Adam Back Review

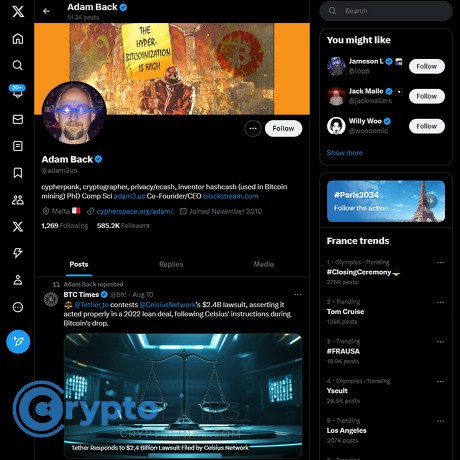

Adam Back

x.com

Adam Back Review Guide: Everything You Need to Know + FAQ

Thinking about following Adam Back on X but wondering if it’s actually worth your time?

You’re not alone. Crypto Twitter can feel like a firehose—loud, fast, and full of hot takes that don’t age well. It’s tough to sort out who’s legit, what’s educational versus hype, and when to engage or just keep scrolling.

Two quick realities make this harder:

- False signals spread fast: Research from MIT found that false news travels faster on X/Twitter than true stories, especially around tech and politics. That’s a problem when you’re trying to learn anything technical.

- A few voices dominate your feed: Pew Research shows just 10% of users create 80% of all tweets—so your perception skews toward the loudest, not the most accurate.

Now add markets moving 24/7, complex game theory around mining, and never-ending debates over privacy and scaling. No wonder people hear Adam Back’s name a lot but aren’t sure what he actually does, if he’s credible, or how to make his posts useful day-to-day.

Describe problems or pain

Here’s what I see most people struggle with when they try to learn from X:

- Signal vs. noise: Everyone has an opinion. Very few explain how things work.

- Hype cycles: Your feed swings from doom to euphoria, leaving you confused instead of informed.

- Time sink: You want practical takeaways, not another hour lost to quote-post drama.

- Credibility gap: You’ve heard Adam Back is influential—but why? And how do you use his posts without falling into tribal debates?

If that feels familiar, you’re exactly who this review is for.

Promise solution

I’m going to make following x.com/adam3us both efficient and useful. I’ll show you who Adam is (credentials, role, impact), what his feed looks like, how to filter for signal, and where criticisms show up—so you leave with a simple system to turn his posts into real learning.

Who I am and why this review matters

I run Cryptolinks.com, where I review crypto platforms, tools, and the voices that actually move the space. I spend a silly amount of time separating signal from noise so you don’t have to. This guide pulls from years of watching how industry veterans communicate, what they get right, and what readers should watch for.

Who this guide is for

- Bitcoin-curious users who want high-signal education

- Builders and miners looking for technical and market context

- Investors who want credible commentary without fluff

TL;DR up front

Short answer: Yes—following Adam Back is usually worth it if you care about Bitcoin, privacy, and infrastructure.

- Why listen: Veteran cryptographer, creator of Hashcash (a key proof-of-work idea), and co-founder/CEO of Blockstream.

- What you’ll get: Bitcoin-first posts, technical insights, privacy-aware takes, and industry context. Occasionally, company updates.

- Best way to follow: Use lists, save educational threads, and skim the hot takes. Read carefully when he gets into mining, proof-of-work, and incentives.

- Value check: Great for learning mechanics and history. Treat market opinions as opinions, and cross-check anything you plan to act on.

Quick example: When fees spike, expect explanations about mempool pressure, miner incentives, and why proof-of-work economics matter—useful if you’re trying to understand real-world behavior, not just narratives.

Want the full story on why his background actually changes how you should read his posts—and how that helps you avoid common mistakes? Let’s start there next.

Who is Adam Back and why his voice matters

Some people in crypto comment from the sidelines. Adam Back helped write the early playbook. When I read his posts, I’m not just seeing opinions—I’m seeing a long memory of what worked, what broke, and what actually shipped.

Credentials: PhD, Hashcash, and early crypto work

Adam earned a PhD in computer science from the University of Exeter, focused on distributed systems—the kind of background that translates directly to understanding consensus, fault tolerance, and network incentives.

In 1997, he created Hashcash, a proof-of-work system designed to make spam expensive by attaching a small computational cost to each email. Years later, Satoshi Nakamoto cited Hashcash in the Bitcoin whitepaper as a key building block for mining and network security.

- Original paper: Hashcash: A Denial of Service Counter-Measure (Back, 2002)

- Bitcoin whitepaper reference: Bitcoin: A Peer-to-Peer Electronic Cash System (Nakamoto, 2008)

What does that look like in practice? Hashcash introduced the idea of a “stamp” you compute before sending a message. A simplified example stamp looks like: 1:20:2025-01-01:[email protected]::random64:counter—proof that your machine did work before the message left your inbox. That same concept powers Bitcoin mining, just scaled up and battle-tested.

Before crypto was cool, Adam was tinkering with PGP encryption, electronic cash experiments, and remailer tech—early bricks in the wall of privacy-preserving communication. That hands-on period gave him a radar for what’s real and what’s performative.

Blockstream co-founder and CEO

Adam co-founded Blockstream and serves as CEO, steering projects that are core to Bitcoin’s infrastructure:

- Sidechains (Liquid Network): Faster settlement for exchanges and traders, with 1-minute blocks and Confidential Transactions to hide amounts. Learn more at liquid.net. The technical roots go back to the paper Enabling Blockchain Innovations with Pegged Sidechains (Back et al., 2014).

- Blockstream Satellite: Global broadcasts of Bitcoin data via satellite, keeping nodes in sync even when the internet is down or censored. Details: blockstream.com/satellite. It’s practical resilience—handy in remote regions or during outages.

- Mining: Infrastructure, enterprise hosting, and research on economics and block templates. More at blockstream.com/mining.

When Adam talks about miners’ incentives, fee markets, or cross-exchange settlement, he’s reflecting what he sees daily across production systems—not just theory threads.

Privacy and cypherpunk roots

Adam has been consistent on privacy and user rights since the mailing-list days. That ethos isn’t nostalgia—it’s a north star. Bitcoin’s design is full of trade-offs, and privacy is one of the hardest. Expect him to push for solutions that protect users without breaking the economics.

“Privacy is necessary for an open society in the electronic age.” — Eric Hughes, A Cypherpunk’s Manifesto

That line captures the backbone of a lot of Adam’s thinking. Decades later, it still guides how he weighs proposals—whether they improve user safety or leak metadata that can’t be put back in the bottle.

Why this background helps you

Here’s why his voice is more than commentary:

- Proof-of-work: He helped shape it before Bitcoin existed. When he talks about energy, security, and costs, you’re getting first-principles reasoning.

- Infrastructure: Running a company that ships sidechains, satellites, and mining lets him separate workable ideas from academic dead-ends.

- Privacy: Years in the trenches mean he spots weak points quickly—where data leaks, who could exploit it, and what an upgrade might fix.

If you’ve ever wondered whether a hot new “scaling fix” actually respects Bitcoin’s threat model, or if a mining narrative holds up under real economics, his context is the shortcut you want.

So what does all this look like on his actual X feed—educational threads, hot takes, or something else? Let’s open it up next and see what you’ll run into day-to-day.

What you’ll actually see on x.com/adam3us

If you’re tired of loud accounts calling tops and bottoms, this feed feels more like walking into a workshop than a casino. Expect Bitcoin-first posts, clear technical reasoning, and the kind of context you can actually reuse later.

“Follow the signal, not the spectacle.”

Core topics you’ll find

Bitcoin protocol, proof-of-work, and scalability:Threads that unpack how fees emerge, why block space is scarce, and what actually changes with upgrades. He’ll reference BIPs, mempool behavior, and historical choices that shaped today’s design. When inscriptions pushed fees to triple-digit sats/vB in 2023–2024, his posts focused on incentives and the long-term security budget instead of outrage. That pattern matters.

Mining economics and infrastructure:Comments on hashprice trends, halving-driven revenue shifts, and miner survival strategies. Expect takes on stranded energy, grid coordination, and why miners act as flexible load—often pointing to public grid data (like ERCOT curtailment reports) or industry dashboards you can cross-check. When miner margins compress, he talks about it in terms of economics, not drama.

Privacy, encryption, and digital rights:Practical notes on address reuse, transaction fingerprinting, and the limits of “compliance theater.” You’ll see reminders to audit your threat model, not just your wallet. He often highlights why default privacy is hard, and where tools or habits actually move the needle.

Industry news and reactions:ETF inflows, exchange blowups, regulatory pushes—filtered through a security and incentives lens. It’s rarely “number go up,” more “what does this change for Bitcoin’s game theory and users?”

Blockstream updates and experiments:Liquid Network releases, mining expansions, satellite broadcasts for Bitcoin data, Jade hardware wallet improvements, and Lightning-related work. He links to posts and repos rather than marketing fluff, which makes it easy to verify details on the Blockstream blog or GitHub.

Style and frequency

- Direct: Short, plain language, minimal theatrics. He’ll cut straight to trade-offs and incentives.

- Technical-leaning: BIPs, fee charts, mempool screenshots, and references to prior research show up often. You don’t need a PhD to get the point if you follow the links.

- Bitcoin-first: Critiques of altcoin claims usually anchor on engineering reality and security assumptions, not tribe vs. tribe.

- Engagement: He replies when there’s a teaching moment—especially on mining, fee markets, or privacy mistakes. Expect longer back-and-forth with engineers and researchers.

- Cadence: A steady stream most weeks, with spikes around protocol debates, halvings, policy news, or big releases.

How to separate signal from noise

- Prioritize mechanism explainers: Threads that walk through how PoW, fees, or L2 trade-offs work are keepers. If you see BIP numbers or mempool charts, slow down and read.

- Bookmark data-first posts: Save anything with concrete references—e.g., mempool visuals (mempool.space), miner metrics (Hashrate Index), or energy context (Cambridge CBECI). They make great study notes.

- Skim the hot takes, study the trade-offs: Quick reactions are fine, but the real value is when he compares design choices (e.g., PoW vs. alternative consensus) in terms of security budgets, attack costs, and user risk.

- Look for teachable debates: When he engages developers on fee dynamics, miner behavior, or privacy pitfalls, that’s where you’ll find nuanced answers and links to prior work.

- Cross-check energy and mining claims: If he mentions demand response, curtailment, or grid benefits, you can often verify with public grid data (like ERCOT releases) or independent research summaries. It’s a good habit—and he encourages it.

Post formats to watch

- Educational threads: Step-by-step walk-throughs of PoW mechanics, miner incentives post-halving, or privacy gotchas. These are the ones that turn into weekend bookmarks.

- Market structure commentary: Not price calls—mechanics. How fee markets might evolve, what security looks like when subsidies fall, and why incentives beat ideology.

- Links to research, talks, and releases: Expect pointers to technical talks, long-form interviews, and Blockstream updates. If you see a link, you’ll usually find source material attached—useful for your own rabbit holes.

I like feeds that make me sharper in 10 minutes, not noisier in 60. If you want to convert those insights into a simple, repeatable routine—without letting notifications hijack your day—want to see the exact setup I use next?

Practical tips: getting real value from following Adam

I want Adam’s posts to make you smarter, not busier. Here’s the exact setup I use to turn his feed into an education stream you can actually stick with—without getting lost in noise or hot takes.

“Attention is your scarcest asset in crypto—protect it like your seed phrase.”

Build a high-signal List

Lists are the secret sauce. One focused List cuts out the chaos and lets you check the right voices in minutes.

- Create a private List: On X, go to Lists → New List, name it “Bitcoin Infra,” set to Private.

- Add core accounts: Include @adam3us plus a tight group of devs, miners, and researchers. Examples (not endorsements): engineering voices like ajtowns, security/infra like lopp, mining research like hashrateindex, and protocol educators like matt_odell.

- Trim ruthlessly: If an account starts posting more price memes than mechanics, remove it. Keep the List small and sharp.

Quick link if you need it: How Lists work on X.

Use notifications smartly

Notifications can wreck focus if you’re not careful. Research on interruptions shows it takes about 23 minutes to refocus after a ping (Mark, Gudith, Klocke, 2008; ACM study). Here’s how to get the upside without the attention tax:

- Turn on Highlights, not All Posts: Tap the bell on @adam3us → choose Highlights. You’ll catch the meaty threads and skip the smaller stuff.

- Batch your checks: I check my “Bitcoin Infra” List once in the morning and once in the evening. Zero interruptions in between.

- Use Focus modes: iOS/Android let you silence social apps during deep work. Set a recurring block. Your brain will thank you.

Fact-check and bookmark like a pro

When Adam references something technical, open two tabs and build your own receipts. It compounds your learning fast.

- Source hop in 60 seconds:

- Mentions Hashcash? Scan Hashcash and the Bitcoin whitepaper references.

- Talks mining fees/incentives? Cross-check with a mining data hub (e.g., public dashboards) and a neutral explainer from a reputable source.

- Bookmark with intent: Don’t just save—add a one-line note in your notes app: “Review: PoW vs. energy arguments → pros/cons + data chart.”

- Revisit on a schedule: The spacing effect beats the forgetting curve. I batch-review saved threads every Saturday. That’s where ideas stick.

Mute keywords you don’t need

Muting is your time firewall. You’ll keep the high-signal technical posts and cut the bait.

- How to do it: Settings → Privacy and safety → Mute and block → Muted words. Guide: Muted words on X.

- What I mute when I’m learning: “airdrop”, “giveaway”, “price target”, “10x”, “ETF rumor”, “WL”, “alpha”. Add/remove based on your distractions.

- Tip: Mute for 7 days first. If you don’t miss it, set to Forever.

Builders: ask focused questions (and get real answers)

Well-formed questions pull in high-quality replies—from Adam or the engineers watching his threads.

- Give context: “I’m testing a Taproot multisig flow on regtest with Bitcoin Core v25.0…” beats “Help with TR multisig?”

- Show your homework: Link what you read: relevant BIPs (e.g., BIP340 for Schnorr), a gist, or a minimal code snippet.

- Ask one crisp question: “Given CPFP, is there any mempool policy edge case with P2TR inputs and low feerate parents I should account for?”

- Be courteous, be precise: Engineers love specifics. You’ll either get the answer—or the breadcrumb you need.

“Cypherpunks write code.” — Eric Hughes

If you set this up, Adam’s feed stops being a scroll and starts being a system. Want to know where this system can still go wrong—and how to read his takes with the right filter? Let’s talk about the frictions and blind spots next.

Critiques, frictions, and a balanced view

High-signal doesn’t mean low-friction. If you follow Adam Back, you’ll get sharp technical context with a strong point of view. That’s useful—but it also means reading him with the right frame.

"Signal beats serotonin." I follow for hard-won lessons, not dopamine hits.

Common criticisms you might hear

- Bitcoin-first to a fault: He often treats altcoin features as trade-offs not worth taking. If you’re exploring new L1s or DeFi experiments, his replies can feel blunt or dismissive. Example: when staking centralization or premines come up, he tends to frame them as structural risks, not innovations.

- Strong views in heated cycles: During moments like ordinals/inscriptions congestion or ETF mania, his tone gets direct. He usually leans on fee-market dynamics and “don’t break Bitcoin” principles, which some read as inflexible.

- Company overlap: Expect mentions of Blockstream work (Liquid network, mining, satellites). That’s normal for a builder, but it does shape what he emphasizes—e.g., Bitcoin-first scaling vs. jumping chains.

I don’t see these as deal-breakers. I just build a filter: note when a post is educational vs. when it’s opinionated, and save my energy for the first bucket.

What he consistently gets right

- Proof-of-work history and rationale: He’s unusually strong at connecting Bitcoin’s design to earlier research (e.g., Hashcash and anti-spam). If you want the “why” behind PoW, this is the lane. For background on the academic lineage of Bitcoin, see Princeton’s overview “Bitcoin’s Academic Pedigree” (ACM Queue).

- Privacy and security mindset: Long-standing cypherpunk instincts show up in practical ways: don’t leak data you don’t have to, prefer minimization over trust, and build systems that fail safely.

- Mining and infrastructure realities: Posts on cost curves, fee markets, and halving incentives tend to be grounded. If you’re weighing energy debates, it helps to pair his takes with independent data like Cambridge’s Bitcoin Electricity Consumption Index (CCAF) and mining map (CCAF Mining Map). Industry reports (e.g., KPMG’s “Bitcoin’s role in the ESG imperative” KPMG) add context on grid balancing and methane mitigation—useful counterpoints when energy FUD flares up.

The pattern I’ve seen: when he’s talking cryptography, incentives, or network constraints, the signal-to-noise is high. When the topic drifts into short-term markets, I shift into “opinion only” mode.

Where to be cautious

- Treat price talk as scenario, not certainty: He occasionally posts big-picture targets around cycles (e.g., six-figure paths around a halving). Interesting scenarios, not investment instructions. I bookmark for thesis-building, not trading.

- Distinguish principles from product: Posts about sidechains, mining, or L2s can overlap with Blockstream’s roadmap. That’s fine—just separate the principle being explained from the product being showcased.

- Hot takes vs. hard data: When topics get emotional (fees, inscriptions, regulation), I pair his perspective with neutral sources (CCAF data, peer-reviewed work, independent researchers). It keeps my mental model tight.

One practical example: when ordinals spiked fees, he framed it as the fee market doing what it’s supposed to—price block space. Whether you agreed or not, the useful part was the refresher on incentives, not the culture-war side threads.

Why I still recommend following

In a space full of hype, he sticks to first principles: proof-of-work, privacy, and buildable infrastructure. That makes his feed a steady classroom. Even when I disagree with a take, I leave with something testable: a metric to track, a research thread to read, a model to refine.

Want quick, concrete answers on credentials, company role, stance on altcoins, and where to follow him without the guesswork? The next part has a rapid-fire FAQ that covers exactly that—what do you want clarity on first?

FAQ: quick answers people actually ask

What are Adam Back’s qualifications?

Short answer: deep technical chops with real-world impact.

- PhD in computer science (distributed systems) from the University of Exeter, with early work on compilers and parallel computing.

- Invented Hashcash (1997)—proof-of-work designed to throttle spam and denial-of-service. It’s explicitly cited in the Bitcoin whitepaper and is a core conceptual ancestor to modern Bitcoin mining.

- Hands-on history in PGP encryption, remailers, and electronic cash, which shaped today’s privacy and security conversations.

Real-world tie-in: if you’ve ever asked why miners spend energy to secure Bitcoin, the answer tracks back to Hashcash’s “costly computation to create scarce, verifiable stamps.” That mechanism anchors Bitcoin’s security budget today and is widely discussed in academic and industry analysis.

Is Adam Back the co-founder and CEO of Blockstream?

Yes. He co-founded Blockstream and serves as CEO. The company focuses on Bitcoin-first infrastructure—think sidechains (Liquid), mining and hosting, and connectivity projects like the satellite service broadcasting Bitcoin data.

Example you’ll see reflected in his posts: commentary on miner economics (especially around difficulty adjustments and fee markets), Bitcoin scaling via sidechains/L2s, and operational updates from Blockstream’s products and research.

What is Adam Back’s role in digital privacy?

He’s long aligned with the cypherpunk ethos: strong encryption, minimal data collection, and user sovereignty. Before Bitcoin was mainstream, he worked on privacy-preserving tools (like remailers) and supported the broader pushback against surveillance culture.

Practical impact: his takes often emphasize threat models, metadata risks, and trade-offs between convenience and privacy. When he talks about mixing, addresses, or communication security, it’s informed by years of hands-on work and ongoing community research.

What’s his stance on altcoins?

Bitcoin-first and unapologetically so. Expect critiques of token models that introduce undue trust, governance capture, or centralization. He often highlights risks around staking concentration, regulatory surface area, and attack incentives in non-Bitcoin systems.

Why that matters: if you want a feed that tests claims (especially around security and incentives), his lens is useful—even when you disagree. It’s less about market hype and more about engineering and economic realism.

Where can I follow him?

https://x.com/adam3us

Further reading and resources

Want to go deeper? I’ve bundled high-signal materials here:

Still wondering who should definitely follow and how to set up your feed in five minutes? I’ll show you exactly how I do it next.

My verdict and your next steps

Verdict: If you want consistent, Bitcoin-first signal with real engineering context, following x.com/adam3us is absolutely worth it. His posts are strongest when the market gets noisy—fee spikes, policy headlines, mining shifts—because he frames what’s happening through incentives and protocol mechanics, not hype.

Quick proof this matters: during the 2023–2024 fee spikes around inscriptions, he consistently reframed the “fees are broken” narrative into a clear explanation of fee markets and blockspace scarcity. That’s the kind of lens you want when your timeline is on fire. And when the 2024 halving approached, his commentary on miner breakevens and hashrate elasticity lined up with what we saw post-halving: short-term hashrate churn, followed by rebalancing as less efficient rigs unplugged. For context on mining realities, I like to cross-check with the Cambridge Bitcoin Electricity Consumption Index—it’s a good sanity check when you’re reading takes about energy, hashrate, and costs.

Follow for engineering signal. Skim the hot takes. Save the threads that explain incentives and mechanisms.

Who should definitely follow

- Bitcoin learners who want accurate historical and technical framing—especially on proof-of-work, fees, and infrastructure.

- Miners and infra folks who care about on-the-ground economics, financing realities, and deployment trade-offs.

- Privacy-focused users who want a rights-first perspective on encryption, censorship resistance, and security habits.

Set up your feed in 5 minutes

- Follow x.com/adam3us

- Add him to a “Bitcoin Infra” list with a handful of engineers, miners, and researchers you trust

- Turn on Highlights notifications (not all posts) to catch the meaty threads

- Bookmark explanatory posts for weekend study; cross-check claims with sources like the CBECI and the Bitcoin whitepaper citations list on bitcoin.org

What this looks like in practice:

- When you see a post on fee pressure, look for a mechanism explained (mempool backlog, L2 incentives, miner behavior). Save it.

- If it’s a market-timing take, treat it as opinion. Read, note, move on.

- If there’s a link to a talk, research note, or release, skim the primary source and file it in your bookmarks. Ten minutes here compounds over time.

Final take

Bottom line: Adam Back’s feed is a steady source of Bitcoin signal—especially strong on proof-of-work, privacy, and infrastructure. Use lists and filters to keep it tight, save the posts that teach you something, and your timeline turns into a quiet edge in a loud market.

If this was useful and you want more no-nonsense reviews of the people and tools that actually move crypto forward, bookmark cryptolinks.com. I’ll keep cutting the noise and highlighting where the real signal lives.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.