Peter McUnburdened Review

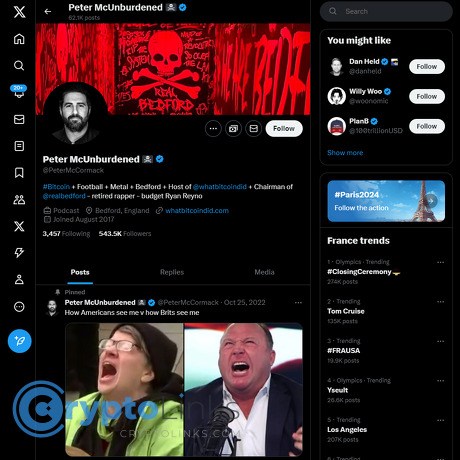

Peter McUnburdened

x.com

Peter McUnburdened: My honest review of Peter McCormack’s X feed and What Bitcoin Did (with FAQ)

Ever scroll X (formerly Twitter) and wonder, “Is following Peter McCormack actually worth my time?” Or maybe you’ve seen his podcast, What Bitcoin Did, pop up in your feed and you’re not sure if it’s signal or just more noise. You’re not alone.

The problem most Bitcoin-curious people hit

Crypto timelines can be chaos. Hot takes move faster than facts, and it’s easy to mistake loud for useful. Add in name confusion (yes, there are other Peter McCormacks/McCormicks out there) and you get a simple question that’s surprisingly hard to answer: is this the right Peter to follow, and what will I actually learn?

- Signal vs. noise: X rewards speed and controversy, which can bury thoughtful analysis beneath snark and quote-tweets.

- Time cost: If you’re new to Bitcoin, bouncing between threads and clips can waste hours with little to show for it.

- Name confusion: People sometimes tag or follow the wrong “Peter.” If you’ve ever wondered why the posts didn’t match the podcast you heard—there’s your answer.

This matters because social feeds shape how we learn. Research has shown that false or sensational content can spread faster than the truth on social platforms—the well-known 2018 study in Science found that false news traveled “farther, faster, deeper, and more broadly” on Twitter than true news. Source: Science (Vosoughi, Roy, Aral). And large numbers of people now say they get news from social media at least sometimes, according to ongoing work by Pew Research Center. In short: choosing the right voices is a real edge.

What you’ll get here

I’m going to keep this simple and useful. You’ll get:

- A straight-up review of Peter’s X account at @PeterMcCormack—what he posts, where the value is, and what to skip.

- A quick map of What Bitcoin Did—what the show covers, who he talks to, and how to sample it without burning time.

- Standout content to check first so you can judge his signal fast.

- Strengths and blind spots—where he shines for Bitcoin education and where you should look elsewhere.

- Who should follow (and who won’t get much from it).

Example you might recognize: a typical week on his feed might include a clip from a mining episode, a strong opinion on inflation or free speech, an update from Real Bedford FC, and a thread teasing an interview with a high-profile economist or miner. That mix is the point—you get Bitcoin plus the culture around it.

Why you can trust this review

I spend every day testing Bitcoin resources, curating links, and fact-checking claims so readers can skip the fluff. When I look at a public voice like Peter, I use a simple framework:

- Usefulness: Does the feed or episode help you understand Bitcoin, money, or policy better—today?

- Originality: Is he bringing on credible guests and asking real questions, or just echoing the timeline?

- Accountability: Are takes sourced, corrected when wrong, and consistent over time?

- Time efficiency: Can a beginner or builder extract value quickly, without needing a week of context?

I’m not here to do fan service. If something wastes your time, I’ll say so. If it’s worth your follow, I’ll show you why.

Quick note on identity and accuracy

This review is about Peter McCormack—the British Bitcoin podcaster who hosts What Bitcoin Did and owns/chairs Real Bedford FC. His official X handle is @PeterMcCormack. Don’t confuse him with other similarly named people you might find online.

- How to confirm you’ve got the right account: check the handle spelling (McCormack), look for cross-links from the podcast site (whatbitcoindid.com), and verify that the bio mentions What Bitcoin Did and Real Bedford.

- Accuracy note: Social platforms blur the line between opinion and reporting. When Peter posts stats or charts, click through to the source—especially for macro or policy claims.

Nothing here is investment advice. Always do your own research and verify original sources.

So, is Peter McCormack the right Bitcoin follow for you—and what exactly does he bring to the table? Let’s start by clearing up who he is (and who he isn’t)…

Who Peter McCormack is (and who he isn’t)

Peter McCormack is a British Bitcoiner who turned curiosity into a platform. He hosts the long-running podcast What Bitcoin Did, chairs the non‑league football club Real Bedford FC, and spends a lot of time on X challenging bad ideas about money, speech, and property rights. He’s opinionated, sure—but that’s part of the draw. He tests arguments out loud, brings on people who disagree, and keeps a strong focus on Bitcoin.

"Follow people who make you think, not people who tell you what to think."

If you want crypto content that actually moves beyond price charts, he’s one of the more visible names taking Bitcoin conversations to mainstream ears—from energy and mining to macro and policy.

Short bio and why people follow him

Peter discovered Bitcoin, got obsessed, and built a media machine around asking simple questions that many are too shy to ask. He’s not a protocol engineer, and he doesn’t pretend to be; his strength is pulling out clear explanations from technical guests and pressing policy folks on practical outcomes.

People hit “follow” because he blends three worlds:

- Media: An interview style that’s beginner-friendly without talking down. Expect high‑profile guests like Michael Saylor, Lyn Alden, Adam Back, Saifedean Ammous, Jack Dorsey, Alex Gladstein, Jack Mallers, and Senator Cynthia Lummis—names that anchor his episodes in both technical depth and real-world policy.

- Community: He amplifies builders, educators, and miners, and he runs live shows and meetups that make the scene feel human, not just “CT drama.”

- Football: Real Bedford gives him a unique local angle—Bitcoin meets matchday. That crossover pulls non‑crypto folks into the conversation and keeps things grounded.

It’s not just vibes, either. Podcasts have become a major on‑ramp for complex topics. The Reuters Institute’s Digital News Report (2024) notes the steady rise of news and explainer podcasts among younger audiences; that shows why approachable hosts matter. Peter leans into that—fewer lectures, more “ask-it-like-a-normal-person” sessions that help people stick around long enough to actually learn.

Not this person: the name confusion

There are other Peter McCormacks (and McCormicks) floating around the web. If you want the Bitcoin podcaster, here’s how to be certain you’re looking at the right one:

- X handle: @PeterMcCormack (British flag in the bio is common; links out to his podcast and Real Bedford.)

- Brand tells: Frequent references to What Bitcoin Did, “Bitcoin‑only” language, and Real Bedford updates.

- Context clues: Interviews with Bitcoin builders and economists; occasional UK football content; discussion of his very public UK libel case against Craig Wright (he’s the Peter from that case, which ended with nominal damages awarded).

- Imposter watch: On X, the blue check doesn’t guarantee identity. Cross‑check the handle, the podcast link, and the Real Bedford site before engaging or sending DMs.

If you see a “Peter McCormick,” different profession, or a random crypto trader with a similar name, that’s not the same person. This review is about the British Bitcoin podcaster and club owner at @PeterMcCormack.

Why he matters in Bitcoin

He’s a bridge. For many newcomers, Peter is the first stop on the way to understanding Bitcoin’s why—not just its price. The show is one of the space’s biggest, with millions of downloads, and his interview bench spans:

- Developers and educators who can explain protocol changes and best practices without jargon.

- Miners and energy experts who unpack grid dynamics, flare gas, and why hashing economics matter to real-world power markets.

- Economists and policymakers who frame inflation, regulation, and capital controls in plain English.

That mix shapes talking points you’ll see echoed across Bitcoin X. Think of the post‑FTX push for self‑custody (on‑chain data showed record exchange outflows in Nov 2022) or the “Bitcoin mining stabilizes grids” debate that moved from niche reports to dinner-table conversations. Peter didn’t start those narratives alone, but his platform amplified them to audiences who wouldn’t otherwise touch a whitepaper.

He’s also an example of Bitcoin touching normal life. Real Bedford features Bitcoin sponsors, community events, and education woven into a Saturday game. That signals a culture play, not just a price bet—something that tends to stick with people who are new and skeptical.

He won’t be everything to everyone—he’s Bitcoin‑first, politics-curious, and not your altcoin analyst. But if you want the loud-and-clear reasons people care about Bitcoin, he’s hard to ignore.

Curious how all of that shows up in his day‑to‑day posts? Next, I’ll map out his X presence—what’s signal, what’s heat, and how to get value fast without wading through the entire feed. Want the short list I watch for? It’s coming up.

Peter on X: what to expect from @PeterMcCormack

Open Peter’s X feed and you’ll get a fast-moving stream of Bitcoin-first commentary, politics, free speech takes, football notes from Real Bedford, and steady promotion of new podcast drops. It’s opinionated and busy—in the best way, if you’re here for Bitcoin signal and credible people.

“Follow for the education, stay for the network — and bring your own thinking.”

Content style and tone

Peter’s voice is direct and unapologetic. He prioritizes Bitcoin, property rights, and freedom-of-speech themes, and he’s comfortable mixing big-picture politics with day-to-day life around his club.

- Bitcoin-first lens: Monetary debasement, self-custody culture, mining and energy myths, and policy news. Expect straight talk and pushback when narratives feel off.

- Politics, but anchored to money: Inflation charts, regulatory headlines, and on-the-ground reactions when laws touch personal finance or privacy.

- Community and human side: Match-day photos and quick updates from Real Bedford; shoutouts to guests, builders, and educators.

- Promo—without pretending it isn’t: Clear posts when a new episode drops or when he’s hosting a live event or debate.

He posts most days—often several times—so your feed won’t go quiet. If you want a lower-noise version, add him to a private List and skim that once or twice a day.

Best types of posts to watch

Not every post is equal. These are the ones that consistently carry useful signal:

- Big guest announcements: When he flags conversations with economists, miners, or policymakers (think names like Lyn Alden, Adam Back, Jack Mallers, or energy researchers), that’s the cue to queue an episode or skim replies for extra resources.

- Live-event threads: Conference days, match days, and policy hearings. He’ll thread highlights, photos, and key quotes. These threads are a quick way to catch up without watching a 2‑hour stream.

- Energy/mining debates: Posts challenging anti-mining narratives often surface studies, charts, and rebuttals from engineers and miners in the replies.

- Spaces and live recordings: He announces live Q&As and Spaces where miners, devs, and analysts weigh in. Even if you miss them live, recordings are usually linked afterward.

Pro tip for scanning: use X search operators. Try from:PeterMcCormack with keywords like guest, episode, mining, or energy to jump straight to high-signal posts.

Signal vs. noise

The feed is strongest when it acts as a switchboard—connecting you with guests, new episodes, and primary sources. Where it thins out is when threads turn into tribal arguments or when you’re hunting for multi‑chain or trading alpha.

- High signal: Bitcoin education, mining/energy context, regulatory updates tied to real sources, and episode previews that introduce experts.

- Lower signal (for some): Heated back-and-forths that drift into ideology rather than evidence. If you’re here for altcoin analysis or trading signals, this isn’t the channel.

Why be picky? Research from MIT found emotionally charged misinformation can spread faster than facts on social platforms. Using Lists, Bookmarks, and muting charged keywords for a week can keep the educational value high while cutting the cortisol.

Quick filters to keep the feed sharp:

- Make a List: Add Peter plus a handful of educators, miners, and energy analysts. Read that List, not your full timeline.

- Bookmark threads: Save live-event threads and episode posts; batch-read once daily.

- Mute strategically: Hide terms that trigger pile-ons (you can always unmute later).

Who he engages with

Expect recurring names across Bitcoin education, energy, and policy—use these as discovery trails.

- Educators and analysts: You’ll often see interactions around work from people like Lyn Alden, Jameson Lopp, and independent researchers who publish data on money and security.

- Builders and miners: Operators discussing firmware, power markets, curtailment, and grid stability. When these folks reply, I pay attention.

- Policy and advocacy voices: Conversations intersecting with civil liberties and financial privacy, including human-rights advocates and pro‑Bitcoin lawmakers.

- Club/community: Real Bedford supporters, local initiatives, and match-day updates that humanize the feed and attract grassroots Bitcoiners.

Scan the replies under his bigger posts—credible people often drop charts, papers, and links you won’t see in your main timeline.

Pros and cons

- Pros

- Clear Bitcoin focus with accessible language

- Strong network effect—big guests and serious operators

- Frequent signposts to long-form content (episodes, debates, Spaces)

- Community feel via Real Bedford and local events

- Cons

- Little value if you want altcoin/trading strategies

- Some threads get spicy and can distract from the meat

- High cadence can feel noisy unless you filter

If you’re nodding along, you’ll probably want to know which long-form episodes actually deliver the most value right now. Want a simple 3‑episode starter pack that covers beginner basics, mining/energy, and macro—so you can decide fast if it’s your thing?

What Bitcoin Did: the podcast at a glance

When someone asks me for a single Bitcoin podcast that’s both welcoming to newcomers and still sharp enough for industry folks, I point them to What Bitcoin Did. It’s Peter McCormack in long-form: open questions, strong opinions, and a guest list that stretches from core developers and miners to macro thinkers and policymakers.

“Come for Bitcoin, stay for the people who are trying to make money fair again.”

What the show covers

Expect a tight focus on Bitcoin—never watered down, rarely off-topic, and frequently tied to the real world. If you’ve ever wondered how a digital asset intersects with energy markets, inflation, or free speech, this feed connects the dots.

- Bitcoin technology: Wallets, nodes, security, scaling trade-offs, personal sovereignty.

- Mining and energy: Economics of hash rate, grid stability, demand response, flare mitigation.

- Macroeconomics: Inflation, fiscal policy, debt cycles, why sound money narratives have legs.

- Regulation and policy: Banking rails, legal risks, what policymakers get wrong (and sometimes right).

- Freedom and speech: Censorship, financial surveillance, and how money rules shape everyday life.

- Personal finance: Self-custody, risk management, and staying rational in volatile markets.

Apple Podcasts frames it as exploring Bitcoin’s role in reshaping money, freedom, and the future of finance—an accurate read of what you’ll hear. You can browse the archive at whatbitcoindid.com or on Apple/Spotify.

Episode types to start with

If you’re new, don’t try to binge everything. Pick a lane, then add contrast:

- Beginner-friendly explainers: Episodes with educators and builders who speak plain English help you level up fast. Look for conversations with people like Lyn Alden (macro meets Bitcoin basics) or Jameson Lopp (security and self-custody).

- Energy and mining essentials: Want the “Bitcoin and the power grid” picture? Check talks with miners and researchers such as Nic Carter, Harry Sudock, or Steve Barbour. These set a baseline for understanding curtailment, stranded energy, and costs.

- Macro and policy context: For the why-now, listen to recurring voices like Jeff Booth or Lyn Alden on inflation, debt, and incentives. Add a policymaker or regulator episode for contrast—Caitlin Long often brings the legal nuance.

- Big-picture conversations: Interviews with public figures (for example, Nayib Bukele on El Salvador’s Bitcoin law) add geopolitical texture you won’t get from price charts.

Tip: If you’re unsure where to begin, search the site for a name you already trust—then branch out to the voices you haven’t heard yet.

Strengths and limitations

Where the show shines:

- Accessibility without dumbing down: Peter asks the questions people actually have. That lowers the barrier to learning without losing substance.

- Guest quality and range: Developers, miners, macro thinkers, and policymakers in one feed. You get different angles on the same core idea.

- Consistency: Regular cadence and a deep back catalog mean you can build a real Bitcoin education over time.

Where it’s not built for you:

- Altcoins and trading: If you want multi-chain analysis or short-term trading setups, this isn’t the lane.

- Ultra-technical rabbit holes: You’ll hear about nodes, mining, and protocol trade-offs, but it’s not a code-level seminar. For deep protocol design, pair it with dev-focused resources.

Want to sanity-check energy claims you hear? Independent sources like Cambridge’s Bitcoin Electricity Consumption Index offer baseline data, and grid operators such as ERCOT routinely publish demand response records. I like to compare those against mining episodes to keep my own bias in check.

How to sample efficiently

Time is scarce. Here’s a three-episode test that works:

- Pick one “beginner” episode: Something on security, wallets, or “why Bitcoin” with a clear outline.

- Pick one “energy/mining” episode: Focus on grid dynamics, curtailment, or stranded energy economics.

- Pick one “macro/regulatory” episode: Debt, inflation, or legal frameworks from a credible guest.

If two out of three hold your attention, subscribe. Then use the site’s show notes, timestamps, and often full transcripts to jump straight to the parts you care about. I also keep a notes doc of ideas, sources, and names to research—turns passive listening into active learning.

One more thing: the best insights often appear when guests disagree. Episodes where energy researchers and miners compare notes are gold because the friction forces clarity.

You’ve heard the show; now see how this philosophy spills into the real world. Curious how a lower-league football club became a Bitcoin education hub and community experiment? That’s up next…

Beyond the mic: Real Bedford and other projects

If you only know Peter for the podcast, you’re missing half the picture. He’s been building in the real world too—and that context colors how he uses X, who he invites on the mic, and the kind of community he’s growing around Bitcoin.

Real Bedford FC

Real Bedford is a small English football club with a big, Bitcoin-forward identity. Think grassroots football meets open-source ethos: public, scrappy, and powered by a global community that doesn’t mind supporting a lower-league side because the mission resonates.

- Bitcoin-friendly by design: Merch and tickets are often available with Bitcoin, sponsorship slots are open to Bitcoin-native companies, and matchdays double as soft onboarding for locals who just want a good game and a clear explanation of why this matters.

- Global reach for a local club: A Saturday fixture might pull in fans from Bedford—and orders from far beyond the UK. That cross-border energy is rare for clubs at this level, and it funds real upgrades: better facilities, youth development, and consistent community programming.

- Education via the badge: The club creates a visible, low-pressure “Bitcoin 101” environment. It’s easier to ask questions about money over a pie at halftime than on a Telegram thread.

“If you want to understand a movement, watch what its people build—not just what they post.”

There’s a reason this works. Research from sport bodies like Sport England has repeatedly tied local clubs to higher wellbeing, stronger social connections, and more volunteering. Pair that with Bitcoin’s open, internet-native culture and you get a flywheel: a club that helps the town, a town that gives the club purpose, and a global fanbase that keeps the lights bright.

Want a quick taste? Check the fixture list on realbedford.com, scan the sponsors on the kit, and watch how often match threads pull in Bitcoiners you’d normally only see at conferences. It’s football as onboarding, and onboarding as football.

Events and community building

Peter’s calendar isn’t just studio time. He’s consistently out in the wild with formats that make Bitcoin feel accessible—and useful.

- Live recordings: On-stage conversations in the UK and abroad, often with miners, economists, energy operators, or policymakers. The energy in the room helps cut through the online noise and makes it easier to ask blunt questions.

- Club meetups: Pre-match and post-match hangouts around Real Bedford bring miners, educators, and local business owners into the same space. You get practical talk—grid constraints, treasury strategy, custody—mixed with normal life.

- Conference appearances: Expect talks, panels, and sometimes heated debates. Even when you disagree, it’s a useful map of the arguments shaping Bitcoin’s public narrative.

- Workshops and Q&A: Wallet set-ups and “bring-your-questions” nights give newcomers a safe way to learn without feeling foolish.

Pro tip for networking at these events:

- Arrive early and introduce yourself to staff and volunteers; they know who’s building what.

- Bring one clear ask: “I’m looking for mining hosting in X region” or “I need a custody policy template for my small business.”

- Follow the event hashtag on X and DM two people afterward with a concrete next step.

Community is the moat. That’s not a buzzword; it’s a reality backed by years of sport and civic research showing that shared rituals (weekly matches, recurring meetups) increase trust. Bitcoin rides that wave when it’s anchored in places and people—not just price charts.

Business model and disclosures

It’s smart to know where incentives sit. Here’s the high-level model I watch for:

- Podcast revenue: Ads and sponsorships from Bitcoin-native firms (hardware, custody, mining, exchanges), plus platform monetization. When a sponsor also appears as a guest, you’ll usually hear a disclosure. Keep your bias radar on and cross-check claims; that’s just good practice.

- Events: Ticket sales, partner sponsors, and sometimes merch. Events can shape guest lineups and topic choices—pay attention to who’s backing the stage.

- Real Bedford: Matchday income, kit sponsors, merchandise, memberships, and occasional global campaigns that tap into the Bitcoin audience. Some sponsors are Bitcoin companies, which reinforces the club’s positioning but also aligns incentives toward Bitcoin-first narratives.

None of this is unusual for media operators or club owners; the difference is the Bitcoin-only stance. That brings clarity and trust for Bitcoiners, while making the content less useful if you’re hunting altcoin analysis or trading signals. It also means you’ll hear strong opinions—useful for conviction, but worth balancing with sources that take a different angle.

So here’s the real question: if your goals are education, signal, or network, does this ecosystem fit you—or will it box you in? Keep reading; I’ll match different kinds of readers to the value you’ll actually get and how to avoid the echo chamber.

Should you follow Peter? A quick fit check

If you’re Bitcoin‑curious or new

Short answer: yes. If you’re learning the basics, his feed and show are like a friendly front door—plenty of context, big voices, and less jargon than most Bitcoin corners.

- What you’ll get fast: clear explanations, big-picture narratives (why sound money matters), and timely takes when the news cycle heats up.

- Real examples: look for beginner‑friendly chats with educators and macro thinkers (Lyn Alden has been a frequent favorite for newcomers; Alex Gladstein brings the human rights lens). Those pair well with simple security and self‑custody episodes.

- Action plan: follow his X, then queue 3 starter episodes: one “Bitcoin 101,” one about energy/mining, one macro. If two stick, you’ve found your lane.

Tip you’ll thank me for later: use an X List called “Bitcoin Learning” so his posts don’t drown in your main feed. Research from MIT found false news spreads faster than true news on social platforms; keeping a clean list makes it easier to slow down and sanity‑check claims before you retweet. Source: Science (2018).

If you’re a builder or miner

There’s signal here. He often brings on operators, energy researchers, and policy voices, which helps you absorb how mining fits into grids, markets, and regulation—not just hashrate charts.

- What’s useful: on‑the‑ground mining discussions, energy economics, and policy angles. You’ll hear how miners engage with curtailment, demand response, and stranded energy.

- Real‑world anchor: Texas is a recurring backdrop for mining talk. ERCOT has publicly documented that flexible loads (which include miners) can curtail quickly to stabilize the grid during stress events; pair those discussions with primary grid sources to separate hype from reality. See ERCOT resources on large flexible loads and curtailment summaries, and keep an eye on their market notices (ercot.com).

- Action plan: set X keyword alerts for “mining,” “curtail,” “ERCOT,” and “policy.” When an episode drops, skim the show notes for links to research and pull the original PDFs.

Builder’s rule of thumb: never quote a stat from a clip. Click through to the primary paper or dataset first.

If you’re a trader or multi‑chain user

You’ll get less mileage. He isn’t focused on altcoin tokenomics or short‑term trading setups, and there’s little multi‑chain coverage. That said, the macro and policy talk can still sharpen your top‑down view.

- What to mine for: regulatory shifts, inflation frameworks, Bitcoin liquidity cycles—useful for your bigger narrative calendar.

- Pair it with: your favorite market data dashboards and (if you must) alt‑focused sources. Keep them in separate X Lists to avoid mixing time horizons or strategies.

- Time‑box it: cap yourself at one episode a week and pull only the 10 minutes that map to your trade plan. No plan, no play.

If you want balanced debate

Expect strong opinions and honest pushback. He brings in critics and policy folks often enough to keep the conversation interesting, but it’s still a Bitcoin‑first lens. If you’re chasing deep protocol mechanics or adversarial testing, add dev‑heavy resources alongside.

- What you’ll like: direct questions, room for disagreement, and a willingness to platform people outside the standard Bitcoin echo chamber.

- What you’ll miss: long‑form code‑level breakdowns or multi‑chain comparisons. For that, subscribe to developer‑focused shows and read research hubs.

- Workflow: after any “spicy” episode, read the guest’s original work and one critique from a credible opponent before you post a take. You’ll be 10x sharper than 99% of replies.

How to use his content without the echo chamber

I want you to get value without getting trapped. Here’s the kit I use:

- Build two X Lists: “Bitcoin Signal” (his account, educators, energy researchers) and “Skeptics/Policy.” Flip between them when news breaks so you don’t get stuck in one lane.

- Always click through: when he cites data or a study, open the source. For energy claims, a neutral baseline is the Cambridge Bitcoin Electricity Consumption Index (CBECI).

- Save, then think: save threads to a read‑later app and come back once. That single delay cuts impulsive sharing—exactly where misinformation wins.

- Opposition ratio: for every 2 pro‑Bitcoin pieces you consume, read 1 credible critique on the same topic (environment, monetary policy, mining incentives). Your brain will thank you.

- Mute bait: mute words like “wen,” “lambo,” and coin tickers you don’t follow. Protect attention; it compounds like capital.

Last point, backed by research: exposure to random opposing content can sometimes harden views if it’s just dunking and no substance. Curate your skeptic list for expertise, not outrage. The goal isn’t whiplash—it’s calibration.

Still on the fence—or have specific questions about his X presence, the show cadence, or how to start? I’ve put the quick answers you actually need next. What do you want cleared up first?

FAQ: everything you need to know before you hit follow

Who is Peter McCormack?

He’s a British Bitcoin podcaster and media host best known for the show What Bitcoin Did, and the owner/chairman of the football club Real Bedford FC. His X account is @PeterMcCormack.

What is the What Bitcoin Did podcast about?

It’s conversations about Bitcoin, money, freedom, energy, mining, and policy—featuring everyone from developers and miners to economists and public figures. Expect accessible questions, practical context, and a consistent focus on why Bitcoin matters.

If you’re browsing, start at the homepage: whatbitcoindid.com or on Apple: What Bitcoin Did on Apple Podcasts.

Is he the same person as other “Peter McCormack/McCormick” you might find online?

No. You want the Bitcoin podcaster at @PeterMcCormack. Quick checks:

- Handle: @PeterMcCormack (exact match)

- Bio cues: What Bitcoin Did, Real Bedford FC

- Linkouts: whatbitcoindid.com and realbedford.com are common in his posts

Where should I start if I’m new?

I like a simple 3-episode sampler you can knock out in a weekend:

- Beginner explainer: A fundamentals chat with a builder or educator (think Adam Back, Parker Lewis, or Jameson Lopp). Search the guest’s name on the WBD site.

- Energy/mining: An episode with an energy researcher or miner (Troy Cross, Daniel Batten, Harry Sudock). This is where the “Bitcoin and the grid” discussion gets real.

- Macro/regulatory: A conversation with a macro analyst or policymaker (Lyn Alden, Jeff Booth, Sen. Cynthia Lummis). You’ll get the why behind Bitcoin’s monetary case.

If two of those three click, subscribe. Edison Research’s Infinite Dial 2024 shows podcast listening keeps climbing, and stacking audio + transcripts is a smart way to learn on the go.

Does he cover altcoins or trading strategies?

Not really. His content is Bitcoin-first. If you’re hunting multi-chain analysis or short-term trading setups, pair him with dedicated trading and research sources.

How often does he post on X—and what’s worth watching?

He’s active. The posts with the most signal tend to be:

- Guest announcements (useful for planning your listening queue)

- Event threads (live conversations from conferences, panels, or home games at Real Bedford)

- Replies with experts (miners, economists, energy folks—great discovery paths)

Is the tone political?

Sometimes. Expect free-speech, property rights, and monetary policy threads. It’s part of the broader Bitcoin conversation. If you want counterpoints, follow critics and policy analysts alongside him—healthy portfolio of views beats any echo chamber.

For context on news literacy, the Reuters Institute Digital News Report 2024 shows many people are wary of misinformation on social platforms. Good rule: check original sources Peter cites and save threads to read later with a clear head.

What about Real Bedford—why should I care if I’m here for Bitcoin?

It’s useful signal. You’ll see how Bitcoin ties into community building, sponsorships, and on-the-ground education. Those posts can be a refresh from pure macro talk and help you map the human side of this space.

Is this investment advice?

No. It’s media and education guidance, not financial advice. Always do your own research.

My take: is he worth your time?

Yes if you want a strong, accessible Bitcoin voice with high-caliber guests and an active community angle. Maybe if you need multi-chain or trading-heavy content—pair him with other sources and you’ll be set.

Bottom line

Use Peter’s X feed for timely context and guest discovery. Use the podcast for structured learning on Bitcoin, energy, and policy. Stay curious, keep your critical thinking switched on, and cross-check sources. That’s how you turn a loud social feed into real signal.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.