signals about when building on Bitcoin gets easier, cheaper, and safer for end users.

If you’re brand new

Here’s the 60‑second mental model for Bitcoin layers and where Stacks fits:

- Bitcoin base layer: Ultra-secure, conservative changes, best place for final settlement and large value. Limited scripting on purpose.

- Layer tools:

- Lightning — payment channels for fast BTC payments.

- Sidechains (e.g., Liquid) — separate chains pegged to BTC with their own security models.

- Stacks — a Bitcoin-aligned app layer anchoring its state to Bitcoin via PoX, designed for smart contracts and identity.

- Fees and tokens: Stacks apps use STX for fees. That’s why you’ll see fee estimates quoted in STX, even though security rides on Bitcoin.

- Finality: The important checkpoint is the Bitcoin block where Stacks settles. Once that’s in, your Stacks transaction is backed by Bitcoin’s finality.

If you want to go deeper later, the official docs are clean and beginner-friendly: docs.stacks.co. They explain PoX, sBTC design, and how Clarity contracts avoid “hidden” behavior. That clarity (no pun intended) is a big reason security-minded developers pay attention.

I still remember the first time I claimed a .btc name: a few clicks, a tiny STX fee, and then the anchor to Bitcoin. It felt like owning a piece of my identity in a way a username on a website never could.

Now that you’ve got the essentials, want my short, practical checklist for using wallets, screening links, and getting the most value out of those roadmap threads—without getting burned by scams? That’s up next.

Practical guide: engage safely and get value

Want the signal without the stress? Here’s the exact way I follow muneeb.btc and @muneeb on X to learn faster, avoid scams, and keep momentum without getting sucked into reply-bait.

“In crypto, convenience is often the attack vector.”

Follow smart

You don’t need to read every post in real time. You need the right posts at the right time.

- Set precision notifications: Turn on notifications for https://x.com/muneeb, but choose “fewer” to avoid noise. When you see words like roadmap, release, RC, or SIP, pay attention.

- Use a private X List: Name it “Bitcoin Builders.” Add @muneeb and the official project accounts you trust. Lists cut out the algo chaos.

- Quick-search the good stuff: In X search, type:

from:muneeb (release OR roadmap OR SIP OR thread) has:links - Weekend saves: Bookmark deep threads and attach a note like “Stacks upgrade context” so you remember why you saved them.

- Repo-aware = smarter: If a post references an upgrade, click through to the repo and Watch releases. For Stacks core work, start at github.com/stacks-network.

- Create calendar pings: When dates are mentioned (even tentative), add them to your calendar with the linked post + repo URL. If it slips, you’ll still catch the follow-up.

Security basics you shouldn’t skip

Scams adapt to what you care about. If you’re excited about Bitcoin apps and Stacks, attackers know it. Chainalysis and the FBI both continue to report billions lost annually to crypto investment and phishing schemes—simple habits save real money.

- Bookmark official domains (type them in):

x.com/muneeb

stacks.co

hiro.so

trustmachines.co

xverse.app

leather.io

If a link in replies is even slightly different (extra letters, weird accents), don’t click. - Hardware-first for meaningful funds: Use a Ledger or Trezor with a Stacks-compatible wallet (e.g., Xverse or Leather) and confirm addresses on-device.

- Wallet-connection hygiene: Never connect a wallet from a reply link. Only connect from the sites you bookmarked. If a dApp is new, use a low-balance “burner” wallet first.

- Read the transaction preview: On Stacks, your wallet shows the contract name and function you’re calling. If you don’t recognize it, cancel. No FOMO.

- DM rules: Turn off open DMs or at least don’t click links sent by “help” accounts. Real teams rarely reach out first.

- Check for lookalikes (Punycode): If something feels off, paste the domain into a Punycode checker. “stаcks.co” (with a Cyrillic “a”) isn’t “stacks.co”.

- Assume “airdrops” are bait: “Claim STX” or “send BTC to get more” = no. If it looks generous, it’s likely engineered for your wallet signature.

Helpful reads: The FBI’s IC3 annual report and Chainalysis crime reports both highlight phishing and investment scams as persistent top threats. They’re worth a skim before you transact.

Timing expectations

Product roadmaps move. That’s normal. Here’s how I separate real progress from wishful thinking:

- Green flags: Posts with GitHub release notes, an active PR or issue link, a specific SIP ID, or a datestamped changelog.

- Yellow flags: “Soon,” “next week,” or “around the corner” without a repo link. Treat as exploratory until sources appear.

- Where to verify:

- Stacks blockchain releases

- Stacks Explorer for live chain activity

- SIPs repository to see proposal status - Version language matters: “RC” (release candidate) and “mainnet date window” carry more weight than “preview” or “concept.”

Community sync

When an update hits your feed, do a quick cross-check to avoid echo-chamber hype.

- Cross-check channels:

- @Stacks

- @TrustMachinesCo

- @hirosystems

- Stacks GitHub org

- Stacks forum

- Official Discord - Two-source rule: Don’t act on a single tweet. Wait for a matching note from an official account or a linked repo update.

- Watch respected builders: Independent devs confirming a change on GitHub is stronger than any meme-filled thread.

My real-world playbook (steal this)

- Step 1: Follow @muneeb, add to a private List, mute replies from new accounts (< 30 days old).

- Step 2: Bookmark official domains and only navigate via those bookmarks.

- Step 3: Use a hardware wallet; keep a low-balance burner wallet for testing new apps.

- Step 4: Before acting on any “big” post, check for: repo link, SIP number, release notes, or explorer data.

- Step 5: Save long-form threads for weekend reading; add calendar reminders for any date windows mentioned.

- Step 6: If something sounds urgent, pause. Urgency is a common social-engineering trick.

Want fast answers to practical stuff—like how long a Bitcoin withdrawal should take or which wallet to try first? Keep going—your next questions are queued up right ahead.

FAQ: quick answers to common questions

How long does it take to receive a Bitcoin withdrawal?

Short version: usually 10–60 minutes, but it can stretch to a few hours during busy periods. Here’s what actually drives the timing:

- Exchange processing: Many platforms broadcast withdrawals within minutes, but fraud checks, batching, or security holds can add 5–30 minutes (occasionally longer).

- Network fee you (or the exchange) used: If the fee is set too low relative to mempool demand, miners will prioritize other transactions. That’s when you wait.

- Confirmations required: Most wallets show your BTC as “pending” until 1 confirmation (~10 minutes on average). Some services want 2–3 confirmations (20–30 minutes) before funds are considered final. High-value or sensitive flows may require up to 6 (~1 hour).

Real-world context: when inscriptions/BRC-20 minting spiked in 2023–2024, the mempool often stayed full, pushing many low-fee transactions into hours of wait time. If your TX was sent with Replace-By-Fee (RBF), you (or the sender) can bump the fee to speed it up.

What I do if it feels “stuck”:

- Ask the sender (or check your exchange withdrawal page) for the TXID.

- Paste it into a block explorer (e.g., mempool.space) to see if it’s broadcast but unconfirmed, or not broadcast yet.

- If it’s unconfirmed with a low fee, use RBF (if enabled) or try CPFP from the receiving wallet if it supports it.

- If there’s no TXID after 2–3 hours, it’s likely internal review or batching—contact support.

Rule of thumb: 1 confirmation for small amounts, 2–3 for moderate, 6+ if you need old-school finality.

Who is the co-founder of Stacks Muneeb Ali?

Muneeb Ali co-founded Stacks and leads Trust Machines, a company building Bitcoin applications. He’s known for clear roadmaps and long-term focus on Bitcoin-aligned apps.

What is a Stacks wallet?

A Stacks wallet lets you store, send, and receive STX, use Stacks apps, and manage identities like .btc names. Some wallets also integrate Bitcoin features, but your BTC remains on the Bitcoin network while STX stays on Stacks.

- Keys matter: Write down your seed phrase offline. No screenshots. No cloud.

- Separation of concerns: Keep your “play” wallet small; secure larger amounts with a hardware wallet that supports your flow.

Who is the CEO of STX coin?

Nobody. A coin doesn’t have a CEO. STX is the native asset of the Stacks network. Muneeb Ali co-founded Stacks and is CEO of Trust Machines, but he’s not the “CEO of STX.”

Can I trust links shared in replies to @muneeb’s posts?

Treat replies as untrusted by default. Scammers spoof domains, copy avatars, and push fake “allowlists” or “connect wallet to claim” links.

- Only click links posted by the verified handle or official project accounts you already know.

- Type the domain manually or use your own bookmark. Don’t trust “helpful” reply guys.

- Before connecting any wallet, double-check the URL and look for the exact domain you expect.

“If a link appears in replies first, assume it’s a trap.” Better to be late than drained.

How many confirmations should I wait before I spend incoming BTC?

For day-to-day amounts, I’m comfortable after 1–3 confirmations. For large or mission-critical transactions, I still aim for 6 confirmations, the long-standing Bitcoin norm for minimizing double-spend risk.

Why can a Bitcoin withdrawal fee look “high” compared to a simple send from my personal wallet?

Exchanges often batch multiple withdrawals and may set fees based on current or anticipated congestion to ensure timely confirmation. Your personal wallet can hand-pick fees and use smarter coin selection, but exchanges prioritize reliability at scale—hence the difference.

Is a .btc name the same as a base-layer Bitcoin name?

No. .btc names you see in Stacks are part of the BNS system secured by Stacks, which anchors to Bitcoin. That’s different from anything recorded directly and solely on Bitcoin’s base layer. The result: better UX for identity across Stacks apps, while still drawing security from Bitcoin via Stacks’ design.

Still wondering whether following @muneeb is worth your time and how I personally filter the signal from the noise? I’ll show you exactly how I do it next.

My verdict and next steps

Is following @muneeb worth it?

Yes. If you care about Bitcoin apps and the Stacks roadmap, his feed is one of the few that consistently ships signal over noise.

- Early, actionable updates: You’ll often see milestone notes on the Stacks Nakamoto upgrade, sBTC progress, and ecosystem funding before they hit headlines—usually with links to repos, SIPs, or release notes.

- Builder-first perspective: Posts skew toward code, architecture choices, and trade-offs rather than price talk. That’s rare in crypto social and genuinely useful if you’re building or allocating.

- Clear stance on Bitcoin layers: He regularly lays out how Bitcoin-aligned apps can scale in practice (finality, security, fee markets) without the hype-to-nowhere you see elsewhere.

Real-world example: threads around Stacks’ Nakamoto readiness and sBTC dev/test milestones included direct links to GitHub discussions and testnets. That’s the kind of trail you want—words backed by code. And given how often social scams target reply sections, having the signal start from the source matters. Chainalysis has repeatedly shown that scams remain the top revenue source for crypto criminals; sticking to verified, repository-backed updates is just smart.

How I suggest using this guide

- Follow and filter: Follow @muneeb. Add him to a dedicated “Bitcoin Apps” list and turn on notifications for threads (not every post). I watch for keywords like Nakamoto, sBTC, roadmap, and release notes.

- Bookmark the sources: Keep these handy:

- stacks.org (roadmap and upgrade posts)

- docs.stacks.co (how everything fits together)

- explorer.hiro.so (live network activity)

- github.com/stacks-network (SIPs, clients, repos)

- trustmachines.co (company updates)

- Protect your wallet flow: Use a hardware wallet for meaningful funds, a separate “test and try” wallet for new tools, and only connect via domains you’ve bookmarked yourself. If a link lives in replies, treat it as hostile by default.

- Cross-check before acting: When you see a claim, look for one of: a GitHub PR, a SIP, a mainnet/testnet release tag, or an official post on stacks.org/roadmap. No references, no rush.

- Set a cadence: I skim his feed daily and batch-read technical threads on weekends. Saves time and keeps me from reacting to half-baked announcements.

What I’m watching next

- Nakamoto stability and throughput: Does time-to-Bitcoin finality hold under real usage, and how do fees behave when the network is busy?

- sBTC user flows: Clear, repeatable mint/burn and developer integrations—ideally reflected in public repos and explorer metrics.

- App traction, not headlines: Daily active addresses, tx counts, and new contracts deployed on the Stacks Explorer tell the story better than any thread.

- Security posture: Response speed to incidents, transparency in post-mortems, and how fast patches ship. Mature ecosystems treat these as table stakes.

Rule of thumb: follow the code, not the hype.

Final thoughts

Bottom line: following @muneeb is a good use of attention if you want grounded updates on Bitcoin apps and the Stacks path forward. Keep your security tight, verify claims through official docs and repos, and focus on products that ship and persist.

I’ll keep tracking key threads, network stats, and upgrade milestones on cryptolinks.com so you can stay on the signal path without wasting time. Stay curious, stay cautious, and keep your bookmarks—and your keys—under your control.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.