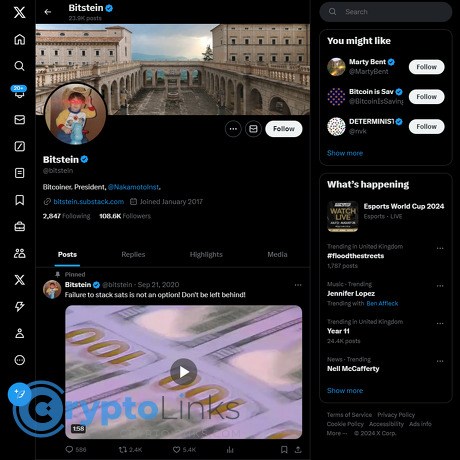

Bitstein Review

Bitstein

x.com

Bitstein on X (Twitter) Review Guide: What You’ll Learn, Why It Matters, and a Quick FAQ

Ever wonder if following @bitstein on X is actually worth your time?

If you care about Bitcoin signal, smart memes with teeth, and links that sharpen your thinking, you’re in the right place. I keep feeds tight and useful, so you don’t waste hours scrolling through noise. In this guide, I’ll show you who Bitstein is, what you’ll get from his feed, and how to set things up so the good stuff hits your screen first. Bonus: I’ll also clear up a surprisingly common mix‑up with “Bilstein” (yes, the car shocks).

The problems: crypto X is noisy, time‑sucking, and full of traps

Let’s be blunt: crypto on X can feel like a casino lobby—loud, distracting, and full of people trying to pull you into the wrong game.

- Too many accounts, not enough signal: The most active users dominate timelines, and it’s easy to mistake volume for wisdom. Pew Research found that the top 10% of users create the majority of tweets—your feed is skewed before you even start.

- Hot takes drown out hard ideas: A well‑known study in Science (Vosoughi, Roy, Aral, 2018) showed false or sensational stories spread faster than true ones on Twitter. In crypto, that effect gets turbocharged by price hype.

- Impostors and phishy links: Lookalike handles, zero‑day accounts, and deceptive links are still common. Chainalysis reports show social‑engineering scams remain a big slice of crypto crime year after year.

- Feed clutter: Even solid accounts can bury your timeline if you don’t organize lists, filters, and notifications properly.

- Real confusion over names: People searching “Bitstein” sometimes mean “Bilstein” (the suspension brand). It’s minor, but it wastes clicks and attention.

If you want to learn, not doom‑scroll, you need a way to filter for signal. That’s where the right follows—and a smart setup—matter.

Promise: a simple, practical way to judge @bitstein and get value fast

Here’s what you’ll get out of this review and how to use it:

- Who @bitstein is and why Bitcoiners keep him in their signal lists

- What he posts day to day—so you know exactly what to expect

- How to catch the good stuff using lists, filters, and notifications

- A quick evaluation framework I use to judge crypto X accounts

- Safety tips to avoid impostors and junk engagement

- Quick FAQ including the funny “Bitstein vs Bilstein” confusion

By the time you’re done, you’ll know if he’s worth a follow and how to set up your feed so it works for you—not the other way around.

What this review covers (and what it doesn’t)

You’ll get practical, hands‑on value without the fluff:

- Included: profile snapshot, key themes, what to expect, who should follow, time‑saving tools, and a clear verdict

- Not included: tribal drama, altcoin hype, or “number go up” cheerleading

“Signal beats volume. If a follow doesn’t make you smarter, it’s a tax on your time.”

Ready to see who @bitstein is and why his feed actually matters? That’s up next—along with a dead‑simple way to avoid impostors and set your X to show signal first. Want a quick peek at the Bilstein confusion too? I’ll make sure you never mix them up again.

Who is @bitstein and why his feed matters

If you’ve ever felt your feed pulling you into flame wars when you just wanted signal, you’ll understand why @bitstein stands out. Michael Goldstein—better known as Bitstein—has been shaping Bitcoin conversations since the early “Bitcoin Twitter” days. He’s a co‑founder of the Nakamoto Institute, the archive many of us treat like a university for cypherpunk and monetary history. That connection matters: when he posts a link, it’s usually a primary source or a piece that has stood the test of time.

There’s also a practical reason his feed matters. Research shows that filtering and structuring information reduces overload and improves decision quality—exactly what good curators do. If you’ve felt the pain of crypto noise, you’re not imagining it. Information overload is real and documented in management and communication studies (see Eppler & Mengis, 2004). A Bitcoin‑only curator who references original texts is the antidote.

"I don’t believe we shall ever have a good money again before we take it out of the hands of government." — F. A. Hayek

That’s the kind of quote he resurfaces at the right moment—not to posture, but to frame why Bitcoin exists in the first place.

Background and credibility

- Early and consistent voice: Active since the formative years of Bitcoin on X, with a long public track record and receipts you can verify.

- Institutional signal: Co‑founded the Nakamoto Institute (2013), home to foundational pieces like Tim May’s Crypto Anarchist Manifesto and Hal Finney’s early emails.

- Bitcoin‑only lens: He sticks to sound money and Bitcoin—no scattershot altcoin commentary. That focus cuts distraction and deepens context.

- Receipts over rhetoric: During contentious moments (think scaling debates or macro shocks), he’s the person who posts the Hayek/Mises passages or Szabo essays that ground the discussion in first principles.

- Builder network: Longstanding interactions with respected Bitcoiners, from cypherpunk historians to protocol educators, which helps surface high‑quality threads and sources.

It’s not about authority for authority’s sake. It’s about a documented habit of pointing back to original works and the economic logic behind Bitcoin—exactly what most feeds miss.

Core themes you’ll see

- Austrian economics: Clear nods to Mises, Hayek, and Rothbard; spot references to knowledge problems, regression theorem, and spontaneous order. Expect links like Hayek’s “Use of Knowledge in Society” and commentary that connects those ideas to Bitcoin’s rules.

- Monetary history: From gold standards to 1971, from Weimar to modern QE—context that keeps price chatter in its place.

- Cypherpunk roots: Privacy, proof‑of‑work, credible neutrality. You’ll often see primary sources such as Nick Szabo’s Shelling Out: The Origins of Money and Trusted Third Parties Are Security Holes.

- Sound money principles: Why strict rules beat discretion, why issuance schedules matter, why fiat incentives distort behavior.

- Memes that teach: Yes, memes—paired with links and summaries that make the lesson stick.

It’s a loop: classic ideas → context → meme → link → your brain, upgraded. That’s the point.

Tone and style: smart, snarky, and sticky

His posts carry wit and a bit of edge, but they’re anchored to ideas, not outrage. Think: a screenshot of a 1970s headline about inflation, a sharp one‑liner about policy incentives, and a link to an essay that explains the mechanism. You get the smile and the source in one scroll.

- Memetic framing with a thesis: Jokes are rarely just jokes; they’re pointers to a concept or a reading list.

- “Receipts” culture: Primary sources, archived essays, original texts—so you can check claims yourself.

- Humor that helps you remember: Meta‑analyses in education show appropriate humor improves learning and recall (Banas et al., 2011). That’s why his memes aren’t fluff—they’re memory hooks.

When a feed makes you laugh and learn in the same breath, you come back. When it also hands you the link that upgrades your thinking, you bookmark it.

So what actually lands in your timeline when you follow him—today, tomorrow, next week? I’ll show you exactly what to expect and how to catch the best posts without getting stuck in the scroll next.

What you actually get by following @bitstein

Here’s the simple truth: my feed gets sharper when I keep @bitstein close. I’m not chasing price candles—I’m collecting mental models, timeless links, and cultural cues that help me spot fluff fast. When headlines scream, his posts remind me to step back and think in decades, not days.

“The curious task of economics is to demonstrate to men how little they really know about what they imagine they can design.”

— F. A. Hayek

Signal highlights

- Classic essays resurfaced at the right time — Expect links that anchor hot news to first principles. Think Nick Szabo’s “Shelling Out”, Satoshi’s emails and forum posts, and Hayek’s “The Use of Knowledge in Society”. These aren’t nostalgia hits; they’re context loaders you’ll use again and again.

- Commentary beyond price action — Instead of “number go up,” you’ll see takes that map news to monetary history, sovereignty, and custody. When people argue about inflation, you’ll often get a pointer to the Cantillon Effect or a resource on time preference. It’s the difference between reacting and understanding.

- Cultural framing that kills weak arguments fast — Smart memes, sharp one-liners, and references that help you smell bad takes in seconds. It’s teaching through culture: funny enough to remember, clear enough to use in your next debate.

Why this matters: social feeds can mislead even careful people. MIT researchers found that false stories spread significantly faster than true ones on social platforms—especially for “novel” topics (MIT study). Curated, historically grounded accounts reduce that risk. And since a large share of people now do catch news on social media (Pew Research), choosing the right sources isn’t optional—it’s your filter against noise.

Value by audience

- Newcomers — A map of what actually matters so you don’t drown in hot takes. You’ll see repeat references to the few essays that keep showing up in serious Bitcoin conversations, which saves months of trial and error.

- Builders — Clear ideological spine. If you’re shipping anything in Bitcoin, the mix of Austrian econ, cypherpunk roots, and security-first thinking helps you make decisions that age well.

- Traders/investors — Macro context without “buy here, sell there.” You’ll pick up mental models—time horizons, monetary regimes, custody risk—that quietly improve your PnL and your sleep.

Real example patterns I keep seeing:

- Banking scare? A link to monetary history or a Satoshi quote about “trustless” settlement.

- Price mania? A reminder post that points to long-term adoption curves and opportunity cost.

- Policy news? A thread that connects incentives, capital controls, and why custody choices matter.

Cadence and how to catch the good stuff

Activity ebbs and flows with the news cycle. When something meaningful breaks, expect high-signal posts and well-timed links. To make sure you actually see them:

- Turn on notifications for 7 days — Let your feed learn what you care about, then dial back if needed.

- Add to a focused List — Keep a “Bitcoin Signal” list and check it when you want quality over chaos.

- Use a quick X search — from:bitstein filter:links surfaces resource posts fast. Batch-read on weekends with bookmarks or a thread reader.

Quick question before we keep going: how do you know if an account actually deserves a spot in your scarce attention budget? I use a simple framework that cuts through hype in under a minute—want to see how @bitstein stacks up against it?

My framework for judging crypto X accounts (and how @bitstein stacks up)

I keep a simple scorecard for any X (Twitter) account in crypto: transparency, originality, consistency, and incentives. One question sits above all of it: does this feed actually teach me something—or just farm engagement?

“If you don’t believe me or don’t get it, I don’t have time to try to convince you, sorry.” — Satoshi Nakamoto

In a space where hot takes travel faster than truth, I want sources that leave breadcrumbs, not just punchlines. Here’s how that lens plays out with @bitstein.

Transparency and skin in the game

Transparent accounts leave a trail you can verify. With @bitstein, you can cross-check positions across years and link them to primary sources. When he makes a point about money or Bitcoin culture, he rarely leaves it floating—he’ll anchor it to something durable like Nick Szabo’s “Shelling Out”, “Trusted Third Parties Are Security Holes”, or other classics hosted at the Nakamoto Institute.

- Receipts: Long public history, a consistent Bitcoin-first stance, and links back to foundational texts. That’s what “skin in the game” looks like on X: your record is visible, and your arguments are traceable.

- Why this matters: A 2018 study in Science found that false news spreads significantly faster than true news on Twitter. Source-backed posts help you resist that dynamic when your feed heats up. Reference: Vosoughi, Roy, Aral (2018).

Emotional check-in: I trust people who put their name next to ideas you can click, read, and argue with. That’s how you learn without getting played.

Original insight vs retweets

I look for accounts that add context, not just boost noise. With @bitstein, the value shows up as original framing and curated classics that hit at the right moments—think a quick meme that distills a monetary principle, paired with a link to a primary source. It sounds simple, but it’s rare.

- Original framing: Memes with a thesis—tying current events back to first principles, not just dunking for likes.

- Curated timing: Resurfacing canonical essays exactly when the timeline forgets them. For example, pointing to Szabo or Satoshi writings when the narrative tilts toward “blockchain, not Bitcoin.”

- RTs done right: When he retweets, it’s usually to amplify a source (a long-form read, a relevant archive, or a sharp primary thread) rather than a pulse-chasing hot take.

There’s a reason this works. Communication research shows we remember ideas better when they’re encoded with images, humor, or stories (dual-coding and narrative effects). In plain English: smart memes stick, and @bitstein leans into that without sacrificing rigor.

Red flags I watch for

- Hidden promos or pay-to-play shills — undisclosed ads, “DM for whitelist,” or miracle threads that end in a referral link.

- Hop-on trends with no expertise — suddenly “covering” a sector for clout after it starts pumping.

- Low-effort outrage — constant dunking with no arguments or sources attached.

Patterns matter more than one-offs. The consistent pattern here: no shill behavior, no opportunistic pivots, minimal outrage farming. When he takes a jab, it’s anchored to an idea, not just a flame.

Scorecard for @bitstein

- Transparency: High. Years of publicly consistent takes, heavy use of primary sources, easy to audit.

- Originality: High. Memetic framing with substance; not an RT machine.

- Consistency: Strong. Bitcoin-only lens that doesn’t wobble with cycles.

- Incentives: Clean. No pay-to-play vibes; content points to education and historical context, not funnels.

What you won’t get: altcoin coverage, trading setups, or “next 100x” threads. What you do get: a feed that makes you think harder about money, culture, and why Bitcoin’s design choices matter.

Ready to turn this into an edge? In the next section, I’ll show you how to spot impostors in seconds, build a tight Bitcoin list, and filter for high-signal posts so you see the good stuff first. Want the exact setup?

Safety and setup: avoid impostors, cut noise, and save time

I want signal without the headaches. Here’s exactly how I set things up so I see the real @bitstein, skip flame wars, and actually learn instead of scroll.

“Your attention is your scarcest coin—spend it where returns compound.”

Verify you’re on the real account

Scammers lean on look‑alike handles and stale RT farms. I do three quick checks before I follow or bookmark:

- Use the direct link: https://x.com/bitstein

- Handle spelling: watch for swaps like bitste1n (number 1), bítstein (accent), or bitsteln (L for i).

- Follower graph: click “Followers” and “Following.” You should see long‑standing Bitcoin voices in common and organic interactions (replies with history, not just fresh accounts spamming “gm”).

- Cross‑links: look for mentions from established Bitcoiners and references to classic resources that match his posting history.

- Timeline test: scroll back a year. Real accounts have consistent themes, not a sudden pivot from giveaways to “macro expert.”

Bonus basic opsec that saves tears: turn on app‑based 2FA (TOTP) in X settings. SIM‑swap thieves live for crypto audiences.

Build a clean Bitcoin list

Lists are the difference between quality and chaos. I treat my list like a reading room, not a party.

- Create a private list: call it “Bitcoin Signal.” Make it private so it stays your space and doesn’t invite drama.

- Add @bitstein and a handful of Bitcoin‑only educators, researchers, and builders you already trust. Keep it under ~40 accounts so it stays sharp.

- Pin the list timeline in your app for one‑tap access when you want substance.

- Weekly pruning: if an account starts posting off‑topic promos, remove it. Lists should evolve as your standards rise.

Why this works: fewer inputs = less context switching. Research on attention (for example, studies by Professor Gloria Mark) shows interruptions can cost about 23 minutes to fully recover focus. Lists save that recovery tax.

Mute and filter like a pro

I’d rather pre‑empt drama than react to it. Mutes and filters let you “design out” the junk.

- Turn on Quality filter: Notifications → Filters → Quality filter ON.

- Mute notifications from accounts you don’t follow and “new accounts” to cut drive‑by spam (same menu).

- Muted words: Settings → Privacy and safety → Mute and block → Muted words. Example set that keeps my Bitcoin feed clean:

- “airdrop”, “giveaway”, “free mint”, “WL spot”

- “follow for follow”, “engagement farm”

- “price target”, “signals group”, “100x soon”

- “NFT drop”, “WL”, “casino”

Set duration to “Forever” and apply to Home timeline and Notifications. - Hide replies with bait: On individual tweets, use “Mute this conversation” the moment you see low‑value pile‑ons.

Save searches that surface his best work

When I’m in learning mode, I don’t want to guess what to read. I use targeted searches that pull up resources, not brawls. Save these:

- Links, no replies:

from:bitstein filter:links -filter:replies - Long‑form and classics:

from:bitstein ("essay" OR "paper" OR "history" OR "Nakamoto Institute") -filter:replies - No retweets, straight originals:

from:bitstein -filter:replies -filter:retweets

Bookmark each search URL in a “Bitcoin Reading” folder in your browser. Two focused sessions a week beats 200 micro‑scrolls.

Handy tools

- Bookmarks (and folders): Save the posts you actually plan to read. If you’re on Premium with bookmark folders, create “To Read,” “Reference,” and “Threads.”

- Thread readers: Use a thread‑to‑readable tool to export longer threads for quiet reading. Always keep the original X link for context.

- Read‑it‑later apps: Tools like Readwise Reader or Omnivore let you clip links from @bitstein, highlight, and resurface notes so ideas stick.

- X Pro (optional): If you have access, make two columns: one for your “Bitcoin Signal” list, one for the saved search from:bitstein filter:links -filter:replies. Zero hunting, all signal.

- Notification batching: Schedule when you allow X notifications (use your phone’s Focus/Scheduled Summary). Protect your deep‑work windows; check the list on your terms.

One last sanity check I use: if a tip, meme, or link doesn’t make me smarter in 30 seconds, I scroll on. Attention is a position too—manage it like capital.

Quick question before we keep going: have you ever searched “Bitstein” and ended up reading about car suspension? You’re not alone—and the next section clears that up fast, plus a few other questions you probably have queued up.

FAQs (including the “Bitstein vs Bilstein” mix‑up)

Is Bitstein the same as Bilstein?

No. Bitstein (Michael Goldstein) is a Bitcoin commentator on X (Twitter). Bilstein is a German automotive suspension brand. Different worlds, similar spelling.

Pro tip: if you meant the Bitcoin guy, it’s Bitstein; if you’re shopping shocks, it’s Bilstein.

Real example: I’ve had readers email me links to “Bilstein B8 reviews” thinking I covered Bitstein threads. If the page has part numbers, spring perch talk, or ride height charts… you’re in car parts territory.

What is the difference between Bilstein B4, B6, and B8?

- B4: OE-style replacement focused on comfort and stock-like behavior. It’s the “freshen up my daily driver” option. Typically maintains factory ride height and compliance. In many applications, B4 uses gas pressure twin-tube (some are monotube).

- B6: Performance “heavy-duty” monotube for cars at factory ride height. Tighter body control and better response without slamming your spine. Great for sporty daily drivers (think GTI, 3-Series, WRX) that still see real roads.

- B8: Shortened monotube tuned for lowered cars. If you’re on lowering springs or a mild drop, B8 keeps travel in the sweet spot and preserves handling. For trucks/SUVs, you’ll also see the B8 5100 family for off-road and mild lift duty.

Why this matters: monotube designs generally dissipate heat better than twin-tube, which helps resist fade during repeated compression cycles (you’ll find this echoed in SAE literature and numerous instrumented tests). Translation: consistent damping when pushed.

Quick sanity checks:

- Stock height + more control? B6.

- Lowered car? B8.

- Just want “like-new” comfort? B4.

Is the Bilstein B8 adjustable?

Ride height: It depends. For many trucks/SUVs, the B8 5100 front “adjustable lift strut” uses multiple snap-ring grooves on the body, letting you raise the spring perch for roughly 0–2.75" of front lift (exact range varies by vehicle). For most car applications, B8 is not height-adjustable—its job is to match lowered springs.

Damping: B8 and 5100 units are generally not user-adjustable for damping. They’re pre-tuned with digressive pistons for a firm, controlled feel.

What is Bilstein PSS?

Bilstein B14 (formerly PSS) is a height-adjustable coilover system. You get threaded bodies to set ride height/stance but no external damping knobs. Typical drop range is model-dependent (often around 30–50 mm). If you want damping clicks, that’s the B16 (PSS10), which adds adjustable damping with multiple settings.

In short: B14 (PSS) = height adjustable only. B16 (PSS10) = height + damping adjustable.

More questions I get about @bitstein

- Does he cover altcoins? No. It’s Bitcoin-only, full stop.

- Is he biased? Yes—toward Bitcoin and sound money. That’s why people follow him.

- Will I learn trading? No signals or setups. You’ll get mental models, history, and frameworks you can apply to your own decisions.

Sample of what I bookmark from him: links to the Nakamoto Institute’s classic essays, threads on monetary history, and memes that actually teach. It’s less “buy/sell now” and more “here’s why this matters.”

Further reading and tools

- Nakamoto Institute archives: foundational cypherpunk and Bitcoin writings he often references.

- Bitcoin history threads: timelines and primary sources to sharpen your priors.

- Thread readers and bookmarking: great for batching learning so you don’t get stuck scrolling.

- Curated Bitcoin book lists: if you prefer deep work over hot takes.

So here’s the real fork in the road: if you want fewer distractions and more durable ideas in your Bitcoin feed, what’s the smartest next move? I’ll show you exactly how I decide—coming up next.

Should you follow @bitstein? My take

If you care about Bitcoin more than crypto noise, yes. I keep him in my rotation because his posts nudge me back to first principles and away from distraction. When timelines get hot with price chatter or trendy narratives, you’ll often see him resurface foundational pieces like Nick Szabo’s Shelling Out or Hayek’s The Use of Knowledge in Society—links that recalibrate your thinking instead of amplifying the hype.

There’s also a practical angle: short, witty posts stick. That’s not just vibes; memory research shows visuals and humor can improve recall (see dual coding and the humor effect). In a feed that moves fast, sticky ideas matter.

Less noise. More signal. Strong opinions, long memory.

Who will love it

- Bitcoin-first thinkers who want context, not coin-of-the-week takes.

- Builders and researchers who appreciate links to primary sources and classic essays.

- Curious learners who enjoy smart memes that actually teach something you’ll remember.

Who might not

- Short-term traders looking for entries, exits, or chart calls.

- General crypto dabblers who want coverage across alt ecosystems.

- Anyone allergic to a Bitcoin-only lens.

Quick next steps

- Follow: https://x.com/bitstein

- Add to a focused List (I name mine “Bitcoin Signal”) so posts don’t get buried. How-to: Twitter Lists

- Turn on notifications for a week; if it’s too chatty, switch to list-only.

- Bookmark a couple of his resource links for weekend reading (e.g., Shelling Out)

Pro tip: batching your reading via Lists reduces cognitive overload compared to raw home feeds—a known UX win (NN/g on cognitive load). You’ll learn more, scroll less.

Bottom line

I follow @bitstein because he tightens my thinking and points to sources that age well. If you want a cleaner Bitcoin signal anchored in history and ideas—not just headlines—he’s an easy add to your X setup.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.