Cameron Winklevoss Review

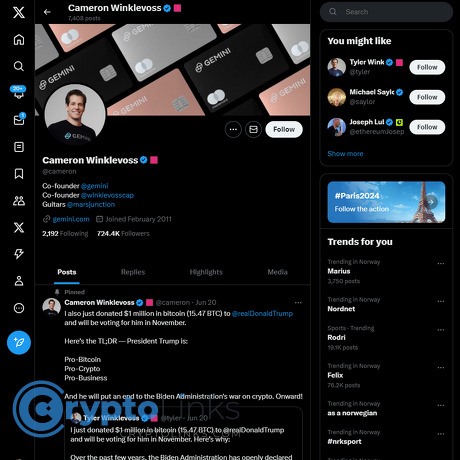

Cameron Winklevoss

x.com

Cameron Winklevoss on X — Is @cameron Worth Your Follow If You Care About Bitcoin?

Wondering if following @cameron actually helps you make better crypto decisions—or just adds to the noise?

You’re not alone. Crypto X is a firehose. Big names talk loud, incentives hide in plain sight, and the algorithm rewards drama. Cameron Winklevoss is one of the loudest voices: early Bitcoiner, cofounder of Gemini, and a regular presence during major market moments. His feed can be high-signal—but only if you read it right.

In this guide, I’ll show you exactly what you’ll get from following @cameron, when to trust it, and how to turn his posts into real value—without getting caught in hype.

The problem: Crypto X is noisy, fast, and incentive-heavy

Here’s why it’s hard to tell what’s useful on your feed:

- Velocity beats accuracy: False or exaggerated claims spread faster than truth on social platforms, especially during breaking news. Research in Science (MIT) found false news travels wider and faster than true news on Twitter.

- Sentiment moves markets: Social buzz can amplify volatility in crypto. A PLOS ONE study showed feedback loops between social signals and Bitcoin price dynamics.

- Conflicts are everywhere: Founders, exchanges, and investors are talking their book. That doesn’t make their insights useless—but you need a filter.

Cameron’s account fits this pattern. He posts sharp takes on Bitcoin, regulation, and industry milestones. He also promotes Gemini and takes hard positions during disputes. The trick is learning to separate operator insight from brand narrative.

The promise: a simple way to read @cameron like a pro

I keep this straight-forward and practical. You’ll get:

- What he actually posts (themes, cadence, tone)

- Where he’s strong vs where bias shows

- How I verify key claims quickly and cleanly

- Smart-follow tactics to turn his feed into signal for traders, long-term investors, and builders

Goal: Use @cameron to sharpen your thesis and catch real market structure signals—without letting one account steer your decisions.

How I review crypto accounts (so you know the lens)

I score and analyze accounts on:

- Transparency: Are incentives and conflicts clear?

- Track record: Do public calls age well? Are receipts easy to check?

- Conflicts: Is there exchange, token, or fund exposure?

- Educational value: Are posts helpful for learning, not just reacting?

- Signal frequency: How often do posts contain actionable info vs. marketing?

- Usefulness by reader type: Traders, builders, policy watchers each need different things—does the feed serve them?

What you’ll get from this guide

- Context that matters: quick bio and why his background shapes his feed

- What to expect: core themes, cadence, and tone

- Real examples: the kind of posts that are worth your time

- Credibility check: strengths, blind spots, and a fast verification workflow

- Smart-follow playbook: lists, alerts, and how to interpret market-moving tweets

- FAQ: quick answers to common questions people actually ask

Why Cameron’s feed can be useful—if you frame it right

- Operator lens: He’s an exchange cofounder. Expect clear views on custody, security, ETFs, and market plumbing.

- Bitcoin-first framing: You’ll see strong conviction on BTC’s monetary role and macro narratives.

- Policy focus: He’s vocal during regulatory flashpoints and major U.S. policy events.

…and why it’s also tricky

- Brand alignment: Posts often support Gemini’s positioning. That’s normal—but it’s a bias.

- Dispute-era tone: During industry conflicts, threads can turn combative. That’s when you need extra verification.

- Selective emphasis: Expect more airtime for Bitcoin milestones than competing networks.

Expect references to big news (ETFs, halving cycles, major enforcement moves), occasional open letters during disputes, and policy commentary aimed at lawmakers and crypto voters. You’ll also see Gemini product updates and security/custody talking points woven into the narrative. The value is there—you just have to label each post for what it is.

What I’ll cover next (so you can read his feed with confidence)

I’ll map his background to his posting style, including how the Gemini Earn and DCG/Genesis saga shaped his tone on X, where he stands on regulation, and how that affects what you should expect from @cameron.

Ready to get the fast context that makes his feed click? In the next section, I’ll answer a simple question: who is Cameron Winklevoss to crypto readers—and why does that history matter when you’re reading his posts?

Who is Cameron Winklevoss (for crypto readers)

Cameron Winklevoss is one half of the Winklevoss twins and a long-time Bitcoiner who helped bring crypto into the mainstream through Gemini, the New York–regulated exchange he co-founded with Tyler. His earlier role in the ConnectU/Facebook story still shapes how people react to him online, but in crypto he’s best known for being early, loud, and focused on building within a compliant framework.

“Bitcoin is Gold 2.0.” — Cameron Winklevoss, on X

If you’re thinking, “Okay, but what does that past actually mean for his voice on X?”—stay with me. The backstory matters more than you might think.

From Harvard to Bitcoin

The arc is clear and unusually public:

- Harvard/ConnectU: Cameron co-founded ConnectU with Tyler and Divya Narendra. The dispute with Facebook’s founders led to a settlement that became early venture firepower. Background: ConnectU, Cameron Winklevoss.

- Early BTC: With capital from prior wins, the twins reportedly built a large Bitcoin position in the 2012–2013 window, planting their flag as believers before it was fashionable.

- Gemini: They launched Gemini (founded 2014, launched 2015) as a New York trust company, leaning hard into compliance and custody—the “buttoned-up” counterpoint to wildcat crypto operations.

That path—lawsuits, settlement, disciplined building—creates a posture you’ll feel in his posts: assertive, legal-aware, and unapologetically pro-Bitcoin.

Gemini, Earn, and the DCG/Genesis saga

This chapter defines a lot of Cameron’s tone on X and explains why you’ll see open letters, not just market takes.

- What Earn was: Gemini’s Earn program let users lend crypto to Genesis Global Capital (a Digital Currency Group subsidiary) for yield. Gemini acted as the on-ramp/agent; Genesis took borrower risk.

- Freeze and fallout: On Nov 16, 2022, Genesis paused withdrawals after the FTX shock. Earn customers were stuck. In Jan 2023, Genesis filed for Chapter 11.

- Open letters and public pressure: Cameron posted very public letters to DCG CEO Barry Silbert, pushing for a resolution and alleging serious issues. Example: Open Letter to Barry Silbert. If you see a combative thread from him, this is the context.

- Regulatory actions: The SEC charged Gemini and Genesis in Jan 2023 over the unregistered offering of Earn; press release: SEC (2023-7). The New York Attorney General later sued multiple parties in Oct 2023.

- 2024 recovery progress: In 2024, the bankruptcy court approved a Genesis liquidation plan aiming to return assets in kind. Gemini shared updates indicating substantial distributions to Earn users—because assets were returned in crypto, many saw recoveries benefit from BTC/ETH price appreciation. Court docs and Gemini updates spell this out; see Gemini’s blog and the bankruptcy docket for details.

Why this matters for how you read his feed: when customer funds are trapped, leaders get louder. Cameron’s posts in this period weren’t just hot takes—they were part of a public negotiation to get users paid. Expect strong language when he thinks customer protections or fair dealing are at stake.

Political and regulatory stance

Cameron leans into policy—not as a hobby, but because it directly shapes custody, market access, and product design.

- Pro-clarity, pro-innovation: He pushes for clear rules over enforcement-by-press-release. You’ll see support for pragmatic frameworks and sharp criticism when regulation feels arbitrary.

- ETF milestone advocate: He championed the spot Bitcoin ETF effort and publicly celebrated the Jan 2024 approvals, framing them as a mainstreaming moment for BTC market structure.

- Elections and alliances: He’s signaled support for pro-crypto policymakers and candidates (including headline-grabbing 2024 donations). That political positioning shows up in how he amplifies legislative news and scorecards.

- NYDFS-first ethos: Gemini’s roots as a New York trust company are core to his message: security, audits, and compliance aren’t optional—they’re the product.

There’s a reason for this emphasis. Social attention around crypto policy can move flows and price. A decade of research connects online sentiment and market action—see early work like Kristoufek (2013) on attention and Bitcoin dynamics and Garcia et al. (2014) on social bursts and price swings. When Cameron hammers a policy theme, he’s not just talking ideals; he’s aiming at real market impact.

What this background means for his X content

Once you know the story, the feed makes sense:

- Bitcoin-first narratives: Expect BTC as the reference asset, the monetary standard, and the long-term winner.

- Operator lens: Security, custody, compliance, market plumbing—these aren’t side notes; they’re front and center.

- Brand-aligned messaging: Gemini updates and positioning will appear. That’s not a flaw; it’s a known bias. Read with that filter on.

- Escalation during disputes: Open letters, receipts, and hard lines when user funds or rule-of-law issues are involved.

If you’ve ever wondered why he goes from calm macro takes to courtroom energy in a single week—it’s usually because a legal or creditor milestone just hit.

Cameron vs. Tyler: style differences that matter

Both twins are aligned, but they play different instruments.

- Cameron: Longer threads, public letters, direct challenges to counterparties, and sweeping macro framing. He often sets the narrative and keeps receipts.

- Tyler: Punchier one-liners, sharper sarcasm, and quick-hit commentary on markets and policy. He tends to amplify and sharpen the angle Cameron set.

- Why you should care: Following both gives you the “press conference” (Cameron) and the “headline/market pulse” (Tyler). Seen together, you’ll spot coordinated themes vs. personal emphasis.

Reputation baggage and how it colors replies

The Facebook-era story still shadows the replies under Cameron’s posts. Some readers project that conflict narrative onto every crypto take. It’s useful to separate that noise from actual operator signal. When the comments get emotional, I look for external references in the thread—court filings, regulator releases, or independent analytics—to ground the discussion.

“People don’t follow accounts. They follow a story that proves something about their world.” Cameron’s story is conviction, regulation, and pressure when needed. If you read him through that lens, his feed becomes predictable—in a good way.

So now that you’ve got the context, here’s the real question: when you open @cameron on a random Tuesday, what exactly do you see—what themes, how often, and how much is signal versus promo? Let’s break that down next so you can decide if the follow is worth a notification or just a list add.

What you actually see on @cameron: themes, cadence, tone

If your feed is a battlefield of hot takes, Cameron’s X stream is the general with a megaphone: Bitcoin-first, policy-aware, and timed around real market moments. Expect conviction over caveats—and learn to read the context.

“Strong opinions can be useful — as long as you check the receipts.”

Core themes

- Bitcoin adoption and cycles: Halving narratives, “digital gold” framing, and long-horizon price thesis. Around the April 2024 halving, you’ll see posts that tie scarcity to macro demand and institutional flows.

- ETF milestones: Celebratory, high-energy commentary when the spot Bitcoin ETFs were approved (Jan 2024) and on days with strong inflow prints. Expect takes like “mainstream rails are here,” often paired with a bigger story about legitimacy.

- U.S. policy and regulation: Reactions to SEC/CFTC moves, Congress hearings, and court decisions (e.g., the Grayscale win in Aug 2023). He threads together narrative and policy stakes, calling out what it means for Bitcoin on-ramps.

- Exchange-operator lens: Updates that spotlight Gemini’s security, compliance, and product distribution—especially during high-trust or high-fear cycles.

- Security/custody: Cold storage, audits, and institutional-grade custody positioning. Less “how-to” content, more “why security matters” framing during contagion headlines.

- Macro tie-ins: Inflation, rates, U.S. fiscal trajectory—used as backdrop for a Bitcoin thesis. Think short, shareable one-liners that connect fiat risk to BTC adoption.

Cadence and format

- Frequency: Moderate. A few posts a week on quiet weeks; bursts around big news (ETF approvals, court rulings, halving, regulatory actions).

- Formats:

- One-liners: Quick macro/Bitcoin takes designed to be quoted.

- Threads: Policy interpretations, “what this means” breakdowns, industry warnings.

- Open letters: Public pressure plays during disputes (e.g., DCG/Genesis saga) with links or screenshots. These are rare but agenda-setting.

- Timing: Often U.S. business hours and event-aligned (morning after major filings, right after court orders, post-FOMC). If you care about market structure, set alerts on those days.

Signal vs self-promo

Both show up. The trick is tagging each post in seconds so you don’t overreact.

- Likely signal:

- Reacts to new primary developments: SEC orders, court rulings, ETF flow data, on-chain events (halving).

- Threads that explain “what changes now” for policy or market access.

- Posts that link to non-Gemini sources (filings, government sites, reputable analytics).

- Likely promo:

- Links to gemini.com or blog.gemini.com with product highlights or brand milestones.

- Security/compliance flexing on days competitors are under stress.

10‑second tagging trick: If it contains a non-Gemini filing/chart → treat as “signal”; if it’s a product link → “promo”; if it’s a one-liner on macro → “narrative” (useful for thesis, not timing).

Best-of examples to watch for

- Policy reactions that simplify chaos: After big cases (e.g., Grayscale’s court win), you’ll see “what this unlocks” takes that frame access and precedent. These tend to travel widely and shape sentiment.

- Cycle calls around halving and ETFs: Posts that sequence “institutional rails + scarcity + macro tailwinds” as the backbone of a BTC supercycle thesis. Great for positioning, not scalp entries.

- Fast-moving news summaries: When agencies, courts, or Congress move, he’s quick with the “so what.” Screenshot these for your notes and compare with primary docs later.

Pro tip: Use X search filters to surface his high-signal posts quickly:

from:cameron ETF,

from:cameron open letter,

from:cameron halving.

Engagement and sentiment

- Engagement spikes on structural news—ETF approval days, halving week, big court rulings. Expect 10x+ likes and reposts vs baseline.

- Tone: Confident when celebrating Bitcoin milestones; combative when defending users or calling out policy overreach. During disputes, expect sharper language and open-letter energy.

Why it matters: Multiple studies suggest high-profile crypto tweets correlate with short-term volume and volatility surges—especially during news shocks. See, for example, research on social media’s impact on crypto markets on SSRN and empirical work on attention-driven price effects in digital assets on ScienceDirect. In practice: engagement isn’t proof, but it’s a good “attention proxy.”

How often he cites sources, uses charts, and who he amplifies

- Sources: During policy cycles, you’ll often see links to primary materials (court PDFs, SEC pages) or reputable news. On narrative posts, links are rarer.

- Charts: Infrequent. He prefers clean text and screenshots over chart threads. When charts appear, they’re usually ETF flow tables or institutional-access visuals.

- Amplification: Skews toward policy voices (pro-crypto lawmakers, regulatory news) and major institutions bringing capital to Bitcoin. Less airtime for builders in alt ecosystems; more for Bitcoin infra and market structure.

Format tells you intent

- One-liner: Narrative setting. Good for thesis reinforcement.

- Thread: Persuasion or interpretation. Good for “what changes now.”

- Open letter: Pressure campaign. Read as advocacy with stakes.

Timing patterns you can use

- Before/after regulatory windows: Expect posts around ETF decision days, court decisions, and Congressional hearings.

- Macro moments: FOMC days, CPI prints, and halving week—he’ll tie Bitcoin to the macro narrative.

- Crisis-response: If a large player stumbles, look for security/compliance positioning within hours.

One last thing to keep in mind: attention moves markets faster than fundamentals on X-time. Are his high‑conviction takes your green light—or your reminder to check the paperwork first? Keep reading, because the next section separates strengths from blind spots and shows how to verify his claims in minutes.

Credibility check: strengths, blind spots, and how to verify

“Strong opinions are fine. Unverified opinions are expensive.”

Where he’s strong

There’s real signal in his feed if you know what to look for.

- Operator insight: He speaks like someone who runs an exchange. Expect thoughtful notes on custody, banking rails, market structure, and security standards. When he talks SOC 2 audits or cold storage, that’s his wheelhouse. For context, Gemini’s security/compliance summaries are public (see Gemini Security).

- Early-Bitcoiner context: He frames events through multi-cycle experience—halvings, liquidity cycles, institutional adoption. These takes often help you zoom out during noise-heavy weeks.

- Policy awareness: He reacts quickly to enforcement actions, ETF milestones, and Congressional/agency signals—useful for timing your own research sprints.

- Direct line to industry players: Public letters and open disputes draw attention from the biggest desks and journalists. You’ll see information surface in reply threads that won’t show up in the average crypto account.

Where bias shows

This is where you keep your guard up.

- Exchange-first framing: Posts about custody, market structure, and user protection often align with Gemini’s model. That’s not bad—it’s just a lens.

- Bitcoin-first narrative: Expect heavy Bitcoin emphasis. Competing L1s/L2s and alt narratives get less airtime and nuance.

- Legal disputes = higher spin risk: During the Genesis/DCG saga, threads were understandably forceful. When reputations and users’ funds are on the line, rhetoric heats up and nuance can drop. Example coverage of his Jan 2023 open letter: Reuters.

Track record and receipts

Here are a few categories where his posts aged well—or needed context.

- ETF milestones: He consistently argued the spot Bitcoin ETF was inevitable and net-positive for market structure. That aligned with reality. The SEC approved spot BTC ETPs in Jan 2024 (see the SEC statement). Pair his commentary with hard data: daily creations/redemptions and net flows via Farside Investors ETF flow tracker or Bloomberg ETF dashboards.

- Halving + supply schedule: His “hard cap matters” posts are consistent with Bitcoin’s issuance math. For factual checks, use issuance/realized cap metrics on Coin Metrics State of the Network or live issuance data at mempool.space. Post-2024 halving supply trends matched the mechanical reduction narrative, even if short-term price action wobbled.

- DCG/Genesis conflict: He sounded the alarm early and kept pressure on. It took longer than his tone sometimes suggested, but core claims of misalignment and losses were validated by multiple actions and filings. For neutral reference points, check the NY Attorney General’s updates (e.g., NYAG press release on Genesis settlement) and case dockets via CourtListener.

Pro tip: Keep your own “receipts board.” A simple spreadsheet with columns for date, claim, source link, your verification notes, and a 30/90/180-day follow-up can turn a fast feed into compounding insight.

How I validate his claims

Here’s the exact workflow I use to turn a hot take into something investable—or discard it.

- File it: Bookmark the post and copy the text to a note with the timestamp and any attached documents.

- Primary sources first: If it references policy or ETFs, check SEC EDGAR and official SEC statements. For legal matters, pull court documents via CourtListener (free RECAP mirrors) before reading takes.

- On-chain and market data: Confirm claims with neutral dashboards: issuance, fees, active addresses (Coin Metrics, Glassnode), and ETF fund flows (Farside, issuers’ pages). For Bitcoin network status, use explorers like mempool.space.

- Independent researchers: Look for confirmation or rebuttals from analysts with a track record (ETF specialists, policy attorneys, security researchers). Avoid threads that only echo his stance.

- Context window: Snapshot competing explanations. Is this structural, cyclical, or just narrative? Write one sentence for each and see which survives the next week of data.

Red flags to watch

When I see these, I slow down and verify twice.

- Emotion-forward threads: High emotion often equals low nuance. Treat forceful language as a prompt to read filings, not as a conclusion.

- Selective metrics: If a post cherry-picks one chart (e.g., only price or only addresses), add at least two corroborating metrics from independent sources before acting.

- Binary framing of complex rivals: If a competing network or product is painted as all-bad, seek a measured counterpoint from a credible builder or researcher in that ecosystem.

- Timeline certainty: Strong claims with tight timelines—especially around legal outcomes—tend to slip. Anchor on process, not dates.

A quick reader checklist before you act on any post

- What’s the claim in one sentence? What would make it false?

- Is there a conflict of interest (exchange, product, portfolio)? Note it up front.

- Do I have at least two primary sources or datasets that support it?

- Is my response a trade, a thesis update, or just awareness? Label it.

- What’s the invalidation rule and the date I will revisit this?

- Have I read a credible opposing view yet?

Reading tone vs signal

His advocacy often comes through as urgency. That’s powerful for motivation, risky for execution. Use the passion to find the thread—and the paperwork to test it.

Ask yourself: “If this post vanished tomorrow, what evidence would still make the idea stand on its own?”

Want the exact setup I use to turn posts like his into clean, low-drama research—and share them with a team without creating an echo chamber? Keep going; the workflow is next.

Make his account work for you: practical tactics

Set it up right

I want signal fast, without getting trapped in the replies. Here’s the setup I use so @cameron is high-signal and low-noise.

- Build a “Policy + Macro” List: Put @cameron in a private X List with policy analysts, ETF experts, and macro calendars. One column, one purpose.

- Turn on notifications, but only for event days: Enable alerts during catalysts like CPI, FOMC, and ETF deadlines. Use:

- BLS CPI release schedule

- FOMC calendar

- SEC actions and rule changes

- Filter replies and set quality thresholds: In X search, use operators like from:cameron -is:reply or from:cameron min_faves:500 to surface only high-signal posts.

- Mute common noise: Add mute phrases for bait and off-topic drama. Keep the focus on BTC, policy, custody, and exchange rail news.

- Pin a “verify before act” reminder: A tiny friction—one pinned note that says “Primary source or it doesn’t exist.” You’d be surprised how many mistakes that saves.

“Strong opinions are fine. Strong evidence is better.”

Research workflow

When @cameron posts something market-relevant, I run a quick, repeatable loop. Speed matters, but so does proof.

- Tag by theme in real time: Policy, ETF flows, security/custody, macro, Gemini. I use a simple note or a spreadsheet with columns for Date, Claim, Source Link, Status.

- Log the claim in one sentence: “ETF inflows accelerating” or “Policy headwind easing.” That short line forces clarity.

- Verify with neutral sources:

- ETF flows: Farside Bitcoin ETF flows (fast, clean)

- Primary/regulatory: SEC EDGAR, Federal Register

- On-chain: Glassnode Studio (free tier), Coin Metrics charts, mempool.space for BTC

- Independent dashboards: Dune (search vetted dashboards, not random ones)

- Archive for later judgment: Save the post URL with your verification note. I revisit these monthly to see what actually played out.

Worth noting: research on attention and sentiment shows social media can move short-term crypto behavior, but effects fade fast and are noisy. If you care, browse the evidence yourself: SSRN search: bitcoin twitter sentiment. That’s one more reason to require a primary source before acting.

Interpreting market-moving tweets

Not every high-engagement post is a trade. I bucket what I see into three types and react accordingly:

- Vision: Big-picture takes (e.g., Bitcoin as a monetary standard). Use to shape your long-term thesis, not to time entries.

- Catalyst: Specific events (ETF updates, policy shifts, partnerships). Don’t act until you have the primary source (filing, official announcement, regulator page).

- Evidence: Data-based claims (flows, on-chain movement). Cross-check the exact metric and timeframe; beware cherry-picked windows.

My guardrails keep me honest:

- The 2-source rule: I need at least one independent source that doesn’t rely on the same upstream rumor.

- Timing discipline: If I didn’t plan a trade before the tweet, I don’t place one because of the tweet.

- Pre-written invalidations: Before any position, I define what would prove the idea wrong (price level, time window, or missing confirmation).

Portfolio and risk mindset

I love the rush when a big post hits, but I refuse to let a single voice steer my book. Here’s the simple guardrail set I use:

- Balance with opposites: Pair Cameron’s Bitcoin-first stance with credible skeptics and neutral data feeds. Bias is fine; monoculture is not.

- Cap idea exposure: Pre-commit maximum allocation for any one narrative. If a post triggers FOMO, that cap saves you from over-sizing.

- Journal the impulse: If I feel urgency, I write the trade idea down, wait for one confirmation, then reassess. Most hype fades within hours.

- Separate investing from reacting: Long-term accumulation strategies should not change because of a tweet—only because your thesis or base rates changed.

Complementary accounts to follow

To get the full picture around @cameron, I layer in specialists who either validate or challenge the angle:

- ETF + Market Structure: @JSeyff (James Seyffart), @EricBalchunas

- Policy + Legal: @jchervinsky, @n1ckchong (policy/markets)

- Security + On-chain: @zachxbt, @peckshield

- Bitcoin Engineering: @mattcorallo, @nic__carter (energy/policy takes)

- Data Feeds: @coinmetrics, @glassnode

With this mix, @cameron’s posts slot into a richer context: what’s narrative, what’s a regulatory breadcrumb, what’s measurable today.

SOP for sharing posts with your team (without creating an echo chamber)

This is the simple playbook I use so a hot post becomes knowledge, not groupthink.

- Step 1 — Snapshot: Share the post link in Slack/Telegram with a one-line summary and your initial confidence score (0–100%).

- Step 2 — Source tag: Add one “primary or it’s pending” label with a link to any filings or official pages (SEC, company newsroom, regulator).

- Step 3 — Devil’s advocate: Assign one teammate to argue the bear case or the alternative explanation. Rotate this role to avoid hierarchy bias.

- Step 4 — Decision box: Decide: Track only, Prepare (set alerts/levels), or Act (with pre-written invalidation). No other options allowed.

- Step 5 — Cool-off rule: For anything without a primary source, impose a cooling period (e.g., 30–60 minutes). If it’s real, confirmations arrive.

- Step 6 — Post-mortem in 24–48h: Record what actually happened, update the note, and keep a running “claims that aged well/poorly” board.

Pro tip: sprinkle in structured serendipity. Once a week, force the team to bring one post that contradicts the most popular narrative in your chat. That’s how you stay antifragile when the timeline gets loud.

When a tweet hits like a headline, but you still need a plan

Here’s my fast checklist before I do anything:

- Is this vision or catalyst? Vision = no trade. Catalyst = find the primary source first.

- Is the data repeatable? If it’s a chart, can I rebuild it or find a neutral version?

- What’s my invalidation? If I can’t write it in one sentence, I’m not ready.

- Am I reacting or executing? If it’s the former, I step away for 10 minutes.

If this sounds strict, it is. But strict beats sorry. And if you’re wondering whether he’s actually offering financial advice or just opinionated operator takes, you’ll want the next part—because that’s exactly what I answer in the FAQ. Want the quick version or the nuance?

FAQ: quick answers people actually ask

Is Cameron Winklevoss still bullish on Bitcoin?

Yes—consistently. He frames Bitcoin as the winning monetary network and a long-term store of value. If you follow him, expect recurring takes around the halving, hard money vs fiat, and institutional adoption. On ETF approval week (January 2024), he highlighted it as a structural unlock rather than a short-term trade—useful framing for long-horizon readers.

- Sample moments to watch: Bitcoin halving milestones (April 2024), nation-state narratives (e.g., El Salvador references), and on-ramps like spot ETFs.

- Receipts worth bookmarking: SEC’s official spot Bitcoin ETP approval statements are a neutral reference point you can use alongside his commentary: SEC statement on spot Bitcoin ETPs (Jan 2024).

How often does he post and what’s the tone?

Moderate cadence. Tone is direct, occasionally combative in defense of users/policy positions, and promotional when it aligns with Gemini. During major industry events or disputes, he shifts into longer threads or open letters.

Does he give financial advice?

No. Treat everything as opinion from an operator with clear skin in the game. His posts can shape thesis-building, but they’re not entry signals. If you’re trading, always pair his takes with independent data and a defined invalidation plan.

Do the Winklevoss twins like Mark Zuckerberg?

They had a high-profile 2004 legal battle over Facebook’s origins that settled. It’s rarely relevant to his X feed today and shows up only when media cycles revive the story. If you’re here for crypto signal, this history is background noise.

Is there a conflict of interest?

Yes—Gemini and personal portfolio exposure. That doesn’t nullify the signal; it just means you should separate brand-aligned statements from market-relevant insight. During the DCG/Genesis dispute, for example, he published open letters advocating for Earn users—useful context, but obviously not neutral. For a primary source, see Gemini’s post: Open Letter to Barry Silbert (Gemini).

Cameron vs Tyler on X—any difference?

Cameron tends to push broad narratives and public letters during high-stakes moments. Tyler often echoes key points with his own emphasis and sometimes sharper one-liners. If you follow both, you’ll get redundancy on big items but slightly different tones.

How do I tell if a post is a timely market input or a brand statement?

- Timely market input: Mentions hard data (ETF flows, policy filings, hash rate), references primary sources, frames risk or timing windows, and avoids celebratory slogans.

- Brand statement: Heavily Gemini-centric language, product links, recruiting/marketing tone, or victory laps without actionable context.

- Quick test: If you removed the Gemini context, would the post still help you make a decision or refine a thesis? If yes, it’s likely market-relevant.

Can his tweets move the market?

Direct price impact is usually limited outside major news cycles, but his posts can amplify attention around policy, ETFs, or custody issues—areas that do affect flows and volatility. Academic research has found that social media attention and crypto sentiment correlate with trading volume and price swings, especially in risk-on regimes. The takeaway: treat his account as part of the information flow, not a price trigger.

Does he talk about altcoins?

He’s Bitcoin-first. You’ll see far more about BTC, market structure, custody, and policy than deep altcoin analysis. If you’re hunting alt-specific alpha, this isn’t the feed; use it for macro and infrastructure context instead.

How often does he link sources or share charts?

When the stakes are high—policy decisions, legal disputes, or exchange updates—he often links to primary materials (official letters, filings, blog posts). Charts pop up less frequently than narrative takes. If you need numbers, pair his posts with neutral analytics or filings.

What’s the fastest way to verify a claim he makes?

- 60-second check: Look for a link in the post → scan the primary doc or announcement → cross-check with a neutral outlet (SEC, court filings, reputable analytics).

- For policy/regulation: Prioritize official documents or statements over media summaries.

- For market structure: Confirm with on-chain dashboards or ETF flow trackers before acting.

What’s a good way to read his posts during disputes?

Assume framing. He’ll champion user protection and industry fairness, which is valuable, but it comes from an operator’s vantage point. Read his claims, then check the other party’s filings and third-party legal summaries before you anchor your view.

Any real examples that are useful to watch for?

- ETF milestones: On approval days, look for his framing around what changes structurally (custody access, RIA adoption). Pair it with the SEC’s release and ETF flow data.

- Security/custody: When he stresses proof-of-reserves or custody best practices, note the specifics and compare to industry standards.

- Policy reactions: He’ll often post right after major rulings or enforcement actions. Treat these as “heads-up” signals to review primary texts the same day.

Pro tip: If a post feels urgent but lacks sources, archive it, set a reminder, and revisit once primary docs land. Patience beats impulse.

Bottom line for expectations

Expect steady Bitcoin conviction, clear policy stances, and high engagement on big news—plus promotional posts when it aligns with Gemini’s goals. If you can tag each post as “market input” or “brand,” you’ll extract value without bias creep.

Want a simple setup to turn that into a daily workflow without adding noise? That’s exactly what I’m breaking down next—alerts, lists, and a dead-simple verification loop you can run in minutes. Ready to make this practical?

Next steps and how to get the most from this guide

Follow @cameron with intention. Treat his posts as fuel for your thesis and research—not as trade triggers. Here’s a tight setup that turns his feed into real signal without adding stress to your day.

Quick recap

- What you’ll see: Bitcoin-first narratives, policy and market structure takes, and Gemini updates.

- Why it’s useful: Operator-level context and early-Bitcoiner perspective during key moments.

- How to read it: Helpful, but not neutral. Always filter through incentives and verify big claims.

Your 10‑minute setup

- Follow + Alerts: Follow @cameron. Turn on notifications for market-critical days (ETF deadlines, CPI/FOMC, halving windows).

- List it: Add him to a “Policy + Macro” List so you separate thesis-building content from trader chatter.

- Saved searches: Use X’s search filters to catch high-signal posts fast:

- from:cameron ETF OR “spot bitcoin”

- from:cameron policy OR regulation OR SEC

- from:cameron Gemini OR custody OR security

- Key calendars in one bookmark folder:

- FOMC calendar and CPI releases

- SEC EDGAR (to verify filings)

- Bitcoin halving countdown

- Gemini status (for operational updates)

The verification habit (fast SOP)

- Classify the post: Is it a policy alert, market framing, company update, or narrative?

- Find a primary source: Filing, hearing agenda, court doc, on-chain data, or an official status page.

- Log it: Save the link, date, and the exact claim in your notes (Notion/Sheets works fine).

- Cross-check: One independent analytics source (e.g., mempool.space for BTC network data, an ETF flow tracker, or a neutral newswire).

- Set a timer: Wait 15–30 minutes before reacting. Social attention often spikes volatility in the short term; letting the first wave pass usually improves decisions.

Read his posts like a pro

- Policy alert: If he flags regulatory moves or ETF milestones, check the underlying doc or docket. Example: when he references SEC activity, go straight to EDGAR or the Commission’s notices.

- Market framing: Use it to shape thesis, not entries. If he talks halving impact or macro tailwinds, note it for your next portfolio review.

- Company update: Validate with Gemini status or official blog posts. Treat platform updates as operational context, not immediate catalysts.

- Open letters / disputes: These are negotiation tools. Read them to understand positions and timelines, then seek court filings or settlement docs for facts.

Team sharing without echo chambers

When you share a post internally, use a simple format that encourages thinking, not cheering.

Summary: One line on what’s being claimed

Primary source: Link to filing/doc

Independent check: Link to a neutral dataset/article

Implications: What changes if true? What if not?

Action: Observe / Research / Prepare / Execute

Quarterly claim check

- Keep a short ledger: Track 5–10 notable claims per quarter with dates and outcomes.

- Score for yourself: Which posts were actionable? Which were narrative-only? What aged well?

- Tune your filters: If policy alerts are most useful for you, set alerts only for those keywords and mute the rest.

When to act vs when to observe

- Act (research immediately): New filings, hard dates, status changes, or credible policy news with a source.

- Observe (log, don’t move): Macro predictions, victory laps, and brand positioning.

- Skip (noisy replies): Engagement bait, unverified screenshots, and out-of-context charts.

Common traps to avoid

- Single-voice bias: Don’t anchor your portfolio to one account—no matter how early or influential.

- Attention =/= truth: High engagement often follows bold takes. Verify first, act later.

- Timing confusion: A correct idea can still be early. Separate “directionally right” from “tradeable now.”

- Selective metrics: If a post highlights one metric (TVL, flows, hash rate), check at least one counter-metric before deciding.

Save, share, and keep score

Bookmark this page. Share the checklist with your team. Keep a single running note of claims to revisit each quarter—it’s the easiest way to improve your signal-to-noise over time.

Bottom line

If you care about Bitcoin, his feed is worth a follow—as long as you read it like a pro. Set alerts for the right days, verify big claims, and balance his takes with independent data. I’ll keep tracking high‑signal crypto accounts on cryptolinks.com so you always know who’s worth your time—and how to use them smartly.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.