Rob Paone Review

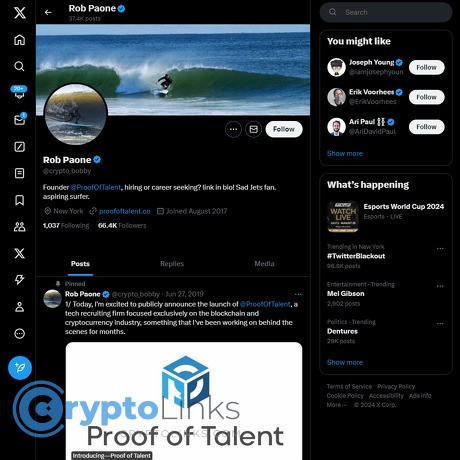

Rob Paone

x.com

Rob Paone (Crypto Bobby) Review Guide: Everything You Need To Know About + FAQ

Ever scroll crypto Twitter and wonder, “Is this worth my time?” With so many hot takes, charts, and victory laps, it’s tough to know who actually helps you make smarter moves. If you’re thinking about following Rob Paone—aka Crypto Bobby—let’s cut through the noise so you can decide fast and set up a simple way to get value from his feed.

What makes crypto Twitter so frustrating?

It’s not just the noise—it’s the uncertainty. Who’s credible? What’s real signal vs. hype? And how does an influencer actually make money?

- Mixed incentives: Some accounts are trading, some are recruiting, some are marketing. Without context, it’s easy to misread a post.

- Time sink: You can’t fact-check every thread. A 5-minute scroll becomes an hour fast.

- Hype vs. practicality: Most people want useful, realistic insights—not “100x by Friday.”

- Career confusion: Crypto jobs move in waves. What’s legit? Which skills actually land offers?

There’s plenty of proof this is a real problem. Research from MIT found that false news on Twitter spreads faster than truth because it’s more novel and emotional (Vosoughi et al., 2018). And Pew’s ongoing surveys show low trust in news found on social platforms. Translation: if you don’t have a system, it’s easy to be misled—or just waste your day.

Here’s my promise to you

I’ll explain who Rob Paone is, what he posts on X, where he’s strong, what to watch for, and how to use his content without getting sucked into the scroll. I’ll also tackle the most common questions I see, so you can walk away with a clear yes/no on following him—and a simple playbook to squeeze real value from his feed.

Who this guide is for

- Traders who want level-headed context (not moon calls).

- Builders and operators who care about hiring, market cycles, and team dynamics.

- Job seekers who want a realistic path into crypto, not fluffy advice.

How I evaluate accounts like his

- Consistency: Does the tone and quality hold up across cycles?

- Bias and incentives: How does this person make money, and how might that shape what they post?

- Accuracy over time: Do takes age well, or are they rewritten after the fact?

- Clarity: Are posts understandable without being online 24/7?

- Actionable signal: Can I use this to make a better trade, hire, or career move?

Rule I use: follow fewer accounts, but set up a process that turns their posts into decisions. If a post doesn’t help you act smarter, it’s entertainment—treat it that way.

Quick verdict snapshot

Short answer: Rob is most useful for practical market commentary, career insights, and no-nonsense industry context. He’s not a hype machine—which is good if you value signal over sizzle.

- Best for: Builders, job seekers, and investors who want steady context.

- Use with: Your own research, on-chain data, and one technical analyst you trust.

- Note: He runs a recruiting firm, so weigh hiring and talent-market takes with that lens in mind.

So who is Rob Paone, what exactly does he post, and how often? In the next section, I’ll break down his background and what you can expect from following @crypto_bobby—including the angles that save you time and the ones to double-check. Ready to look into that?

Who is Rob Paone (Crypto Bobby)?

Rob Paone—better known as Crypto Bobby—is a long-standing crypto voice who keeps things grounded on X. If you’re tired of empty hype and want market context plus real talk about careers, he’s the guy who shows up with clarity instead of chaos.

“Signal beats spectacle. Find the voices that help you act, not react.”

Fast bio snapshot

Rob founded Proof of Talent, a crypto-native recruiting firm. That vantage point shapes a lot of what he shares: what teams are building, who they’re hiring, and how the market cycle actually translates to opportunities. He’s been around since earlier cycles (think 2017–2018 and onward), so he has the context to tell you what’s new—and what’s a rerun with better branding.

Worth noting for anyone career-minded: macro headlines don’t always match the on-the-ground hiring trend. Industry data backs that up; funding and developer activity move in waves that don’t turn on a dime. For example, independent resources like the Electric Capital Developer Report show how talent shifts over time, often lagging market tops and bottoms—exactly the kind of nuance Rob often highlights when he talks jobs and teams.

What he posts on X

His feed is a steady blend of market sanity and career practicality. Expect:

- Market thoughts: level-headed commentary on price action, narratives, and catalysts—no fireworks, just context that helps you think.

- Industry reactions: short takes on news that actually matters to builders and investors, not just what’s trending.

- Hiring trends: what roles companies want, how compensation sentiment shifts, and how teams adapt during bull and bear stretches.

- Practical advice: how candidates can stand out, what hiring managers look for, and when founders should speed up or slow down recruiting.

Concrete examples you’re likely to see on his timeline:

- “Security and infra roles are heating up again” after a string of high-profile exploits—aligned with broader risk awareness.

- Notes on “longer interview cycles” during quieter markets and how to plan for it (portfolio, referrals, take-home tests).

- Short market check-ins like “range intact” or “rotation risk” paired with a reminder of what matters for operators and job seekers.

That mix is rare. Most feeds lean pure price or pure careers—he connects the two in a way that’s actually usable. If you’ve been burned by headline-chasing, this feels like a reset.

Where he stands in the influencer map

Rob isn’t the “alpha caller” or the on-chain wizard. He’s squarely in the business/career + market context lane. That means:

- You’ll get commentary that helps you stay rational during volatility.

- You’ll see the employment side of crypto in real-time—what teams need now vs. six months ago.

- You won’t get a feed full of price targets and victory laps.

If you care about jobs, hiring, team-building, or just understanding why the market move of the day matters for product and people, this is your corner of crypto Twitter.

How often and how deep

He posts regularly—short takes when the market moves and digestible threads when a topic deserves more oxygen. You can scan his feed in a few minutes and come away informed without getting sucked into an hour-long scroll.

One pattern I appreciate: he breaks big moments into “what matters for investors” and “what this means for hiring or teams.” That format helps you turn a headline into an action list. And when broad funding trends shift (you’ve probably seen reports from sources like Crunchbase showing how capital ebbs and flows), he tends to connect the dots to actual teams—where pipelines slow, which roles rebound first, and how candidates should time their moves.

Want to know whether that calm tone is just good vibes or backed by incentives and a solid track record? That’s exactly what I’m tackling next—how trustworthy he is, how his business shapes his lens, and how his claims age. Curious what I found?

Is Crypto Bobby trustworthy? Signals, incentives, and realism

Trust on crypto X is fragile. Flashy calls get clicks; consistency keeps me following. With Rob Paone (Crypto Bobby), I look for steady thinking, clear incentives, and takes that age well. That’s what matters when you’re trying to separate signal from dopamine.

“Trust is built in drops and lost in buckets.”

Track record and tone

He’s measured. That alone sets him apart. Instead of chest-thumping predictions, he explains the why behind market moves and what they could mean for builders and job seekers. When price rips, he leans into risk controls and what’s actually shipping. When things cool off, he looks at runway, hiring health, and which teams are still executing.

That style lines up with what long-term followers tend to reward: consistent context over hot takes. Research like the Edelman Trust Barometer has repeatedly shown that people value transparent intent and steady behavior more than follower counts—exactly the kind of cadence he keeps. You won’t get “100x by Friday”; you’ll get “here’s what matters and why.”

Quick tells I use to judge credibility here:

- Language: words like “likely,” “risk,” and “trade-offs” signal realism; you’ll see that in his posts more than pumpy absolutes.

- Time horizon: mid-term context over low-timeframe entries; useful if you invest, build, or hire.

- Explanations: threads tend to connect market events to team behavior, product timelines, and hiring—less moon math, more operating reality.

How he likely makes money

Rob runs a crypto recruiting firm, Proof of Talent. That matters. Recruiting businesses typically earn fees when companies hire (contingency or retained search). In short: he benefits when the market is healthy enough for teams to grow and when candidates trust his brand.

What that incentive lens means for his content:

- He’ll naturally highlight trends in hiring (wallets scaling up, infra staffing, compliance roles returning).

- He’s aligned with ecosystem health and sustainable growth, not short-term pumps.

- He has every reason to be practical—bad advice hurts his reputation with both candidates and teams.

Is that a conflict? It’s a lens. I like lenses—they help me predict bias and interpret posts correctly.

What I watch for (and you should too)

- Recruiting-adjacent takes: If he says “hiring is thawing,” I cross-check with independent data. A quick pass: open roles on company job boards (Greenhouse/Lever), the Electric Capital Developer Report for dev activity trends, and research dashboards (Messari, CoinMetrics, The Block Research) for funding and usage signals.

- Disclosures: When he mentions specific companies or projects, I look for clarity. If disclosures aren’t explicit, I treat it as context, not a call-to-action.

- Evidence links: When posts reference data (fees, user growth, layoffs), I want a source or at least a thread that ties to credible reporting.

- Consistency check: Does the tone stay steady across green and red weeks? With him, yes—less whiplash, more continuity.

- My rule of two: For anything actionable, I verify with at least one independent source before I move a dollar or a resume.

Realistic expectations: what you’ll get (and what you won’t)

- You’ll get: level-headed market commentary, hiring signals, compensation and timing sanity checks, and insights on how teams make decisions in crypto.

- You won’t get: early airdrop farming playbooks, high-leverage trade calls, or deep on-chain forensics.

Example of how I translate his lens into action: if he notes a pickup in wallet or security hiring, I flag that category on my watchlist. That often correlates with product pushes, partnership pipelines, or a shift in user pain points—useful for both investors and job seekers. It’s not an entry signal; it’s a narrative thermometer.

Who benefits most from following him

- Builders and founders: Need to benchmark comp, time a hire, or sense when the talent market is loosening? His feed helps you avoid expensive mistakes.

- Job seekers and career switchers: You’ll spot which roles are real, which skills are in demand, and how teams think about hiring velocity.

- Investors who value context: If you anchor decisions in industry health over meme rotations, his perspective adds useful guardrails.

- Operators (BD, PM, Growth): Reading hiring patterns alongside market news is an edge for planning roadmaps and partnerships.

If that sounds like the kind of signal you want in your feed, you’ll get a lot from following Rob. Want a fast, low-noise setup to turn his posts into real outcomes—without living on X all day? I’ve got a 5-minute system you can copy next. Ready to make his feed actually work for you?

How to get real value from following @crypto_bobby

You don’t need more crypto noise—you need a simple system that turns his posts into signal you can act on. Here’s the exact setup I use, with tweaks for trading, job hunting, and hiring.

“You do not rise to the level of your goals. You fall to the level of your systems.” — James Clear

Setup in 5 minutes

- Create an X List: Call it Signal + Context. Add @crypto_bobby and 3–5 other high-signal accounts. Lists reduce feed noise and decision fatigue.

- Smart notifications: Tap the bell on his profile. For sanity, use your phone’s “Do Not Disturb” schedule so alerts land during your research window, not your sleep.

- Save a filtered search: Use X’s Advanced Search and save this: from:crypto_bobby min_faves:50 -is:retweet. It surfaces the posts that resonated most, fast.

- Build a lightweight research doc: One page, five fields—Date, Topic, Key takeaways, Action, Result. Weekly review beats endless scrolling (the forgetting curve is real; spaced reviews stick).

Pro move: In TweetDeck/X Pro, create a column for your saved search. Now high-signal posts come to you.

If you’re trading

Use his posts as context, not entries. I run a quick “T.R.I.M.” pass before putting capital at risk:

- T — Thesis: Write a one-line narrative from his post. Example: “Spot ETF flows stabilizing could support large-cap strength this week.”

- R — Risk: Mark an invalidation level on your chart (TradingView). If price closes beyond it, you’re out. No exceptions.

- I — Independent data: Cross-check with:

- Open interest/funding (e.g., Coinglass)

- On-chain flows or supply metrics (e.g., Glassnode/CryptoQuant summaries)

- Event overhangs: token unlocks, listings, macro dates (FOMC, CPI)

- M — Method: Spot or perps? Define size, stop, take-profit. If you can’t get 2:1 R:R, skip.

Example workflow: He flags risk in alt L1s → you check funding turning positive and OI spiking → your play becomes either hedge via majors or reduce exposure into strength, not shorting blindly. A simple checklist reduces impulse errors—there’s a reason checklists improved outcomes in complex fields from aviation to surgery.

If you’re job hunting

He’s a reliable early-warning system for hiring shifts. Turn his feed into a job pipeline that actually moves.

- Spot trends → update skills: When he notes “security engineers” or “GTM hires picking up,” add those keywords to your resume and LinkedIn. Applicant filters often match exact phrases.

- Build a target list: Track 15–20 companies he mentions or that interact with him. Columns: Company, Role, Why now, Key skills, Contact, Status.

- Portfolio proof: Replace claims with artifacts—GitHub PRs, dashboards, a Notion case study. One strong artifact outperforms five buzzwords.

- DM template you can send today:

“Hey Rob—saw your post about [trend/role]. I’m a [title] with [X years] in [skill]. Two quick wins: (1) [Result with metric], (2) [Result with metric]. Open to roles like [A/B]. If anything comes to mind, here’s my portfolio: [link]. Appreciate any pointers.” - Weekly cadence: 3 quality applications, 2 warm intros, 1 artifact shipped. Repeat. Consistency beats bursts.

Interview tip: Use a simple STAR outline (Situation, Task, Action, Result) for 3 stories you can remix. Hiring managers remember crisp outcomes.

If you’re building or hiring

Use his perspective to time searches, calibrate comp, and tighten your process.

- Timing: When he signals broader hiring thaw or specific role heat, open your pipeline 2–4 weeks earlier. Good candidates move fast in those windows.

- Comp sanity-check: Pair his market tone with public ranges (e.g., Levels.fyi for eng benchmarks and web3 salary dashboards). Avoid ranges that scare off A-players or flood you with mismatches.

- Structured interviews: Build a scorecard with 4–6 competencies tied to real outcomes (e.g., protocol design, incident response, GTM execution). Research in industrial-organizational psychology has repeatedly shown structured interviews predict performance better than unstructured chats.

- Simple hiring brief:

- Mission: What they’ll ship in 90 days

- Must-haves: 3 non-negotiables

- Nice-to-haves: 3 flexible skills

- Signals: Artifacts or experiences that prove ability

- 30–60–90 offer framing: Present outcomes you expect per phase; candidates with strong agency will self-select in (or out) faster.

Practical example: He notes compliance and risk roles heating up post-reg headlines. Your move isn’t just “post a JD”—it’s drafting a 90-day incident-readiness plan and hiring against it. Clarity attracts operators.

My personal workflow (quick peek)

- Morning, 5 minutes: Skim his List column + saved search. Bookmark 1–2 items max.

- Tags: I label saved posts Market, Careers, or Teams so Friday review is painless.

- Friday, 20 minutes: Update the research doc with takeaways → pick one action (adjust watchlist, tailor resume bullet, tweak hiring brief).

- Boundaries: I mute hype keywords and use screen-time limits. Your brain isn’t a notifications inbox—protect it.

Time is your edge. Every minute you don’t filter is a minute you donate to the feed. Want to know who pairs best with his style so you cover data, research, and careers without adding chaos? The answer’s next—curious which voices round out the stack?

How he compares to other crypto voices

Every voice on crypto Twitter has a lane. Rob Paone (Crypto Bobby) sticks to a lane that’s rare: calm market context + real hiring intel. When the timeline is screaming, he sounds like the adult in the room.

“Signal beats volume. Especially when the volume is fear and greed.”

Strengths versus peers

Here’s where he stands out against the usual suspects (alpha callers, chartists, and on-chain wizards):

- Career and team insight you can actually use. When BTC ripped on ETF approval in early 2024, most feeds were chanting price targets. He talked hiring freezes vs. reopenings and what that meant for builders and job seekers. That perspective ages better than “$100k next week.”

- Low-hype, steady voice. A well-cited MIT study found that false or sensational content spreads faster on Twitter than truth. In crypto, that effect is multiplied. He resists that trap, which makes his posts safer as inputs to your process.

- Operational realism. If you’re running a team or trying to get hired, market comments are paired with what it means for runway, comp, and timing. That’s a gap most influencers don’t even try to fill.

Quick, real-world contrasts I’ve seen:

- Volatile weeks: Where meme accounts push lottery tickets, he points at risk, liquidity, and job market signals. It’s a reminder to protect capital (and your resume).

- New L2 launches: Dev-heavy accounts explain the EVM internals; he talks about headcount, GTM hiring, and whether teams are scaling or consolidating. Different lens, real signal.

Potential gaps

He’s not trying to be everything—and that’s fine. Just cover the blind spots:

- Not an alpha caller. If you’re chasing fast-moving microcaps, you’ll still need your own system and risk controls.

- Not an on-chain or deep-tech specialist. For exchange flows, smart money labels, or protocol-level breakdowns, pair his feed with data-native sources.

Think of him like a strong “context layer” sitting on top of your charts and dashboards. If you only eat context, you’ll miss entries. If you only eat charts, you’ll miss reality.

Best combo follows

If you want a complete picture without drowning in tabs, build a small, purpose-built stack around him:

- One technical analyst for structure and levels:

CryptoCred,

Rekt Capital - One on-chain data account for flows, wallets, and funding:

Glassnode,

Santiment,

Nansen - One research outlet for deep dives and quarterly state-of-crypto:

Messari,

Delphi Digital

Layer those with Rob’s hiring and business context, and you’ll cover breadth (narratives), depth (data), and reality (teams and jobs).

Who should prioritize him

- Breaking into crypto? You’ll learn what companies want now, not last cycle.

- Operators and founders? He’s useful for sanity-checking comp, timing, and team design.

- Investors who value macro-industry reads over meme churn? You’ll get a calmer dashboard for weeks when emotions run hot.

One last note on outcomes: LinkedIn’s workforce data shows emerging-tech hiring waxes and wanes in tight cycles, then rebounds with velocity when capital and narrative line up. Having a recruiting-native lens in your feed can help you catch those inflection points earlier—whether you’re allocating, applying, or building.

Curious about incentives, paid promos, and the best way to follow him without getting flooded? I’m answering those exact questions next—no fluff, straight to the point.

FAQ: Everything you wanted to ask about Crypto Bobby

I get these questions all the time, so I’m answering them straight, with quick examples and simple, no-BS guidance you can actually use.

Who is Rob Paone and why do people follow him?

Rob Paone, known as Crypto Bobby, is one of the steadier voices on crypto X. He’s been around for multiple cycles and focuses on practical, grounded commentary. The big draw is his mix of market context and career insight. If you want level-headed takes instead of hopium, he’s worth your follow at https://x.com/crypto_bobby.

Example of what you’ll see from him: short, simple takes like “funding and hiring are picking up in infra, still slow in consumer,” or quick reactions to big headlines that cut through noise instead of hyping it.

What is Proof of Talent?

It’s Rob’s crypto-focused recruiting firm. They place candidates at crypto companies—protocol teams, exchanges, infra, startups—so he has a unique read on hiring trends. Expect posts about what roles are opening, what skills companies actually pay for, and how teams think about comp and timing.

Real-world benefit for you: if he signals that infra engineering or security roles are picking up before DeFi product roles, you can adjust your job search or hiring plan a few weeks faster than the average person watching headlines.

Does he post trading calls?

Not really. Think context and narrative awareness, not signals. Use his posts like weather reports: helpful for awareness, but you still need your own map and gear.

Pro tip: A large body of behavioral finance research shows that acting on hot tips and fast opinions increases overtrading and hurts results. One classic paper (Barber & Odean, 2000) found frequent traders underperform due to overconfidence. Translation: treat any influencer content—his or anyone’s—as input, not a button to press.

Is he paid to promote tokens?

Always assume incentives can exist and look for clear disclosures. In the U.S., the FTC’s Endorsement Guides require that paid relationships are disclosed in a clear, conspicuous way. If you don’t see disclosures or something looks too tidy, pause and verify with a second source. That’s not “about Rob”—that’s just good hygiene on crypto X.

- Check for “ad,” “sponsored,” “partner,” or explicit conflict statements.

- Look for consistency: does the tone change when a bag benefits?

- Cross-check claims with primary sources (project docs, on-chain data, reputable news).

Why I’m strict here: a well-known study in Science (Vosoughi et al., 2018) found that false news spreads faster than truth on Twitter. Crypto is even noisier. Protect yourself by verifying.

What’s the best way to follow him?

Keep it lightweight and systemized so you don’t get sucked into the feed.

- Follow on X: https://x.com/crypto_bobby

- Turn on alerts for threads only (not every post).

- Save key posts to a weekly note and write one sentence about how it affects your plan.

Why the weekly note? Writing your own takeaway boosts retention and judgment—much better than passive scrolling.

Is he beginner-friendly?

Yes. He writes in plain English, focuses on what matters, and stays away from hype. If you’re moving from Web2 to Web3, you’ll get a fast read on what teams value: shipping, security mindset, compliance awareness for certain roles, and realistic timelines.

How does his recruiting angle help me?

Two ways:

- Job seekers: Spot early hiring signals (e.g., infra/security uptrends) and align your resume with the skills companies actually request. If he’s seeing demand for Golang + cloud infra with on-call rotations, don’t lead your resume with random hackathon projects—front-load the stack they want.

- Founders/hiring managers: Sanity-check comp ranges, timing, and where competition for certain roles is heating up. That alone can save you a failed search or a month of churn.

Any red flags to watch?

Same rules I use across all crypto accounts:

- Conflicts: If a take clearly supports a business incentive (e.g., “everyone should hire right now”), weigh it accordingly.

- Verification: Cross-check market claims with on-chain dashboards, exchange announcements, or reputable research notes.

- No single-source decisions: If a post would cause you to buy, sell, or quit your job on the spot, slow down and add a second data point.

How to contact him?

Start on X: @crypto_bobby. For career-related messages, use the contact details linked from his profile (typically his recruiting firm’s site). Keep it short, relevant, and specific—what role, what skills, what timeline.

Can I rely on him during market chaos?

He’s steady during volatile stretches, which is useful. Still, I always pair any commentary with data-driven sources before acting—on-chain metrics, liquidity data, or reputable market structure notes. During 10–15% days, that combo (context + data) keeps you from getting whipped around.

Ready for something you can set up in under 10 minutes? In the next section I’ll share the exact checklist I use so you get the signal without the screen-time. Want the same setup I run every week?

Action checklist and final take

Here’s the exact 10-minute setup I use so following Crypto Bobby actually turns into better decisions—not just more scrolling.

Quick start checklist

- Follow https://x.com/crypto_bobby and add him to a List called “Context”.

Fast path: On his profile → “…” → Add/remove from Lists → create “Context.” Keep this list tight (10–20 max) so it stays high-signal. - Turn on smarter notifications for substantial posts.

Tip: Use X Pro (TweetDeck) and add a column with this search: from:crypto_bobby min_replies:3 OR min_likes:50. That bubbles up threads and higher-signal posts without pinging you for everything. - Create a note titled “Bobby — Market/Careers” with three sections: Market Context, Careers, Actions. I keep mine in Notion, but a Google Doc works fine.

- Each week, save 2–3 posts and add your own takeaways.

Example: He flags “L2 hiring is heating up for infra + Rust.”

My takeaway might be:- Action: update resume with Rust + async examples; link a small repo.

- Search: “site:jobs.lever.co (Rust OR Go) (rollup OR L2)”.

- Track: Set alerts on Proof of Talent + company career pages (Optimism, Arbitrum, zkSync).

Why this matters: Research on retrieval practice shows writing your own quick summaries boosts retention and follow-through compared to passive reading. - Cross-check anything actionable before you move.

Examples:- ETF flow takes → verify with Farside Investors or SoSoValue.

- “Fees are up on L2s” → check L2Fees.info.

- “Token X momentum” → confirm FDV/liquidity on CoinGecko + Token Terminal, and pull a 30D usage chart on Dune/DefiLlama.

Why this matters: An MIT study (2018) showed false news spreads faster than true news on social platforms. Slowing down to verify is your edge.

Optional: build your stack

He’s great for context and careers. Pair that with one tool in each category so you’re covered on data and depth without drowning.

- On-chain/data dashboard (pick one): Dune, Token Terminal, Glassnode, DefiLlama, Artemis.

- Technical analyst (pick one): find a style you trust and stick to it—consistency beats hopping between charts.

- Long-form research (pick one): Messari, Blockworks Research, Delphi, Coinbase Institutional.

5-minute weekly loop: open your “Context” List → add 1–2 notes → verify with your chosen dashboard → scan one long-form piece. That’s it. Atul Gawande popularized how simple checklists reduce errors; this tiny routine does the same for your crypto decisions.

What I’ll do for you on Cryptolinks.com/news

- Keep a living shortlist of high-signal feeds (including Rob) with how I use each one.

- Post quick “signal recaps” during volatile weeks so you can act without doomscrolling.

- Share mini how-tos like “verify ETF flow claims in 60 seconds” or “build a role-targeting query for L2 jobs.”

If you want fewer tabs and more wins, check back here—I test the workflows so you don’t have to.

Final word

My bottom line: Rob Paone is a steady, useful follow for clear market context and career signal. Use his posts as inputs, not triggers. Set up the simple workflow above, write your own two-line takeaways, and verify the big claims. You’ll cut the noise, keep your head clear, and make smarter moves—without living on X.

Borrow signal. Verify with data. Act on your plan.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.