sassal.eth/acc Review

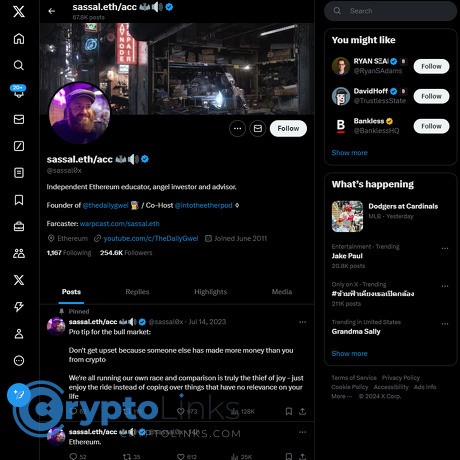

sassal.eth/acc

x.com

sassal.eth/acc and @sassal0x Review & Guide: Your High‑Signal Ethereum Feed on X (FAQ Included)

Ever feel like Ethereum news on X moves faster than you can track—and half of it is noise? Wondering if following sassal.eth/acc and @sassal0x actually helps you learn faster and avoid bad info?

I’ve got you. I use this account as a filter for upgrades, staking, L2s, MEV, governance, and “what really matters” in Ethereum. In this guide, I’ll show you exactly what you’ll get, how to set up your feed for signal, and where this source shines (and where it doesn’t).

Goal: less doom-scroll, more clarity—so you can act with confidence and skip the hype.

Why Ethereum updates on X feel overwhelming

Crypto Twitter is loud. The algorithm rewards hot takes, not accuracy, and major Ethereum changes get buried in memes or engagement bait. That costs time—and sometimes money.

- Real example: When Dencun activated in March 2024, L2 fees dropped fast. On some rollups, transactions went from dollars to cents within hours. If you missed the right threads, you probably kept paying old fees longer than you needed to.

- Staking confusion: After Shanghai/Capella enabled withdrawals, timelines were misunderstood for weeks. Exit queues can stretch during peak demand; people who followed accurate updates planned better and avoided panic.

- MEV and L2 rumors: Technical topics get misquoted. Without curated sources, it’s easy to share an outdated chart or take that doesn’t reflect current client releases or EIPs.

And this isn’t just “crypto being crypto.” Research shows false or sensational content spreads faster online. One Science study found false news on Twitter was significantly more likely to be retweeted than the truth across many categories (Vosoughi, Roy, Aral, 2018). If you’re not careful, your feed becomes a lagging indicator.

What I’m going to help you do

I’ll show you how to treat @sassal0x like an ETH command center:

- Know exactly who he is and what the account delivers

- Cut noise with alerts, Lists, and smart search

- Spot the best formats (threads, explainers, digests) fast

- Understand strengths and limits so you don’t get tunnel vision

- Keep a quick-reference FAQ—yes, including “How long is staked ETH locked?”

What you’ll get from this guide

- Quick profile: who runs sassal.eth/acc and what to expect from the @sassal0x feed

- Content pillars: upgrades, staking, L2s, MEV, governance, dev progress, and when policy enters the chat

- Follow smart: alerts, Lists with client and L2 teams, and “from:sassal0x keyword” search tricks

- Best starting points: upgrade explainers, staking timelines, and weekly digests you can actually use

- Trust, but verify: simple credibility checks, disclosures, and first‑hand sources to bookmark

- FAQ: staked ETH timelines, scope of coverage, impersonator safety, and more

If you’ve ever thought, “Just tell me what matters for Ethereum—without the fluff,” you’re in the right place. Ready to see who runs the account and what you can expect from following it?

What is sassal.eth/acc and @sassal0x? Quick profile and what to expect

When I want fast, accurate context on what’s happening across Ethereum, I check @sassal0x. He’s one of those rare accounts that mixes real-time updates with clear explanations, so you don’t have to sit through a two-hour dev call to understand what changed and why it matters.

Who he is

He’s an Ethereum educator best known for The Daily Gwei—a long-running stream of ETH-focused content that stays grounded in what’s shipping and what users should actually do. If Ethereum is your lane, this account is built for you.

- Focus areas you’ll see often: network upgrades (Shanghai/Capella, Dencun, Pectra), staking mechanics and withdrawals, L2 ecosystems and fees, MEV and validator economics, governance signals, and developer progress across clients.

- Style: practical, ETH-first, and quick to link primary sources so you can verify. Strong opinions, but aimed at clarity, not hot takes.

“In a world that won’t stop shouting, the edge is simple: listen to signal.”

Where he posts

The main stream is on X at @sassal0x. That’s where you’ll catch breaking updates, threads, and retweets from core devs. He regularly links out to:

- The Daily Gwei newsletter for written breakdowns and context

- The Daily Gwei YouTube for quick explainers and longer walk-throughs

- Podcast appearances when major milestones hit (upgrades, MEV conversations, L2 roadmaps)

About “sassal.eth/acc”:sassal.eth is his ENS name (on-chain identity) and “/acc” is shorthand people use online for “account.” The actual place to follow his activity is the X handle @sassal0x.

Posting style and cadence

Expect near-daily activity with a pattern that’s predictable—in a good way. It’s built for people who want to act fast without sifting through noise.

- Timely threads on breaking news: When Dencun went live, he summarized EIP‑4844’s impact on L2 fees and linked to client releases so validators knew what to do. During Shanghai/Capella, he highlighted withdrawal mechanics, queue dynamics, and realistic timelines.

- High-signal retweets: You’ll see quotes and RTs from core contributors (client teams, researchers, coordinators) so you catch the raw updates without chasing 20 accounts.

- Actionable summaries: Short takes that translate “what this means” for users, stakers, and builders—often with pointers to docs, dashboards, or PRs.

- Consistency: Regular posts during upgrade windows and ongoing monitoring of staking flows, MEV research, and L2 progress so you stay ahead of the curve.

If you’ve ever felt overwhelmed by Ethereum updates, this feed works like a filter: fewer tabs, clearer decisions. Want the exact setup I use to catch the important stuff without getting spammed—alerts, lists, and search tricks that actually work?

How to get the most value from following @sassal0x

Crypto Twitter moves fast, and your attention is scarce. I treat my ETH updates like an ops dashboard: clean inputs, quick context, and zero fluff. Here’s the exact setup I use to turn @sassal0x into a high-signal feed you can actually act on.

“Attention is a currency. Spend it on signal, not noise.”

Turn on alerts for key updates

When upgrades, staking changes, or L2 fee shifts hit, timing matters. Post alerts make sure you see the important stuff first without babysitting your feed.

- Go to @sassal0x → tap the bell → choose Highlights to avoid every single post, or All Posts if you want full coverage.

- On mobile, you can enable notifications for Spaces if he joins upgrade or dev recap conversations.

- Real example: during Dencun week (EIP-4844), blob-fee chatter and L2 cost snapshots came fast. Alerts let you time bridging or batch transactions when fees were calm, not spiky.

Why this works: quality beats quantity. Research shows false news spreads faster than true news on social platforms, so prioritizing trusted sources reduces whiplash and FOMO-driven mistakes (Science, 2018).

Use Twitter Lists to keep signal high

Lists are your noise-canceling headphones. Instead of doom-scrolling, I check a small ETH list twice a day—morning and late afternoon.

- Create a private List called ETH — High Signal.

- Add:

- Core: @sassal0x, @TimBeiko

- Clients: @prylabs, @sigp_io (Lighthouse), @Teku_ConsenSys, @NethermindEth

- L2s: @arbitrum, @optimismFND, @BuildOnBase, @zkSync, @Scroll_ZKP

- MEV/Research: @flashbots

- Check just this List twice a day. That 2× cadence keeps you informed without context-switch fatigue.

Bonus: staying in one focused “information patch” is classic information-foraging—less time hunting, more time learning (Nielsen Norman Group). It also cuts interruptions, which are proven to increase stress and slow you down (UCI study).

Search smarter

His feed is a goldmine if you can pull the right thread fast. Use X’s advanced search operators to zero in on explainers and timely takes.

- Basic pattern:

from:sassal0x keyword - Add dates:

from:sassal0x keyword since:2024-01-01 until:2024-12-31 - Only original posts:

from:sassal0x keyword -is:retweet - With links (long-form):

from:sassal0x keyword filter:links - With media (charts, screenshots):

from:sassal0x keyword filter:media

Real searches I use when news breaks:

from:sassal0x Dencun 4844 -is:retweet— upgrade summaries and impact.from:sassal0x staking withdrawals queue since:2023-04-01— post-Shanghai/Capella context.from:sassal0x Pectra EIP— early read on what’s next.from:sassal0x L2 fees blobs filter:links— fee narratives with sources.from:sassal0x MEV builder relays— MEV-Boost and relay updates.

Keep X’s official advanced search guide handy: Advanced Search.

Bookmarks and folders

When you find an evergreen explainer, lock it in. These become your quick reference when headlines start flying.

- Use X Bookmarks (and Foldering if you’re on Premium) — here’s the official guide: Bookmarks on X.

- If you don’t have folders, mirror the structure in your browser bookmarks or a notes app (Notion, Obsidian, Apple Notes).

Suggested folder setup:

- Upgrades — named upgrades (Shanghai/Capella, Dencun, Pectra), EIP summaries, timelines.

- Staking— validator how-tos, exit/withdrawal explainers, LST risk notes.

- L2s — fee updates, DA/blobs context, roadmap notes for Arbitrum/Optimism/Base.

- MEV — MEV-Boost, builder/relay changes, proposer commitments.

- Security/Governance — incident recaps, client advisories, governance proposals.

Real bookmarks worth keeping an eye out for:

- “What changes for users in Dencun” style threads (great for practical action items).

- “Solo staker checklist before [upgrade]” posts.

- “L2 fee explainer with blobs” references you can share with teams and friends.

- Short videos from The Daily Gwei that condense a week’s context into 10 minutes.

Engage without getting lost

Good questions attract good answers—from him and from devs who follow him. Keep it targeted and you’ll get signal back.

- Ask specific, situational questions. Example:

- “Running a single Lighthouse validator. Any action needed before Pectra? Client versions you recommend pinning?”

- “Planning a large transfer to Base—best time-of-day window you’re seeing post-Dencun for low blob-congestion?”

- Use reply filters on X to scan responses: switch between All, Verified, and Following to sort noise.

- Turn on the Quality filter and tune muted words to avoid phishing and giveaway spam.

- Mute impersonators and obvious bait accounts right from the thread to keep future replies clean.

I built this workflow so I can check ETH in minutes, not hours. The payoff is calm, confident action when the network evolves.

Next up: what exactly does he cover best—and where should you be cautious? Curious which topics are his unfair advantage (and which ones you should cross-check)? Let’s look at that next.

Content pillars: what he covers well (and where to be cautious)

“In a market that never sleeps, credibility is your edge.”

Strengths

I follow @sassal0x because he consistently nails the essentials for staying current on Ethereum without drowning in noise. Here’s where he shines:

- Ethereum-first lens that cuts through hype: Upgrades, staking, L2s, MEV, and governance are his bread and butter. You’ll see context that actually helps you act, not just hot takes.

- Clear upgrade timelines and what to do next: During Dencun’s mainnet launch, for example, his updates distilled EF’s official notes and linked to EIP-4844 so users knew how blobs would impact L2 fees and when to expect changes.

- Staking explainers you can sanity-check against data: He routinely points to client releases and validator resources when discussing withdrawals, queue times, and risks. When I want a live reality check, I pair his commentary with public trackers like validatorqueue.com and explorers like Beaconcha.in.

- L2 ecosystem tracking that feels practical: Expect notes on rollup roadmaps, DA costs, and fee pressure post-4844. I’ve seen him reference L2 fee dashboards and client blog posts to show real-world effects, not just theory.

- MEV and censorship conversations with real sources: He shares research threads and points to primary resources (e.g., Flashbots research and censorship metrics like MEV Watch) so you can cross-check claims about builder/relay dynamics.

- Links to primary sources: AllCoreDevs notes, EIPs, client release posts—he habitually anchors claims to first-hand materials. That saves me hours chasing context.

Small but meaningful detail: when upgrade windows or client RCs shift, he usually acknowledges it quickly and points straight to the source (Tim Beiko’s coordination updates, client GitHubs, EF blog). That speed matters when you’re running validators or planning deployments.

Potential blind spots

Every strong lens has a trade-off. A few things I keep in mind while following him:

- ETH-centric by design: If you’re chasing cross-chain rotations, low-cap narratives, or Solana/Cosmos-specific setups, you won’t get a full picture here. Treat this as your Ethereum core, not your entire crypto view.

- Opinionated takes: I like the clarity, but strong views can compress nuance—especially around hot timelines (withdrawal backlogs, fee trajectories). When stakes are high, I double-check with client docs and trackers.

- Fee expectations aren’t static: Post-upgrade fee assumptions can deviate under real traffic. L2 costs swing with usage; one good thread doesn’t lock in a forever reality. Watch ongoing data, not only the first day’s charts.

- Less coverage of trading tactics: You’ll get infrastructure and ecosystem signal, not perpetuals setups or short-term trade plans. If that’s your thing, supplement with trading-focused sources.

Disclosure and bias check

He’s generally transparent, but I treat every crypto account the same: informative, not prescriptive. A few guardrails I use:

- Scan for disclosures: If a post includes affiliate links, sponsorships, or paid partners, it should be clear. When in doubt, assume content is informational only.

- Follow the link trail: For staking providers, L2s, and MEV tools, I click through to official docs, GitHub repos, or EF pages. Canonical sources reduce misreads.

- Cross-verify the technicals: For upgrade specifics, I keep EIPs and EF blog handy, and I watch client release notes from teams like Lighthouse, Teku, Prysm, and Nethermind.

Bottom line: “sponsored” isn’t automatically “bad,” but clarity matters. I appreciate when posts spell it out, and I plan decisions based on primary documents, not commentary alone.

Track record and accuracy

He’s been around for multiple upgrade cycles and tends to correct quickly when specs or expectations shift. A couple of reality checks I’ve seen play out over recent cycles:

- Withdrawals and exit queues: Post-Shanghai, a lot of people expected endless bottlenecks. Actual churn limits and validator behavior painted a more nuanced picture. He acknowledged the updated pace and pointed to data sources so followers could track exits in real time.

- L2 fee shifts after 4844: Costs dropped, but unevenly across rollups. He leaned on charts and EF explanations rather than promises, which helped temper over-optimism.

Accuracy-wise, I trust the process: link back to client teams, highlight uncertainties, and update when reality diverges from early narratives. That’s how I use his feed—fast signal, then verification via official channels.

If you’re wondering what to actually read first—specific threads, formats, and examples that turn this signal into action—want a short list that won’t waste your time?

Starter pack: threads and formats to watch

“Attention is a currency—spend it where it compounds.”

Upgrade explainers

I watch for his upgrade threads the same way traders watch price alerts—because they save time and prevent mistakes. When a named upgrade hits, he breaks it down without fluff: what changed, who it impacts, and what (if anything) you should do now.

- Shanghai/Capella (Apr 2023): His coverage focused on withdrawals going live, showing how partial and full withdrawals work and why exit queues matter. This helped a lot of folks avoid panic when they saw “pending” for hours. If you’re new to staking, this is baseline knowledge.

- Dencun (Mar 2024): Expect plain-English explainers on EIP-4844 (blobs), why blob space is separate from calldata, and the expected L2 fee drops. You can cross-check the impact live on L2Fees.info—fees for simple transfers on some rollups fell to cents (and often sub-cent) levels after Dencun. The Ethereum Foundation’s Dencun announcement also backs up the design goals.

- Pectra (upcoming): He’s already laying groundwork on what to expect: account abstraction improvements (EIP-7702 discussion), validator quality-of-life (EIP-7251 raising the effective balance cap to consolidate validators), and UX wins. These previews are perfect for builders and validators planning ahead.

Tip I use: I bookmark one upgrade explainer per cycle and update my notes from there. It beats digging through 10 threads when a client release lands.

Staking and validator content

His staking posts are practical and timely. You’ll see explainers on validator duties, slashing risks, LST tradeoffs, and real talk about exits and queue times. This is the kind of content you want open while you’re configuring a validator or picking a provider.

- Withdrawals and queues: He often points to exit dynamics during busy times. If he says “queues are building,” confirm with the public queue data at beaconcha.in/validators/queue. It shows churn limits and expected wait—super helpful if you’re planning a full exit.

- LSTs vs native: Expect clear pros/cons on options like Lido, Rocket Pool, or cbETH. He won’t tell you what to buy, but he will highlight custody, redemption queues, and smart contract risk so you don’t gloss over the basics. For a bigger picture, dashboards like Hildobby’s ETH staking on Dune show how the ecosystem is allocating to LSTs over time.

- Risk reminders: Client diversity and MEV settings come up often. If he flags a client vulnerability or recommends an upgrade window, treat it as a “check your setup tonight” nudge, then verify with your client team’s release notes.

Mini-checklist I keep next to his staking threads:

- Am I on the latest client versions for both EL/CL?

- Do my MEV settings match current best practices?

- Am I diversified across clients and infrastructure?

- Do I understand my exit timing if I needed it?

L2 coverage and fee talk

He tracks L2 fees and roadmaps like a hawk. That matters if you’re choosing where to trade, build, or settle activity.

- Post-Dencun fees: You’ll see him compare fees across Arbitrum, Optimism, Base, zkSync, and more—often with context on blob availability and batch posting. After EIP-4844, several rollups saw 5–20x cheaper transactions during normal blob supply; you can sanity-check those claims on L2Fees.info and explorers.

- Roadmap notes: Expect mentions of data availability (DA), proof systems, and finality windows. When he flags a roadmap milestone (e.g., new prover, DA changes, or refund mechanics), it’s a cue to check your own assumptions about cost and settlement risk.

- Builder angle: If you’re shipping apps, his “where fees are trending” posts are gold for planning user experience. Example: if blobs are abundant, you can lower slippage/adjust batching to pass savings to users.

Quick reality check: Fees fluctuate. If a thread says “fees are low,” open an L2 explorer or L2Fees right then. Screenshots lie; live data doesn’t.

Daily/weekly digest links

When you don’t have time to swim in threads, his digests keep you synced without losing your weekend.

- The Daily Gwei newsletter: Short, actionable rundowns of what moved in Ethereum—perfect with your morning coffee. Skim, click the parts that matter, move on. Link: thedailygwei.com

- Refuel on YouTube: 10–15 minutes of context you’d otherwise spend an hour piecing together. He recaps core dev calls, L2 changes, and policy noise with receipts. Channel: The Daily Gwei on YouTube

On busy upgrade weeks, I queue the latest Refuel at 2x speed and keep a tab open for client release notes. It’s the fastest way to turn signal into action.

Starter threads to keep on your radar right now:

- Shanghai/Capella withdrawals walkthroughs (know partial vs full exits)

- Dencun go-live breakdown (EIP-4844, blobs, fee expectations)

- Pectra previews (EIP-7702, EIP-7251, UX improvements)

- L2 fee comparisons and blob supply notes (when to transact cheapest)

- Validator ops reminders (client releases, MEV settings, diversity)

Want to pair these threads with first-hand sources and the right voices so you never second-guess a headline again? Keep going—I’m about to share the exact complements and official resources that make this a complete Ethereum command center.

Complements, alternatives, and resources to round out your feed

I love using one high-signal account as my anchor, but I never rely on a single voice. Here’s the compact “who else to follow and where to check” list that keeps my Ethereum view grounded in first-hand info, backed by client releases, and sharpened by research. I’ll include what to watch for and practical workflows you can copy right now.

Essential complements to keep your ETH view first‑hand

Core coordination

- Tim Beiko — the clearest public window into Ethereum core dev coordination. Watch for ACD call summaries, EIP status updates, and upgrade readiness reads.

Pro move: Turn on notifications for call-week posts. I skim his summaries first, then click through to specs or client releases.

Client teams (validator ops + upgrade confidence)

Consensus clients:- Prysm releases — high-quality notes for validators.

- Lighthouse releases — clear “required/optional” upgrade flags.

- Teku releases — great for enterprise setups and metrics.

Execution clients:- Geth releases — the most widely used execution client.

- Nethermind releases — popular with power users and infra.

- Besu releases — enterprise‑friendly, strong docs.

- Erigon releases — performance‑focused, archival strengths.

- Reth releases — fast‑moving alt implementation to watch.

Real use: Before an upgrade, I confirm fork blocks in EIPs, then cross‑check each client’s release notes for the exact version flagging “mandatory.” It takes 3–5 minutes and avoids ugly surprises.

L2 teams (fees, roadmaps, and incident updates)

- Arbitrum, Optimism, Base

Watch for: fee changes, data availability updates, sequencer incidents, and roadmap milestones (e.g., EIP‑4844 impacts). After blobs shipped, L2s reported materially lower fees; I pair their posts with data from l2fees.info to see the drop in practice.

Research and MEV

- Flashbots and the Flashbots research blog — rigorous coverage of MEV, builder/relay dynamics, and PBS discussions.

Why it matters: MEV affects validator yields and user experience. Flashbots regularly publishes quantitative analyses and proposed mitigations you can reference when risk‑checking staking setups or understanding inclusion/censorship debates.

Official sources to bookmark

The Daily Gwei

- Newsletter: thedailygwei.com

- YouTube: youtube.com/@TheDailyGwei

How I use it: When I don’t have time to scroll, I grab the latest 10–15 minute video for a clean ETH context check.

Canonical Ethereum references

- Specs: ethereum.org

- EIPs catalog: eips.ethereum.org

- All Core Devs coordination repo: github.com/ethereum/pm

Workflow: When a new EIP is trending, I open its EIPs page, skim Motivation and Specification, then check if client teams have tagged a release as “implements” or “compatible.”

Client blogs and release notes (validator must‑reads)

- Prysm

- Lighthouse

- Teku

- Geth

- Nethermind

- Besu

- Erigon

Tip: Bookmark these, then batch‑check versions before restarts. If one client has a known issue, you’ll catch it in minutes.

Data and neutral trackers that save time

L2Beat — l2beat.com

Why it’s in my dock: Independent methodology, risk disclosures, bridge details, upgrade keys. When a new L2 narrative hits X, I sanity‑check here first.

L2 Fees live — l2fees.info

Quick decision tool: If I’m about to transact, I glance at this to choose the cheapest L2 in that moment. Pair it with project posts for context on volatility.

MEV censorship and relay stats — mevwatch.info

Validator reality check: Helpful for understanding relay distribution and OFAC‑related filtering over time, which can influence your relay choices.

ethresear.ch — ethresear.ch

For the curious: Early research ideas show up here. I don’t read every post, but it’s perfect when you want the “why” behind what you’re seeing on X.

Sample workflows you can copy

Upgrade week checklist

- Read Tim’s ACD summary → check EIP pages for fork details → confirm each client’s “required” release → schedule validator restarts off‑peak → watch L2 team posts and l2fees.info for fee behavior shifts post‑fork.

Staking sanity check

- Skim latest Flashbots research notes on builder/relay dynamics → review your relay configuration against mevwatch.info → read your client’s latest release notes for known issues → keep one fallback relay ready.

L2 routing when fees spike

- Open l2fees.info → confirm L2 health on L2Beat (bridge status, upgrade keys) → check the L2’s official X account for incidents → execute.

Reminder: When in doubt, trust-but-verify with client release notes and EIPs. It’s the fastest way to separate real network changes from hot takes.

One more thing before you move on: the most common question I get is about staking timelines. How long is ETH actually locked depending on your method—and what can change that in a busy exit queue? I’ll break it down next with clear scenarios you can use today. Ready?

FAQ and final take: is following sassal.eth/acc and @sassal0x worth it?

How long is staked ETH locked up?

Short answer: it depends on how you stake and what’s happening on the network when you exit.

If you run a native validator (32 ETH):

- Partial withdrawals (anything above 32 ETH) happen automatically once you’ve set your 0x01 withdrawal credentials. Ethereum processes up to 16 withdrawals per block (every ~12s), which is roughly ~115,200 per day. If lots of withdrawals queue up at once, you may wait a bit, but the system clears them steadily. Reference: ethereum.org/staking/withdrawals.

- Full exits (you stop validating) go through the exit queue. The throughput scales with the number of active validators, so in normal times exits complete in days. In peak waves, it can stretch to weeks. You can check current conditions here: beaconcha.in/validators/queue.

If you use pooled or “app” staking:

- Some wallets or providers add their own minimum lock or batching schedule. For example, Trust Wallet lists a ~4 day minimum in certain flows. Source: Trust Wallet’s guide.

- Centralized exchanges often add internal processing time on top of the network timeline. Always read their current withdrawal policy.

If you use liquid staking tokens (LSTs) like stETH, rETH, cbETH:

- Trading the token is immediate if there’s liquidity. You’re not “locked” from selling the token.

- Redeeming back to native ETH follows each protocol’s own queue and buffer. In quiet periods it can be fast; during heavy exits, expect waits. Example: Lido’s withdrawal info is here: Lido withdrawals.

TL;DR: Native staking has no fixed lock now that withdrawals are enabled (Shanghai/Capella). You’re bound by the dynamic exit queue, not a hard timer. Pooled/LST solutions add their own rules on top.

Tip: Set your withdrawal credentials to 0x01, bookmark the queue page on beaconcha.in, and check your provider’s status page before you plan a big move.

Does he cover non-Ethereum content?

Mostly ETH and ETH-adjacent topics: L2s, MEV, staking, upgrades, and policy/regulatory items that can affect Ethereum. If you want multi-chain trading setups or small-cap narratives, pair his feed with broader market sources.

How do I avoid impersonators?

- Only trust the handle: https://x.com/sassal0x.

- Open links from his posts in a new tab and check the domain. His content typically points to The Daily Gwei, YouTube, or known client/team blogs.

- Be cautious with DMs, giveaways, and “opportunities.” If it sounds urgent or secret, it’s almost always a scam.

- Cross-check announcements with core devs or client teams before you click anything with permissions or signatures.

Conclusion

If you care about Ethereum and want one account that consistently surfaces the important stuff, @sassal0x is worth your follow. Turn on alerts for key updates, put him in a Twitter List with core devs and client teams for clean signal, and bookmark his evergreen explainers so you can act fast when news breaks. I’ll keep an updated version of this guide on Cryptolinks.com so you can reference it anytime.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.