Binance Staking Review

Binance Staking

www.binance.com

Binance Staking Review Guide – Everything You Need to Know About It (+FAQ)

Have you considered staking your crypto on Binance to earn passive income, but you're skeptical whether it's actually worth your time? Or maybe you're even questioning if Binance staking is truly safe and legit?

If that sounds familiar—don't stress! You're definitely not alone.

Every single month, thousands of crypto investors just like you visit my site, Cryptolinks.com, because they want clear, unbiased answers about crypto issues—including Binance staking. And frankly, I totally understand the uncertainty. With so much noise in crypto, doubt is normal: you may wonder how much you could realistically earn, whether Binance staking is genuinely secure, and if this is even the right path for your financial goals.

Struggling With Doubts About Binance Staking? You're in The Right Place!

I'm about to clear up the confusion and give solid answers. In this guide, I'll tell you exactly what you need to know, without the crypto-jargon overload. I'll answer crucial questions you've probably already asked yourself, including:

- Is Binance staking legit, or could it put your crypto in danger?

- Does staking crypto on Binance realistically generate good passive income and how much exactly?

- How do you get started staking on Binance safely?

I'll Give You the Answers and Confidence You're Looking For

You'll learn—clearly and simply—what Binance staking actually means, how to avoid common staking mistakes, and tips on maximizing returns safely. Together, we'll look at the most important basics you should understand before staking your crypto, including:

- The exact process of Binance staking (in easy terms, no complicated crypto lingo!)

- Real-world examples and clear expectations of how much you can realistically make with Binance staking

- Important red flags and potential downsides that many guides gloss over—no sugar-coating here!

Why Trust My Cryptolinks Guide?

At Cryptolinks.com, I'm known among crypto investors for impartial, thoroughly researched advice and transparent reviews. My readers trust me primarily for these reasons:

- Real and Unbiased Reviews: I don't earn from recommending shady deals; every review and guide is built on fact-checking and research.

- Straightforward Language: My guides present complex topics in simple terms—you won't need a blockchain degree to understand Binance staking here.

- I Value Your Crypto Safety: Earning passive income is fantastic, but not if it puts your crypto at risk. I focus heavily on security best practices to protect my readers.

My goal here is straightforward: by the end of reading this Binance staking guide, you won't just learn facts—you'll become confident enough to make an informed decision.

But before jumping head-on into earning with Binance staking—there’s an important first step you really can't afford to skip:

Do you actually understand how Binance staking works in simple terms? Let's explore that next.

First Things First: What Exactly Is Binance Staking?

You might've heard friends rave about earning passive income by "staking crypto" on Binance. But what exactly does staking mean, and how is Binance involved in the whole process? If you feel a bit lost or confused, you're certainly not alone—staking can seem like a tricky concept, but I'm here to clear things up for you in plain English.

How Does Binance Staking Work?

At its core, crypto staking is similar to earning interest from a savings account in traditional banking—but with cryptocurrency tokens instead. You basically "lock up" or temporarily hold your cryptocurrencies in a secure wallet or platform, and in return, you earn rewards or interest in those cryptocurrencies.

This process is tied to what's called "Proof-of-Stake" (PoS). Without going super technical, PoS helps secure certain cryptocurrency blockchains by verifying transactions. Instead of powerful computers mining crypto (like Bitcoin's Proof-of-Work approach), staking involves simply putting your existing crypto holdings to work to secure the network. When you stake, you become part of that network validation process—and you're rewarded for contributing to blockchain stability.

Consider Binance staking as your crypto savings bank. You deposit, let the tokens rest safely, and collect interest. Binance seamlessly does all the heavy lifting for you, offering clearly-defined staking periods—anywhere from a few days to several months—and allowing you to pick what works best for your crypto strategy.

There are often some terms tossed around that confuse beginners, so let me break them down clearly:

- Lock-up Duration: It's the period your crypto stays staked without withdrawal availability. Shorter periods usually mean lower returns, but higher flexibility.

- APY (Annual Percentage Yield): The estimated earning or interest rate you'd earn by staking your crypto for one full year.

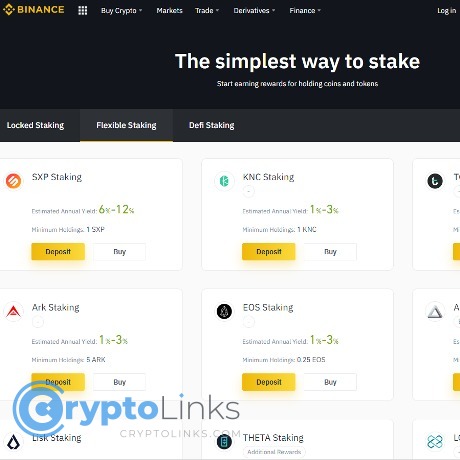

- Flexible vs Locked Staking: Binance provides both. Flexible allows easier withdrawals with lower APY, while Locked provides higher earnings but requires that you keep your crypto in place until the lock-up period ends.

"Compound interest is the eighth wonder of the world." – Albert Einstein

Exactly like Einstein hints—staking, when done consistently and smartly, can compound your crypto holdings steadily over time.

Why Many Crypto Investors Choose Binance for Staking

It's no surprise Binance staking is so popular. Binance offers a winning combination of convenience, reliability, and flexible options. Let's look at why it truly stands out:

- Reliability and Trust: Binance is among the most recognized and trustworthy crypto exchanges globally, consistently ranking high in reliability and user satisfaction. CoinMarketCap's exchange rankings consistently attest to this.

- Easy of Use: Whether you're a crypto newbie just starting your first staking journey or already well-seasoned, Binance simplifies the entire staking process. Its intuitive interface smooths out potential roadblocks and makes staking fast, easy, and beginner-friendly.

- Diverse Crypto Assets: Binance staking supports an impressive number of coins—from popular assets like Ethereum and Cardano to smaller or newer altcoins. Whatever your crypto preference, you probably can stake it on Binance.

- Flexible Timeframes: With flexible and locked options, Binance allows you to tailor staking strategies to your financial goals. You choose how long you stake and when you're paid—while earning consistent passive income along your journey.

In fact, a recent research survey from Finder.com showed Binance is the top staking destination among global crypto investors because of intuitive design, strong security protocols, and dependable payment timing.

By now, you might be wondering: is staking truly safe on Binance? How do you verify Binance staking legitimacy for yourself? Great questions—and essential ones for making a secured decision.

If these questions resonate, trust me, you won't want to miss the crucial information in the next section—it's exactly what you need to stake safely and confidently. Ready to discover if Binance is genuinely secure and legit? Let's find out together.

Is Binance Staking Legit and Secure?

Let's be real: safety is non-negotiable in crypto. No one wants to wake up one morning to find their crypto vanished into thin air. When staking your crypto on Binance, doubts naturally surface: Is Binance staking actually safe? Am I risking my precious crypto?

I get it! Your hard-earned crypto deserves solid protection, which is exactly why I'm tackling these concerns head-on.

Checking the Legitimacy of Binance Staking

Think of legitimacy checks as putting your crypto safety belt on before driving—it only takes a second but can save you from serious trouble. Here’s what I personally recommend you check to ensure your Binance staking journey is safe and legit:

- Correct URLs & SSL Certificates: Make sure you're always visiting the real Binance domain: https://www.binance.com/. Double-check the SSL padlock icon in your browser's address bar; it should always clearly indicate Binance's verified company certificate.

- Independent Platform Reviews: Don't just trust Binance blindly. Platforms like Trustpilot, CoinMarketCap, or Reddit communities can give you valuable insights into Binance's real-world track record. Binance has consistently maintained a strong reputation, often ranking among the most-trusted crypto platforms globally.

- Third-party Security Audits: Check out external audits and security verification groups. Binance has passed rigorous tests from reputable security firms, including CertiK and Blockchain Transparency Institute, confirming the stability of their staking mechanisms and smart contracts.

"When it comes to crypto, you can't afford to cut corners with security."

Keep these checkpoints in mind to reassure yourself you’ve got all your bases covered.

How Binance Protects Your Funds While Staking

Binance didn't gain millions of loyal users overnight for no reason. They've built a robust system specifically designed to keep staked funds secure. Here’s how Binance works behind the scenes to ensure your crypto assets stay protected:

- Cold Storage Solutions: A majority of user crypto funds are stored offline in secure, air-gapped hardware wallets. Cold wallets are essentially untouchable by hackers or unauthorized actors—as safe as crypto storage gets.

- Insurance-backed Asset Protection: Binance maintains an emergency insurance fund—called SAFU (Secure Asset Fund for Users)—which reportedly has grown to over $1 billion in reserve. According to a 2022 Binance transparency report audit, this reserve can cover security incidents such as hacks or internal errors, safeguarding users up to substantial limits.

- Robust Security Layers & Transparency: Binance employs multi-layered security measures, from multi-signature wallets and rigorous KYC procedures to ongoing cybersecurity audits. With a proven track record of swiftly dealing with rare security incidents, Binance has consistently demonstrated quick responses to potential threats.

In short, Binance maintains a very tight ship when it comes to protecting your staking rewards and crypto assets.

Of course, risks in crypto can never be reduced to zero—let's stay realistic—but having looked closely, my verdict is clear: Binance staking is genuinely legit and prioritizes impressive safeguards for users’ funds.

But just being secure doesn't automatically mean staking on Binance will fill your pockets. The big question you might be itching to ask: "Is staking actually worth your time and crypto, in terms of profitability?" Well, let's find out together in the next part.

Is Binance Staking Really Worth It?

Let's be real—for most of us, crypto is all about earning extra passive income. You've probably already heard it—Binance staking can put your crypto assets to work and grow your portfolio effortlessly. But does the reality match the hype? Is Binance staking genuinely worthwhile? Let's take an honest (and friendly!) look.

Benefits of Staking with Binance

Here's why many crypto investors love Binance staking in simple terms:

- Truly Passive Income – Once you've staked your crypto, you earn rewards automatically without having to do anything else. It's passive income in its purest form (and who doesn't love earning while sleeping?).

- Higher Returns Than Traditional Savings – Let's face it; bank savings accounts barely beat inflation these days. With Binance staking, you can typically earn between 4% to 15% annually depending on the crypto asset you stake. For example, staking popular coins like Cardano (ADA) and Solana (SOL) often offers APYs leagues above what traditional finance can compensate.

- Automatic, Hassle-Free Payouts – Binance calculates and pays your staking rewards directly into your account regularly. No messy calculations, no confusing terms—only straightforward results, which translates to less stress for you!

"Compounding interest is the eighth wonder of the world. He who understands it earns it. He who doesn't pays it." – Albert Einstein

Binance staking brings this famous quote to life by allowing generated rewards to compound over time, meaning your earnings can snowball into something impressive.

Potential Risks and Downsides You Should Understand

But wait—before you jump in feet-first, let's talk openly about some risks and concerns so that you aren't caught off guard:

- Your Tokens Can Be Locked Up Temporarily – Staking crypto usually means locking your assets for a certain period, which could be from a few days to months. If the market moves significantly and you want immediate liquidity, you might find yourself stuck and unable to move your coins right away. Not a situation you want to find yourself in without preparation.

- Crypto Market Volatility – While staking lets you gain additional tokens, it doesn't shield you from market volatility. Earning 10% APY won't help if the cryptocurrency you're staking falls 30% or more. So it's important to choose stable, reputable cryptocurrencies and maintain proper risk management.

- Reduced Liquidity – Locked staking periods can hamper your flexibility to jump on other potentially profitable crypto opportunities. If your assets are tied up, you might miss out when lucrative crypto trades appear unexpectedly.

Now, you might be thinking—that's great info, but get to the point—can staking actually make me money every single day? Can you, for instance, safely make $20 daily just from Binance staking alone?

That's the million-dollar question…or should I say, twenty-dollar question? Stick with me—because I'll answer exactly that in the next section!

Can You Earn $20 Daily Using Binance Staking?

One of the burning questions I hear on Cryptolinks from crypto enthusiasts every day is: "Can Binance staking realistically earn me $20 a day?" It's a great question, and I appreciate the sincerity behind it. After all, putting your crypto to work sounds amazing—but is earning this much passive income doable or just a dreamy hype?

Realistic Expectations for Daily Earnings

Let's talk openly. Earning $20 per day from staking crypto on Binance is absolutely possible—but let's set realistic expectations. Your daily staking income depends heavily on these key factors:

- Amount invested: Large principal equals larger daily earnings. For example, staking around $10,000 worth of a crypto asset at 7.5% APY (Annual Percentage Yield) could generate approximately $2 a day. To hit $20 daily, you’d obviously need a much larger stash.

- Asset type and APY: Different cryptocurrencies have different staking rewards. Binance often offers attractive APYs for coins like Ethereum, Binance Coin (BNB), or Cosmos (ATOM). Choosing coins wisely can significantly ramp up your daily gains.

- Market volatility and token price: Remember—the daily dollar value of rewards fluctuates with crypto prices, meaning your daily earning in USD could easily vary.

Let's break it down with a practical example: staking BNB coin might net you anywhere between 4-6% APY, while higher-risk altcoins could hit above 10%. To achieve the $20/day goal solely from staking at around 6% APY, you'd need approximately $120,000 staked, which is substantial but doable for some crypto investors.

"Opportunities multiply as they are seized." – Sun Tzu

This isn't meant to discourage but to set clear expectations—real earnings come from long-term decisions and patience. But what if you're eager to reach the $20/day goal faster, even if you don't have a fortune in crypto assets yet?

Other Proven Ways to Reach Your $20/day Goal on Binance

If staking alone doesn't seem feasible yet, there's some good news: Binance provides other equally legitimate pathways to hit your daily passive earning targets.

- Binance Affiliate Program: By simply sharing your Binance referral link, you could generate commissions whenever your friends trade. Binance’s affiliate commissions are generous and can substantially supplement your staking earnings. Check out Binance's official referral program details.

- Savings and Flexible Earnings Accounts: Binance offers flexible saving products with competitive yields, complementing your staking approach. Mixing these can quickly compound your daily earnings.

- Trading and Investing Smartly: While slightly riskier, strategic trading or investing in promising new tokens can result in substantial passive and semi-passive gains.

Combining staking with other tools such as affiliate programs and savings could easily take you far beyond your $20/day passive income goal.

So, the question isn't just, "Can Binance staking alone get me there?"—think of it this way: "What combination of methods can most effectively push me above my daily earning goals?" Curious what’s next and how to safely use Binance within the United States? Stay with me as I show you exactly how to make staking work smoothly for US crypto holders.

Binance Staking in the United States: Which App Should You Use?

Being a crypto enthusiast in the United States definitely comes with its own set of unique challenges. I get it—regulatory hurdles can be confusing, and it can feel like you're missing out on exciting crypto opportunities available to people elsewhere.

Let's take a clear look at Binance staking for those of us based in the USA. I'll explain exactly why you need to use Binance.US instead of the global Binance platform, plus how to make the most of what's available to you.

"With crypto, compliance isn't about restrictions, it's about being smart and protecting your investments for the long haul." — Anonymous Crypto Investor

Why You Must Use Binance.US (Instead of Binance.com)

Maybe you've tried signing up with Binance.com, just to realize it's not workable from inside the States. Frustrating, right? Trust me, I've been there. Due to strict SEC regulations and specific compliance requirements in the US, Binance needed to create an entirely separate platform—Binance.US—specifically designed to fit American regulation standards.

But don't worry! Binance.US offers reliable crypto staking opportunities that are fully compliant and easy for US residents to access safely. By using Binance.US rather than Binance.com, you're ensuring:

- Compliance with SEC guidelines, reducing regulatory risk

- Stronger customer protection measures required by US laws

- Transparent and secure payment methods supporting major US banks and institutions

Skipping compliance or attempting to bypass geographic limits can lead to account lockouts or legal hassles—definitely not worth the headache!

Making the Most of Binance.US Staking App

Now you're probably thinking, "Okay, got it—so how do I stake crypto effectively on Binance.US?" Glad you asked. Using the Binance.US app, staking crypto is convenient, straightforward, and surprisingly rewarding.

Here’s what you should do to kick-start your staking game using Binance.US:

- Get the right app: First, make sure you're downloading the official Binance.US app. You can easily get it on the Play Store.

- Verify your account: Verification ensures regulatory compliance and unlocks valuable platform features (staking included!). It's a quick process—typically just requires your ID and proof of residency.

- Choose attractive staking assets: Binance.US regularly offers solid proof-of-stake crypto options where annual returns can be generous. Depending on your crypto preferences and investment strategy, popular staking coins like Solana (SOL), Cardano (ADA), and Polygon (MATIC) often hit a sweet spot of decent yield plus lower volatility.

- Stake and relax: Choose your assets, lock them up for your chosen terms, and passively earn crypto yields delivered directly into your account. Easy!

Honestly, I've seen many investors pleasantly surprised at how user-friendly and rewarding the Binance.US staking app truly is once they got over their initial hesitation. You might not have every single coin that Binance.com offers globally, but real opportunities are waiting for you right here in the US.

Ready to take it a step further? Curious about exactly how to select the best staking assets, or how timing might impact your returns? I've got some incredible expert insights lined up next that can help you truly ace your Binance staking strategy. Want to check them out?

Expert Tips: Making the Most from Your Binance Staking Experience

Who doesn't love a good insider tip? Trust me—staking your crypto on Binance can genuinely boost your passive earnings, but only if you choose the right assets and get the timing just right. Let me share some proven strategies and a couple of useful insights that most staking beginners miss.

How to Choose the Best Staking Assets on Binance

Not all staking options on Binance are created equal. I've seen investors jumping into staking solely due to high Annual Percentage Rates (APR), only to regret their decision when coin prices tank. Here's how you can pick staking assets you won't regret later:

- Prioritize Projects with Strong Fundamentals – Always look into the crypto asset you're considering. Stronger assets, those with genuine utility, proven teams, and active communities, usually weather market storms far better. Consider checking third-party coin analytics or popular crypto forums to measure sentiment and real-world use.

- Balance APR and Risk – Attractive staking rewards can be tempting at first glance, but extremely high APR might indicate higher volatility, lower market confidence, or emerging risks. Moderate rates that are sustainably offered by well-known coins (like ADA, SOL, or DOT) can often deliver better long-run returns than those tempting “super-high APRs” from uncertain projects.

- Analyze Market-Outlook Carefully – Crypto is notoriously emotional. Coins that show steady growth trends or long-term bullish outlooks typically offer better security when staking. Check analyst consensus, recent technical analysis from reputable sources, and market sentiment on platforms like Twitter or Reddit before committing your coins.

Remember—research takes just a fraction of your time but saves you from loads of potential losses. As Warren Buffett famously said,

"Risk comes from not knowing what you're doing."

When You Should Stake – and When You Shouldn't

Timing your staking position is definitely crucial—it’s not just about what you stake, but when. Market cycles play a huge role in your profitability.

- Bull Market Good, Bear Market Caution – Generally speaking, staking during bullish or upward-trending market cycles tends to maximize your revenues, since your staking rewards multiply with rising coin prices. However, during bear markets, declining prices often wipe out those gains—even with high APRs.

- Global Crypto Sentiment Matters – Are governments introducing regulations? Any widespread FUD (fear, uncertainty, and doubt)? Stay informed—bad news can shake prices negatively overnight and could significantly impact your staking profits.

- Consider Liquidity Needs – If you need immediate cash or expect expenses in the near future, avoid locking in excessively long staking durations. Binance does offer flexible staking options you can enter and exit without major penalties—perfect for short-term uncertainty.

Every pro investor or crypto enthusiast struggles sometimes with timing, but the key is patience, solid knowledge, and clear-headed decision-making. So how can you further sharpen your staking strategy and make winning decisions every single time? Productive investing means being prepared—ready to gain even deeper insights that most Binance users completely overlook?

Keep reading. Up next are crucial resources that'll equip you to stake smarter, safer, and with total confidence...

Resources to Explore Further (Because Knowledge is Power!)

If you’re serious about staking your crypto on Binance, you're probably hungry for more trustworthy resources. With so many misleading information out there, knowing exactly where to look is half the battle won, right? I've gathered a few brilliant resources below that I personally recommend to anyone who wants to stake confidently and safely with Binance.

Binance Official Staking Information

The first stop you should always make is Binance’s official staking page. This directly updated resource is straight from the source, ensuring you get timely, accurate info about supported assets, APR rates, and any ongoing staking campaigns. I always emphasize that official documentation trumps hearsay—we owe it to our crypto balances to verify directly with Binance itself!

Crypto Security Verification Tools and Reviews

Wondering how safe Binance staking (or any crypto webpage) really is? Well, no smart investor leaves security to chance. Here's what I use, and you should too:

- Trustpilot – You can quickly scan authentic user reviews and complaints to ensure that you're dealing with a reputable platform that's treating users fairly.

- URLscan.io – An awesome cybersecurity tool to check website legitimacy and detect phishing attempts instantly. Simply paste in any webpage URL, and URLscan gives you a detailed safety report in seconds. I use this every time before interacting with crypto websites.

- CoinMarketCap – A great resource not only for checking coin prices but also to verify if your staking asset has useful updated information, credible exchanges, and official links.

Community Insights That Actually Help

Have you ever noticed that when it comes to crypto, community is king? That's especially true with staking. Trustworthy community forums and Reddit threads provide real-world experiences and insights you won’t find in any official documentation. Here are my favorites:

- r/Binance Subreddit – Arguably the most vibrant community dedicated entirely to Binance-related discussions. Here, you get firsthand experiences from actual investors who openly share their staking results, strategies, and even mistakes.

- BitcoinTalk – An evergreen resource among crypto veterans. Don't underestimate outdated-looking forums—BitcoinTalk remains a goldmine of crypto wisdom that I still frequently check out.

By keeping these resources at your fingertips, you'll become a savvier Binance staker in no time. But wait—you might be wondering: "Which common staking questions have others been asking repeatedly, and what unexpected advice could help me even further?"

Well, you're in luck! In the final part coming up, I’ll answer the frequently asked questions people have about Binance staking—clear, straight-to-the-point answers that'll likely cover exactly what’s on your mind. Let's tackle them next!

Frequently Asked Questions About Binance Staking

Let's wrap things up by answering some of the most common questions I hear from readers about Binance staking. I'll keep it simple and easy to follow, so you can feel totally comfortable using Binance staking without worrying.

How do you make $20 a day on Binance?

Honestly, this is one of the most frequent questions—and for good reason. Earning a consistent daily income through crypto staking sounds amazing, but the truth is you'll need a decent initial investment to comfortably reach that $20-a-day mark through staking alone.

For example, let’s look at a realistic scenario: say you're staking BNB (Binance Coin) currently offering an APR (Annual Percentage Rate) of around 5%. For simplicity, assume BNB’s price is around $300 (of course, prices fluctuate). Earning $20 per day ($7,300/year) would require holding around $146,000 worth of BNB at this rate—that’s nearly 487 BNB coins. Quite a hefty investment, right?

But don’t get discouraged! If you don’t have that much capital to invest upfront, there are other ways to reach your daily earning goal on Binance. Affiliate commissions from Binance's referral program, futures trading (although higher risk!), or combination of solutions are all viable alternatives to supplement staking.

How to check if crypto is legit?

Spotting crypto scams—and knowing if something is genuine—can save you tons of headaches. Luckily, there are some quick fool-proof ways to verify legitimacy:

- Always double-check the URL and only use official, verified pages. Official Binance staking should start with https://www.binance.com (global users) or https://www.binance.us (U.S. users).

- Look up genuine customer reviews online from reputable platforms and communities such as Trustpilot, Reddit crypto groups, or major cryptocurrency forums before investing.

- Ensure official licenses or formal certifications exist (well-known exchanges typically publish registration and legitimacy certificates).

- Avoid platforms promising crazy-high returns overnight—they're usually scams.

If you use these checklist methods, you'll be pretty safe when staking your crypto on Binance or elsewhere.

Is staking crypto worth it?

My short, honest answer? Yes, staking can definitely be worth it—IF done wisely. Let me break down both sides clearly for you.

On the upside:

- Earn passive income even during market downturns.

- Usually, good returns compared to traditional banking or savings accounts.

- Helps you patiently hold quality crypto assets for the long term, avoiding impulsive trades.

But you should be cautious about:

- Locking-in your coins means reduced flexibility. Prices can fluctuate, and you might face limitations withdrawing when you need it most.

- Risk of the coin you're staking losing value in a prolonged bear market, offsetting your staking gains.

- Careful to choose reputable platforms only, such as Binance, to keep risks low.

If you're aware and okay with these trade-offs, staking Binance crypto can be a genuinely smart long-term investment strategy.

Final Thoughts: Your Path to Binance Staking Success

Binance staking isn't rocket science—but like anything in crypto, there's a learning curve involved. I've walked you through what makes it legit, how realistic earnings actually look, how to stay safe, and some simple ways to boost your gains by choosing wisely.

Bottom line—you can definitely earn meaningful passive income staking crypto on Binance, as long as you adjust your expectations realistically and always double-check legitimacy beforehand. Be patient, do your homework, and don't be afraid to combine staking with other opportunities on Binance to accomplish your goals faster.

You're now equipped with the knowledge—and confidence—you need for successful staking. It's your turn to give it a shot and see the results for yourself. Let's get staking!