Joseph Young Review

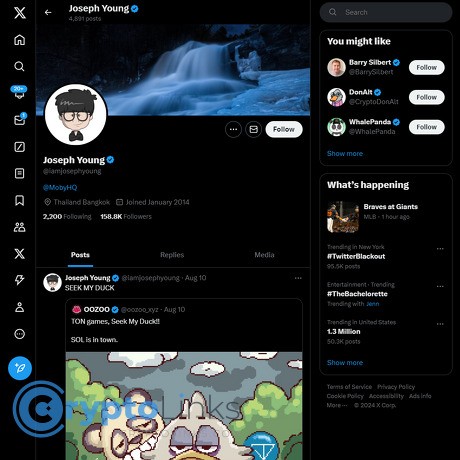

Joseph Young

x.com

Joseph Young (@iamjosephyoung) review guide: what to expect, how to use his posts, and a clear FAQ

Can following @iamjosephyoung on X actually help you make better crypto decisions without getting dragged into FOMO?

Short answer: yes—if you use his posts the right way. I use his feed for fast market context, clean news signals, and smarter research—not blind trades. It’s the difference between being early to a story and being bait for a pump.

The real problem: Crypto X is a noisy minefield

It’s wild out there. Hype threads, fake “alpha,” and bots crowd your feed. Then come the impersonators. Add one more layer of chaos: there are multiple well-known “Joseph Youngs” online (a conductor, a historical figure, and the crypto commentator). People get confused, follow the wrong account, miss real news—or worse, get pulled into fake narratives.

- Noise overload: Your brain is juggling 50 headlines with no clear priority.

- Impersonation risk: Clone accounts run “giveaways” and push scams. Always confirm the handle: https://x.com/iamjosephyoung.

- Wrong Joseph: Search “Joseph Young” and you’ll find a conductor and a 19th‑century figure—neither is the crypto commentator you want.

- FOMO traps: A hot headline hits, you chase the move, liquidity vanishes, and you’re the exit liquidity.

It’s not just a crypto problem. About half of U.S. adults say they get news from social platforms at least sometimes, and many worry about misinformation and context loss—especially during fast-moving events. Source: Pew Research.

What I’m going to solve for you

I’ll show you exactly how I use Joseph’s feed:

- Who he is (and which account is real)

- What he actually posts and how it’s different from “trade calls”

- Where he’s strong—and where he isn’t

- How to plug his posts into a clean research workflow so you act with facts, not adrenaline

- FAQ that clears up confusion (including those strange Google questions that mix him up with other Joseph Youngs)

The goal: turn his updates into reliable context you can verify and use—without turning your feed into a casino.

Who this guide is for

- Investors who want fast market context without drowning in noise

- Builders, analysts, and traders who need reliable news cues

- Newcomers who want to avoid influencer traps and impersonators

Quick disclaimer

This is not financial advice. Treat every influencer—Joseph included—as one input. I use public info, a clear process, and strict risk rules.

How I rate crypto voices (so you can copy the framework)

I don’t “follow and hope.” I score accounts by how well they fit a real research stack: news → verify → thesis → risk.

- Signal-to-noise: Do their posts consistently surface the catalysts that actually move markets?

- Timeliness: Are they early on meaningful data (ETF flows, liquidations, policy headlines) without sacrificing accuracy?

- Original insight vs. retweets: Are they adding context, or just echoing the timeline?

- Transparency: Clear about sources, careful with rumors, not shilling “programs.”

- Stack fit: Can I convert their post into an action: open the source, check data, update watchlist, define risk?

Simple example: If Joseph posts about unusual ETF flows or a regulatory headline, that’s a context spark. I immediately open the primary source (issuer page, regulator site, or reputable newswire), confirm the numbers, and then check price/volume/oi to see if the market’s already priced it in. No headline-chasing, just structured steps.

Ready to make this practical? Next, I’ll show you who Joseph Young is in crypto, what he actually posts, and why his style works as a quick market radar. Curious what you should expect in your feed during real news cycles?

Who is Joseph Young (@iamjosephyoung) in crypto?

Joseph Young is one of those accounts I keep open when markets get loud. He’s a long-time crypto and macro commentator on X who focuses on Bitcoin, ETFs, macro headlines, Asia trading flows, and the big institutional/exchange stories that actually move price. Think news radar + one-sentence context. Not threads for the sake of threads—just the stuff you need to stay oriented.

What he posts, in a nutshell

When something market-moving hits, I expect a quick snapshot from him that answers “why this matters right now.” Typical themes include:

- BTC/ETH movers: fresh catalysts behind a sharp move, liquidation clusters being cleared, or funding flipping.

- ETF flows: early sharing of daily net inflows/outflows and streaks. Think: a flow table or chart (often seen from trackers like Farside or SoSoValue) with a one-line takeaway on sentiment.

- Regulation/policy: SEC/ETF updates, enforcement headlines, or court rulings that change risk-on/off faster than a chart can.

- Exchange and institution news: major outages, institutional buys/sales, stablecoin shifts, or big liquidity events.

- Asia session pulse: notes on activity during Seoul/Hong Kong/Singapore hours, where liquidity often sets the tone before the U.S. open.

Real-world sample patterns I’ve seen over time:

- “Spot BTC ETF flows flip green after a red week; BTC reacts quickly.” Usually paired with a chart and a sentence on why it’s a big deal.

- “Sharp wick down during Asia hours—OI flush + funding reset.” A fast way to flag a clean-out rather than a narrative shift.

- “Institutional headline (custody, corporate treasury, or exchange listing) → watch liquidity response.”

Why this format works: market research from outlets like Kaiko and other data providers has consistently shown that ETF and regulatory headlines correlate with intraday volatility. Quick context, when accurate, can keep you from chasing the wrong move.

Style and tone

Short, clear, market-first. He tends to highlight the catalyst and the likely direction of pressure without trying to be a guru. It feels more like a newsroom squawk—built to be skimmed, not studied.

“In fast markets, context beats speed. The first headline you see shouldn’t be the last step you take.”

That’s the energy: quick enough to keep you in the game, calm enough to avoid FOMO traps.

Frequency and timing

He’s active around market-moving windows and major news cycles. You’ll often see him early on:

- Daily ETF prints and streaks (especially on big reversals)

- Liquidation waves that wipe open interest and reset funding

- Institutional headlines that flip risk sentiment

- Asia hours shifts before the U.S. session ramps

That rhythm pairs well with a structured routine: scan in the morning, check around ETF data drops, and glance during policy events.

What he is not

He’s not your buy/sell button. Don’t expect:

- Personal trade calls with entries/exits

- Step-by-step coaching or strategy threads

- Portfolio transparency or sizing rules

- DM “opportunities,” giveaways, or schemes (avoid anyone pretending to be him)

Use his posts as the early alert, not the final decision.

Curious where he truly shines—and where the gaps are? In the next part, I’ll lay out a straight-shot credibility check: strengths I rely on, limits that matter, and simple rules to keep you out of trouble when the headlines fly. What do you think I’ll list first?

Credibility check: strengths and limits

I keep Joseph’s feed on my screen for one reason: fast, clean context. When the market starts humming and you don’t have time to open 20 tabs, his posts help you understand the “why now” without drowning in noise.

“In fast markets, context beats conviction.” If you know the catalyst, you can decide—calmly—whether it’s your trade or not.

Strengths I’ve seen

- Quick on ETFs and macro headlines. When daily spot BTC ETF flows hit, I often see a short summary framing net inflows/outflows and the likely sentiment shift. It’s the right level of detail to decide if I should open my data dashboards.

- Clear “why this matters” framing. He’ll point to what’s actually moving price (policy updates, liquidity shocks, ETF prints), not just the headline itself. That one line of context saves time.

- Good pulse on Asia hours. If you track those 00:00–08:00 UTC moves, you know how Asia session liquidity can front‑run or fade New York. I’ve seen timely notes on liquidations, basis, and exchange stories during those windows.

Two quick real-world moments that underline why this style helps:

- SEC’s account incident and the spot BTC ETF approval (Jan 2024): The fake “approval” from the SEC’s account sent BTC whipping around the day before the actual approval. That week was a reminder that crypto reacts within minutes to official-looking headlines. A concise, level-headed post can help you step back, verify, and avoid being the exit liquidity.

- CPI prints and rate expectations: Crypto’s intraday beta to CPI/Fed surprises is well documented by desks and public data. Short, timely context on those releases is valuable if you’re deciding whether to reduce leverage or hedge into the print.

There’s a broader point here: exchange-traded product flows and macro releases are public, time-stamped, and widely tracked. Multiple industry studies and desk notes over the years have shown that these data points can explain a lot of short-term crypto volatility. A feed that reliably flags them—fast—earns its keep.

Limits to note

- Not deep on-chain or tokenomics. You won’t get detailed vesting schedules, liquidity maps, or protocol-level mechanics here. Bring your own on-chain and fundamentals tools.

- Momentum bias. What’s moving gets talked about. That’s great for awareness, but it can crowd out early-stage, low-liquidity gems that require longer research cycles.

- Not a portfolio guide. No position sizing, no entries/exits, no risk frameworks. It’s commentary, not a signal service—keep your own playbook tight.

Why these limits matter: academic and industry research repeatedly shows that headline-chasing without a process tends to underperform due to slippage and whipsaw. Use the information to refine your plan, not replace it.

Best-fit use case

- Use for triage. Spot the catalyst (ETF flows, policy move, liquidity shock).

- Verify fast. Open the primary source: issuer flow sheets, regulator pages, official press releases, or reputable terminals.

- Quantify impact. Check funding, open interest, volumes, and your on-chain dashboards if relevant. Decide if it fits your thesis and timeframe before touching the buy/sell button.

Two micro “case studies” from my screen:

- ETF outflow day: I see a post summarizing net outflows. I open the issuer sheets, confirm totals, check price reaction vs. prior outflow days, and see if funding turns sharply negative. If price already moved and structure’s broken, I wait for a clean retest instead of chasing.

- Asia session liquidation sweep: A quick note highlights heavy long wipes. I pull liquidation heatmaps, compare to spot/futures basis, and decide whether the move is panic or a trend break. No headline-trades, only plan-trades.

Red flags to watch (general X hygiene)

- Impersonators. Always confirm the handle: https://x.com/iamjosephyoung. A blue check isn’t proof—check bio links, join date, and post history.

- Too-good-to-be-true offers. Ignore “giveaways,” investment programs, and DMs. Reputable commentators don’t run your money.

- Screenshot bait. Headlines in images without source links are a tell. If you can’t verify in one click, assume it’s noise.

The takeaway is simple: Joseph’s feed is a strong radar, not an autopilot. If you like staying a step ahead of headlines without turning your portfolio into a reaction machine, this is the kind of account you keep on—but you still run your own checks.

Want to see the exact filters, lists, and notification rules I use so I catch the signal and skip the FOMO? I’ll show you the step-by-step workflow next—curious which three checks I require before acting on any post?

How I use his feed in my research stack

When markets get loud, I want one thing: fast, trustworthy context I can act on after I verify it. That’s exactly how I use Joseph Young’s posts—like a radar screen, not a trade button.

“Process beats impulse. Headlines are the spark; risk rules are the firebreak.”

News radar

I skim his timeline for catalysts and then run a quick verify-and-validate loop. If it survives the loop, it earns my attention. Here’s the exact pass I use:

- Spot ETF flows mentioned? I confirm with independent trackers like Farside Bitcoin ETF Flow or BitMEX Research. If flows are outsized, I check whether price already absorbed the news.

- Liquidations or leverage spike? I open CoinGlass Liquidation Heatmap, funding rates, and open interest. Elevated funding often warns of short-term mean reversion; industry research from Glassnode and Kaiko has highlighted this dynamic across cycles.

- Asia-session flows or “Kimchi premium” vibes? I look at the KRW premium index on CryptoQuant and check volumes on KRW pairs. If the premium is bloated, I assume air pockets on the way down.

- Regulatory headlines? I click through to the primary source—SEC/agency filings, court dockets, or official statements. If no source is linked, I treat it as a “monitor,” not a “move.”

That’s the key: scan for catalysts, confirm with hard data, then decide if it even belongs on my desk.

Idea sourcing

When a post highlights a ticker, sector, or theme (ETFs, Asia flows, exchange news), I convert it into structured research instead of impulse trades:

- Create a watch card: ticker, narrative, catalyst date/time window, and a one-line thesis.

- Run data checks:

- Spot volume vs. perp volume (greater spot share = healthier move)

- Open interest build or flush (on CoinGlass or Laevitas)

- Funding rate and basis (stretched = caution)

- On-chain exchange flows for majors (Glassnode/CryptoQuant) to see if coins are moving to or from exchanges

- Map the trade path: continuation vs. mean-reversion setups, key levels, invalidation, and target zones.

For example, if there’s buzz around ETH ETFs or institutional flows, I’ll watch the ETH/BTC spread, check options skew on Laevitas for sentiment, and confirm spot-led participation before I consider entries. Academic and industry literature consistently shows that attention spikes alone don’t guarantee alpha; see Tetlock (2007) on media tone and returns, and Da, Engelberg, & Gao (2011) on investor attention—great reminders to pair narratives with numbers.

Risk rules that save me

Headlines tempt you to click buy. Rules stop you from paying tuition to Mr. Market.

- No trades off headlines alone. If I can’t verify the source or quantify the impact, I pass.

- Wait for structure. After a big post hits, I let 1–3 candles print on my execution timeframe (5–15m) to see if the first move gets faded.

- Respect leverage signals. If funding is extreme or OI just ballooned into resistance, I trim size or wait for a pullback/retest.

- Define invalidation first. If the setup needs a wide stop I can’t fund, I size down or skip.

- Avoid the first spike. I prefer pullbacks to broken levels or clear acceptance above/below a range, not the knee-jerk candle.

- Keep a “news risk” bucket. Smaller fixed size for trades influenced by fresh headlines.

Why so strict? Because the data says so. Barber & Odean (2000) showed that high-activity, attention-driven trading underperforms—“Trading Is Hazardous to Your Wealth.” Tetlock (2007) found media tone impacts short-term prices, but effects often fade. In crypto, multiple studies and dashboards (Glassnode, Kaiko) document that overheated perp markets and heavy liquidation clusters tend to precede choppy or reversing conditions. Translation: impulsive clicks are expensive.

Notifications and lists

I want signal, not anxiety. So I keep Joseph in a short “news tier” list and only turn notifications on during high-volatility windows:

- Curated list, tiny on purpose: a handful of reliable news and data voices. If someone repeatedly baits FOMO, they’re out.

- Event-based alerts: on for FOMC, major ETF flow days, big policy decisions, or exchange incidents. Off the rest of the time.

- Companion dashboards: I pin Farside ETF flows, CoinGlass funding/OI, and an options board (Laevitas) next to X. If the post and the data disagree, I side with the data.

- Protect attention: research in PLoS ONE (Kushlev & Dunn, 2015) showed fewer notifications reduce stress and improve focus. I batch-catch up outside event windows to keep my head clear.

The goal is simple: let his feed point me to what matters, then let my dashboard decide if it’s real, ripe, and worth risk.

Curious how this “news radar” pairs with deeper on-chain or policy voices so you cover the blind spots? I’ll show the exact combinations I use—who complements what, and when to ignore even the buzzy stuff—coming right up.

Where he fits vs. other crypto voices

I treat my feed like a workstation. Every account has a job: some tell me what just happened, others help me figure out why it matters, and a few help me test the trade. Joseph sits squarely in that first lane—fast, reliable context on what’s moving right now.

“Speed is only an edge when it points you to the right questions.”

News-first vs. deep analysis

Joseph is the “news/catalyst radar.” He’s most valuable when the market is twitchy—ETF flows, macro headlines, exchange hiccups, Asia-session impulses. I pair that with deeper, slower tools and people so I don’t act on headlines alone.

- News radar (Joseph): Flags the catalyst early—“ETF flows strong,” “regulator moves,” “big exchange headline.”

- Verification/data: I confirm numbers on dashboards and check positioning:

- Spot BTC ETF flows: SoSoValue, Farside, and BitMEX Research.

- Funding, OI, liquidations: Coinglass, Laevitas, Coinalyze, Hyblock.

- On-chain flows (when relevant): Glassnode, CryptoQuant.

- Interpretation/edges: Long-form research or your own notes to decide if the headline changes your thesis or is just noise.

Real-world example: Joseph highlights “heavy Asia-session BTC momentum alongside positive ETF prints.” I confirm the ETF data on SoSoValue, check funding and OI skew on Coinglass/Laevitas to see if perps are getting crowded, then decide if the move is driven by spot demand or leveraged chase. If it’s the latter, I’ll look for a better entry or skip entirely.

Why this split works: attention spikes often move prices in the short term (think attention-based asset pricing by Da–Engelberg–Gao), but reactionary trading hurts performance (Barber & Odean’s overtrading research). News for awareness; data for decisions.

Great pairings

Here’s how I wire Joseph into a complete, low-noise setup:

- ETF/fund flows: SoSoValue, Farside, BitMEX Research — confirm the inflow/outflow narrative before you act.

- Derivatives posture: Coinglass, Laevitas, Coinalyze — funding, OI, options skew to spot froth or hedging.

- On-chain health: Glassnode, CryptoQuant — exchange balances, realized profit/loss, whale flows.

- Policy/legal clarity: Coin Center, SEC, CFTC — read primary sources if a regulatory headline is moving price.

- Exchange/system status (for “why is price weird?” moments): Coinbase Status, Binance Updates, Deribit Status — outages/liquidation cascades show up here before rumors settle.

Quick playbook you can copy: Joseph flags a “big liquidation pocket.” I open Hyblock to see heatmaps, check Coinglass for actual liquidation prints, then confirm if system status is clean (no exchange bugs). If it’s just leverage washout and my higher-timeframe thesis stands, I’m planning entries—not panic.

Beginners vs. pros

- Beginners: Use his posts to learn which headlines move markets—ETFs, funding shifts, regulatory decisions, exchange liquidity. Build a habit: see the post, verify with one data link, write a one-sentence takeaway. No trade? Still worth the rep.

- Pros: Keep him on for timing and awareness. When he flags flows or a policy move, you’re already checking basis, term structure, spot/perp divergence, or on-chain confirms. Use his speed to be earlier in your own process, not to chase.

Emotion check that helps both: if your heart rate jumps when you read a post, you’re late. Screenshot it, verify, then decide. Discipline beats dopamine.

When to ignore

- It doesn’t fit your thesis or timeframe: Great story, wrong playbook. Pass.

- The move already ran: Funding spiking, OI ballooning, and options skew screaming chase? Let it go or wait for structure.

- No independent confirmation: If you can’t verify with a primary source or a trusted dashboard, it’s entertainment—not a trade.

- You can’t explain it in one sentence: “Because X changed, I expect Y within Z timeframe.” If you can’t say that, you don’t have a trade.

One more thing—if you’ve ever Googled “Joseph Young” and seen some truly random results, you’re not alone. Wondering how to avoid mix-ups and impersonators once and for all? I’ll clear that up next and share the quickest checks I use every week.

FAQ: clearing up confusion (and those odd Google questions)

Is @iamjosephyoung the same person as the historical Joseph Young with multiple wives?

No. That’s a completely different person from the 19th century. You’re thinking of a Latter‑day Saint leader named Joseph Young (died 1881). Public records list six wives: Jane Adeline Bicknell, Lucinda Allen, Lydia Caroline Hagar, Mary Ann Huntley, Sarah Jane Snow, and Elizabeth Stevens. That historical figure has nothing to do with crypto or with the X account @iamjosephyoung.

What was Joseph Young’s religion?

Also not the crypto guy. Joseph Angell Young (Brigham Young’s son) was a member of The Church of Jesus Christ of Latter‑day Saints. Again, unrelated to the modern markets commentator on X.

Is Joseph Young still conducting?

Different person entirely: Maestro Joseph Young, the orchestral conductor. Recent arts coverage mentioned Berkeley Symphony’s transition around the 2025–26 season. That’s the music world—not crypto and not the X account you follow for market context.

Does @iamjosephyoung give financial advice?

No. Think of his feed as real‑time market commentary and news highlights. If you see a price‑moving headline there, treat it as a cue to verify and run your own process. Studies consistently show that reacting to headlines without verification increases error rates and FOMO trades. A well‑known MIT study (Vosoughi, Roy, Aral, 2018) found false news spreads faster than true news on social platforms—so your best move is to slow down, confirm the source, and only then decide if it fits your plan.

- Rules I use in practice: no trades from a single post; confirm with a primary source (press release, regulator site, ETF sponsor page); and check price structure before acting.

- Fast verifications that help: for ETF flows, cross‑check the issuer’s website or reputable data dashboards; for exchange incidents, look at official status pages; for policy news, find the original regulator memo or court docket.

How do I avoid imposters?

Impersonators love big market accounts. They mimic avatars, buy usernames with a tiny typo, and push “opportunities.” Here’s how I stay clean:

- Match the exact handle: https://x.com/iamjosephyoung

- Check name + handle alignment: scammers often use small swaps (uppercase I vs lowercase l, extra underscores).

- Scan the post history: the real account posts market context and reputable news—imposters spam giveaways or DMs.

- Be suspicious of DMs: real commentators don’t run “investment programs” or ask you to send crypto.

PSA: Typical imposter DM script looks like this:

“Hello, I’m Joseph. Private fund opening to select followers. 20% weekly. Send USDT to get started.”

If you see that, report and block. No legit analyst needs your wallet seed or an upfront “test” transfer.

Why do weird “wives” or “religion” questions show up when I Google him?

Because search engines blend results across people with the same name. Joseph Young is a common name, and the historical figures are heavily documented online. That’s why I always verify the handle first and sanity‑check context (crypto markets vs. 19th‑century history vs. classical music).

Is it safe to act on a single “breaking” post about an ETF, hack, or regulatory move?

Not without verification. Fast‑moving falsehoods are a known problem in markets. The MIT false‑news study I mentioned showed sensational items spread farther and faster than truthful ones, especially in finance and politics. My fix is simple:

- Two‑source rule: don’t act until you’ve confirmed via a primary source or a trusted independent data feed.

- Timestamp + provenance: check when the data was published and who generated it (issuer, regulator, court).

- Price already moved? I wait for structure or a pullback instead of chasing a headline spike.

Can I reach out for more tools to verify what I see on X?

Yes—here’s my running list of handy reads and tools I keep for source‑checking ETF flows, market data, and policy news. Bookmark it and use it whenever something on your feed looks too good (or too scary) to be true.

One more practical tip: when a headline tags a specific institution—like an ETF issuer, a regulator, or an exchange—jump straight to their official page or press room and look for the matching statement. If it’s not there, assume it’s unconfirmed and slow down.

Ready to turn this clean‑up into a simple, repeatable checklist you can run in under a minute—without missing real opportunities? I’m about to share exactly that next.

Wrap-up and next steps

Use Joseph Young’s feed like a fast, clean news radar. It’s perfect for spotting catalysts and grabbing quick context before you move to your tools. That’s how I keep the upside of X without the FOMO whiplash.

Simple rule I live by: “Use X for awareness, charts for decisions, risk for survival.”

Quick checklist to follow

- Follow the real handle: https://x.com/iamjosephyoung

- Treat posts as awareness, not entries: if something pops right after a headline, I wait for price structure, not impulse clicks.

- Verify key claims: ETF flows, liquidations, and policy headlines get cross-checked with primary dashboards and official sources.

- Use a one-sentence thesis: “I think X because Y; I’m wrong if Z.” If you can’t write it, don’t trade it.

- Define invalidation upfront: set a price level or data condition that proves you wrong. No “I’ll see how it feels.”

- Size small when the news is hot: volatility spikes on headlines; smaller positions keep you in the game.

- Respect attention shocks: research consistently shows social/media attention correlates with short‑term crypto volatility and volume; great for awareness, dangerous for chasing. If you want receipts, search “bitcoin social media volatility” on Google Scholar.

Want a smarter feed?

Pair Joseph’s fast context with data and verification, so you’re early and accurate:

- ETF & flows: Farside ETF Flow Tracker, Coin Metrics charts

- Derivatives & risk: Coinglass (OI, funding, liquidations), Laevitas (options), Deribit (DVOL/vol surfaces)

- On-chain & adoption:Glassnode, Dune dashboards for custom checks

- Policy & legal: Coin Center, Blockchain Association for context behind regulatory headlines

- System status (avoid panic): Coinbase Status, Binance Status, Kraken Status

- Macro timing: CME FedWatch, BLS release calendar for CPI/PPI: BLS schedule

- Research reads: Coin Metrics — State of the Network, Binance Research

Here’s how that looks in practice:

- Example 1: Joseph posts “Spot BTC ETFs log strong net inflows.” I check Farside to confirm, then peek at Coinglass for open interest/funding. If OI is rising fast and funding flips rich, I wait for a pullback or a clean higher‑low instead of chasing.

- Example 2: He flags a regulatory headline. I read the original release or filing, sanity‑check with Coin Center, and note whether it’s enforceable now or just signaling. No trades on headlines alone.

- Example 3: He notes Asia session strength. I track whether that flows into U.S. hours, then only act if it aligns with my timeframe and setup. If not, it’s just context.

Conclusion

Bottom line: Joseph Young is a strong, timely signal for what’s moving crypto right now. Treat his feed as a catalyst scanner inside a disciplined workflow—verify, size responsibly, and let your plan, not the timeline, call the shots.

Follow the real account here: @iamjosephyoung. Want me to review another crypto voice next? Drop a note on cryptolinks.com and I’ll queue it up.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.