Brock Pierce Review

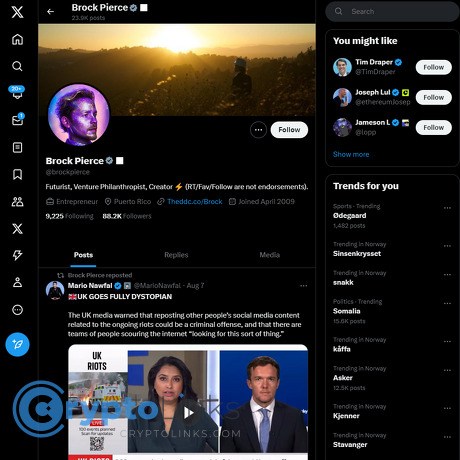

Brock Pierce

x.com

Brock Pierce review guide: everything you need to know + FAQ

Wondering if following Brock Pierce on X (Twitter) is actually worth your time?

If you care about crypto investing, policy, and the history behind stablecoins and big Web3 bets, his feed can be useful—if you know what to watch for and what to ignore. That’s the key. Crypto X is noisy. Big names post promotions, “alpha” that never lands, and a steady stream of conference selfies. You’re here for signal, not fluff.

In this guide, I’m going to show you exactly how I use Brock’s updates: what’s actionable, what’s background, and what’s pure PR. I’ll point to real examples of the kinds of posts he makes, the patterns to notice (events, policy, philanthropy, stablecoins), and a simple workflow to verify claims before you act.

Rule #1: Don’t trust—verify. Use X as discovery, not as a decision engine.

Quick reality check: social feeds are built to amplify engagement, not accuracy. Pew Research Center has shown a large share of adults get news from social media, but confidence in what they see there is mixed—especially on complex topics like finance and policy (Pew data). That’s why having a playbook matters.

The problems people run into

Brock Pierce is a visible operator in crypto, but his feed can be tricky if you’re not clear on context. Common pitfalls I see:

- Hype vs. helpful: It’s easy to mistake motivational lines or vague “big things coming” posts for real updates. They’re not.

- Founder fog: People mix up what he actually founded (gaming businesses, a media network, a venture fund, early stablecoin work) versus what he later advised or supported.

- Actionability: Conference photos and stage clips look exciting, but unless there’s a date, a link, a partner, or a policy docket, you can’t trade or plan off it.

- PR gravity: High-profile accounts attract announcements that are more about optics than operations. Without third-party confirmation, you’re guessing.

Typical real-world examples you’ll see on his X:

- Event updates and stage appearances (summits, policy roundtables, hackathons)

- Policy commentary around stablecoins, financial inclusion, or crypto regulation

- Shout-outs to founders, partnerships, or philanthropic initiatives (often tied to Puerto Rico)

- Occasional historical notes on early crypto and virtual economies

These can be useful, but only when you filter them correctly.

Promise solution

Here’s what I’m going to do for you in this guide:

- Break down his background, track record, and posting patterns—so you know what’s signal vs. show.

- Give you a simple way to turn his posts into high-quality inputs if you’re an investor, builder, or journalist.

- Share a quick verification workflow and a set of links so you can check claims fast and avoid FOMO traps.

- Add a straight-talking FAQ with plain answers and reputable sources to help you fact-check on the fly.

What I’ll cover for you

- A quick bio and why he matters: how gaming money, media, and early crypto set up his public profile

- What he posts and how often: patterns you can actually use

- Wins, misses, controversies: where to be cautious and why

- How to use his posts without getting burned: practical rules that work in the real world

- Resources and notable threads: smart jumping-off points to keep research clean

- FAQs and a bottom line: quick answers to the questions everyone asks

Ready to make sense of the person behind the posts? Next up: who Brock Pierce is and why people care—especially if you keep hearing his name tied to stablecoins, policy, and big events. Want the short version of how he went from gaming money to crypto venture and industry advocacy?

Who Brock Pierce is and why people care

If you’ve been around crypto or online gaming long enough, you’ve seen Brock Pierce’s name pop up in places where new markets are forming. He went from building real businesses around virtual assets to backing infrastructure that still powers crypto today. That arc matters because it explains why his voice travels—across investors, policy folks, and founders.

“In fast-moving markets, the difference between noise and signal is context.”

Context is exactly what his background gives you.

From IGE and ZAM to public crypto figure

Pierce first made waves by turning virtual currency into a real business. He co-founded Internet Gaming Entertainment (IGE), one of the earliest and largest marketplaces selling MMORPG gold and items at scale. Love it or hate it, that market was real: researchers documented the rise of gold farming and real-money trading and the broader virtual economy trend in the mid-2000s. IGE didn’t just participate—it consolidated multiple competitors, professionalized operations, and proved there was sustained demand for digital asset markets years before NFTs or stablecoins were a thing.

He also founded ZAM, a gaming media network that ran guides, databases, and community sites for games like World of Warcraft (think properties that later included Wowhead). ZAM was ultimately acquired by Tencent in 2012, turning early “virtual world” credibility into mainstream gaming media reach. That exit helped cement Pierce’s position as someone who could spot and scale emergent digital economies.

Roles in crypto: venture, stablecoins, advocacy

- Venture: Blockchain Capital — Pierce co-founded Blockchain Capital in 2013, one of the first dedicated crypto VC firms. It funded scores of startups over multiple market cycles, from infrastructure to apps. The key takeaway: he sits close to founders and deal flow, which often shows up in who he’s meeting and what sectors he highlights.

- Stablecoins: Tether (Realcoin) — He helped launch Tether (originally Realcoin) in 2014. Whatever your view of stablecoins, USDT changed crypto liquidity, market structure, and on/off-ramp behavior worldwide. That early seat at the table gives him a unique lens on payments, policy, and where stable-value assets are headed.

- Advocacy: Bitcoin Foundation and industry events — Pierce has served as chairman of the Bitcoin Foundation and remains a fixture at conferences and policy roundtables. This puts him near regulators, lobbyists, and standard-setters—useful if you track how rules are shaping innovation.

Public profile, policy conversations, and Puerto Rico

Pierce ran for U.S. President in 2020 as an independent, signaling a comfort with the messy overlap of tech and politics. He’s also deeply tied to Puerto Rico’s startup and relief ecosystem, supporting community and disaster-response initiatives through philanthropic efforts (for example, the Integro Foundation). That blend—policy, philanthropy, entrepreneurship—explains why his updates often cross from markets into real-world impact.

I’ve seen this matter in practice. When earthquakes and storms hit Puerto Rico, his feeds turned into coordination hubs for supplies, fundraisers, and partner orgs. It’s a reminder that “crypto people” aren’t just tweeting charts; some are organizing buses, generators, and grants.

Why people actually pay attention

- He’s early to new markets. From virtual goods to stablecoins, he’s shown a pattern of getting there before the crowd.

- He has unusual network reach. Founders, policymakers, VCs, and nonprofit leaders all cross his orbit, which can surface themes sooner.

- He’s visible and accessible. Speaking gigs, policy sessions, and philanthropy updates make him a public-facing aggregator of what’s moving.

- There’s signal—but also PR. The reach cuts both ways. Some posts are actionable; some are just shine. Knowing which is which is where the value is.

What this means for you

If you care about how infrastructure, regulation, and entrepreneurship connect, following Brock Pierce gives you a front-row seat to the conversations that shape crypto’s next phase. The trick is using his background as context, not as confirmation. As I like to say, access is an edge, but verification is the superpower.

Curious what actually shows up in your feed when you hit “Follow”—and what’s worth acting on right away? Let’s look at the patterns next…

What you actually get from following his X account

When I follow Brock Pierce on X, I’m not expecting charts or trading calls. What I do get is a steady radar of what rooms he’s in, who he’s backing, and which policy or stablecoin threads are heating up. It’s a mix of event-floor energy, policy signals, philanthropy spotlights, and early-stage deal noise—useful if you treat it like a feed of leads, not a terminal of truth.

Posting style, tone, and frequency

He posts in clusters—quiet for a bit, then highly active around conferences, policy touchpoints, and formal announcements. The tone is upbeat, partner-friendly, and often celebratory. Expect:

- Event bursts: photos from stages, backstage shots, and speaker tags (“See you at [Conference] this week”).

- Partnership signals: announcements or amplifications when a new initiative launches or a foundation backs a cause.

- Policy nods: commentary on regulation, financial inclusion, or payments infrastructure—usually high-level with links to talks or panels.

- Puerto Rico focus: community building, relief efforts, and tech ecosystem updates.

- Occasional retrospectives: reflections on early virtual economies, stablecoins, or “builder” mindset posts.

Think “conference season storyteller” meets “policy-and-payments evangelist.” It’s promotional by nature, but if you’re mapping who’s doing what in crypto, there’s signal in the network he surfaces.

Core themes: policy, events, investing, Puerto Rico, stablecoins

- Policy and regulation: references to regulators, financial inclusion, and how rules shape adoption. These posts help you spot which frameworks and public voices matter right now.

- Industry events: Consensus, Puerto Rico Blockchain Week, global forums—dates, stages, and who’s in the room. Great for planning your calendar and outreach.

- Investing and entrepreneurship: shout-outs to founders, funds, and new ventures. I treat these as warm leads to research, not endorsements to act on.

- Puerto Rico initiatives: philanthropy and community projects—useful for understanding real-world impact and who’s coordinating on the ground.

- Stablecoins and payments: observations on adoption and infrastructure. If you track stablecoin rails, these posts show where narratives are headed.

What’s worth acting on (and what I ignore)

- Actionable:

- Event dates and agendas: add them to your calendar, pitch organizers, or plan side-meetups.

- New initiatives and partnerships: click through to the official site, find the team, and verify the entity.

- Introductions and shout-outs: build a watchlist of founders, funds, and policy folks he tags repeatedly.

- Skip or skim:

- Vague “big things coming” posts with no links or details.

- Generic motivational quotes with no direct relevance to crypto outcomes.

- Photo-only threads that don’t link to primary sources or recordings.

How I turn a single post into usable research (fast)

- Open the link and check the domain: is it the official site? Does it list a legal entity, team, and contact?

- Cross-check with a press release or reputable media: search the org’s newsroom, then look for coverage by established outlets.

- Scan for third-party confirmation: regulator statements, event agendas, or independent interviews.

- Use X advanced search to see context: try from:brockpierce filter:links or from:brockpierce “stablecoin” to pull a thread of related posts.

- Bookmark and tag: save promising posts to a research doc with the source links and status (verified / pending).

“Trust, but verify.” —still the most useful rule in crypto social feeds.

There’s data behind the caution: a 2018 study in Science found false news spreads significantly faster than true news on social platforms. That’s why I never trade or invest based solely on a social post, no matter who shares it.

Red flags I watch for

- No external links to an official site, agenda, or reputable article.

- Overly grand claims (world-changing, historic, unprecedented) without specifics.

- Only selfies and stage shots while avoiding details about outcomes or deliverables.

- One-sided amplification where only insiders or partners discuss the news.

Examples of post types and how I’d use them

- “Speaking at [Major Conference] on [Date].”

- Action: open the official agenda, note the panel topic and speakers, and message attendees for meetings.

- “Proud to support [Initiative/Fund/Project].”

- Action: find the entity’s filings/company page, check the team’s track record, and look for third-party validation.

- “Meeting with policymakers about financial inclusion.”

- Action: search for corresponding hearings, comment periods, or published frameworks; read the primary documents.

- “Highlighting Puerto Rico relief/tech programs.”

- Action: verify the nonprofit or foundation, confirm active programs, and, if you’re local, show up or volunteer to check impact firsthand.

- “Thoughts on stablecoin adoption.”

- Action: compare to current stablecoin volumes, regulatory updates, and payment pilots; save notable data points with sources.

Quick filter tricks to make X work for you

- Create a List with him, key policymakers, and payment founders; scan the List instead of the main feed.

- Use notifications smartly: enable Highlights to avoid getting pinged on every like or retweet.

- Search operators:

- from:brockpierce (conference OR summit) since:2023-01-01

- from:brockpierce stablecoin filter:links

- “Brock Pierce” (partnership OR fund) -filter:replies for third-party mentions

If you treat his feed like a curated hallway at a global conference—full of intros, hints, and room numbers—you’ll find real value. The next question is obvious: which of those posts pointed to things that actually shipped, and where did the hype outrun reality? Let’s look at that next.

Credibility check: wins, misses, and controversies

If you’re scrolling his feed and wondering, “Is this signal or showmanship?”, you’re not alone. The truth sits in the middle: real impact mixed with PR. I treat Brock as a plugged-in operator who has helped shape parts of crypto’s history—while also attracting heat when hype ran hotter than delivery.

“Trust, but verify.” — Ronald Reagan

Notable contributions that actually moved the needle

- Virtual asset economies (IGE): Before crypto was cool, he built a real business selling MMORPG currency at scale. That early bet on digital assets—and the backlash it sparked—helped define what “virtual value” could look like long before stablecoins and NFTs. For context on the practice he operated in, see gold farming.

- Stablecoins (Realcoin → Tether): He helped launch Realcoin in 2014, which rebranded to Tether and ultimately reshaped crypto liquidity. Tether is now foundational to market structure; it’s hard to imagine today’s spot volumes without it. See early coverage: CoinDesk: Realcoin rebrands to Tether (2014). For transparency updates today, check Tether’s transparency page. Also note ongoing academic debate on Tether’s market effects, e.g., Griffin & Shams (2018).

- Venture investing (Blockchain Capital): Co-founding one of crypto’s earliest dedicated funds mattered. Years of checks into exchanges, wallets, infra, and dev tools helped keep builders alive through bear markets. Explore the scope here: Blockchain Capital portfolio.

- Industry advocacy and philanthropy: He’s held leadership roles (e.g., chairman at the Bitcoin Foundation) and pushed ecosystem building and relief efforts in Puerto Rico, including work through the Integro Foundation. That kind of convening power moves conversations, even if it won’t move your PnL tomorrow.

The friction: recurring criticisms

- IGE backlash in gaming: Many gamers and studios hated real-money trading. The criticism: it distorted in-game economies and crossed community lines. My read: it was an early stress test of digital scarcity and markets—messy, but formative.

- EOS/Block.one era expectations vs. reality: The 2017–2018 cycle pushed mega-raises and massive promises. EOS’s $4B ICO remains the emblem. Regulators eventually stepped in; see the SEC’s 2019 settlement with Block.one. Association with that era still triggers skepticism—even when someone’s role was peripheral or advisory.

- Regulatory and reserve questions around Tether: The NY Attorney General’s 2021 settlement with Tether/Bitfinex made “verify first” the only sane policy. Tether has since published regular attestations, but the episode left a mark and a healthy caution sign.

- Promotional tone on X:Optimism is the brand. Expect conference shots, “big things coming,” and cause-driven posts. Great for discovery; terrible if you’re trying to time the market off a slogan.

How I weigh the signal against the spin

- Use it as a radar, not a trigger: I catalog people, projects, and events he highlights, then research them independently.

- Never trade a post: Acknowledge his access, ignore the adrenaline. If I can’t find third-party confirmation, it doesn’t hit my watchlist, let alone my wallet.

- Separate role from narrative: “Involved,” “advised,” “helped launch,” “co-founded”—I look for specific titles, dates, and filings to understand scope.

My verification workflow (fast and practical)

- Classify the claim: Is it about a company role, a funding round, a policy comment, or a philanthropic initiative?

- Check primary sources: Corporate registries, press releases, and legal docs. For US entities, start with SEC EDGAR. For settlements/orders, read the actual PDF when possible.

- Reputable media cross-check:CoinDesk, Bloomberg Crypto, FT on digital assets.

- On-chain and market data: Stablecoin supply and flows via Coin Metrics or block explorers; exchange volume context via Kaiko.

- Event validation: If it’s a talk or partnership announcement, I confirm on the conference site, the partner’s newsroom, or the regulator’s calendar.

- Save receipts: I keep a doc with links, dates, and screenshots. When memories get fuzzy, receipts win.

The bias filter I keep switched on

- Optimism vs. commitment: Words like “support,” “explore,” and “vision” signal vibe. I prefer verbs like “signed,” “launched,” “approved,” “closed.”

- Hard edges: I look for numbers, dates, counterparties, and frictions (regulatory constraints, tech limits, or runway). No friction = likely fluff.

- Incentives: Who benefits if this narrative spreads? The answer usually tells me how far to trust it.

Here’s the part that matters emotionally: in crypto, reputation whiplash is real. Heroes on Monday can look like villains by Friday—and sometimes back again by the next cycle. The point isn’t to love or hate the messenger. It’s to keep your edge.

So how do you turn this radar into results without getting burned? In the next section, I’ll show you the playbooks I use for different roles—investor, builder, journalist, policy watcher. Want the exact steps I follow to turn a single X post into a clean pipeline of leads?

How to use his content (by role)

I treat his feed as a radar. It helps me spot people, places, and policy signals early—then I do the real work. If you use it the same way, you’ll save time and uncover opportunities others miss.

“Treat every post like a breadcrumb, not a map.”

Investors: turn updates into leads, not trades

When he posts, I’m scanning for catalysts, not price calls. Three simple plays work well:

- Event pulse: If he mentions conferences like Consensus, TOKEN2049, Bitcoin Miami, LA Blockchain Summit, Puerto Rico Blockchain Week, I:

- Add the event to a shared calendar with deadlines (speaker lists, startup tracks, pitch windows).

- Build a watchlist from the founders, funds, and policymakers he tags. Then I check Crunchbase, Token Terminal, Dune, and DeFiLlama for traction.

- Message two attendees per event for 15-minute chats. I keep a tight script: who I am, what I’m tracking, one precise question.

- Deal signals: When he praises a founder or fund:

- Look for patterns: repeated shout-outs often mean proximity to a round, partnership, or pilot.

- Verify with filings, press releases, or reputable media. For private rounds, check team activity (GitHub commits, hiring pace, stack changes) and customer logos.

- Map the category. If it’s stablecoin infra, I compare competitors, regulatory exposure, and bank partners.

- Policy edge: References to stablecoin bills or regulatory frameworks are your forward-looking risk map:

- Tag any mention with the jurisdiction (e.g., EU MiCA, NYDFS, OCC, Puerto Rico Act 60).

- Skim the primary text; pull 3 bullet implications for custody, issuance, or disclosures.

- Re-rate portfolio and watchlist on policy sensitivity (payment tokens vs. DeFi governance vs. NFTs).

Hard rule: never buy on “big things coming” posts. Social spikes often precede volatility, not durable returns. Research has shown Twitter mood/activity can foreshadow market swings but doesn’t reliably predict sustained performance (Bollen et al., PLOS ONE; Kraaijeveld & De Smedt, JIFMIM).

Checklist I use before adding anything to my buy/track list:

- Team: full-time, shipping, and reachable? (GitHub, LinkedIn, founder AMAs)

- Traction: DAUs/MAUs, protocol revenue, retention cohorts, or signed pilots

- Financials: runway, cap table sanity, token supply schedule, unlocks

- Legal: jurisdiction, licensing needs, stablecoin or payments exposure

- Evidence: at least two third-party confirmations

Example: If he posts “See you at Puerto Rico Blockchain Week,” I pull the agenda, shortlist three founders building payments or identity, ask for quick coffees, and track their traction for 90 days before making any move.

Builders: use the feed for networking and visibility

His event mentions and shout-outs can be rocket fuel if you’re prepared. I keep it simple:

- Agenda turn-key: Every event he names goes into my “meet-5” plan—five specific people to meet, two sessions to ask a question at, one evening side meetup to host or co-host.

- Reply-right-now: When he amplifies a hackathon, cause, or accelerator:

- Reply with a 20-second product clip, a one-line outcome (“1,200 weekly users”), and a link to a landing page.

- Ask a single, easy yes/no: “Open to intros to payment partners?”

- Tag one relevant collaborator (banking API, infra partner, or NGO if it’s a relief initiative).

- Proof-of-progress pitch: If you want his attention, your thread needs receipts:

- Last 60 days shipped features

- Two metrics that matter (retention, revenue, latency)

- One credible third-party validation (case study, award, audit)

- Leverage the retweet: If he amplifies you:

- Swap your homepage hero to a tailored CTA for 48 hours; use UTM to track.

- Ship a “what’s next” post within 24 hours to keep momentum.

- Line up two partner posts to piggyback on the reach.

Tools that help me move fast: Notion for a lightweight CRM, Cal.com/Calendly for scheduling, X Advanced Search to find event attendees, and a simple Typeform/Tally for pilot signups.

Journalists and educators: turn posts into context, fast

I use his feed to trace people and timelines, then I corroborate everything. A quick system:

- SIFT method: Stop (note the claim) → Investigate the source (role, conflict) → Find better coverage (reputable outlets) → Trace to original (press release, filing, speech).

- Build a “cast list”: Anyone he tags goes into a table with role, org, jurisdiction, and a link to a past quote or talk.

- Timeline the policy: If he references a meeting or bill, I pin the original PDF, the comment deadline, and any prior drafts.

- Corroborate philanthropy and initiatives: Check NGO registries, Form 990s (US), or official NGO pages and confirm with organizers.

Quick win: If you see “historic policy summit” language, grab the agenda and speaker list, then email two independent attendees for quotes. It turns a rehash into a reported piece.

Policy watchers: track frameworks and the people who carry them

His policy and stablecoin mentions are great for building a regulatory heatmap. Here’s how I turn that into signal:

- Name-to-framework map: For each regulator or policymaker mentioned, map to the framework they influence:

- EU: MiCA (issuers, reserves, disclosures)

- US: NYDFS guidance, OCC charters, state money transmitter licenses, federal stablecoin proposals (e.g., Clarity for Payment Stablecoins Act)

- Global: FSB and IMF consults on crypto and payments

- Puerto Rico: Act 60 implications for operators and founders

- Set alerts that matter: Combine his name with “stablecoin,” “regulator,” “hearing,” “consultation,” and jurisdiction names on X search and Google Alerts.

- Comment-cycle calendar: Track deadlines for consultations; prepare a one-page memo with three implications: reserve composition, disclosure cadence, and licensing.

- Primary-first habit: Always read the underlying bill or guidance. Pull exact quotes and page numbers into your notes so you don’t rely on summaries.

Field tip: If he signals a meeting with a central banker or treasury official, look for the streamed panel or published transcript within a week. I clip the exact timestamp where definitions or thresholds change—those lines shape product scope.

Under the hood, this is all about turning visibility into verified opportunities. Want the exact links, saved searches, and tools I keep on my desk to make this easy? I’m sharing the must-visit sources and the specific X queries I use next—curious which ones consistently surface real leads?

Links, notable threads, and extra resources

I keep my research tight by bookmarking a few primary links, running smart X searches, and saving anything important with backups and notes. If you want a clean, repeatable way to track what matters around Brock Pierce, start here.

Must-visit links

- X profile: https://x.com/brockpierce

- Background (career overview): Wikipedia: Brock Pierce

- Historical net-worth coverage: Forbes Middle East (search for “Richest People In Cryptocurrency”)

- Bio snapshot: The Federalist Society (use site search for “Brock Pierce”)

Smart X searches to run

These queries surface the meaty posts (announcements, third‑party links, policy mentions) and filter out generic noise.

- Stablecoins/Tether: from:brockpierce (stablecoin OR tether OR realcoin) filter:links -is:retweet

- Policy and regulation: from:brockpierce (policy OR regulation OR bill OR MiCA OR NYDFS OR FATF OR SEC) filter:links

- Puerto Rico and philanthropy: from:brockpierce ("Puerto Rico" OR philanthropy OR relief) filter:links

- Events and conferences: from:brockpierce (conference OR summit OR keynote OR panel OR "Consensus" OR "WEF")

- High‑signal filter: from:brockpierce filter:links min_faves:50 min_retweets:10 since:2023-01-01

Pro tip: When you see an announcement, click through to the source (press release, official site, reputable media) and save it with a one‑line note on what’s new, the date, and any numbers or named partners.

Examples of threads worth bookmarking

- Post-event debriefs: Look for roundups after big conferences (Consensus, WEF, regional policy events). He often tags founders, policymakers, and partner orgs—great lead list material.

- Stablecoin history or adoption notes: Any mention of “Realcoin,” “Tether,” settlement rails, or cross‑border payments is useful context for how current stablecoin narratives evolved.

- Puerto Rico initiatives: Posts about local accelerators, disaster relief, or gov partnerships can reveal who’s active on the island’s tech scene right now.

- Philanthropy and policy collabs: Threads that include third‑party links (nonprofits, think tanks, university programs) are the ones to archive; they’re easier to verify and often include contacts.

How I keep research clean and fast

- Step 1 — Triage the post: Is it an event, a policy comment, a partnership, or philanthropy? If it’s vague, move on. If it names orgs or links sources, keep it.

- Step 2 — Verify: Open the linked source; cross‑check with a reputable outlet (CoinDesk Policy, DLNews, The Block), company newsroom, or official gov page.

- Step 3 — Note it: Save the URL, key claim, date, named people/orgs, and any numbers. Tag by theme: “policy,” “stablecoin,” “event.”

- Step 4 — Backup: Use Wayback Machine or archive.today to preserve anything that might change.

I treat every post as discovery, not proof. If there’s no third‑party link or official doc, it goes into the “monitor” pile—not the “act” pile.

Policy and reference sources I trust

- FSB global stablecoin recommendations (2023): Official framework for how global regulators look at stablecoin arrangements.

- IMF: Elements of Effective Policies for Crypto Assets (2023): Policy paper with a practical checklist for national frameworks.

- EU MiCA Regulation text (2023): Official EU law covering stablecoins (ART/EMT) and crypto service providers.

- NYDFS stablecoin guidance (2022): Supervisory guidance on redeemability, reserves, and attestation practices.

- CPMI‑IOSCO principles applied to stablecoins (BIS): Standards document mapping stablecoin systems to financial market infrastructure rules.

- Ongoing coverage: CoinDesk Policy and The Block: Policy & Regulation for day‑to‑day updates.

Tools that speed up your workflow

- Saved searches on X: Keep the queries above pinned; run them weekly.

- RSS + alerts: Track policy pages (US, EU), CoinDesk Policy, and The Block with RSS or email alerts. Feedly works well.

- Company lookups: For startups mentioned, check Crunchbase for funding rounds and team members before you allocate time or capital.

- Research doc: Maintain a simple log (Notion, Sheets, or a text doc). Columns: Date, Topic, Link, Source type (official media/press/gov), Notes, Confidence.

Want the straight answers to the biggest questions people ask about Brock—how he made his money, what he actually founded, and whether his X feed is worth your follow? I’ll give you clear, no‑spin answers next. What do you want to know first?

FAQ about Brock Pierce (and my bottom line)

How did Brock Pierce get rich?

Short version: he built and sold virtual economies before crypto was cool, then moved that playbook into venture and stablecoins.

- Virtual goods at scale: He founded Internet Gaming Entertainment (IGE), which commercialized the sale of MMORPG currency and acquired competitors during the mid-2000s boom in online games.

- Gaming media: He founded ZAM, a major gaming media network that later ended up under Tencent’s umbrella (2012), turning early visibility into capital.

- Crypto venture + stablecoins: He co-founded Blockchain Capital (2013) and helped launch Tether in 2014 (originally called Realcoin). Tether went on to become crypto’s dominant liquidity layer; its market cap crossed $100B in 2024.

Put together: cash flow from early businesses, equity in venture bets, and early exposure to crypto infrastructure. That’s the base. Speaking gigs, advisory roles, and board seats are add-ons, not the core.

How much is Brock Pierce worth?

Ballpark, not gospel. Forbes Middle East historically listed him in the $700m–$1bn range at the time of publication. Treat any net worth number in crypto as a moving target—prices swing, private stakes get marked up or down, and some holdings are illiquid.

- Why I don’t obsess over it: It tells you he has resources and access. It doesn’t tell you whether a specific post or theme is actionable today.

What companies did Brock Pierce found?

- IGE (Internet Gaming Entertainment) — virtual goods marketplace

- ZAM — gaming media network later associated with Tencent

- Blockchain Capital — crypto-focused venture firm (co-founder)

- Tether — helped launch it in 2014 when it started as Realcoin (with Reeve Collins and Craig Sellars)

He’s also held leadership roles like chairman of the Bitcoin Foundation. The throughline is being early to virtual asset economies, then doubling down with venture and industry-building.

Is it worth following his X?

Yes—if you use it as discovery, not trading signals. You’ll see conference circuit updates, policy meetings, philanthropy, and shout-outs to founders.

- What I track: event dates, policy roundtables, new initiatives, who he’s amplifying.

- What I filter out: vague “big things coming,” motivational filler, anything without a third-party link.

- How I verify: cross-check event claims with organizer sites, policy talk with hearing calendars or think tank write-ups, and partnership claims with official press releases.

One practical reason this works: stablecoins and policy are where the action is. Chainalysis has shown that stablecoins make up the majority of on-chain transaction value in recent years, and Tether/USDC flows often correlate with liquidity and market structure shifts. When he flags a stablecoin policy conversation or global event, I pay attention—but I still confirm with primary sources.

My rule: use his feed as a radar. If something pings twice—once on X and again via a reputable source—I add it to my research doc.

Any quick examples of how I turn his posts into value?

- Policy: If he mentions a stablecoin roundtable or meeting, I check the agenda on official sites (e.g., a committee page or a think tank publication). If it’s real and the names are heavyweight, I read the actual memo or transcript.

- Events: When he highlights a conference, I scan the speaker list and sponsors. If I see multiple Tier-1 funds or regulators, I book it or at least set up remote notes. If it’s heavy on “web3 lifestyle” and light on content, I pass.

- People: If he praises a founder with specifics, I pull the product, GitHub, or traction metrics and decide whether they’re watchlist-worthy.

Final word

My take: following Brock’s X is useful if you’re hunting early signals about policy, stablecoin infrastructure, and who’s moving in the room. He’s a builder-operator with reach, and that can surface opportunities before they hit mainstream headlines.

Just remember: the value is in what you verify, not who posted it. If you bring your research hat, you’ll get more signal than noise—and that’s the whole point.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.