Camila Russo Review

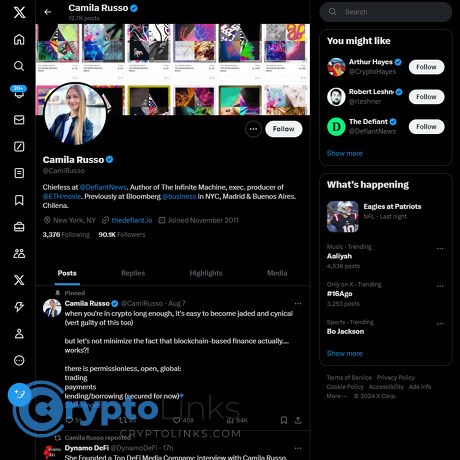

Camila Russo

x.com

Camila Russo (@CamiRusso) Review Guide: Everything You Need to Know + FAQ

Does following Camila Russo on X actually make you smarter about crypto—or just add to the noise?

If you’ve ever opened Crypto Twitter and felt your brain melt from hot takes, tribal spats, and endless threads, you’re not alone. The algorithm rewards outrage and speed, not accuracy. In crypto, that can cost you real money—or worse, send you chasing stories that go nowhere.

Describe problems or pain

Here’s the reality:

- Noise overload: Shills, sponsored “opinions,” and price bait drown out real progress and research.

- No time for context: You need clear, sourced updates in minutes—not 40-tweet threads with no links.

- Hype beats facts: A landmark study in Science found false news spreads faster than truth on social platforms. Crypto isn’t exempt.

- Trust is thin: According to Pew Research, many users get news from social media but trust it less—especially when money is involved.

- Missing disclosures: Too many threads skip conflicts, token exposure, or who benefits if you act on the info.

“Attention is the rarest resource in crypto. Spend it where signal is high and bias is disclosed.”

That’s why a focused review of a voice like Camila Russo matters. Not because you should outsource your thinking, but because you should curate the few feeds that consistently help you make better calls.

Promise solution

I’ve built a simple system to separate signal from noise. In this guide, I’ll walk you through:

- What you really get by following @CamiRusso, in practical terms.

- Where she shines (and when to be cautious) so you don’t over-index on any single voice.

- How to use her feed to catch early narratives without falling into hype cycles.

- How to get in touch and engage in a way that actually gets noticed.

- Who else to add so your info stack isn’t an echo chamber.

No fluff. No hero worship. Just a clear playbook for turning her posts into smarter decisions.

What you’ll learn in minutes

- Who she is and why her coverage of Ethereum and DeFi gets attention.

- What to expect from her X feed: formats, cadence, and how it fits your day.

- How to verify her posts quickly using primary sources and simple tools.

- How to plug updates into your workflow so you save time and avoid secondhand summaries.

Example of how I measure “signal” on any crypto account (and how you can too):

- Source density: Are there links to primary docs (GitHub, EIPs, court filings, governance forums) or just screenshots?

- Context in one screen: Can you grasp the “so what” without scrolling a mile?

- Corrections and updates: Does the account clarify when facts change?

- Disclosure: If there’s a potential conflict, is it mentioned?

- Cross-chain awareness: Even if Ethereum-focused, does it acknowledge the wider market when relevant?

Why listen to me?

I spend my days testing crypto news sources and voices for consistency, accuracy, disclosure, and usefulness. I track patterns like:

- Time-to-source: How quickly a post links to the original doc after breaking news.

- Signal ratio: How many posts deliver new info vs. opinion or recycled headlines.

- Actionability: Can a busy builder, analyst, or investor use it the same day?

Here’s a simple rule of thumb I use that you can steal today:

- If a post makes a claim about Ethereum upgrades, look for a link to an EIP, client release notes, or a core dev call summary. No link? Flag it mentally as “unverified.”

- If a post mentions DeFi metrics or TVL, check L2Beat, DefiLlama, or project analytics before acting.

- If policy or enforcement is involved, skim the actual filing or press release. Summary threads miss nuance.

The goal isn’t to follow more people. It’s to follow the right people—and to know exactly how to use their posts. That’s the lens I’m bringing to Camila Russo’s feed.

Curious who Camila is and why her voice carries weight in Ethereum and DeFi? That’s next—want the short version or the receipts?

Who is Camila Russo and why her voice matters

If you’re trying to separate real signal from the endless noise on crypto X, a strong, consistent voice is gold. Camila Russo has been that for years—rooted in reporting, plugged into Ethereum, and allergic to fluff.

“In a market where noise is cheap, context is priceless.”

Quick bio and credentials

Camila started in traditional finance journalism and made the hard turn into crypto long before it was fashionable. That matters because habits formed in real newsrooms translate into better context and fewer hot takes.

- Former Bloomberg News reporter across New York, Madrid, and Buenos Aires—covering macro and emerging markets before tracking Ethereum’s early years.

- Author of The Infinite Machine, one of the first full-length books to chronicle Ethereum’s origins, culture, and early drama.

- Founder of The Defiant, a media brand that treats DeFi like a serious beat, not a click farm.

- Bilingual and global perspective (Latin America + Europe + U.S.), which shows in how she frames policy and adoption stories.

Journalists trained on markets tend to prioritize sources, chronology, and disclosures—exactly the filters crypto needs when headlines move money and rumors travel fast.

The Defiant and The Infinite Machine

The Infinite Machine doesn’t just recount Ethereum’s creation—it maps the incentives and personalities that still shape today’s debates. That historical scaffolding helps when narratives get loud: you see what’s truly new versus what’s just a remix.

The Defiant built on that foundation with a daily news site, newsletter, video, and interviews. The format is straightforward: get builders, researchers, and policy voices on record; link to the underlying docs; explain why it matters now.

- Access to founders and core contributors means you often get roadmap signals straight from the source.

- Coverage spans protocol upgrades, market structure, governance, security incidents, and regulation—without treating any single token like a sports team.

- There’s a film project based on The Infinite Machine in development, which keeps Ethereum’s story in the broader cultural conversation.

What she posts on X

Her feed at @CamiRusso blends quick hits with source-backed pointers so you can verify fast instead of guessing.

- Ethereum upgrade explainers with links to primary sources like EIPs and AllCoreDevs notes (think Merge, Shanghai/Capella, Dencun).

- DeFi structure and risk—AMM mechanics, L2 maturation, governance shifts, and post-mortems when exploits happen, usually pointing to audits, forum threads, or on-chain evidence.

- Regulatory and policy snapshots that flag the real implications (market structure, disclosures, compliance costs) instead of sensational headlines.

- Interviews and event clips—short teasers plus links to long-form conversations hosted by The Defiant or partner channels.

- Personal and project updates tied to the book/film or editorial initiatives, with clear context when there’s an overlap.

It’s Ethereum-leaning without being maximalist, and there’s a consistent pattern: short take, source link, then a “so what.” That format saves time.

Why this matters to you

Two realities shape crypto social feeds:

- False news spreads faster than truth. A 2018 MIT study in Science found false stories were 70% more likely to be retweeted than true ones—especially in finance and politics. Linking to primary sources is a practical antidote.

- Trust follows transparency. The Reuters Institute’s Digital News Report repeatedly shows that clear sourcing and explanation boost perceived credibility in online news. That’s the editorial muscle memory you want in crypto.

Camila’s mix of reporting discipline and industry access helps you:

- Catch early narratives around upgrades, L2 economics, and policy shifts—without wading through engagement bait.

- Verify fast via primary docs, not anonymous threads or cropped screenshots.

- Understand the “why now” behind a headline so you can decide whether it belongs in your watchlist, roadmap, or risk log.

If you’re optimizing for clarity over hype, that voice is a tailwind. Want to know exactly what shows up in your feed—and how often—when you follow her? That’s up next.

What you actually get from following @CamiRusso

Crypto can feel like a firehose. You want someone who slows the flow, adds context, and points you to the source. That’s the day-to-day value here—Ethereum-first coverage, clear summaries, and links to the primary docs so you’re not guessing.

"Clarity beats hype when your money’s on the line."

Content mix and cadence

Expect a steady, Ethereum-centric stream that’s easy to scan and easy to verify:

- Short takes on breaking news: Quick notes when major updates hit—think Ethereum upgrade milestones like EIP-4844/Dencun, L2 fee shifts, or new policy developments. These usually include a link so you can check the primary source.

- Explainer threads for complex topics: Digestible breakdowns of things like restaking risks, governance proposals, or L2 decentralization phases—with links to docs, GitHub, or research. Example topic you’ll see: how rollups move from “Stage 1” to “Stage 2” decentralization (pair with L2Beat risk frameworks to validate).

- Links to deeper reporting: Pointers to long-reads and interviews on The Defiant, often timed with market or policy shifts so you catch the “why now.”

- Spaces/podcasts: A few live sessions most weeks—either hosting or guesting—so you can hear builders and policymakers directly.

- Event notes: Quick takeaways during conferences (ETHCC, Devcon, Token2049, etc.) to keep you in the loop even if you’re not there.

Cadence tip: Expect multiple posts during busy news cycles and a consistent weekly rhythm otherwise, plus a handful of meatier threads each month.

Signal vs. noise

The feed favors verifiable information over hot takes—useful in a world where social rumors often outrun the truth. A 2018 study in Science found false news spreads “farther, faster, deeper” on social networks than true news; linking back to sources helps counter that tendency.

- Source-first habit: You’ll often get EIPs, GitHub PRs, court documents, or direct statements instead of screenshots and hearsay. That’s the difference between “noise” and “signal.”

- Interview-driven updates: When founders or policymakers speak, she’ll clip or link the conversation so you can hear it unfiltered.

- No pump bait: You won’t see random price targets or “next 100x” chatter. It’s context-first, not chart-hype.

- Credibility cues: URLs, named sources, and on-the-record quotes are frequent. Research suggests these cues meaningfully increase perceived credibility and reduce misinterpretation in fast feeds (see the Reuters Institute’s Digital News Report for patterns in social news consumption: 2023).

Editorial tone and possible bias

Tone: Pro-innovation, pragmatic, and mostly Ethereum-facing. The lens is open finance and builder-forward, with skepticism toward pure speculation.

Bias to watch:

- Ethereum-leaning perspective: Expect deeper attention on ETH and DeFi primitives. Coverage of other ecosystems tends to be compared against Ethereum’s roadmap and norms.

- Project proximity: She founded The Defiant and wrote The Infinite Machine about Ethereum’s origins. When topics intersect with her projects or partners, read disclosures and compare with independent sources. It’s good practice any time money or policy meets editorial.

Cross-check tip: For policy or market-moving claims, open at least two primary links—e.g., the bill text or court filing, plus a technical source like an EIP or GitHub issue. It takes two minutes and saves you from secondhand errors.

How I use her posts

I treat the feed like a fast filter and a map to deeper sources. Here’s the simple workflow that works:

- Scan for narratives: Restaking risks, L2 decentralization, stablecoin rules, MEV changes—when a topic surfaces repeatedly, it’s a signal worth tracking.

- Open the source immediately: If there’s a link to an EIP, court doc, or research, I open it alongside the post. Two tabs: commentary + primary source.

- Tag and timebox: I add a quick note (e.g., “EIP-4844 impact on L2 fees”) and give myself five minutes to capture the core fact, the risk, and an action (follow-up link, question, or metric to watch).

- Use X’s tools: Hit the bell on @CamiRusso for “All Tweets,” and add her to a “Primary Sources” List so her posts don’t get buried by the algorithm.

- Verify with a neutral lens: Example: if there’s an L2 decentralization claim, I cross-check it on L2Beat. If it’s an upgrade claim, I check the relevant EIP on eips.ethereum.org and scan the latest client release notes on GitHub.

- Save high-signal interviews: I queue founder or policymaker interviews during my commute and jot 2–3 bullet takeaways. If a stat is mentioned, I link the source right in my notes.

Want to skip straight to the formats that consistently pay off—interviews, threads, and event takeaways—and the ones to approach with caution? I’ll show you exactly what to watch and what to skip next. Which type of post do you think reveals the biggest edge right now?

Highlights, threads, and what’s worth your time

You don’t need to read everything she posts—just the pieces that consistently move your understanding forward. Here’s where I focus my attention to get the most signal in the least time.

Must-watch: Interviews and Spaces

Her interviews and Spaces are where early signals show up first—think roadmap hints from core contributors, candid founder commentary after a governance vote, or regulatory context while headlines are still noisy.

- Founder/operator angles: Expect sharp questions for builders behind major protocols (Uniswap, Aave, Maker, L2 teams). These talks often surface what’s next—fee switches, sequencer decentralization, token design, and revenue models.

- Policy voices without fluff: When regulators, lawyers, or policy leads join, you’ll get plain-English readouts on rulemaking and enforcement. Pair that with primary sources on the SEC or Federal Register if you need the receipts.

- Actionable follow-ups: After big moments—like Ethereum upgrades or a Wells notice—these conversations give you the “what now” for builders and users. I bookmark these for team syncs.

Time-saver tip: Skip to the sections on “trade-offs” and “what could go wrong.” That’s where real insight lives.

“Attention is your scarcest resource—spend it where insight compounds.”

Strong threads on Ethereum and DeFi structure

When she threads about Ethereum or DeFi mechanics, it’s usually tight, sourced, and easy to scan. Perfect for getting smart fast without going down a rabbit hole.

- Upgrade explainers with sources: For Dencun and proto-danksharding (EIP-4844), look for links to client notes and core dev updates. Post-upgrade, fees on many L2s fell materially—check L2Fees.info to see how swaps/bridges got cheaper.

- Governance snapshots: Uniswap fee discussions, Aave’s risk changes, Maker’s Endgame shifts—her threads typically include Snapshot proposals and forum debates (e.g., Uniswap, Aave, Maker) so you can verify claims.

- Market structure and new primitives: Restaking, L2 sequencers, intent-based architectures—expect clean outlines of incentives, risks, and who pays/benefits. Keep DeFiLlama open for TVL/liquidity context while you read.

Why this format works: it compresses hours of GitHub and forum reading into 90 seconds, with links if you want to go deeper. That’s the right balance for a fast-moving market.

Event coverage and takeaways

Can’t make it to Devcon, EthCC, or ETHDenver? You’ll still get the useful bits—no swag, all substance.

- Panel highlights → practical implications: Instead of listing speakers, she surfaces the “so what.” Example patterns you’ll often see:

- Dev velocity: Which EIPs/core-client milestones actually advanced and what they unlock next.

- Infra shifts: Signals on L2 decentralization, shared sequencers, and modular stacks to watch.

- Adoption hooks: Payments, stablecoin rails, and enterprise experiments that might cross the chasm.

- Post-conference narrative checks: If a concept (say, restaking) dominates a conference, you’ll usually get a tempered recap plus links to research so you can validate hype vs. reality.

Small but important: I grab her top 3 takeaways from big events and turn them into watchlists for the next quarter—tools, teams, and governance threads to revisit.

When to be cautious

Everyone has angles. Transparency matters. Here’s how I keep my guard up without losing speed.

- Check disclosures: If content touches The Defiant’s sponsors or her own projects (book/film updates, partnerships), read the fine print and seek a second independent source.

- Verify with primary docs: For anything that could affect capital or policy, open one source link: an EIP/GitHub issue (Ethereum GitHub), a governance forum, or an official court/regulatory filing.

- Remember the platform effect: False news spreads faster than truth on social media, per a large MIT study in Science (Vosoughi et al., 2018). Link your decisions to data, not retweets.

- Spot opinion vs. reporting: She separates them well, but in heated moments (market stress, enforcement news), label the content in your notes: is this analysis, an interview pull-quote, or verified reporting?

One last trick: when a thread triggers FOMO, I pause and check a single neutral metric (fees, volumes, TVL, active users). If the data doesn’t back the emotion, I wait.

Now, if you want to actually interact—get a thoughtful reply, pitch a story, or ask a question that gets noticed—what’s the smartest way to reach out without looking like a shill? That’s next, and it’s simpler than you think.

How to engage, contact, and get value without wasting time

You want access, not noise. The fastest path is clear communication, solid sources, and respect for time—yours and hers.

“Clarity beats cleverness. Keep it short, source it, and state the why.”

How do I contact Camila Russo?

She’s reachable and responsive when the pitch is tight and credible.

- Email: [email protected] or [email protected]

- X (Twitter): Thoughtful replies to @CamiRusso get noticed, especially on active threads.

Subject line formula that works: [Topic] — [New evidence] — [Why now]

- ETH client diversity — new dashboard + repo — potential risk this quarter

- SEC filing leak — timestamped PDF + counsel notes — market impact today

Quick tip: Link to docs (Dune, GitHub, PDFs on Drive) instead of attachments. Include a one-paragraph TL;DR up top. Data from Boomerang found concise emails (50–125 words) get the best reply rates—keep it lean and specific.

Tips for pitching stories or interviews

- Lead with the why: One sentence on why this matters now (risk, milestone, policy window).

- Provide hard evidence: link to primary sources (transactions, contracts, filings, governance votes, code).

- Disclose conflicts: token exposure, advisory roles, seed/SAFT—up front. It builds trust and saves back-and-forth. See the FTC endorsement guide for best practices.

- Offer specifics: names, dates, on-record/off-record status, and 10–15 minute slots for a quick call.

- Make it easy to verify: public links beat screenshots; add block explorer URLs, forum threads, or PRs.

5-sentence email template you can copy:

Subject: L2 MEV spike — new Dune board + validator logs — urgent this week

Body:

- TL;DR: MEV extract on [L2] jumped 38% week-over-week after [upgrade]; users paying higher effective fees.

- Evidence: Dune board, validator logs, code diff .

- Why now: Governance vote on fee policy closes Friday; dev call agenda includes MEV mitigation.

- Disclosure: I hold [token], no grants; contributor on [repo] since 2023 (view-only links).

- Happy to share data and join a 12-min call today 11:00–13:00 ET or 17:00–18:00 ET.

Smart ways to engage publicly

- Ask one sharp question tied to a source. “Do you see the staking churn after EIP-xxx changing client diversity?”

- Add context, not noise: cite a governance thread, PR, or on-chain tx. One link > five opinions.

- Quote timestamps: if you reference her interview or Space, include the minute mark. It shows you did the work.

- Be early: replying within an hour of a fresh thread increases visibility and the chance she sees it.

Example of a reply that gets traction:

“The ‘fees down’ claim post-[upgrade] looks mixed. Median dropped, but P90 rose on L2s with sequencer backlog (Dune). Is the next milestone targeting P90? If not, how should users think about timing?”

What not to do

- No shills: “Can you tweet my token?” = instant ignore.

- No hidden ads: paid promo or affiliate links without disclosure are a reputational landmine.

- No “partnership?” vagueness: if you can’t define the value in one sentence, it’s not ready.

- No file dumps: avoid unsolicited attachments; use public links with view-only access.

- No mass tagging/fear bait: tagging a dozen accounts or pushing price predictions kills credibility.

- No DM spamming: one thoughtful message beats three follow-ups in 24 hours.

Reality check: Not hearing back usually means the timing or evidence wasn’t strong enough. Strengthen the source, tighten the TL;DR, try again when there’s a real update.

Want to stack the odds even higher? Next, I’ll share the exact voices and verification tools I use to confirm claims in under two minutes—so you never act on a shaky post again.

Build your crypto info stack: complements and tools

If you’re using Camila’s feed as your Ethereum/DeFi signal, great—you’ve already cut a lot of noise. To really stay sharp, round it out with a few complementary voices, a fast verification habit, and a simple workflow that turns headlines into confidence.

Complementary voices to follow

I pair Camila with a mix of investigative, technical, strategy, security, and policy perspectives. It keeps my feed balanced and reduces blind spots.

- Laura Shin — Unchained and @laurashin. Deep interviews and investigative work that add context around people and incentives.

- Bankless — Newsletter/Podcast and @BanklessHQ. Strategy, user-level frameworks, and macro-DeFi narratives.

- Messari — Research and @MessariCrypto. Data-backed reports and project updates you can cross-reference.

- Tim Beiko — @timbeiko. Ethereum Core Dev coordination; follow for upgrade timelines and ACD insights.

- Justin Drake — @drakefjustin. Research-first takes on Ethereum security, issuance, and roadmap.

- Tarun Chitra — @tarunchitra. Mechanism design and risk analysis across DeFi.

- L2BEAT — Site and @l2beat. Rollup risk, security assumptions, and transparency dashboards.

- OpenZeppelin — @OpenZeppelin. Security advisories and best practices from a top audit firm.

- PeckShield — @peckshield. Rapid exploit alerts and on-chain incident threads.

- Jake Chervinsky — @jchervinsky. Policy/legal clarity when headlines get political.

Rule of thumb: if your feed agrees with you all day, widen it. Contrasting, credible voices improve your decisions.

Tools and habits for verification

Headlines move fast. A quick check can save you from bad trades and bad takes. Two research findings I keep in mind:

- MIT (Science, 2018) found false news spreads “farther, faster” on Twitter than truth—especially for finance and politics. Translation: rewarding virality, not accuracy, is a platform feature.

- Stanford’s “lateral reading” research shows experts evaluate claims by opening multiple sources in parallel, not by staring at a single page. The habit matters more than the tool.

My 5-minute verification checklist:

- Step 1 — Identify the claim: Is it an upgrade date, a governance vote, a hack, or a funding announcement?

- Step 2 — Pull a primary source:

- Ethereum upgrades: EIPs, ACD notes, PRs on GitHub.

- Governance: Snapshot, Tally, forums like Uniswap or MakerDAO.

- On-chain events: Etherscan (txs/contracts), Dune dashboards, DeFiLlama (TVL, fees), Token Terminal (fundamentals).

- Security incidents: Protocol’s post-mortem, @peckshield, OpenZeppelin blog.

- Step 3 — Cross-check one independent source: A reputable research post or a second explorer/analytics view.

- Step 4 — Time-box it: If you can’t confirm in 5 minutes, mark it “watch”, not “act”.

Examples:

- “Protocol X was hacked.” Look up the attacker’s address on Etherscan, check the protocol’s official statements, and confirm with a known security firm. If funds are moving through mixers or bridges, Dune or Breadcrumbs can show the flow.

- “EIP-XXXX ships next month.” Check the EIP status, ACD notes on GitHub, and a credible thread from a core dev like @timbeiko. Calendars can slip—don’t price in certainty.

- “Token Y’s fees just exploded.” Verify on DeFiLlama Fees and a second source like Token Terminal. Sudden spikes can be one-offs or mislabeled contracts.

Helpful utilities:

- News aggregator:CryptoPanic to scan headlines across outlets fast.

- RSS reader: Feedly to track dev repos, forum threads, and research blogs in one place.

- Receipts: Wayback Machine for deleted or edited announcements.

Tip: If a post lacks links, treat it as a lead, not a fact. Your future self will thank you.

Resource picks to keep handy

- Ethereum governance hubs: Ethereum Magicians, Ethereum GitHub.

- Rollup explorers: L2BEAT risk profiles plus each network’s explorer (e.g., Optimism, Arbitrum).

- Market structure: CoinGlass (open interest, funding) to separate market noise from narrative shifts.

My workflow suggestion

This is the lightweight routine I actually use when Camila flags something important:

- Morning scan (5–10 min): Read Camila’s latest posts. If a topic repeats across sources (e.g., upgrade milestone, enforcement action), tag it as “priority.”

- The two-link rule: Open two primaries for each priority item—one technical (EIP, GitHub, governance) and one data (Etherscan/Dune/DeFiLlama). No links, no conviction.

- Notes doc: Keep a living page with three buckets: Act (operational changes, risk alerts), Watch (developing stories), Archive (settled facts with sources).

- Alerts: Use X Lists for core devs + security, set alerts on key dashboards, and star the governance threads you care about.

- Weekly reset (20 min): Review what moved from Watch → Archive. Anything still unverified after a week gets dropped or re-framed as a question.

Want a blunt, one-sentence verdict on whether following @CamiRusso is worth your time—and quick answers to the most common questions I get? That’s coming up next.

FAQ and my final verdict on following @CamiRusso

Frequently asked questions

How do I contact Camila Russo?

Email [email protected] or [email protected]. For quick interactions, reply on X: https://x.com/CamiRusso.

Is this investment advice?

No. Treat her posts as information and context. Always verify with primary sources and make your own decisions.

How often does she post?

Steady weekly activity, with more during major releases, policy news, and events (ETHDenver, Devcon, etc.).

Is she Ethereum-biased?

She focuses on Ethereum and DeFi. The upside: clearer context and better sources. Still, check key claims with independent data, especially when policy or money is on the line.

Who will get the most value

- Builders who want signal on Ethereum roadmaps, governance changes, and what actually matters to users and regulators.

- Analysts and investors who prefer sourced threads, interviews with credible guests, and quick links to original docs.

- Researchers and journalists who need clean entry points to primary sources and expert perspectives.

- Curious users who want to understand DeFi mechanics without getting stuck in hype threads.

Real example: when major Ethereum upgrades or DeFi incidents hit, she tends to post short context plus links to core dev notes, security writeups, or long-form explainers. That saves time. It also reduces the chance you get swept up by rumor cycles. For what it’s worth, an MIT study on X/Twitter information spread found false news can be significantly more viral than true news—so source links matter a lot when the timeline gets noisy. See: The spread of true and false news online (Science, 2018).

Rule of thumb: if it impacts tokens, protocols, or policy, open at least two primary sources before acting. Her posts usually make that easy.

How to turn insights into action

- Set smart alerts: Turn on notifications for threads from @CamiRusso. Use X Lists to group her with a few core devs, researchers, and regulators so you see context side-by-side.

- Open the sources she cites: For upgrades, read the EIPs, client release notes, or dev call summaries. For policy, read the actual filing, speech transcript, or press release.

- Cross-check quickly: Compare with one independent outlet or research note. If on-chain data matters, check a dashboard or explorer to confirm the numbers.

- Save the receipts: Bookmark or save links to a notes doc, and jot one takeaway plus one open question. This compounds fast.

- Act with a trigger: Define what would make you trade, publish, or pass (e.g., “two independent confirmations,” “client releases out,” or “reg text posted”). Stick to it.

- Use search operators: On X, try from:CamiRusso upgrade or from:CamiRusso source to resurface threads when you need them later.

Here’s what this looks like in practice: she posts a thread on an Ethereum upgrade; you open the linked EIPs and a client release note, scan for breaking changes, then check a neutral recap from a research outlet. If it passes your checks, you set a watchlist alert or update a thesis—not because of a hot take, but because the sources line up.

Final take

Follow @CamiRusso if you want consistent, source-backed coverage of Ethereum and DeFi. You’ll get interviews worth saving, threads that point to the right docs, and event takeaways that tell you the “so what.” Use her posts to spot narratives early, verify with your own checks, and you’ll cut through the noise. That’s exactly how I use her feed—and why she’s on my daily list.

CryptoLinks.com does not endorse, promote, or associate with Twitter accounts that offer or imply unrealistic returns through potentially unethical practices. Our mission remains to guide the community toward safe, informed, and ethical participation in the cryptocurrency space. We urge our readers and the wider crypto community to remain vigilant, to conduct thorough research, and to always consider the broader implications of their investment choices.