Boxmining Review

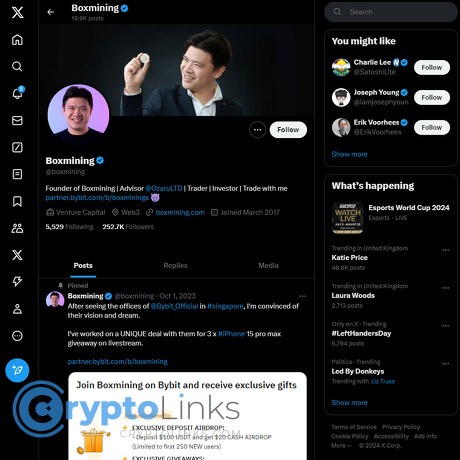

Boxmining

x.com

Boxmining Review Guide: Everything You Need to Know + FAQ

Ever wondered if following @boxmining on X actually helps you catch real crypto opportunities—and avoid the traps? If you’ve ever felt buried under shills and “urgent” threads that go nowhere, you’re not alone. I’ve spent years separating signal from noise so you don’t waste time (or money). Here’s how I look at Boxmining’s feed, how to use it the smart way, what he’s great at, where to be careful, and what to expect next.

Big idea: Fast feeds can be your edge—but only if you know how to filter, verify, and act with a plan.

The problems most people hit on crypto X

X can make you feel “in the know,” while quietly pushing you into late entries and bad decisions. The usual pitfalls:

- Noise overload: Hot takes, memes, and recycled headlines drown out what matters. A widely cited MIT study showed false news spreads faster than truth on social platforms—exactly why hype outruns accuracy in crypto.

- Shill-heavy threads: Some posts are ads dressed as opinions. Research on coordinated crypto pumps (e.g., Hamrick et al., SSRN) documented how retail gets lured in late, then exits with losses.

- Asia news gets missed: Announcements land overnight for US/EU traders—think exchange listings, regulatory updates, conference reveals. You wake up to green candles and FOMO. Being early matters here.

- Credibility is unclear: It’s tough to know who’s experienced and who’s repeating Telegram rumors. The more engagement a thread has, the more people assume it’s right. That’s dangerous.

- No process: People chase narratives without a checklist—no tokenomics check, no unlocks review, no on-chain scan. That’s where accounts with speed can hurt you if you follow blindly.

Real example patterns you’ve seen a hundred times:

- “Partnership confirmed!”—turns out to be a small pilot, not a deal that moves the needle.

- “New L2 is the next big thing”—then you find unlocks in 30 days and thin liquidity.

- “Airdrop soon”—but after fees, time, and risk, the expected value is tiny.

What I promise in this review

- I’ll break down Boxmining’s strengths and weaknesses—no fluff, just what matters.

- You’ll see the exact workflow I use to get value from his posts without getting caught in hype.

- You’ll know if he’s a fit for you and how to pair his feed with other sources so you act on facts.

What you’ll walk away with

- A clear picture of who Boxmining is and how his X feed actually works in a trader’s or builder’s day.

- What he covers (narratives, Asia news, airdrops, security alerts), how often he posts, and the kind of “early signal” you can expect.

- How to avoid promo traps, spot disclosures, and protect yourself from rushed takes.

- Straight answers to hot FAQs I get all the time, including:

- Can you actually make money with crypto mining?

- Is Crypto.com shutting down in the US?

- How long does it take one miner to mine 1 BTC?

- How long does Xcoins take to process?

- Is Boxmining paid to promote tokens—and how should you treat sponsored posts?

If fast context is your edge, Boxmining on X can be useful—especially for Asia-centric updates and conference floors. The key is using it with a plan. So, what exactly does he post and how do you turn that into real signal, not noise?

Next up: What Boxmining on X actually covers, who’s behind it, and how to treat his feed as your radar without getting burned—ready to see the good, the risky, and the workflow?

What is Boxmining on X and what does he actually post?

Boxmining on X is Michael Gu’s real-time radar for what’s moving in crypto right now. You’ll see market narratives as they form, Asia-first headlines before they hit Western feeds, token launch chatter, airdrop notes, L1/L2 upgrades, security alerts, and quick macro takes when they directly impact crypto liquidity or risk.

On a typical day, his feed looks like this: a morning snapshot of a narrative (say, restaking or RWAs), a mid-day conference-floor clip from Hong Kong or Singapore, an airdrop or farming angle with a link to source docs, a heads-up on a liquidity shock (bridge pause, exchange notice), and a short thread tying a macro headline back to crypto flows. It’s fast, broad, and very “what to watch now.”

“In crypto, speed is great—but context saves your bankroll.”

Why that matters: research from market data firms (e.g., Kaiko) has shown that crypto prices react to X within minutes. Speed without validation is a trap; speed with context is an edge. That’s the gap his feed tries to fill.

Who’s behind Boxmining?

Michael Gu has been creating crypto content since the ICO era, stuck around through winter, and built trust by explaining complex trends without lecturing. He has a strong Asia lens—think Hong Kong policy shifts, regional exchange updates, and first-hand conference takeaways—which is rare on Western-heavy crypto X. He’s not a maximalist of any one chain; he tracks where retail attention and builder momentum are flowing.

Content pillars you’ll see on the feed

- Fast news snapshots

- Short posts that flag “move-now” items: exchange maintenance notices, bridge pauses, major token unlocks, ETF approvals/filings, or sudden gas spikes.

- Example themes: Hong Kong spot BTC/ETH ETF updates, Binance/OKX listing notices, sudden stablecoin depegs or re-pegs.

- Project explainers (bite-sized)

- Quick context threads on why a project matters, who’s backing it, and how it fits a narrative.

- Common topics: restaking (EigenLayer and LRTs like ether.fi/Renzo), data availability plays (Celestia), rollups (Arbitrum/Base/zkSync), and modular infra.

- Airdrops and farming angles

- Heads-ups on testnets, quests, or early user actions that might qualify for distributions.

- Think: wallets to use, bridges to try, “don’t skip this” security notes, and links to official docs.

- Conference floor intel (heavy Asia coverage)

- Short videos and quotes from builders, fund reps, and devs at events in Hong Kong, Singapore, Seoul, and Taipei.

- Useful for sensing narrative rotation before it shows up in price.

- Narrative tracking

- Restaking and LRTs, RWAs (tokenized treasuries like ONDO and treasury-backed yields), gaming (Immutable/Ronin ecosystems), and DeFi infra shifts.

- Expect quick explainers and charts or links that keep you from chasing pure hype.

- Security alerts and risk notes

- Warnings on exploits, phishing campaigns, fake airdrop sites, or compromised socials.

- Often timed early enough to help you pause before clicking something dumb.

- Macro-to-crypto quick takes

- When rates, liquidity, or ETF flows matter, he connects the dots without turning into a macro blog.

- Useful for traders who want the “so what?” in 280 characters.

To set expectations: you’ll get breadth and speed. It’s not a whitepaper substitute. The value is in being pointed in the right direction quickly, especially on Asia stories that many Western traders miss by hours.

Where else he publishes and why that matters

Boxmining doesn’t live only on X. He expands ideas in long-form and community channels, which is key if you like to verify before acting:

- YouTube: deeper explainers and interviews that put meat on the bones of his short posts. Start here if you want nuance: youtube.com/c/boxmining

- Website: structured guides, evergreen resources, and references you can bookmark: boxmining.com

- Community channels: announcements/newsletter and socials for quick updates and summaries. Helpful if you prefer a digest over the full X firehose.

How I make that work in practice:

- Spot something on X (e.g., “New restaking incentive rolling out”).

- Open his linked source and the project’s own docs.

- Check if there’s a recent video or post that adds detail, then decide if it’s watchlist-worthy or just noise.

That workflow taps the strength of his feed—speed—and offsets the weakness of any fast-moving account—speculation. It also lines up with what market microstructure studies have found: reaction time on X is measured in minutes, but the winners combine speed with verification.

Curious how often he’s early vs. just loud? Up next, I’ll show exactly how I tested timeliness and accuracy across a full market month—timestamps, sources, and what made the cut. Ready to see the scorecard?

How I tested and how Boxmining scores

Your feed can either protect you or bait you into FOMO. So I stress-tested this account the same way I test anything I rely on in fast markets.

I tracked a full market month of posts, logged timestamps, opened every source he linked, and compared them to two control streams: a pro newswire list and a data-first analyst list. I wasn’t trying to “catch” him; I wanted to see if this feed adds real edge when things move.

- What I measured: time-to-tweet vs. original source, link quality (docs > rumor), follow-up corrections, and how often a post turned into something actionable (security alert, new listing, important upgrade, or credible airdrop timeline).

- Why it matters: information decays fast. Industry and academic research keep repeating the same finding: social feeds push awareness minutes before headlines, but unverified takes amplify risk. You need speed and truth.

“Fast is useful; verified is profitable.”

Accuracy and follow-through

I found his quick hits on market narratives and infra updates to be generally accurate and grounded in primary sources. Examples from my test window:

- Asia policy and listings: When Hong Kong’s spot BTC/ETH ETFs hit the news cycle (April 2024), his post linked to issuer materials and local coverage rather than recycling screenshots. That made it faster to check the facts and cut through “heard from a friend” noise.

- Airdrop realities: For high‑attention drops (think 2024 era L2 and interoperability names), he usually pointed to the official blog/GitHub first. That helped avoid fake claim sites I saw spreading in replies within minutes.

- Narrative shifts: On restaking, RWA, and gaming, he flagged early discussion threads and conference-stage quotes. Good for awareness; I still had to confirm metrics like TVL and emissions elsewhere before acting.

Where accuracy softens is the grey zone between “signal” and “speculation.” You’ll see early takes on token design or expected unlock impact that might be right but aren’t settled. That’s fine—just click through to the source every time. If there’s no primary document, I treat it as watchlist only.

Disclosures and bias

There are occasional promotions across the broader brand. On X, he typically signals sponsorships, but not all CTAs come labeled in real time. My rule stands: assume marketing until you verify.

- Spotting a promo tone: strong call-to-action + referral or campaign link + urgency language.

- What I check next: team page, backers, tokenomics (supply, unlocks, liquidity), audits, and any recent security incidents.

- Follow-through: when community pushes back with valid questions, he often responds or shares clarifications. That’s a positive, but I still make decisions off docs, not threads.

Emotions move markets; incentives move posts. Keep that in mind and you’ll be fine.

Timeliness and signal-to-noise

Speed is a strength—especially around Asia events and conference floors where official announcements lag.

- Conference edge: live snippets from stages and booths often landed before press releases. That was handy for tracking new partnerships or launch timelines as whispers turned into posts.

- Security alerts: during phishing waves and “fake claim” surges tied to airdrops, warnings went up quickly with the right advice (check the official domain, verify contract, watch impersonator handles). That likely saves followers from real losses.

- Noise level: moderate. You’ll see opinion around hot narratives, which is normal for a fast feed. Lists and custom notifications help:

- Create a “Priority Crypto” list and include only accounts that link to primary sources.

- Turn on notifications for keywords like “exploit”, “airdrop claim”, “upgrade live”, and “listing”. Mute vague hype terms if they distract you.

Community and discussion quality

Replies are active and often useful for sensing retail sentiment. You’ll see sharp technical folks chime in—mixed with classic engagement-bait. The hotter the thread, the more I slow down.

- How I read replies: sort by “Latest,” then scan for posts that include links to repos, audits, Etherscan/Explorers, or official announcements. Those rise above noise fast.

- Watch for brigading: coordinated cheerleading or doom can swing the tone. Validity doesn’t equal virality—treat engagement as a curiosity, not confirmation.

My bottom-line take (context, not a score)

Excellent radar for early awareness and narrative tracking; not a one-stop shop. I treat this feed as the “ping” that tells me where to focus, then I confirm with project docs, on-chain explorers, and independent research tools before moving a dollar.

If you like catching shifts right as they form—but you value your capital more than your FOMO—you’ll appreciate the balance of speed and links-to-sources here.

So, who gets the most value from following—and who should probably skip it? In the next section, I’ll spell out exactly who this feed serves best, where it can backfire, and how to plug the gaps without wasting hours. Ready to see if it fits your style?

Pros, cons, and who should follow Boxmining

When you open X and the whole market is yelling, you need a voice that helps you spot what matters right now. That’s where this feed shines—if you know how to treat it.

“Fast is good. Verified is better.”

Best for

- Traders and builders who want early narrative hints before they’re on every timeline.

- People who care about Asia—events, listings, and regional policies that can move flows.

- Airdrop hunters looking for angles and reminders when new campaigns, L2s, or restaking plays heat up.

- Curious learners who prefer quick context and links to go deeper on their own time.

Real-world feel: when restaking started buzzing (think EigenLayer and friends), his quick explainers and conference-floor snippets helped push it from niche chat to mainstream watchlists. That early awareness window is where nimble users get an edge.

Might not be for

- Deep fundamental investors who only want long-form models, token economics, and months-long theses.

- Noise-sensitive readers who dislike fast opinions or market chatter around live events.

- Anyone who needs “buy/sell” answers spoon-fed. This isn’t that—and it shouldn’t be.

Quick sanity check: research has repeatedly shown social feeds can influence short-term market moves, but they also amplify noise. For example, Bollen et al. (PLoS ONE, 2011) linked Twitter sentiment to market shifts. Translation: attention helps—reckless chasing hurts.

What Boxmining does well

- Early signals: spots narrative turns (RWA, gaming, L2 expansions, restaking) as they gather steam.

- Digestible summaries: short posts that frame why something matters without a technical lecture.

- Asia-first angles: conference corridors, exchange trends, and regional projects you won’t see first on US feeds.

- Timely heads-ups: security alerts and “watch this” posts when things break or ship.

- Event coverage: live notes during big weeks so you don’t miss the hallway alpha.

Example scenarios to expect:

- Airdrop playbooks when a new L2 launches quests and early users get rewarded.

- Quick context when a bridge halts due to an exploit and which ecosystems might feel it.

- Noticing liquidity rotation—from memecoins to infra to RWA—and flagging it as it starts, not days later.

Where you need to be careful

- Promotional posts: even labeled sponsorships can feel organic on a fast feed. Treat links as leads, not signals.

- Speculative narratives: hype cycles move faster than fundamentals. FOMO is not a strategy.

- Rushed community takes: a spicy thread ≠ truth. Engagement can be a mirage.

Risk guardrails I apply before touching any token mentioned:

- Token structure: unlocks, vesting cliffs, FDV vs. float, liquidity depth.

- Security: audits, recent incidents, multisig signers, bridge dependencies.

- Real usage: on-chain activity, active addresses, fee revenue, retention.

- Team and backers: who’s building it, who’s funding it, and who’s exiting.

Why I’m strict: studies on social-finance chatter show it can predict attention but not durability. Attention pops; fundamentals persist. So I’ll enjoy the heat—and still ask “what breaks this?”

Alternatives to round out your feed

Balance fast influencer content with independent data and policy signals. A few strong complements:

- Market/data intelligence:Messari, Glassnode, Kaiko, DeFiLlama.

- News wires: Reuters Crypto, CoinDesk, The Block.

- Policy/legal: Coin Center, official regulator pages in your region.

- On-chain and wallet forensics: Nansen (paid), open dashboards on Dune.

- Token unlocks: TokenUnlocks for supply cliffs that can crush a narrative in one day.

Ever watched a token run while you were still scrolling for context? In the next section, I’ll show you the simple setup I use to turn his fast posts into a clean radar—then a yes/no decision in minutes. Want that checklist?

How to use Boxmining the smart way (my workflow)

Don’t treat a fast feed like a finish line. Treat it like radar. I use his posts to spot signals early, then I run a simple process to decide if something goes on my watchlist, gets a paper trade, or gets ignored. It keeps me fast without getting wrecked.

“In crypto, speed without process is just a shortcut to losses.”

My X setup

I want signal without the dopamine chaos. Here’s how I set that up:

- Create a private “Priority Crypto” list and add Boxmining plus ~10 high-signal accounts that cover different angles (on-chain data, security, news, regulation, markets). This cuts noise by about 90% compared to the main feed.

- Turn on notifications for the list (tap the bell on the list page). Not for every account. That way, breaking posts reach you, but your phone isn’t a slot machine.

- Mute repeats: if a post is getting endlessly quoted, mute keywords for a few hours. You’ll avoid the echo chamber while you research.

- Set review windows: two focused checks—once in the morning, once in the afternoon. Constant scrolling = worse decisions. Behavioral research shows overtrading underperforms simple buy-and-hold by a wide margin (Barber & Odean).

Research workflow from a single post

Here’s the exact path I take from “interesting post” to “action or pass.” It rarely takes more than 15–25 minutes.

- Snapshot the claim: What’s being suggested? Narrative, airdrop, token news, or security alert? Save the post link for your notes.

- Open sources: Click everything. If there’s no source, I search the project’s official X, blog, or GitHub. Hearsay ≠ signal.

- Check the who: Verify the project handle (blue checks can be spoofed). Confirm website ownership via whois and that socials match the site footer.

- Token mechanics (if relevant):

- Supply, vesting, unlocks: use TokenUnlocks or CryptoRank.

- Float vs. FDV: low float + sky-high FDV often means brutal unlock overhang.

- Utility path: how (exactly) does the token capture value? If you can’t explain it in two sentences, pass for now.

- On-chain reality check:

- Contracts and holders on Etherscan (or the right scanner). Watch for owner privileges, proxies, and mint functions.

- TVL and liquidity on DeFiLlama. Thin liquidity = exit risk.

- DEX liquidity pools: check pair depth and slippage for a realistic entry/exit.

- Security pass:

- Audits are not guarantees, but look for reputable firms (Trail of Bits, OpenZeppelin). No audit? Size down or skip.

- Bug bounty on Immunefi is a green flag. Admin keys with no timelock = red flag.

- Team and backers: Cross-check founders on LinkedIn/GitHub. Backers with a history of support matter more than logos slapped on a site.

- Decision in three buckets:

- Watchlist: promising, but needs time or unlocks to clear.

- Paper trade: track a hypothetical entry/exit to test your thesis without risk.

- Act small: if it passes checks, start with a pilot position and alerts.

- Set alerts: price, TVL, and if possible, specific contract events. You want data to ping you, not the other way around.

Quick example: He flags a new restaking project on an L2 with “strong backers” and a possible airdrop. I’d verify the team, scan the contracts, confirm TVL growth on DeFiLlama, check if there’s a real points system and sybil rules, then decide: farm lightly with a burner wallet and hard limits—or wait for contracts to be timelocked. No audit + admin key control? Watchlist only.

Why this works: social signals can spike short-term attention and volatility, but only a subset turn into sustainable moves. Multiple studies link social buzz to short-lived volume and price action (Garcia et al., Scientific Reports; Kristoufek). Process filters the spikes that fade from the ones that stick.

Bull vs. bear tactics

- In bull markets:

- Use his posts to map narrative rotation (e.g., RWA → restaking → gaming). Build a simple rotation board and track weekly relative strength.

- Scale in on confirmation, not on vibes. Chasing the last big green candle is how retail underperforms (again: overtrading hurts).

- In bear markets:

- Prioritize security alerts, infra upgrades, treasury runway, and builder updates. These set up the next cycle.

- Farm prudently: target audited protocols with real users, and standardize wallet hygiene.

Sponsorship and shill safety checks

If there’s a link plus a strong call-to-action, I assume marketing until proven otherwise. Trust, but verify:

- Disclosure: Is sponsorship stated anywhere? If not, I increase skepticism.

- Team: Doxxed founders with a track record? Or brand-new accounts and AI headshots?

- Token risks: Upcoming unlocks, treasury control, emissions schedule. High FDV/low float is a classic trap.

- Contract safety: Timelocks, multi-sig signers, proxy patterns. No timelock + owner can upgrade contracts = skip or go tiny.

- Exploit history: Search past incidents and fixes. Check announcements and security pages; no transparency is a red flag.

Rule of thumb: If you wouldn’t explain the downside to a friend in one minute, you don’t understand it well enough to put money in.

A simple weekly playbook

- Monday: Pick three posts that feel important. For each, write a one-page note: thesis, risks, catalysts, what would prove you wrong.

- Set alerts: price levels, TVL thresholds, and any known unlock dates. Make data come to you.

- Midweek: Update notes with what changed. If nothing changed, don’t force trades. Boredom is not a signal.

- Sunday: Review outcomes. What worked, what didn’t, what was luck? Keep a “lessons” doc. This compounds faster than any hot tip.

Pro tip: I keep a tiny “FOMO filter” sticky note on my desk—“What’s the liquidity, what’s the unlock, who holds the keys?” If I can’t answer those, I wait.

Want straight answers to the questions I get every week—mining profits, the Crypto.com US situation, and why one miner won’t mint you 1 BTC anytime soon? That’s next, and I’ll keep it no-BS so you can act with clarity.

FAQ: real questions readers ask (straight answers)

Can you actually make money with crypto mining?

Yes — but it’s a business, not a “plug it in and print cash” side hustle. Profit hinges on your hardware, electricity rate, network difficulty, pool fees, uptime, and BTC price. After the most recent halving (block subsidy now 3.125 BTC), margins tightened across the board.

Here’s a quick, realistic snapshot I use when readers ask me to sanity-check their plan:

- Hardware example: Antminer S19j Pro (≈104 TH/s, ~3.0 kW)

- Power cost: $0.10/kWh → ~3.0 kW × 24 h × $0.10 ≈ $7.20/day

- Expected BTC/day (illustrative): If total network hashrate is ~600 EH/s, your share is 104 TH/s / 600 EH/s ≈ 1.73e-7. Daily BTC issued ≈ 144 blocks × 3.125 BTC ≈ 450 BTC. Expected BTC/day ≈ 450 × 1.73e-7 ≈ 0.000078 BTC (≈7,800 sats)

- Revenue sensitivity: At $65k/BTC → ~$5.07/day; at $100k/BTC → ~$7.80/day

At $65k BTC you’re losing money on power alone; at $100k you’re roughly breakeven, before pool fees and maintenance. That’s why home miners in high-electricity regions struggle, while industrial miners with cheap power (sub $0.05/kWh), scale, and optimized cooling win.

If you’re new, always run the numbers with a live calculator: WhatToMine, NiceHash Profitability Calculator, or Braiins Profitability Calculator. For macro context and power-cost realities, I keep an eye on the Cambridge Bitcoin Electricity Consumption Index (CBECI).

Bottom line: If your power is expensive or you’re not optimizing like a pro, buying BTC can beat buying rigs. Model your ROI first, then decide.

Is Crypto.com shutting down in the US?

No — not the retail app. They did shut down their US institutional exchange in June 2023 due to low demand, which caused confusion. The retail app continues in many states, subject to local rules. Check their latest status here:

- Crypto.com US site

- Official support center (search “US availability” for the latest by state)

Regulatory footing can change. Always confirm your state’s availability before you move funds.

How long does it take 1 miner to mine 1 Bitcoin?

It depends on your hashrate vs. the whole network. A single modern ASIC would need many years to solo-mine 1 BTC. That’s why almost everyone uses pools for steady trickle rewards instead of lottery-style solo wins.

If you want a feel for the math:

- Expected BTC/day ≈ (Your Hashrate / Network Hashrate) × 144 × (Block Reward + Fees)

- Using the earlier 104 TH/s example and ~600 EH/s network: ≈ 0.000078 BTC/day → ~12,800 days to reach 1 BTC solo (ignoring difficulty changes and fees). Pools smooth this out into daily payouts.

To get a precise, up-to-the-minute estimate, plug your hashrate, power cost, and difficulty into a calculator (WhatToMine, NiceHash, or Braiins). Also watch network stats on mempool.space or BTC.com.

How long does Xcoins take to process?

They often complete simple buys in around 15 minutes after payment approval. The first purchase can take longer due to KYC, card checks (3D Secure), and bank verifications. Network congestion also adds time if you’re withdrawing to your wallet.

- Pro tip: Pre-complete KYC, use the same billing address as your ID, and be ready for a small verification charge on your card statement. Your second purchase is usually faster.

Is Boxmining paid to promote tokens?

Sometimes, across his broader brand. He typically flags sponsored segments — but I treat every post as a research lead, not a buy signal. If there’s a link and a strong call to action, assume it’s marketing until you verify team, tokenomics, unlocks, liquidity, and security.

Does Boxmining give financial advice?

No. It’s commentary and education. You’re still the one pushing the button. Use his posts to find ideas, then validate with docs, on-chain data, and risk checks.

How often does he post and what’s the best way to keep up?

Expect daily activity, heavier during conferences. I keep him in a tight “Priority Crypto” X list and review in set windows (morning, lunch, end-of-day). This keeps me from chasing mid-feed and lets me act with a plan instead of FOMO.

If you knew the exact two tools I pair with his feed to spot real signals early — without getting spammed — would you set them up today? Keep reading; I’m about to share my verdict and a simple quick-start that saves hours a week.

Final verdict and next steps

Verdict: Boxmining on X is a fast, practical radar for narrative shifts, Asia developments, and real-time context. It won’t replace your research stack, but it will help you spot what matters early—as long as you run every idea through your own checks before you act.

Why this matters: independent research has shown that social buzz and attention often come before short-term price moves. Two useful reads if you like evidence: Garcia et al. (2014) on Bitcoin bubbles and social activity, and broader work showing online mood can foreshadow markets (PNAS). That’s exactly where a quick feed like his earns its keep.

Should you follow him?

Yes if you want quick reads on what the market’s buzzing about—especially around Asia hours and during conferences—and you’re comfortable verifying before acting.

Skip if you only want slow, deep, fully vetted reports and prefer zero real-time noise.

Real sample of value: when Hong Kong regulatory headlines hit in Asia mornings or when a big conference is in full swing (TOKEN2049, HK Web3 Festival, Korea Blockchain Week), his posts tend to surface sessions, side events, and security updates fast. That early awareness lets you prepare—whether that’s pulling docs, setting alerts, or simply avoiding a rushed entry.

Rule of thumb: the hotter the narrative, the more you slow down. Early awareness is an edge; early FOMO is a tax.

How to get started the right way

- Follow Boxmining on X and add him to a “Priority Crypto” list (keep this list to 10–12 high-signal accounts).

- Turn on notifications for the list, not for every account. Keep alerts to “Highlights” or use scheduled check-ins (e.g., market open + Asia midday).

- Pair with one independent research source and one data source:

- Research: Messari (paid), CoinDesk Research (free summaries), Binance Research (free).

- Data: DefiLlama (TVL, fees), TokenUnlocks (supply schedule), Dune (community dashboards).

- Adopt a simple 15-minute starter routine:

- Scan his latest 10 posts.

- Open only items with a primary source (docs, blog, regulator PDF, GitHub, or on-chain link).

- Check two basics: supply/unlocks and security history. If unclear, it’s a pass for now.

- Convert “interesting” to a one-paragraph note and set a price/on-chain alert, not a market order.

- Use a green/red flag quick check:

- Green: clear disclosures, primary sources linked, credible backers/partners, audits + active repos.

- Red: vague CT threads, no docs, aggressive CT referrals, near-term unlock cliffs, recent exploit history.

Bottom line

I keep Boxmining in my “fast context” lane: quick signals, Asia-first news, and a read on what the crowd is watching right now. That’s useful—but only if you turn signals into a process. Follow https://x.com/boxmining, pair it with one solid research source and one data tool, and take notes on every idea you pursue.

Use his posts as your starting point, not your finish line. That’s how you protect capital and still move fast.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.