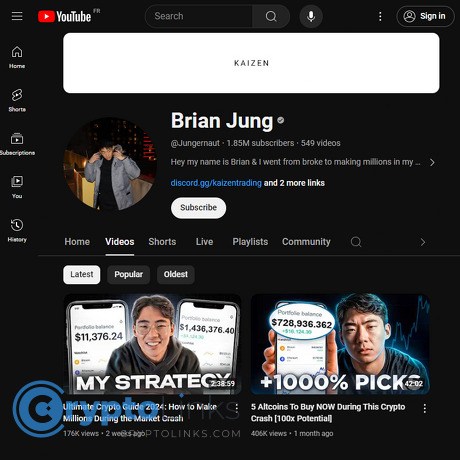

Brian Jung Review

Brian Jung

www.youtube.com

Brian Jung (Jungernaut) YouTube Review Guide: Everything You Need to Know + FAQ

Thinking about following Brian Jung for crypto, credit cards, and personal finance tips? Wondering if his YouTube channel is actually worth your time—and how to turn his videos into real results, not just background noise?

Why Finance YouTube Feels Risky (and How Not to Get Burned)

Let’s be honest: a lot of finance channels love big thumbnails and bigger promises. You get “10x altcoin” titles, cherry‑picked wins, and affiliate pushes that appear moments before a “sponsored” mention. It’s not always clear who’s credible, what’s an ad, and which videos are actually useful for your wallet—today and six months from now.

Context that matters: Pew Research has found a significant share of U.S. adults get news from YouTube—great for access, risky when creators skip nuance or bury conflicts of interest. See Pew’s look at news on YouTube for why platform incentives matter.

Crypto adds another layer. During hype cycles, misleading narratives spread fast. We’ve seen “can’t-lose” yields from platforms that later froze withdrawals, aggressive card churn tips that ignore fees and credit score impacts, and investment “strategies” that boil down to buying what’s trending. When sponsorships and affiliate links are involved, it’s on you to spot the incentive.

- Overhyped coins or sectors: Trend-chasing without risk frameworks or exit rules.

- Affiliate-first messaging: “Must-have” cards or platforms nudged by commission, not fit.

- Thin sources: Claims without links to filings, official docs, or reputable news.

- Time traps: 45 minutes later, you’re motivated—but with no clear next step.

None of this means YouTube can’t help you. It can—if you follow creators who are clear, practical, and transparent, and if you use a simple system to turn videos into smart actions.

The Plan: A Straight-Shot Guide That Saves You Time

Here’s my no-fluff guide to Brian Jung’s channel (@Jungernaut): what he does best, where to be cautious, how to use his content for smarter decisions, and the exact videos and playlists I’d start with. I’ll keep it practical, point to proof where it matters, and show you how to avoid common traps—sponsor bias, fear-of-missing-out buys, and card perks that don’t actually fit your life.

What You’ll Get

- Clear breakdown of his content types—crypto updates, credit card strategy, and money habits—so you can pick what fits you fast.

- Accuracy and trust checks: how he sources, what’s disclosed, and when you should double-check.

- Fit analysis: who gets the most value from his channel (and who won’t).

- Overwhelm-proof setup: a simple way to follow along without turning your watchlist into a second job.

- Fast FAQ: what he’s known for, how he earns, and YouTube basics if you’re new to learning money online.

Who This Is For

- Crypto‑curious beginners who want plain-English market context without living on X.

- Credit card enthusiasts who want perks and points without hidden gotchas.

- Practical investors who prefer realistic, step-by-step money moves over hype.

- Busy professionals who want useful, skimmable insights they can act on this week.

If that sounds like you, you’re in the right place. So who is Brian Jung, why do so many people listen to him, and how does that line up with your goals? Let’s answer that next.

Who Brian Jung Is and Why People Listen

Quick background and rise on YouTube

Brian Jung’s story is classic “learn it, build it, share it.” He started out as a student and young entrepreneur tinkering with online businesses, then pivoted to personal finance on YouTube—credit cards first, then broader money habits and crypto. Instead of hot takes, he leaned into step-by-step explainers and calm, practical advice. That tone resonated fast.

As credit cards got popular again and crypto took center stage, his channel grew past the million-subscriber mark with videos that felt like a conversation, not a lecture. You’ll notice he keeps things straightforward: screen shares, clear pros/cons, and simple frameworks you can steal immediately. During fast-moving headlines—think exchange blowups or ETF approval buzz—he became a “keep-me-grounded” tab for viewers who didn’t want to live on X/Twitter but still wanted credible, quick context.

“Simple beats complicated when your money is on the line.”

That’s the energy of his content: actionable, not academic—exactly what busy professionals and beginners tend to stick with.

What he’s famous for

He carved his lane with clean, real-world breakdowns that help people actually do something after watching. You’ll often see:

- Credit card strategies that make sense in real life: starter setups (like pairing a beginner-friendly travel card with a no-annual-fee cashback card), upgrade paths, and redemption examples that don’t require a PhD in award charts.

- Approachable crypto commentary: market sentiment, risk talk, and what to watch without pretending to predict the future. You’ll hear about catalysts (like regulation or ETF flows) and the practical “what this means if you’re on a budget” angle.

- Personal finance habits that stick: building an emergency fund, boosting credit scores, basic investing principles, and simple budgeting moves that complement any crypto curiosity.

He’s also known for the “show your work” style—walking through screens, calculators, and real examples. It’s not about being first to a headline; it’s about making the headline useful to a normal person with a day job.

How he makes his money (and why it matters)

Creators in this niche rarely rely on one income stream, and he’s no exception. Based on what he shares publicly and what’s typical for channels at his size, revenue likely includes:

- YouTube ads (AdSense): the standard share from video views.

- Sponsorships: segments from brands (fintech apps, brokerages, finance tools, sometimes crypto platforms). These are usually noted in the video or description.

- Affiliate links: especially with credit cards, banks, and exchanges. If you sign up through a link, he may earn a commission.

- Investments and business ventures: the typical “creator portfolio”—equities, crypto, and projects behind the scenes.

- Speaking or media appearances: occasional extras that come with a large audience.

Why you should care: incentives shape recommendations—on any channel. That doesn’t make a video “good” or “bad,” it just means you should filter it smartly. For example:

- Spot the label: look for “sponsored” tags in the video or description. The FTC expects clear, conspicuous disclosures.

- Check the link: affiliate URLs are common; treat them as a nudge to research, not a green light to apply or invest.

- Cross-check quickly: if a product is featured, confirm key terms on the official site; if a crypto claim is made, compare it to a reputable source (CoinDesk, The Block, or an official project doc).

There’s a bigger picture too. A lot of people now learn finance on YouTube—Pew Research has reported that a notable share of U.S. adults get news and information from the platform. That’s exactly why transparency matters, and why it pays to understand how creators earn. It helps you separate education from promotion in a few seconds.

If you’re wondering, “So what am I actually going to watch when I land on his channel?”—you’re going to like what’s next. Want the fastest way to find the videos that match your goals without getting lost?

Channel Breakdown: What You’ll Watch on @Jungernaut

If you want straight, usable information without living on X/Twitter all day, Brian’s channel (@Jungernaut) is organized around three pillars: crypto updates, credit card strategies, and grounded money habits. Here’s how that actually looks when you hit play.

Crypto content: news, market takes, and risk talk

This is where he keeps you current without turning you into a chart zombie. Expect short, context-rich updates that connect headlines to what they might mean for portfolios.

- Market recaps with context: CPI print, Fed meetings, ETF flow data, and how Bitcoin/ETH reacted in plain English. Example scenario: “Fed holds rates ➜ DXY softens ➜ BTC tests resistance” explained in under 10 minutes.

- Sector spotlights: clear summaries of themes like AI tokens, L2 scaling, stablecoins, or memecoins—what’s narrative vs. what’s durable.

- Regulation watch: coverage of SEC actions, ETF approvals, and big enforcement headlines, plus what retail should actually pay attention to.

- Sentiment reads: how fear/greed and news cycles can trap new investors into FOMO/PANIC loops—and how to slow down.

- Risk reminders baked in: frequent “don’t overextend” notes, especially around pumps and pre-news speculation.

He’s not doing deep on-chain sleuthing or exotic DeFi math, and that’s the point. It’s a daily-driver view that helps you stay oriented. If you’ve ever missed a macro headline and bought the top, these quick check-ins help you avoid “trading the tweet.”

“Volatility is the price of admission for meaningful returns—pay it consciously, not emotionally.”

Credit cards and points: practical and popular

Brian’s credit card videos are where many viewers first subscribe. He keeps it tactical and real—what’s worth it, what’s marketing fluff, and how to stack perks without creating debt traps.

- Card comparisons: Chase Sapphire vs. Amex Gold vs. Capital One Venture—annual fees, transfer partners, lounge access, and when each card shines.

- Points strategy (beginner to advanced): starter “one-card” builds, then moving to two- and three-card stacks for 3–5x categories and travel protections.

- Perk breakdowns that actually matter: trip delay/cancellation, primary rental coverage, cellphone protection—he explains the hidden value, not just shiny welcome bonuses.

- Seasonal plays: rotating 5% categories, limited-time transfer bonuses, or annual benefit refreshers so you don’t leave value on the table.

He regularly stresses paying balances in full. That’s critical. According to a 2023 Bankrate survey, roughly 47% of cardholders revolve a balance, which wipes out the value of points. His content pushes you toward smart rewards, not expensive rewards.

If you like to double-check point valuations while you watch, cross-verify with resources like TPG’s monthly valuations or NerdWallet’s points values to calibrate your own redemption goals.

Personal finance and wealth habits

These are the glue videos that make the crypto and card advice sustainable. He covers the basic operating system for money: budgeting, emergency funds, investing discipline, and simple rules that reduce stress.

- Budgeting without spreadsheets from hell: practical envelopes, percentage rules, and “pay-yourself-first” automation.

- Emergency funds: he nudges you toward a buffer so market dips or surprise bills don’t force bad decisions. The Fed’s SHED report shows many households still struggle with a $400 shock—this content helps change that.

- Behavior beats brilliance: set rules for buying, selling, and saving so you’re not trading your mood. Thaler & Benartzi’s “Save More Tomorrow” research backs the power of automation—Brian’s habits echo that.

- Beginner investing basics: dollar-cost averaging, long-term thinking, tax-aware accounts, and keeping it boring where it should be.

“Doing well with money has a little to do with how smart you are and a lot to do with how you behave.”

—Morgan Housel

Upload cadence, video style, and length

The schedule is steady enough to rely on: a consistent stream of weekly uploads, with bursts when the news cycle gets hot (ETF headlines, rate decisions, big hacks). Videos typically sit in the 8–15 minute window, with occasional deeper dives in the 15–25 minute range and some quick-hit Shorts for timely updates.

- Style: direct-to-camera delivery, screen shares of headlines/charts, crisp cuts, and clear takeaways at the end.

- Pacing: fast enough to keep you engaged but not rushed; no filler monologues just to stretch runtime.

- Why this works: research on online learning shows attention stays higher with shorter videos—see the edX/Harvard-MIT study by Guo, Kim, and Rubin (2014), which found engagement drops as videos get long; sub-10 minutes often wins for comprehension. Source: ACM paper.

Net result: it’s easy to stay current without feeling like you need a notebook and a pot of coffee for every upload.

Who this channel fits best

- Crypto-curious beginners who want the “what matters today” without heavy jargon.

- Busy professionals who need market context and card strategies that actually save money/time.

- Points and travel fans optimizing everyday spends for real-world perks.

- Cautious investors who like reminders about risk and staying power.

- Not the ideal fit if you want deep on-chain analytics, quant trading systems, or technical breakdowns of protocols line by line.

All of this sounds great—but how accurate is it, and where might sponsorships shape what you hear? Next, I’ll open the hood: sources, disclosures, wins, misses, and how to spot the difference between education and promotion before you act.

Accuracy, Trust, and Transparency

Before I let any YouTube channel influence my crypto or money decisions, I look at how they handle facts, risks, and promotions. With Brian Jung (Jungernaut), the signal is generally strong—clean explanations, timely coverage, and frequent reminders about risk—but you still need to keep your guard up and your process tight.

"Your job isn’t to trust creators; it’s to test them."

Research approach and sources

He typically references mainstream finance outlets and crypto news (think CNBC, WSJ, CoinDesk), plus market headlines and official announcements. On-screen article screenshots are common; links are often in the description. When a source isn’t linked, I copy the exact headline shown on-screen into Google—nine times out of ten, it pops right up.

What I check quickly when he mentions a big claim:

- Official docs: Company blogs, SEC filings, or regulator press releases for policy/regulatory topics.

- Primary data: Project docs, GitHub, Etherscan/Blockchair for token supply and contract addresses; ETF issuer pages for flows and fees.

- Reputable news: Cross-check with at least two outlets (e.g., CoinDesk and Bloomberg) to avoid rumor-chasing.

He’s strongest when breaking down practical credit card strategies and market-moving news. For deeply technical on-chain analysis or token engineering, I treat his take as a starting point and then look for specialist sources.

Track record: highlights and misses

No creator nails timing. The test is whether the process is fair and the risk framing is honest.

- Where he shines: Big macro and industry moments. When spot Bitcoin ETFs were approved in January 2024, his coverage focused on what it could mean for mainstream access and near-term volatility. That “buy the rumor, sell the news” whipsaw is exactly what played out around launch week—good context for beginners.

- Where to be cautious: Fast-moving altcoin narratives (AI, gaming, L2 seasons) shift in weeks, not months. Any creator’s “hot sector” video can age quickly if you treat it like a signal instead of context.

- How he handles uncertainty: He regularly states volatility and risk, and you’ll often hear a version of “this is not financial advice.” I look for that language whenever a video leans into speculative topics.

One reason to stay humble with timing: long-term data shows most active approaches underperform benchmarks. The SPIVA scorecards consistently find the majority of active managers lag their indexes over 5–15 years. In other words, use YouTube for education and perspective, not as a trade alert feed.

Source: S&P Dow Jones Indices (SPIVA)

Sponsorships, affiliates, and disclosures

Finance YouTube runs on AdSense, sponsorships, and affiliate links—especially with credit cards and platforms. Brian uses these too. You’ll usually see:

- Mid-roll ad reads: “This video is sponsored by …” around the first minute or near the middle.

- Description disclaimers: Affiliate/referral links and a note that he may earn commissions.

- Pinned comments: Sometimes the offer is repeated with terms or a reminder about bonuses.

How I separate education from promotion on any video:

- Frame check: Is the sponsor clearly separated from the main argument? If the thesis only “works” if you click the offer, I discount it.

- Incentive check: Credit card referrals and exchange sign-ups are high-commission. I compare the recommendation to unsponsored reviews or official terms to see if perks are cherry-picked.

- Link check: Are fees, lockups, and risks linked or summarised? If not, I look them up directly on the issuer or platform site before acting.

Regulators want these disclosures obvious. If you’re new to this, the FTC’s endorsement rules are a quick read, and the SEC’s investor alerts on celebrity/influencer promotions are worth bookmarking.

FTC Endorsement Guides • SEC Investor Alert on Endorsements

Risk reminders and realistic expectations

He frequently stresses volatility and “don’t risk what you can’t afford to lose.” Good. But here’s the reality check I keep in mind even when a video sounds convincing:

- Bitcoin drawdowns: Historically 70–85% in bear markets; if that’s tough to stomach, size positions smaller.

- Altcoins: 90%+ drawdowns are common; many never reclaim all-time highs even in later cycles.

- Stablecoin risk: Depegs happen. The 2022 Terra/UST collapse wiped out “yield” narratives in days—counterparty and design risk are real.

- Platform risk: If a yield/product is mentioned, I check who holds custody, how redemptions work, and where the yield comes from—before I put in a cent.

- Self-custody: If you’re moving beyond exchanges, understand hardware wallets, seed phrases, and recovery. Education first, transfers second.

Good creators remind you about risk. Great viewers build rules around it. “No FOMO buys,” “24-hour cooling-off period,” and “position sizes capped at X%” are simple guardrails that save real money.

Pros and cons snapshot

- Pros: Clear explanations, strong on credit card strategy, balanced tone during big news, consistent production, beginner-friendly risk reminders.

- Cons: Sponsor influence is a standing bias to watch for, technical/on-chain depth is limited, and timing any news-driven idea is tough—titles and thumbnails can feel spicier than the underlying thesis.

Want a quick system to turn his videos into repeatable results—what to watch first, how to fact-check in under 10 minutes, and how to move from notes to action without overwhelm? That’s exactly what I’m breaking down next—ready for the simple playbook?

How to Get Real Value From Brian Jung’s Channel

Start here: best playlists and video types

I want you to get traction fast—not just watch another video and forget it. Here’s a simple, high-impact path that works for both crypto-curious folks and credit card optimizers.

- Step 1: Two fresh market updates — Go to Brian’s Videos tab and grab the two most recent crypto or market update videos. Use chapters to jump to headlines that touch assets you actually own or plan to own. The goal: understand what changed this week and what didn’t.

- Step 2: One card strategy video that matches your spend — Open the Playlists page and look for beginner-friendly credit card strategy guides (think: “best starter cards,” “two-card combo,” “Chase/Amex stacks”). Pick the one that matches your monthly spend and travel goals—don’t chase perks you won’t use.

- Step 3: One personal finance fundamentals video — Choose a budgeting or investing basics video to anchor the “boring but essential” part of your plan. You’ll accelerate the benefits from the first two steps by pairing them with a clean money system.

Pro tip: Use the channel’s search (magnifying glass on the channel page) to find exactly what you need: “BTC ETF,” “staking,” “Chase points,” “annual fee,” “beginner” etc.

“You do not rise to the level of your goals. You fall to the level of your systems.” — James Clear

Fact-check like a pro (fast)

I keep a 10-minute, 3-step check to separate signal from noise. It’s quick and ruthless:

- 1) Pin the claim — Write down the exact line you want to verify. Example: “Spot Bitcoin ETFs saw accelerating inflows this week.”

- 2) Hit the primary source — Verify from the horse’s mouth:

- Crypto/regulation: SEC filings, issuer sites (e.g., BlackRock iShares), project docs, governance forums.

- Data: Reputable dashboards (e.g., ETF flow trackers like Farside), CoinGecko for supply/market cap, Etherscan for on-chain activity.

- Credit cards: Official issuer pages for terms, categories, and effective annual fees (Chase, AmEx, Capital One, Citi). Never rely on screenshots.

- 3) Cross-check one neutral outlet — Scan a mainstream source or a respected crypto news site for context (macro events, regulatory notes, sector risks). One pass is enough to catch red flags.

Examples in action:

- ETF inflows claim: Confirm on an ETF flow tracker like Farside’s daily flow page; sanity-check with the issuer’s press center. If flows are net negative, treat “bullish” takes as opinion, not fact.

- Card perk claim: If a video mentions “5x at groceries,” open the card’s official site and the offer terms. Check caps, activation rules, and expiration. Rotating categories and first-year promos are where people get burned.

- Token emissions/staking APY: Look for a recent governance vote or tokenomics doc; match it with on-chain issuance data. If you can’t find it in 5 minutes, assume it’s uncertain.

Why this matters: Morningstar’s “Mind the Gap” research shows investors underperform the funds they own by roughly 1–2% a year because of timing mistakes and poor filters. Ten minutes of verification often saves years of regret.

From video to action: simple playbook

Watching isn’t winning. Here’s the simple setup I use to turn one video into measurable results:

1) 3-line summary (keep it tight):

- Thesis: What’s the core idea?

- Action: What, if anything, will I do?

- Risk: What must be true for this to work? What kills it?

2) Set rules before money moves (this prevents FOMO):

- Crypto:

- Buckets: 80% core (BTC/ETH), 20% explore (sectors Brian covers: L2s, DeFi, AI, etc.).

- Position size: Max 2% per speculative asset. No exceptions during hype weeks.

- Entry plan: DCA on a weekly schedule with pre-set amounts. Vanguard’s research shows lump sum often wins, but DCA reduces regret and keeps you consistent—behavior beats bravado.

- Exit plan: Pre-set trims at +50%/+100% on explore positions; reassess thesis quarterly.

- Credit cards:

- Stack builder: 1 daily driver + 1 category booster + 1 no-fee backup. Only add cards that clear your break-even math.

- SUR rule (Sign-Up ROI): Only apply if the bonus nets at least $500 in value for your spend and the effective annual fee is acceptable after credits.

- Redemption plan: Decide where your points will go before you apply (e.g., transfer partners vs. cashback).

3) Track results without overwhelm (one sheet, five columns):

- Date | Source (video title/link) | Action | Rule used | Result (win/learn + note)

Examples:

- Market update → action: “ETH upgrade narrative heating up.” Action: Add ETH to DCA for 8 weeks; set a portfolio note to revisit gas fees and staking data next quarter.

- Card video → action: “Two-card combo for groceries + travel.” Action: Keep no-fee grocery 4–6% card; pair with a transferable-points travel card if you’ll redeem 1.5¢+/point. If not, switch to straight cashback.

Tools and habits that help

Systems beat willpower. Here’s the toolkit that makes Brian’s videos pay off:

- YouTube workflow:

- Tap the bell and set notifications to All for timely updates.

- Save to a “Watch → Act” playlist. After watching, rename the saved item like “ACTED – ETH DCA Q4” or “PASS – Card AF too high.”

- Use timestamps/chapters to skip sponsor segments or topics you don’t need this week.

- Notes that move you:

- Use a simple notes app (Notion, Apple Notes, Obsidian). Limit yourself to 5 bullets per video and 1 Next Action.

- Tag notes with #crypto-core, #crypto-explore, or #credit-cards so you can filter when you’re ready to act.

- Alerts and checks:

- Price alerts on TradingView or CoinGecko for DCA entries and profit trims.

- Card category reminders with your calendar (e.g., rotating categories activation on the 1st of each quarter).

- Points tracking with tools like AwardWallet or a simple spreadsheet so you actually redeem value instead of hoarding.

- Balance the viewpoint:

- For any strong take you hear, intentionally queue one contrasting take and one data-only source. It’s a 3-video triangle that keeps you rational. I’ll share my favorite complements next.

One last nudge: when a video gives you an “aha,” translate it into a calendar event, an alert, or a dollar amount. If it doesn’t change your calendar or your allocation, it’s entertainment—not education.

Want a short list of channels, newsletters, and trackers that pair perfectly with Brian’s style so you never rely on a single source? Keep going—this is where your edge gets sharper.

Good Alternatives and Helpful Complements

If Brian’s videos are your primary feed, here’s how I round things out so I don’t get caught in a single narrative. A wider lens helps you spot risks, confirm trends, and avoid impulse decisions. Pew Research has noted that a lot of adults now get news on YouTube and that independent creators shape much of what viewers see—great for accessibility, but also a nudge to cross-check different voices. See: Pew: News on YouTube.

Other YouTube channels to compare

- Coin Bureau — Clear project explainers, token histories, and risk talk. Great for understanding the “what” and “why” behind coins and sectors.

- Finematics — Visual explainers on DeFi, rollups, L2s, and MEV. If you want to actually understand how the plumbing works, start here.

- Unchained (Laura Shin) — Interviews with founders, regulators, and analysts. Useful for hearing both bull and bear arguments straight from the source.

- The Defiant — DeFi news and trends with a builder’s perspective. Good for tracking new primitives and real usage.

- Benjamin Cowen — Macro-cycle and data-driven crypto commentary. Helpful when you want to sanity-check market timing and seasonality.

- Real Vision Finance — Macro, rates, liquidity, and how they bleed into crypto. Tightens your link between broader markets and your crypto moves.

- Patrick Boyle — Evidence-based finance and risk stories with humor. Keeps you skeptical in the best way.

- Ask Sebby — Credit card strategies, perk valuations, and realistic redemption math. A perfect counterweight when you’re optimizing points.

- The Points Guy — Airline/hotel program updates and major perk changes. Good for keeping your travel playbook current.

- Graham Stephan — Broader personal finance and market sentiment. Useful if you want a mainstream money barometer alongside crypto.

Tip: If two creators who rarely agree are saying the same thing (e.g., “liquidity is tightening”), I pay extra attention.

Newsletters, podcasts, and trackers

These let you skim daily headlines, dig deeper on weekends, and watch the data—not just the commentary.

- Newsletters:

- Bankless — DeFi, Ethereum, and market structures. Mix of explainers and macro takes.

- Coin Metrics: State of the Network — On-chain data with readable charts and context.

- Blockworks Daily — Fast market and policy hits in your inbox.

- Lyn Alden — Macro liquidity, rates, and Bitcoin’s place in the system.

- Messari — Sector summaries and regulatory notes to keep your radar sharp.

- The Defiant — DeFi protocols, airdrops, governance shifts.

- Podcasts:

- Unchained — Regulation, hacks, founders’ strategies.

- Bankless — L2s, modular stacks, crypto macroculture.

- Real Vision Crypto — Long-form interviews with quant and macro angles.

- What Bitcoin Did — Mining economics, policy, and BTC history with practitioners.

- Odd Lots (Bloomberg) — Liquidity, supply chains, volatility—vital context for risk.

- Trackers & data dashboards:

- CoinGecko — Prices, categories, token distributions.

- DeFiLlama — TVL by chain/protocol, fees, stablecoins, airdrops.

- CryptoPanic — News aggregator with sentiment flags for quick scanning.

- Dune — User-built dashboards; track real usage and flows.

- TradingView — Charts, alerts, and macro overlays.

- Glassnode Studio — Free on-chain metrics like active addresses and NUPL.

- FRED — CPI, unemployment, M2, and rates—macro inputs that move risk assets.

Beginner-to-intermediate learning path

Use this simple path to build real skills without getting overwhelmed.

- Step 1: Core crypto basics

- Watch: Finematics: How Blockchain Works and Finematics: Rollups Explained to understand L2 scaling.

- Read: Ethereum.org Intro for a neutral foundation (even if you’re BTC-first).

- Step 2: Security and self-custody

- Watch: Crypto Casey’s security videos on seed phrases, password managers, and phishing.

- Read: Ledger Academy and Jameson Lopp’s resource hub for wallet hygiene and threat models.

- Check: CFTC Advisory on Virtual Currencies for a regulator’s view of risks.

- Step 3: Risk frameworks that protect your capital

- Decide on allocation rules (e.g., “Max 5–10% of net worth in crypto,” or “DCA weekly, don’t chase pumps”).

- Evidence check: Historically, lump-sum often beats DCA, but DCA reduces regret and timing risk; see Morningstar’s analysis. Pick the one you’ll actually stick to.

- Track entries/exits with TradingView alerts and a simple spreadsheet. Consistency beats intensity.

- Step 4: Sector deep dives

- L2s: Rollups Explained (Finematics), plus dashboards on L2BEAT to monitor risk assumptions.

- DeFi: The Defiant + DeFiLlama to validate TVL, fees, and runway.

- BTC ETFs: Read the SEC ETF investor bulletin, then scan a live list on ETF.com for spreads, fees, and AUM.

Action trick: Each week, pick one sector and one data dashboard. Watch a 10-minute explainer, then confirm it with real metrics. You’ll level up faster than binge-watching random headlines.

Want to know whether I actually think you should subscribe to @Jungernaut and who gets the most value from his channel? I’ll answer that next—and clear up the most common questions I see from readers every week.

FAQ and Final Take on Brian Jung’s Channel

What is Brian Jung famous for?

Short answer: practical money videos that don’t waste your time. He’s built a big audience by simplifying credit card strategy, day‑to‑day personal finance, and approachable crypto talk. Expect content like “best starter cards,” “travel card stacks for the year,” and “what actually happened in crypto this week,” often paired with clear steps and risk reminders.

Two things I notice when I watch his channel:

- He keeps it usable. Card rundowns usually come with who it fits and why, not just shiny perks.

- Crypto coverage is approachable. He tends to focus on market news, sector overviews, and sentiment—useful for staying current without living on CT or Discord.

How did Brian Jung make his money?

Like many creators in this space, it’s a mix: YouTube ad revenue, sponsorships, affiliate deals (credit cards, brokerages, crypto platforms), investments, and business ventures. That combo is common—and it’s why you should always keep an eye out for incentives.

How I handle it:

- Look for disclosures. YouTube’s “includes paid promotion” flag, on‑screen text like “sponsored,” or verbal notes are your cue. The FTC Endorsement Guides require clear disclosure.

- Separate education from the pitch. If a card or platform segment has a “limited time offer” and a unique link, I’ll take the tips but confirm details on the official site before acting.

- Use a waiting rule. I keep a 24–72 hour cooldown for anything that involves new spending or account openings. It costs nothing and saves headaches.

What do I need to know about YouTube as a platform?

YouTube rewards watch time and clicks. That means strong thumbnails and headlines tend to win, and that can lean toward hype. Nothing wrong with that—just plan for it.

A few quick facts and why they matter:

- Many people get news on YouTube. Pew Research Center has reported that a large share of U.S. adults consume news on the platform, with a mix of traditional outlets and independent creators. Great for access; it also means quality varies. Source: Pew Research Center.

- Regulators urge caution with “finfluencers.” Both FINRA and the SEC’s Investor.gov remind retail investors to verify claims, understand conflicts, and be wary of guaranteed-return language.

My simple system to stay smart on YouTube:

- Check the date on market videos and ignore outdated calls.

- Verify perks and fees on the card issuer’s official page and take screenshots for your records.

- Cross‑check crypto narratives with a neutral source (official project docs, regulator releases for ETF news, and at least one reputable outlet).

Bottom line: treat finance videos as a starting point. Take notes, verify, then act.

Conclusion: Should you watch @Jungernaut?

Yes—if you want clean, accessible coverage of crypto headlines, credit card strategy, and basic money moves, this channel is a strong add to your rotation. I think his credit card content is the standout, with crypto updates helpful for everyday tracking. It’s not the spot for advanced on‑chain analytics or niche DeFi tactics, and that’s fine—he’s aiming for clarity over complexity.

How I get value without overdoing it:

- Use his roundups to spot topics (ETF flows, regulation talk, sector momentum), then read one neutral source before you touch your portfolio.

- Take the card strategies, confirm everything with the issuer, and run the math on your actual spend. If the annual fee doesn’t pay itself, skip it.

- Mute the FOMO. If a segment is sponsored, I note it, thank the algorithm for the deal, and still wait a day before deciding.

If you keep those habits, you’ll get the best of his channel with none of the common pitfalls. Want ongoing picks of channels and tools that are actually worth your time? Bookmark cryptolinks.com—I keep it fresh so you can learn fast and avoid the noise.

CryptoLinks.com does not endorse, promote, or associate with youtube channels that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.