Elon Musk Review

Elon Musk

x.com

Elon Musk on X (Twitter): My No‑Nonsense Review Guide for Crypto Fans + FAQ

Ever scroll Elon’s X feed, see a meme, watch DOGE rip, and wonder if you should FOMO in—or run? You’re not alone.

Describe problems or pain

Following @elonmusk can feel like riding a rocket with no seatbelt. One joke, and markets snap. A logo swap, and DOGE jumps double digits. Then scam accounts pile in with “giveaways,” and new traders get burned.

Here’s why most people struggle:

- Noise beats signal: Elon’s posts mix memes, product updates, replies, and likes—fast. If you miss context, you misread the message.

- Price whiplash is real: When Twitter briefly swapped its bird logo for the Doge icon in April 2023, DOGE spiked ~25–30% within hours. Great if you were early, brutal if you chased.

- Scammers weaponize his name: The FTC reports consumers have lost over $1B to crypto scams since 2021, with celebrity impersonation a recurring pattern. “Send 1 BTC, get 2 back” never ends well.

- Context gets lost fast: He might tease payments, crack a joke about DOGE, or like a niche reply. Without a method, you get trapped between memes and moves.

“Dogecoin is the people’s crypto.” — a short line like this once sent charts vertical. But not every line today does the same.

Bottom line: if you scroll X like everyone else, you’ll react late and risk chasing the wrong things.

Promise solution

I’ll show you a practical way to follow @elonmusk without losing your edge. You’ll see how to:

- Spot real signals (product news, filings, policy hints) vs. memes and throwaway jokes

- Use X notifications, Lists, and filters so you get the right alerts—without spam

- Apply simple rules to reduce FOMO trades and avoid impersonator scams

- Read patterns in his tone, timing, and post formats so you know when to act—and when to do nothing

Why listen to me

I audit crypto platforms and tools daily, separating useful from risky. That means testing sites, chasing sources, and flagging red flags before they hit most feeds. I’m used to cutting through noise, and this guide distills that same approach to Elon’s X presence.

Real-world context matters. When Tesla announced a $1.5B Bitcoin purchase in Feb 2021, BTC jumped sharply. When he hosted SNL in May 2021 after weeks of DOGE hype, the market famously pumped into the show—and then cooled off. Patterns like these show up again and again if you know what to look for.

What you’ll learn

- How Elon’s posts can affect BTC and DOGE—and when they usually don’t

- How to set up X so you catch the signal and skip the junk

- Fast verification tactics: company pages, filings, product links, and Community Notes

- How to react (or not) when prices move: cool‑down rules, alerts, and protection against scams

Who this is for

- Crypto traders and investors who don’t want to get lured by memes or fake links

- Curious readers who want straight answers to questions like:

- Does Tesla still hold Bitcoin?

- Is Elon launching a coin—or is that always a scam?

- Will X add crypto wallets or on‑chain payments?

- How do I get instant alerts for @elonmusk without going crazy?

Quick note

Not financial advice. Treat this as a smart way to use X around @elonmusk. Always verify with a second source, never send funds to a “giveaway,” and remember: the real account won’t DM you asking for crypto.

Ready to turn the chaos into clarity? Let’s look at what makes @elonmusk on X unique—his style, timing, and the tiny cues that separate entertainment from potential signals. Which of those cues matter most to you right now?

What makes @elonmusk on X unique (and worth watching)

Elon’s X account is a strange mix of boardroom signals, late‑night humor, and real‑time product hints. That combo is exactly why it’s worth tracking if you care about crypto. He can flip from a meme to a material update in seconds, and the format he chooses often says as much as the words he uses.

“The most entertaining outcome is the most likely.”

That line isn’t just a slogan; it’s a posting style. Entertainment pulls in attention. Attention pulls in liquidity. If you know what to watch for, you won’t mistake a joke for a genuine signal.

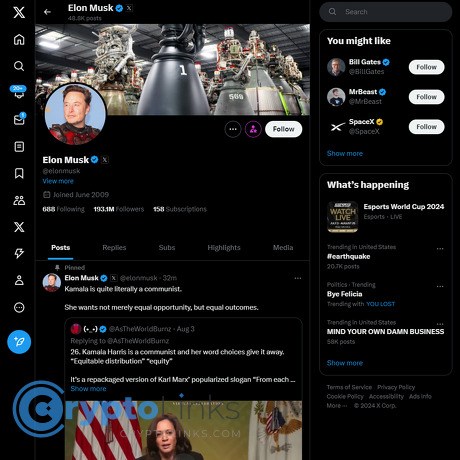

Account basics and authenticity

The real account is @elonmusk with a verification badge and a long posting history (active since 2009). Scammers rely on fatigue and tiny visual tricks. A quick 10‑second check saves you money and stress.

- Handle check: It’s exactly “elonmusk.” Watch for look‑alikes like “eIonmusk” (capital i) or “elonrnusk” (rn for m).

- Profile history: Years of posts, deep reply threads, and consistent media. Fresh accounts with a handful of posts are out.

- Behavior tells: He doesn’t ask you to send crypto, scan a QR to “verify,” or join a surprise airdrop. If you see “send 1 BTC, get 2 back,” it’s a scam.

- Follower scale: One of the most‑followed accounts on X. If you’re looking at a profile with a few thousand followers, it’s not him.

Pro tip: open the profile on desktop, click the three dots, and view “About this account” if available. Anything newly created or renamed recently should raise an eyebrow.

How he posts: tone, timing, and formats

He mixes meme energy with product talk, and the tempo shifts throughout the week. That’s your first filter: tone often telegraphs intent.

- Memes and one‑liners: Think “ancient doge secrets” or a single emoji. Fun, fast, easy to misread as market direction.

- Polls: Used for serious decisions and social temperature checks. Notable examples include “Sell 10% of my Tesla stock?” (2021) and “Step down as head of Twitter?” (2022). If a poll touches money, policy, or platform features, it’s worth paying attention to the outcome and follow‑ups.

- Long‑form posts: When something matters—policy, product, safety—expect longer text and sometimes attached screenshots. The more structured the post, the more likely it carries weight.

- Spaces and replies: He drops into Spaces or threads for off‑the‑cuff remarks. Quick replies like “Interesting…” or “Indeed” to engineers, regulators, or founders can hint at where he’s mentally parked.

- Timing: Late nights, weekends, and news‑cycle shocks are common. Set alerts, but don’t assume midnight memes equal Monday morning moves.

There’s data to back the “format matters” idea. Research like the Blockchain Research Lab’s 2021 analysis found abnormal crypto returns in minutes around high‑salience Musk tweets—especially ones that looked like clear endorsements or platform decisions. The joke‑heavy posts often created shorter, noisier blips.

Community Notes: your built‑in context layer

Some posts carry Community Notes, which add citations and corrective context. Read them. A Note that clarifies a claim (e.g., past statements, prior filings, or policy limits) can sharply reduce the chance you misread a post.

- Why it matters: Notes frequently link to primary sources—company pages, previous announcements, or regulatory documents.

- Practical tip: If a Note is pending (“currently rated helpful by reviewers”), wait. Acting before the Note lands is how traders get caught on the wrong side of a narrative.

Pinned posts = current priorities

The pinned spot is prime real estate. If you want a pulse check on what he cares about right now—X features, safety, payments groundwork, Grok updates—that’s where it usually sits. If the pin shifts, he’s shifting focus.

Quote posts and source checks

He often quote‑posts engineers, creators, or news snippets. The temptation is to react to his caption; the edge is in the source.

- Click through: Read the original thread or article. A single sentence can lose all nuance without the full context.

- Scan the comments: Look for official accounts (company, product, regulator) replying. That’s your breadcrumb trail to verification.

Likes and replies as early tells

His likes can front‑run formal announcements. It’s not a rule, but patterns show up: a string of likes around creator payouts, payments infrastructure, or DOGE jokes sometimes precedes a larger statement.

- Workflow: Check his Likes tab once a day. If you see clusters around one topic, that’s a hint to expect more on that front.

Quick answers to the big “is it real?” questions

- Is the account real? Yes—@elonmusk with a verification badge and a deep history. Anything else is noise.

- How often does he post? Most days, often multiple times, with bursts around big news cycles.

- Does he still talk about crypto? Yes—especially DOGE and payments‑related chatter—but the focus rotates among X features, AI, space, and cars.

If a single post can entertain millions and still move serious money, the question isn’t “Is he influential?”—it’s “Which posts actually move price, and which ones fizzle?” Ready to separate memes from market signals? Let’s look at what has historically triggered real crypto moves next.

How Elon Musk moves crypto markets (and when he doesn’t)

I’ve watched Elon bend candles in minutes—and I’ve watched the same candles flop when the joke didn’t land. The trick is knowing which signals tend to move price and which ones just farm engagement. If you’re reading this with a chart open, good. Keep it open.

“Who controls the memes controls the universe.” — Elon Musk

Memes matter. But markets still respect liquidity, context, and credibility. Here’s where the real action has happened—and where it hasn’t.

DOGE and meme-driven spikes

DOGE is the most sensitive to his posts, especially when there’s a visual gag or a platform-level change.

- Logo switch (April 2023): When the Twitter bird briefly became the Doge head, DOGE ripped roughly 20–35% intraday. It was visual, global, and instantly verifiable on x.com—the perfect recipe for a knee-jerk pump.

- “Dogefather” and SNL (May 2021): Weeks of memes and teasers sent DOGE vertical into the show—then a classic “sell the news” drop hit, wiping ~30–40% within hours as the skit called DOGE a “hustle.” Hype can cut both ways.

- Literal memes (Jan–Apr 2021): Posts like “Doge”/“ur welcome,” “Doge barking at the moon,” and “SpaceX will put a literal Dogecoin on the literal moon” (April 1) sparked rapid spikes. The common thread: clear DOGE references, simple language, and timing into thin liquidity.

- Tesla merch for DOGE (Jan 2022): Confirmation that some Tesla merch could be bought with DOGE triggered a fast pop. Real utility—even small—beats vague hints.

What these “pumpy” posts share:

- Direct DOGE references or iconography (logos, Shiba memes)

- Platform-wide visibility (profile, UI changes, pinned posts)

- Easy verification (you can see it live without clicking a risky link)

What cools off quickly:

- Ambiguous jokes or niche memes without DOGE context

- Likes/replies without a primary post

- Noise periods when macro headlines drown out memes

Typical timeframes I see: a 5–30 minute impulse move, 1–3 hour volatility window, and then either consolidation or give‑back. Several event studies find the effect is strongest in the first 1–2 hours and decays fast—see Lennart Ante’s paper, How Elon Musk’s Twitter Activity Moves Cryptocurrency Markets. More recent market structure research (e.g., Kaiko’s analyses) suggests the “Elon effect” on DOGE has been fading unless the post is tied to a tangible change.

Bitcoin, Tesla, and treasury talk

BTC reacts most to corporate-level facts—not jokes.

- Feb 8, 2021: Tesla disclosed a $1.5B BTC purchase. BTC jumped ~10–15% the same day. That’s a filing-backed catalyst.

- Mar 24, 2021: Tesla said it would accept BTC for cars. Price popped on the headline. The page lived on Tesla’s site—again, instant verification.

- May 12, 2021: Tesla suspended BTC payments over environmental concerns. BTC dropped quickly—clear, negative, and official.

- Q2 2022 earnings: Tesla sold ~75% of its BTC. The hit was real but partially priced in during a brutal risk-off period. Post-2022, quarterly reports showed holdings largely unchanged.

- “The B Word” (July 2021): He said he personally holds BTC/ETH/DOGE and that SpaceX holds BTC. BTC perked up, but the move wasn’t as violent as the initial Tesla buy disclosure.

What actually moves BTC now: official filings, support pages changing, or explicit acceptance/treasury decisions. Casual tweets without a corporate action rarely produce anything durable.

X payments rumors and what’s realistic

Every few months, “X is adding crypto payments” trends. Here’s the practical read:

- Licenses first: X Payments LLC has pursued U.S. money transmitter licenses in multiple states. That’s a fiat step and a real one. Watch state registries and X’s official updates—not rumor posts.

- Likely rollout: fiat peer‑to‑peer first, then maybe stablecoin rails via partners. An on‑chain retail wallet on day one would be a regulatory headache.

- What would count as signal: a product page on x.com, TOS/privacy policy updates, or a licensing milestone shared by official accounts. A meme about payments? Fun, but not a catalyst by itself.

“Is Elon launching a coin?” Why that’s unlikely (and how scammers farm it)

He’s publicly said X won’t launch its own token. Scammers keep exploiting the idea anyway.

- No official token: Coverage like Cointelegraph’s report captured his stance: no “X token.”

- Common traps: “X/ELON/GROK” presales, airdrops, and fake customer support accounts. They’ll use stolen avatars, misspelled handles, and smart contract tricks (high taxes, trading pauses).

- Reality check: If anything launches, you’ll see it on an official company domain, in product docs, and echoed by multiple verified corporate accounts—not a screenshot of a QR code.

SpaceX/Starlink mentions and crypto rumors vs reality

- SpaceX BTC: He said in 2021 that SpaceX holds Bitcoin. Later reporting suggested write‑downs. Neither produced lasting crypto trend changes by themselves.

- Starlink payments: Rumors about DOGE or BTC acceptance have circulated for years. As of now, no official, persistent on‑chain checkout for retail users. If it happens, it’ll show up in Starlink’s checkout flow—not in a reposted meme.

- Tesla: The company did enable DOGE for select merch. That’s the kind of narrowly scoped, verifiable utility that can nudge DOGE—but it’s not the same as full vehicle checkout via crypto.

When he doesn’t move the market

It’s easy to remember the fireworks and forget the fizzle. Here’s why many posts do little:

- Diminishing impact: The market’s learned his patterns. Unless a post adds new, verifiable information, liquidity providers fade it.

- Macro > memes: CPI, FOMC, ETF flows, and liquidity regimes often overpower a meme spike—especially for BTC/ETH.

- Pre-positioning: Traders front‑run expected posts around events (e.g., product launches), reducing follow‑through.

- Time decay: Research and order book data often show the “Elon effect” half‑life in minutes to a few hours. If there’s no second confirmation, the move mean‑reverts.

What actually counts as a signal

Filter every post through this lens before you chase a candle:

- High‑credibility signals: SEC filings (10‑K/10‑Q), earnings call remarks, official help/product pages, licensing databases, and posts from verified corporate accounts (Tesla, SpaceX, X, xAI) linking to company domains.

- Medium: A clear, on‑record statement about payments, treasury, or product availability, plus rapid confirmation by a company page.

- Low: Memes, polls, vague hints, liked posts, and third‑party screenshots. Entertainment value ≠ trade signal.

Fast rule I live by: If I can’t verify it on an official page in 60 seconds, I treat it as noise.

So how do you catch the real signals without getting spammed by noise and fakes—while still being early? That’s where your X setup does the heavy lifting. Ready to tune notifications, Lists, and filters so you see the right post at the right second?

Follow smarter: set up X so you catch signals and skip the noise

I want your feed to work like a radar: clean pings for real signals, zero distraction from junk. Elon can move markets, but most of the time you’re fighting memes, fake accounts, and late entries. Here’s how I set up X so I see what matters—and act only when it’s worth it.

“In markets, as in rockets, noise is the enemy of signal.”

Notifications, Lists, and filters

Turn on alerts without frying your brain:

- Go to @elonmusk → tap the bell → start with Highlights. If you can handle more, switch to All posts during major news cycles, then dial back.

- On mobile: Settings → Notifications → Preferences → enable Quality filter and Mute notifications from non-followers/new accounts. This cuts bot spam while big threads are exploding.

- Switch your Home to Following (tap the star icon on top right) for a chronological feed when speed matters.

Build a dedicated List that extracts signal:

- Create a List called “Elon — Market Signals.” Add: @elonmusk, @Tesla, @SpaceX, @X, @xAI, and official product accounts relevant to payments or crypto (e.g., @CommunityNotes, plus the @dogecoin account).

- Use X Pro (TweetDeck): one column for your List, one for from:elonmusk, one for from:elonmusk has:poll, and one for your price watchlist (explained below). Pin this workspace. When something breaks, you’ll see it all at a glance.

Mute words to clear the junk:

- Settings → Privacy and safety → Mute and block → Muted words. Add: airdrop, giveaway, “send 1 get 2,” claim, free crypto, bonus, double, QR, whitelist, and common variants (give away, airdrops, crypto bonus).

- Apply to Home timeline and Notifications, from Anyone, Forever. You’ll still catch the real posts—just not the reply-grift that follows.

Spotting fakes and avoiding scams

I assume every “Elon” post is fake until proven real. Here’s the 10-second check:

- Handle and age: Real handle is @elonmusk. Look for odd characters (eI0nmusk), trailing underscores, or fresh accounts. The real account has been around for years and has massive history.

- Follower pattern: Scam accounts often spike to thousands fast but show thin history, low-quality replies, or AI-generated banners.

- Language tells: “Send 1 BTC, get 2 back,” QR codes on “live streams,” or “official airdrop” links. Real Elon doesn’t ask you to send funds. Ever.

- Community Notes: If a post is contentious, look for Notes. Tap the note to read sources. If it’s missing but feels off, wait—Notes often get added minutes later.

- Check the source trail: For quotes or screenshots, click through to the original post. Scammers count on you not checking.

Red flags I act on immediately:

- New account “impersonating” with paid verification

- Off-platform links for “verification” or “claim”

- Wallet connect prompts for mystery sites

- Looping “live” streams with QR codes and old footage

Use Advanced Search to get instant context

When something’s brewing, I pull history in seconds with search operators:

- from:elonmusk (doge OR dogecoin) -is:reply — see his major DOGE mentions

- from:elonmusk has:poll — polls can hint at direction or priorities

- from:elonmusk (btc OR bitcoin) since:2021-01-01 — filter by timeframe

- from:elonmusk is:quote — quotes add context to someone else’s news

On mobile, run the search once and tap Save search. In X Pro, keep a permanent search column. Context kills FOMO.

Read Community Notes before acting

Notes are the fastest way to sanity-check a wild post. If a Note references filings, product pages, or official accounts, that’s your green light to continue due diligence—or to stand down. I also peek at @CommunityNotes directly when a post is heating up.

Pair alerts with exchange watchlists or price alerts

Seeing a post is one thing. Knowing if the market actually cares is another. I run a simple alert stack:

- TradingView: Set alerts for DOGEUSD, BTCUSD, and key pairs you trade. Quick templates: “Price moves 2% in 5 minutes,” “Breaks last hour high/low,” “Volume spike on 1–5m.”

- Exchange apps (Binance, Coinbase, Kraken): Create watchlists just for Elon-sensitive assets (DOGE, BTC). Turn on price alerts with a tighter threshold during known high-activity windows.

- CoinGecko/CoinMarketCap: Use portfolio alerts for secondary confirmation and notifications when market caps or rankings shift.

Why the overkill? Because research (e.g., Blockchain Research Lab, 2021; follow-up market microstructure papers in 2022–2023) shows influencer-driven spikes are often short-lived—minutes to hours. Alerts confirm whether a move has legs or is already fading.

Create cool-down rules you’ll actually follow

I keep rules visible on my screen during volatile moments. Pick yours and stick to them:

- Wait window: If a meme-like post hits, wait 15–30 minutes. Spikes on logo changes or jokes often retrace fast. In April 2023 when the Twitter logo briefly swapped to a doge, the initial pop on DOGE faded significantly within hours—classic “first spike, then chop.”

- Two-source rule: Don’t trade a “signal” until it’s echoed by either an official company account or a product/filing page you can verify.

- Size small near headlines: If you must play momentum, scale in tiny, set hard stops, and predefine exits. Headlines move faster than your thumbs.

- No link, no click: If a post pushes you off-platform to connect a wallet or “claim,” you’re done. Close the tab.

Extra filters that save time (and money)

- Replies off, List on: During big moments, read original posts only from your List or X Pro column. Skip replies; scammers live there.

- Media-only scan: In X Pro, add a search column for from:elonmusk filter:media to spot images, design mockups, or screenshots that hint at product work.

- Turn on “Show potentially sensitive content” so platform flags don’t hide relevant info (you can still use your brain to filter).

- Speed-check the URL: When a link appears, scan the domain and subdomain (punycode traps and typos are common). If it’s not the official domain you expect, you already have your answer.

One last thing on timing: even legit news can whip both ways. I’ve seen DOGE rip on a joke, then undercut the starting price an hour later. Cool heads keep capital.

You’ve got the setup. Next question: which topics from Elon are actually worth your alerts—and which are just entertainment? In the next section, I break down his go-to themes and how they translate into real crypto takeaways.

Translating Elon’s favorite themes into crypto takeaways

If you’ve watched @elonmusk on X for any length of time, you’ve noticed the same motifs looping back: free speech, payments, Dogecoin, big tech products (Tesla/SpaceX/Starlink), and lately AI/Grok. Each theme has a different “market weight.” When you learn which ones tend to precede real, tradable changes—and which ones are just culture and comedy—you stop reacting blindly and start reading the room.

“Who controls the memes, controls the universe.”

—Elon Musk

Free speech, policy, and regulation

When he talks about policy and platforms, he’s not just venting. It often telegraphs how X is thinking about compliance and what kind of rails future payments would realistically use.

What to watch and why it matters:

- KYC/AML posture: If X leans into payments, expect standard Know Your Customer and Anti-Money Laundering checks. That means identity verification, sanctions screening, and potential geo-restrictions. Translated to crypto: if X ever touches on-chain assets, it would likely be via custodial, compliant partners—not anonymous wallets. See FinCEN basics for the U.S. and EU’s MiCA for a sense of the ruleset.

- Moderation and content liability: Free speech battles aren’t just culture-war stuff; they shape risk tolerance. A platform pushing “minimal moderation” may go slower on anything that could invite regulatory heat—like on-chain transfers—until guardrails are clear.

- Takeaway: Policy-heavy days usually aren’t instant price catalysts, but they set the stage. I file these under “probability updates” for future product moves, not immediate trades.

Payments on X and what it could mean

He’s been teasing peer-to-peer payments and creator monetization for a while. The likely rollout path is boring before it’s exciting: closed-loop fiat first, then maybe more.

What’s real today:

- Licensing breadcrumbs: X Payments LLC has applied for or secured money transmitter licenses in multiple U.S. states. You can check company licenses yourself via the public registry: NMLS Consumer Access (search “X Payments LLC”). Licenses ≠ live crypto, but they’re a prerequisite for any wallet-like features.

- Closed-loop first: Platforms almost always start with a ledger-based balance (think gift card/PayPal-style credits) and tightly controlled rails. Expect fiat P2P and in-app tipping before any on-chain integrations.

- Real signal vs hype:

- Real: updated Terms of Service, a live product page, App Store release notes mentioning “wallet” or “payments,” or a partner announcement from a known processor/custodian (e.g., Stripe, Coinbase, Circle).

- Hype: viral screenshots, random “X coin soon” accounts, or tokens using the X logo. No official token has been announced.

Crypto takeaway: If/when X plugs into on-chain rails, the first realistic step is stablecoins via a regulated partner. Watch for stablecoin language in help docs or SDK notes—not just tweets.

Dogecoin culture and why it keeps coming up

DOGE is the recurring character in Elon’s feed. Culture bleeds into price because attention is flow, and flow moves thin markets fast.

Concrete moments that mattered:

- May 2021: “The Dogefather” SNL era—huge run-up into the show and a sharp sell-the-news after.

- Jan 2022: Tesla starts accepting DOGE for select merchandise (not cars). That’s a product change, not a meme—stronger signal.

- May 2022: SpaceX merch gets DOGE support as well.

- April 2023: X briefly swaps the bird logo for the Doge logo on web—DOGE spikes hard intraday, then normalizes.

How I interpret future DOGE mentions:

- Memes and wordplay: expect fast spikes and quick fade (minutes to hours).

- Product knobs: “We accept DOGE for X” is a different animal. Until it’s on an official page or in a company help center, I treat it as noise. When it is on a live policy page, that’s where I lean in. For example, check brand-owned pages like Tesla IR and official shop/support pages before acting.

Evidence note: Academic and industry analyses have repeatedly found short-lived, statistically significant abnormal returns around Musk’s crypto-related posts—especially for DOGE—followed by mean reversion within hours to a couple of days. If you want to browse the literature, try an SSRN search and you’ll see the pattern.

Tesla, SpaceX, Starlink: where crypto fits (or doesn’t)

When he references the companies, pay attention to whether it’s a corporate action or a thought experiment.

- Tesla: The company still reports “digital assets” on its balance sheet in SEC filings, widely understood to be Bitcoin. That’s a filing-based signal, not a tweet. If you’re tracking BTC risk, watch quarterly reports and 8-Ks for changes, not memes.

- SpaceX: Media reports have suggested BTC holdings in the past. Treat anything not backed by filings or official statements as unverified.

- Starlink: Micropayments chatter pops up occasionally, but there’s no official crypto billing product. A real step would be a Starlink support article or pricing page referencing on-chain payments or specific processors.

What counts as a real company-level signal:

- SEC filings (10-Q/10-K/8-K) or official investor relations posts

- Updated support docs or payment pages on company domains

- Press releases and verified product page updates

- App release notes referencing wallet/payment functionality

AI and Grok: tokens vs tooling

Grok is part of xAI’s push into AI products that live inside X. That invites scammers to launch “GROK” tokens and pretend they’re official.

- No token: There is no official Grok or xAI cryptocurrency. Check x.ai for product updates and research releases. If a token claims to be “the Grok coin,” it’s a bait.

- Real signal types: new Grok features inside X, API announcements, compute partnerships, or on-device integration talk. These can shift AI-adjacent equity narratives more than crypto—unless they explicitly include payments or wallet rails.

Crypto takeaway: “AI + token” is a reflex pump in meme season, but if it’s not announced by a verified corporate channel, it’s likely a farm-and-dump. Protect your attention, not just your wallet.

Market psychology: memes, sentiment, and why timing matters

You don’t have to guess what happens after a spicy tweet—this pattern repeats:

- Attention shock: Price jumps within 1–10 minutes if the post is interpretable as positive to DOGE or a crypto narrative.

- Liquidity vacuum: Thin books amplify moves; slippage is real.

- Half-life: Without a second confirmation (product page, filing, partner quote), the move tends to fade within 30–120 minutes and often mean-reverts in 24–48 hours.

- Second leg: If a credible follow-up lands (e.g., official terms updated), that’s when a trend can extend beyond a single session.

My quick-read cheat sheet for his posts:

- Meme/photo/pun-only: high noise, short window. If you trade it at all, it’s about speed, spreads, and strict exits.

- Quote-tweet of a product or regulation update: stronger. Cross-check the linked source and look for an on-site confirmation.

- Direct statement about a company feature + link to official page: strongest. Expect higher persistence, but still size small and plan exits.

There’s a reason I keep one eye on the feed and the other on verification tabs. Emotions spike with memes, but profits usually follow documentation. So here’s the real question: when a post hits and price jumps, what exactly should you do in the first 5–15 minutes to avoid being the exit liquidity? Keep reading—I’m about to lay out the risk rules I use next.

Risk management: how to act (or not) on Elon‑related moves

Here’s the hard truth: by the time a meme rockets across X, the easy trade is gone. The edge is in preparation, not reaction. I treat anything tied to @elonmusk as a special-news event with its own rules, because the first minutes are all about speed, liquidity, and emotion. Your job is to slow the pulse, verify the signal, and size like a pro.

When to act, when to watch

Not all Elon posts are equal. I bucket them into three levels and behave differently for each:

- Level 1: Meme/banter — Jokes, image posts, movie quotes, or loose Doge references. Historically can spark fast DOGE wicks, but they fade. My system: observe only. If I trade, it’s tiny and extremely short-term.

- Level 2: Interest signals — Likes, replies, or quotes that hint at tech, payments, or a product direction. Watchlist, set alerts, and wait for a second source.

- Level 3: Confirmed product or corporate news — Official pages updated, licenses filed, company accounts and reputable media in sync. That’s the only category I’ll size for.

Real examples

- Dogecoin logo swap on Twitter (April 2023): DOGE spiked roughly 20–30% within hours and retraced after the novelty wore off. This was a Level 1–2 event (platform branding gag) and proved why chasing the first green candle is dangerous. Coverage: Reuters.

- Tesla’s BTC headlines (2021): The initial buy and later payment suspension both moved Bitcoin sharply. These were Level 3 corporate events and deserved systematic treatment: verify, define risk, then act.

Rule of thumb: If you can’t point to an official page, filing, or coordinated company post that confirms the claim, you’re probably looking at FOMO, not a thesis.

Playbook: a 60‑second checklist before you click “buy”

- Post type: Is it a meme, a quote, or a concrete update?

- Source check: Is there a link to an official site, product page, or filing?

- Second source: Do reputable outlets report it consistently (no copy‑paste blogs)?

- Chart/liquidity: What’s the spread, depth, and recent wick behavior? Thin books = wider stops.

- Plan: Entry, invalidation, target, size cap. If you can’t write it in one sentence, don’t trade it.

Fast fact‑checking workflow

I keep these in a bookmark folder for 30‑second verification:

- Official accounts/pages: @elonmusk, company handles, and product pages that reflect live changes.

- Corporate filings and IR: For Tesla news, check Tesla IR and SEC filings on EDGAR.

- Licensing/registrations (payments): Money transmitter status via NMLS Consumer Access (search “X Payments” or comparable entities).

- Reputable outlets: Reuters, Bloomberg, WSJ, AP, and established crypto desks (to cross‑confirm, not to outsource thinking).

- Community Notes + archives: Read the Notes under the post. Save claims via Wayback Machine or archive.today for context.

This isn’t about being skeptical; it’s about being fast and right.

Position sizing around headline volatility

Elon‑linked volatility is real. A working paper by Blockchain Research Lab observed abnormal returns and elevated volatility in BTC/DOGE around his tweets, often short‑lived and clustering near the event window (you can start your read at blockchainresearchlab.org). That supports how I size:

- Risk per trade cap: I limit headline trades to a small fraction of daily risk budget (for example, 0.25–0.75% of account), because win/loss is path‑dependent and slippage is common.

- Wider invalidations: Volatility expands spreads. Place stops where “noise” won’t knock you out instantly, or use mental stops if you’re very disciplined and watching live.

- Partial scaling: If I’m early, I start tiny and add only on confirmation (official page updated, second source matches).

- Leverage caution: If I use leverage at all, it’s lower than usual. Funding spikes and thin books can nuke decent ideas.

Headline trades should feel “too small to matter.” If they don’t, size is wrong.

Time zones, after hours, and pre‑market traps

- Crypto trades 24/7. Late‑night US posts can hit thinner liquidity, creating exaggerated wicks and gap‑like behavior on lower‑cap coins.

- Equities context matters. If a post touches Tesla or a public company, remember: pre‑market (US) has less depth. Crypto may react immediately, stocks price it later. Don’t project one market’s liquidity onto another.

- Regional flows: A weekend post can see Asia/Europe amplify or unwind the move hours later. I set alerts for those hand‑off windows rather than forcing a trade at 3 a.m.

Tools that keep you calm under pressure

- Price alerts: TradingView, CoinMarketCap, CoinGecko alerts on key levels; set both upside and downside triggers.

- On‑chain pings: Whale Alert on X for big transfers; for deeper work, platforms like Arkham or Nansen can flag movement in wallets tied to entities—but remember, correlation isn’t causation.

- News squawks: A real‑time audio/text feed (Benzinga Pro, The Fly, or Bloomberg if you have it) helps you catch confirmation or refutation quickly.

- Community Notes watch: Leave the post open for a few minutes; Notes often land fast on anything controversial.

Red‑flags I never ignore

- Newly created accounts with look‑alike handles (extra letters, swapped characters) using the verified check as cover.

- “Send 1 BTC, get 2” giveaways, QR codes, or airdrop claims allegedly from Elon or company accounts. They’re fake.

- Brand‑new tokens using his name (“ELONPAY”, “GROKCOIN”, etc.). Check contract code, tax, holders, and LP lock on Etherscan/BscScan. If it launched minutes ago and influencers are pushing it, assume exit liquidity.

- External wallets in replies with urgency (“ends in 10 minutes”). Real announcements don’t force timers.

- Unverifiable screenshots or “insider” DMs. If there’s no public source, treat it as fiction.

Case studies: what the tape taught me

- DOGE logo swap (April 3, 2023): The first candle was violent, the follow‑through was choppy, and liquidity dried as traders chased. My approach: alert goes off, I check source (it’s real, the logo changed), tag it as a branding gag, consider a scalp only if spreads are OK, and let it go if I miss the first rotation. FOMO avoided, capital preserved.

- Tesla BTC headlines (2021): Corporate actions hit with immediate BTC repricing, then secondary waves as mainstream media catches up. That’s where a plan wins: confirm via Tesla IR/SEC, define risk, and accept slippage as the cost of certainty.

Practical rules you can copy

- If the post is a meme and there’s no official page update: no trade or tiny size. Set a 30‑minute cool‑down and reassess.

- If the post hints at payments but there’s no license trail on NMLS or product page: watchlist, alerts only.

- If official accounts + pages + reputable media align: plan the entry, cap risk, use staggered exits. Screenshot your plan to keep yourself honest.

- If a token appears “because Elon tweeted” and it’s hours old: assume it’s a trap until proven otherwise. Most aren’t.

One last thought: studies consistently show the impact window around his posts is short and volatility spikes hard. That’s why the best trade is often the one you don’t take. Want the quick answers to questions like “Does Tesla still hold Bitcoin?” and “Is Elon launching a coin?” I packed those into the next section—curious which myths are actually true?

FAQ: quick answers to the most common Elon + crypto questions

Does Tesla still hold Bitcoin, and does Elon personally hold crypto?

Tesla: Yes, Tesla still holds Bitcoin. The company sold about 75% of its stack in Q2 2022 but has not disclosed any further sales since. Their filings show ongoing BTC exposure; carrying values changed with accounting updates and price moves. Exact wallet addresses aren’t public, but independent estimates typically put holdings in the ballpark of ~10k BTC. If you want the official paper trail, check Tesla’s quarterly and annual filings on the Investor Relations page.

Elon personally: He has publicly said he owns BTC, ETH, and DOGE. No amounts or wallets are verified. Treat any “Elon’s wallet” post as unconfirmed unless he makes a clear, verifiable disclosure (he hasn’t).

Is Elon Musk launching his own cryptocurrency?

Extremely unlikely. He’s publicly dismissed the idea of an “X coin” multiple times. Scammers keep spinning up “X,” “MUSK,” or “GROK” tokens anyway. If you ever see a post claiming an official token, assume it’s a scam until proven otherwise by a signed corporate announcement, product page, or filing.

Why does DOGE pump when Elon posts, and how long does it usually last?

Why: Attention + meme culture + liquidity. A high‑engagement post can fuel a rush of market orders, especially on perpetual futures. That reflexive pop is part meme, part momentum.

How long: Often minutes to hours unless there’s a concrete action behind it.

- April 3, 2023: When the Twitter logo briefly switched to the Doge head, DOGE spiked roughly 25–30% within an hour before cooling off over the next few days (check TradingView/CoinGecko for the intraday print).

- Jan 14, 2022: Tesla enabling DOGE for merch triggered a fast move that partially retraced after the initial excitement.

- May 2021 SNL: A classic “buy the rumor, sell the news” moment. Huge run-up into the event, then a sharp reversal right after.

Short-term spikes from social posts have been tracked across crypto for years; you’ll often see quick volatility bursts followed by mean reversion unless follow-up news locks in the narrative.

Will X add crypto wallets or on-chain payments?

X has been building payments plumbing under X Payments LLC, collecting money transmitter licenses across many U.S. states through 2023–2024. The rollout they’ve teased centers on P2P fiat first. There’s no official announcement of on-chain wallets or crypto settlement. If that changes, you’ll see it in:

- Company posts from official X handles or an in-app product page

- Licensing/filing updates

- Press releases with clear product specifics (not vague “web3” language)

How do I get instant alerts for @elonmusk without going crazy?

- Tap the bell on his profile and start with Highlights, not All. If you miss things, bump it up.

- Create a List with Elon + a handful of trusted sources (company accounts, engineers, product managers). Check the List tab when markets are moving.

- Pair X notifications with price alerts on DOGE/BTC so you know if a post is actually moving markets.

- Self-imposed rule: wait 15–30 minutes before any trade on a meme post. If it’s just a joke, momentum usually fades fast.

How do I spot fake Elon accounts and giveaway scams?

- Handle check: It’s @elonmusk. Scammers swap letters (e.g., “eIonmusk” with a capital i). Always tap through to the profile before clicking anything.

- History: The real account has a massive follower count and deep post history. New accounts or weird follower ratios = nope.

- Giveaways: “Send 1 BTC, get 2 back” is always a scam. Real Elon doesn’t ask for your funds, seed phrase, or QR scans.

- Links/QRs: Treat shortened links, “event livestreams,” and wallet-connect QR codes as red flags. Check Community Notes and look for coverage by reputable outlets before engaging.

- Video deepfakes: They’re getting better. If a video urges a deposit, assume it’s fake until a legitimate company source confirms an official promotion (which will still never ask you to send crypto to “activate” anything).

What’s Grok, and does it connect to any tokens?

Grok is xAI’s chatbot, integrated in X for some users. There is no official Grok token. Multiple “GROK” memecoins popped up in late 2023; at least one experienced a classic rug where the deployer dumped or pulled liquidity (on-chain security accounts like PeckShield flagged incidents at the time). If it’s not announced on an official xAI/X channel with product details and legal disclosures, assume the token is unrelated.

Any tips for reading between the lines?

- Memes = entertainment or sentiment nudge. Good for short bursts, weak for sustained trend unless there’s follow-up.

- Product or policy posts = higher signal, especially if they reference specific features, partnerships, or regulatory steps.

- Company filings and product pages = strongest signal. These are the ones worth acting on—carefully.

Mini glossary: X features he uses (and what they might signal)

- Community Notes: Context cards added by vetted contributors. Read these before reacting; they often clarify what a post actually means.

- Pinned post: Usually reflects current priorities. If payments or a product link is pinned, it’s worth extra attention.

- Spaces: Live audio. Real-time remarks can move markets, but wait for replays/summaries for accuracy if you’re not there live.

- Polls: He has acted on some big polls (e.g., selling stock, leadership changes). Not binding, but they can hint at direction.

- Quote post: When he quotes a source (engineer, company, regulator), click through and read the original for context.

- Likes/Replies: Soft signals. A streak of likes/replies around payments or DOGE sometimes precedes a louder statement.

Pro tip: If a post could impact price, look for a second confirmation: a company handle, a support article, a filing, or a product page that actually changed.

Wrap-up

He’s entertaining and influential, but the edge isn’t from chasing the first candle—it’s from context, filters, and patience. Set up smart alerts, verify before you act, and size small if you trade at all. Most meme spikes fade; real products and filings stick.

Bookmark this on Cryptolinks, share it with that friend who panic-buys every time a meme hits, and keep your funds safe first, curious second.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.