Barry Silbert Review

Barry Silbert

x.com

Barry Silbert Review Guide: Everything You Need to Know + FAQ

Ever wondered if tracking Barry Silbert actually gives you an edge in crypto—or if it’s just noise?

I’m going to make this simple, clear, and practical so you can decide what to track, what to ignore, and how to use his updates without getting caught up in hype.

You’ll get a straight-shot overview of who Barry is, what company he owns, how Grayscale fits in, what his new Yuma venture is about, and the signals I watch before making any moves. Stick around for a tight FAQ at the end.

The problems most readers face

Barry’s name pops up in headlines, in X threads, and anytime Bitcoin ETFs or AI+crypto are trending. That’s where the confusion starts:

- What does he actually own? People mix up DCG, Grayscale, and other affiliated brands.

- Is Grayscale “his fund?” It sits under the DCG umbrella, but that doesn’t mean every product decision equals a personal bet.

- What happened with Genesis? The lending fallout created a lot of headlines that still echo today.

- What’s “Yuma” and why is everyone mentioning Bittensor (TAO)? He’s linked to a new AI+crypto angle that’s getting attention—especially from builders who want open, decentralized AI rails.

The result: a messy stream of hot takes where important signals get lost. That’s risky. There’s research showing that attention and sentiment can move crypto markets in the short term—great for awareness, dangerous for impulse decisions. For example, studies on investor attention and Bitcoin have found meaningful links between online interest and volatility (see SSRN: Investor Attention and Bitcoin Returns and Kristoufek’s Google Trends–Bitcoin analysis). Translation: headlines can move prices, but not always for the right reasons.

The promise: one page, clear answers

Here’s my approach:

- Map the entities: what DCG is, where Grayscale sits, and why that structure matters.

- Spot the real signals: filings, flows, leadership changes—not just tweets.

- Track the new angle: Yuma’s focus on Bittensor (TAO) and what that could mean for AI+crypto.

- Balance it out: big wins and hard lessons so you don’t follow any single personality off a cliff.

I’ll keep this guide grounded in what actually moves markets—not just what’s trending on your feed.

Who this guide is for

- Investors who want useful context without spending hours parsing rumors.

- Builders who care where capital, talent, and narratives are shifting—especially around ETFs and decentralized AI.

- Curious readers who want a clean map of “who owns what” and where to follow the right updates.

What you’ll learn

- Quick profile: why Barry Silbert’s decisions tend to ripple through crypto cycles.

- DCG and Grayscale in plain English: how they connect and what to watch.

- New company, new focus: Yuma’s link to Bittensor (TAO) and the AI+crypto thesis.

- How to read his X activity: what’s signal vs. noise.

- Key controversies in context: why they matter for risk management.

- My checklist for staying updated: the exact places and metrics I monitor so you don’t chase headlines.

Ready for the fast snapshot that ties this together? Up next, I’ll share who Barry Silbert is, the story that got him here, and why people actually care—so you can see the bigger picture before making any moves.

Who is Barry Silbert? Snapshot, story, and why people care

If you’ve been around crypto long enough, you’ve felt Barry Silbert’s fingerprints on the market. He’s the founder of Digital Currency Group (DCG) and the force behind Grayscale—two engines that helped bring Bitcoin from a fringe idea to something institutions can actually buy, hold, and report.

Before crypto, he built SecondMarket, a platform for trading private company shares and other illiquid assets. That company was acquired in a deal that helped form Nasdaq Private Market in 2015—the same year he launched DCG. In other words: he’s been building market plumbing for a long time.

Why do people care? Because his decisions tend to echo. When Grayscale’s Bitcoin product (what became GBTC) opened the door for traditional investors, it didn’t just enable exposure—it shaped the narrative that Bitcoin is a legitimate macro asset. When he shines a light on a new theme, attention—and often liquidity—follows.

“Attention is a form of capital. Where leaders look, liquidity often follows.”

He also plays the long game. Through multiple cycles—2013, 2017, 2021—he’s been a constant presence: investing, building, and, yes, taking hits along the way. That resilience is part of why markets watch him.

Fast facts I keep in mind

- Founder & CEO of Digital Currency Group (DCG), a major holding and investment company in crypto.

- Grayscale’s early champion—its Bitcoin vehicle attracted institutions long before spot ETFs existed.

- Market builder at heart: previously founded SecondMarket, an early marketplace for illiquid assets.

- Long-time Bitcoin advocate with a track record spanning multiple bull/bear cycles.

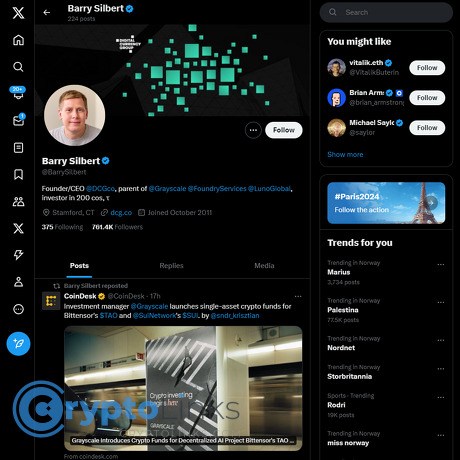

- Active voice on X: I track him at https://x.com/BarrySilbert.

- Backer of crypto infrastructure via DCG’s portfolio—exchanges, custody, analytics, and developer tooling.

Why he matters in crypto cycles

I watch Barry because his world touches three levers that drive crypto markets:

- Access: Grayscale’s vehicles gave institutions a simple way to get Bitcoin exposure. That changes who can buy and when they can buy. When spot Bitcoin ETFs launched in early 2024, multi‑billion-dollar flows (tracked by Bloomberg and CoinShares) reminded everyone how access products can move narrative and liquidity—GBTC outflows, competing ETF inflows, yet net positive attention on BTC.

- Narrative: Leadership doesn’t just allocate capital; it allocates attention. When he leans into a theme—Bitcoin as digital gold, or the AI+crypto crossover—builders, funds, and media tend to look in the same direction. Academic work on ETFs and flows has shown that investment vehicles can influence underlying asset prices and volatility; crypto is no exception when narrative and access collide.

- Timing: He’s a cycle veteran. The combination of product design, regulatory timing, and communication can amplify or cushion moves. For example, the long push to convert GBTC into a spot ETF shaped years of market chatter and set expectations institutions could act within a traditional wrapper.

In plain terms: Barry’s choices can affect who gets in, how they get in, and what story they believe they’re buying. That’s why I track him closely—especially during inflection points.

Curious how his companies actually fit together—what he owns directly, where Grayscale sits, and what’s under the DCG umbrella?

What company does Barry Silbert own? DCG, Grayscale, and the umbrella

If you’ve ever felt lost trying to separate Barry Silbert the person from the companies tied to his name, you’re not alone. The clean version: he founded and leads Digital Currency Group (DCG). Under that umbrella, Grayscale grew into one of the biggest digital asset managers in the world. Different entities, different roles—but the market often reacts to them as one signal. That’s where smart tracking starts.

“In crypto, structure beats story. Know who owns what, and you’ll understand why the market moves.”

DCG at a glance

DCG is a holding company for crypto businesses and a prolific investor across the industry. Think of it as an operating and investment hub: it builds, buys, and backs companies that sit across the crypto stack—markets, infrastructure, custody, mining, data, and wallets.

- What it is: A parent company (founded by Barry Silbert) that owns and incubates businesses, and holds a large venture portfolio.

- What it does: Launches subsidiaries and invests in external teams across early to growth stages. The mandate has always been “infrastructure first.”

- Examples you’ll recognize:

- Grayscale — the asset manager (more below).

- Foundry — mining and infrastructure services; its pool has frequently ranked at or near the top by hashrate share during peak cycles.

- Luno — a retail crypto exchange historically under DCG’s umbrella.

- Media history: CoinDesk was long associated with DCG before being sold to Bullish in 2023. You’ll still see headlines connect the two because of that legacy.

- Why it matters: DCG’s portfolio and operating choices shape liquidity, narratives, and sometimes policy conversations. When a DCG business changes fees, products, or leadership, markets listen.

When I map influence, I don’t just watch DCG’s logo slide; I look at where its subsidiaries touch flows (asset products), block production (mining), and information (media/data). That triangle is where sentiment gets set.

Grayscale’s role under DCG

Grayscale is the DCG subsidiary most people feel in their portfolios—because it’s about products and flows. Its flagship vehicles, historically the Bitcoin Trust (GBTC) and Ethereum Trust (ETHE), brought institutions and RIAs into crypto exposure at scale. In January 2024, GBTC converted to a spot Bitcoin ETF in the U.S., a watershed moment that turned fee schedules and daily creations/redemptions into market-moving news.

- Why it moves markets:

- Flows are the loudest signal. Net spot BTC ETF flows, including GBTC redemptions vs. peer inflows, have shown strong short-term correlation with Bitcoin’s price action. Analysts at firms like CoinShares track this weekly in their Digital Asset Fund Flows reports.

- Fees and product design matter. Changes to expense ratios, creation/redemption mechanics, or rules around staking (for ETH products) can shift assets and sentiment fast.

- Headline risk is real. A new filing, an approval, or a leadership change at Grayscale can nudge institutions and algorithmic flows the same day.

- What I watch in practice:

- Daily ETF flow dashboards from reputable data providers and issuers.

- Grayscale product updates (filings, fee changes, conversions) on grayscale.com and through their press releases.

- Relative positioning versus competitors—are assets rotating out of GBTC to lower-fee peers, or stabilizing?

Real example: after GBTC’s ETF conversion in early 2024, heavy redemptions weighed on net flows while competing spot ETFs attracted inflows. That tug-of-war was visible in price. Later, when aggregate net ETF flows flipped positive, Bitcoin’s momentum followed. It wasn’t a mystery—just mechanics.

Other history you’ll see referenced

To decode headlines, a few legacy pieces help:

- Genesis (the lending arm): A DCG-affiliated lender that ran into severe counterparty risk after the 2022 contagion. It filed for bankruptcy in 2023, triggering lawsuits, regulatory actions, and long-running creditor negotiations into 2024. When you see “Genesis” in the news, it’s usually about repayments, settlements, or restructuring—not DCG’s ongoing operating companies.

- CoinDesk (media): Historically under DCG, later sold to Bullish in 2023. You’ll still see “DCG/CoinDesk” paired in retrospectives because CoinDesk broke major stories during the 2022–2023 unwind and previously shared the parent.

- GBTC discount-to-NAV saga: Before ETF approval, GBTC traded at a persistent discount, which influenced trading strategies, balance sheets, and yes—some of the stress in the lending market. When the ETF conversion unlocked redemptions, that discount closed, but it also unleashed pent-up supply. That context explains a lot of the 2024 flow dynamics.

I keep emotions in check by anchoring to the org chart. Who owns the product? Who controls the fees and filings? Who carries the balance sheet risk? Answer those three, and the noise fades.

So here’s the question that’s got my attention now: if DCG and Grayscale already command so much market power, why is Barry pouring energy into a brand-new venture—and why is it centered on Bittensor (TAO)? Let’s look at the next chapter.

What is Barry Silbert’s new company? Yuma, Bittensor, and the AI+crypto link

Here’s the fast answer: as Fortune reported, Barry Silbert launched a new company called Yuma that is focused on the Bittensor (TAO) ecosystem. He’s even said it’s the most excited he’s been since Bitcoin. That’s not a small claim—especially from someone who helped push crypto into the institutional era.

“This is the most excited I’ve been since Bitcoin.” — Barry Silbert, on his new Bittensor-focused venture (source: X)

Why does that matter? Because it signals a serious bet on the open AI networks thesis—where model building, inference, and data markets are coordinated by incentives on-chain, not by a single company’s API limits.

Why Bittensor (TAO) is on his radar

Bittensor is an open network that rewards useful AI work with its native token, TAO. Think of it as a marketplace where:

- Miners supply model outputs (e.g., text generation, retrieval, embeddings).

- Validators score those outputs for quality and usefulness.

- Rewards flow on-chain to the best performers, creating a continuous tournament for intelligence.

In practice, that means a small team with GPUs can plug in, produce model outputs, and—if they’re consistently scored well—earn TAO. It’s permissionless, measurable, and global. I like this because it aligns incentives around a scarce resource (good model outputs) without central gatekeepers.

A few reasons builders and investors care:

- Open distribution: No single API bottleneck. Anyone can build on top of a subnet and compete on merit.

- On-chain incentives: Payments and penalties are transparent, making it harder to hide underperforming models.

- Specialized subnets: The network can spin up subnets for different tasks (e.g., language, retrieval, or other modalities), letting quality surface within each niche.

- Composability: Developers can stitch together multiple subnets to build end-to-end AI apps—with pricing and performance visible on-chain.

If you want to go deeper, take a look at overviews from credible research outfits that have been tracking the AI+crypto crossover:

- Binance Research on AI x crypto networks and token-incentivized inference

- Messari coverage of decentralized AI infrastructure and open model markets

- OpenTensor Foundation for the Bittensor network’s core materials and updates

Real-world sample you can visualize: a retrieval-focused subnet posts queries; miners return ranked results; validators compare outputs and score them; emissions tilt toward miners who consistently surface the best answers. That scoring process is the engine that keeps quality improving, and it’s the kind of loop that traditional model marketplaces struggle to enforce at scale.

What Yuma could signal for the market

When someone with Barry’s track record pivots attention, I look for second-order effects. Here’s how I’m reading it:

- AI infra meets crypto infra: Expect movement around validators, staking pools, and tooling that make it easier for teams to participate in Bittensor subnets.

- Builder acceleration: Yuma could incubate projects that sit between enterprises and Bittensor’s raw plumbing—think gateways, data pipelines, and evaluation frameworks.

- New incentive designs: If Yuma helps shape subnet rules or launches service layers, we may see novel reward mechanics for data quality, latency, or reliability.

- Attention shift beyond ETFs: This is a narrative handoff from “financial wrappers” back to “networks that do useful work.” Capital often follows these narrative shifts.

Example scenario I’m watching for: Yuma supports a validator set that rewards latency-sensitive inference. That could pull in a wave of GPU miners chasing TAO yields, push devs to build real-time AI products on top, and create measurable, on-chain SLAs. If that flywheel starts, it’s very different from the slow pace of traditional fund products—it’s product velocity you can actually track on-chain.

Risks I’m not ignoring:

- Gaming the scoring: Any incentive system invites attempts to cheat. Robust validator sets and evaluation design matter.

- Centralization creep: If a few validators/miners dominate, quality can stagnate. Healthy competition is non-negotiable.

- Adoption vs. hype: TAO price action can outpace real usage. I watch on-chain participation and subnet activity, not just charts.

Following the story in real time

If you want signal without the noise, here’s how I track it day to day:

- Barry’s X feed: https://x.com/BarrySilbert

- Fortune Crypto coverage: https://fortune.com/crypto/

- Bittensor official updates: https://x.com/bittensor_ and opentensor.org

- TAO market/overview: CoinGecko: Bittensor (TAO)

- Code and commits: https://github.com/opentensor

Practical tip: set an alert for “TAO” + “subnet” on X, and watch for hiring posts or partnership announcements that mention Yuma. Early team formation signals where value is likely to accrue next—whether that’s validators, data partnerships, or enterprise pilots.

I’m staying close to this because it sits at a powerful intersection: AI demand is exploding, and crypto is the first tooling set that can pay the world to produce intelligence on open rails. The big question now: does this mark another “right-place, right-time” call—or does it carry the same execution risks that tripped up parts of the industry before?

Track record, wins, misses, and the lessons I use

I look at Barry’s history like a trading journal: entries for what worked, what hurt, and what those moments teach. That’s the only way to avoid getting blindsided by headlines or hero worship.

“In bull markets you earn; in bear markets you learn.”

The big wins

1) Building the institutional on-ramp with Grayscale. Long before spot ETFs were reality, the Bitcoin Investment Trust (later GBTC) gave traditional investors a familiar wrapper. That wasn’t just a product; it was narrative infrastructure. It put “Bitcoin exposure” on brokerage screens and in wealth manager decks.

- Measurable impact: Research has shown how GBTC’s premium/discount and flows shaped market structure during 2019–2021, influencing liquidity and sentiment. A good explainer on the premium dynamic: Coin Metrics.

- Brand campaigns that stuck: Grayscale’s “Drop Gold” pushed Bitcoin as a macro hedge years before that framing went mainstream.

2) The court win that unlocked spot ETFs. Grayscale’s legal victory over the SEC in 2023 was a turning point. The court’s decision opened the door to convert GBTC and paved the way for other spot ETFs in early 2024. That wasn’t luck—it was a deliberate, high-stakes strategy.

- Receipts: See Grayscale’s own summary of the ruling and the SEC’s statement acknowledging spot Bitcoin ETP approvals.

- Why it matters: Spot ETFs created clean, regulated pipes for capital. You could literally watch flows update and see the feedback loop with price. A handy tracker I use: Farside’s ETF flow dashboard.

3) Pattern of being early on major themes. From Bitcoin to institutional products—and now the AI + crypto crossover—Barry tends to show up before the crowd. You can scan the kinds of companies DCG backed to get a sense of this “infrastructure-first” instinct: DCG portfolio.

The tough chapters

1) Genesis, counterparty risk, and the cost of opaque lending. Genesis Global Capital, the DCG-linked lender, halted withdrawals after 3AC and FTX collapsed, then filed for bankruptcy in early 2023. It was a harsh reminder that yield comes with hidden pipes and counterparties.

- Timeline anchors: Reuters on the bankruptcy. Later, New York’s Attorney General announced a settlement aimed at returning funds to investors: Reuters coverage (2024).

- The teaching moment: When lending programs blow up, it’s rarely “just one” bad bet. It’s interlocked counterparties, collateral assumptions, and maturity mismatches. If you’ve ever waited on a withdrawal freeze, you know the feeling in your gut.

2) The GBTC premium flipping to a deep discount. For years, investors paid a premium to own GBTC. Then the door slammed shut: the premium evaporated and turned into a steep discount through 2021–2023. Many holders were stuck underwater, discovering the hard way that structure risk is market risk.

- Why it happened: No redemption mechanism and changing demand dynamics. Again, Coin Metrics’ analysis is a solid resource.

- What it taught: If a product can’t create and redeem shares freely, its price can wander far from the underlying asset. That’s fine when it favors you—until it doesn’t.

3) Fees and the new ETF battleground. After GBTC’s conversion to an ETF, higher fees relative to peers triggered sustained outflows as investors rotated to cheaper products. That’s not a moral failing; it’s market gravity.

- Context: See fee comparisons across spot Bitcoin ETFs via Morningstar.

- Reality check: In a commodity-like wrapper, basis points matter—especially for large allocators reporting to committees.

My takeaways for readers

- Separate the person from the product. Charisma isn’t collateral. If you’re considering any product tied to Barry’s orbit (or anyone else’s), evaluate the wrapper: trust vs. ETF vs. on-chain, creation/redemption mechanics, lockups, and who the custodian is.

- Assume counterparty risk exists—even when it’s quiet. Ask: who borrows, who lends, what’s the collateral, what’s the rehypothecation policy, and how fast can redemption halt? If you can’t answer in one paragraph, your risk is higher than you think.

- Watch filings and flows, not vibes. SEC filings, sponsor updates, and ETF flow trackers tell you where capital is moving. When flows accelerate, narratives suddenly “make sense.”

- Price can look wrong longer than you can stay stubborn. The GBTC discount punished anyone who assumed “it must revert soon.” If a structure has no native arbitrage, discounts and premiums can persist.

- Fees are gravity. A 50–100 bps gap may sound trivial until you annualize it on a 7-figure position. Products with higher fees need a clear edge to justify the drag.

- Transparency beats promises. Prefer products with clear attestations, audited financials, and, where applicable, public holdings or third-party verification. “Trust, but verify” isn’t cynicism—it’s survival.

- New narratives, old rules. Whether it’s AI + crypto or Bitcoin ETFs, the same checklist applies: incentives, issuance, governance, custody, and liquidity. Curiosity is great; position size is better.

If you held GBTC at a -40% discount, or waited months for a lending withdrawal, you already know why these rules exist. The wins were real—and so were the scars. The edge comes from treating both with equal respect.

Want the exact signals I monitor to avoid the noise and catch the real moves—filings, flow flips, leadership changes, and on-chain tells? I’ll show you the simple system I use next. Which one matters most this quarter, and how can you track it in five minutes a week?

How I track Barry Silbert (and how you can too)

I keep a clean, repeatable system so I don’t get whiplash from every headline or tweet. Here’s the exact approach I use to track Barry’s moves, filter noise, and react only when the signal is strong.

Signals that actually matter

Product filings and launches

Why it matters: SEC filings and official product updates are hard catalysts. For anything Grayscale-related, watch S-1s (issuers) and 19b-4s (exchanges) for ETFs and any new trust conversions or share class tweaks.

Example: When GBTC converted to a spot ETF in early 2024, monitoring daily creations/redemptions gave an early read on market tone. I now treat filings as “priority alerts” because they tend to precede narrative waves.

Fund flows

Why it matters: Persistent inflows/outflows can pressure price because of creation/redemption mechanics and sentiment feedback. Multiple research notes (including working papers on SSRN) have shown that flows and liquidity shocks are tied to short-term crypto volatility.

How I use it: I check spot Bitcoin ETF flows and compare them with price/volume. If flows diverge from price, I size risk more carefully instead of trusting the headline move.

Leadership changes and org signals

Why it matters: New leadership often means new fees, new distribution, or a different go-to-market. Hiring surges in BD, legal, or engineering usually preface product pushes.

What I look for: CEO/board announcements, job postings tied to ETF operations or new asset coverage, and changes in custody partners.

Major partnerships

Why it matters: Custody, market making, index providers, and data partners can reshape product economics and accessibility. These deals tend to show up in press rooms and service provider blogs before they hit mainstream crypto media.

On-chain activity tied to relevant networks (especially TAO)

Why it matters: For the AI+crypto angle, I track Bittensor’s developer activity, subnet participation, emissions, and validator health. If Barry talks TAO and I see builder momentum and healthy network metrics, that’s a stronger signal than a hot thread on X.

What he actually posts on X

Why it matters: It’s not the meme—it's the timing and emphasis. I note recurring themes (Bitcoin macro, ETF structure, AI+crypto) and then check if filings, flow data, or hiring back them up.

Evidence check: Peer-reviewed and working-paper research has repeatedly linked social media sentiment to short-term crypto volatility. Treat it like a spark, not the fuel.

Rule of thumb: A tweet is a hint. A filing is a move. Flows confirm or contradict the story.

Where to look without wasting time

His account on X: https://x.com/BarrySilbert

Pro tip: Build a tight X List with Barry, DCG, Grayscale, and core Bittensor contributors. Turn on alerts only for the List to avoid endless pings.

Official press rooms and blogs

DCG: dcg.co • Grayscale: grayscale.com

What I scan: product changes, fee updates, custody notes, and partnership announcements. I keep a note of anything that could alter flows or access.

Filings and approvals

SEC EDGAR search: sec.gov/edgar

What to watch: S-1s for issuers, 19b-4s for exchange rule changes, and any updated risk language that hints at future product scope.

ETF flow dashboards

I use Farside for a quick daily snapshot of spot BTC ETF flows, then compare with price and volume. If flows heat up but price stalls, I tread carefully.

Developer and network health (TAO)

Bittensor GitHub: github.com/opentensor/bittensor

What I check: commit velocity, open issues, releases, and any core repo discussions that suggest protocol-level changes. Pair that with activity from subnet operators and validator chatter in public channels.

Credible news and regulatory reporting

I cross-check big stories with primary sources. If a headline claims “new product,” I look for the filing. If it touts “big partnership,” I want a press release on both companies’ sites. Saves hours of back-and-forth.

Hiring boards and leadership updates

Public job boards and LinkedIn company pages can tip a hand—look for roles in ETF ops, compliance, market structure, or AI/ML engineering. That’s often the smoke before the fire.

My 90-second weekly routine

- Monday: Check ETF flows and any fresh SEC filings (S-1, 19b-4).

- Midweek: Scan DCG/Grayscale press rooms + job boards for structural changes.

- Friday: Skim Barry’s X for themes; cross-check with GitHub activity on Bittensor (commits, releases) and any TAO ecosystem updates.

- Monthly: Review fees, AUM shifts, and any custody/provider changes that could affect product competitiveness.

Simple filter I use: If I can’t tie a headline to a filing, a flow, a hire, code, or a contract, it stays in the “interesting, not actionable” bucket.

Helpful links and deep reads

- Curated resources I keep bookmarked

- Forbes search: Barry Silbert profile and company overview

- Fortune coverage: Yuma and Bittensor

- SEC EDGAR company/filing search

- Farside spot BTC ETF flows

- Bittensor core GitHub

- SSRN search: crypto + Twitter sentiment studies

One last tip: set two tiers of alerts—Tier 1 for filings, flows, and official announcements; Tier 2 for X posts and media stories. You’ll cut 80% of the noise and still catch the moves that matter.

Wondering which alerts I keep on at all times and which I mute? I’ll answer that in the quick FAQ next—plus a couple of “don’t-get-burned” checks you can copy in under a minute.

Barry Silbert FAQ and quick wrap-up

Quick FAQ

- What company does Barry Silbert own? He’s the founder and CEO of Digital Currency Group (DCG). Under DCG, Grayscale is the asset manager most people associate with him.

- What is Barry Silbert’s new company? Reported by Fortune: Yuma, focused on the Bittensor (TAO) ecosystem.

- How can I follow him directly? His X account: https://x.com/BarrySilbert.

- What’s his connection to Grayscale? Grayscale is a DCG subsidiary; Barry leads DCG. Grayscale has its own leadership and product roadmap.

- Why does his activity move markets? Because decisions and narratives tied to DCG/Grayscale (ETF actions, product changes, flows) shape sentiment and capital rotation. Example: when a U.S. appeals court ruled in favor of Grayscale in Aug 2023, Bitcoin jumped sharply intraday. And when spot Bitcoin ETFs were approved in Jan 2024, GBTC redemptions and broader ETF flows became a daily macro signal for BTC.

There’s a simple reason this attention-sensitivity exists: markets react to visibility. Multiple studies have found that investor attention and social media/search trends correlate with crypto price and volume moves—see, for example, work linking Google Trends and Wikipedia interest with Bitcoin dynamics (PLOS ONE) and early research on Twitter sentiment and Bitcoin price swings (Aalto University).

How to use this info smartly

- Treat personalities as signals, not trade triggers. Attention is a catalyst, not a thesis.

- Verify structures and filings. For Grayscale products, read the prospectus, 8-Ks/10-Qs, and issuer updates—not just headlines.

- Track flows, not just posts. ETF creations/redemptions and trust flows often explain short-term price action better than tweets.

- Size positions to your plan. Cap any “narrative” bet (including TAO/AI-crypto) to a small, predefined slice. No doubling down because an influencer is excited.

- Set a review cadence. Weekly or monthly checkpoints beat chasing every alert.

Rule of thumb: “Follow the filings and the flows; let the feed alert you to what to research next.”

Want a simple next step?

- Follow @BarrySilbert and turn on alerts.

- Add the DCG and Grayscale newsroom pages to your bookmarks for official updates.

- Create a watchlist: BTC, ETH, and TAO (if you’re exploring AI+crypto). Track volume, not just price.

- Set calendar reminders to skim monthly ETF flow summaries and any Grayscale product changes.

- For TAO specifically, scan ecosystem news and repos to separate hype from real network growth.

Conclusion

You now have a clean, practical map of who Barry Silbert is connected to, how DCG and Grayscale fit in, what Yuma signals around Bittensor (TAO), and the exact places to watch for usable signals. I’ll keep tracking the noise-versus-signal here on Cryptolinks.com. Use this as your reference, keep your risk rules tight, and let the data—filings, flows, and real network activity—tell you when it’s time to act.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.