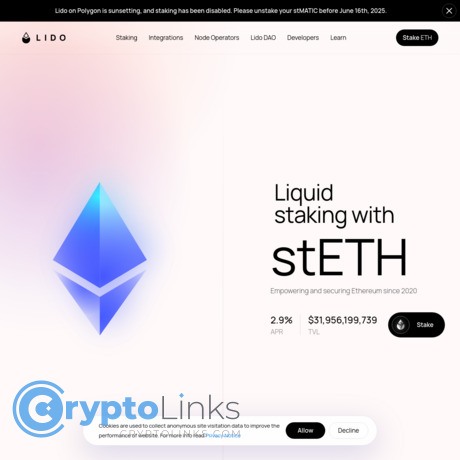

Lido Liquid Staking Review

Lido Liquid Staking

lido.fi

Lido Liquid Staking Review: Fixing Traditional Staking Problems

Have you ever considered staking your crypto assets but then paused, wondering if it's worth the hassle? Maybe you're worried about your funds being locked up, the headaches of technical setups, or simply the lack of flexibility. You're not alone. These are common barriers that keep many people from diving into staking, even when it seems like the perfect way to earn passive income in crypto.

The good news? These exact problems are what Lido was designed to solve. But before we get into how Lido can make staking simpler and more user-friendly, let's talk about why traditional staking can feel frustrating in the first place.

Staking Problems: Why Lido is Even Needed

Staking sounds amazing on paper: lock your crypto, let it earn rewards, and watch your portfolio grow. But in reality, it comes with some serious challenges that can leave users feeling trapped or overwhelmed. Here are the most common issues:

Common Issues with Traditional Staking

- Locked assets: Once you stake your funds, they’re often frozen for weeks, months, or even years. Want to trade that crypto or use it elsewhere? Too bad.

- Complex setup: Traditional staking platforms can feel intimidating, especially for beginners. Between finding validators and managing private keys, it’s not exactly plug-and-play.

- Lack of liquidity: You might earn rewards, but your staked funds are essentially untouchable. This can cause major frustration if you need flexibility in a volatile market.

These problems are big enough to deter even seasoned crypto enthusiasts. So, how does Lido flip the script?

How Lido Addresses These Issues

Lido introduces one game-changing concept: liquid staking. Imagine staking your crypto while still keeping access to it for trading, DeFi projects, or anything else. Sounds too good to be true? Here's how Lido pulls it off:

- Liquid staking: When you stake with Lido, you receive tokenized derivatives of your assets (like stETH if you're staking Ethereum). These tokens represent your stake and can be traded, swapped, or used across different decentralized finance (DeFi) platforms.

- User-friendly experience: Staking with Lido is designed to be simple, even for total beginners. No advanced blockchain knowledge or validator hunting required.

- Flexibility: You’re never completely tied down. Your funds earn rewards while staying usable in different ways. It’s staking without the annoying strings attached.

The flexibility and ease Lido offers address almost every problem traditional staking throws at you. But what exactly makes it work, and is it as reliable as it sounds? Keep reading, because up next, we’ll explore what Lido is, how liquid staking actually functions, and why so many people are making the switch.

What is Lido, and how does it work?

A simple introduction to Lido

Let’s be honest—staking is exciting but often feels like you need a degree in blockchain to get started. Here’s where Lido comes into play. Lido is a decentralized platform that changes the game for staking. Think of it as your go-to partner for making the process not only simpler but also a lot more flexible. Whether you’re holding Ethereum or other supported cryptocurrencies, Lido lets you stake without all the usual headaches.

You know how in traditional staking, your assets just sit there, locked and inaccessible? Lido says, "Not here!" It introduces the concept of liquid staking, which we’ll break down in just a moment. But the bottom line? Lido’s mission is to remove barriers, so anyone—even if it’s your first time staking—can start earning smoothly.

The concept of liquid staking

Alright, here’s the magic sauce: liquid staking. Imagine staking without saying goodbye to your funds for months. Instead, when you stake an asset like Ethereum through Lido, you get a one-to-one token in return. For example, stake ETH, and Lido gives you stETH (short for staked ETH).

But what’s the big deal about these tokens like stETH? They’re not just proof that you staked your assets—they’re a whole new layer of freedom. You can move them, trade them, or use them in DeFi protocols to earn even more rewards. So essentially, Lido lets your funds work double time: earn staking rewards while staying liquid. It feels like having your cake and eating it too, doesn’t it?

"The real golden rule in crypto? Flexibility is power. Lido gives you that power to stake and still stay liquid."

Here's a practical example: Let’s say you’ve staked 5 ETH through Lido and received 5 stETH in return. While your ETH earns rewards in the background, you could use those 5 stETH as collateral on platforms like Aave or trade them directly if market opportunities come up. Traditional staking platforms can’t compete with that kind of versatility.

Key features of Lido

What makes Lido stand out? It’s not just one thing—it’s a mix of unique features designed for ease, efficiency, and inclusivity.

- Support for multiple blockchains: While Ethereum gets much of the spotlight, Lido is a multi-chain staker’s paradise. You can also stake SOL (Solana), MATIC (Polygon), and more.

- No minimum staking requirements: You don’t have to be a whale to participate. Even if you only have a small amount to stake, Lido welcomes you. This removes a massive barrier for many smaller investors.

- Instant reward activation: You don’t have to wait—or wonder—when rewards begin ticking in. They kick in as soon as your stake is confirmed.

Now, some might think, "This sounds too good to be true!" It does feel that way at first—but the platform’s design is intentionally transparent and user-first.

Still wondering what kind of rewards you can expect—or if Lido takes a cut? Don’t worry, we’re just getting to the juicy details about staking rewards and fees. Stick around; you’ll want to see how it compares to other options out there.

What are the staking rewards and fees on Lido?

One of the biggest questions anyone has before staking is: How much will I earn? And how much does it cost? With Lido, the answers are refreshingly straightforward. Let me break it down for you in plain terms, so you know exactly where your crypto is going and what you’re getting back.

How much does Lido charge for staking?

Nobody likes unexpected fees, right? Well, good news—Lido is super upfront about its costs. The platform charges a 10% fee on your staking rewards. To be clear, this isn’t a fee on your initial deposit; it only applies to the rewards you earn.

Why the 10%? It’s essentially the price you pay for Lido’s convenience, high-level security, and liquid staking flexibility. Unlike some platforms that hide fees in fine print, Lido puts it all out there from the start. You’re never left wondering what’s happening behind the scenes.

A lot of users don’t mind this fee because it takes the hassle and anxiety out of traditional staking. Here’s an example: Say you stake ETH and earn $100 in rewards. Lido takes $10, and the rest ($90) is yours to keep. If user-friendly staking with liquidity sounds like your thing, this fee might feel completely worth it. Still, everyone’s needs are different, so it’s important to weigh the cost against what you value most in a staking platform.

Average rewards you can expect

So, what can you actually make? Here’s where it gets interesting! The answer largely depends on the blockchain you’re staking. For instance:

- Ethereum: The staking APR varies depending on the network’s activity, but it’s generally around 3% to 5%.

- Other supported chains: If you’re staking coins like Polygon or Solana via Lido, the returns will depend on their respective networks too. Expect similar percentages with some variation.

It’s worth noting, though, that Lido users consistently report solid returns, thanks to the platform’s efficient management of validator nodes. In other words, yes, there’s a small fee, but the upside can be well worth it—especially if staking solo feels too confusing or restrictive for you.

Fee transparency and why it matters

Transparency is a big deal in crypto. Nobody wants surprise deductions suddenly eating into their rewards. This is where Lido shines. The platform ensures you’re fully aware of the 10% fee from day one. There’s no fine print, no sneaky deductions hidden behind technical jargon—just a clean, simple fee structure.

And let me tell you why that matters. A 2021 study by the Blockchain Transparency Alliance found that DeFi users are far more likely to stay loyal to platforms that communicate fees clearly upfront. It’s not just about the numbers; it’s about trust. Lido’s straightforward approach to pricing earns it huge points here, especially for newer stakers wary of being taken advantage of.

“It’s not about how much you spend—it’s about knowing exactly what you’re paying for and why.”

With Lido, the message is clear: they value your trust and your crypto. If you’ve ever felt blindsided by hidden fees on other services, their transparency will feel like a breath of fresh air.

But of course, no staking platform is perfect. While the rewards and fees of Lido make it attractive, there are always risks to any strategy in crypto. Security, validators, and even market volatility can play a role in your journey. So, how does Lido handle these challenges? And more importantly—what’s at stake for you? I’ll show you exactly what to watch out for next.

What are the risks of staking with Lido?

Let’s face it: everything in crypto comes with a level of risk—and staking with Lido isn’t an exception. While it’s an excellent tool for maximizing your assets, it’s important to know what you’re getting into. After all, understanding the potential pitfalls helps you make smarter decisions. Let’s take a closer look at some of the risks tied to staking with Lido and how you can keep them in check.

Smart Contract Vulnerabilities

Lido operates using smart contracts—those magic bits of code that automate transactions without middlemen. While they’re incredibly efficient, they’re not foolproof. A coding bug or exploit could put funds at risk. Even though Lido has been rigorously audited (and hasn’t had any major security breaches so far), the reality of DeFi is that no system is 100% immune. This is the trade-off of participating in decentralized finance.

If you’re wondering how serious this can be, consider this: some DeFi protocols have had their vulnerabilities exploited in the past, with devastating losses running into hundreds of millions of dollars.

The good news? Lido is proactive with frequent audits and partnerships with top-tier security firms. But it’s always smart to think about the age-old rule: Never invest more than you’re willing to lose. It’s harsh, but it’s true.

Validator Risks

When you stake with Lido, your funds are delegated to validators—nodes that validate transactions on the blockchain. These validators play a critical role in making staking work, but even they aren't perfect.

- If a validator underperforms, it could lead to fewer staking rewards.

- Worse yet, penalties like slashing (when a portion of staked funds is forfeited for validator errors) can result from misconduct.

Fortunately, Lido works with a highly-reputable network of professional validators who actively minimize these risks. While slashing scenarios are rare, be aware that they’re not impossible. Knowing this makes you a more informed participant.

Market Risks Due to Tokenized Derivatives

This is one risk that often flies under the radar. When you stake with Lido, you get derivative tokens like stETH in return. These represent your staked assets and can be traded or used in DeFi. But here’s the catch: the value of these tokens doesn't always stay in sync with the underlying asset, especially in turbulent markets.

Picture this—if a wave of panic selling hits the crypto world, the value of stETH could deviate from Ethereum’s price, potentially leaving you in a worse position if you need to sell quickly. It’s not a guaranteed scenario, but it has happened before in other contexts.

For example, during events of extreme market volatility, liquid staking derivatives can sometimes trade at a discount. This isn’t unique to Lido, but if something like this catches you off guard, it could sting.

Mitigating These Risks

Okay, so now you’re probably thinking, "With all these risks, is staking with Lido even worth it?" Here’s the thing: Lido doesn’t just throw you into the deep end. They’ve built several layers of protection to keep things as secure as possible.

- Frequent security audits ensure their smart contracts are robust.

- They partner only with top-performing validators to reduce the chances of errors or slashing events.

- As a user, you can mitigate risks too: diversify your assets, keep an eye on market trends, and don’t stake more than you’re comfortable holding long-term.

Like the old saying goes: "Don't put all your eggs in one basket." Diversification is your best friend in crypto—spread your assets across multiple platforms and strategies to soften the impact of any single loss.

Still, there’s one question you might be wondering: if risks are a reality, how does Lido maintain such trust and credibility in a space that’s inherently unpredictable? The answer lies in how it’s governed and overseen. But to understand that, you’ll need to explore the next layer of Lido’s operation: the role of the Lido DAO.

Why is Lido DAO important?

Let’s be real—when you trust your valuable crypto assets to a platform, it’s natural to wonder, “Who’s really in charge here?” With Lido, the answer is refreshingly clear. The project isn’t controlled by a single company or entity; instead, it’s steered by the community through something called Lido DAO. And trust me, this is a big deal.

The role of Lido DAO

Lido DAO is the backbone of Lido—and not in a corporate-control kind of way. It’s a completely decentralized governance model. Why does that matter? Because when decisions aren’t left to just a handful of executives sitting in a boardroom, users like you and I get a voice. That’s what makes crypto tick, doesn’t it?

Through Lido DAO, the community oversees critical operations like protocol upgrades, validator selection, and fine-tuning fees. Decisions that directly impact your staking experience are put to a vote, ensuring a transparent and fair process. You’re part of the ecosystem, not just another "user" in a faceless transaction.

How it works

Here’s where it gets interesting: as someone holding the LDO governance token, you have voting power. Let’s say Lido wants to add support for a new blockchain or make adjustments to how staking rewards are calculated. These decisions go up for community voting, and every LDO holder plays a part in shaping the direction Lido takes.

The voting process is conducted on decentralized platforms, and everything is recorded on-chain for maximum transparency. It’s democracy, but in the crypto way—efficient and driven by the stakeholders.

Difference between Lido and Lido DAO

Now, here’s a question I often get asked: “Isn’t Lido the same thing as Lido DAO?” Not quite.

Think of it like this: Lido is the product. It’s the actual platform where you stake your assets and receive those liquid tokens like stETH. On the other hand, Lido DAO is the engine. It’s the organization ensuring everything runs smoothly, remains decentralized, and aligns with the community’s best interests.

In essence, Lido DAO is to Lido what a captain is to a ship—it steers the course, avoids icebergs, and communicates with the crew (that’s you!). The beauty? You can have a say in where this ship sails by participating in the DAO.

Why it all matters

It’s not just about governance; it’s about trust. A platform can have the best features or the sleekest design, but without transparency, the foundation feels shaky. With Lido DAO, there’s no need for blind faith. Every update, every policy, every vote—it's all out in the open, waiting for the community to weigh in.

"Decentralization isn’t a buzzword; it’s a shield against bias, bad decisions, and central control. That’s what makes Lido DAO worth trusting."

You’ll find very few staking platforms that share this level of accountability with their users. In many ways, Lido DAO isn’t just a cool add-on—it’s the heart of what makes Lido unique in the world of crypto staking.

A question to think about

Would you rather trust a closed-door system or join a platform where you can actively shape its future?

And if this level of collaboration excites you, don’t stop reading now. Coming up next: we’re going to explore whether staking with Lido is worth it for your specific goals. This is where it all comes together, and I promise you won’t want to miss it.

Is Lido Worth It?

Who Should Use Lido?

If you're a long-term crypto holder wondering, “What’s the best way to make my ETH or other assets work harder for me?” then Lido might just hit the sweet spot for you. Lido offers a way to earn staking rewards without losing the freedom to move or trade your funds whenever you want. That’s priceless for anyone who wants to keep hold of their liquidity while still earning passive income.

It’s especially great if you’re someone who:

- Holds crypto for the long term and wants it to generate extra rewards while it’s sitting in your wallet.

- Feels intimidated by the technical hurdles of traditional staking but still craves the benefits.

- Wants an easier, no-hassle staking setup compared to managing a validator on your own.

Remember, all of this happens without locking up your assets like traditional staking does. Think about it—earning rewards and still staying flexible? It’s a win-win.

When Might It Not Be Worth It?

That being said, Lido isn’t everyone’s cup of tea. Here are some scenarios where Lido might not align with your approach:

- If you’d rather avoid paying fees: Lido takes a 10% cut of your staking rewards. While this fee is reasonable given the simplicity and benefits it offers, those who prefer squeezing out every last bit of ROI might feel otherwise.

- If you value direct control: Some folks just aren’t comfortable relying on third-party protocols, no matter how decentralized they claim to be. If you want to stake entirely on your own terms, Lido might feel limiting.

It all boils down to your priorities—how much do you value liquidity and simplicity versus control and minimizing fees? There isn’t a one-size-fits-all answer here, so weigh it carefully before jumping in.

Comparisons with Other Platforms

Here’s where it gets interesting. Imagine you’re stuck in a room with 10 different DeFi platforms shouting about staking, each promising to be the “best.” Where does Lido stand in this noisy crowd? It’s not just hype; Lido has earned its spot by being practical and user-focused.

For example:

- Ease of Use: Compared to rivals with bulky or tech-heavy interfaces, Lido’s setup feels more like a few clicks and less like solving a puzzle.

- Breadth of Supported Chains: While some platforms only stake ETH or focus on one ecosystem, Lido broadens your options with multi-chain support—from Ethereum to Solana and beyond.

- Community Trust: Lido’s decentralized governance through its DAO (powered by the LDO token) ensures it isn’t some shadowy centralized middleman. Alternatives may lack that transparency.

Of course, some competitors charge lower fees or cater to niche staking strategies, but few can match Lido’s balance between flexibility, accessibility, and trust. As they say, “the best tool is the one you’ll actually use.”

"Simplicity is the ultimate sophistication." — Leonardo Da Vinci

Lido embodies that wisdom beautifully: liquid staking, simple interface, and actionable results for everyday crypto holders like you and me.

Still on the Fence?

What’s your biggest concern when it comes to earning with your crypto? Are you worried about the fee percentages? Or maybe you’re just concerned about finding the easiest way to get started? Don’t fret—I’ll break down exactly how to begin staking with Lido in just a few clear steps. Trust me, it’s easier than it sounds.

How to Get Started with Lido

So, you’re ready to stake your crypto with Lido? Awesome choice! Whether you're aiming to earn passive income or just explore the world of liquid staking, getting started with Lido is easier than you might think. Let me guide you through the process step by step, and share a few pro tips that can make your staking experience smoother and smarter.

A Step-by-Step Guide to Staking

Setting up your staking game with Lido is as simple as brewing coffee in the morning. Here's how you can jump in:

- Visit the official Lido website: Go to Lido.fi. Always double-check the URL to ensure you’re on the legitimate site (scammers are everywhere in the crypto world).

- Connect your wallet: You’ll need a supported wallet like MetaMask or Ledger. Simply look for the “connect wallet” button and follow the instructions to link it.

- Select the cryptocurrency you want to stake: Lido supports multiple options like Ethereum (ETH), Solana (SOL), and Polygon (MATIC). Choose your token and enter the amount you’d like to stake.

- Confirm the transaction: After reviewing the details, confirm the transaction in your wallet. Boom, you're staking!

- Receive your staking token (e.g., stETH): Once your crypto is staked, Lido issues a token that represents your staked asset. This token can be traded, used in DeFi apps, or simply held for staking rewards.

Congratulations, you’re now staking with Lido! It’s as beginner-friendly as it gets, and the whole process takes just a few minutes.

Useful Tips Before You Begin

Before you click that "stake" button, here are some useful tips that can save you time and headaches:

- Stake only what you're comfortable holding long-term: While liquid staking gives you flexibility, remember that crypto markets are volatile. Don't put in more than you can afford to lose or hold during market swings.

- Keep an eye on network performance: For assets like Ethereum, staking rewards vary based on network activity. Tools like Lido’s performance dashboard can give you insight into current rates, so you know what to expect.

- Understand tokenized derivatives: The moment you stake, you’ll be receiving tokens like stETH (staked ETH). These tokens don’t just earn staking rewards but also come with market risks. Keep tabs on their value and trading environment.

- Check gas fees: For Ethereum users, gas fees can eat into your profits, especially if the network is congested. Plan your staking during off-peak hours to save a few bucks.

“Risk comes from not knowing what you're doing.” – Warren Buffett

Staking can indeed be rewarding, but the key is preparation. The more confident you are in your setup, the more enjoyable your experience will be. That said, why not explore some extra tools and resources to take your staking game to the next level? The next part will cover exactly that—ready to check out some helpful tools and insights designed just for you?

Resources and Extra Tools for Lido Users

Let’s be honest: staking can feel daunting at first. But once you start, it’s important to have the right tools and resources to guide you and maximize your staking experience. Whether you want to track rewards, trade tokenized derivatives like stETH, or just learn more, the good news is that Lido offers a mix of options to make your journey easier.

Tools Worth Checking Out

If you're serious about staking with Lido, a few tools can dramatically enhance your experience. Here are some I think you’ll find super useful:

- Official FAQ Section: Got questions about staking or fees? Lido’s official FAQ page is your go-to guide. It’s detailed, user-friendly, and updated regularly.

- Analytics Dashboards: Want to track your potential earnings or see how staking is performing overall? Use platforms like Dune Analytics to explore real-time staking data. It's fascinating to see how rewards add up!

- Token Trading Platforms: If you’d like to trade your stETH or similar tokenized derivatives, trusted DeFi platforms such as Uniswap offer you the flexibility to do so. The liquidity is almost unmatched and super convenient.

Remember, the crypto space is all about being informed and keeping track of what’s happening with your funds. These tools can help you stay on top of things without losing hours trying to figure things out on your own.

Monitoring Your Rewards

Curious about how much you’ve earned with Lido so far? Tracking your staking rewards has never been easier. You can do this directly in your crypto wallet or use intuitive dashboards like Zerion. These platforms break down your investments to show exactly how your rewards are stacking up.

For example, Zerion lets you sync your wallet and see performance updates in real time. No guesswork, just clear visuals showing your financial growth. Tools like this are especially valuable if you’re juggling multiple staking positions across different platforms.

Whether you’re a data junkie who loves every detail or someone who just wants a quick glance at how your assets are doing, monitoring tools make a world of difference.

Are You Missing Out?

With all the resources and tools available, it’s clear that staking with Lido isn’t just about depositing your crypto—it's about unlocking opportunities you might not have even considered. The next step could surprise you. Have you tapped into everything Lido offers yet? Ready to find out why it’s worth staking with them?

Final Thoughts: Should You Stake with Lido?

Recap of Lido’s Pros and Cons

Let’s take a final look at where Lido stands. On the plus side, it’s all about liquidity, ease of use, and being backed by a strong reputation. No need to lock up your funds indefinitely or navigate through complex setup processes. And that ability to use your staked assets in other DeFi opportunities? Game-changer.

But we’ve got to talk about the downsides too. The fees at 10% could turn off those looking for the lowest-cost option, and of course, you have added market risks with token derivatives like stETH. That said, Lido does what it promises: it simplifies staking while handing you flexibility on a silver platter.

Answering "Is Lido Worth It?"

So, let’s answer the big question: is Lido worth it? For a majority of users, especially those who want a reliable and easy way into staking without sacrificing liquidity, it’s a resounding yes. It’s not perfect, but Lido succeeds in making what was once tedious into something anyone can do with just a few clicks.

Take Ethereum as an example. Traditionally, staking ETH required locking it up for long periods, specifically until Ethereum’s network upgrades matured. That’s no longer the case with Lido. You don’t need to wait—your funds stay liquid while also earning rewards. If you’re into exploring DeFi, this opens up a stack of creative possibilities for generating even more returns.

Ready to Make the Move?

The crypto world can feel a little overwhelming at times, but staking doesn’t have to be. Whether you’re a first-timer seeking simplicity or a seasoned investor wanting liquidity, Lido is designed to meet you there. One small action—staking your assets through Lido—can unlock a steady stream of potential passive income while keeping your options open.

But hey, let’s not forget the golden rule: always make moves that align with your goals. Crypto isn’t a “one size fits all” deal. Whether you’re staking $1,000 or $10,000, take time to understand the risks and sources of returns. Explore what makes sense for your portfolio.

So, is it time to let your idle assets start working for you? With Lido, it might just be easier than you think.

Stay staked, stay liquid, and here’s to smarter crypto investing!