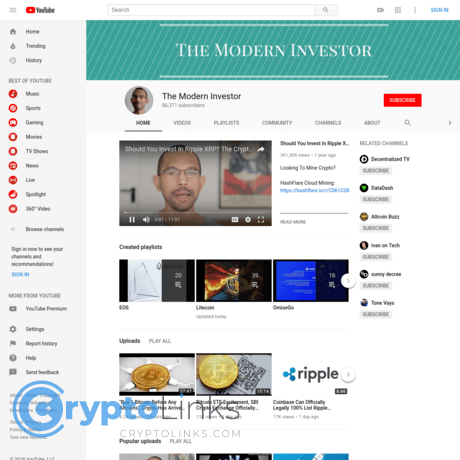

The Modern Investor Review

The Modern Investor

www.youtube.com

The Modern Investor YouTube Review Guide: Everything You Need to Know (+ FAQ)

Wondering if The Modern Investor is worth adding to your crypto routine—or just another hype channel with loud thumbnails and thin substance?

I watched, tracked, and cross-checked so you don’t have to guess. If you want clear answers about content quality, credibility, cadence, and how to use this channel without wasting time (or getting nudged into FOMO), you’re in the right place. This review will live on cryptolinks.com, written the same way I always write—straightforward, no fluff.

The problem: crypto YouTube can be a time sink

Crypto YouTube is noisy: clicky thumbnails, repeating headlines, coin bias, and “urgent” predictions that don’t age well. You can burn an hour listening to ETF whisper stories, “institutions are buying,” or “XRP to $X” takes and still feel unsure what’s real, what’s opinion, and what deserves attention.

Why this matters: Research from Pew shows YouTube is a major news source for many people. That convenience comes with a catch—trust is fragile, and sensational content travels far. A well-known MIT study also found false news spreads faster than true news on social platforms. Translation: verify before you act.

Here’s the plan

I’ll break down The Modern Investor in plain language: what the channel does best, where it falls short, how reliable it is, and how to use it as a fast news scanner—without turning it into your only source.

What you’ll learn here

- A quick snapshot of the channel and what it focuses on

- Credibility checks you can run in under a minute

- Strengths and weaknesses that matter for real-world use

- A simple workflow to get value without drowning in videos

- A crisp verdict so you can subscribe with confidence—or move on

My quick verdict up front

Good for: daily crypto news roundups and adoption headlines you can listen to while doing other things.

Not great for: deep technicals, rigorous on-chain analysis, or nuanced token economics.

How to treat it: like a news feed—handy for headlines, not financial advice.

How I tested

- Watched a batch of recent uploads at different times of day

- Noted sources shown on screen, then clicked through to originals

- Cross-checked headlines against primary links (press releases, regulator pages, company blogs)

- Tracked recurring topics: BTC, ETH, XRP, adoption, regulation, ETFs, macro

- Compared tone versus thumbnails to see if the content matched the packaging

Typical session example: a 20–30 minute video cycling through 6–10 headlines (think BTC price catalysts, ETF flows chatter, a regulatory update, and an “adoption” story—banks, payment networks, or a country piloting something). The voiceover is calm, the screen shows articles, and you can spot links to the original sources—useful if you’re the “trust but verify” type.

So, is this channel really a smart fit for your daily scan—or just familiar noise wrapped in new thumbnails? In the next part, I’ll spell out exactly what the channel is and who gets the most value from it. Ready to see if it matches your style?

What The Modern Investor channel actually is (and who it’s for)

Think of The Modern Investor like crypto news radio. It’s voiceover plus on-screen headlines, posted daily or close to it, so you can let it run while you’re working, commuting, or charting. No flashy studio shots—just a steady stream of stories and commentary pulled from fresh articles and social posts.

“Attention is the scarcest resource in crypto; everything else is copy-paste.”

Channel at a glance

- Focus: Bitcoin first, then majors like ETH and XRP, plus regulation, ETFs, adoption, and big macro headlines. Expect topics like ETF filings and flows, court updates, institutional partnerships, and policy moves.

- Cadence: Very frequent uploads. If you want a fast “what’s moving today” hit, this fits the bill.

- Format & style: Calm voiceover reading key parts of articles with added commentary. Thumbnails can be punchy, but the spoken tone is typically measured.

- Typical episode flow: Start with a macro or Bitcoin headline (think rate talk or ETF flows), jump into majors (ETH staking chatter, XRP case developments), then adoption or regulatory snippets (corporate integrations, government pilots, exchange updates).

- Watch experience: Usually commute-friendly. Easy to listen in the background and pause when something touches your portfolio.

On any given day, you might hear about a spot BTC ETF headline, an XRP-related court filing, an ETH roadmap tidbit from a dev call, and a country testing a payments pilot—useful, fast, and broad enough to keep your antenna up without drowning you in charts.

Who runs it?

The host keeps things pseudonymous. In crypto, that’s not unusual—ideas and sources matter more than a face. You’ll be evaluating the curation and the logic. When a claim sounds important, click through to the original article and check the primary document if it exists (press release, regulator PDF, company blog). Here’s the channel hub if you want a feel for the flow: The Modern Investor on YouTube.

Who will get the most value

- Busy listeners who like news in the background. Spoken-word formats are easier to pair with other tasks than text-heavy feeds—something multiple media studies have noted. If that’s you, this channel slots in nicely. For context, see NPR/Edison Research’s take on the rise of spoken-word listening: Spoken Word Audio Report.

- Crypto watchers who want a daily pulse before deeper research. You’ll catch the big headlines fast—ETF updates, policy moves, institutional adoption—then decide what deserves your time.

- Investors tracking majors like BTC, ETH, and XRP. These get frequent airtime, alongside regulation and macro angles that can shape sentiment.

- Newer entrants who need context without battling TA jargon. It’s news-first, commentary second—handy for building a mental map of what matters.

If you’ve ever wished crypto news felt more like a quick morning briefing than a maze of tabs, this format will feel familiar. The real question is: how much should you trust it at face value? Up next, I’ll show you the simple credibility checks I use—so you can listen fast and decide even faster.

Is The Modern Investor legit? Credibility and trust checks

I treat this channel like a live crypto news scanner: useful, long-running, and usually grounded in visible sources. Still, I never take a headline at face value—especially in a market where speed and emotion can hijack your decisions.

"Trust, but verify. If it matters to your money, open the source."

What I look for

- Are sources shown? Yes, most videos show the article on-screen and read it out. That’s your cue to click through and confirm context.

- Is the tone sensational? Thumbnails can be punchy (it’s YouTube), but the voiceover is usually calmer and anchored to headlines.

- Is it framed as advice? It’s commentary and curation. I don’t treat any YouTuber as a signal to buy or sell.

Why this matters: research shows catchy headlines stick even when details change later. That “continued influence effect” is real—our brains remember the claim more than the correction. So I keep a quick note of what’s reported vs what’s opinion to avoid acting on a feeling.

Green flags

- Consistent output: frequent uploads make it a reliable “pulse” for what’s trending.

- Sources visible: articles are on screen; you can click the originals and check timestamps.

- Broad adoption coverage: ETFs, regulation, institutions, and macro headlines—not just coin pumps.

- Tone vs thumbnails: titles pull attention, but the commentary often re-centers on the actual article text.

Red flags to keep in mind

- Occasional hype-y framing: all crypto YouTube battles the algorithm. Headlines may feel urgent even when the underlying story is developing.

- Recurring coin bias risk: certain assets (like XRP) get a lot of airtime. Coverage ≠ confirmation. Treat it as interest, not evidence.

- Second-hand sources: sometimes the source shown is a news blog that’s quoting another primary source. You want the first link in the chain.

Real-world check: how I verify sample stories

- ETF flows and approvals: If a video mentions big inflows or “record volume,” I verify with issuer pages and neutral dashboards:

- iShares Bitcoin Trust (IBIT) page for official notices

- Farside Investors Bitcoin ETF flow tracker for day-by-day flows

- Nasdaq or SEC EDGAR for filings and listings

- Ripple/SEC updates: When legal headlines pop, I confirm with the court docket instead of relying on summaries:

- CourtListener Ripple case entries (free RECAP mirrors)

- Reputable law firm blogs for context when filings are technical

- Adoption announcements: Claims like “X integrates crypto payments” should link back to an official release:

- PayPal newsroom for PYUSD or crypto feature updates

- Company blogs, regulator portals, or ETF issuer press rooms for direct confirmation

- On-chain or market stats: If numbers are quoted (addresses, liquidity, funding), I sanity-check with neutral dashboards:

- CoinGlass for funding rates, liquidations, ETF flow visuals

- mempool.space for Bitcoin fee pressure and network activity

How to protect yourself (simple system)

- Click the original link: move one layer deeper until you hit the primary source (issuer, court, regulator, company).

- Label claims in your notes: write “reporting” for confirmed facts and “opinion” for commentary. It keeps FOMO in check.

- Look for weasel words: “could,” “might,” “set to,” “expected” = speculation. No action until you see “announced,” “filed,” “approved,” “launched.”

- Timestamp and outcome: jot the date of any bold prediction and circle back in a week. Patterns will jump out—consistency beats charisma.

- Cross-source anything price-moving: major stories should echo across at least two independent, reputable outlets (and ideally the primary source).

One more nudge from research: a well-known 2018 MIT study found false news spreads faster than true news on social platforms—emotion travels quicker than facts. That’s why I slow down for 60 seconds when I hear a big claim. If I can’t confirm it quickly, it goes on the “watch” list, not the “act” list.

So, is it trustworthy enough to add to your daily routine? Yes—as a curated feed you verify. The bigger question is what you actually get for your time. How much signal per minute is realistic, and where does it fall short compared to data-first tools? Let’s unpack that next.

Value vs time: what you actually get from watching

I judge any crypto YouTube channel by a simple trade: minutes spent vs. actual signal gained. With The Modern Investor, the payoff is a fast scan of what’s moving right now. Think headline triage. In a typical 15–25 minute upload, I can catch the big currents—Bitcoin ETF flows, an XRP legal wrinkle, an ETH roadmap tidbit, a central bank CBDC pilot, and a couple of adoption headlines (payments, banks, or institutions).

“Headlines should start your research, not finish it.”

That awareness is valuable. It keeps you from waking up late to market mood shifts. Just don’t mistake the speed and breadth for depth.

Strengths

- Speed: It’s a quick way to know what the crypto crowd is buzzing about today. Recent examples you’ll often hear first or fast: ETF inflow/outflow swings, big on-chain moves during CPI/Jobs prints, or an exchange listing rumor that sets Twitter on fire. When Bitcoin ETFs post eye-catching net inflows or a mainstream brand tests stablecoin payments, it tends to show up here the same day.

- Breadth: Coverage spans BTC, majors like ETH and XRP, regulation, ETFs, and institutional steps toward adoption. If a regulator publishes a new note, a bank pilots tokenized deposits, or a country updates its licensing framework, you’ll usually get it in the rotation.

- Convenience: It’s a listen-in-the-background format. You can absorb the gist while making coffee or scanning charts. Research on sped-up lectures generally shows comprehension holds up around 1.25–1.5x playback—use that to compress time without losing much clarity.

Weaknesses

- Repetition: Adoption headlines recur. “Another bank pilots blockchain,” “Another city tests crypto payments,” “Another ETF milestone.” Useful for pulse, but the marginal value of the fifth similar story in a week drops fast.

- Limited depth: You’ll hear what happened, not the complete why. Expect less on on-chain metrics, token supply mechanics, protocol governance, or code-level changes. If you need to model flows, user cohorts, or emissions, you’ll still need your own tools.

- Bias risk: Some coins get more airtime than others. That can tilt your perception of what’s important. A coin showing up more often doesn’t mean its fundamentals improved—just that it made more headlines.

How to watch smarter

- Run at 1.25–1.5x. You’ll save minutes without losing the thread. If a segment sounds crucial for your holdings, drop back to normal speed.

- Use the “Stop-and-Validate” rule. If a claim could affect your portfolio—regulator action, exchange listing, ETF flow, protocol change—pause and open the source. Skim the primary link (press release, regulator page, issuer blog). It takes 60–90 seconds and protects you from “headline drift.”

- Turn awareness into action. When you hear “BTC ETF inflows surged,” check a flow tracker you trust (e.g., an issuer’s dashboard or a reputable analytics site). When it’s “major partner integrates stablecoins,” read the partner’s announcement and verify the timeline and scope.

- Skip the déjà vu. If you notice a theme repeating (e.g., multiple similar adoption blurbs), cherry-pick only the ones with new variables—new jurisdictions, new licensing, real user counts, or a concrete go-live date.

- Protect focus. Background listening is great for awareness, but multitasking during critical parts can nuke retention. When something tagged “urgent” pops up, give it a clean 90 seconds of attention, then resume.

- Set a “one-link minimum.” Every watch should yield at least one saved primary link or ticker to review later. If a video yields zero, you probably got enough from the title and can skip similar ones in the future.

- Mind the opportunity cost. Ask, “What will I do differently after this episode?” If the answer is “nothing,” fast-forward or move on. Your time is a position too.

Bottom line for this section: use the channel as a fast radar, then graduate promising headlines into real research. Want a dead-simple 10-minute routine that turns a 20-minute video into concrete decisions without FOMO? That’s exactly what I’m breaking down next—ready to make your watch time pay for itself?

A simple workflow to use this channel in your crypto research

I use this like a radar sweep: quick pass, capture what matters, verify, then act. Keep it light, fast, and evidence-first. As the old line goes, “trust, but verify.”

“What gets measured gets managed.” — Peter Drucker

Before you watch

- Set your focus for today. Write 1–3 priorities:

- “Check BTC spot ETF net flows and any SEC headlines.”

- “Track ETH fee trends and L2 updates.”

- “Any regulatory moves impacting exchanges I use?”

- Open your capture tools so you don’t “mean to save it” and forget:

- Notes: Notion, Obsidian, or even Apple Notes

- Read-later: Pocket or Readwise Reader

- Watchlist/alerts: TradingView with price levels pre-set

- Create a 10-second triage key for what you hear:

- Green = official announcements, filings, regulator posts

- Yellow = reputable media report (needs a second source)

- Red = rumor, anonymous “insider,” or recycled hype

- Prime your brain for accuracy. A 2019 study by Pennycook & Rand showed a tiny “think accuracy” nudge improves truth-checking of headlines. Literally write a sticky note: “Is this true? Where’s the source?”

While you watch

- Log claims, not chatter. Create a quick template and fill it as you listen:

- Headline: “BlackRock BTC ETF saw $500M inflow yesterday”

- Source on screen: link or outlet

- Impact tag: Price / Adoption / Regulation / Tech

- Action: Verify on SoSoValue or Farside

- Pause at any “market-moving” statement and grab the primary link:

- ETF flows: Farside, SoSoValue, CoinShares weekly flows

- Regulation/SEC: SEC press releases, CourtListener

- Company news: official blogs (e.g., Coinbase Blog, PayPal Newsroom)

- Macro: US CPI (BLS), FOMC rates (FRED)

- Tag the claim’s confidence in your note:

- Strong = SEC/official filing/link shown

- Medium = reputable outlet cites sources

- Weak = no link, speculative language, recycled rumor

- Keep your emotion in check. The illusory truth effect (Hasher et al., 1977) shows repetition makes things feel true. If a headline keeps popping up, don’t let familiarity replace evidence.

After you watch

- Verify each “Green/Medium” claim with a primary source before you do anything:

- Example: “XRP legal milestone” → check the actual docket on CourtListener or the judge’s order PDF, not just an article summary.

- Example: “ETH supply deflationary today” → confirm with on-chain dashboards: Ultrasound.money, Glassnode, or CryptoQuant.

- Example: “Major token unlock” → check Token Unlocks for date, amount, and recipient wallets.

- Cross-check sentiment with data:

- Price move or just noise? Look at volume, open interest, and funding on Coinalyze or exchange dashboards.

- Adoption headline? See if wallets/tx counts actually changed via Dune dashboards or project explorers.

- Update your watchlist and alerts:

- If ETF flows are surging, set a price alert near key levels (e.g., prior weekly high) and a news alert for tomorrow’s flows.

- If regulation risk appears, reduce position size or add a conditional alert at your invalidation level.

- Use a 24-hour rule for big claims. If something sounds “portfolio-changing,” wait for at least two independent confirmations. Research on note-taking (Mueller & Oppenheimer, 2014) shows active processing improves understanding—writing a short summary of the claim often exposes gaps or hype.

A 5-minute checklist you can actually stick to

- Minute 1: Skim today’s video at 1.5x, capture only claims with possible impact.

- Minute 2–3: Open primary links; mark Green/Medium/Weak.

- Minute 4: Check one data source to confirm (flows, on-chain, or official site).

- Minute 5: Set or adjust alerts; write one sentence: “If X confirms, I’ll do Y.”

Real-world sample workflow

- What you hear: “Spot BTC ETFs posted strong net inflows; institutions keep buying.”

- Your steps:

- Open Farside and SoSoValue; confirm the exact dollar figure and which funds led.

- Check CoinShares weekly flows next business day for broader context.

- If flows align with price/volume expansion on TradingView, set alerts above the prior daily high; note invalidation under prior daily low.

- Write: “If flows remain net positive 3 days in a row, consider scaling in 25% of planned position.”

Little guardrails that save portfolios

- No trade on a single source. Two independent confirmations or it’s a pass.

- Separate facts from forecasts. Label “prediction” vs “reporting” in your notes.

- Use position sizing, not conviction, to manage risk. Confidence can be wrong; math won’t lie.

- Bookmark official hubs you’ll actually check:

- SEC press releases

- Federal Reserve policy

- Ethereum roadmap

- IMF news (macro)

Your time is finite and your capital is real. Headlines are the spark; your verification is the fireproofing. Want quick, straight answers to the usual questions—how often the uploads land, how reliable this format really is, and whether those thumbnails should worry you? I’ve got those up next—curious which one matters most to your strategy?

The Modern Investor FAQ (straight answers)

I get these questions a lot, so here are my no-nonsense answers based on regular viewing, cross-checking sources, and long experience sorting signal from noise in crypto media.

Is The Modern Investor reliable?

Reliable for what it is: a consistent news-and-commentary feed. You’ll see headlines on screen and hear quick takes. I treat it as a curation tool to spot stories fast, then I click into the original sources to confirm details before I make any move.

Real-world example: if a video mentions an ETF update or a regulator action, I’ll open the filing or announcement on SEC.gov or the relevant regulator site to verify tickers, effective dates, or enforcement language. This keeps you from trading off a summary when the fine print matters.

Who is behind the channel?

The host is pseudonymous. That’s normal in crypto. I judge on the strength of sources shown on screen and whether claims line up with primary documents. You won’t get a resume; you will get a steady stream of links and headlines—use them as breadcrumbs.

How often are videos posted?

Typically daily or close to it. On busy news weeks (think ETF approvals, big policy shifts, or major exchange updates), you may see more than one upload. This cadence makes it useful as a morning or commute-time scan.

Does he cover only Bitcoin?

No. Bitcoin leads, but you’ll hear about ETH, XRP, regulation, ETFs, adoption, and broader macro. Example: when there’s a central bank pilot or a large institution integrating crypto rails, it usually gets airtime alongside BTC headlines.

Are the thumbnails clickbait?

Sometimes eye-catching, yes. The spoken content is usually calmer and anchored to articles on-screen. That mismatch is common on YouTube—curiosity gaps get clicks. There’s even research on how “tease” headlines drive attention without guaranteeing substance (see Potthast et al., 2016: Clickbait analysis).

My move: ignore the thumbnail energy, play at 1.25–1.5x, and open the linked sources for anything that could impact your portfolio.

Is it financial advice?

No—commentary and curation only. Crypto is volatile and heavily sentiment-driven. Academic work has tied attention spikes to price swings (e.g., Kristoufek, 2013: Google Trends/Wikipedia and Bitcoin; Garcia et al., 2014: digital traces of bubbles). That’s another reason to verify before acting.

What’s the best way to use this channel?

As a headline finder.

- Watch or listen in the background.

- When something touches your holdings or watchlist, pause and open the original article or announcement.

- Confirm with primary docs (company press rooms, regulator pages, project blogs or GitHub) and a data lens (on-chain dashboards or ETF flow data) before you trade or allocate time.

Example: if you hear “X company announces a partnership,” check the company’s newsroom for the press release, note the effective date and scope, and then see if usage metrics or integrations show up in product docs—not just in headlines.

Any alternatives to complement it?

Yes—pair a news-curation channel with data-first and build-focused sources so you’re not flying on headlines alone.

- On-chain analytics for objective trends (supply dynamics, exchange flows, active addresses).

- Official regulator and issuer pages for filings and approvals (SEC, ESMA, FCA, exchange press rooms).

- Project-owned channels for dev updates, GitHub releases, and governance proposals.

- Long-form research (reports and newsletters) for context that a 15–25 minute video can’t cover.

If you want a single place to keep tabs on crypto news sources I rate, I keep my running picks updated on my crypto news hub.

Pro tip: Keep a simple note with three columns—Headline, Primary Source, Action. Most “news” won’t become “action,” and that’s okay. The clarity saves you from FOMO trades.

Still unsure whether this channel should be in your daily stack—or exactly how I’d slot it next to data tools and research so you don’t double work? I’m about to spell that out next with a clear yes/no and a simple action plan you can follow today.

My verdict and next steps

Use The Modern Investor as your daily crypto pulse, not your decision engine. It’s handy, quick, and broad enough to flag what’s moving. I treat each video like a morning headline scan: I listen at 1.25–1.5x, jot a few tickers, and click through to the original links for anything that could actually affect my positions. Think of it as a time-saver that points you to what deserves a closer look—then you confirm with primary sources.

Simple rule I live by: “Treat headlines as alerts, not answers.”

Subscribe if this sounds like you

- You want frequent updates and adoption headlines in one place.

- You prefer listening while you work or commute.

- You’re comfortable verifying anything important before acting.

Quick, real-world ways this helps:

- ETF flows chatter? Hear “inflows hit a weekly high”? Open a tracker like Farside’s Bitcoin ETF flow page before you touch a trade.

- Regulatory rumor? If the topic is U.S. filings or a deadline, check SEC EDGAR or the SEC’s press releases. For EU rules, skim ESMA’s MiCA hub on esma.europa.eu.

- XRP case whisper? Don’t trade the whisper—pull the docket on CourtListener to see what actually happened.

- Adoption headline? If a company “integrates crypto,” check the official newsroom (e.g., PayPal Newsroom) for wording and timelines.

- Market stress? Back up the vibe with liquidation and OI data on CoinGlass before you assume momentum.

Not for you if…

- You want deep technical analysis, on-chain modeling, or code-level breakdowns.

- You prefer tutorials and step-by-step guides over commentary.

- You need hard numbers, dashboards, and original research in every session.

What to pair it with

- Data and flows: ETF flows, OI/liquidations, Coinbase/Deribit research blogs.

- On-chain and dev: Free dashboards from exchanges, explorer stats (e.g., mempool.space), project GitHubs for release notes.

- Regulatory: SEC, ESMA, and official company press pages for confirmations.

- Independent analysis: Mix in long-form research (exchange or fund reports) to balance the headlines.

Why this approach works

- Speed without losing comprehension: Studies on accelerated playback show learners can keep understanding content at up to ~1.5x in many cases—handy for news scanning. Example: UCLA reported students maintained comprehension at increased speeds for short lectures (Applied Cognitive Psychology, 2021; UCLA Newsroom summary).

- Cross-checking cuts hype risk: Research on online news spread shows sensational or false items travel faster than true ones (Science, 2018, Vosoughi et al.). Using original sources and data tools counters that bias.

Next steps I recommend

- Subscribe if you want a reliable daily heads-up, then build a habit: listen fast, flag what matters, verify once, act later.

- Create a mini toolkit with 3–5 links you trust (ETF flows, on-chain explorer, regulator site, your favorite research blog) so verification takes 2 minutes, not 20.

- Keep a simple log of “claims vs. confirmations” to train your filter and avoid FOMO traps.

Bottom line

The Modern Investor is a solid news-curation channel for crypto watchers. Use it for fast awareness, pair it with your own verification and a few data-first resources, and you’ll get the signal without the noise. I’ll keep this review updated on cryptolinks.com—drop your questions or your experience with the channel and I’ll add them to the FAQ. Subscribe if it fits your style; skip if you need heavier analysis. Your time is the asset—use it wisely.

CryptoLinks.com does not endorse, promote, or associate with youtube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.