99Bitcoins Review

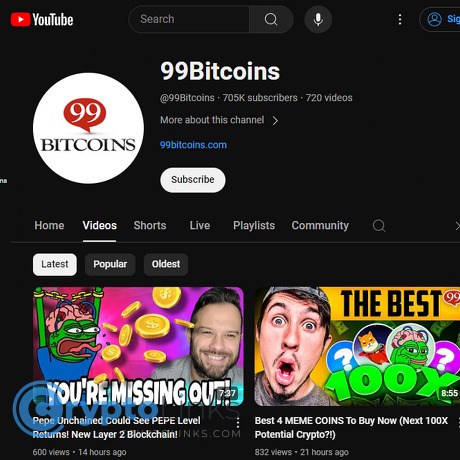

99Bitcoins

www.youtube.com

99Bitcoins YouTube review guide: everything you need to know (with FAQ)

Ever type “Bitcoin explained” into YouTube and end up in a maze of hype, jargon, and bold predictions? If that sounds familiar, you’re exactly who I wrote this for. Let’s cut through the noise and talk about one of the most consistent beginner channels out there: 99Bitcoins.

Describe problems or pain

Most crypto channels play the algorithm, not the student. That means:

- Clickbait over clarity: “3 Coins to 100x This Week!” gets the view, but rarely teaches you how wallets, fees, or private keys actually work.

- Jargon-heavy content: Newcomers bounce when a “simple guide” turns into a protocol lecture.

- Shills and stealth ads: “Educational” videos that quietly push risky products.

- Time sinks: 20 minutes of talking for 2 minutes of value.

This isn’t just a feeling. Research shows that people increasingly get news and explanations on YouTube, but a lot of it comes from independent creators, not traditional outlets—which means opinions and sponsored content are common. If you’re curious, check out Pew Research Center’s “Many Americans get news on YouTube” (2020). Regulators have also warned about “finfluencers” and undisclosed promotions (see ASIC INFO 269, 2022, and the FTC’s Endorsement Guides, 2023).

There’s one more headache: the name 99Bitcoins gets copied by unrelated tokens or random projects. You might see a “99BTC” coin pop up and assume it’s connected. It’s not. That confusion leads to costly mistakes—exactly what we want to avoid.

“If a channel teaches you how to secure a wallet but never pushes you to buy their ‘secret coin,’ you’re in safer territory.”

Promise solution

Here’s what you’ll get from this guide: a straight-up review of what 99Bitcoins actually is, what it does well, where it falls short, and who it’s perfect for. I’ll map a simple path so you can use the channel to learn fast, not wander aimlessly. I’ll also clear up the confusion around “buying 99Bitcoins” and point you to trustworthy places to dig deeper.

Who I am and why listen

I’ve been curating legit crypto resources since 2018 and I favor platforms that teach, not hype. I watch crypto channels so you don’t have to, and I keep notes on what actually helps beginners build confidence—especially around wallets, security, and basic Bitcoin concepts.

What this guide covers

- What the 99Bitcoins YouTube channel is (and isn’t)

- How the content is structured for beginners

- Strengths, gaps, and realistic expectations

- How to use the channel to learn safely—step by step

- Credibility checks and how they handle sponsors

- FAQ, including the frequent “How do I buy 99Bitcoins?” confusion

What this guide won’t do

- No price targets or “next moonshot” calls—use channels like this to build fundamentals, not gamble.

- No financial advice—only practical learning tips, risk pointers, and sources so you can double-check everything.

- No technical rabbit holes—plain English that helps you act safely.

If you’ve ever wished someone would just show you a calm, structured way to use YouTube to actually learn Bitcoin—and not get sucked into the hype—you’re in the right place.

Ready to see what 99Bitcoins looks like at a glance and whether it matches your goals? I’ll break that down next so you can decide in under two minutes.

99Bitcoins at a glance: what the channel is and who it’s for

If you want one crypto YouTube channel that keeps your brain calm and your wallet safe, 99Bitcoins is built for that. It’s focused on Bitcoin first, then the practical crypto basics most people actually need—wallets, fees, security, scams, buying/selling, and how to avoid costly mistakes. No shouting, no moon-calls, just clear explanations.

“Clarity beats FOMO every time.”

The mission and tone

The channel’s mission is simple: explain Bitcoin and crypto essentials in plain English so regular people can use them safely. The tone is friendly, patient, and steady. Think “helpful teacher,” not “hype merchant.”

- Simple, non-technical language: Core ideas come first—what a private key is, why confirmations matter, how fees work—without drowning you in jargon.

- Practical over predictive: You’ll get tutorials and safety tips instead of price theatrics.

- Beginner-first mindset: If you’ve ever paused a crypto video because it got too nerdy, this channel feels like a relief.

Content types you’ll see

Expect repeatable formats that make learning fast and painless. Research on multimedia learning shows that short, segmented videos help people absorb complex topics more easily, and that’s exactly how these videos are structured. Even Pew Research found that over half of U.S. YouTube users rely on the platform for “how‑to” learning—99Bitcoins leans into that with step-by-step clarity.

- Short explainers: Bite-sized answers to “What is Bitcoin?”, “What is a wallet?”, “What are confirmations?”—the questions everyone actually has.

- Bitcoin Whiteboard Tuesday: A signature format that breaks down the building blocks—great for visual learners who want the big picture first.

- How-to tutorials: Walkthroughs for setting up wallets, sending small test transactions, and basic exchange tasks.

- Scam alerts: Red-flag checklists and common scam patterns to help you avoid traps that cost newcomers real money.

- Wallet and security tips: Backups, seed phrases, 2FA, hardware wallet basics—practical steps you can follow immediately.

- Occasional market explainers: Context on halvings, fees, or demand shocks—useful background without the trading noise.

Playlists and structure

The channel is organized so you can start from zero and level up in the right order. Videos typically run under 10 minutes, so you can learn a topic over lunch without getting overwhelmed.

- Bitcoin basics: Start here to understand money, scarcity, keys, addresses, and confirmations.

- Bitcoin Whiteboard Tuesday: Clean visual breakdowns for the foundational concepts.

- Wallets and security: Seed phrases, backups, hardware wallets, and everyday safety habits.

- Buying and selling: How to move from “watching” to making your first small, safe purchase.

- Mining 101: What mining is, how it secures the network, and why home mining isn’t for most people.

- Scam alerts and red flags: Real examples of promises and patterns that should make you walk away.

It’s the kind of structure that helps you build confidence step by step—first understand, then try a tiny, low-risk action, then secure it properly.

Who it’s perfect for

- Total beginners who want to learn without feeling judged or confused.

- Busy professionals who need 6–10 minute lessons that fit into a commute or coffee break.

- Cautious learners who care more about security and self-custody basics than altcoin roulette.

- Returning learners who got burned by hype and want to reset with fundamentals.

- Non-technical teams (small businesses, creators) exploring simple Bitcoin payments or custody practices.

So, it’s clear who the channel serves and how it stays calm and useful. But how good is the information, really—how accurate, how unbiased, and how deep does it go? Let’s answer that next.

Content quality, accuracy, and level of depth

I care about signal, not noise. The whole point of watching a crypto channel is to learn something you can use without getting lost in hype. Here’s how this channel stacks up where it matters: clarity, correctness, and staying power.

Beginner-friendly without fluff

The teaching style is plain-English, example-driven, and stays focused on the “why” behind each step. You’re not hit with jargon first—you’re shown what a thing does and why it matters, then the terminology makes sense.

- Private keys vs. seed phrases: Instead of tossing cryptography terms around, you’ll see what a seed phrase is, why it’s the master key to your funds, and how to store it safely. They hammer home the golden rule:

“Not your keys, not your coins.”

- Wallets explained: Software vs. hardware vs. custodial wallets are compared with real-world analogies (cloud account vs. personal safe). You’ll actually understand what you’re choosing—not just the brand names.

- Fees and confirmations: They show how network congestion impacts confirmation time and why paying the lowest fee can stall a transaction. That “why didn’t it arrive yet?” panic moment gets handled before it happens.

- Exchanges and KYC basics: Clear coverage of trading accounts, limits, identity checks, and withdrawal policies—plus what to double-check before sending funds off-platform.

- Common pitfalls: Address mix-ups, phishing links, fake support accounts, and too-good-to-be-true yield offers. You’ll hear the red flags early and often.

There’s a reason this style works: research on learning with video shows that short, focused explanations with clean visuals boost engagement and recall. One well-cited edX analysis found that viewer engagement drops sharply as videos get longer, and that concise, well-structured clips perform best (edX: Optimal Video Length). The format here plays to those strengths—no long monologues, just what you need, step by step.

Accuracy and sources

Explanations stick to fundamentals and avoid rumors. When a topic needs more detail, you’ll usually get a link to a written guide for deeper reading on their site. That combo—clear video plus a longer-form article—helps reduce misunderstandings, especially around security and wallet setup.

What I checked for accuracy while watching:

- Seed phrases and backups: Aligned with standard practices (BIP-39 style phrases and offline storage). If you want to see the underlying standard, here’s the BIP-39 reference.

- Addresses and confirmations: Correct explanations of why confirmations matter and the basics of how transactions queue up on the network.

- Security advice: Consistent with common-sense crypto hygiene: verify URLs, use 2FA, prefer hardware wallets for meaningful amounts, test with small sends first.

- Speculation vs. education: Price talk is kept separate from how-to knowledge, which protects beginners from mixing learning with gambling.

When the industry changes (new wallet flows, fee market shifts, exchange policies), I’ve seen updates posted on their site and clarifications in video descriptions or pinned comments. That matters because crypto moves fast, and evergreen content needs small tune-ups to stay accurate.

Sponsorships and bias

Sponsored segments do appear, and they’re labeled. The overall tone remains educational, but I never take any brand mention as a green light. You shouldn’t either. If a product shows up, treat the video as your starting point and then pressure-test the claims.

Quick bias-check I use on any mentioned product:

- Custody: Do you hold the keys, or do they? If not you, assume counterparty risk.

- Withdrawals: Any limits, delays, or “maintenance” patterns? Search: “site:reddit.com [brand] withdrawals”.

- Fees and spread: What’s the real cost versus headline fees?

- Proof-of-reserves or audits: Is there transparency, or only marketing?

- Support track record: Response times and human help when things go wrong.

- Impersonation risks: Verify domains and social links from official pages only.

That simple checklist protects you from most sponsor bias—on any channel.

Production value and cadence

Clean visuals, clear audio, and a steady pace mean less cognitive overload. That’s not just preference; it’s how people learn. Studies in multimedia learning repeatedly show that simple, well-structured visuals paired with clear narration improve understanding versus flashy effects or text-heavy slides (summary of multimedia learning research).

Most guides are “evergreen,” so you can watch them months later without feeling like you missed the moment. New uploads arrive on a regular rhythm, but the focus is on timeless topics (wallets, security, transactions) rather than chasing daily headlines. That’s ideal for building a solid foundation without constant FOMO.

If you’ve ever felt overwhelmed by crypto video rabbit holes, this is the kind of structure that calms the noise and turns knowledge into muscle memory. Ready to turn what you watch into safe first steps—without risking more than a coffee?

How to get the most from 99Bitcoins (fast-track learning)

If you’ve ever watched a crypto video, nodded along, and then froze when it was time to actually move a coin, this is your shortcut. The 99Bitcoins YouTube channel is built for real action—learning that sticks because you pair it with tiny, safe steps.

“Slow is smooth. Smooth is fast.”

That’s my entire approach here. Move slow on purpose, and you’ll pick up speed without making expensive mistakes.

Start here: the basics

Open the channel’s homepage, hit the Playlists tab, and queue up the Bitcoin basics and “Whiteboard Tuesday” series. Aim for one sitting (30–45 minutes) where you learn just enough to take your first micro‑step.

- Watch order (fast):

- What Bitcoin is (not hype—use cases, why it matters)

- Wallets 101 (addresses vs. wallets, private keys, seed phrases)

- Fees and confirmations (why transactions wait and what “1 conf” means)

- Outcome to look for: you can explain to a friend:

- Why a seed phrase is the master key to your funds

- The difference between a wallet and an exchange account

- What a confirmation is and why fees vary

- Non‑negotiable rule: never store your seed phrase digitally and never share it. No screenshots. No cloud. Paper or steel, offline.

Build your path: from watching to doing

People remember what they use. Research on the “testing effect” shows that practice and recall beat passive watching for long-term learning (Cepeda et al., 2006; see also the testing effect). So watch one topic, then do one tiny action.

- Session 1 (20–30 min):

- Watch a wallet setup tutorial.

- Install a reputable non-custodial mobile wallet from the official app store (example apps people often use: BlueWallet, Muun—your choice, your research).

- Write your 12/24-word seed by hand. Store it offline. Set a strong passcode.

- Session 2 (20–30 min):

- Watch a security tips video.

- Back up the wallet (follow the app’s backup prompts). Practice a view-only restore on another device if supported.

- Enable 2FA (authenticator app, not SMS) on your email and any exchange account you use.

- Session 3 (20–30 min):

- Watch an exchange basics/how-to-buy video.

- Make a tiny buy (think coffee money). Withdraw to your wallet. Track confirmations.

- Verify in a block explorer like mempool.space by pasting your receive address or TXID.

By splitting into short sessions, you gain confidence without overwhelm. The spacing effect—studying a little over time—improves retention versus cramming (meta-analysis).

Use YouTube features to learn smarter

- Chapters/timestamps: jump right to “seed phrase,” “fees,” or “security” sections.

- Playback speed: 1.25x is perfect for most explainers; slow to 0.75x for step-by-steps.

- Captions + Transcript: click the three dots > “Show transcript,” search terms like “UTXO” or “multisig.”

- Keyboard shortcuts: J (rewind 10s), K (pause), L (forward 10s). See the full list here: YouTube shortcuts.

- Your own playlist: create a “Crypto 101” playlist and save only the videos you’ll rewatch when sending, backing up, or withdrawing.

Pair videos with hands-on practice

- Testnet first: If your wallet supports it (desktop options like Electrum or Sparrow do), switch to Bitcoin testnet and grab free test coins from a faucet (e.g., coinfaucet.eu). Practice sending, restoring, and setting fees. Testnet coins are worthless—that’s the point.

- Micro-transactions on mainnet: When you’re ready, send the smallest amount your wallet allows to yourself. Observe the fee, the mempool, and the first confirmation.

- Active recall: After each video, write three bullet points from memory. If you can’t explain “why confirmations matter,” rewatch just that chapter. This one-minute habit compounds results.

- Keep a “no-mistakes” log: a simple notes doc with:

- Steps that worked (e.g., “verify address on screen before sending”)

- Things to avoid (“never copy seed into any app”)

- Questions to research next session (“what is RBF?”)

Avoid common traps

- Seed hygiene: never type your seed into a website or share it with support staff. No screenshots. No email. Ever.

- Impersonators: only click links in the video description on the official channel. Check the URL carefully before any download or signup.

- 2FA the right way: use an authenticator app, not SMS. Store backup codes offline.

- Sponsor sanity check: sponsored segments are labeled; treat them as starting points, not endorsements. Compare fees, reviews, and policies before trying any product.

Copy‑paste checklists (use these every time)

Wallet setup checklist

- Install from official app store/developer link

- Create wallet; write seed on paper/steel, offline

- Set strong passcode; enable biometrics if available

- Backup verification completed

- Test receive with a tiny amount

Tiny buy and withdraw checklist

- Buy a very small amount on a reputable, compliant exchange in your country

- Enable 2FA (authenticator app) on the exchange before withdrawal

- Copy your wallet’s receive address; verify the first and last 6 characters

- Send small; confirm in a block explorer

- Record what worked and any issues in your notes

Weekly learning loop (30 minutes total)

- Watch: one 99Bitcoins explainer (10–15 min)

- Do: one micro‑action (send, backup, restore, fee tweak) (10 min)

- Recall: write 3 bullets from memory (2 min)

- Plan: one question for next week (3 min)

You’ll notice something strange after two or three weeks: the fear fades. You won’t just “know about Bitcoin”—you’ll know how to use it, safely and calmly. And once you’ve got a rhythm, the obvious next question is: who’s actually behind the content I’m trusting, and how transparent are they about it? Let’s answer that next.

Credibility check: team, reputation, and transparency

Who’s behind 99Bitcoins

99Bitcoins is a long-running educational project founded by Ofir Beigel, and it shows. The brand spans a plain-English website and the YouTube channel, built to explain Bitcoin concepts without jargon or hype. If you’ve seen the recurring series “Bitcoin Whiteboard Tuesday”, that’s them — short, focused explainers that hold up years later.

One of the strongest proof points that they care about education over noise is their famous Bitcoin Obituaries page. It archives public claims that “Bitcoin is dead,” going back many years, and timestamps each one. That kind of transparent, methodical record-keeping is unusual in crypto media and speaks to a mindset that values consistency and source-checking over hot takes.

Quick sanity checks I like to run (and 99Bitcoins clears them):

- Clear founder identity and history on the site’s About page

- Consistent brand voice across site and channel

- Evergreen beginner content updated over time, not just trend-chasing

- Visible disclaimers and labeled promotions

“Clarity beats hype. If a channel makes you feel smarter after 5 minutes, keep it. If it makes you anxious, mute it.”

What others say

Public sources generally describe 99Bitcoins as a reputable, beginner-friendly resource for learning Bitcoin and crypto basics. You’ll often see their explainers and the Bitcoin Obituaries tally referenced when journalists or educators talk about crypto narratives and how often Bitcoin has been written off. That kind of recurring citation doesn’t make them infallible, but it does indicate standing in the community as a reliable starting point for newcomers.

I also look at simple signals: steady upload history, coherent playlists for fundamentals, and comment sections that focus on questions and learning rather than tribal fights. 99Bitcoins checks those boxes.

How they make money

Transparency around monetization matters, because it tells you where incentives might nudge recommendations. With 99Bitcoins, monetization appears straightforward and is typically labeled:

- YouTube ads — standard display and pre-roll ads on videos

- Sponsorship segments — usually called out verbally and in descriptions (look for timestamps like “Sponsored”)

- Affiliate links — common on “how to buy” or wallet/exchange guides; these are industry-standard and should be disclosed

- Courses/tools — they’ve offered structured learning options alongside the free content

None of this is unusual. What matters is disclosure. In the U.S., the FTC Endorsement Guides require clear sponsorship disclosures, and 99Bitcoins typically labels them. My rule: treat any mention as a research starting point, not an instruction. Cross-check across at least two independent sources, especially before choosing a wallet or exchange.

Limitations to keep in mind

As solid as the channel is, it’s important to set expectations:

- Not for advanced traders — you won’t find deep TA, on-chain modeling, or complex derivatives strategies

- Selective on altcoins — the focus is Bitcoin and core crypto literacy, not every new token

- Conservative scope — fewer “breaking news” takes; more evergreen education

- Sponsored content exists — labeled, but you should still compare options before adopting any product

In short: think of 99Bitcoins as a trustworthy foundation for understanding, not a one-stop shop for every niche or pro-level tactic.

Quick question before you move on: if you’ve seen people asking how to “buy 99Bitcoins,” do you know why that’s a red flag and how to spot brand impersonations? I’ll answer that in the next section — and clear up a few other popular questions you’re probably thinking about.

FAQ: quick answers people actually search for

What is 99Bitcoins?

99Bitcoins is an educational brand and YouTube channel that explains Bitcoin and crypto in plain English. It creates explainers, tutorials, and safety tips. It is not a cryptocurrency, token, or coin. If you’re seeing a “99BTC” or “99Bitcoins” token on a DEX, that’s not the official brand—treat it as unrelated unless proven otherwise.

Is 99Bitcoins reputable?

Yes. It’s widely recognized for beginner-friendly education and straight talk. The content is steady, sources are typically referenced back to their website, and product mentions are labeled when sponsored.

For context, brand impersonation and fake endorsements are common in crypto. Industry research (for example, annual crime reports from firms like Chainalysis) keeps showing that scams often piggyback on well-known names. So even with reputable educators, it’s smart to:

- Follow links from official profiles only.

- Check the channel URL: https://www.youtube.com/@99Bitcoins

- Avoid Telegram/Discord DMs claiming “support” or “partnerships.”

Quick rule: if someone messages you first, asks for money, or pushes a “limited-time” token with a familiar brand name—walk away.

What is 99Bitcoins’ Bitcoin 2025 price prediction?

On their site, they outline scenario-based ranges rather than a single “number.” One commonly cited range puts an “average” target around $95,000–$125,000, with clear caveats on volatility, macro risk, and black swan events. The framing is educational—think “what-if” math, not a promise.

Two fast tips to use any projection wisely:

- Treat it like a weather forecast: useful for planning, not a guarantee. Academic work on expert predictions shows even pros struggle with complex markets.

- Stress test: ask “what if I’m wrong?” and plan for risk before acting on any number from any source.

How to buy 99Bitcoins?

You don’t. There is no “99Bitcoins” coin to buy. If you see a “99BTC” or “99Bitcoins” token, assume it’s unrelated unless the official channel and website explicitly say otherwise.

If you’re still curious about a token using that name, run this checklist first:

- Official confirmation: Is it announced on the verified YouTube channel and the official site, consistently?

- Contract transparency: Is the contract open-source and verified on Etherscan/BSCScan? Any mint or blacklist functions?

- Team and history: Real people with a track record? Or anonymous devs and zero accountability?

- Liquidity risks: Is liquidity locked with a reputable locker? Any tax mechanics that trap buyers?

- Audits: Independent audits from recognized firms? Screenshots and PDFs can be faked—verify on the auditor’s site.

- Community signals: Genuine discussion vs. botted hype and scripted comments.

Red flag sample: “Official 99Bitcoins token live now! 0% tax! Team KYC! Listed on major CEX next week!” This mashup of claims shows up in countless rug pulls. If it sounds like a rocket ship, it usually lands in zero liquidity.

Where else to follow 99Bitcoins?

Start with the verified YouTube channel: 99Bitcoins on YouTube. Use the companion website for articles, tools, and longer reads.

Want a straight answer on whether it’s actually worth your time to subscribe—and how to fit it into a smart learning stack without wasting hours? That’s up next.

My verdict: is 99Bitcoins worth your time?

Short answer: yes—if you want straight answers and safer habits without wading through hype. The channel’s strength is turning confusing crypto topics into clear, repeatable steps you can actually use.

Who will love this channel

- Beginners and cautious learners who want to understand wallets, keys, fees, and basic security without technical walls. The “Bitcoin Whiteboard Tuesday” format is built for clarity and recall.

- Busy people who prefer 8–12 minute explainers that stay on one topic and get to the point.

- Anyone burned by clickbait who wants practical guidance, not promises. Their scam/“how not to get rekt” content is a useful filter.

Why this style works: researchers like Richard Mayer have shown that short, focused visuals with clear narration beat flashy, overloaded lessons for retention. 99Bitcoins sticks to that playbook—clean visuals, plain language, and tight structure.

Who might outgrow it

- Advanced traders chasing order flow, perp funding data, or niche execution strategies. You’ll need specialist sources and platforms.

- On‑chain analysts who want UTXO cohort breakdowns, miner behavior metrics, or custom dashboards. Think dedicated analytics suites and research reports.

- Developers looking for protocol-level discussions, BIPs, and implementation details. Pair with technical documentation and engineering newsletters.

How it fits into your learning stack

Here’s a simple stack that keeps you safe, focused, and progressing:

- Foundation: Use 99Bitcoins for core concepts—wallets, seed phrases, fees, confirmations, and common mistakes.

- Practice: After watching a wallet tutorial, set up a wallet and send a tiny test transaction to yourself. Cognitive science calls this “retrieval + application”—it cements knowledge far better than passive watching.

- Security: Move critical funds to a reputable hardware wallet once you’re comfortable. Enable 2FA (authenticator app, not SMS), use a password manager, write down (don’t screenshot) your seed phrase, and do a recovery rehearsal before storing real value.

- News filter: Use a news aggregator or a light RSS feed so you stay informed without getting pulled into hype cycles. Set a fixed time window each week and ignore the rest.

- Network context: Check fee dashboards like mempool.space before sending. It prevents overpaying and helps you understand confirmations in practice.

- Scam radar: Treat anything named like “99Bitcoins token” as suspicious. Verify domains, follow official links only, and remember that the FTC has repeatedly warned about crypto scams using social media comments and fake live streams. When it smells off, walk away.

“Learn slow, fund slow. Security first, forever.”

Final word

Bottom line: 99Bitcoins is one of the safest bets on YouTube for building real Bitcoin confidence without the noise. Subscribe if you want plain-English education and step-by-step basics done right. If you’re already deep into quant trading, on‑chain modeling, or protocol development, keep it as your friendly refresher and add more specialized sources on top.

Use the channel to nail the fundamentals, stay skeptical of anything claiming to be a “99Bitcoins coin,” and keep practicing with small amounts until every step feels second nature.

CryptoLinks.com does not endorse, promote, or associate with youtube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.