WhalePanda Review

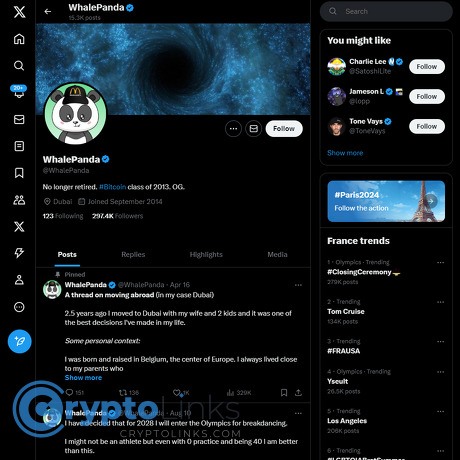

WhalePanda

x.com

WhalePanda on X (Twitter) Review: Who He Is, What He Posts, and How to Get Real Value From Following Him

Ever looked at WhalePanda’s feed and wondered if it’s actually worth your time—or just another voice in the noise?

I spend a lot of hours tracking crypto feeds, muting nonsense, and bookmarking what matters. If you want clear expectations on what you’ll actually get from following WhalePanda—and how to use his posts without getting sucked into hype—this is for you.

Short version: if you’re Bitcoin-first and allergic to fluff, there’s signal here—if you follow smart.

The problem most people face on Crypto X

Crypto X can be a battlefield of engagement hacks and tribal hot takes. If you’ve tried building a clean signal-to-noise timeline, you’ve probably felt these pains:

- Shilling vs. signal: It’s hard to tell if someone’s sharing insight or quietly bag-pumping.

- Fast takes, slow truth: Big claims spread instantly; corrections barely reach anyone. Research from Science (2018) showed false news travels farther and faster on social media than the truth.

- FOMO pressure: Emotional feeds lead to rushed trades. Classic findings like “Trading Is Hazardous to Your Wealth” (Barber & Odean, 2000) remind us that reactive trading often underperforms.

- Impostors and reply scams: Fake profiles, giveaway DMs, malicious links—the usual traps. The SEC has a standing warning on this exact problem (Investor.gov).

- Sentiment distortions: Markets react to narrative waves. Social media mood has been shown to correlate with price action in financial markets (Bollen et al., 2011), which makes filtering sources crucial.

So where does WhalePanda fit? People ask if he’s legit, whether he shares signals, if he’s biased, and how to avoid wasting time. All fair questions.

Here’s what I’ll do for you

I’ll set expectations before you hit “follow.” You’ll see what WhalePanda posts, how to read his feed without getting caught in FOMO, and how to use it to improve your own decision-making—without relying on anyone for entries and exits. I’ll also keep a practical FAQ handy for the common questions people ask.

Who this is for

- You want Bitcoin-first perspectives and blunt commentary over glossy PR.

- You prefer a smaller list of reliable voices on your timeline.

- You want strong BS detection and early red flags on industry nonsense.

- You’re okay with opinionated posts—as long as they help you think better.

Quick snapshot before you follow

- Main vibe: Bitcoin-focused commentary, regulation and policy takes, security and custody reminders, market sentiment, and memes.

- What it’s not: Not a signals feed. Don’t expect entries, exits, or leverage play-by-plays.

- Strengths: Fast reactions to news, sharp skepticism of hype, early warnings on questionable projects and exchange risk.

- Potential bias: Bitcoin-first lens; expects self-custody and long-term thinking.

- Safety tip: Follow the real handle: https://x.com/WhalePanda. Ignore DMs offering giveaways. Never connect a wallet from replies.

If that sounds like what you want in your feed, we’re on the same page. But who exactly is WhalePanda, and why do so many Bitcoiners trust his read on markets and policy? Let’s answer that next—along with what’s public, what’s private, and where bias might show up…

Who is WhalePanda? Background and credibility at a glance

I’ve watched WhalePanda’s feed through multiple cycles, from the 2017 fork wars to the 2022 contagion and the 2024 ETF era. He’s a long-time Bitcoin personality known for sharp, timely commentary and a very healthy suspicion of hype. If you remember the “Magical Crypto Friends” era—alongside Samson Mow, Riccardo Spagni, and Charlie Lee—he was part of that crew’s debates and events, bringing a Bitcoin-first lens, a quick BS filter, and a knack for turning complex industry drama into clear takeaways.

What stands out to me isn’t just what he says—it’s how fast he spots red flags. When flashy “risk-free yield” schemes were everywhere in 2021, his posture stayed the same: self-custody over yield-chasing, caution over clicks. When forks and rebrands tried to hijack the Bitcoin narrative in 2017–2019, he called out the marketing spins early. During regulatory waves, he tends to anchor to primary sources and encourages people to read the actual documents, not the engagement-bait summaries.

“Signal beats volume.”

That mindset matters. Research shows false information spreads faster than the truth on social platforms, especially in high-emotion topics like crypto; one landmark study in Science found false news is more likely to go viral than true news because it triggers surprise and disgust. In an environment like that, a reliable filter is worth its weight in sats.

What he’s known for

- Bitcoin-first stance: You’ll notice a strong alignment with Bitcoin fundamentals—security, self-custody, and incentives—over speculative altcoin narratives.

- Calling out shaky trends: From fork politics (BCH/BSV, SegWit2x debates) to ICO mania and high-yield lending, he’s been consistent about risk and custodial exposure.

- Memes with meat: He uses humor, but the punchlines land because they’re tied to real events, market structure quirks, or policy moves.

- Public conversations with notable builders: Regular interactions with Bitcoin developers, entrepreneurs, and policy voices help surface trustworthy context fast.

- Event presence and community roots: He’s been active at major Bitcoin gatherings over the years, including the “Magical Crypto” crowd’s events—useful for understanding where his network comes from.

- Early warnings that age well: Custodial risk, too-good-to-be-true yields, and exchange opacity—recurring themes that proved costly for many who ignored them.

Is WhalePanda anonymous, biased, or sponsored?

Pseudonymous, not a ghost. He uses a handle, but he’s not hiding in the shadows. He’s appeared on stages and panels for years. That said, you won’t find a glossy corporate bio. I treat that as standard in Bitcoin culture where privacy is a feature, not a bug.

Bias: Expect a Bitcoin-first perspective. That means skepticism of most altcoins, preference for self-custody, and a tendency to push back on marketing-heavy narratives. None of that is hidden; it’s part of the value proposition. Remember: everyone in crypto has a stack and a worldview. The key is knowing it.

Sponsorships and affiliations: I don’t see him acting like a billboard, but it’s smart to maintain a default posture of “assume interests exist.” If any post looks promotional, I scan for:

- Disclosure tags: #ad, “sponsored,” or explicit partner language.

- Affiliate breadcrumbs: Discount codes, shortened URLs that redirect, or vanity links.

- Unusual enthusiasm: If the tone shifts into pure hype without balanced caveats, I pause and verify elsewhere.

That checklist isn’t just for him—it’s how I weigh any influencer’s post. Social platforms reward engagement, not accuracy, and that creates incentives you should always factor in.

Why people follow him

- Clear, fast reactions to big news: He’s quick during market-moving events, but usually anchors to primary sources and reputable announcements.

- Reliable BS detector: He’s comfortable saying “nope” when narratives don’t add up. That saves time—and sometimes capital.

- Network effects: By engaging with credible devs, policy folks, and veteran traders, he helps surface strong voices and bury noise.

- Memes that inform: It’s easier to remember a take when it’s funny; it’s useful when it’s also right.

Here’s why this mix works: attention drives outcomes in crypto. Studies have shown that social media attention correlates with short-term price moves, which is exactly when you need steady filters and source-first thinking. His combination of speed and skepticism helps you avoid the trap of acting on the loudest headline in your feed.

So the real question is: what exactly shows up on his timeline day to day—news, memes, warnings, market color—and how do you surface the good stuff fast? Let’s break that down next.

What does WhalePanda post about on X?

If you scroll WhalePanda’s feed for five minutes, you’ll notice a clear pattern: Bitcoin-first commentary, fast reactions to policy news, and a steady stream of scam warnings, security tips, and memes that cut through industry nonsense. It’s not a signals feed. It’s a blunt filter for what matters, delivered with a wink and sometimes a flamethrower.

“Trust, but verify.” In crypto, that’s not a cliché—it’s survival.

Here’s the texture of his posts and how to make them work for you.

Posting style and frequency

The tone is direct, often spicy, and rarely hedged. When markets move or a big headline hits, expect activity to spike—quotes, reposts, and short, punchy takes that set expectations fast. During normal days, you’ll see a steady cadence of posts, mostly centered on Bitcoin, policy battles, and red flags in altcoin marketing.

- During market-moving events: He’s quick. ETF headlines, exchange outages, major hacks—expect fast, opinionated reactions and curation of credible sources.

- Format: Short posts, quote-posts for context, occasional threads when a topic needs receipts; memes for emphasis and to call out hype.

- Practical tip: Tap the bell on his profile and set notifications to “Highlights” during volatile weeks so you don’t get overwhelmed.

There’s a reason this style works: X has become a breaking-news feed for crypto. A recent Pew Research brief shows a large share of users consume news directly on social platforms. That speed is useful—but it also means you should validate before you act.

Topics you’ll see the most

- Bitcoin advocacy and policy: Strong support for Bitcoin’s design and self-custody. Expect takes on ETFs, mining narratives, and regulatory pressure in the U.S. and EU. You’ll see praise for sensible policy and pushback when regulators grandstand.

- Security and custody best practices: Self-custody over convenience, skepticism toward custodial “features” that add attack surface, and reminders to verify wallets, firmware, and domains.

- Exchange risk and transparency: Flags on withdrawal pauses, unusual proof-of-reserve claims, or PR that doesn’t match on-chain reality. You’ll often get a “slow down, verify” nudge when rumors fly.

- Scam and shill warnings: Call-outs on airdrop phishing, reply-guy wallets, and altcoin marketing stunts aiming for engagement over substance.

- Market sentiment and memes: Sarcasm as a filter. Memes to puncture hype cycles and remind you not to chase green candles.

- Industry drama (with a purpose): Not for gossip, but to surface where incentives are misaligned—VC lockups, exchange listings, or “innovations” that quietly reintroduce trusted third parties.

This mix is valuable, but remember: fast takes can still be wrong. A well-known MIT/Science study found that false news spreads faster than true news on social platforms. Treat early posts—his and everyone else’s—as provisional until confirmed.

Interactions and network effects

You’ll see him engage with Bitcoin builders, security researchers, policy analysts, and market data folks. That matters because his replies and quote-posts act like a curated discovery feed. Click through and you’ll find accounts that consistently add signal:

- Builders and security: Wallet devs, open-source contributors, and researchers who publish post-mortems after exploits.

- Policy and markets: Analysts who track ETF flows, stablecoin bills, and exchange data with receipts.

- Skeptics with receipts: People who fact-check charts, chase contract addresses, or call out copy-trade cartels.

Use this to your advantage:

- When he quote-posts someone credible, open that thread and hit “See context”—the replies often contain the missing piece you need.

- Check his Posts vs Replies tabs. Posts give you the headline; replies uncover nuance, sources, and disagreements worth reading.

- Build a mini network from his network. Follow a few names that consistently provide data, not drama.

How to find his best posts

X’s search is your edge. Surface the high-signal stuff in seconds:

- Use advanced search: Advanced Search supports operators that cut noise.

- High-engagement posts: from:WhalePanda min_faves:500

- Bitcoin-only filters: from:WhalePanda bitcoin OR btc

- Regulation watch: from:WhalePanda etf OR sec OR regulation

- Hacks and security: from:WhalePanda hack OR exploit OR custody

- Time-bound review: from:WhalePanda since:2023-01-01 until:2024-12-31

- Media-only: from:WhalePanda filter:media (great for charts, screenshots, event clips)

- Pinned + Media tabs: Check his pinned post for timely context. Then open the Media tab to find charts, conference clips, and receipts that don’t show in text-only scans.

- Save searches: On X Pro (TweetDeck), set columns for from:WhalePanda with different keywords like “withdrawals,” “ETF,” or “phishing.” You’ll catch early mentions that regular timelines bury.

- Quote-post recon: When he quote-posts a claim, tap through to the original source and check if it links to an official domain or on-chain data. If not, file it as “unconfirmed.”

One more emotional checkpoint—because it matters: when a post triggers excitement or fear, pause. Ask, “What would I need to see to confirm this?” Screenshots can be faked. Links can be spoofed. A 30-second verification habit beats any “alpha” thread.

So the big question: is this the kind of account you follow for actual trades—or for sentiment and risk radar? Let’s sort that out next, including what to expect (and what not to) if you’re hoping for entries and exits.

Should you follow WhalePanda for trading? Expectations and limits

If you’re looking for a signals feed, this isn’t it. WhalePanda’s X account is commentary-first—fast reactions, sharp skepticism, and a solid feel for market and policy risk. That’s useful for traders, but not as a “buy/sell now” tool. I use his posts to sense shifting sentiment, catch early red flags, and prioritize what deserves deeper research. Think of him as a high-signal scanner, not an entry/exit machine.

When he’s early on a concern—an exchange wobble, a regulatory headline, or a too-good-to-be-true yield scheme—it often shows up in price and liquidity later. The key is to treat that as a prompt to verify, not a trigger to market-buy or panic-sell. Social feeds move attention; your edge comes from what you do next.

Is WhalePanda a “Bitcoin maxi”?

In practice, yes—Bitcoin-first, security-first, self-custody-first. That means:

- Skepticism toward most altcoins: He’ll push back on marketing-heavy narratives, exchange tokens, algorithmic “innovation” with hidden risk, and cycles of overpromised tech.

- Self-custody over yield: Custodial promises and “risk-free” returns get side-eyed. Expect consistent reminders about keeping coins off exchanges unless you’re actively trading.

- Bitcoin alignment: You’ll see more on mining economics, fee markets, L2s, monetary policy, and security culture than on speculative new tickers.

“Not your keys, not your coins.”

If you trade alts, this stance won’t feed you setups. But it will sharpen your risk filter—especially when mania is loud and liquidity is thin. I’ve found his skepticism helps me avoid the traps that look hottest right before liquidity disappears.

Track record and accuracy

Social media rewards loud winners and quietly buries misses. That’s survivorship bias 101. A few practical truths to ground your expectations:

- Being early can feel wrong—until it isn’t: Warnings about dodgy incentives or opaque solvency often age well, but the timing rarely lines up with your next trade.

- Narratives drive attention, attention drives volatility: Multiple academic and industry studies show strong links between social activity and short-term crypto volatility and volume. The effect tends to be fast and fleeting; it doesn’t replace a strategy.

- Algorithm glare: X amplifies hot takes. Validate by checking older posts around key events with advanced search. If a claim sounds absolute, look for the nuance in the thread and replies.

Bottom line: treat “accuracy” on X as a mix of thesis, timing, and risk framing—not a scoreboard of perfect calls. Use his feed to stress-test your own views, not to outsource them.

How to extract real value

- Turn on smart notifications: Instead of alerting on every post, set up alerts or saved searches around high-impact terms he frequently comments on: “withdrawals,” “hack,” “exploit,” “SEC,” “ETF,” “liquidity,” “insolvency.”

- Build a curated X List: Add WhalePanda plus policy analysts, security researchers, and reputable BTC devs. This cuts the noise and lets you see context when something breaks.

- Use advanced search like a pro:from:WhalePanda hack, from:WhalePanda withdrawals, from:WhalePanda ETF. You’ll surface older posts fast when you need receipts mid-chaos.

- Mute time-wasters: If you’re here for signal, mute keywords like “airdrop,” “giveaway,” “100x,” or anything that triggers FOMO rather than research.

- Bookmark or screenshot: Save threads that articulate a thesis or risk you want to revisit. I keep a simple folder labeled by topic (exchanges, stablecoins, security, policy) so I can re-check assumptions later.

- Separate signal from execution: His post is the spark; your playbook handles entries, sizing, and stops. That gap is where most people lose money.

Risk reminders

- Trust, then verify: Treat every hot claim as unconfirmed until you see an official statement, an on-chain reference, or a reputable news desk.

- Impostors exist: Always verify the handle: https://x.com/WhalePanda. Ignore DMs about giveaways, private groups, or trading bots—100% of those are scams.

- Beware reply-bait links: Never connect a wallet from a random reply. If a link looks urgent, it’s usually engineered to make you skip checks.

- Hype is not liquidity: A viral thread can’t fill your exit. Check order books, spreads, and funding before acting on anything with momentum.

- Protect your setup: Use hardware wallets for long-term holdings, app-based 2FA (not SMS), and a separate “degen” machine or browser profile for testing unknown sites.

- Slow is smooth, smooth is fast: If a trade only works when you rush, it probably doesn’t work.

Curious where this stance came from—and which high-profile warnings earned him trust (and which didn’t)? The next part walks through the moments that shaped his reputation. Ready to see which calls aged like wine and which… didn’t?

Notable moments, controversies, and takes that shaped his reputation

I’ve watched his feed through every wild turn of the market. A few moments stand out because they show what he gets right, where he rubs people the wrong way, and why his profile carries weight when the noise hits maximum.

The 2017 fork wars. During the Bitcoin Cash and SegWit2x drama, he planted a clear flag: protect Bitcoin’s consensus and decentralization, push back on corporate pressure, and don’t frame miners or exchanges as the final arbiters. That stance won him credibility with Bitcoin-first followers and still defines how people read his posts today—skeptical of shortcuts, fiercely against narrative manipulation.

The ICO comedown (2018–2020). When retail was buying every whitepaper, he kept saying most ICOs were vapor with marketing budgets. The years that followed—SEC actions, dead tokens, refund drama—validated the skepticism. Think about the legal hits to big-name token sales (Kik, Telegram) and how regulators framed “decentralization” claims. His tone wasn’t warm, but it was useful.

“Not your keys” and exchange risk (2019–2022). Long before high-profile collapses, he hammered a simple idea: if someone else holds your coins, you’re holding a promise, not Bitcoin. Quadriga, Celsius, and then FTX turned that mantra into cold reality for a lot of people. He wasn’t alone in warning about it, but he was unrelenting, and it shaped how his audience treats custody today.

Yield skepticism and algorithmic stablecoins. He questioned “risk-free” yields and algo-stables well before Terra/UST exploded. That wasn’t a niche take—many Bitcoiners were loud on this—but his consistency matters. When 20% APY collapsed into a smoking crater, those earlier warnings aged well.

Ledger Recover backlash (2023). When Ledger rolled out a firmware feature that touched self-custody nerves, he sided with users who wanted transparent threat models and fewer trust assumptions. He wasn’t subtle about it. The pushback forced clarifications from Ledger and turned into a useful industry-wide debate on UX vs. sovereignty.

ETF-era realism (2024). He championed Bitcoin while rolling eyes at the “ETF solves everything” takes. He treated the spot ETF approvals as a big win—without pretending it changed Bitcoin’s first principles. When altcoin ETF hopium popped up, he stayed consistent: don’t confuse attention with durable adoption.

“In crypto, skepticism isn’t cynicism — it’s self-defense.”

Calls that aged well vs misses

Everyone’s feed has hits and misses. What matters is whether the wins came from sound principles and whether the misses teach you something.

- Aged well: Standing against 2017’s fork pressure; warning on ICOs before enforcement landed; repeating “self-custody or regret” before exchange failures; calling out yield theater and algorithmic stablecoins; pushing back on influencer-led altcoin marketing cycles.

- Mixed or timing-challenged: A hard Bitcoin-first lens can make him early—or too early—on some “this won’t end well” takes. If you traded against momentum based on that alone, you could’ve missed big rallies. Likewise, general skepticism toward certain stablecoins or exchanges sometimes sounded like “danger now” when risks were more slow-burn. The lesson: use his posts to size risk, not to front-run the market.

That balance is why I treat his feed like radar, not autopilot. Signal? Yes. Entries and exits? That’s on me.

Ads, affiliations, and disclosures

He’s blunt, but that doesn’t mean bias disappears. On X, sponsorships are a minefield—subtle, inconsistent, and sometimes absent. Here’s how I read the tea leaves to weigh commentary fairly:

- Language tells: Look for words like “partner,” “sponsored,” “ad,” “ambassador,” or “supporting.” Some posts use softer phrasing like “proud to back” or “friends at [company].” That still matters.

- Links that track: Ref codes, shorteners, and UTM tags (for example, “?ref=”, “?affid=”) often imply commercial intent. I treat those as a nudge to double-check incentives.

- Event and network ties: If he’s boosting a conference, tool, or podcast appearance, I assume relationships exist. That’s not bad—just context for your filter.

- Consistency test: When a take aligns with his long-term stance (Bitcoin-first, self-custody, anti-scam) I weigh it more. When it’s outside that lane and includes links or codes, I slow down and cross-check.

Bottom line: disclosures on X are uneven across the board. Read posts with curiosity, not devotion.

Red flags on crypto X (general)

The fastest way to lose money is to trust the wrong screen. I use a few simple rules so I don’t get trapped by scams wearing familiar avatars.

- Reply-guy drainers: Bots in replies promising airdrops, refunds, or “official support” that require you to connect a wallet. Don’t. Many wallet-drainer kits abuse token approvals with deceptively named signatures.

- Cloned profiles: Handles with swapped letters (l vs I), recent creation dates, tiny follower counts, or a blue check used as a costume. Always verify the real handle: https://x.com/WhalePanda.

- Giveaway bait: “Retweet + send 0.1 BTC to receive 0.2 BTC.” This is the oldest trick in the book. Real accounts don’t ask you to send funds to “verify.”

- Fake urgency: “First 500 wallets,” “closes in 10 minutes,” “claim now.” Urgency is used to bypass your common sense.

- Phishing links: Domains that mimic wallets, exchanges, or explorers with a single character off. Bookmark official domains and use them from your own list, not replies.

- Deepfake and screen-cap scams: Polished videos or doctored screenshots “confirming” partnerships or returns. An MIT study on Twitter showed falsehoods spread faster and further than truth—speed is not your friend when verification is slow.

Studies consistently show that deception travels faster on social media than corrections. The only antidote is a system you stick to: verify the handle, verify the domain, and never connect a wallet from a reply. If a post makes your heart rate jump, that’s your cue to stop.

Strong opinions are useful, but position sizing is merciful. Want to see the exact alerts and filters I use so I catch the good stuff and skip the traps? In the next section, I’ll show you my setup step-by-step—so you get the signal without absorbing the stress.

How I use WhalePanda’s account in my research workflow

I keep my X workflow simple, fast, and objective. I want early signals without noise or bias. WhalePanda is on my shortlist because he’s quick on market-moving news and blunt about risk. Here’s exactly how I fold his feed into my day.

My practical setup

- Two Lists on X:

- Bitcoin Policy & Regulation: lawmakers, ETF analysts, Coin Center, and a few journalists. This turns his posts about policy/regulation into a quick “what’s actually changing” scan.

- Security & Custody: wallet devs, researchers, and incident responders. When he flags scams or custody mistakes, I cross-check with this list for remediation steps.

- X Pro (TweetDeck) columns:

- Search column for high-impact terms tied to his account:

from:WhalePanda (ETF OR SEC OR approval OR denial) -is:retweetfrom:WhalePanda (exploit OR hack OR "exchange halt" OR withdrawal) -is:retweetfrom:WhalePanda (custody OR multisig OR "self-custody") -is:retweetfrom:WhalePanda min_faves:500 -is:reply(helps surface posts that resonated widely)

- User column for All tweets from @WhalePanda with alerts on. I don’t rely on algorithmic timelines when markets move.

- Search column for high-impact terms tied to his account:

- Saved searches: for follow-ups and context:

(from:WhalePanda) (SEC OR ETF) (since:2024-01-01)(from:WhalePanda) ("self custody" OR multisig OR hardware) -is:retweet

- Muted words and phrases: stops bait from draining attention:

- giveaway, airdrop, 100x, presale, free mint, DM for VIP, signal group

- Bookmarks + screenshots: if he posts a smart custody thread or a sharp warning, I bookmark it and screenshot key charts to a “Crypto Notes” folder. That way, I’m not scrolling later to find it.

My rule: use social for discovery, not decisions. Find the smoke, then confirm the fire.

Cross-checking before acting

When a post could impact money or security, I run a quick, repeatable checklist. This takes minutes and saves headaches.

- Official source first: if it’s ETF or policy news, I look for a press release or filing on sec.gov. For exchange issues, I check the exchange’s status page or corporate account, not screenshots.

- Secondary confirmation: at least one reputable desk or analyst covering that domain. For ETF chatter, I check specialist analysts; for exploits, I look for confirmations from security researchers or incident trackers.

- On-chain or market data: for Bitcoin network health or exchange flows, I glance at free dashboards (e.g., mempool congestion on mempool.space) and spot-volume/liquidity on my terminals.

- Time buffer: I add a cooling-off period for anything trade-related. Hype is a tax. A 15–30 minute buffer eliminates most knee-jerk mistakes.

This “trust, but verify” habit isn’t paranoia—it’s data-backed sanity. Academic work has shown that social feeds can nudge short-term returns and volatility through sentiment and herding. A few examples worth knowing:

- Bollen, Mao, Zeng (2011) found Twitter mood can predict market moves in traditional assets.

- Kristoufek (2013) showed attention/social signals correlate with Bitcoin price dynamics.

- Mai et al. (2018) documented how social media signals link to crypto returns and liquidity.

Translation: strong voices can move attention—and attention moves price. That’s why I separate information intake from execution.

Complementary voices

I keep a balanced bench so I don’t get trapped in one lane of thinking. This makes WhalePanda’s posts more useful, not less.

- Security: wallet devs and incident responders for real-time exploit breakdowns and practical fixes.

- Policy/Regulation: advocacy orgs like Coin Center and a handful of legal analysts to parse bills and enforcement actions.

- Bitcoin infrastructure: node and Lightning builders who post updates on releases, network issues, and best practices.

- Market microstructure: analysts tracking ETF flows, liquidity pockets, and derivatives positioning.

When WhalePanda raises a red flag, these voices help me validate quickly: is it noise, or a structural risk worth acting on?

What I avoid

- Engagement bait: “Like/RT for $500” replies, wallet-drainer links, and “DM me for alpha.” If the value was real, it wouldn’t be in the replies.

- Ratio wars: I don’t waste cycles on drama. If a take doesn’t change my risk or my process, it’s a scroll.

- “Buy now” urgency: instant-action language without verifiable substance is an auto-mute. If it’s legit, it will still be legit in 30 minutes.

- Unverified screenshots: I treat every image as suspect until I can find the source post or site.

I also keep a small “Decision Log.” If WhalePanda highlights a potential risk (say, withdrawal delays at a venue), I note the time, my checks, and the action (or non-action). This stops hindsight bias from rewriting history and keeps me honest about what actually helped.

Want the straight answers to the questions people ask most—Is he legit, does he share signals, and how do you dodge impostors while squeezing real value from his feed? Keep going; that’s exactly what I’m tackling next.

FAQ and Final Verdict on Following WhalePanda

Is WhalePanda legit and worth following?

Yes. He’s a long-standing Bitcoin voice with a sharp BS radar. I follow him for fast read-throughs on Bitcoin news, regulatory shifts, exchange risk chatter, and security-minded takes. He’s not a trade-signal account, and you shouldn’t treat him like one.

What will you actually get from his feed?

- Bitcoin-first commentary: Clear stance, minimal fluff.

- Policy and regulation: Quick alerts and blunt context on headlines that actually matter.

- Risk flags: Early warnings on exchange drama, shady narratives, or obvious grifts.

- Security reminders: Self-custody and “don’t get phished” mantras you’ll be glad you saw.

- Memes with signal: Humor that often nails market mood or exposes hype.

Does he post signals, entries, or exits?

No. Think of his feed as sentiment and risk context. If you trade, it’s on you to set entries/exits and validate with data. I treat his posts as a starting point for research, not the final word.

How to avoid scams and impostors

- Check the handle: Only follow https://x.com/WhalePanda. Scammers love tiny character swaps.

- Don’t trust DMs: Real accounts don’t reach out about giveaways, refunds, “support,” or “surprise airdrops.”

- Verify links: Open official domains directly in your browser. Never click “claim” links from replies.

- Never connect your wallet: Random reply links = wallet drainers. Don’t do it, even “just to check.”

- Use X search to confirm: In the search bar, type from:WhalePanda + your keyword. If you don’t see it from the real handle, assume fake.

For context: a Science (MIT) study found false news spreads faster than the truth on social platforms, and Chainalysis has reported billions flowing to crypto scams in recent years. Your best protection is slow clicking and strict URL hygiene.

Is he biased?

He’s Bitcoin-first. That means strong skepticism toward most altcoin marketing, exchanges that play games with user funds, and narratives that smell like cash grabs. If you want altcoin cheerleading, you won’t find it here.

Who benefits most from following him?

- Bitcoin-forward readers who like blunt commentary and quick signal.

- Security-conscious users who value custody reminders and scam warnings.

- News-focused traders/investors who want sentiment context and early risk notices (while doing their own execution work).

Who probably won’t like it?

- If you want high-frequency trade calls or “buy now” prompts.

- If you prefer soft language over direct critiques.

- If you mainly want altcoin promotion.

How do I get the most value with minimal noise?

- Turn on notifications only for major market hours or when volatility spikes.

- Bookmark key threads that summarize policy shifts or security tips.

- Mute bait terms that waste your time (e.g., “airdrop,” “double your BTC”).

What if I disagree with him?

Perfectly fine. Use disagreement as a prompt to research. Check primary sources (company blogs, filings, dev repos) and corroborate with reputable desks. The goal isn’t to “win” arguments; it’s to make better decisions.

Use social media to source questions, not answers.

Quick answers to common questions

- Is he credible? Yes, long-time presence with consistent Bitcoin ethos.

- Does he post trades? No. Consider it a commentary and risk-awareness feed.

- Can I learn security basics? Yes—expect frequent self-custody and scam-avoidance reminders.

- Is the tone spicy? Sometimes. That’s part of the filter—strong takes, low tolerance for hype.

- Is following enough? No. Always pair with primary sources and your own rules.

Final Verdict

Follow WhalePanda if you want concise, Bitcoin-first commentary, early flags on industry nonsense, and a feed that won’t spoon-feed trades. Keep your research tight, your links verified, and your wallets disconnected from random replies. Do that, and you’ll get real value without getting caught in the hype machine.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.