Anthony Pompliano Review

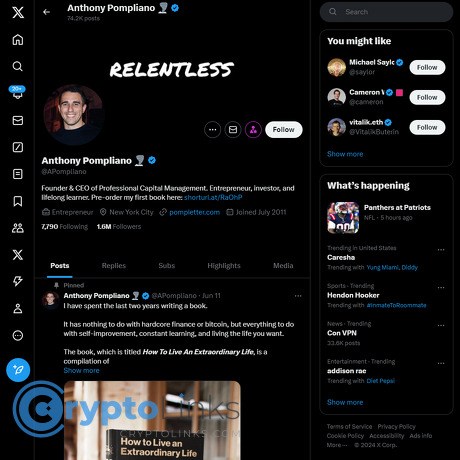

Anthony Pompliano

x.com

Anthony Pompliano Review: What to Expect, How to Use His Insights + FAQs

Wondering if following Anthony “Pomp” Pompliano on X is actually worth your time, or just another distraction in your feed?

If you want fast clarity, less scrolling, and a simple way to turn his posts into practical investing value, you’re in the right place. I’m going to show you what to expect from Pomp’s X account, how to use his content without getting caught in the noise, and how to keep your edge while you learn. This is written for readers of Cryptolinks who care about signal, not hype.

Describe problems or pain

Crypto Twitter is a firehose: bold claims, hot takes, and three charts before breakfast. It’s easy to confuse motion with progress.

- Information overload: 24/7 feeds push you into reactive mode. You see great calls, but you miss the context that made them work.

- FOMO traps: Big accounts post during volatile moments, and you feel late unless you “do something” right now.

- Copy-trading without a plan: People imitate positions they don’t understand. No thesis, no sizing, no exit rules.

- Time sink: You scroll for an hour and end up with five opinions and zero decisions.

There’s also a real data problem. Social sentiment can move crypto—especially intraday—but without a framework, you end up chasing it. Several studies suggest Twitter sentiment is correlated with short-term crypto returns and volatility, which is useful only if you’ve got rules and timing that fit your goals. If not, it’s noise.

- For example, research in Finance Research Letters found that Twitter sentiment has predictive power for cryptocurrency returns and volatility. That’s a signal—but only if you know how to handle it.

Bottom line: Pomp’s feed can be high signal—if you approach it with a system. If you don’t, it’s just speed and opinions.

Promise solution

Here’s the plan: I’ll break down who Pomp is, what you actually get from his X feed (x.com/APompliano), how his investing lens shows up in his content, where his daily show fits into your routine, and how to extract value without falling into FOMO or tribal fights. I’ll also cover the most common FAQs so you can decide quickly if he belongs in your workflow.

Expect practical examples like:

- When he flags ETF flows: Use it as an early alert to check primary sources (issuer websites, custodians, exchange prints) before you act.

- When macro data hits (CPI, jobs, FOMC): He’ll post a simple frame. Log the idea, then compare it with your timeframe and risk rules.

- When he shares founder or operator lessons: Grab the framework, not the position. Turn it into a checklist you can reuse.

Who this guide is for

- Crypto-curious investors who want a clean, simple way to learn without drowning in noise.

- Bitcoin-first readers who want consistent macro + BTC framing without maximalist echo chambers.

- Busy pros who need quick alerts, quality context, and repeatable routines.

- Builders and founders who want the business lessons and frameworks more than the hot takes.

Quick snapshot of Pomp

Anthony “Pomp” Pompliano Jr. is an investor and entrepreneur with a clear Bitcoin and macro focus. He invests in blockchain companies through Pomp Investments, keeps a high-cadence presence on X, hosts a daily show, and publishes long-form interviews and notes. He’s known for simple, consistent framing—think punchy one-liners on Bitcoin, rates, and policy—plus pointers to long-form content when you want depth.

So what makes people listen to him in the first place—and when should you be skeptical? Keep reading, because that’s exactly what I’m unpacking next.

Who is Anthony Pompliano and why people listen

Anthony “Pomp” Pompliano sits in that rare pocket where Bitcoin, startups, and macro collide. He speaks in clean, memorable lines that travel fast, and he’s usually early to frame a story in a way busy investors can act on. You don’t have to agree with him to benefit from the way he reduces chaos into one or two clear takeaways you can carry into a meeting or your portfolio review.

“Long Bitcoin, Short the Bankers.”

—Anthony Pompliano

That rallying cry isn’t just merch—it’s a lens. He’s built a brand by repeating a few strong ideas with conviction and then backing them up with consistent content across X, podcasts, and notes. In an attention economy, that matters. There’s a reason economists like Robert Shiller have shown how contagious narratives can shape markets—stories move behavior as much as spreadsheets do. If you want a quick primer, Shiller’s Narrative Economics is a useful backdrop for why Pomp’s style lands.

Background and track record

Pomp didn’t appear out of thin air. He’s ex-U.S. Army, spent time at Facebook in growth/product, co-founded Full Tilt Capital, then co-founded Morgan Creek Digital with Mark Yusko and Jason Williams before launching Pomp Investments. The throughline: he likes early-stage builders and bets where conviction and time horizon matter more than perfect timing.

- Focus: Bitcoin as a cornerstone asset + “picks-and-shovels” startups in the crypto stack (custody, infrastructure, data, payments, mining services).

- Approach: Venture-style risk, asymmetric upside, heavy on founder quality and market tailwinds.

- Reality check: Wins and misses, like any VC. He’s been praised for pounding the table on Bitcoin early; he’s also been criticized for giving too much oxygen to questionable players during the last cycle (for example, interviews with Celsius’s CEO drew heat after Celsius imploded). He’s addressed some of that in later content—worth noting as a “verify, don’t outsource due diligence” reminder.

Why this mix matters to you: it explains his content cadence. He moves fast on macro headlines, keeps the Bitcoin thesis centered, and highlights founders and rails that could compound for years. It’s a VC’s lens applied to a public, 24/7 market.

Real name and basics

His real name is Anthony “Pomp” Pompliano Jr. You’ll find a clean biography and references on IQ.wiki. He’s American, an entrepreneur and investor, and a high-frequency content creator who favors plain English and direct calls-to-action. Expect fewer caveats, more clarity.

Media footprint

Pomp’s edge isn’t just what he says—it’s where and how often he says it. He’s built a layered media machine that lets him set the frame on X and then expand it in long-form.

- X: x.com/APompliano for quick hits on Bitcoin, rates, liquidity, ETF flows, and founder lessons. He’s often early on narrative pivots (think: spot Bitcoin ETF approvals, CPI prints, rate pause chatter, miner economics).

- Daily show: “From the Desk of Anthony Pompliano” for weekday breakdowns—macro, business, and policy filtered through an operator/investor lens.

- Long-form: The Pomp Podcast + YouTube for deep interviews with names like Michael Saylor, Cathie Wood, Balaji Srinivasan, Jack Mallers, and builders you probably haven’t heard of yet (the ones VCs quietly back).

- Notes/newsletters: Written frameworks and summaries (e.g., The Pomp Letter) you can pin, tag, and revisit when the next headline storm hits.

There’s also a practical reason this gets traction: social channels do move markets at the edges. Research has shown that online sentiment can correlate with volatility and flows (see early work like Bollen, Mao, Zeng on Twitter mood and market moves). Crypto is even more sentiment-sensitive given 24/7 trading and a retail-heavy audience. That doesn’t make X a trading signal—but it explains why Pomp’s real-time framing matters.

What supporters and critics say

- Supporters: Clear, consistent Bitcoin stance; strong macro framing; quick distillation of complex stories; access to top founders and investors; repeatable mental models you can actually use. Many credit his content with helping them build conviction and stick to a plan through volatility.

- Critics: Maximalist bias; promotional tone; simplified narratives that can miss nuance; survivorship bias in highlighting winners; past platforming of players later shown to be fragile. The fair takeaway: use his signal, but set your own guardrails.

Emotionally, that’s the tightrope. Certainty can feel great when candles are green, and brutal when they aren’t. Remember what behavioral finance has taught us for decades: attention and confidence can lead to crowding and overtrading. If a post makes you feel urgent, pause. Urgency is a feature of social media, not a feature of good process.

So what do you actually get when you follow x.com/APompliano? What topics show up most, which ones are worth your time, and how do you separate signal from the comments-section noise? I’ll show you the exact themes, post types, and my filtering tricks next—curious which ones save me the most time each week?

What you actually get on X.com/APompliano

If you like clean signal and quick reads, APompliano on X is built for you. Expect fast, punchy one-liners on Bitcoin, rates, inflation, ETF flows, and founder-style business takeaways. Most posts are the “heads-up” you want before the rest of your feed catches on; when he wants depth, he links you out.

“Clarity is a competitive edge.”

Content themes to expect

You’ll see a consistent rotation of Bitcoin-first topics with macro context. Here’s what shows up most:

- Bitcoin + monetary policy: How rate expectations, liquidity, and central bank moves set the backdrop for BTC’s narrative.

- Inflation and rates: CPI, PCE, unemployment prints, and what they imply for risk assets. He often frames these as simple “risk-on/risk-off” cues.

- ETF flows: Net inflows/outflows for spot Bitcoin ETFs and why that behavioral demand matters more than any single headline.

- Founder lessons and business frameworks: Short riffs on building, pricing power, and compounding—useful cross-training for investors.

- Policy and regulation: U.S. and global moves that could widen or narrow crypto adoption channels.

- VC/startup trends: Infra, custody, payments, data—what I call “picks-and-shovels” stories that support the crypto economy.

- Big-picture tech crossovers: When AI, fintech, or payments news bleeds into the Bitcoin/crypto opportunity set.

Types of posts

- Quick takeaways: 10–30 words, usually one clear line that frames what just happened and why it matters to BTC or builders.

- Charts with simple captions: A clean visual plus one-sentence context—no jargon. Good for saving to bookmarks.

- Link-outs to deeper content: Clips, podcast episodes, or notes when a topic needs more than a tweet.

- Occasional threads: 3–10 posts that walk through a thesis or fast-moving news (ETF milestones, macro shock days, regulatory updates).

This cadence works because it matches how most people scan social feeds. Research from the usability firm Nielsen Norman Group shows users skim for headlines, numbers, and bullets; short, scannable content wins attention and recall. In a feed full of noise, brevity is a feature.

Signal vs. noise

To get value without the doom-scroll, build a simple filter:

- Create a “Macro + BTC” List: Add @APompliano and a few macro/data accounts you trust. Check it on a schedule (e.g., market open and after key prints). Turn off push notifications.

- Use X search operators:

- from:APompliano BTC (Bitcoin-only)

- from:APompliano ETF (flow updates)

- from:APompliano inflation (CPI/PCE references)

- Use since: and until: for date windows and min_faves: to surface posts the crowd found useful.

- Mute the hype: In his profile, tap “Following” and set “Mute retweets” if you want pure originals. Consider muting words like “giveaway”, “lambo”, or anything that triggers you.

- Log before reacting: A quick note beats a quick trade. Attention-driven behavior is a known risk—Barber & Odean (2008) documented how flashy news can push investors into impulsive buys. Write it down, then decide.

When volatility spikes, heart rate follows. That’s when you want a checklist, not a hot take.

Engagement quality

The replies and quote posts around his feed are busy on CPI days, FOMC days, and ETF flow records. That’s useful—crowd energy helps you see what the market is actually focused on—but it can also create herd bias.

- Strength: Clear framing and early headlines. Great for catching catalysts fast.

- Watch-out: Algorithmic amplification can inflate confidence. Use the “Replies” tab to find nuance from operators and data folks.

- Pro tip: Search with from:APompliano min_retweets:500 or min_faves:2000 to surface posts that cut through.

How to use his posts

Treat the feed like an early alert system, then go to primary data before you act. Here’s the simple workflow I use:

- If he flags ETF flows:

- Check issuers and reputable trackers for the actual numbers: BlackRock iBIT, Fidelity, and aggregate trackers like Farside’s Bitcoin ETF flow.

- Compare with price/volume and on-chain metrics from sources you trust (e.g., FRED for macro baselines, and your preferred on-chain dashboard).

- Action: Note whether flows and price agree. If flows are strong but price is flat, that’s interesting—supply absorption or rotation. Set a price alert instead of forcing a trade.

- If he highlights inflation or jobs data:

- Open the BLS CPI release and the CME FedWatch Tool to see how rate odds shifted.

- Map it to your timeframe: Is this a 1-day move or a multi-month narrative change?

- Action: If it’s only a small shift in rate odds, I log it and wait for confirmation. If odds swing meaningfully, I re-check Bitcoin’s correlation to risk-on assets that week.

- If he posts a chart with a simple claim:

- Find the original data. Screenshots compress context.

- Add a one-line interpretation to your notes: “What would have to be true for this to matter to my plan?”

I keep a running “idea log” in Notes/Sheets with three columns: Prompt (what he posted), Source (primary links I checked), Decision (watch, act, ignore). It takes two minutes and saves me from headline-chasing. Investors who work this way reduce the classic recency bias that ruins entries and exits.

Here’s the real edge: fast alerts, simple framing, and your own verification loop. Want to see how this matches the way he actually allocates capital and thinks about risk? That’s where it gets interesting—shall we look at the strategy behind the feed next?

Pomp’s investment strategy in plain English

Here’s how I read it: build a core Bitcoin position, then look for “picks-and-shovels” companies that power the crypto economy. Keep a long clock, accept volatility as the toll, and let compounding and founder execution do the heavy lifting. Simple doesn’t mean easy—but it is repeatable.

Core thesis

Bitcoin is treated as sound digital money in a world where policy changes fast and liquidity cycles whip prices around. The playbook is straightforward:

- Own BTC as a core position. Think in multi-year cycles, not weeks.

- Use rules-based accumulation. Dollar-cost averaging (DCA) keeps you honest when emotions spike. Historically, lump-sum often wins in rising markets, but Vanguard research shows DCA reduces regret and timing risk—useful when an asset can drop 50% in months.

- Respect volatility. Bitcoin has had multiple 50–80% drawdowns; see the drawdown history on LookIntoBitcoin. Size it so you can sleep.

“Volatility is the price you pay for the chance at outperformance.” — Morgan Housel

Emotionally, this matters. If you feel sick on a -30% week, that’s your sizing—not the thesis—screaming at you.

Venture lens

He leans into the rails, not the roulette wheel. In other words, back the infrastructure that everyone needs regardless of which token trends this month. Think “sell the picks,” not “guess the gold vein.” Categories I map to this approach (illustrative examples, not endorsements):

- Custody and security: enterprise-grade safekeeping, multi-party computation, key management (e.g., Fireblocks, BitGo).

- Payments and settlement: on/off-ramps, Lightning tooling, stablecoin rails (e.g., Strike, MoonPay).

- Data and compliance: analytics, AML/forensics, market data APIs (e.g., Chainalysis, Kaiko).

- Developer and infra: node services, indexing, L2 tooling, wallets/SDKs (e.g., Alchemy, Blockstream).

- Mining and energy: hardware, immersion cooling, demand response, financing services.

The bet is that rails monetize consistently across cycles. You don’t have to time tops if you own the tollbooths.

Time horizon and risk

This mindset is closer to venture capital than to day trading:

- Asymmetric outcomes. A handful of winners carry the portfolio. The Kauffman Foundation and AngelList have both written about power-law returns in startups.

- Staged exposure. DCA into BTC; stage checks into companies as they hit milestones. Avoid “all-in” moments.

- Fundamental patience. Product-market fit and regulatory clarity take time. Your worst enemy is timeline frustration.

One nuance I like: DCA isn’t magic, but it mutes the pain of being early or wrong on timing. Vanguard’s work suggests lump sum beats DCA most of the time in rising markets, but DCA wins on behavior—and behavior usually decides outcomes.

Where he’s likely right vs. where to be careful

- Likely right

- Bitcoin’s staying power. The Lindy effect grows with time and infrastructure.

- Infrastructure value accrues. Custody, compliance, and payments monetize across cycles.

- Macro relevance matters. Rates, liquidity, and policy shifts are real catalysts.

- Be careful

- Timelines. Big narratives can be right but late; over-levering the “inevitable” breaks portfolios.

- Confirmation bias. A Bitcoin-first lens can underweight risks like regulation or technical obsolescence.

- Copying positions. You don’t share his liquidity, deal access, or risk capacity. Borrow the framework, not the exact trades.

Make it yours

Here’s a simple way I turn this into a rules-based plan you can actually follow on ugly red days:

- Position sizing: Pick a % that passes the “sleep test.” If a -50% hit ruins your month, you’re too big.

- Accumulation rules:

- Baseline DCA every week or month.

- Optional add-ons only at pre-set drawdown bands (e.g., -30%, -50%), never on headlines.

- Rebalance bands (e.g., ±20%) to keep BTC from dominating your net worth unnoticed.

- Venture checklist for infra bets:

- Thesis: What mission-critical pain does it solve? Who pays?

- Evidence: Traction, retention, compliance posture, and unit economics.

- Edge: Moat (distribution, data, regulation, or network effects).

- Risks: Single-country regulation, key-man, custody failure modes.

- Catalysts: Integrations, licenses, new markets, macro tailwinds.

- Kill-switch: What breaks the thesis? Pre-write it and honor it.

- Process hygiene: Write decisions, size small first, scale with proof, set calendar reviews, not price-triggered panic.

That’s the spirit of the strategy: high conviction, long horizon, rules over vibes. Want the fast track to put this into your daily routine without getting stuck on X all day? In the next section I’ll show how I use his weekday show and notes to run this playbook in under 20 minutes.

Beyond X: podcasts, newsletters, and other ways to learn

X is the headline feed. The compounding happens in the longer stuff—his daily briefings, interviews, and written notes. If you like fast context in the morning and deeper thinking on your own time, this is where you turn quick takes into actual edge.

“Information without a system is just noise. Turn it into a workflow and it becomes wealth.”

“From the Desk of Anthony Pompliano”

Five days a week, the From the Desk of Anthony Pompliano show breaks down the headlines that actually move founders, investors, and operators—macro prints, policy updates, Bitcoin catalysts, and business lessons. It’s snackable, consistent, and perfect for a morning routine.

How I use it:

- 10-minute morning ritual: Listen at 1.2x speed while scanning your dashboard (BTC price, ETF flows, calendar). Note one actionable idea.

- Simple capture template:Macro takeaway → Bitcoin angle → Founder lesson → Action. If there’s no action, it’s entertainment. Move on.

- Primary-source pivot: If he references CPI, FOMC, or ETF inflows, open the original release or issuer page immediately and bookmark it. No secondhand trades.

Real sample moments I’ve logged from the show:

- ETF flows mention: I opened the issuer data, compared net inflows to rolling 7-day, and added a note on whether volume confirmed the move.

- Jobs or CPI print callout: I tagged it with my timeframe (trader vs. builder) and looked for rate-cut odds impact rather than reacting to the headline.

Small science-backed tip: spaced, bite-size learning beats bingeing. The spacing effect and retrieval practice both improve recall. Short daily shows + a one-line summary you write yourself = you’ll actually remember it when it counts.

The Pomp Podcast and YouTube

When a topic on X hooks me, I search the long-form archive. The Pomp Podcast and his YouTube channel are where context lives—deep macro, founder tactics, and market structure explained by the people building it.

What to queue up:

- Lyn Alden (macro + liquidity): Note the indicators she watches (liquidity cycles, fiscal impulse) and add them to your dashboard once. Reuse forever.

- Michael Saylor (corporate BTC strategy): If you manage treasury, copy the checklist: volatility policy, custody, board alignment, comms plan.

- Jack Mallers (payments + Lightning): Track real-world merchant adoption vs. press releases. Add proof points, not narratives, to your notes.

- Jeff Booth or Cathie Wood (tech + disruption): Pair the big thesis with one measurable KPI (users, fees, cash flow) so it doesn’t stay abstract.

Listening system that saves hours:

- Transcript skim first: Use YouTube’s transcript or podcast show notes to spot sections worth your time.

- Time-stamped notes: Jot “12:48—liquidity proxy” so you can revisit fast. Next time that topic comes up on X, you know where to get depth.

- One-page debrief: 3 bullets: What’s the thesis?Evidence cited?What would change my mind?

Newsletter and notes

His written work—historically via The Pomp Letter—is where frameworks crystallize. I treat these like playbooks I can reopen before a decision.

How I make written notes pay off:

- Clip frameworks, not hot takes: Look for repeatable models: how he sizes risk, how he reads macro prints, how he thinks about Bitcoin allocation.

- Build a “crib sheet” page: One scrollable doc with your top 10 takeaways. It beats scrolling feeds when you’re under pressure.

- Dual-coding trick: Pair a short summary you write with a chart or screenshot. That combo is easier to recall when markets move.

Light automation that compounds:

- RSS to Notion/Readwise: Send new episodes and posts to a single inbox so nothing gets lost.

- IFTTT/Zapier: Auto-tag items with “macro,” “BTC,” or “founder” to speed up weekly reviews.

If you’re tired of the scroll-and-forget loop, this is the fix: alerts on X, context from the daily show, conviction from long-form, and a written trail so your future self thanks you.

Want the two-minute fact-check routine I use, a no-FOMO watchlist template, and the bias checklist that saves me from dumb trades? Keep going—this is where it gets practical.

How to get real value and avoid common mistakes

You don’t need to check his feed 50 times a day. You need a simple capture-to-action system. Here’s how I turn fast takes into useful signals without getting sucked into hype or tribal fights.

Turn posts into a watchlist

When he flags a theme, I don’t react. I log it, attach trusted data sources, and set review rules. That’s it. Here are real examples you can copy:

ETF flows — When he posts “Spot ETFs saw big net inflows today,” I track:

- Primary metrics: net inflows/outflows, 5-day trend, cumulative AUM

- Sources to pin: issuers’ daily flow/holdings pages, a reputable ETF flow tracker, SEC filings

- My rule: I only act if the 5-day moving average of net inflows flips trend and lines up with macro risk-on signals (e.g., softer rates expectations)

- Review cadence: twice a week, not intraday

Fee markets on Bitcoin — If he notes “fees are spiking,” I pull:

- Primary metrics:sats/vB by priority, mempool backlog, miner revenue from fees %, confirmation times

- Context: inscriptions/mempool stress, weekend vs weekday effects, upcoming catalysts (e.g., halving windows)

- My rule: I don’t chase; I log regime changes (sustained fee elevation over multiple days) and adjust my on-chain activity estimates or miner risk exposure

Stablecoins — When he says “stablecoins are eating settlement,” I track:

- Primary metrics: USDT/USDC supply, chain distribution (Tron vs Ethereum), monthly transfer volume, exchange balances

- My rule: If supply growth accelerates while risk assets bid, I increase exposure to infra picks-and-shovels—never because of a single viral post

Rates and inflation — If he highlights CPI/PCE or a Fed pivot, I check:

- Primary metrics: CPI (headline/core), Core PCE, unemployment, Fed funds path (market-implied)

- My rule: I only change risk if the data beats/misses and stays consistent across two consecutive prints or the Fed changes guidance

Copy-paste template:

Theme: [ETF flows / Fees / Stablecoins / Rates]

Primary sources: [Official issuer/agency + 2 independent dashboards]

Key metrics: [3–5 you trust]

My rule: [Predefined condition before any action]

Review: [Scheduled time, e.g., Tue/Fri 30 minutes]

Fact-check playbook

His feed is great for early alerts. I still verify in minutes before I do anything. Here’s my two-minute check:

- Find the number — Grab the official print or issuer page (e.g., CPI release, ETF issuer flow sheet, SEC/EDGAR filing)

- Add context — Compare vs last month/quarter, look at the 3–6 month trend, and note revisions

- Cross-verify — Check one independent dashboard or reputable analyst recap to catch mistakes

- Log it — One sentence in my notes with the source link and whether it changes my stance

For background and quick references, I like clean profile pages and listings to sanity check who’s who and what they claim to do. Helpful sources include IQ-style profiles for people, Apple Podcasts pages for show summaries and timestamps, and investor profiles that summarize stated strategies.

If you want to understand why this matters, there’s decades of behavioral research showing that attention-grabbing news nudges investors into unnecessary trades. Barber & Odean’s work (2000, 2008) famously found higher turnover usually leads to worse performance, and Da–Engelberg–Gao (2011) showed “attention” can explain spikes in buying pressure. Translation: react slower, verify more.

Risk and bias checklist

I assume incentives and human bias are in every feed, including Pomp’s and mine. Here’s the quick checklist I run:

- Incentive bias — He invests, builds, and promotes. I look for disclosures like “we invested in X” or “our portfolio company”

- Confirmation bias — X’s algorithm shows you what you agree with. I actively read one smart counterpoint to any thesis I like

- Recency bias — One hot CPI print or ETF day doesn’t make a trend. I require a multi-print pattern before changing sizing

- Herding risk — Crypto markets are especially prone to herd behavior (documented in multiple academic studies). I never act off engagement counts or influencer pile-ons

And here are my pre-commit rules that protect me from myself:

- Max position size: cap per idea (e.g., 3–5% for speculative, 10–20% for core BTC) before any new info hits the feed

- Cooling-off timer: 24 hours between “idea logged” and “money moved” unless it’s a pre-planned rebalance

- Two-source rule: I need two independent confirmations (official data + one neutral source) for any claim

- Process over takes: I don’t screenshot tweets as justification. I screenshot the primary data that backs the idea

Behavioral finance backs this approach. Prospect Theory (Kahneman & Tversky) shows we overweight recent losses/gains, and crypto-specific studies on herding and sentiment spillover suggest that social signals can push investors into crowded trades at the worst times. Structure beats spur-of-the-moment conviction.

Complements and balance

I pair his lens with a few “neutralizers” so my feed stays balanced and useful:

- On-chain + market structure: mempool and fee dashboards, miner revenue splits, stablecoin supply growth, funding/basis, liquidity maps

- Macro backbone: official inflation/employment releases, central bank calendars and statements, market-implied rates trackers

- Contrarian voices: at least one thoughtful skeptic on Bitcoin/crypto and one macro analyst who challenges my regime assumptions

- Automation: I route posts containing “ETF,” “CPI,” “halving,” “fees,” “stablecoin,” “miners,” “liquidity,” “M2,” into a sheet via a simple keyword workflow; review twice a week

- Time blocking: 15 minutes morning + 15 minutes evening. No mid-day impulse checks

Mini backtest idea: Log daily spot BTC ETF net flows and a 5-day moving average, then compare to BTC performance over the next 5–10 days. You’ll likely find flows are better for context than as a raw trading signal—exactly why I use them to size conviction, not to time entries to the minute.

Bottom line for this section: let his posts set the agenda for what to research, not what to buy in the next 10 minutes. Want to see exactly how I apply this when the next headline hits—and the questions I get most about his strategy and show? You’re going to like what’s coming up next. Which FAQ are you hoping I tackle first?

FAQs about Anthony Pompliano and my final take

Here are quick answers to the questions I get most, plus how I personally use his content for real-world decisions.

What is Anthony Pompliano’s investment strategy?

He keeps it simple and long-term: hold Bitcoin as a core asset, then back “picks and shovels” businesses that power crypto—custody, payments, data, security, and infrastructure. The thinking is venture-like: accept volatility, size positions responsibly, and aim for asymmetric upside over multi-year horizons. You’ll see this general stance reflected across public profiles and interviews, including his IQ.wiki entry.

How I map this to a practical plan:

- Core vs. satellite: Treat Bitcoin as a core long-term position; use smaller “satellite” bets for infra names (public or private) that align with a clear thesis.

- Cycle awareness: Note halving seasons, liquidity shifts, and policy cycles; avoid changing your entire plan based on one headline.

- Rules first: Pre-define max allocation, DCA cadence, and conditions to trim or add before you read any post.

Why this works for some investors: multiple peer-reviewed studies show that attention and sentiment can influence markets, so a clean framework helps you filter noise. Examples worth scanning:

- Twitter mood predicts the stock market (Journal of Computational Science, 2011)

- Bitcoin meets Google Trends and Wikipedia (Scientific Reports, Nature, 2013)

What is “From the Desk of Anthony Pompliano”?

It’s his weekday show that breaks down the biggest headlines in finance, tech, and politics with a builder/investor angle. If you want a quick, repeatable briefing, this is the spot. Check the listing here: Apple Podcasts.

Real example of how I use it:

- CPI morning? I listen while pulling the official BLS release: BLS CPI schedule. I note the headline vs. core inflation and the month-over-month trends.

- Rates/ETF week? I skim the show, then check the FOMC calendar and spot Bitcoin ETF flows (a popular tracker is Farside Investors). I compare the show’s framing with the raw numbers.

It’s a tight daily rhythm—use it as a “what changed today?” filter rather than a trade trigger.

What is Anthony Pompliano’s real name?

Anthony “Pomp” Pompliano Jr. You can see this on his IQ.wiki profile and other public bios.

Conclusion

My verdict: He’s worth following if you want a clear, Bitcoin-first lens on markets, macro, and the business of building in crypto. I treat his feed as signal, not instruction.

Here’s my exact workflow:

- X usage: I keep his posts in a “Macro + BTC” list and check in batches (no push alerts). When he flags ETF flows or rate expectations, I verify with issuers/trackers and the Fed calendar.

- Data pairing: If he mentions CPI, jobs, or GDP, I open the official source—BLS, BEA, or the Fed—and log the numbers against my timeframe.

- Daily show: I use “From the Desk” as a 10–20 minute context booster while I scan primary sources. If something matters, I star it for deeper weekend review.

- Long-form: When a theme keeps popping up (e.g., ETF flows, stablecoin growth, fee markets), I search his long-form interviews to capture the full argument and counterpoints in one place.

- Guardrails: Position sizes are set in advance. I never buy because a post “feels urgent.” Ideas go to a watchlist first, with entry/exit rules attached.

My rule:Borrow ideas, not positions. Keep your edge by fact-checking and sizing to your plan.

If you follow with intention—alerts for awareness, primary sources for truth, and your own rules for action—you’ll get the upside of his signal without the downside of FOMO. That’s how I use creators across X, and it’s how I keep my process tight on cryptolinks.com.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.